August was a month of major product developments, infrastructure improvements, and global expansion. From unveiling our upcoming Perp DEX to releasing powerful features for builders and traders, the month demonstrated our commitment to performance, transparency, and security across the De.Fi Ecosystem.

Announcing DeFi Perp DEX

This month, we revealed the DeFi Perp DEX, our new trading platform built for speed, transparency, and security. The exchange will operate with sub-second order matching latency thanks to an optimized off-chain engine with deterministic on-chain settlement.

At launch, traders will gain access to 50 perpetual pairs – including major assets like BTC, ETH, and SOL and mid-cap altcoins available with up to 30x leverage.

The hybrid order book architecture processes orders off-chain for efficiency while recording settlement and trade data on-chain for transparency. Pricing will be sourced from multiple decentralized oracles to limit manipulation risks. Traders will have access to an integrated toolkit that includes limit and market orders, single-click take-profit and stop-loss and real-time PnL.

Risk management is a cornerstone of the design. The liquidation system will continuously monitor leverage ratios, collateral valuation, and volatility-adjusted buffers, while liquidation triggers will rely on time-weighted average prices. Built-in security features will display token risk scores, liquidity data, and protocol red flags directly in the trading interface.

No gas fees on execution, and capacity for up to 10,000 orders per second, the DeFi Perp DEX is engineered for institutional-grade performance. Wallets with the highest trading volume on DeFi Swap will receive a bonus ahead of the launch.

De.Fi API

We posted a detailed thread on how developers can integrate our API to build digital products with security and yield data at scale. With one call, builders gain access to live data from 41+ blockchains, 350+ protocols, and direct connections to the DeFi Audit and REKT Databases.

This infrastructure enabled use cases like multi-chain portfolio trackers, yield dashboards, and whale tracking tools. Security endpoints allowed developers to flag risky contracts, highlight top holders, and show liquidity distribution in real time. Trusted by industry leaders such as CoinGecko, Consensys, and Avascan, the API made it possible to launch production-ready applications in under an hour.

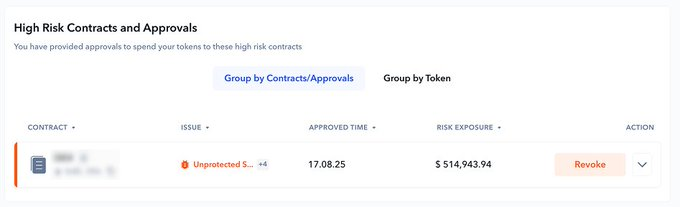

$514,943 saved using De.Fi Shield

DeFi Shield continued to protect DeFiers this month. One DeFier saved $514,943 from a potential drain by revoking a risky approval. Stories like these reinforced why DeFi Shield has become a trusted layer of defense for wallets across the ecosystem.

Culture in Tech

Our CTO Artem also posted insights about building strong engineering cultures. He emphasized that the best engineers are not only fast shippers, but those who inspire collaboration and knowledge sharing.

Failures are shared collectively, and wins are celebrated together. According to Artem, good culture scales teams sustainably, while poor culture causes long-term breakdowns.

De.Fi Scanner

This month, we highlighted the simplicity of using DeFi Scanner to secure wallets in just two clicks. By pasting a contract address, users instantly received a deep risk assessment covering smart contract functions, liquidity analysis, top holder distribution, and governance risks.

With liquidity dashboards, APR tracking, and governance insights, the scanner provided what previously required weeks of costly audits – now free and instant.

Explore Yields and My Opportunities

Yield farming became more intuitive through Explore Yields. With the “My Opportunities” feature, users accessed a personalized playlist of farming and staking options matched to their portfolios. The Borrow/Lending tab enabled comparisons of top rates, while the Profit Calculator brought instant clarity to ROI.

Historical APR trends, TVL flows, and 7-day averages provide additional context, helping users decide when to enter or exit positions. Validator insights offer transparency into staking strategies, and advanced filters give users full control over chains, tokens, and protocols.

De.Fi Swap – Seamless Token Trading Across Chains

In August, DeFi Swap continued to offer a seamless way to trade tokens across eight major blockchains. Designed with simplicity and speed in mind, the interface allows users to adjust slippage tolerance, connect their wallet in seconds, and execute trades instantly.

It’s built to make cross-chain swaps feel intuitive, even for first-time users, while maintaining the power and flexibility experienced DeFiers expect.

👉 de.fi/swap

De.Fi in Japan

August also marked a significant step in DeFi’s global presence. We joined ETHTokyo, WebX 2025, and Japan Blockchain Week, connecting with one of the most innovative markets in the world.

On the ground in Tokyo, our team, including CMO Sonali Gio hosted interviews with C-level leaders, influencers, and builders. On the second day, we joined Superteam Japan at Solana Super Tokyo 2025.

We won’t stop innovating

August was a month defined by product progress, cultural insights, and international expansion. From revealing the DeFi Perp DEX and advancing our security and yield tools, to connecting with global communities.

We are on a mission to make decentralized finance more secure, accessible, and performance-driven. As we look ahead, September promises even more milestones for the De.Fi Ecosystem.