The second half of April brought a lot of updates across the De.Fi Ecosystem. From macroeconomic analysis to wallet security improvements and new features for builders and users, we focused on helping DeFiers stay ahead and protected.

How U.S. Tariffs Could Affect Crypto

Our CTO, Artem, shared thoughts on how the recent U.S. tariffs on goods like electric vehicles and chips might impact crypto.

Tariffs can raise prices, which increases inflation. If inflation goes up, the Federal Reserve might delay cutting interest rates, which often puts pressure on crypto, since the market tends to perform better in low-rate environments.

At the same time, when uncertainty increases, the U.S. dollar often gets stronger. Since crypto is priced in dollars, that can also push prices down in the short term.

But the long-term view is different. When people lose confidence in traditional markets, they often look for global and decentralized alternatives, like crypto and DeFi. That’s why more users may turn to web3, especially lending, staking, or liquidity pools.

You Might Still Be at Risk in Web3

Just because a smart contract is audited doesn’t mean it’s fully safe. Bugs and logic errors can still exist. That’s why we built De.Fi Scanner – to check smart contracts for issues before you interact with them. It works instantly and doesn’t require any coding knowledge.

De.Fi Scanner -> de.fi/scanner

Another big risk is forgotten token approvals. Once you sign them, they can stay active for months or years. De.Fi Shield helps by scanning your wallet, finding risky approvals, and letting you revoke them in one place.

De.Fi Shield -> de.fi/shield

Our goal is to make Web3 safer for everyone – with simple tools that do the heavy lifting.

De.Fi API – Built for Builders

For developers looking to build wallets, dashboards, or risk tools, we launched the De.Fi API – a fast, secure way to access live DeFi data from 35+ chains and 300+ protocols.

With just one GraphQL endpoint, developers can track:

• Wallet balances

• Protocol positions

• Yield opportunities

• Risk scores

• Token analytics and approvals

The API also includes our built-in security tools, like the Rekt Database and wallet safety checks.

It uses a credit-based pricing system, and the Node.js SDK is now live, so teams can build and launch quickly.

Check the docs and get started -> docs.de.fi/api/api

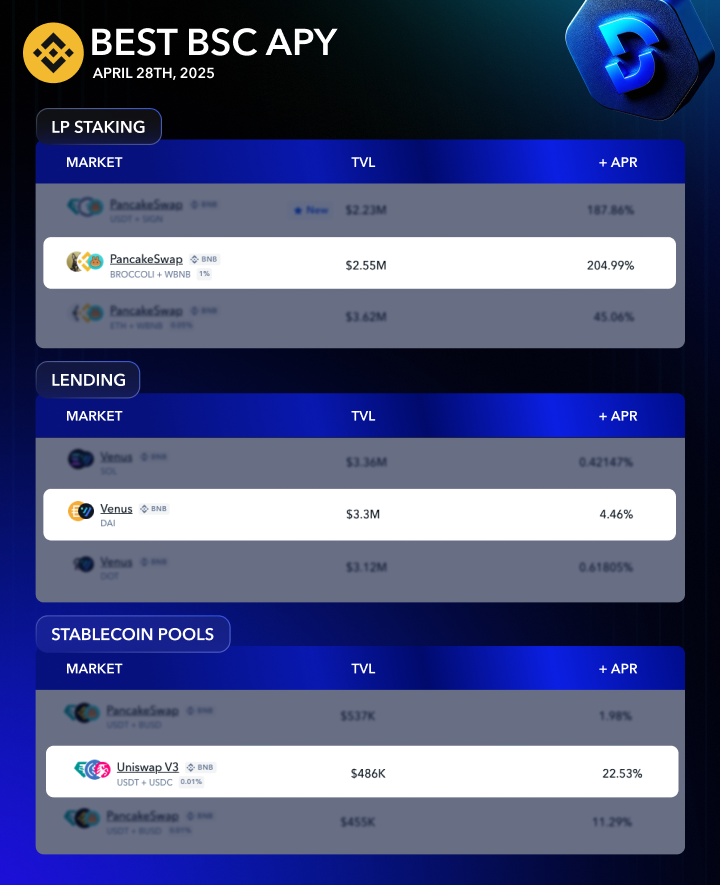

Top BNB Chain Yields

We also shared the best APYs across BNB Chain at the end of April

PancakeSwap (LP Staking) – 205%

Venus (Lending) – 5%

Uniswap (Stablecoin Pools) – 23%

Use De.Fi Explore to find high-yield opportunities across 50+ protocols and 17+ chains 👉 de.fi/explore

SocialFi Profile Update

At the end of April, we rolled out a long-awaited SocialFi update, DeFiers can now customize their profile photos and backgrounds.

The process is simple. Just open your profile, click “Edit” on your photo or background, and sign a quick transaction to confirm the change. In just a few steps, your profile is fully personalized.

This update gives DeFiers more ways to express themselves and stand out in the growing SocialFi community.

Start customizing now -> de.fi/pro

More Updates are Coming

April ended with meaningful updates across the board.

We shared insights on market changes, made Web3 security easier to manage, launched tools for developers, highlighted top DeFi yields and more!

As always, we’re focused on building tools that help you stay safe, grow your assets, and get more from Web3.

Let’s keep moving forward – together.

– Team De.Fi 💙