2025 is now behind us – another year spent doing the hard work of making Web3 safer. December closed the year with steady, hands-on progress. We introduced an upgraded De.Fi Scanner with deeper liquidity analysis, improved De.Fi Send & De.Fi Swap Duo, and helped users discover the best yield farming opportunities with our De.Fi APY Aggregator.

Alongside product updates, our CTO, Artem, shared lessons on product thinking for engineers, drawn from real decisions, trade-offs, and outcomes.

As we step into January 2026, the focus remains on growth, iteration, and building with intention. A new year begins – and so does the next chapter.

De.Fi Scanner 2.0 – Deep Liquidity Analysis

This month, we updated De.Fi Scanner 2.0 with deeper liquidity analysis. The scanner now includes the De.Fi AI Score, which combines multiple risk signals into a single score to give a quick overview of token risk without manual analysis.

The update helps users check how liquidity is structured and spot potential issues earlier. With De.Fi Pro users can access additional features such as AI-based token analysis, full transaction history, data export, and upcoming custom alerts.

The goal is simple: surface meaningful liquidity signals and clearly present them, so users can evaluate projects faster and with more confidence.

De.Fi Send & De.Fi Swap Duo

Everyday DeFi actions should be simple. In December, we continued refining De.Fi Send and De.Fi Swap to reduce friction when transferring and exchanging assets across chains.

De.Fi Send enables crypto transfers across 8 blockchains, supporting wallet addresses, domains, and identities, with adjustable slippage and fast execution. De.Fi Swap allows users to exchange tokens without added platform fees, requiring only network gas while sourcing available liquidity for competitive rates.

Both tools prioritize ease of use, with a clear interface, transparent costs, and seamless switching between supported chains. Support for NFT transfers in De.Fi Send is planned as the next step

We’re Hiring – Help Us Build the Future of DeFi

De.Fi is growing fast, and we’re expanding our team with new roles across development, data, and QA.

Why join us?

• One of the biggest De.Fi dashboards

• Leading security provider in Web3

• The inventor of Crypto’s First Antivirus

• The only all-in-one DeFi gateway

Currently, we have 6 different positions open:

• Senior Full Stack Developer – TypeScript, Node.js, React

• Senior Backend Developer – Node.js, Express, SQL/NoSQL, Kafka

• Senior Frontend Developer – React, Redux, strong UI/UX

• Data Scientist – SQL, Python, data mining, ML basics

• Middle Node.js Developer – Backend skills + Web3 tools

• Manual QA – 3+ years experience, strong communication & detail

Apply here 👉 de.fi/careers

De.Fi REKT Database

Blockchains don’t forget anything. Every exploit, hack, and scam leaves a permanent record. The De.Fi REKT Database brings this information together in one place, tracking major incidents across the ecosystem with continuously updated data.

In December, we added the “Rekt of the Month” section, highlighting the largest exploits from the past 30 days. It offers a quick, high-signal overview with short incident summaries, making it easier to stay informed without digging through reports.

The database helps users review a protocol’s past incidents, compare similar attack patterns, and understand how scams and exploits unfold step by step. Studying past failures makes recurring risks easier to recognize and reduces the chance of repeating the same mistakes.

Product Thinking for Engineers

Recently, our CTO Artem shared his perspective on product thinking for engineers – the shift from simply shipping code to focusing on real outcomes. The message was clear: treating work like a task list limits impact, while understanding users, constraints, and real-world behavior leads to better products.

He emphasized talking to users early, validating ideas before building, and recognizing how small technical decisions can have meaningful business effects. Ownership doesn’t end at launch – it continues through feedback, iteration, and maintenance.

“The Wall Street Era is Over”

December is the coziest season of the year – the time to slow down, pick up a good book, and reflect. “The Wall Street Era Is Over” remains a practical read for anyone looking to better understand DeFi, its risks, and how to navigate the space more thoughtfully. “The Wall Street Era Is Over” has found its place under our Christmas tree as a practical guide to understanding DeFi.

With over 50,000 copies sold since its release in 2020, the book continues to be read and shared years later. It focuses on how DeFi works in practice, where risks come from, and how to approach the space more safely.

The book is based on real experience – covering both successes and mistakes, offering a grounded view beyond headlines and hype.

👉 The Wall Street Era is Over: The Investor’s Guide to Cryptocurrency and DeFi

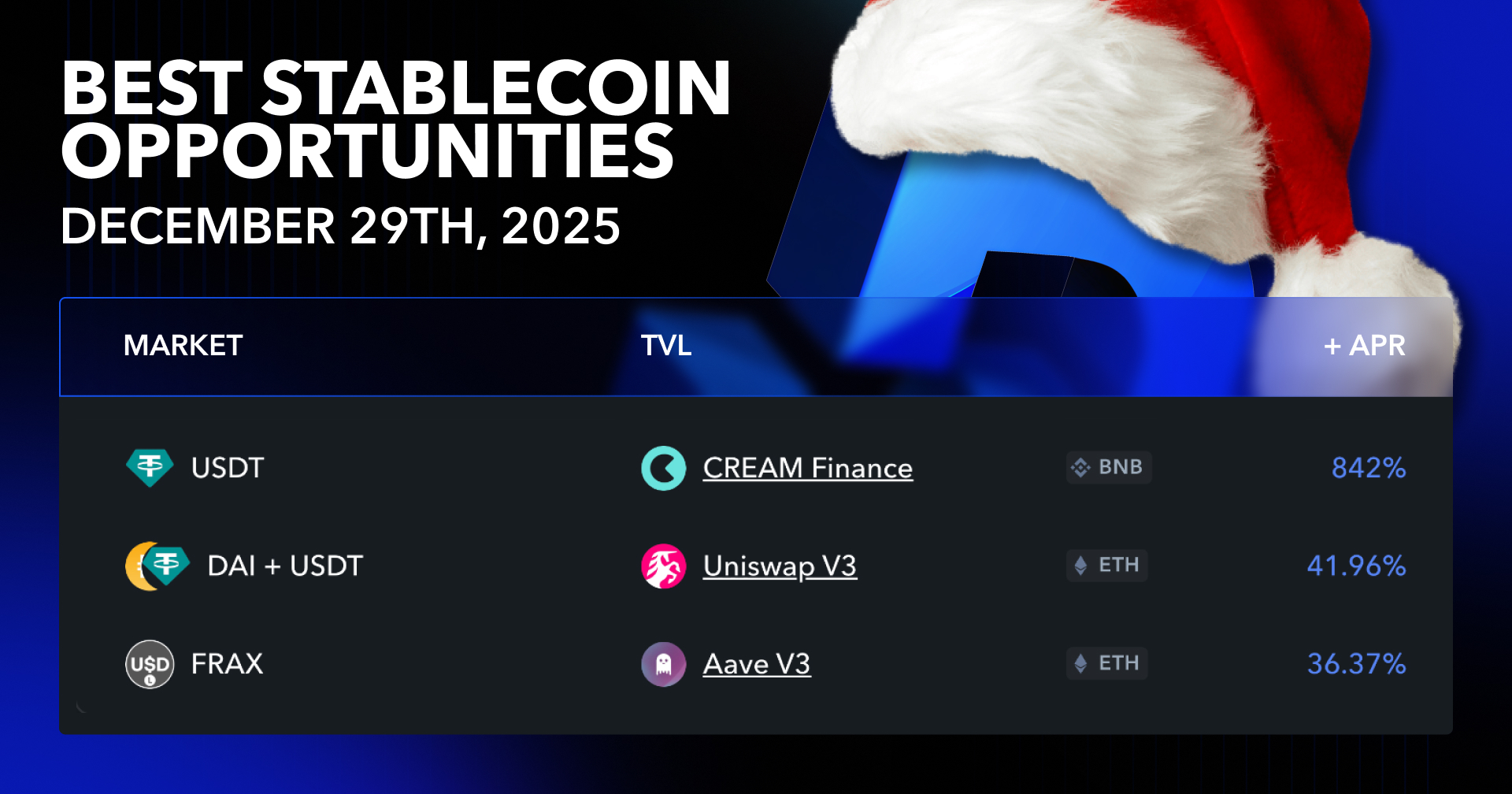

Best Yield Opportunities with DeFi APY Aggregator

After the holidays, it’s often a good moment to review how idle assets are being used. The De.Fi Explore tool helps users find and compare yield opportunities across DeFi, with a focus on stablecoins and lower-volatility strategies.

The De.Fi APY Aggregator tracks yields daily, making it easier to see where returns are coming from without manual research. Users can compare borrowing and lending rates across protocols, helping them choose more efficient options based on current market conditions.

Explore also includes simple calculators for profit tracking and APR/APY comparison, allowing users to better understand real returns without relying on spreadsheets.

That’s a Wrap for December 2025

December closed the year with reflection, care, and continued work across De.Fi. Every improvement, insight, and conversation this year came from people who care deeply about building better tools for Web3. We’re thankful for that as we move into 2026.

Let’s keep building.

– Team De.Fi 💙