DeFi Rekt Report October 2025: $38.6 Million Lost Across 9 Exploits

October 2025 saw a total of $38.63 million lost across nine distinct security incidents in both centralized and decentralized platforms.

When diving into Ethereum’s ecosystem, understanding ERC-20 transfers is essential. The vast majority of tokens used within DeFi are ERC-20s, and the transfer function for these tokens is a bedrock mechanism that allows liquidity to flow properly.

This introduction serves as a guide to ERC-20 transfer mechanics and their limits. We’ll explore how to transfer ERC-20 tokens and the importance of understanding how the transfer function works within the specific coins you may be utilizing.

ERC-20 transfers are the process by which ERC-20 tokens are moved between accounts on the Ethereum network. There are two main functions involved in transferring ERC-20 tokens: the `transfer` function, which directly moves tokens between sender and recipient, and the `transferFrom` function, which allows a third party to send tokens on behalf of the token holder, given that prior approval has been granted.

Technically, an ERC-20 transfer is a fundamental operation within EVM networks, involving the movement of tokens that adhere to the ERC-20 standard from one address to another. This process is governed by the token contract’s `transfer` function, which is needed to properly designate changes in token ownership.

The function checks that the sender has a sufficient balance before debiting their account and crediting the recipient’s address. This transfer function is a critical component of the ERC-20 standard, enabling the decentralized exchange of tokens that power a significant part of the Ethereum ecosystem.

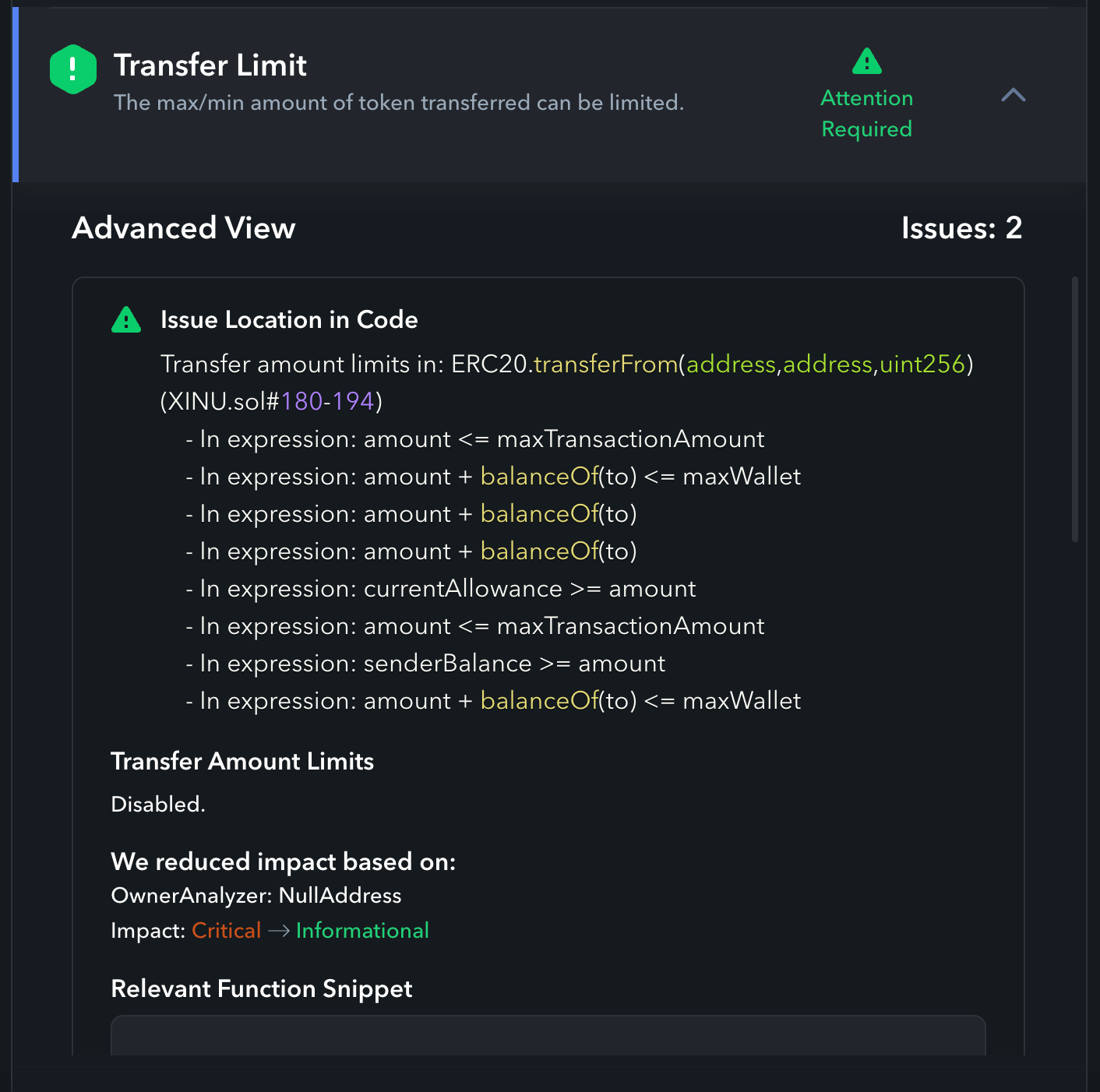

ERC-20 transfer limits are limits that can be put in place within a specific ERC-20 contract to manage transfer functions. They are typically put in place to ensure the safety and integrity of a dapp that relies on certain ERC-20s. These limits can be crucial in preventing the kinds of misuse that can occur if, for instance, an individual tries to transfer more tokens than they own, or if a smart contract tries to execute transactions at an unusually high volume or speed, which could be indicative of a malicious attack or an attempt to manipulate the market.

However, while these limits are meant to protect users and the network, they also present a vector for potential exploitation. Bad actors might seek ways to circumvent these safeguards, exploiting vulnerabilities within the smart contract’s code or the token’s transfer rules to conduct scams or execute hacks. They may also use limits to create ERC-20 tokens that limit owner abilities maliciously. A common example would be Honeypot contracts that prevent the sale of tokens entirely.

The De.Fi Scanner tool can be used to analyze tokens for transfer limits

As such, while the flexibility of the ERC-20 standard fosters innovation and versatility in the creation and distribution of tokens, it also necessitates rigorous security measures and constant vigilance against the ever-present threat of exploitation and manipulation.

De.Fi Scanner free smart contract auditor has become an indispensable tool for traders in the DeFi space, offering an automated approach to identifying risks associated with ERC-20 transfers and the potential for malicious contract behavior. By scrutinizing smart contracts, De.Fi Scanner can detect unusual or potentially harmful properties, such as exorbitant transfer fees or mechanisms that have led to massive token dumping in the past.

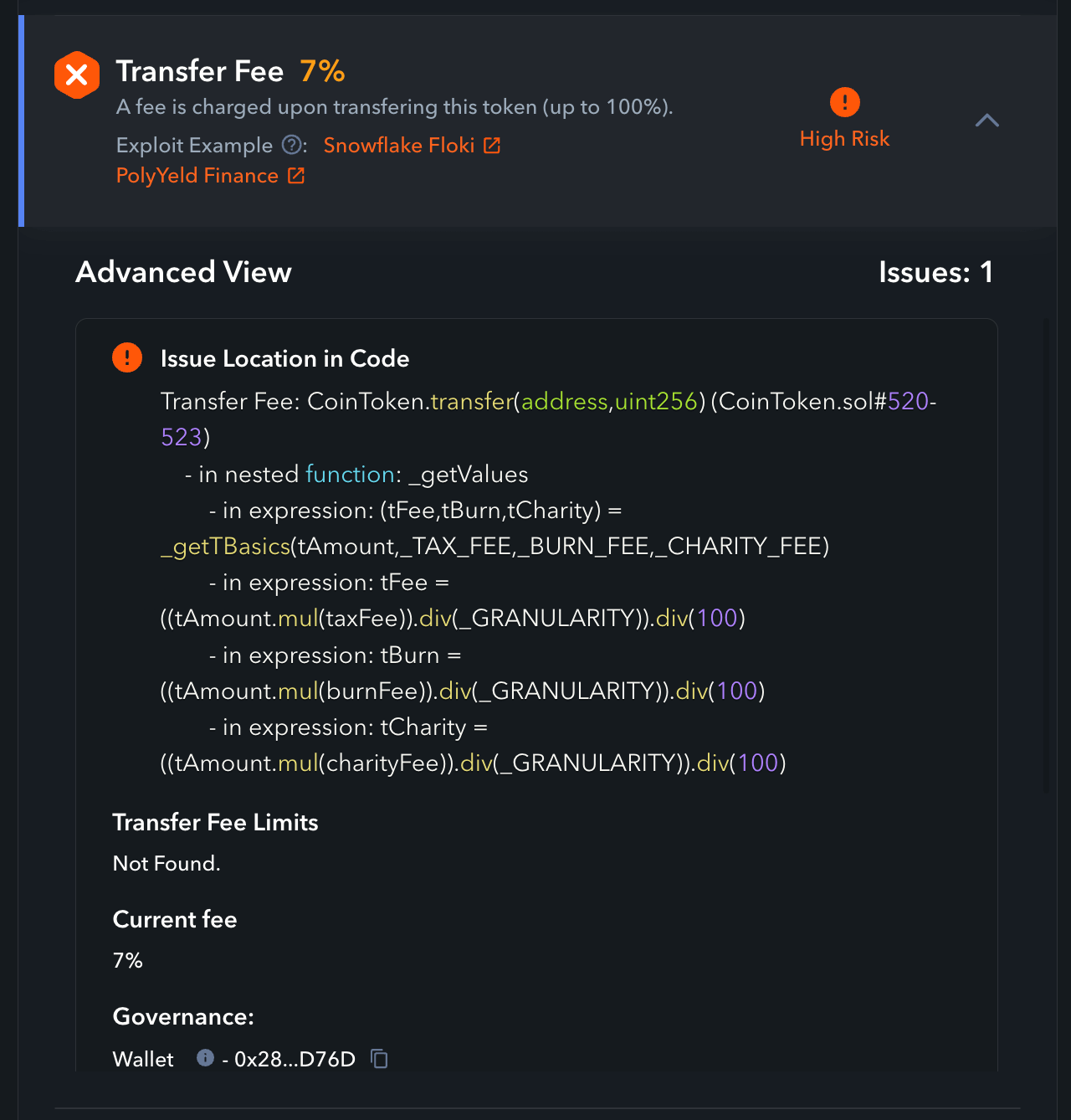

For example, a token with a transfer fee set to a permanent and high rate of 99% would be flagged by Scanner, as this could indicate a mechanism designed more for profit extraction than for fair user transactions.

The transfer fee is a pivotal aspect to scrutinize when assessing ERC-20 tokens, as it can significantly affect the token’s economics and user experience. Take, for instance, the case highlighted by De.Fi on the $COCO token on BNB Chain, where a token has an established transfer fee limit of 7%. This fee is deducted from the transfer amount and typically awarded to the token creators or a designated wallet, which can disincentivize transactions and reduce liquidity.

Fees like this erode trust in a token’s value proposition. When a significant portion of every transaction is siphoned off as a fee, users might deem the token as unviable for long-term investment or everyday use. A high transfer fee could be indicative of a rent-extraction scheme, where the developers or early adopters benefit disproportionately at the expense of regular users.

This structure can also be exploited by the token creators who, if they control a significant portion of the supply, can influence the token’s price by initiating sales that trigger fees and reduce the circulating supply, potentially leading to price manipulation.

Because of these risks, it’s crucial for De.Fi Scanner to alert users to such significant transfer fees, as they can pose a substantial risk to both the token’s utility and market performance. Prospective investors or users should consider these factors and the underlying intentions of the token’s creators before engaging with such ERC-20 tokens.

De.Fi Scanner is also enhanced by its integration with communication platforms like Telegram through the De.Fi Security Bot. This allows users to quickly scan any token, NFT, or vault and identify risks in a more accessible manner, fostering a safer trading environment. The bot can be a first line of defense, alerting traders to the presence of dubious contract clauses or transfer ERC-20 mechanisms that may not align with standard practices.

3/ 🔍 Scan any token and detect risks faster than ever, using our Telegram Security Bot: https://t.co/bWZwMe6fcV

— De.Fi Antivirus Web3 🛡️ (@De_FiSecurity) January 18, 2024

-I

By offering a detailed and user-friendly analysis of ERC-20 transfers, the tool highlights risky transfer limits and potential dangers lurking within smart contracts.

It serves as a vital component of the security infrastructure that supports the health and integrity of the DeFi ecosystem, ensuring that traders can stay informed and protect their investments from the wide array of risks present in this dynamic and often unpredictable market.

Navigating the web3 space requires robust security measures to ensure asset safety. The De.Fi DeFi portfolio tracker provides an array of tools designed for this very purpose.

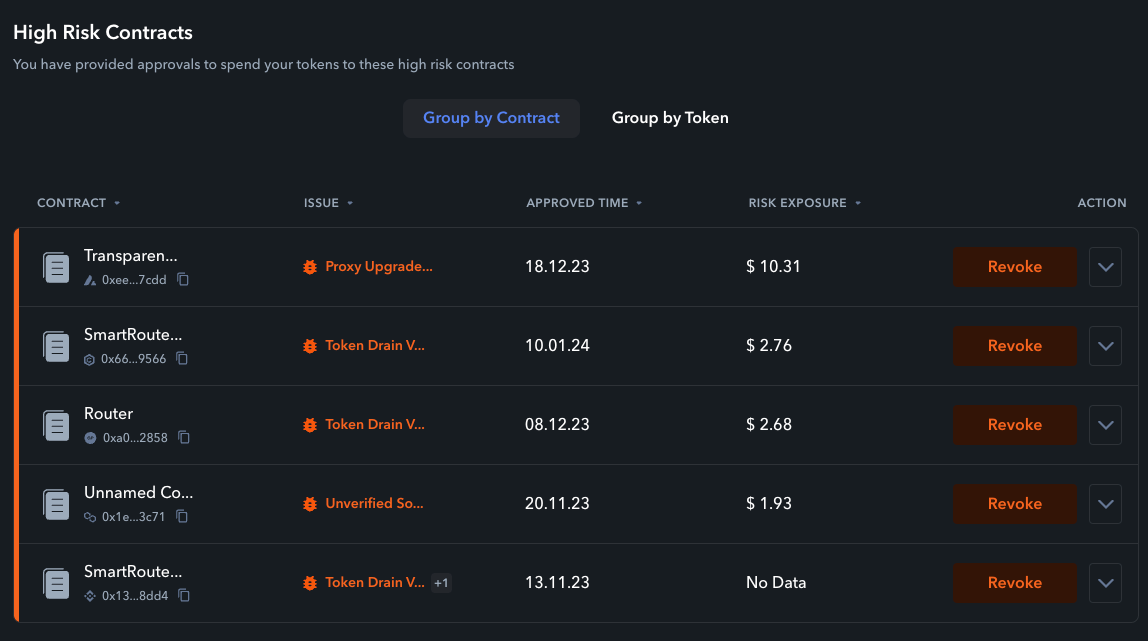

In addition to Scanner, we also offer De.Fi Shield which gives users fine-tuned control over token approvals across the most popular EVM blockchains including Ethereum, Polygon, BNB Chain, Arbitrum, Optimism, and more.

Use De.Fi Shield to scan and revoke approvals across 13 networks

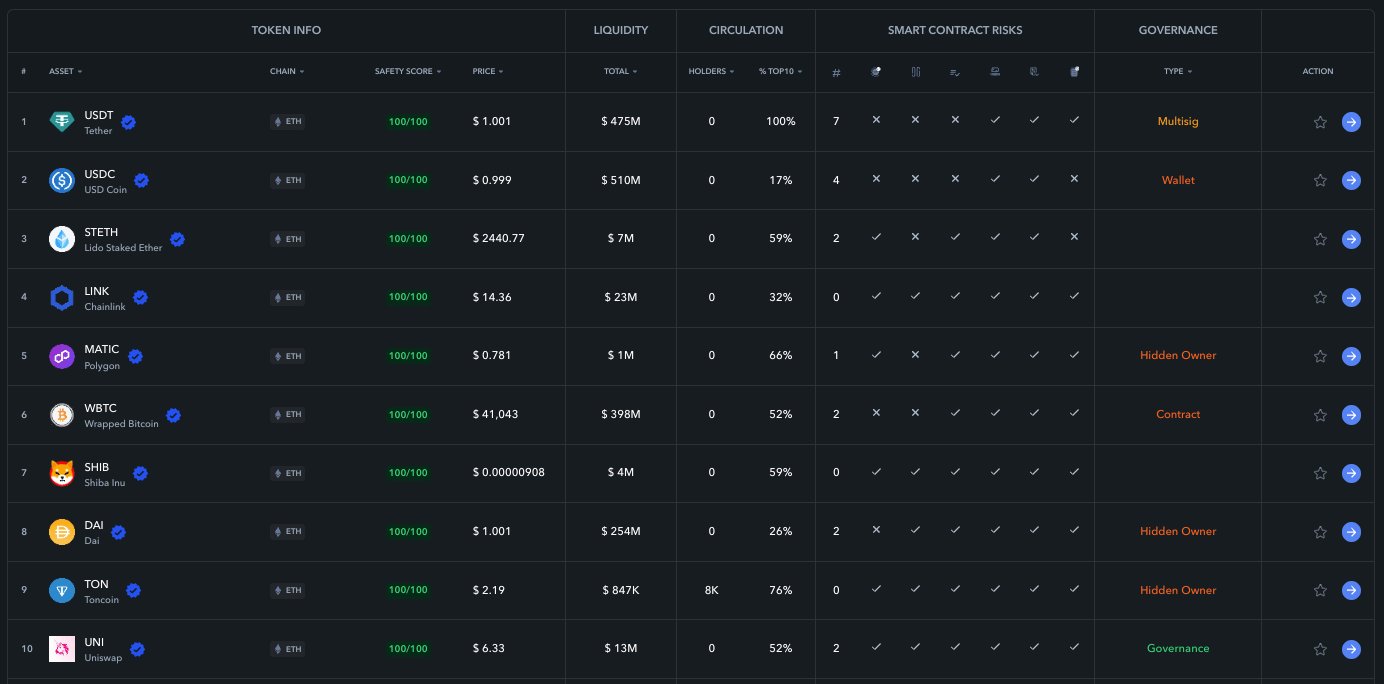

While granular tools like Shield and Scanner let you investigate contracts on a one-off basis, we also offer the industry’s first “CoinMarketCap of Security”. Use our security market dashboard to monitor vital information regarding the status of hundreds of tokens at a glance, comparing aspects such as Governance, Liquidity, and Smart Contract risks.

Visit our Crypto Market Security page to learn more

Users can also browse our REKT Database and Audit Database for some of the most thorough security resources in the industry that cover the entirety of DeFi’s history. By leveraging De.Fi’s dedicated security resources, along with educational content available via our X profiles (De.Fi and De.Fi Security), users can significantly lower the risk of adverse events — ensuring that they don’t get ‘REKT.’

October 2025 saw a total of $38.63 million lost across nine distinct security incidents in both centralized and decentralized platforms.

The third quarter of 2025 marked yet another turbulent period for the DeFi and wider crypto ecosystem, with $434,124,000 lost to exploits, scams, and security failures across both centralized and decentralized platforms.

June 2025 witnessed another alarming month for Web3 security, with a total of $114,768,000 lost during 11 separate attacks

May 2025 saw both DeFi and CeFi security once again under attack, with $275,953,000 lost across just 8 recorded incidents

April 2025 witnessed a large escalation in exploit volume and value, with a massive $5,919,684,000 being stolen in 10 confirmed events.

Q1 2025 marked one of the worst quarters in blockchain exploit history, with total recorded losses topping $2,052,584,700 across 37 incidents

© De.Fi. All rights reserved.