Scalability is the hottest topic in blockchain right now and Elrond, which describes itself as “the Internet Scale Blockchain”, is one of many platforms at the heart of the debate.

Supporters claim that what Elrond has come up with has the potential to combine the properties of Bitcoin as a gold standard, Ethereum as a powerful virtual engine and Solana as a scalable solution.

In this guide, you’ll find out all you need to know, including details on the network’s functionality, wallets that support the native token and step-by-step instructions on how to stake.

What is Elrond?

Elrond is a public blockchain that employs a Secure Proof-of-Stake consensus mechanism in order to deliver scalability and high throughput.

The initial goal of the project was to create a mechanism that meets these objectives as well as or better than a centralized solution, while providing more privacy to its users. This is still the aim today and all decisions since the project’s launch have been driven by the vision of creating an interoperable, scalable and secure solution.

The network was created by a team of entrepreneurs, engineers and researchers with experience in top companies like Google, Microsoft and Intel.

“With Elrond, we intend to build the backbone for a high bandwidth, low latency financial system, and make this accessible to anyone, anywhere in the world.” — Beniamin Mincu, Co-Founder and CEO of Elrond

Technology features

Elrond’s blockchain platform can process more than 10,000 transactions per second. Some of its other features and benefits are described below.

Adaptive State Sharding

Elrond employs Adaptive State Sharding, which allows it to split the blockchain into different shards in order to process a greater number of transactions in parallel at the same time. This results in greater efficiency and speed.

Furthermore, the sharding process occurs at three levels: state, transaction, and network.

State sharding

The history of the network is split across shards so that nodes only have to store the state of the shard they are in, rather than the history of all transactions across the whole blockchain.

Transaction sharding

Transactions are split and assigned to different shards, where they are processed in parallel. This increases the number of transactions that are processed in any given period of time.

Network sharding

This process helps to optimize the connection between nodes in the same shard.

Secure Proof-of-Stake

The security of the network is achieved through an innovative validation method called Secure Proof-of-Stake.

In this consensus mechanism, validator nodes are chosen from a shard based on a combination of the validator’s rating and an element of randomness. The selection process occurs in the following way:

- Nodes are picked based on the amount of EGLD tokens staked by their operators.

- Each node has a rating, based on its validator behavior over time.

- The nodes with higher ratings have a bigger chance of being chosen.

The platform achieves a level of security by randomly picking the consensus group, as well as by randomly shuffling nodes into other shards to prevent collusion.

The Elrond Community

The Elrond community is big.

The project’s Telegram group has over 50,000 members and this number has doubled in the last year. It’s Twitter account has more than 377,000 followers, up from 138,000 a year ago.

Elrond Architecture

The Elrond network consists of various key elements, as described below.

Nodes and users

Like other blockchains, users generate transactions and nodes process them.

Validators

These are special nodes that provide block generation and consensus building. In order to become a validator in the Elrond blockchain, operators need to stake their tokens.

Shards

Every shard is responsible for its own portion of the state and a number of transactions that are being processed there. This occurs in parallel with other shards performing the same process.

Metachain

This is a separate blockchain that is running in a special shard. This shard is responsible for activities such as notarizing and finalizing the processed shard block headers, facilitating communication between shards, storing and maintaining a registry of validators, triggering new epochs, processing challenges, rewarding and slashing.

$EGLD Token

The native EGLD or “Electronic Gold” token was introduced in 2020 to replace the previous ERD token.

It helps to govern the network through staking and validator rewards. It is also used in transaction payments related to smart contracts, dApp rollouts and storage.

The Elrond economic model has a limited supply that starts at 20,000,000 EGLD. New tokens are minted to reward network validators and the maximum supply can never exceed 31,415,926 EGLD.

The circulating supply on February 18 2021 was 21,890,588 and the price of the token was $173.43.

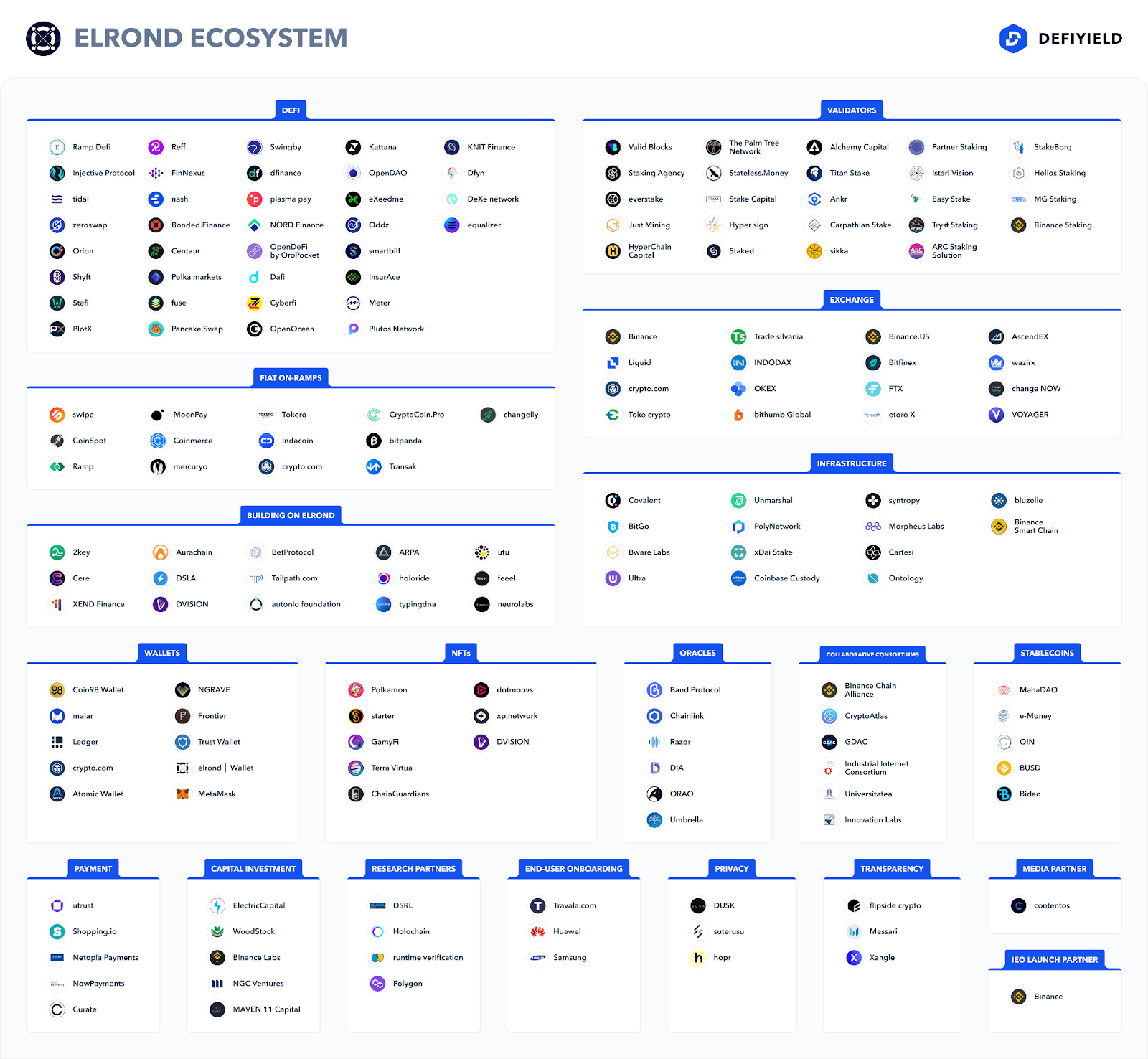

The Elrond DeFi Ecosystem

One of the main attractions of Elrond for developers is the fact that it allows them to earn 30% of the smart contract fees as royalties.

This is a special incentive offered to facilitate the growth of its ecosystem by attracting more projects to build DeFi Dapps on Elrond. Other advantages for developers include the significant speed of transactions, negligible fees and secure base that have already been mentioned.

These have resulted in a growing ecosystem, as demonstrated by the image below.

Partnerships and Cooperation agreements

Elrond has established a number of partnerships and cooperation agreements in order to facilitate the growth of its ecosystem. These include:

- Teaming up with Ardana to promote EGLD’s collateralization operations

- Working with Panther and interchain swaps

- Partnering with Shopping.io to introduce EGLD as a payment option for US eCommerce

- Enabling applications on Cudos to connect to the Elrond Network as a settlement layer

Other partnerships include projects like Netopia, SmartBill, NASH and more.

Bridges for Elrond

According to CEO and Co-Founder Beniamin Mincu, Elrond has functioning cross-chain bridges to Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom and Tron. Some examples of Elrond Bridges are described below.

Elrond Bridge (Ethereum)

This bridge allows you to transfer USDC between Elrond and Ehtereum. At the time of writing, the minimum transfer was 2500 USDC and there was a 50 USDC fee per swap.

Ardana (Cardano)

Ardana, the hub of Cardano, announced in October 2021 that it had entered a long-term partnership with Cardano that included building a bridge between Elrond and Cardano.

Wallets for Elrond

Ledger

A hardware wallet like Ledger is considered to be one of the most secure ways to store cryptocurrencies. It was launched in 2014 by experts with backgrounds in embedded security, cryptocurrencies and entrepreneurship.

Trust Wallet

A mobile wallet that was founded by Viktor Radchenko. It is available for iOS and Android, and allows you to buy crypto with a card directly within the app.

Math Wallet

Math Wallet supports a lot of chains, including Elrond. It’s available for the Chrome, Brave and Edge browsers, and can be set up as a browser extension.

Metamask

This browser and mobile option is one of the most popular wallets today and can also be used to store your EGLD tokens.

Elrond Wallet

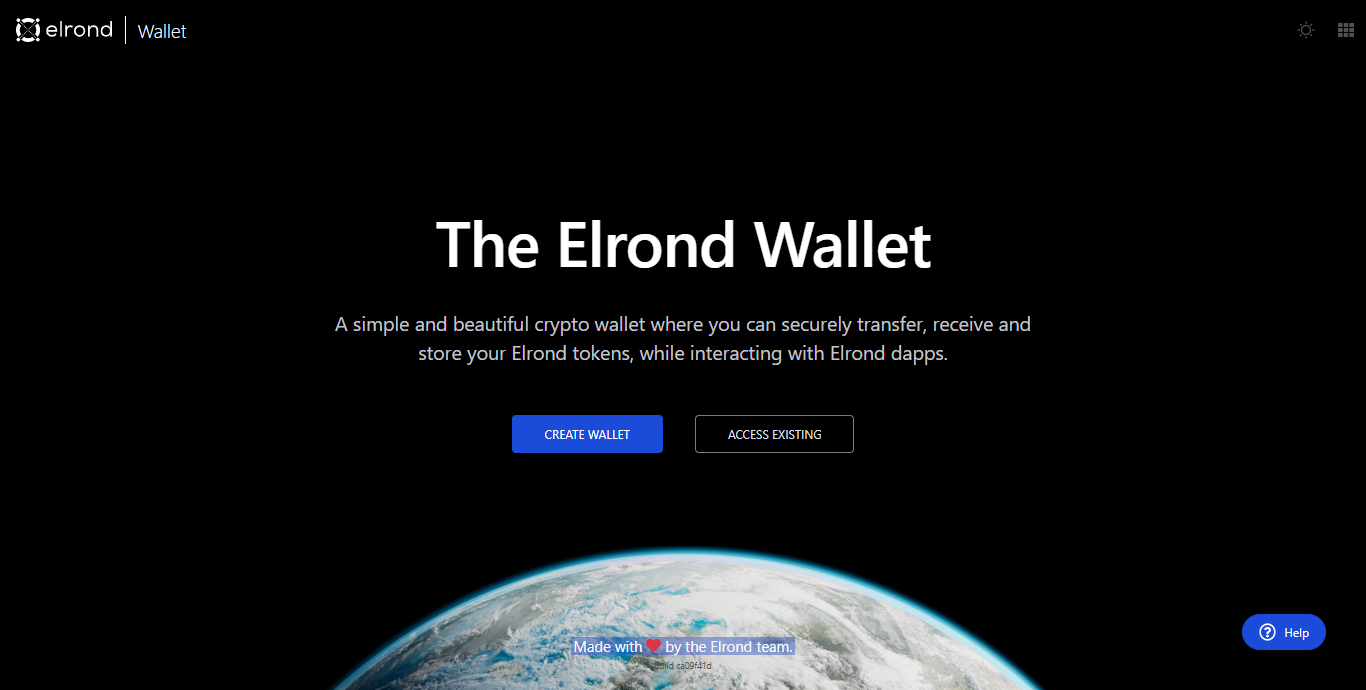

The native wallet of the Elrond blockchain. The wallet is web-based and quite easy to use. It can be used to store EGLD tokens, as well as for staking in order to earn interest.

Staking on Elrond Wallet

This guide focuses on staking and the specific opportunities that exist through the Elrond wallet. We’ve picked this option as it is native to the chain and seems to be easy enough.

Elrond wallet is a web wallet designed for sending, storing and receiving Elrond tokens, as well as for interacting with Elrond-based applications.

You can also use it to stake your tokens and start earning rewards. The application is easy to use and, it is intuitive enough for you to not get lost.

Before jumping into staking, you need to create a wallet. To do this, go to the Elrond Wallet website and click “Create Wallet”, as shown below.

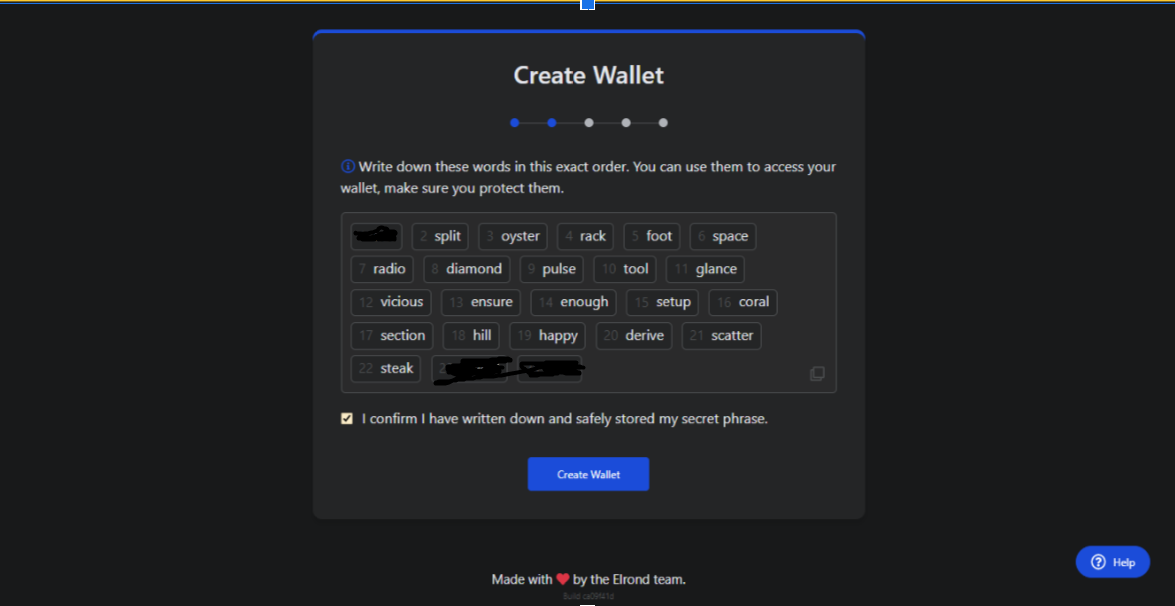

You’ll be given a seed phrase to write down (see below). You need to keep this safe and private, as having this seed phrase will provide access to your funds.

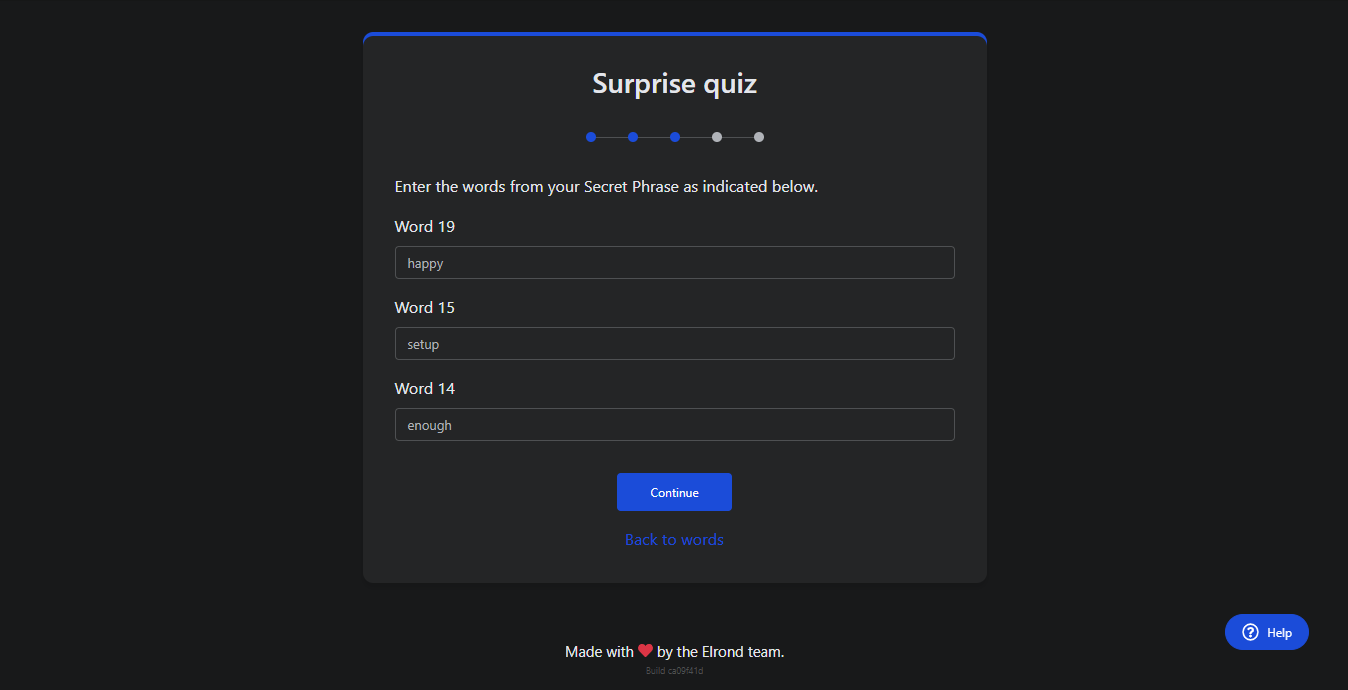

You’ll then be asked to enter certain terms, as shown below, to confirm the phrase.

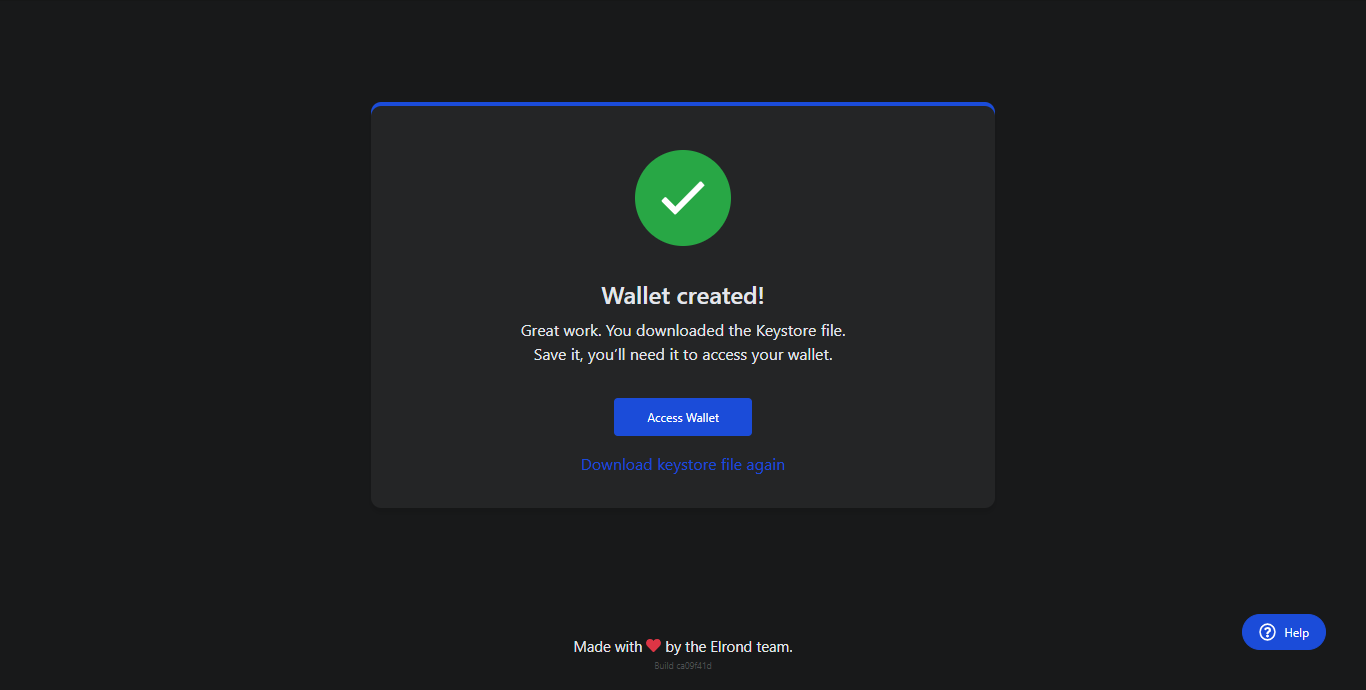

You’ll need to create a password to access the wallet. Once your wallet is created, you can download the keystore file, with this option shown on the screenshot below.

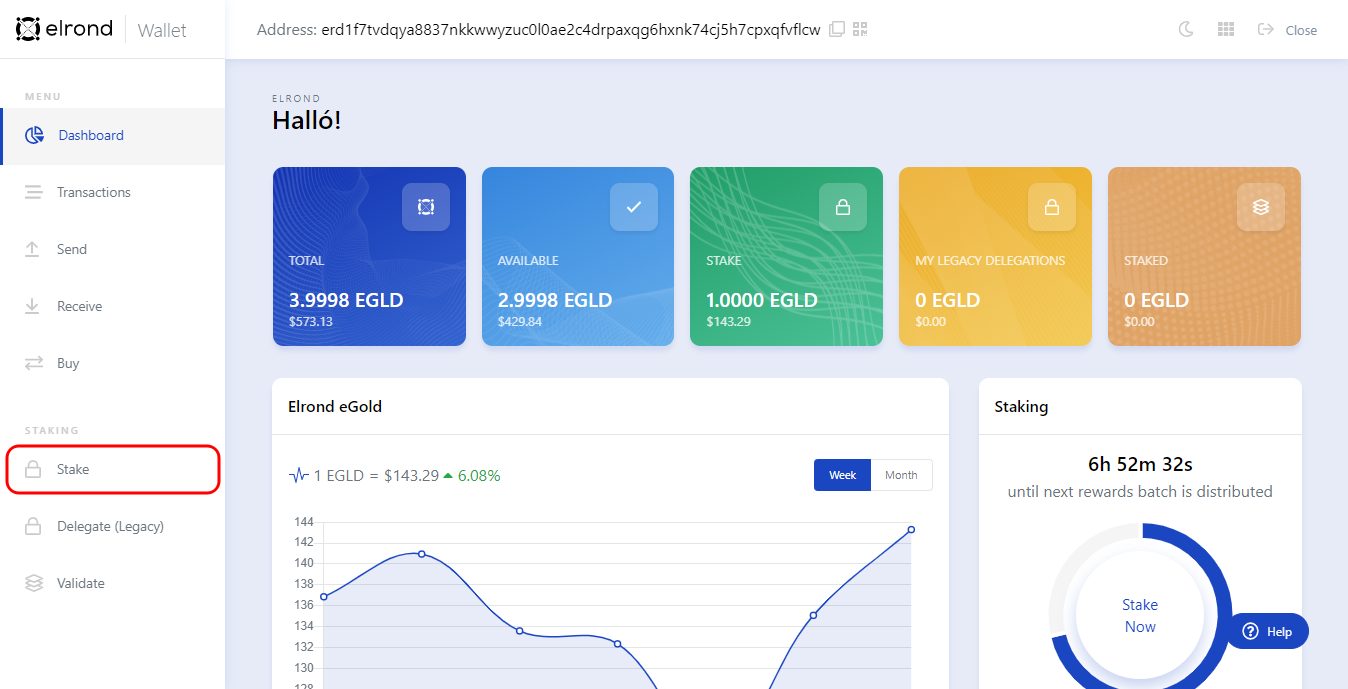

To proceed with staking, you must have funds in your wallet. To send funds to your wallet, use the wallet address shown at the top of the image below. You should use this address to send tokens from the exchange where you bought them to your Elrond wallet.

To start staking, go to the “Stake” tab in the left hand menu of the wallet interface (highlighted below).

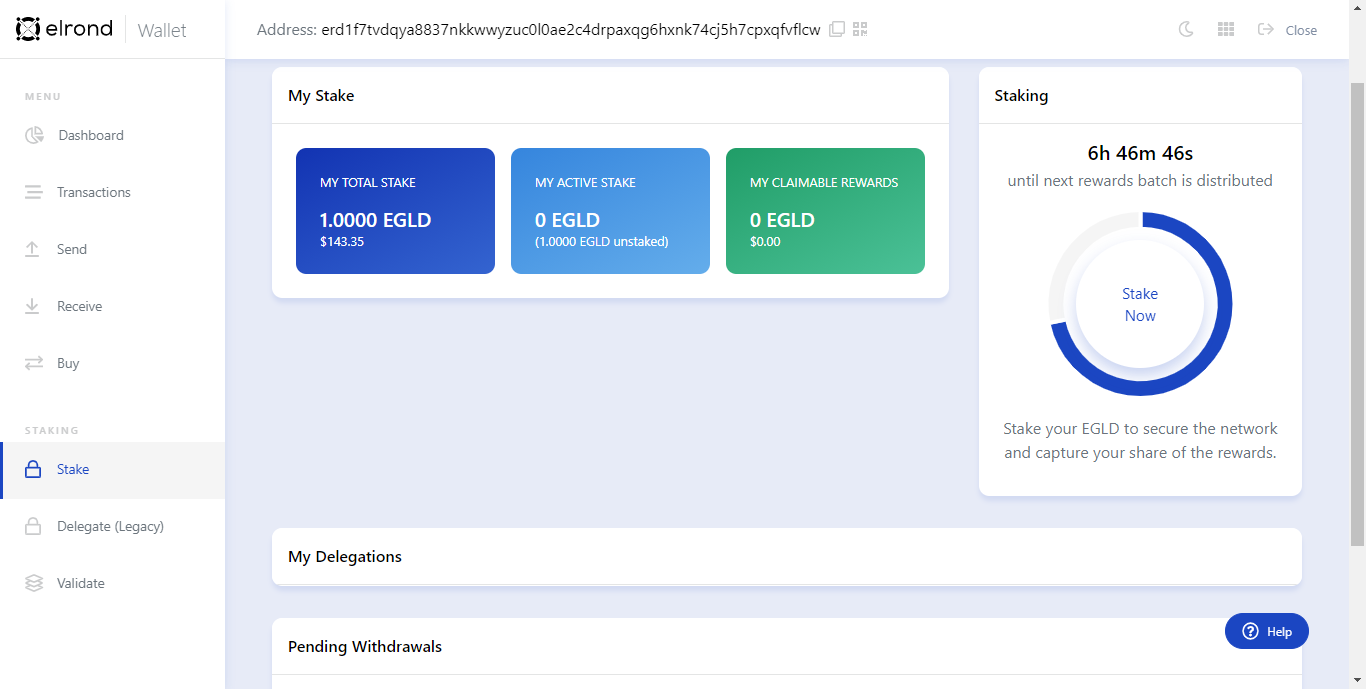

If you click on the “Stake Now” button, the list of validators will open up.

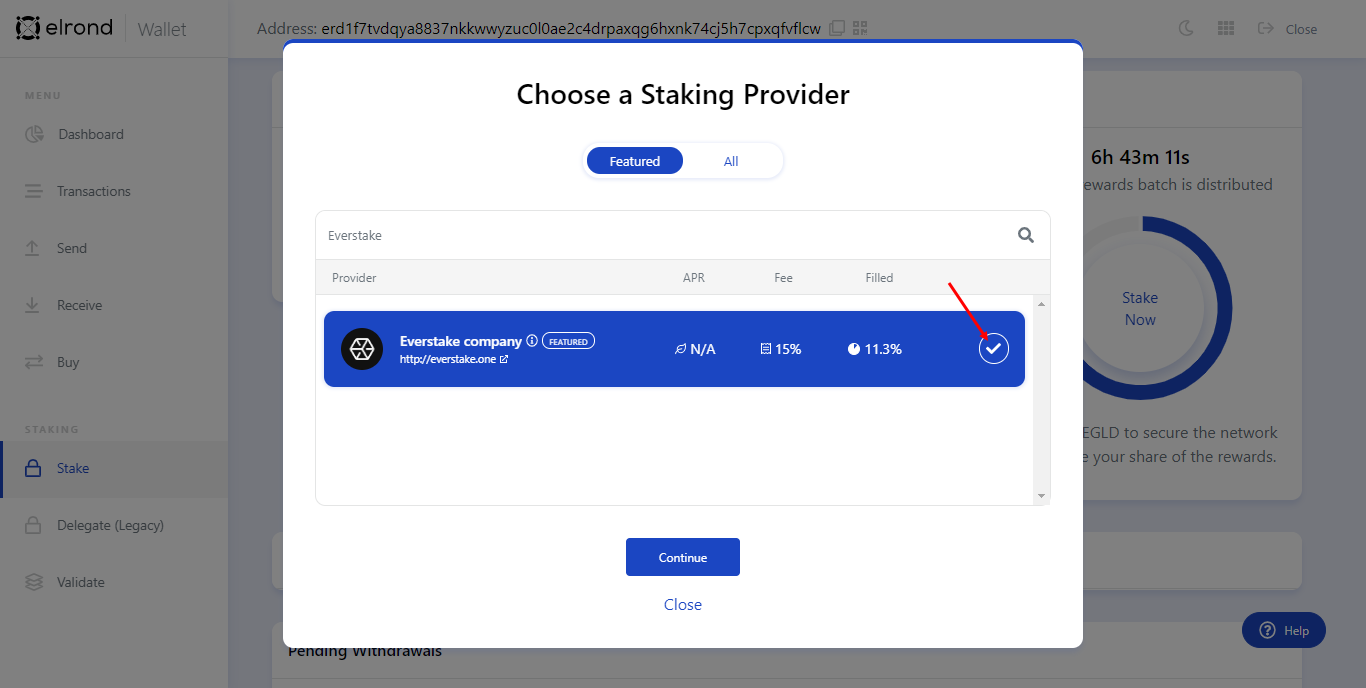

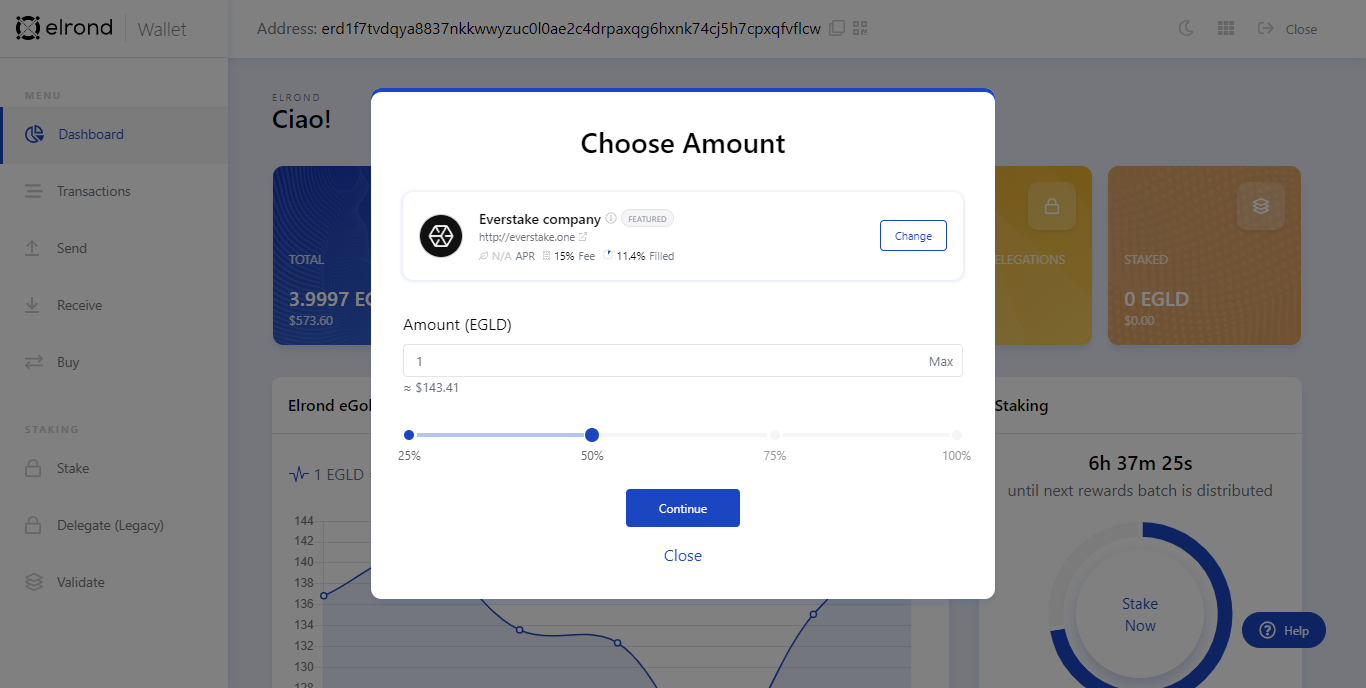

Pick your validator and check the box to the right, as indicated below.

Then you need to enter the number of tokens you want to stake and check the transaction parameters shown in the box below. Click “Confirm” and you’re all done.

One final important thing to note is that the unstake period is 10 days, during which time you cannot withdraw EGLD tokens in order to make other transactions with them.

On the screenshot above you will be able to see the number of rewards you can get daily, monthly, and yearly if you stake 500 EGLD.

Should I use Elrond for Staking?

The big promise of Elrond is a complete Fintech & Internet-of-Things (IoT) ecosystem that is scalable and secure. This is what has led to a lot of interest from the crypto community so far.

Investors looking for opportunities within Elrond will be encouraged by its growing ecosystem and the incentives for developers that could lead to further growth in future. At the same time though, yield farmers should be aware that it seems only staking opportunities exist right now.

Elrond has potential and some interesting fundamentals. Also, for anyone interested in staking, the opportunities within Elrond are completely non-custodial, meaning users remain in control of their EGLD at all times. As always though, this is not investment advice and you should always do your own research first.

Here you can check yield farming opportunities on other chains: de.fi/explore

Join us on Twitter and Telegram!

Good luck in farming!