Are you looking to dive into the realm of crypto and DeFi yield farming, but find yourself stumped by terms like ‘APR’ and ‘APY’? You’re not alone. These terms are crucial to understanding your potential earnings and investment growth, but their meaning in the crypto landscape may seem confusing.

In this article, we will explain what APR and APY mean in crypto, why these terms are often misunderstood, and how they apply to staking or yield farming. Our goal is to clarify these terms so you can make the most out of your DeFi portfolio tools.

APY vs APR in Crypto

When you venture into the world of cryptocurrency and decentralized finance (DeFi), there are two terms you’ll encounter quite frequently: APY and APR. These terms represent different ways of measuring interest, but can sometimes confuse crypto investors. To maximize your returns and understand the different opportunities available, it’s vital to grasp the differences between the two.

What is APY in Crypto?

APY, or Annual Percentage Yield, represents the true rate of return earned on a savings deposit or investment over a year, factoring in the effects of compounding interest. In layman’s terms, compounding interest is the interest you earn on both your original money and the interest you keep accumulating. This powerful financial principle allows your wealth to snowball over time, as you earn interest not only on your initial investment but also on the interest that your investment accrues.

In the world of cryptocurrencies, APY becomes an essential concept to understand, particularly with the rise of liquidity mining, lending protocols, and staking opportunities. With liquidity mining, investors provide liquidity to a DeFi liquidity pool and receive rewards. Similarly, staking involves participating in a proof-of-stake (PoS) crypto network by holding and ‘staking’ a cryptocurrency in a wallet to support network operations like block validation, security, and governance. The rewards you get from staking are sometimes presented as APY. Therefore, the term APY is a useful measure for investors to gauge the profitability of such strategies.

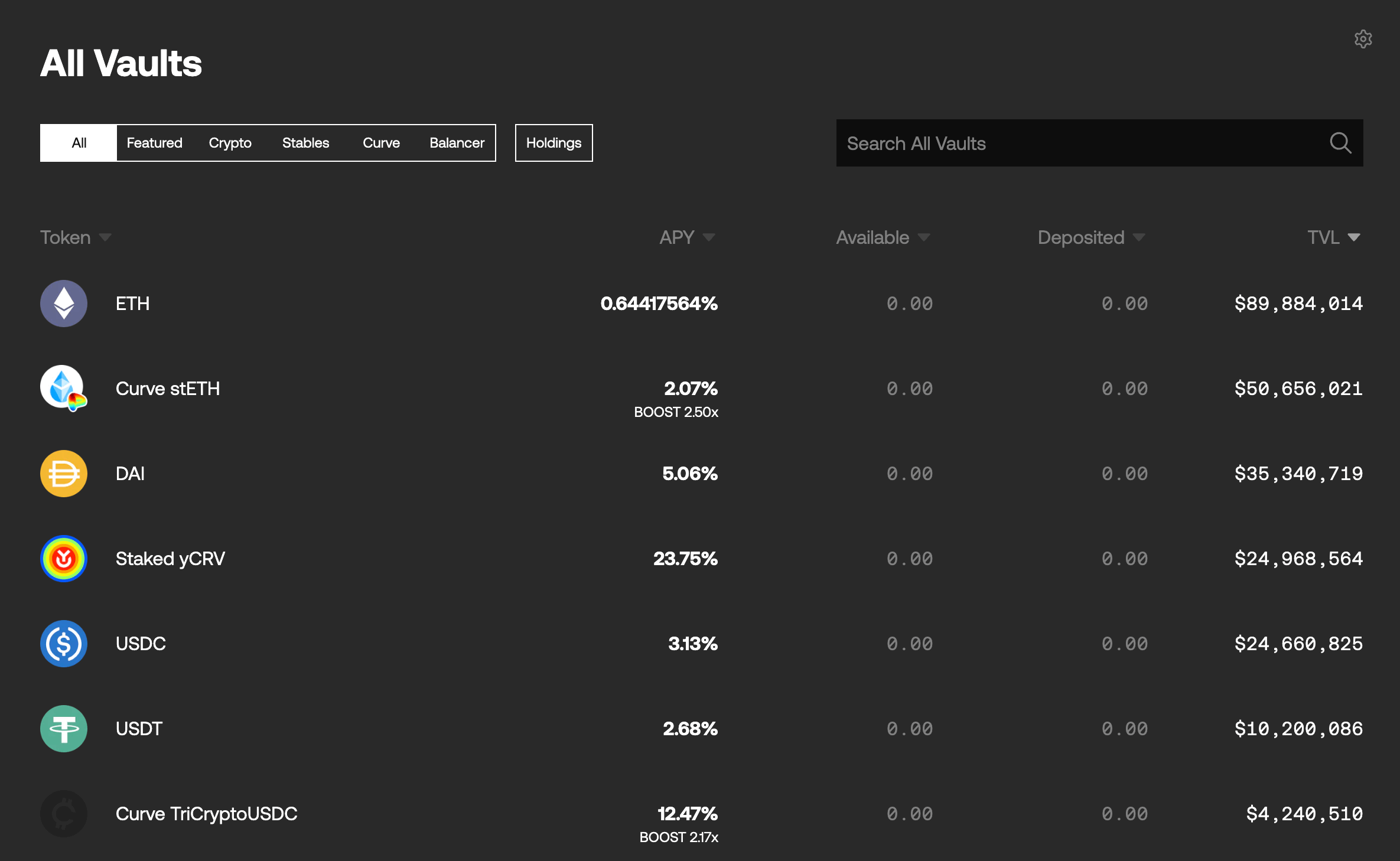

YFI, a sophisticated auto-compounding DeFi platform, lists their rates in APY

What is APR in Crypto?

APR stands for Annual Percentage Rate. In the context of loans, APR represents the yearly cost of funds over the term of a loan. When it comes to investments, APR is the yearly rate of return on that investment. Unlike APY, APR does not factor in compound interest, which makes it different from APY. Instead, it provides a straightforward, non-compounded view of the interest you could earn on an investment or the interest you owe on a loan.

APR is also crucial in the crypto sphere, particularly within DeFi lending platforms. In DeFi lending, users can lend their cryptocurrency to others via smart contracts and earn interest, generally expressed as an APR. Understanding the APR helps lenders compare the return on investment across different platforms and choose the most profitable lending opportunity.

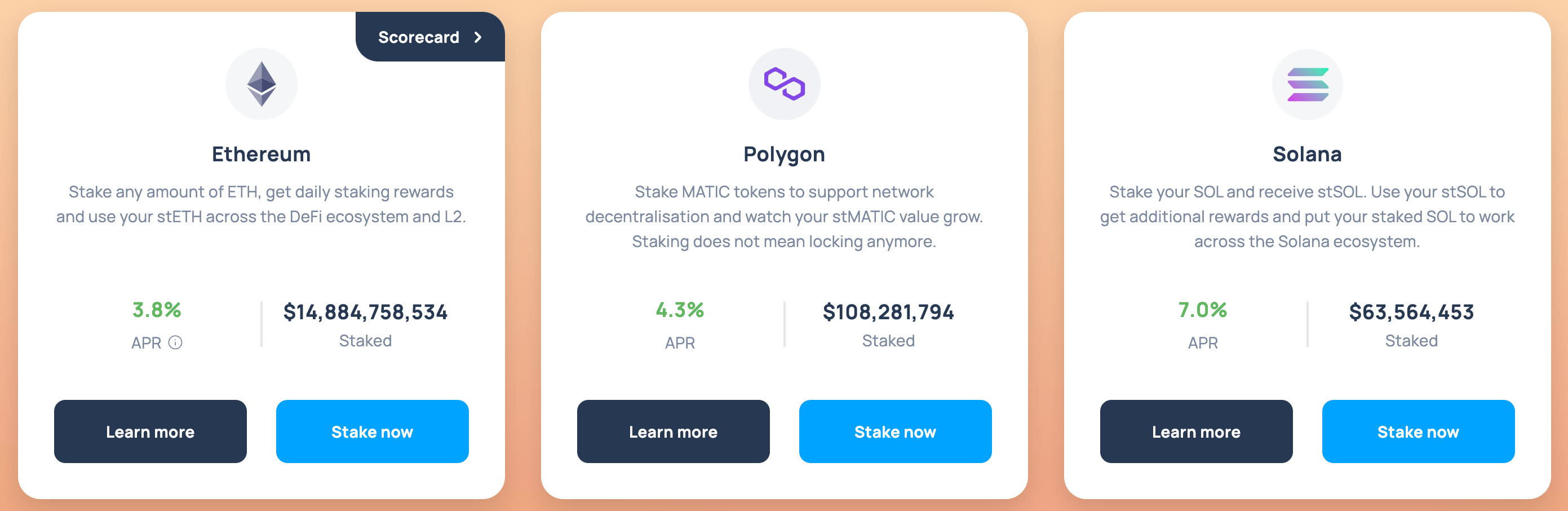

Lido, a straightforward liquid staking service, lists rates in APR

The Key Difference Between Crypto APR and APY

The confusion between APR and APY arises because both are used to express potential return on investment. The key difference comes down to how they account for interest. While APR gives you a basic, non-compounded annual rate, APY gives a more accurate picture of returns by including compound interest. Therefore, when comparing “APY vs APR in crypto,” you’ll generally find that APY will be higher than APR for the same nominal interest rate due to the compounding effect.

Let’s break down the different key points you need to know about each term:

| APY | APR | |

| Definition | Annual Percentage Yield | Annual Percentage Rate |

| Interest | Considers compound interest | Does not consider compound interest |

| Usage | Ideal for assessing investment potential | Useful for determining cost of borrowing |

| In Crypto | Used in yield farming and staking rewards | Used in DeFi lending platforms |

How to Calculate APR & APY

To calculate APR in the crypto context, you simply divide the total interest paid or received over a year by the initial amount of the loan or investment. For example, if you loan 1 ETH at an interest rate of 5%, your APR would be 5% and you will have totaled .05 ETH at the end of a year.

On the other hand, calculating APY in crypto involves a little more complexity as it involves compound interest. The formula is (1+r/n)n – 1, where ‘r’ is the nominal interest rate and ‘n’ is the number of times interest is compounded.

Still confused? You can use the calculator below to sort APY calculations out for you.

The main thing to take away though is this: APY rates will always be higher and look more attractive, but they are dependent on compounding. If you do not know how this compounding will be happening, you may be getting duped by a higher than actual rate because a DeFi protocol advertises the APY assuming people will know to compound their returns.

Understanding these calculations can help optimize your DeFi portfolio management. As a crypto investor, it’s crucial to consider whether returns are based on an APR or an APY when staking in order to maximize earnings. Doing so will empower you to make more informed decisions about your investments so you can harness the full potential of DeFi. With this knowledge, you’re one step closer to becoming a crypto-savvy investor.

Where Does Crypto APR & APY Yield Come From?

In the world of DeFi, one question that often arises is: “Where does the yield come from?” Understanding the source of these yields is crucial as it helps you gauge the potential risks and returns associated with different crypto investment strategies.

Let’s first take a look at lending. In the traditional financial world, banks lend money and charge interest, generating income. DeFi takes a similar approach. DeFi lending platforms enable users to lend their crypto to others via smart contracts, and in return, the lenders earn interest on their lent assets. This interest is often expressed as an APR (Annual Percentage Rate), a simple yearly rate without considering compounding. The APR crypto yield from lending is essentially the money people pay you for lending them your crypto.

Next, let’s dive into liquidity mining, another popular strategy in DeFi to earn returns. Liquidity mining involves providing liquidity to a DeFi liquidity pool. A liquidity pool is a smart contract that contains funds. Users, also known as liquidity providers, add an equal value of two tokens to the pool. In exchange, they earn fees from the trading activity that happens in their pool. Users can use simple tools like a Uniswap calculator to see data for each specific pool and forecast gains.

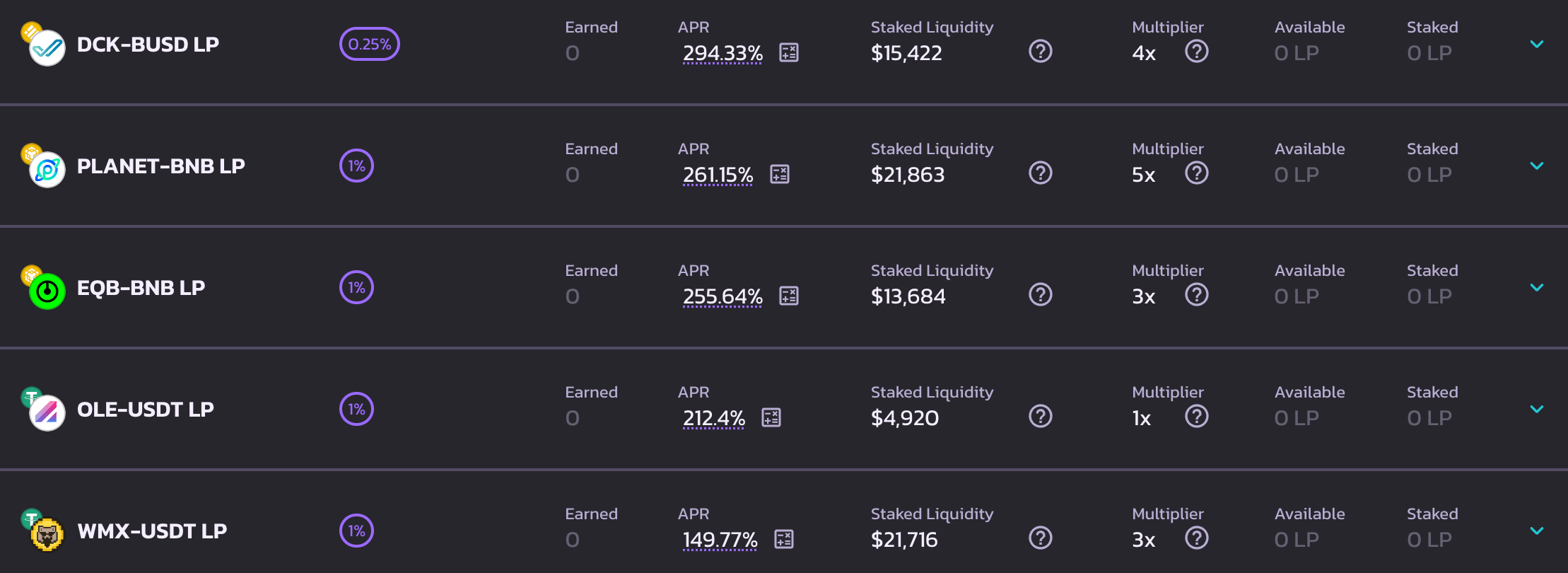

These rewards can be substantial, and they are often expressed as APR. The APR in liquidity mining comes from the trading fees generated by the liquidity pool, as well as additional rewards in the form of tokens that the platform may offer.

A sampling of yields that can be earned via PancakeSwap liquidity pools

Finally, let’s explore staking, a concept that comes into play in proof-of-stake (PoS) crypto networks. Staking involves participating in a PoS blockchain network by holding and ‘staking’ a cryptocurrency in a wallet to support operations like block validation, security, and governance. The protocol automatically rewards you for staking your tokens and helping secure the network. Therefore, the “staking APR” or APY comes from the rewards distributed directly by the protocol for participating in the network’s operations.

To sum up, crypto APR and APY yields come from various sources depending on the strategy you choose. Whether it’s lending, yield farming, or staking, each strategy carries its own set of risks and rewards. A firm understanding of these mechanisms can help crypto enthusiasts optimize their strategies and take advantage of the opportunities present in the DeFi landscape.

Using De.Fi to Find the Best APRs in Crypto

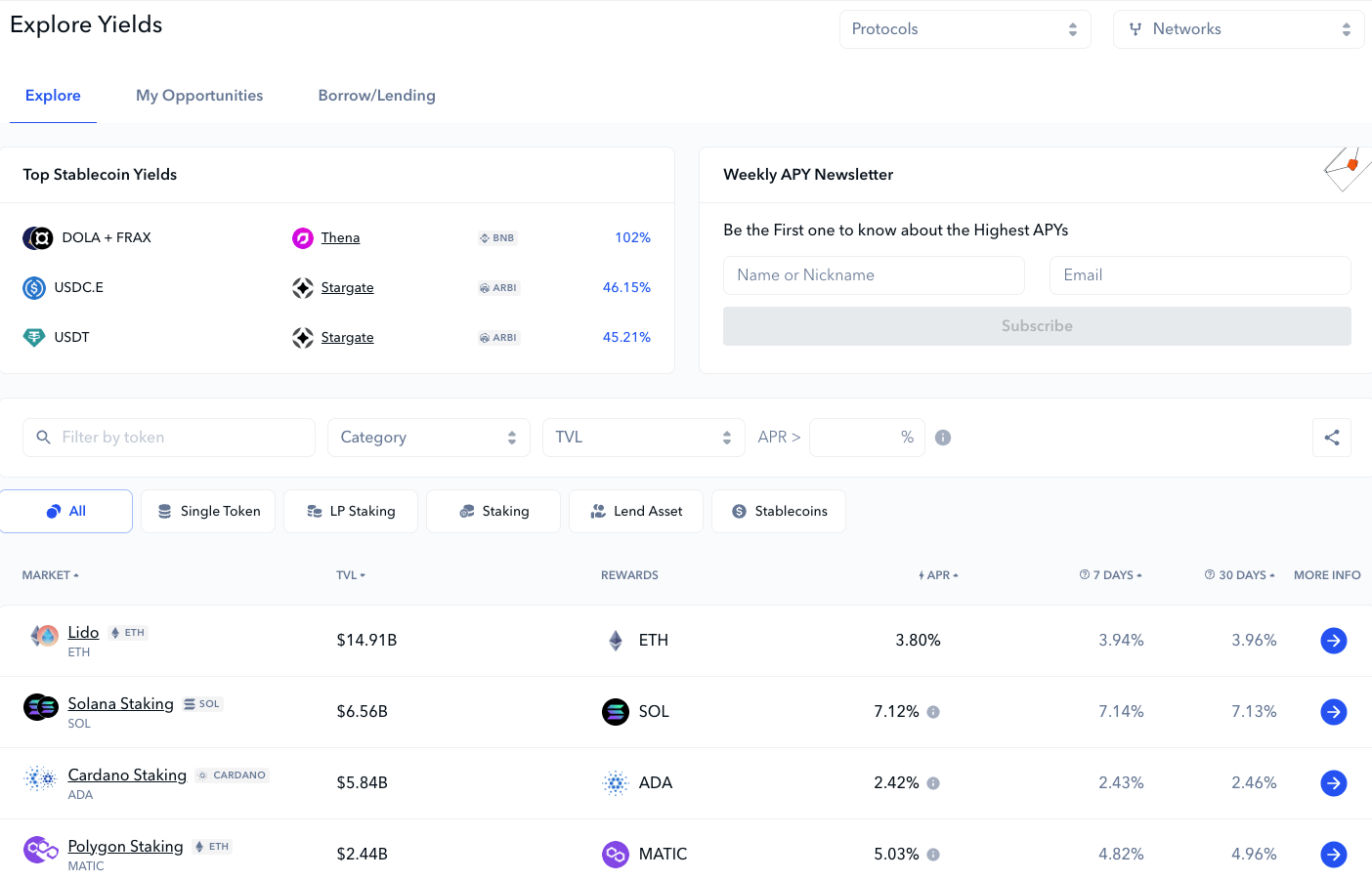

If you’re looking to maximize your returns in the decentralized finance (DeFi) landscape, De.Fi’s Explore Yields tool is an essential asset. This powerful tool helps you navigate the complex world of crypto APR and APY, allowing you to find the best yields in crypto with a few simple clicks.

The De.Fi Explore tool is your all-in-one yield farming database

At its core, the Explore Yields tool offers a comprehensive view of available yields across numerous platforms and protocols. But what makes it truly powerful is its robust filtering capabilities. You can filter results by chain, allowing you to focus on opportunities within specific blockchain ecosystems like Ethereum or BNB Smart Chain. You can also filter by the type of protocol, whether it’s lending, staking, or yield farming, and even by total value locked and minimum yield. This allows you to tailor your search to match your risk tolerance and return expectations.

For those who are looking for opportunities with specific tokens, the search functionality comes in handy. Just enter the token of your interest, and the tool will display all the available opportunities with that token. The Borrow/Lending tab is another unique feature, providing a consolidated view of lending and borrowing rates across different platforms.

Moreover, the category buttons let you filter the results to find specific assets that fall within those categories. This way, you can target your search to areas that align with your investment strategy, whether that’s stablecoins, utility tokens, or others.

The “My Opportunities” tab is a standout feature available when you use De.Fi as your DeFi portfolio tracker. It scans your portfolio and identifies yield opportunities based on your current holdings. This means it takes the guesswork out of searching and brings the opportunities directly to you, based on your unique portfolio.

Using De.Fi’s Explore Yields tool not only saves time and effort but also equips you with valuable insights to make informed decisions. It brings clarity to the intricate world of crypto APR and APY, empowering you to optimize your yields and gain a competitive edge in the rapidly evolving DeFi space.

Stay Safe While Yield Farming With De.Fi

To enhance your web3 safety and protect your digital assets when yield farming, De.Fi provides a range of valuable tools and resources. De.Fi offers comprehensive solutions to help users navigate the decentralized finance landscape securely, such as the De.Fi Scanner, a free, automated smart contract auditing tool, and De.Fi Shield, a convenient wallet revoke permissions tool.

By utilizing our tools and staying informed through their YouTube channel and website resources, investors can make informed decisions and avoid potential pitfalls. De.Fi equips users with the knowledge and insights needed to protect their funds, understand smart contracts, and stay updated on the latest security practices.