De.Fi Bundles, De.Fi AI Score, Scanner Advanced Tab & AI Agent and MORE! - June Development Recap

June was a month of big releases and improvements across...

As we have seen across multiple crypto cycles, investors and enthusiasts are always searching for better solutions to monitor the performance of their digital assets. Furthermore, they are also looking for complex solutions that let them monitor the crypto transactions and performance of wallets tied to prominent individuals, organizations, and governments. Arkham Intelligence, launched in June 2023, has become one such solution.

However, while Arkham Intelligence has proven to be reliable, many users request more flexible tools that can suit broader needs. In this article, we’ll cover the De.Fi suite of crypto tracking products. De.Fi is an excellent Arkham Intelligence alternative that offers extensive characteristics that some users may find more suited to their particular needs. Continue reading to learn why the De.Fi DeFi Dashboard could be the perfect tool for monitoring and optimizing your crypto portfolio.

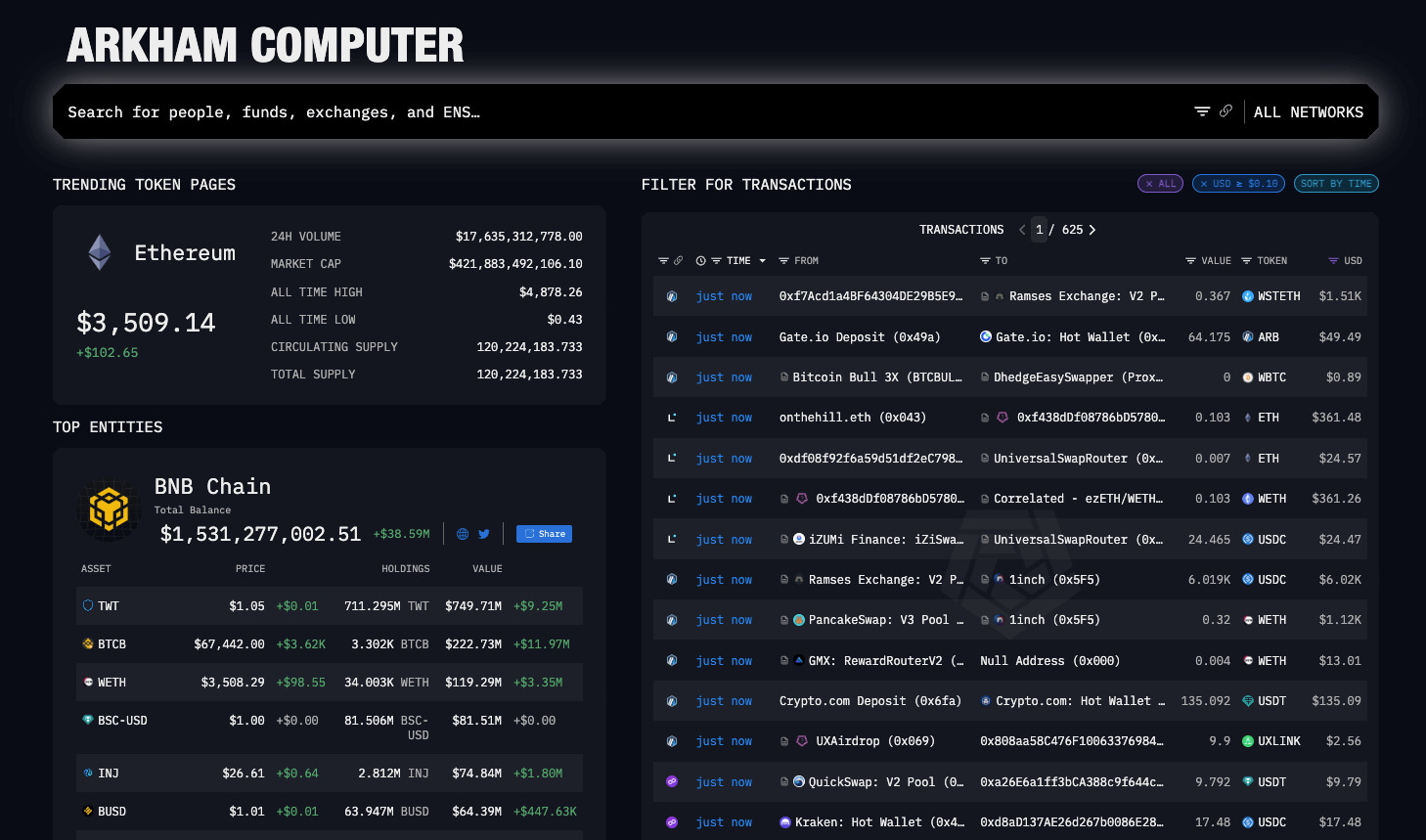

Arkham Intelligence is a blockchain analytics platform that provides detailed insights into the crypto markets by analyzing transaction data across multiple blockchains. The platform is designed to transform raw, complex blockchain data into refined, actionable insights, making it a powerful tool for investors, analysts, and enthusiasts looking to make informed decisions.

The Arkham Computer is an easy-to-read blockchain data interface

Arkham Intelligence offers unique features such as entity-based Intelligence, where data is organized around identities rather than mere transactions, and an Intel Exchange Marketplace, which facilitates the buying and selling of crypto intelligence.

On one hand, Arkham Intelligence has a strong reputation for its thorough analytics and support for numerous chains. Nonetheless, certain users wish for an Arkham Intelligence alternative because it relies on the ARKM token and has some aspects of centralization. For these users, De.Fi is a good choice as it can match the abilities of Arkham in terms of data richness and analytical depth while giving users a quick and streamlined data exploration experience. Let’s cover the characteristics that highlight De.Fi as an Arkham Intelligence competitor for tracking DeFi data and individual transaction movements.

De.Fi provides a wide feature set and characteristics that are suitable for the demanding requirements of today’s crypto investors. De.Fi is not just another portfolio tracker, but rather, the most comprehensive option when it comes to managing digital assets.

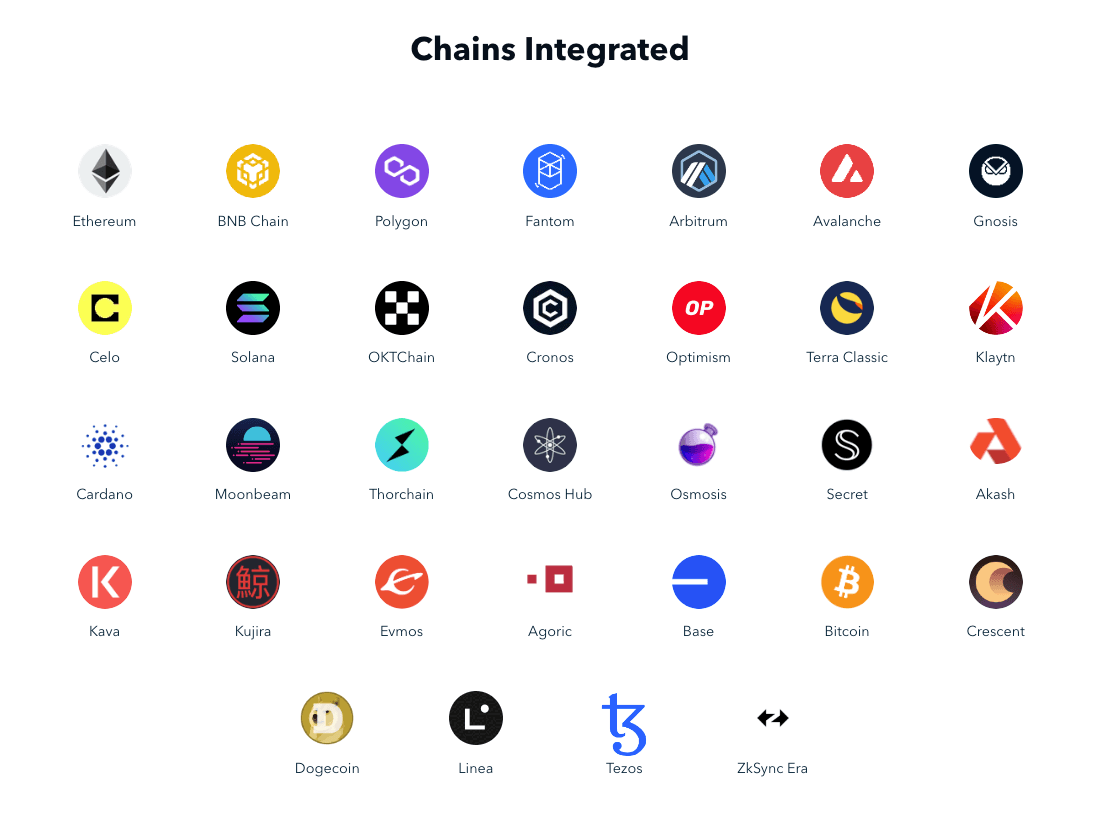

A special aspect of De.Fi that makes it a top Arkham Intelligence DeFi tracker alternative is its ability to monitor various chains and assets. It has broader coverage than Arkham does: De.Fi can track the largest number of blockchain networks among its peers, such as all major EVM-compatible chains and several non-EVM ones.

This wider range of tracking capabilities makes De.Fi more flexible than the Arkham Intelligence website since it covers many different types of blockchains where assets may be located, ensuring comprehensive tracking and analytics no matter what chain they are on.

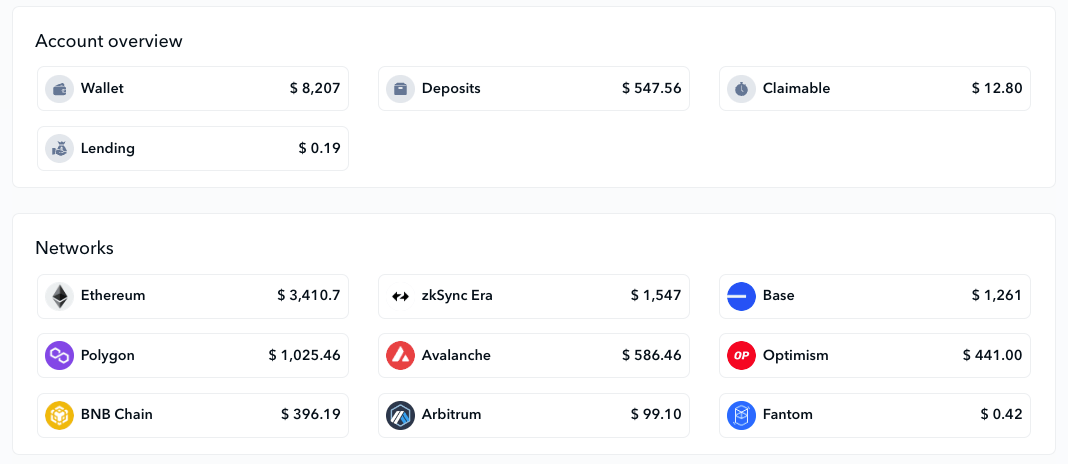

De.Fi’s Portfolio dashboard is a staple feature that allows users to manage their entire crypto portfolio in one place. It includes:

Everything you need to know, all at a glance

Moreover, the “Transactions” panel gives a detailed record of all your crypto transactions that can be sorted and searched; this way, users are enabled to track their activities for tax purposes or performance reviews.

One special feature of the De.Fi SuperApp which is often appreciated by veterans and crypto newbies alike is the Bundling feature.

With the bundling feature, users can combine several wallets into a single ‘bundle’; this feature is a godsend for people who have their portfolios split across many wallets and want to keep an eye on their investments across various platforms, regardless of whether they use a mix of DeFi and centralized platforms, or if they simply prefer to have multiple hot and cold wallets as part of their security protocols.

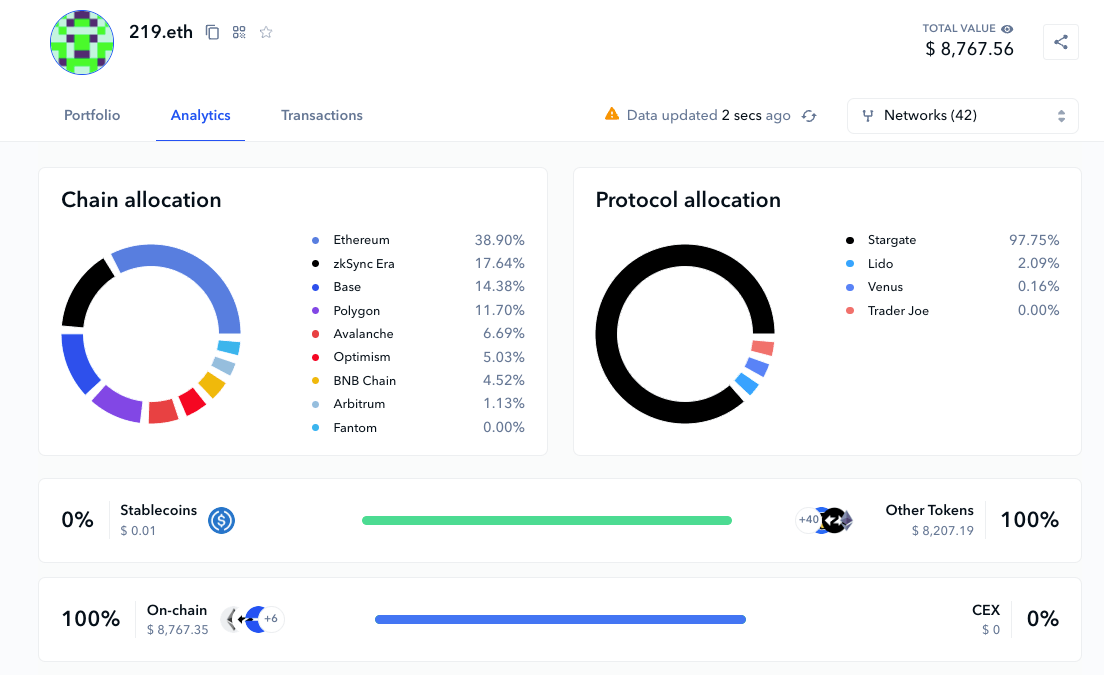

The De.Fi analytics tab is the unique free-to-use tool capable of breaking down on-chain data of over 20+ wallets simultaneously and categorizing it:

With analytics, you can supercharge your address bundles to organize data across chains, ecosystems, and protocols. Data can be measured in both percentage terms or USD.

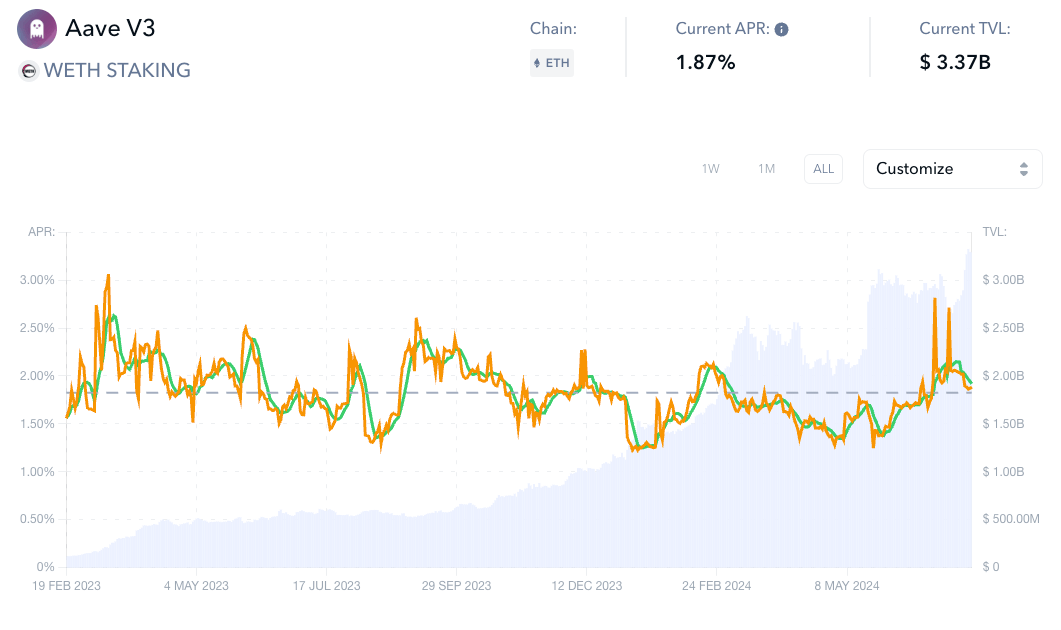

The Explore Yields section of De.Fi is one more area where it clearly separates itself from Arkham Intelligence. This tool is smoothly integrated within the De.Fi dashboard, letting users locate and identify yield farming and staking chances in many different DeFi platforms. It arranges opportunities according to different measures like asset allocation, TVL, or yields. This provides a personalized investment plan that assists users in optimizing their portfolios efficiently.

This section is not only about finding new opportunities; it also provides detailed analytics on each option, including historic yield on a 7-day and 30-day basis, helping users understand the sustainability of different yield strategies in the DeFi space; the comprehensive nature of this feature makes De.Fi an exceptional tool for both new and experienced users, ensuring that they can make informed decisions based on thorough, accessible data.

AAVE WETH staking yield data from De.Fi

If you decide to go with De.Fi as your preferred Arkham Intelligence competitor and portfolio management tool, you will find its multi-chain tracking, portfolio management features, bundling abilities, and yield exploration tools more advanced compared to other options in the blockchain analytics and portfolio management area. It doesn’t matter if you are highly involved in the crypto world or just starting your journey; De.Fi offers the necessary instruments for managing cryptocurrency investments safely and profitably.

The constant danger of scams in DeFi requires strong protective measures. With its advanced security functions, De.Fi faces these problems directly, making it an impressive Arkham Intelligence alternative for protecting user assets.

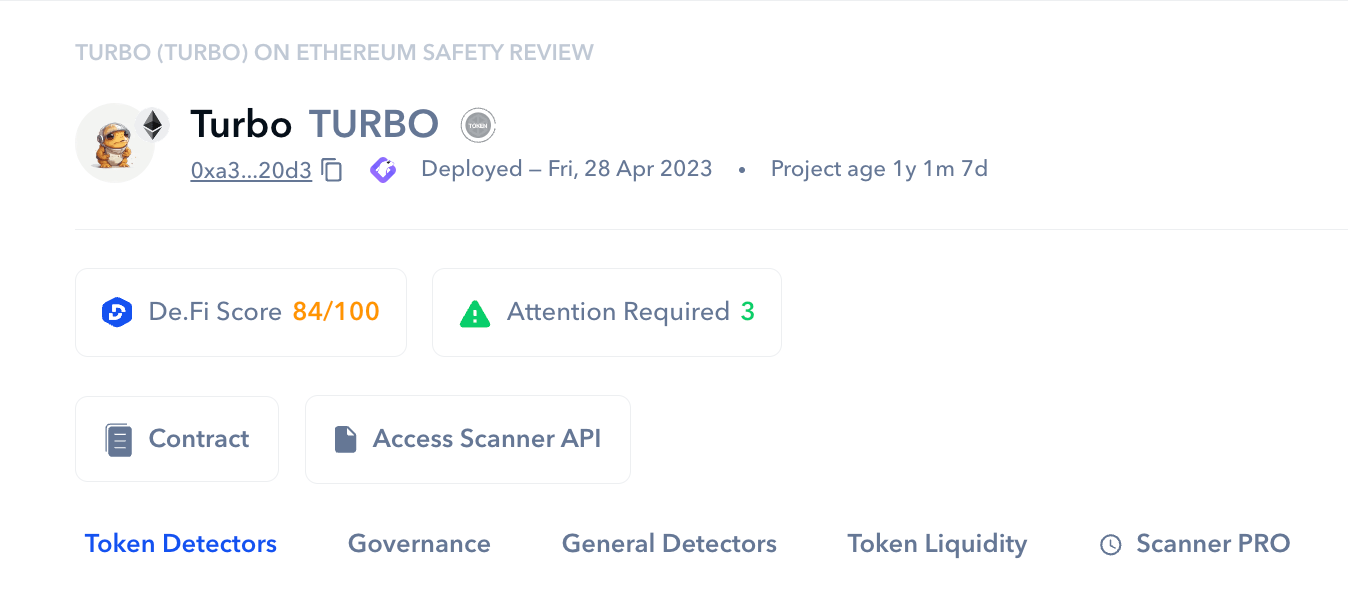

The Scanner allows users to audit smart contracts on a wide range of supported chains on their own – an action that was, until recently, only available to professional audit firms. Anyone can now enter a smart contract address in the scanner, and obtain a real-time security audit of the underlying contract.

De.Fi Scanner analysis for Turbo on Ethereum

Besides this, the scanner not only looks at smart contract code, but also evaluates other issues such as token liquidity, token governance, and dump risk, providing a more holistic view of any given token or contract; the Scanner is constantly being upgraded, with latest additions including the DeFi AI Score, which uses artificial intelligence algorithms to analyze on-chain activity associated with a contract, before scoring the contract on a range of qualitative factors like Sybil Activity, Organic Behavior and others.

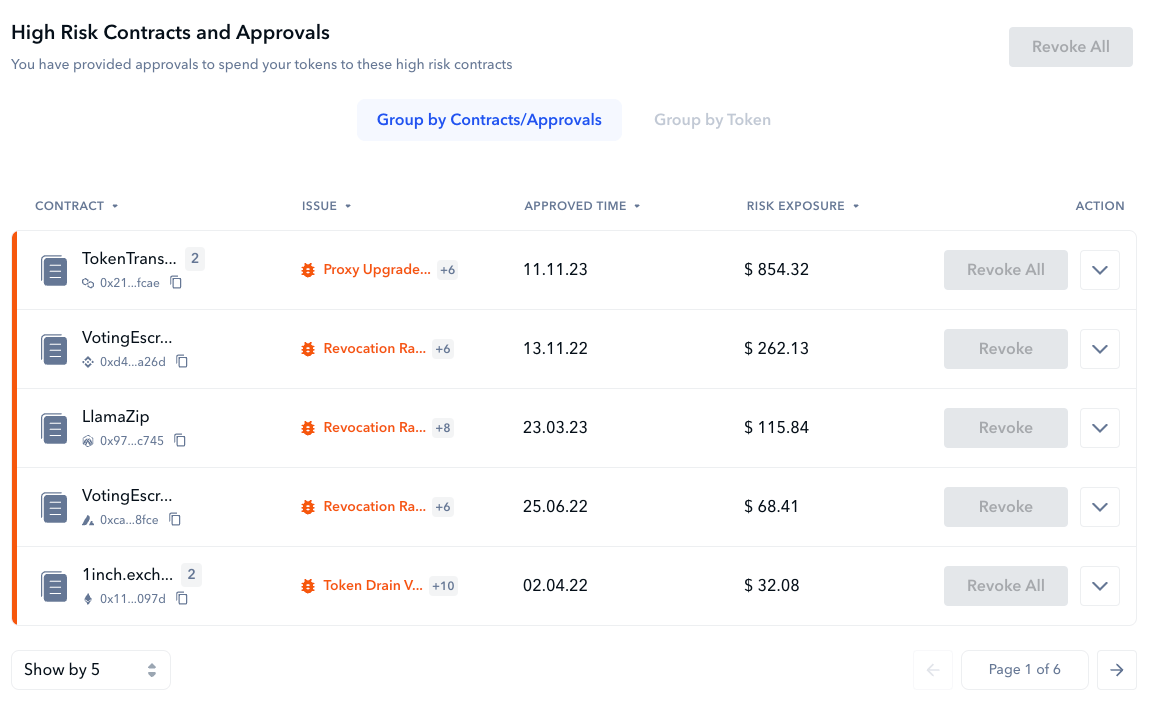

De.Fi Shield is a feature that allows users to do regular checks on their wallets to assess whether they may have been exposed to a risky contract while going about their day-to-day investing activities. Not only does the Shield provide users with information on potential threats, grouped by risk level, but it also conveniently allows them to revoke wallet permissions to these potentially malicious contracts in just one click.

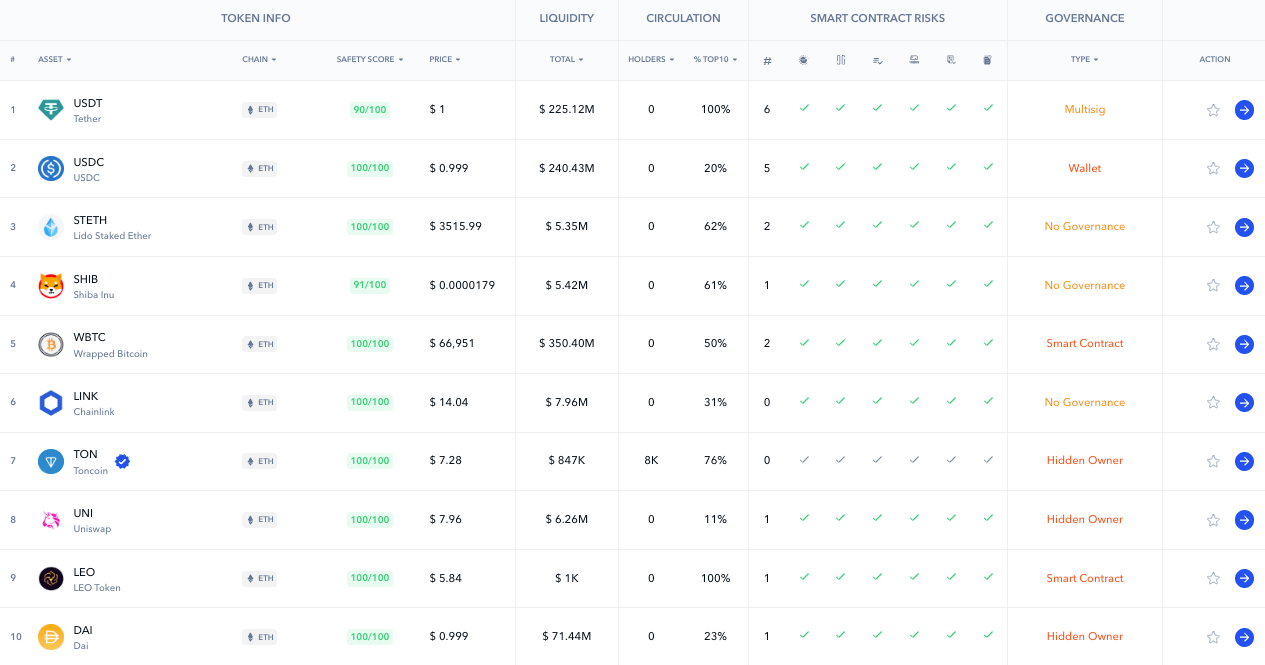

Along with the Antivirus component of Shield and Scanner, De.Fi’s Crypto Market page takes a security-first approach, with a feature that may be best understood as the CoinMarketCap of Security:

These pages show details about how secure different tokens are, together with their market information. This merging of safety knowledge along with financial details lets users choose wisely based on not only possible earnings from price gains but also considering risk factors linked to these tokens.

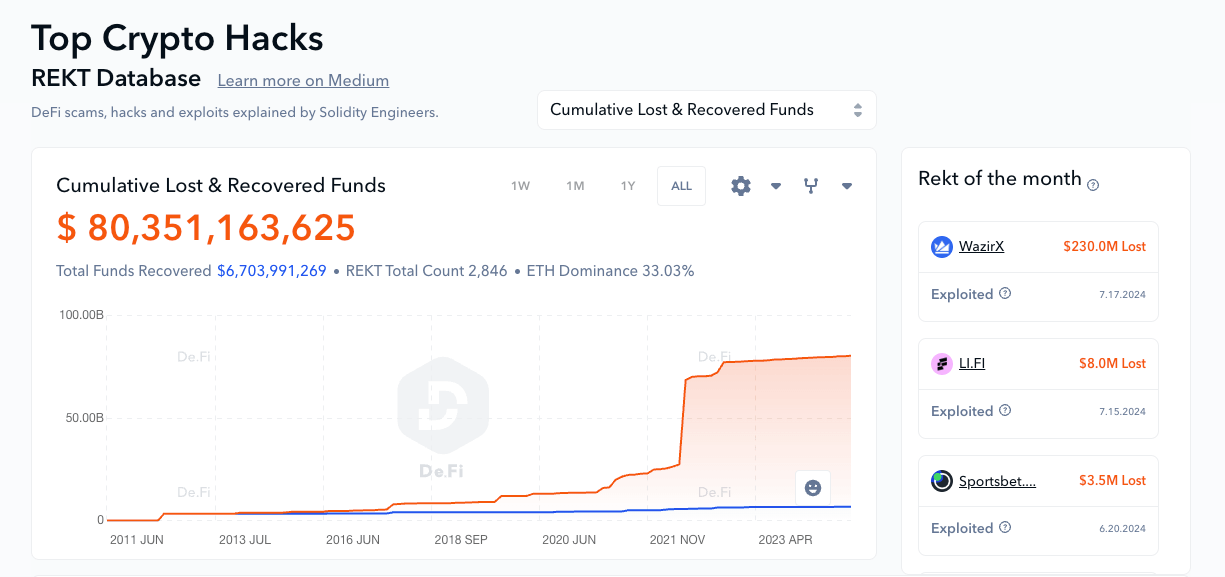

Staying informed and educated is perhaps the most important element to navigating the crypto market safely. De.Fi recognizes this need and offers a rich collection of educational resources. Central to these resources are the comprehensive Audit and REKT databases, which provide users with in-depth research and analysis of various DeFi projects and platforms. These databases are invaluable for assessing the safety and integrity of investments, serving as a public good that enhances the overall security of the crypto community.

De.Fi’s REKT Database has data on over $80B in security incidents

Beyond the app itself, De.Fi’s commitment to education extends to its digital presence on various media platforms. The De.Fi blog is a repository of knowledge, updated weekly with articles that cover a broad spectrum of topics from basic cryptocurrency concepts to educational articles about the hottest crypto narratives.

De.Fi also features active X feeds that provide continuous updates on DeFi and security news, @DeFi and @De_FiSecurity. Follow for the latest breaking news so you’ll never be caught off guard:

🚨~$230M CEX Exploit Alert🚨

— De.Fi Antivirus Web3 🛡️ (@De_FiSecurity) July 18, 2024

Reportedly, @WazirXIndia Exchange Multisig got compromised and lost $230M worth of assets on $ETH

The exploiter was funded via TornadoCash

Credits: @CyversAlerts pic.twitter.com/yRNlh8hapE

Embark on your DeFi journey with De.Fi today and take control of your digital assets with peace of mind. Being the best Arkham Intelligence alternative, De.Fi gives you an all-inclusive dashboard that comes with advanced tracking tools, detailed security characteristics, and wide-ranging educational aids. It doesn’t matter if you’re a skilled investor or new to the cryptocurrency universe, De.Fi has what it takes to handle, safeguard, and enhance your investments in one place.

June was a month of big releases and improvements across...

The end of May brought important updates across...

The start of May was filled with key updates and powerful...

The second half of April brought a lot of...

April started with innovation, milestones, and new...

March was a busy and impactful month for the De.Fi Ecosystem. We launched a ...

© De.Fi. All rights reserved.