$DEFI Trending, Business Insider Featuring $DEFI, Q4 2025 and Q1 2026 Developments and MORE! – October Development Update

October was a month of strong growth and ...

February was filled with major updates, partnerships, and improvements across De.Fi. From significant buybacks to expanding $DEFI listings.

We continued to build a stronger ecosystem, expanding our reach, enhancing functionality, and delivering new features for the YOU, De.Fiers. Here’s everything that happened.

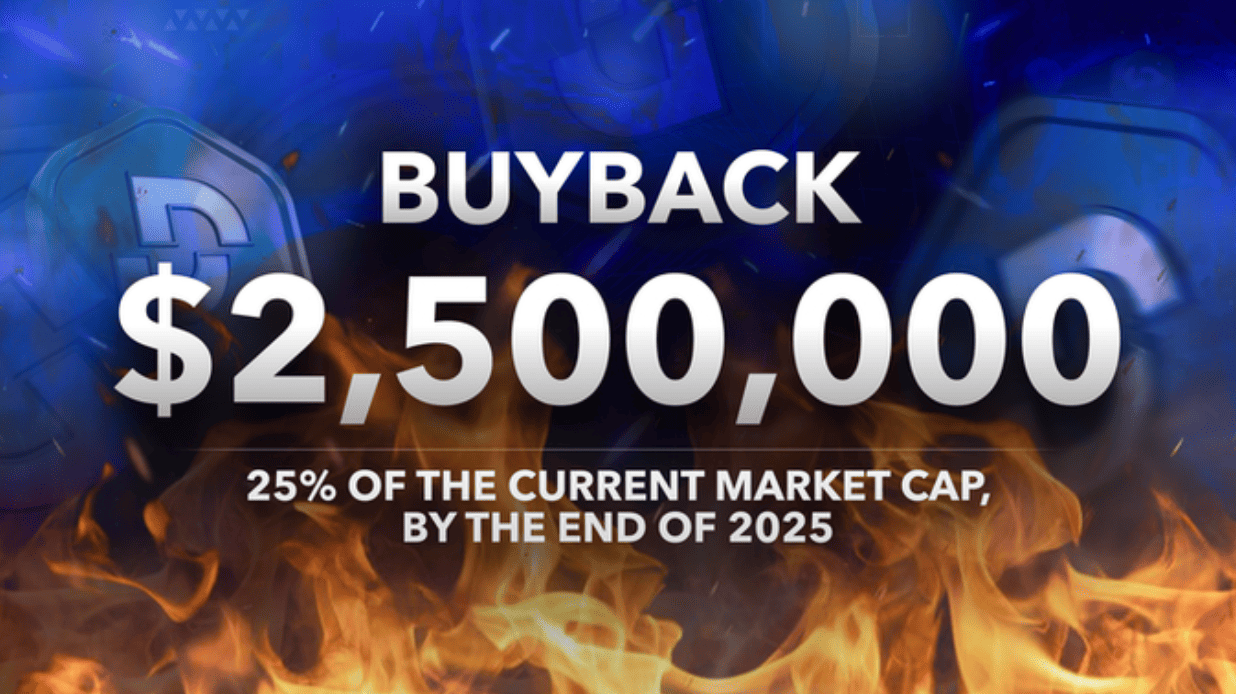

We started the year with a $1,000,000 buyback of $DEFI.

The positive feedback from the community led to an internal decision: by the end of 2025, we aim to buy back 25% of our current market cap ( $10 million ).

More buybacks are coming soon.

Our book, The Wall Street Era is Over, reached a major milestone, selling over 50,000 copies since its 2020 release.

To celebrate, we are running a giveaway where 10 lucky De.Fiers will receive gift boxes.

Join 👉 https://x.com/DeFi/status/1887214302840435159

$DEFI saw significant expansion in February, securing listings on 13 new CEXes, further increasing its reach and liquidity. This strategic move strengthens accessibility for a broader global audience, enhancing market depth and trading opportunities.

Among the newly added exchanges are:

Mercado Bitcoin, CoinW, Latoken, P2B, BIFinance, Biconomy, Tapbit, Weex, Azbit, BVOX, Dex-Trade, BTSE (New Chain Listing), and FameEX.

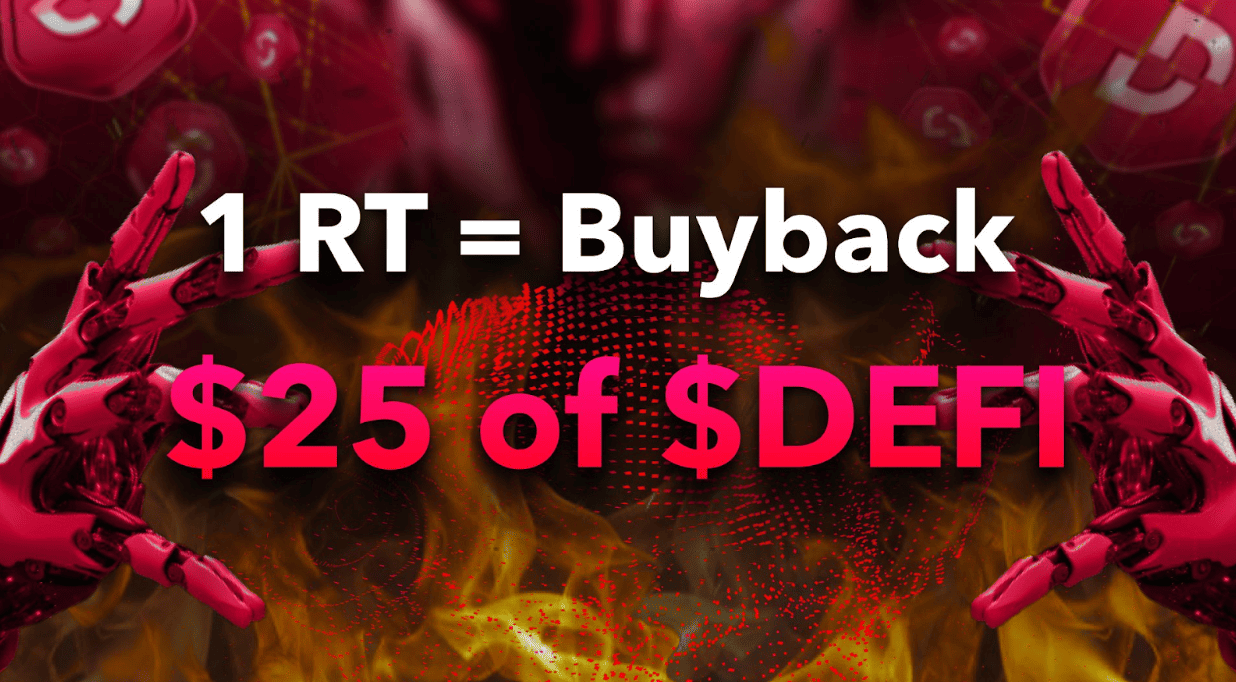

De.Fiers, you’ve hit 14,000 retweets – so we’re rounding it up to 15,000 and committing to a $375,000 buyback of $DEFI.

Stay tuned – it’s just the beginning.

The De.Fi Solana Security Scanner is now available on Telegram, bringing the full power of Web3 Antivirus directly to your pocket.

With this new integration, you can effortlessly scan for risks, verify smart contract security, and stay protected – all within a fast and intuitive Telegram bot.

Test it out here 👉 https://t.me/dedotfibot and keep your assets safe, De.Fier! 💙

We launched major trading contests:

$DEFI was officially listed on WhiteBIT, the largest regulated European exchange, marking another major milestone. This listing enhances accessibility for a broader global audience, increasing liquidity and strengthening $DEFI’s presence in the European market.

To celebrate, we launched an exclusive trading competition with a 300,000 $DEFI prize pool.

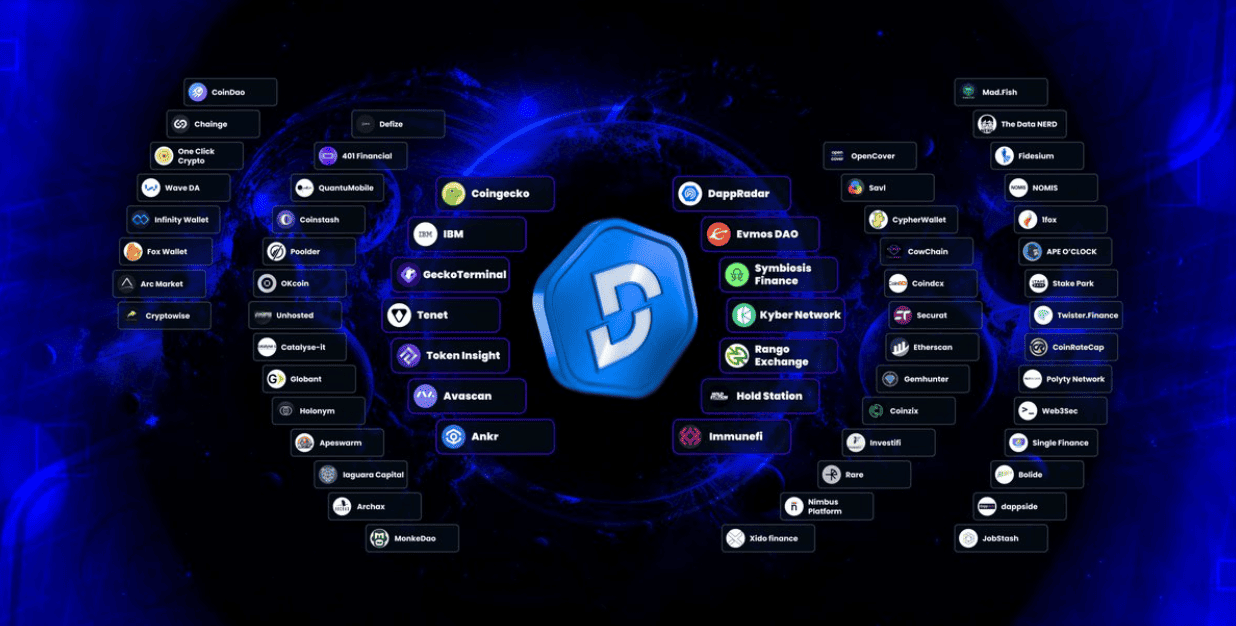

Our De.Fi API surpassed 1,000 integrations, powering IBM, CoinGecko, blockchain explorers, and Web3 wallets. By the end of the year, we aim to support 20% of all Web3 dApps.

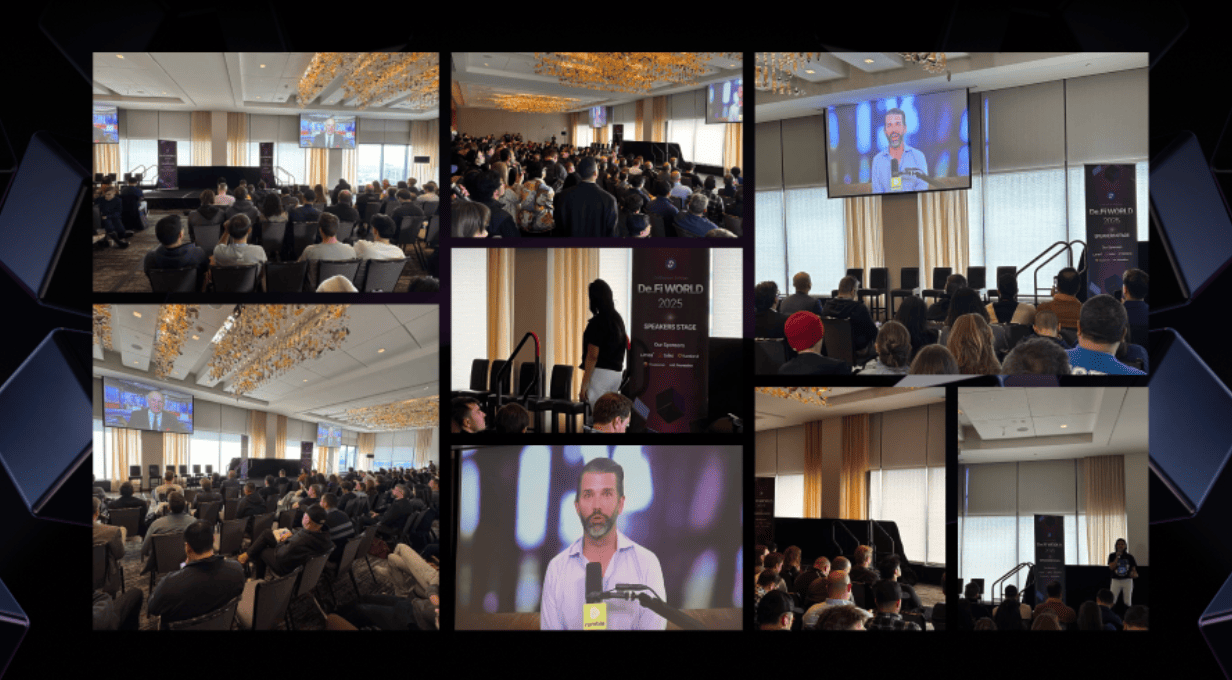

Donald Trump Jr. & Kevin O’Leary took the stage at De.Fi World 2025 on February 26th at the Grand Hyatt, Denver, USA.

They shared their insights on blockchain, finance, and regulations, discussing how emerging technologies are reshaping investment strategies and the global economy.

February was packed with growth, new integrations, and major milestones. With buybacks, listings, security upgrades, and API expansion, we’re getting ready for an even bigger year ahead.

Thank you, De.Fiers, for being part of this journey!

October was a month of strong growth and ...

September was a month of global...

August was a month of major...

From major Explore Yields upgrades to...

June was a month of big releases and improvements across...

The end of May brought important updates across...

© De.Fi. All rights reserved.