$DEFI Trending, Business Insider Featuring $DEFI, Q4 2025 and Q1 2026 Developments and MORE! – October Development Update

October was a month of strong growth and ...

Hello, folks 👋🏻

Though Thanksgiving has passed, I still want to give my thanks to everyone in the community: I love to see your witty and knowledgeable discussions on the channel. With your audit suggestions, alerts and insights, we can make the farming community better together. Stay awesome.💪🏻

Now, let’s get to business. Last month I released my first monthly update, and you seem to take it very well, so that’s the format we’ll go for.

To be short, in November I kept working on developing the website and making it more useful, innovative, and stable.

I was:

Below, you will see a detailed report on what exactly I was working on. If you’d like to check previously conducted developments, I recommend you to visit October Updates.

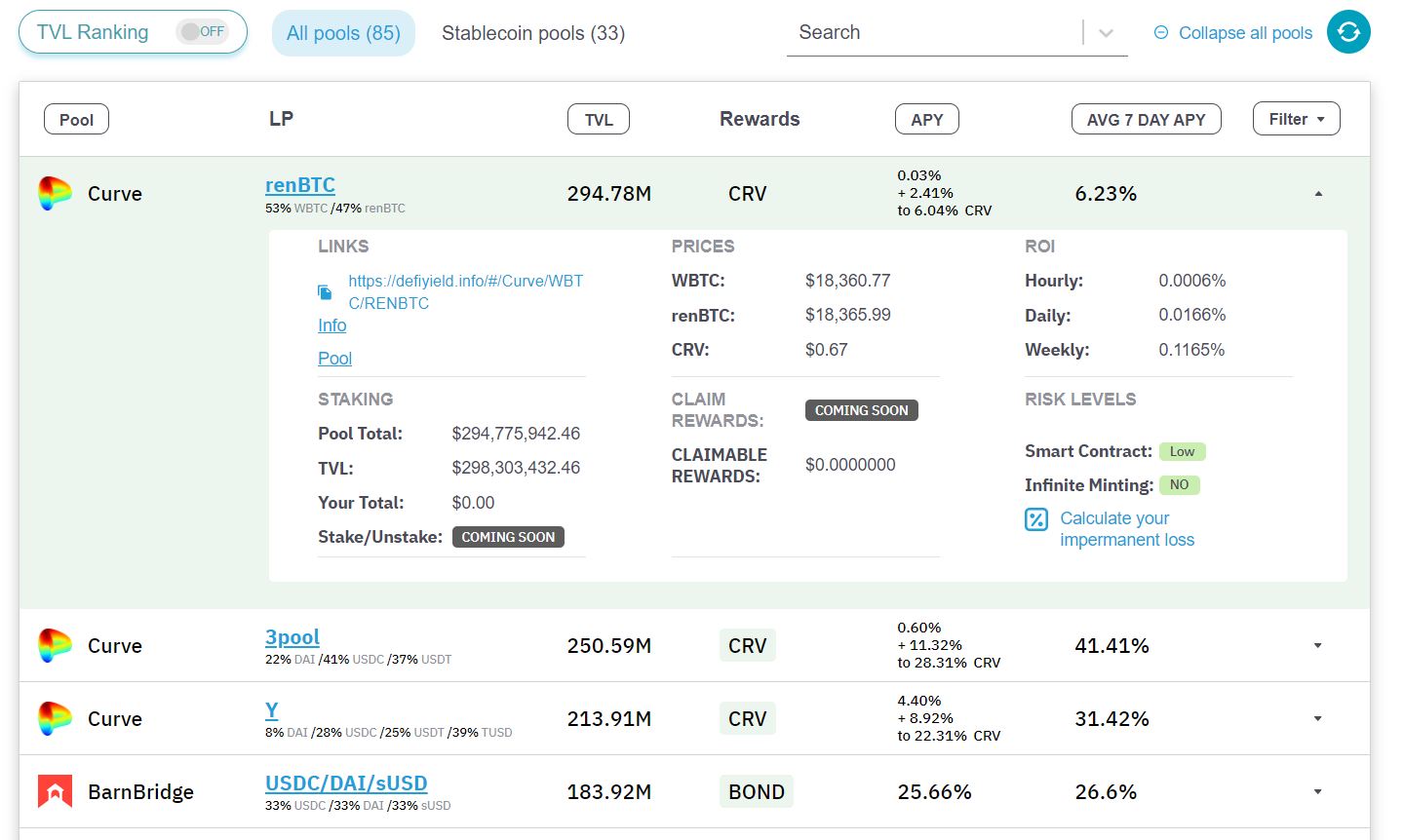

Over the last month, I integrated some new pools and vaults into De.Fi, so you can easily decide where to earn yield. For instance, you might be interested in the Curve Finance pools with 250–300M TVL. Follow this link to get more details.

Each pool and vault added to the website contains a lot of data, including:

My goal with this: to fetch as much data as possible, present it to you in the most suitable and intuitive way so that you could get into and enjoy farming.

I understand that good UI functionality is crucial: I do my best to offer information in the clearest and the most usable way possible.

Thus, I improved the interface of the Impermanent Loss Calculator, the home page and fixed numerous bugs for the mobile version.

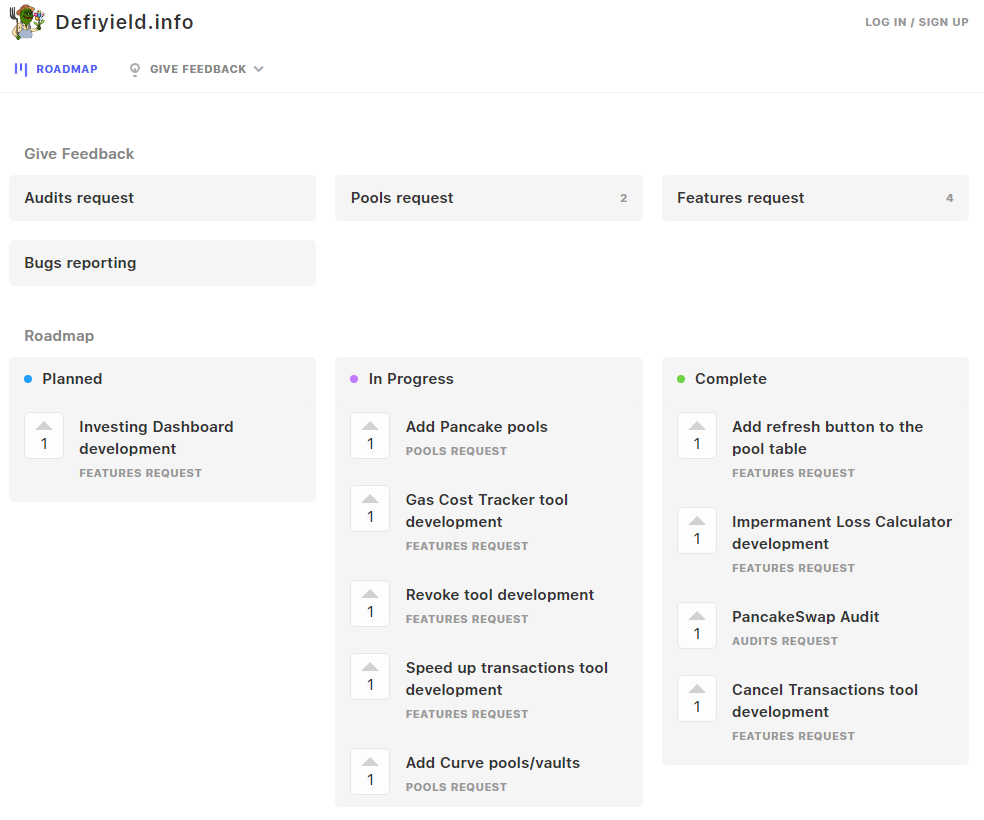

Moreover, I added a feedback page. Now there is a possibility for users to leave their requests on four given topics, such as audits, bugs, pools and the website features.

On the page added, everyone can also see the website roadmap, which allows tracking of the functionality improvements.

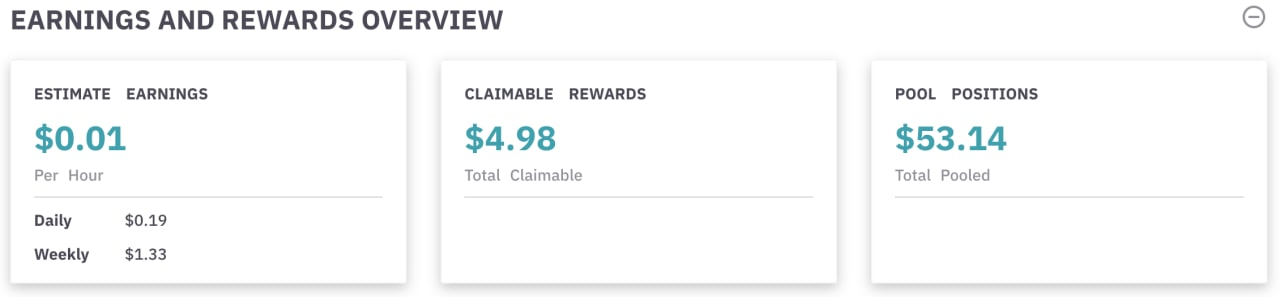

I know that you want to control every penny. That’s why I implemented the Earnings and Rewards Overview.

From now on, you can track weekly or daily earnings estimates, see how many claimable rewards are available, and control the state of your pool assets.

Every day DeFi Yield becomes a more useful tool, don’t you think? 🕶

New yield farming projects pop up every day. However, not all projects have good intentions. Unfortunately, some are designed to baffle the community, cheat the users and exit with pockets full of stolen money.

On the other hand, some projects seem to be safe and transparent at the first glance, but there is a lack of security audit or info regarding its code safety. What if there was a bug and an intruder would be able to withdraw the liquidity, or a team implemented poor functionality?

Indeed, there are too many risks (not to be overdramatic). This is why I conduct my own smart contract audits of different projects. I check how well they are designed and how transparent the code is. I think my mission is to alert the users if there is something to be concerned about — to the best of my ability, of course. I define the risk levels, outline the overall result in the analysis, and publish them on DeFi Yield.

This way I kill two birds with one stone — I inform the community and try to impact teams of the projects reviewed to improve their brainchildren by integrating new features or enhancing the security.

I described one of such situations in the How a Yield Farming Project Was Compelled to Fix Its Code article. Go take a look, if you haven’t already.

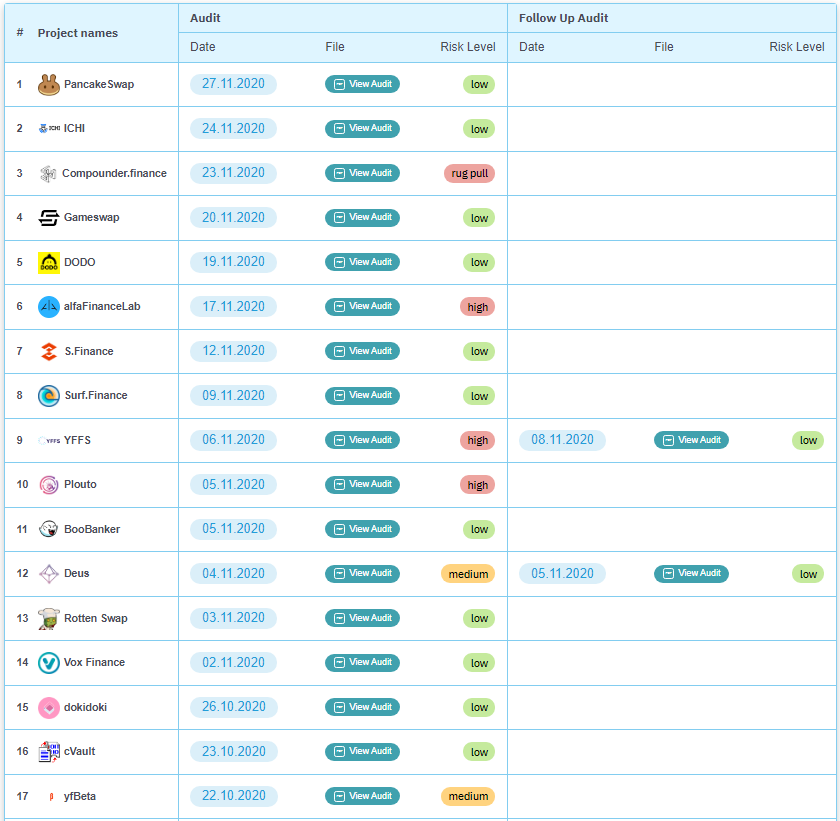

Anyways, here are all the audits that I executed and published in November:

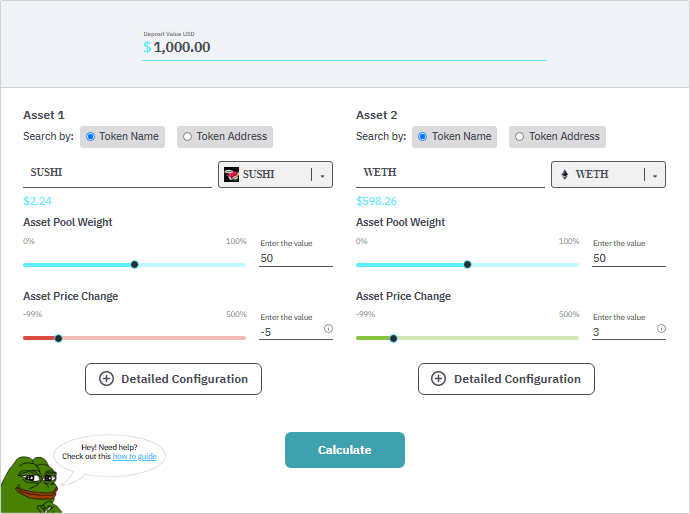

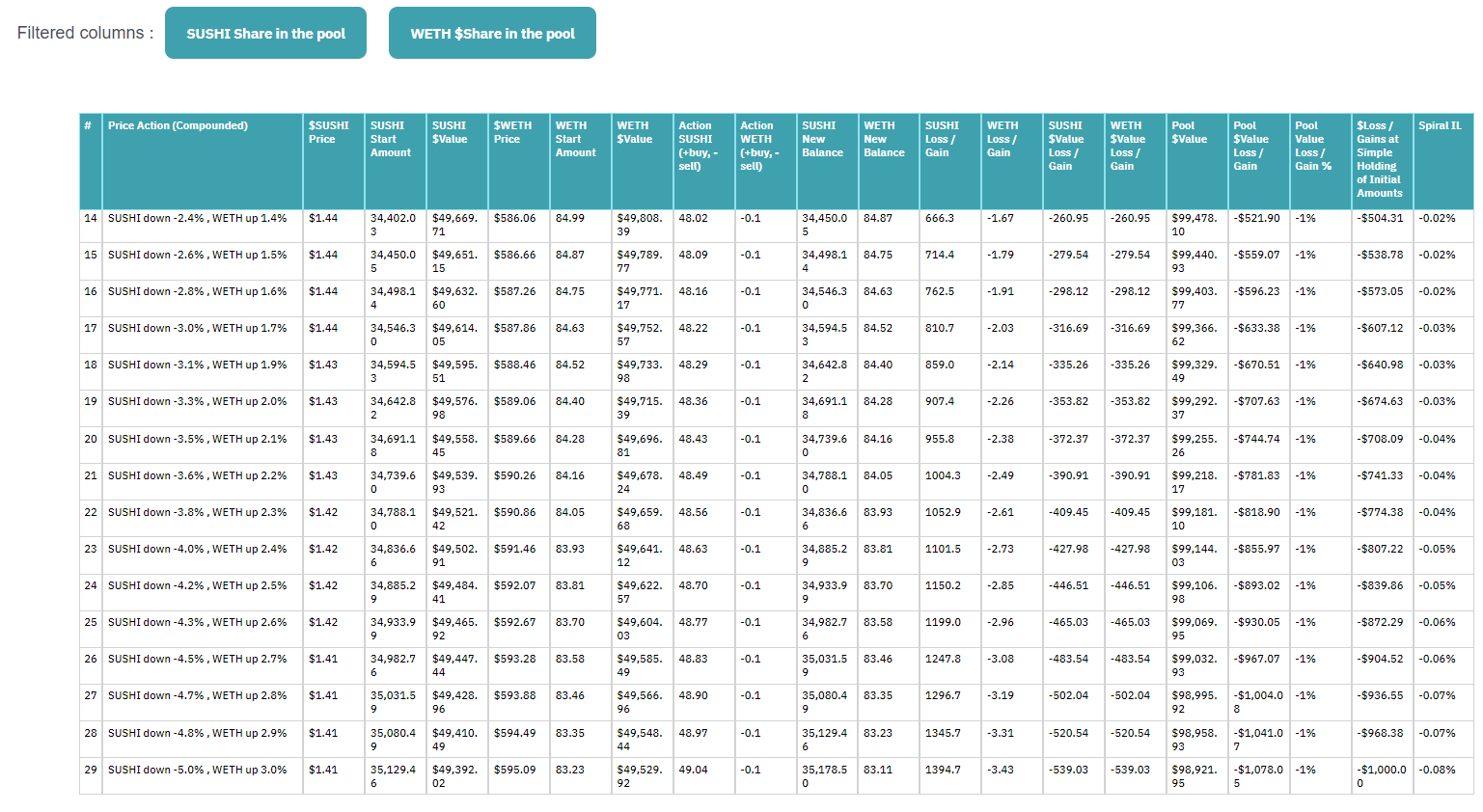

Essentially, the Impermanent Loss is both one of the primary risks and, at the same time, a phenomenon to be aware of for liquidity providers.

When doing research, I realized that neither of the available calculators suited my needs — or anybody’s for that matter. They led to false expectations, funds loss, or simply misinformation regarding the outcomes of the particular investment decision.

Consequently, it encouraged me to roll up my sleeves and design the most accurate Advanced ILC ever.

For this purpose, I developed a well-designed, user-friendly, accurate, and reliable tool for you to predict the impact of price swings on your revenue.

This gives you more data to rely on and make rational decisions.

One more crucial update is implementing the Historical stats for various pools and vaults.

A good idea is to investigate the TVL and its historical change before staking.

Or you just might be wondering how much ETH was locked in the particular pool three days ago 🤷🏼♀️ For this purpose, I suggest that you utilize the Historical stats pages.

Moreover, I also added detailed info about the projects and pinned links to their websites.

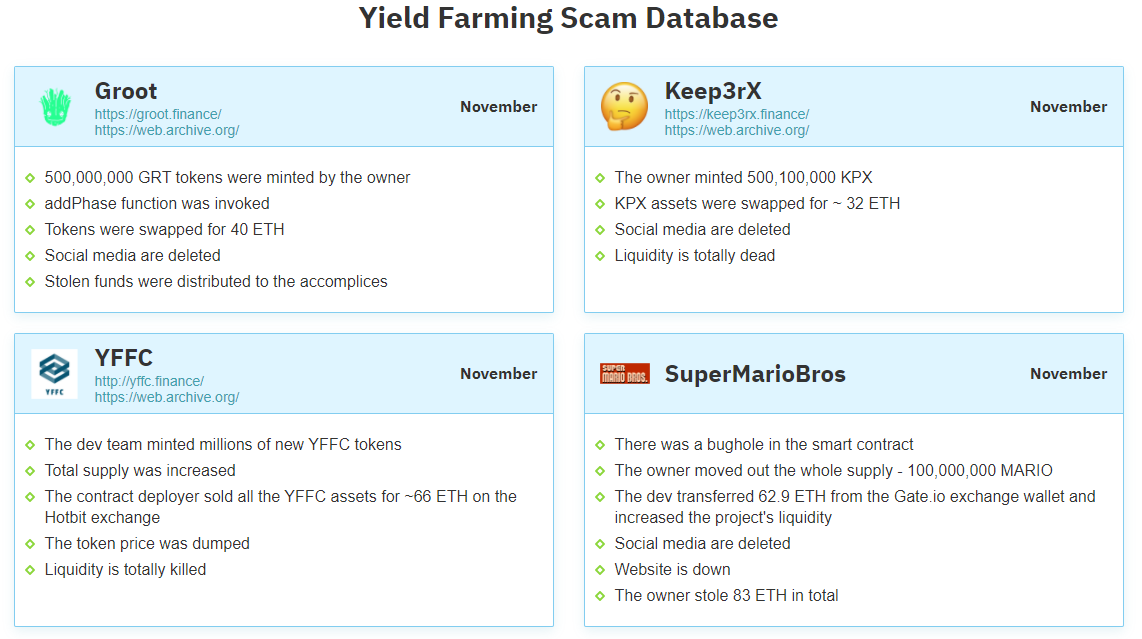

One of my goals is to make the DeFi environment safer and more attractive for investments.

Unfortunately, there are always scammers chasing easy money.

I decided to track such projects and designed the page called Scam Database where I listed all the fraudulent projects — for you to stay out of trouble.

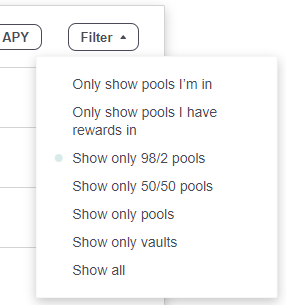

I improved the pools & vaults filter, added new options like Show only pools, Show only vaults, and got rid of the outdated ones.

It allows you to navigate De.Fi with more ease.

As you might know, data gets processed beyond the scenes — through the back-end. Tons of fixes and improvements took place in the back-end so you are presented only with accurate info.

I have a lot of ideas to be implemented soon. Last update you can find here.

I wish you a wonderful Advent season! Stay safe and have great returns!

See the previous De.Fi updates to stay in the know of the progress: https://de.fi-guides-news.medium.com/de.fi-info-october-20-updates-6558c78c1cce

If you’d like to be among the first to know about the updates, make sure to subscribe to the newsletter or follow me on socials.

Join the De.Fi Telegram channel

October was a month of strong growth and ...

September was a month of global...

August was a month of major...

From major Explore Yields upgrades to...

June was a month of big releases and improvements across...

The end of May brought important updates across...

© De.Fi. All rights reserved.