As we embark on a new year, De.Fi has hit the ground running with a series of groundbreaking developments in the first two weeks of January 2024. Our journey has been marked by significant milestones, each underscoring our commitment to leading and innovating within the DeFi space. From exciting new partnerships and expansions to community growth and media recognition, here’s a look at what we’ve achieved.

De.Fi is Trending on X!

Our presence on X has not only grown it has exploded, trending multiple times and showcasing the ever-increasing interest in De.Fi. This surge in popularity is a clear indicator of the growing relevance and impact of our platform in the DeFi space, proving that the journey with De.Fi is just beginning and is already making substantial waves.

Full Synergy with Solana Ecosystem

In a major strategic move, De.Fi has achieved full synergy with the Solana ecosystem, enabling users to comprehensively track their portfolios, monitor staking activities, and explore new yield opportunities. This integration covers over 10 top Solana protocols, significantly enhancing the De.Fi user experience by providing an all-encompassing view of Solana DeFi activities.

Our integration encompasses several major Solana protocols, enhancing the De.Fi dashboard with a wide array of functionalities tailored to the needs of Solana users. This includes:

Staking Protocols: Integration with leading Solana staking platforms such as Lido, Marinade, and Solana Staking. This feature enables users to track and manage their staking positions effortlessly, providing a consolidated view of their investments and rewards.

Yield Farming Platforms: Incorporation of popular Solana yield farming protocols like Orca, Saber, Quarry, and Raydium. Users engaged in yield farming can now monitor their positions and yields across these platforms, optimizing their strategies with comprehensive data at their fingertips.

Lending Services: Solend, a prominent lending protocol within the Solana ecosystem, is also integrated. This allows users to keep track of their lending activities, interest rates, and loan positions, further enhancing their portfolio management capabilities.

MEV Protocols: The integration includes support for Jito Labs, a protocol focused on Maximally Extractable Value (MEV) within Solana. This addition offers users insights into MEV opportunities and risks, enabling informed decision-making for their investment strategies.

Powering Web3: Over 65 Projects Building with Our API

Our commitment to providing robust infrastructure for Web3 projects has reached a new peak with over 65 projects now utilizing our API. This milestone, marked by 10 million API calls, illustrates our role as a foundational element in the Web3 ecosystem, empowering a diverse range of projects worldwide.

Our key integrations to date include the following:

1. Integration with GeckoTerminal

GeckoTerminal, the largest DEX tracker, has integrated De.Fi’s Scanner API.

Users browsing tokens on GeckoTerminal can now utilize our API for a comprehensive analysis of smart contracts and liquidity of assets. By simply clicking on the De.Fi button, users gain access to detailed insights, enhancing their decision-making process and ensuring more informed investments.

2. Integration with AvascanExplorer

AvascanExplorer, often referred to as the ‘Google of Avalanche’, has incorporated De.Fi’s Scanner API.

This integration allows Avascan users to assess the security level of any asset instantly. With a simple click, users can determine the safety and risk associated with assets, effectively minimizing the chances of scams and enhancing the overall security of Web3 interactions.

3. Integration with Ankr

Ankr, a leading DeFi platform for cross-chain staking, has integrated De.Fi’s APY Aggregator API.

Ankr utilizes our API on their dashboard to fetch real-time data on Annual Percentage Rates (APR) and Total Value Locked (TVL) of Liquidity Pools (LPs) and Vaults. This integration provides Ankr’s users with accurate and up-to-date financial information, crucial for managing and optimizing staking strategies.

Surpassing 200K Followers on X

As mentioned earlier, our presence on X has been growing rapidly. Our community on X has seen remarkable growth, now exceeding 227K followers a doubling in just three months. This rapid expansion is a testament to the strength and engagement of our community, setting our sights on the next milestone of 1 million followers. We extend our heartfelt thanks to every member of our community for their support and enthusiasm.

Engaging Discussions in Twitter Spaces with Bitmart

We recently hosted an enriching Twitter Spaces session with Bitmart, discussing the prospects of the next DeFi bull run.

The session featured a panel of renowned experts, including Matt Unchi (@mattunchi), GuthL from Starknet (@GuthL), Kelly Kellam (@Kellykellam), Matthew Sigel, the Head of Research at VanEck (@matthew_sigel), and Andy (@ayyyeandy), among others.

These individuals brought diverse perspectives and deep insights into the current state and future of decentralized finance.

Welcoming 21Shares to Our Investor Team

21Shares, renowned for being the first provider of a Bitcoin ETF, has now invested in De.Fi. This partnership is a powerful endorsement of De.Fi’s vision and strategy, underlining our platform’s credibility and potential in the DeFi space.

The recent approval of the 21Shares x ARK Invest Bitcoin ETF is a milestone in the cryptocurrency market, indicating a growing acceptance and institutionalization of digital assets. This development is particularly significant as it represents one of the first instances of a Bitcoin ETF receiving regulatory approval, paving the way for broader mainstream investment in cryptocurrencies. 21Shares’ vote of confidence in De.Fi, and the wider DeFi space, is a clear signal of more to come.

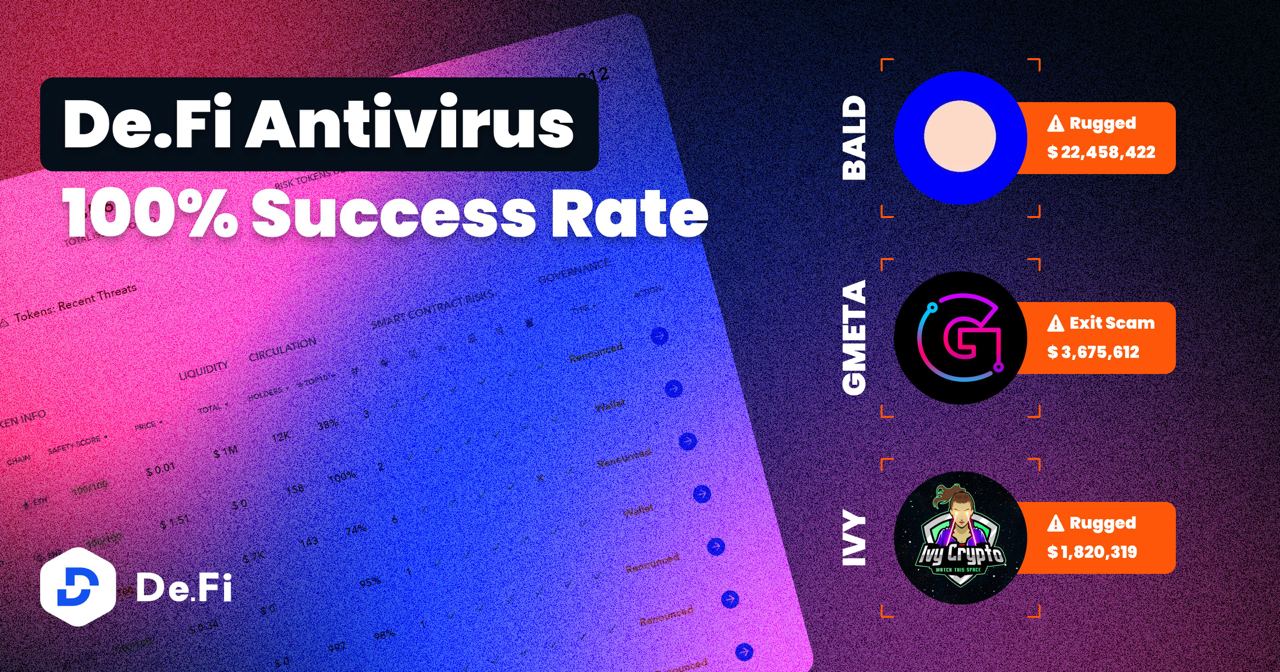

De.Fi Antivirus: A Beacon of Security

In 2023, the cryptocurrency community faced substantial losses due to rug pulls, amounting to over $210 million.

However, De.Fi’s Antivirus has emerged as a critical tool in this landscape, boasting a 100% success rate in detecting these fraudulent activities. This impressive achievement underscores the efficiency and reliability of the Scanner, our free Smart Contract (SC) auditing tool in safeguarding users’ investments against bad actors in Web3.

Make sure to check out the De.Fi Antivirus suite to keep your funds safe in 2024!

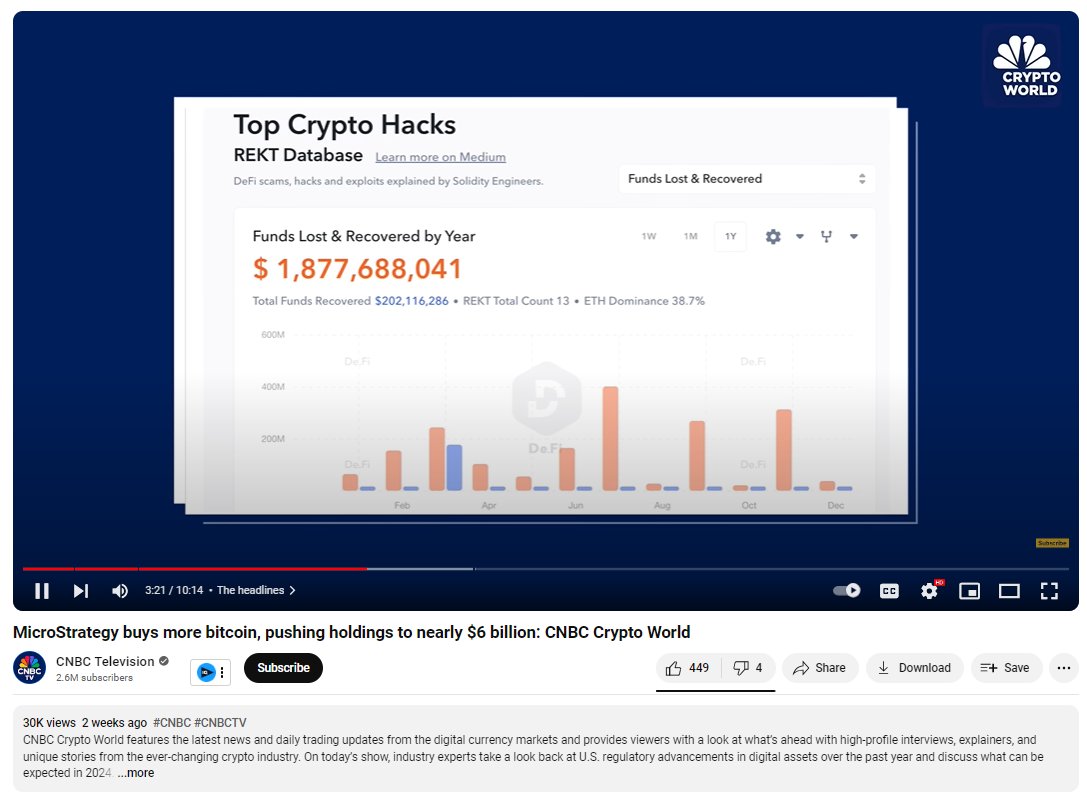

Featured on CNBC Television

The reach and impact of De.Fi extended to mainstream media with a feature on CNBC Television, highlighting our Rekt database. This feature shed light on the prevalence of crypto scams, emphasizing the importance of our comprehensive database in providing critical information to the crypto community.

See the Full CNBC Television Episode

Looking Ahead: A Year of Hot Developments

As we conclude this early January recap, the momentum at De.Fi shows no signs of slowing down.

With each milestone, we reinforce our commitment to innovation, security, and community engagement in the DeFi space. Stay tuned to our blog for more updates, as we continue to heat up the DeFi development landscape with new features, partnerships, and breakthroughs!