DeFi Rekt Report October 2025: $38.6 Million Lost Across 9 Exploits

October 2025 saw a total of $38.63 million lost across nine distinct security incidents in both centralized and decentralized platforms.

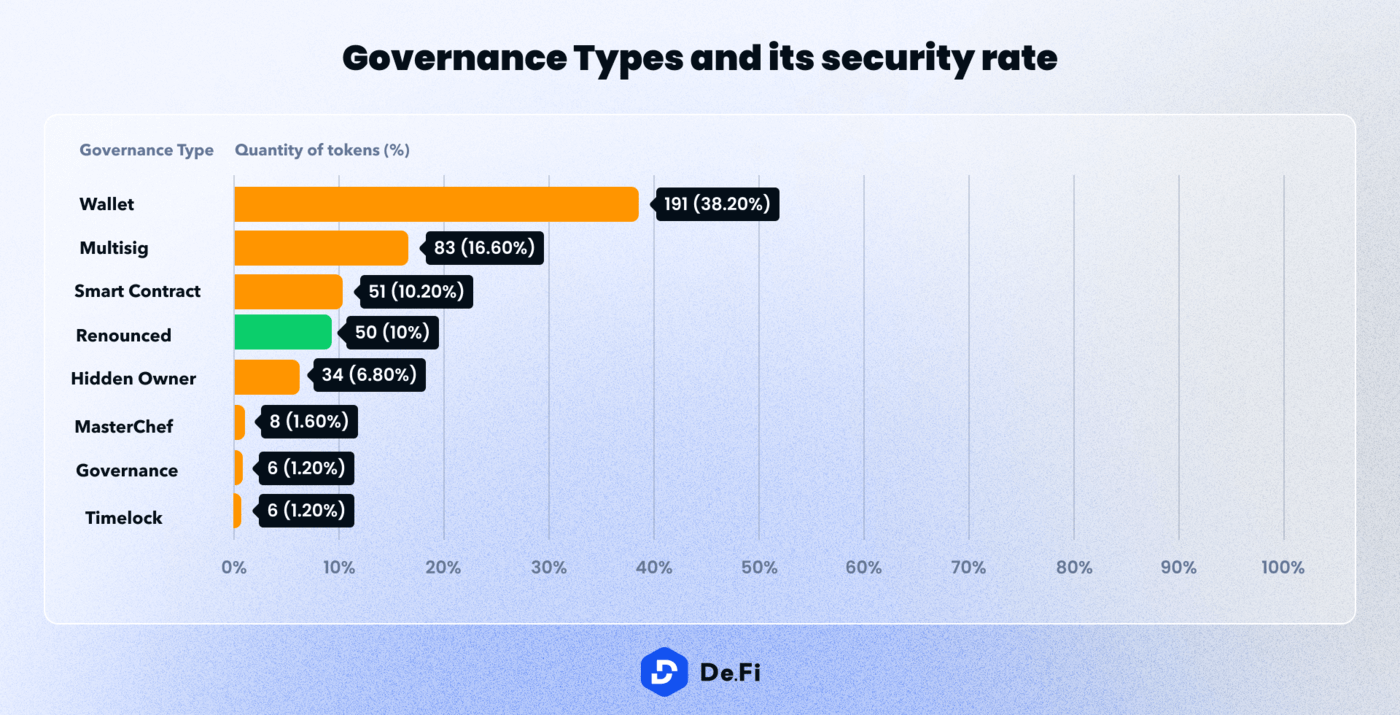

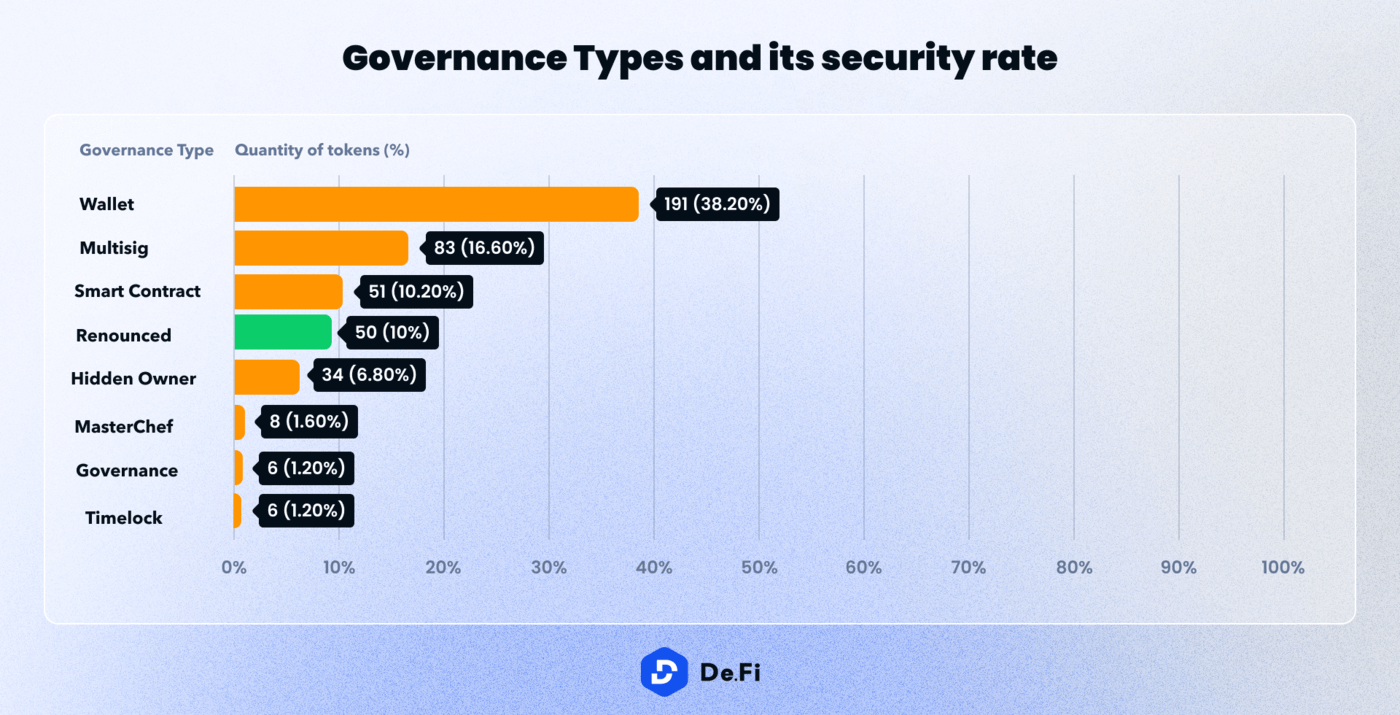

De.Fi, a leading Web3 Super App and creators of the REKT Database, releases new data on token governance and potential risk factors. The latest Governance Security report from De.Fi reveals that 74,6% of the tokens with governance from the top 500 tokens may pose risk factors associated with their governance contracts.

In an era where the crypto landscape is fraught with risks, resulting in billions of dollars in losses each year, De.Fi addresses the urgent need for enhanced security data and analytics. In response, De.Fi has released a comprehensive report on token governance. Governance grants token holders the right to participate in the governance of a protocol, allowing them to engage in decision-making processes through voting.

Our analysts present a study on governance types tracked on De.Fi’s Market Security Page, covering 429 tokens with governance amongst the top 500 tokens by market cap. A staggering 74,6% of the top 500 most popular tokens exhibit a potential risk in governance.

Artem Bondarenko, Tech Lead at De.Fi said:

“An alarming number of projects leave the security of their entire treasuries in the hands of one wallet owner. Most of the time these owners are hidden meaning there’s no way for a DAO participant to verify who manages the funds. This has led to billions of dollars in access control vulnerabilities, exploits and rug pulls.”

“It’s important to note however that while governance parameters may suggest a token is at risk, it doesn’t necessarily lead to a breach in security. Many companies with governance tokens have security departments and advanced security practices not necessarily publicly tracked or on-chain,” added Artem Bondarenko.

Data from De.Fi’s Rekt Database highlights the significant impact of governance exploits in the industry. The top three largest governance hacks resulted in $414M in losses over the years:

Token holders participating as on-chain voters in these proposals need the right tools to analyze security parameters before engaging in new governance proposals.

As an addition to an already complete ecosystem of tools for DeFi investors, De.Fi’s latest Governance metrics aim to mitigate security risks for token holders by providing a clear view of safety aspects associated with various tokens. Users can explore top tokens and their security practices at De.Fi Security Market Page.

About De.Fi

De.Fi is a pioneering Web3 Super App, featuring all-in-one Asset Management Dashboard, Social Profiles, Opportunity Explorer, and the world’s first Crypto Antivirus. With a trusted user base of 1.5M globally, De.Fi is committed to driving DeFi adoption by simplifying and securing the self-custody transition. The platform is endorsed by prominent partners, including OKX and Huobi, supported by former Coinbase M&A expertise, and trusted by leading institutions such as University College London and Coingecko.

Website | Twitter | Security Market Page | Rekt Database

October 2025 saw a total of $38.63 million lost across nine distinct security incidents in both centralized and decentralized platforms.

The third quarter of 2025 marked yet another turbulent period for the DeFi and wider crypto ecosystem, with $434,124,000 lost to exploits, scams, and security failures across both centralized and decentralized platforms.

June 2025 witnessed another alarming month for Web3 security, with a total of $114,768,000 lost during 11 separate attacks

May 2025 saw both DeFi and CeFi security once again under attack, with $275,953,000 lost across just 8 recorded incidents

April 2025 witnessed a large escalation in exploit volume and value, with a massive $5,919,684,000 being stolen in 10 confirmed events.

Q1 2025 marked one of the worst quarters in blockchain exploit history, with total recorded losses topping $2,052,584,700 across 37 incidents

© De.Fi. All rights reserved.