What is De.Fi Accelerator?

De.Fi Accelerator is an inclusive incubator connecting web3 projects with retail investors. It offers exclusive access for retail investors to join in the early-stage funding of web3 projects. Note: participation in De.Fi Accelerator is limited to DEFI token stakers.

Users need to stake DEFI tokens to accumulate points: these points determine their rank within the De.Fi Accelerator ecosystem. Points are determined by both the amount of DEFI token staked and the duration of staking lock. The higher the user’s rank, the greater the benefits unlocked.

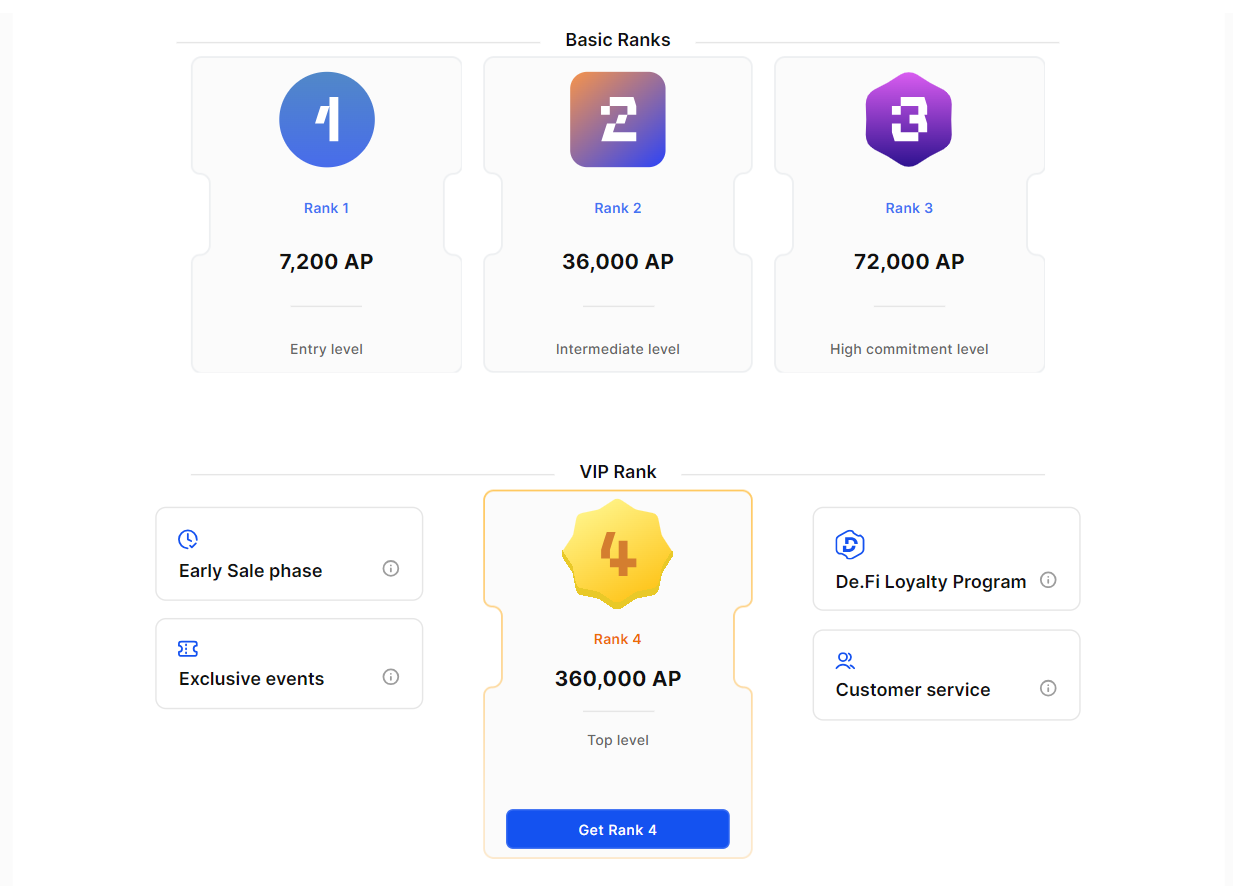

What are De.Fi Accelerator Ranks?

The De.Fi Accelerator is built on a Ranking system. By staking DEFI tokens, you accumulate points and ascend through 5 ranks, including a VIP rank. Higher ranks unlock exclusive opportunities within the De.Fi Accelerator ecosystem, such as access to exclusive raises, enhanced deal flow, priority queue placement, and more.

Staking DEFI tokens not only grants you up to 60% APR, but also gives you access to the exclusive deals of De.Fi Accelerator, where you can invest early in the most promising web3 projects, joining a limited circle of exclusive access.

You are welcome to acquire DEFI tokens through De.Fi Swap or from over 7 leading exchanges. Stake your DEFI conveniently on our Staking Platform.

In total, there are 5 De.Fi Accelerator Ranks:

Rank 0 (Can be enabled or disabled depending on a raise) – doesn’t require staking DEFI, however implies a low deposit limitation.

Rank 1 – 7,200 AP+ (Accelerator Points)

Rank 2 – 36,000 AP+

Rank 3 – 72,000 AP+

VIP Rank 4 – 360,000 AP+

Ranks 1-3 are similar except the allocation size they’ll allow you to buy in a raise: the higher Rank you got, the bigger allocation you’ll get in a raise.

Rank 4 is a VIP Rank that not only allows you buy the biggest allocation size of the raise, it also has numerous advantages beyond that: Early Sale phase, Exclusive events, De.Fi Loyalty Program & Prioritized Customer Service.

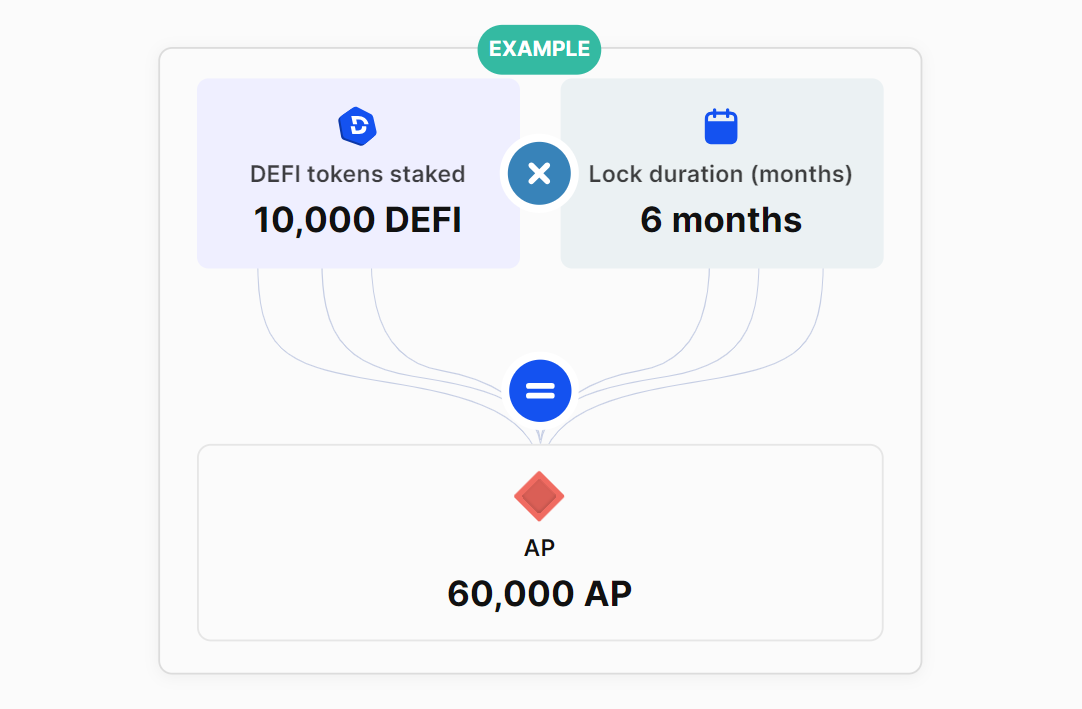

What are AP and how to get them?

AP or Accelerator Points are the points you get for staking your DEFI tokens. These points is what determines your Accelerator Rank (see image above).

Here’s the formula to calculate your AP:

[DEFI you stake] * [Lock duration (months)] = Your AP.

For example, if I stake 10,000 DEFI for 6 months, I will get 60,000 AP.

If I stake 5,000 DEFI for 4 years (48 months), I will get 240,000 AP. And so on.

Note: Superclaim & Stake positions also provide acceleration points, with a 0.5 multiplier. For example, if 5000 DEFI are superclaimed and staked for 12 months, they provide 30000 AP.

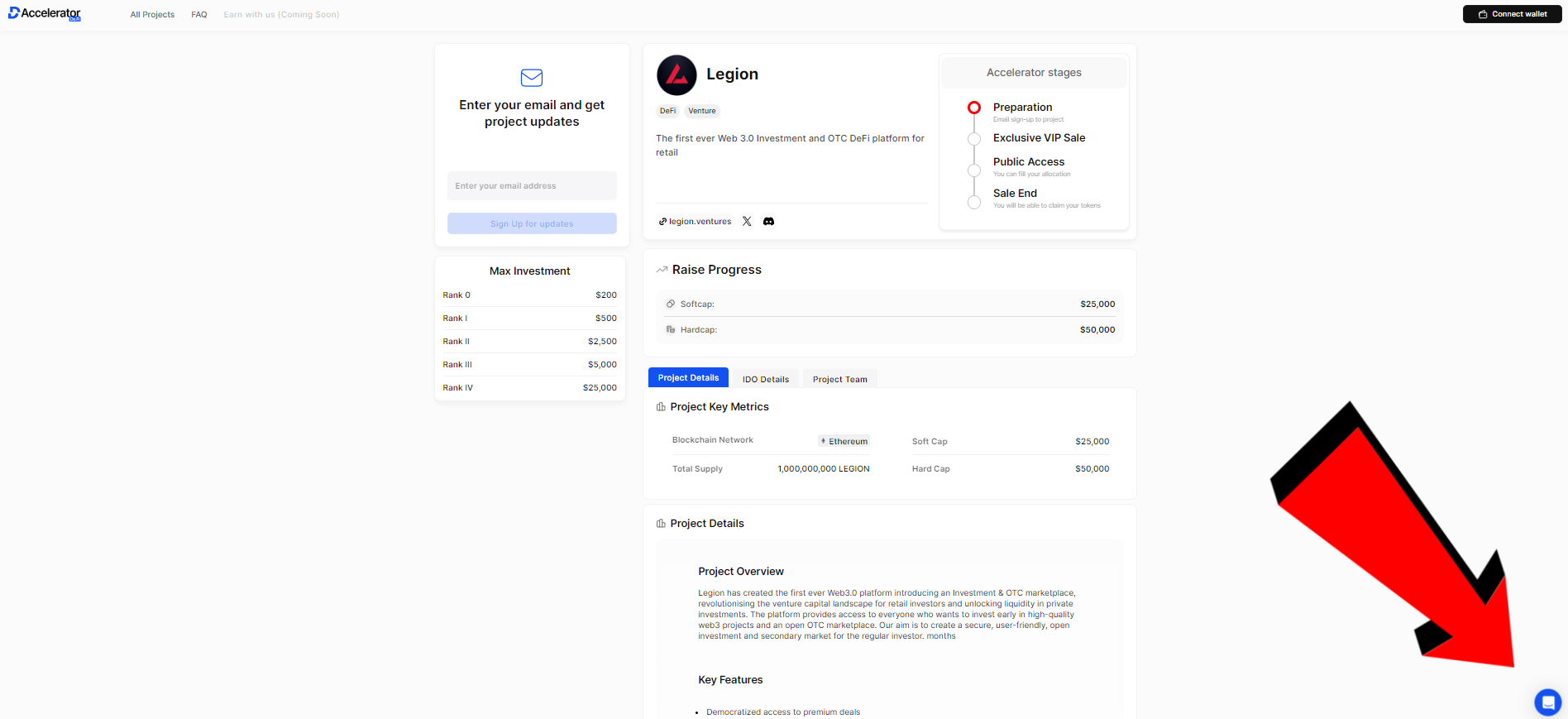

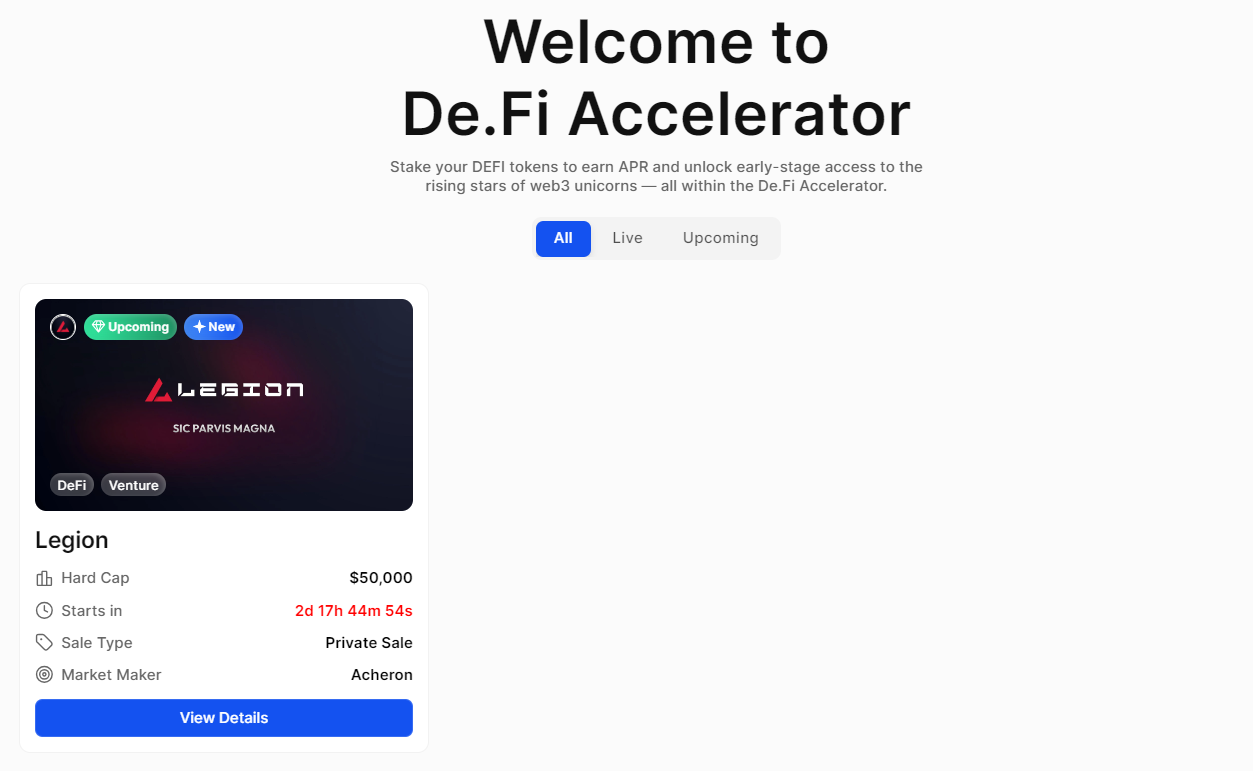

What is Legion Ventures?

Legion has created the first ever Web3.0 platform introducing an Investment & OTC marketplace, revolutionising the venture capital landscape for retail investors and unlocking liquidity in private investments. The platform provides access to everyone who wants to invest early in high-quality web3 projects and an open OTC marketplace. Our aim is to create a secure, user-friendly, open investment and secondary market for the regular investor.

Visit the sale page for more info about Legion Ventures, its tokenomics, vesting conditions, investors & more.

How to participate in the Legion Ventures Private Sale?

To participate in the Legion Ventures Private Sale hosted on De.Fi Accelerator, you need to:

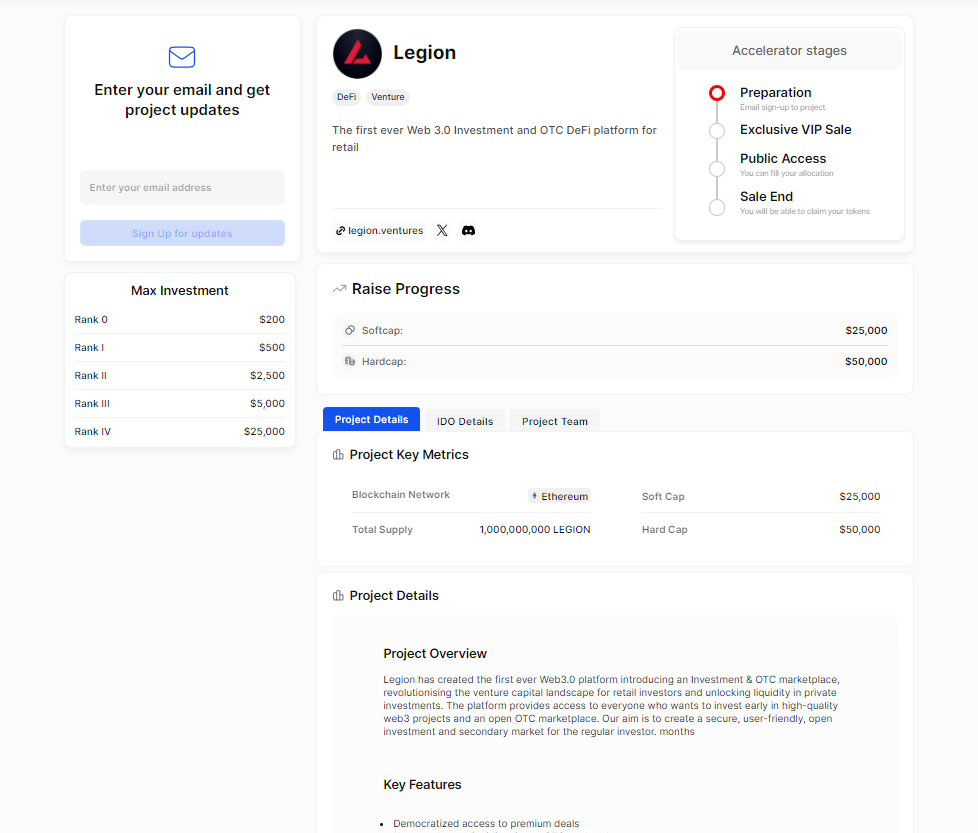

- Make sure you have at least Rank 1 by staking DEFI (You can participate with Rank 0 also but then your max allocation will be as low as $200)

- Navigate to Raise Page and familiarize yourself with project’s tokenomics & details

- Connect your wallet on a Raise Page & participate in a raise

Contact our Live Support for additional Questions

Got any questions left? Contact our 24/7 Live Support and they will assist you!