When engaging with decentralized finance (DeFi), investors often face the challenge of managing investments, tracking yields, and ensuring they keep all their assets safe. Indeed, identifying the best DeFi tools that cater to your investment and security needs can be a daunting task.

De.Fi is a comprehensive DeFi tool suite, offering a wide array of DeFi analytics and security tools to enhance your web3 experience, providing users with a robust platform for overseeing all their activities in one place. This article outlines the functionalities of De.Fi’s platform and how it aids users in navigating the complexities of DeFi.

De.Fi: The Best DeFi SuperApp

De.Fi Portfolio Tracker

The De.Fi Portfolio Tracker is a core feature in the suite of DeFi tools offered by De.Fi. Our app addresses the complexities and dynamic nature of managing assets across the decentralized finance spectrum. In a domain where asset diversification not only spans various tokens but also across multiple blockchains, the need for a comprehensive tool to consolidate and track these assets becomes indispensable. This is where the De.Fi Portfolio Tracker positions itself as an essential DeFi tool for both novice and veteran participants in the DeFi ecosystem.

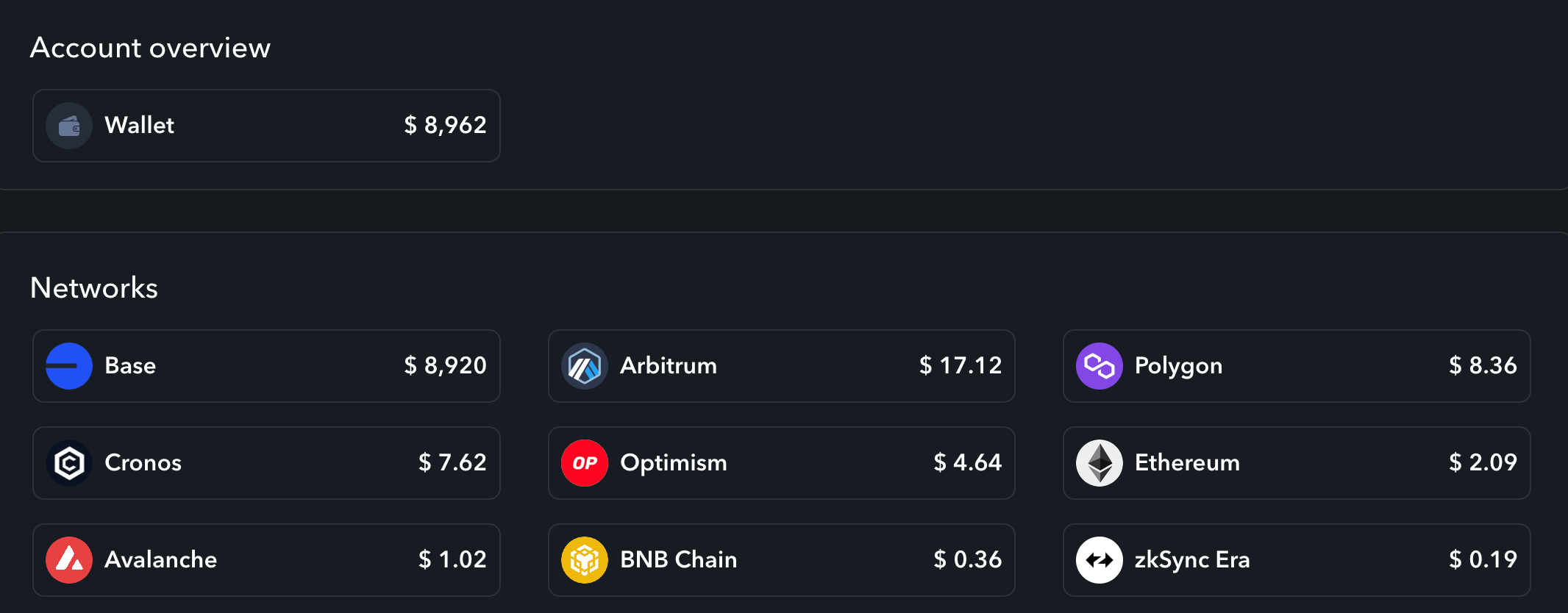

Account Overview

Account overview displays wallet balances across numerous chains

The account overview feature of the De.Fi Portfolio Tracker provides users with a bird’s eye view of their entire digital asset portfolio. It aggregates real-time data across a multitude of networks, offering a consolidated snapshot of a user’s holdings.

This includes an array of cryptocurrencies, tokens, and even non-fungible tokens (NFTs), across both Ethereum Virtual Machine (EVM) and non-EVM chains. The tracker’s ability to offer insights into such a broad spectrum of assets makes it the best DeFi tool for those looking to keep a finger on the pulse of their entire DeFi investment landscape.

List of Assets on Different Networks

One of the distinguishing features of the De.Fi Portfolio Tracker is its support for a wide array of networks, including but not limited to Ethereum, Arbitrum, Solana, and Polygon. This comprehensive network support ensures users can track their assets regardless of where they are held.

The tool’s design acknowledges the fragmented nature of the current DeFi ecosystem and bridges the gap by allowing users to view assets across different chains in one unified interface. This feature not only enhances the usability of the DeFi tools crypto investors use but also elevates the user experience by simplifying asset management.

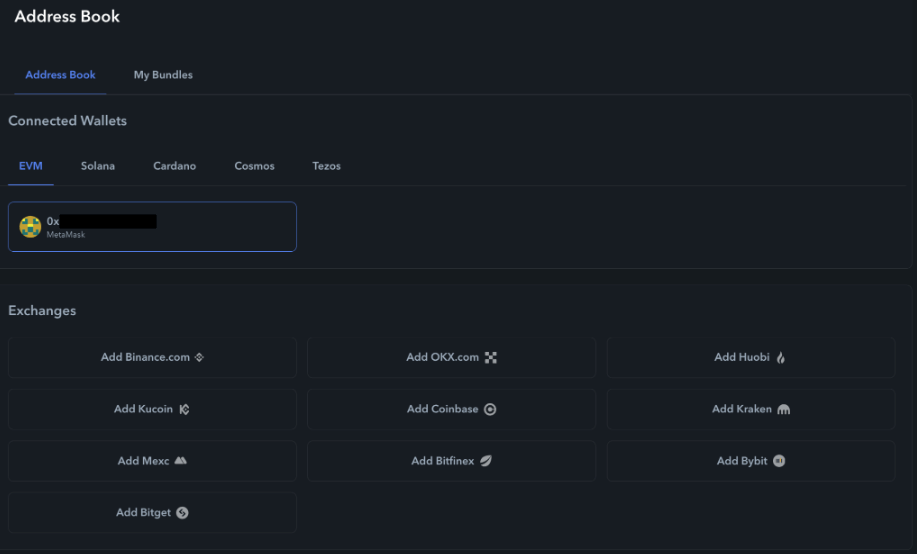

Ability to Create Address Bundles

Address book interface within the De.Fi portfolio tracker

A unique capability within the De.Fi Portfolio Tracker is the creation of address bundles. This feature allows users to group multiple addresses and view their collective assets as a single portfolio. This is particularly beneficial for users who manage multiple wallets or engage in yield farming across different protocols. Users can even monitor data from connected centralized exchange accounts.

By consolidating these addresses, users gain a holistic view of their investments, enhancing their ability to make informed decisions based on comprehensive data. This functionality underscores De.Fi’s position as the best DeFi tool for strategic asset management.

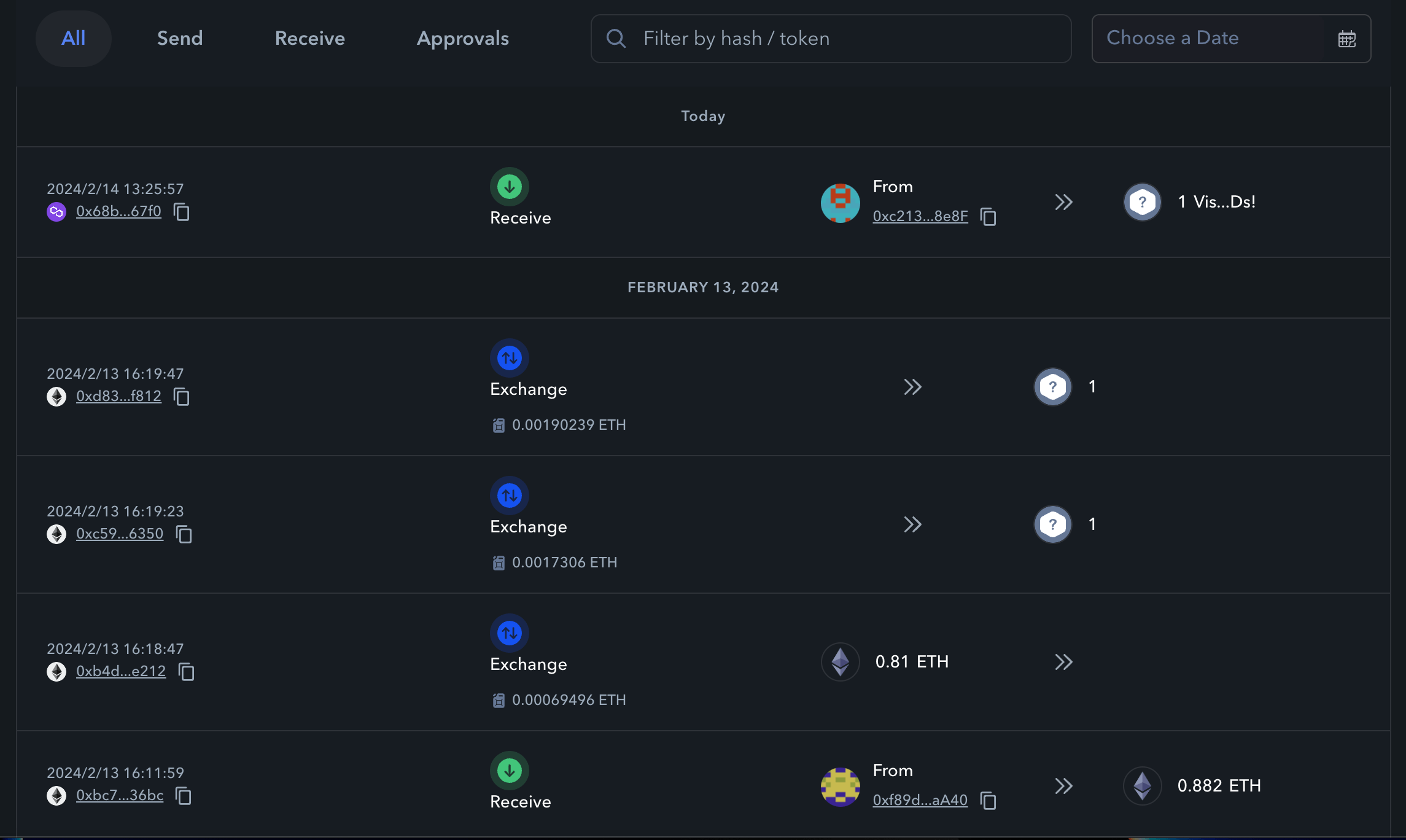

Transaction Tracker

Example portfolio overview transaction feed

The De.Fi Portfolio Tracker also incorporates a transaction tracker that logs all movements of assets across supported networks. This feature is crucial for users who need to monitor the flow of assets in and out of their wallets, be it through trades, staking rewards, or liquidity pool contributions.

The transaction tracker provides a detailed history of these activities, offering insights into the performance and activity levels of the user’s investments. This DeFi analytics tool is indispensable for those looking to analyze their DeFi strategies and optimize their portfolio performance.

Overall, the De.Fi Portfolio Tracker emerges as a must-have DeFi tool, providing users with the means to effectively monitor and manage their diverse portfolios across the decentralized finance landscape. Its comprehensive features, from account overviews to transaction tracking, address the critical needs of DeFi participants.

TRY PORTFOLIO TRACKING

Explore Yields

The De.Fi Explore Yields tool offers users an extensive database of yield data across a variety of decentralized finance platforms. This innovative DeFi tool is designed to simplify the often complex task of yield farming, providing users with a comprehensive resource to compare and analyze potential returns from various DeFi protocols. It stands out as one of the best DeFi tools for yield optimization, offering a level of depth and breadth in yield data that is unparalleled in the DeFi space.

Vast Yield Data Availability

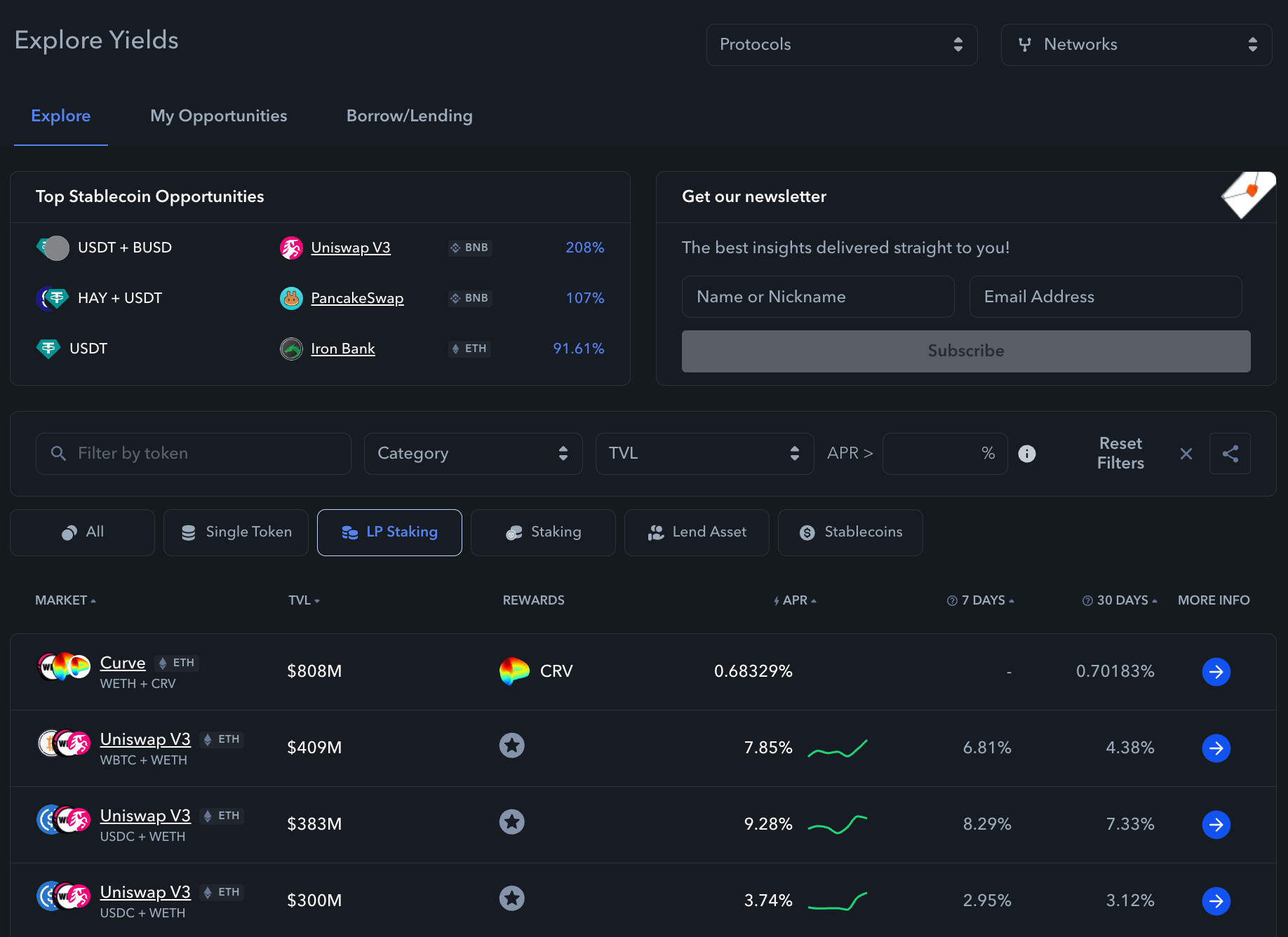

The main overview page for Explore provides a wealth of data

At the core of the Explore Yields tool is its repository of yield data, covering a wide range of DeFi protocols and yield-generating opportunities. This data includes, but is not limited to, interest rates on lending platforms, yield farming pools, staking rewards, and liquidity provider fees.

By aggregating this data in a single, user-friendly interface, the Explore Yields tool simplifies the process of identifying high-return opportunities across the DeFi ecosystem. This feature is particularly valuable in a landscape where yield rates can vary significantly across platforms and over time.

Supported Networks

One of the key strengths of the Explore Yields tool is its support for a multitude of networks, extending beyond the traditional Ethereum Virtual Machine (EVM) chains. This includes but is not limited to, networks like Solana, Osmosis, Cardano, and Tezos.

The inclusion of non-EVM chains broadens the scope of yield opportunities available to users, ensuring that they are not limited to a single blockchain ecosystem. This DeFi tooling allows for a more diversified approach to yield farming, opening up avenues for higher returns and reduced risk through diversification.

Protocol-Specific Filtering

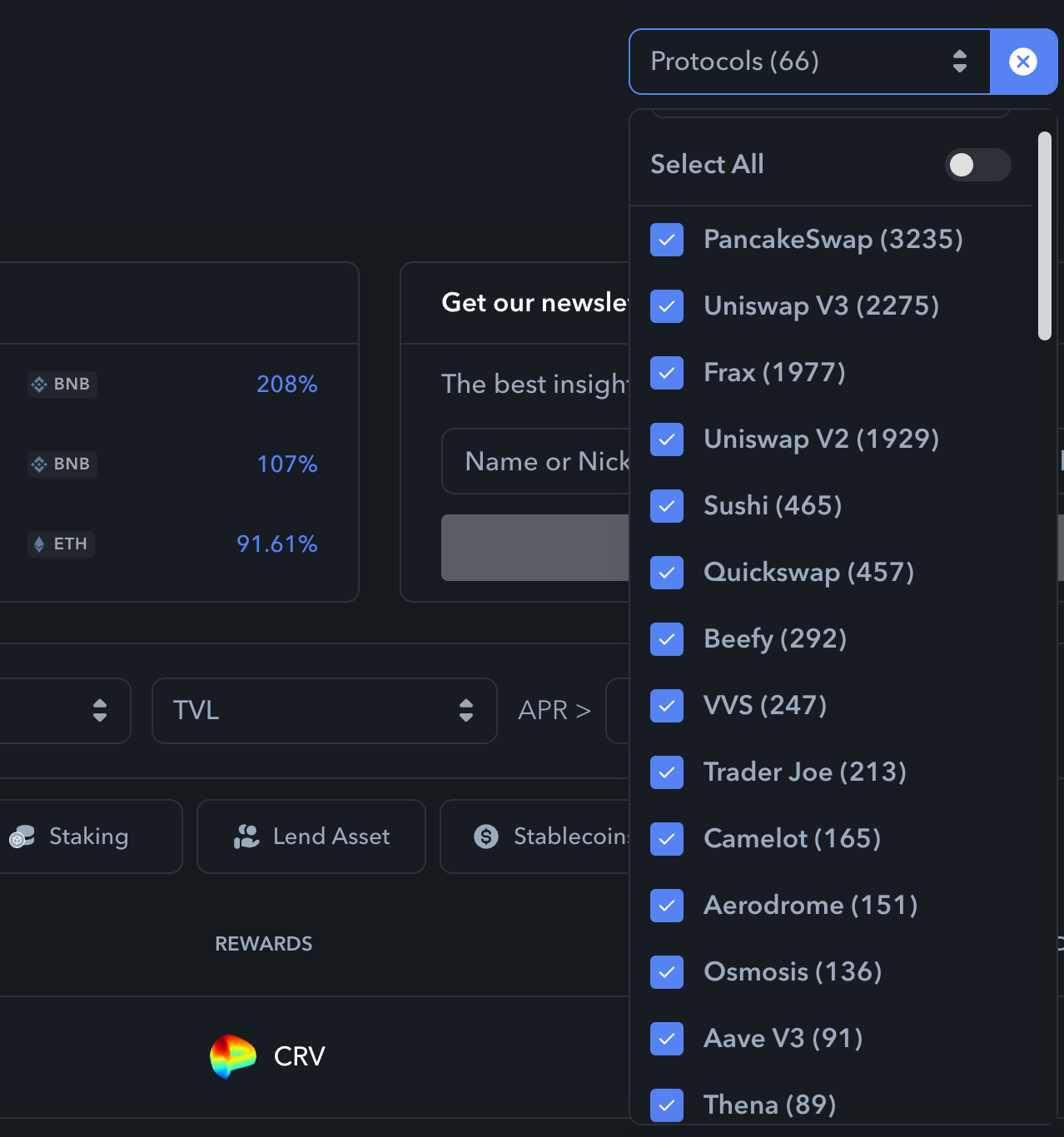

The protocol selector feature within De.Fi Explore

Understanding the diversity of the DeFi landscape, the Explore Yields tool incorporates protocol-specific filtering capabilities. This feature allows users to tailor their search to include only their preferred DeFi protocols or dapps, streamlining the process of finding yield opportunities that align with their investment strategies.

Whether a user is focused on established platforms like Uniswap and Aave or exploring emerging protocols, the ability to filter by protocol ensures a personalized and efficient yield exploration experience.

Integration With the Dashboard

The integration of the Explore Yields tool with the De.Fi dashboard enhances its utility by providing users with a seamless experience in managing their portfolios and exploring yield opportunities. From the dashboard, users can directly access the Explore Yields tool, compare potential returns, and decide on the best way to allocate their assets for optimal yield generation. This integration underscores the tool’s role as a comprehensive DeFi analytics tool, enabling users to make informed decisions without needing to navigate away from their portfolio management interface.

The Explore Yields tool is another key component of the De.Fi DeFi Tool Suite. It offers users a powerful resource for navigating the yield farming landscape. With its extensive yield data, support for multiple networks, protocol-specific filtering, and integration with the De.Fi dashboard, it provides a crucial edge for users looking to maximize their returns in the DeFi space.

TRY DE.FI EXPLORE

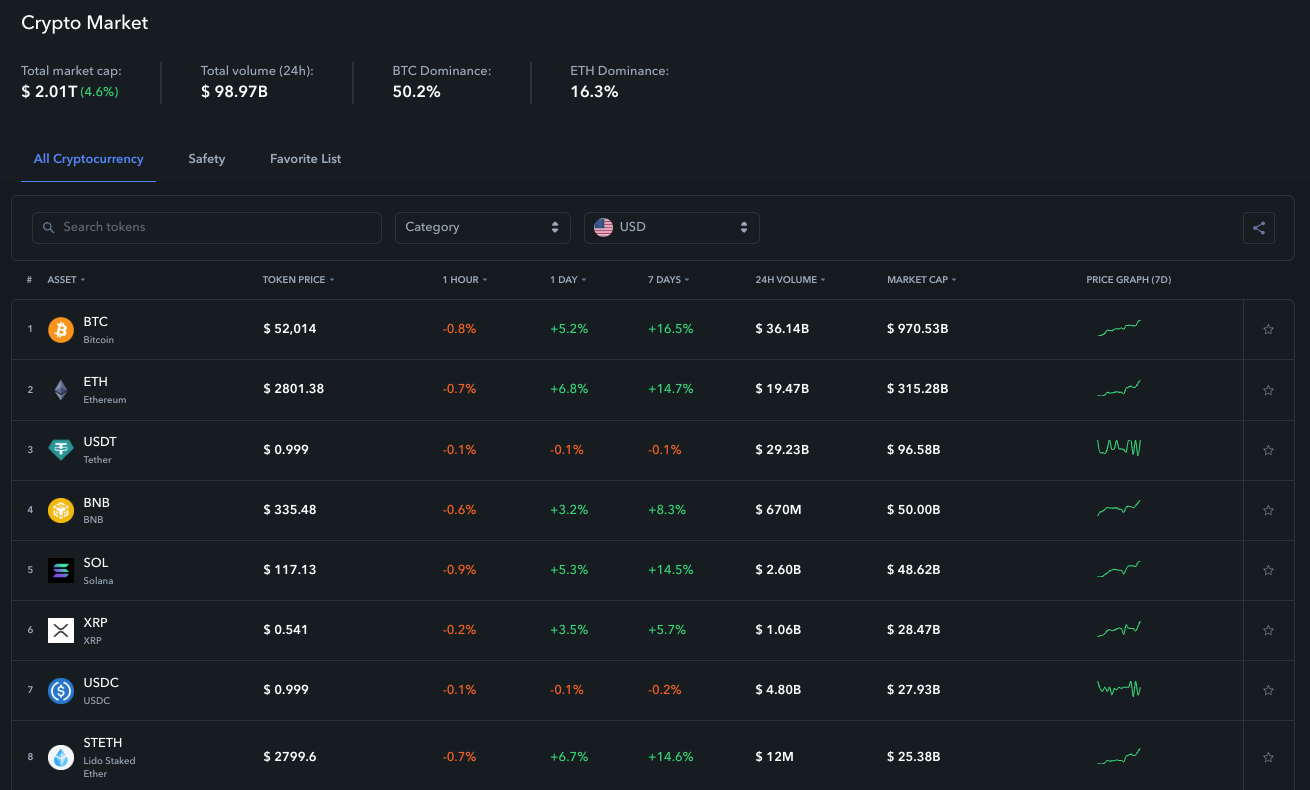

De.Fi Scanner

The De.Fi Scanner is part of the De.Fi Web3 Antivirus suite, and a unique DeFi tool that’s valuable to any investor navigating crypto in 2024. It is designed to enhance the safety and security of DeFi participants by providing a comprehensive analysis of smart contracts and DeFi projects.

This DeFi security tool serves a dual purpose: it not only aids investors in identifying promising opportunities but also plays a crucial role in safeguarding against potential scams and vulnerabilities.

Functionality of the De.Fi Scanner

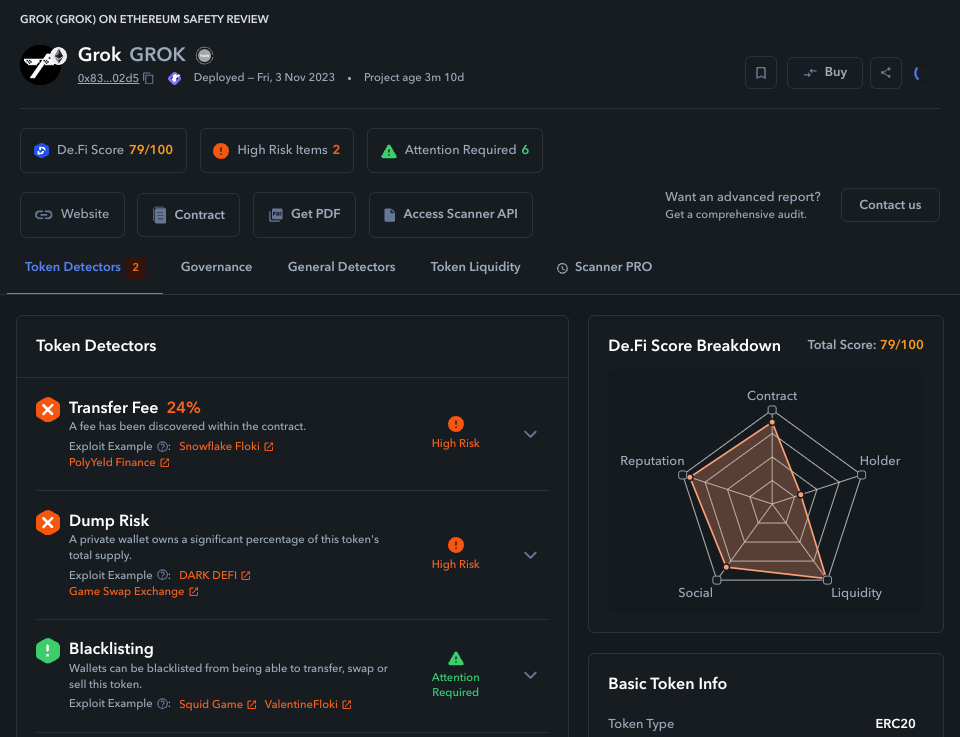

Scanner results for GROK on Ethereum

The Scanner allows users to conduct an in-depth analysis of smart contracts on various blockchain networks. Users have the flexibility to either input a specific contract address they wish to investigate or browse through the Scanner’s extensive database to discover contracts.

This versatility makes Scanner useful for both seasoned investors and newcomers to the DeFi space, enabling a proactive approach to security. If you’re thinking about investing in a specific token, it’s wise to check it via Scanner before making any rash decisions.

Comprehensive Data Analysis

Upon scanning a contract, the Scanner presents a wealth of information critical for making informed investment decisions. One of the standout features is the overall DeFi score, a comprehensive metric that assesses the safety and reliability of a project. This score is calculated through a rigorous evaluation of several factors, including code quality, project longevity, tokenomics, and community trust.

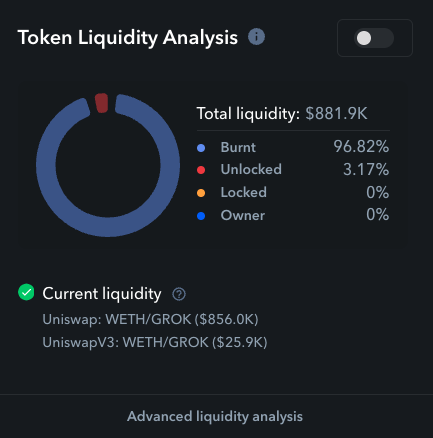

Notably, the Scanner includes token detectors that identify the types of tokens associated with a contract and any peculiarities that might indicate risk. Liquidity analysis is another essential feature, offering insights into the depth and stability of a project’s liquidity—key indicators of its sustainability and potential for rug pulls.

The tool also provides visibility into the top token holders, revealing any concentration of ownership that could signal manipulation or centralization risks. Furthermore, for those with technical expertise, access to the Solidity contract code is available, allowing for a direct review of the project’s underlying codebase.

Why the De.Fi Scanner Is Essential

In an ecosystem as dynamic and complex as DeFi, staying ahead of security challenges is paramount. The De.Fi Scanner equips users with the necessary information to navigate this space confidently. By leveraging the Scanner, investors can:

- Vet projects before committing their assets, reducing the risk of falling victim to scams or poorly designed contracts.

- Gain insights into the liquidity and ownership structure of DeFi projects, enabling more strategic investment choices.

- Access detailed code analysis for a deeper understanding of the project’s technical foundations.

The De.Fi Scanner is more than just a DeFi security tool; it is a comprehensive platform that enhances the security and integrity of DeFi investments. By offering a user-friendly interface to access complex data, it democratizes the ability to conduct due diligence, which just 2 years ago was the preserve of professional audit firms.

Whether you’re exploring new yield farming opportunities or considering a stake in an emerging protocol, Scanner provides the critical insights needed to invest with confidence and security.

TRY SCANNER NOW

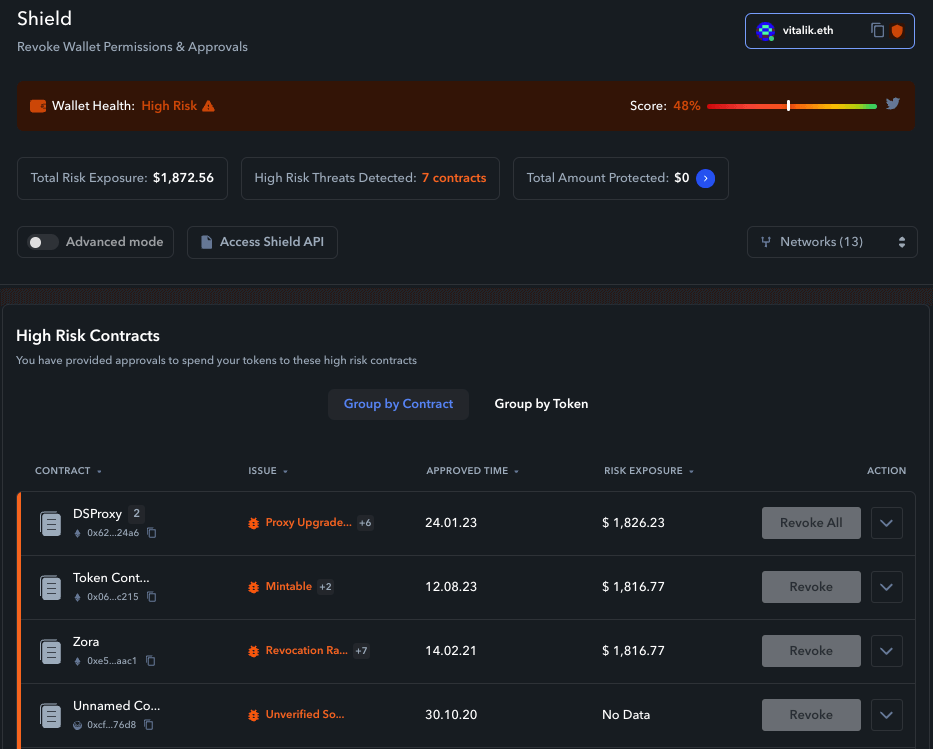

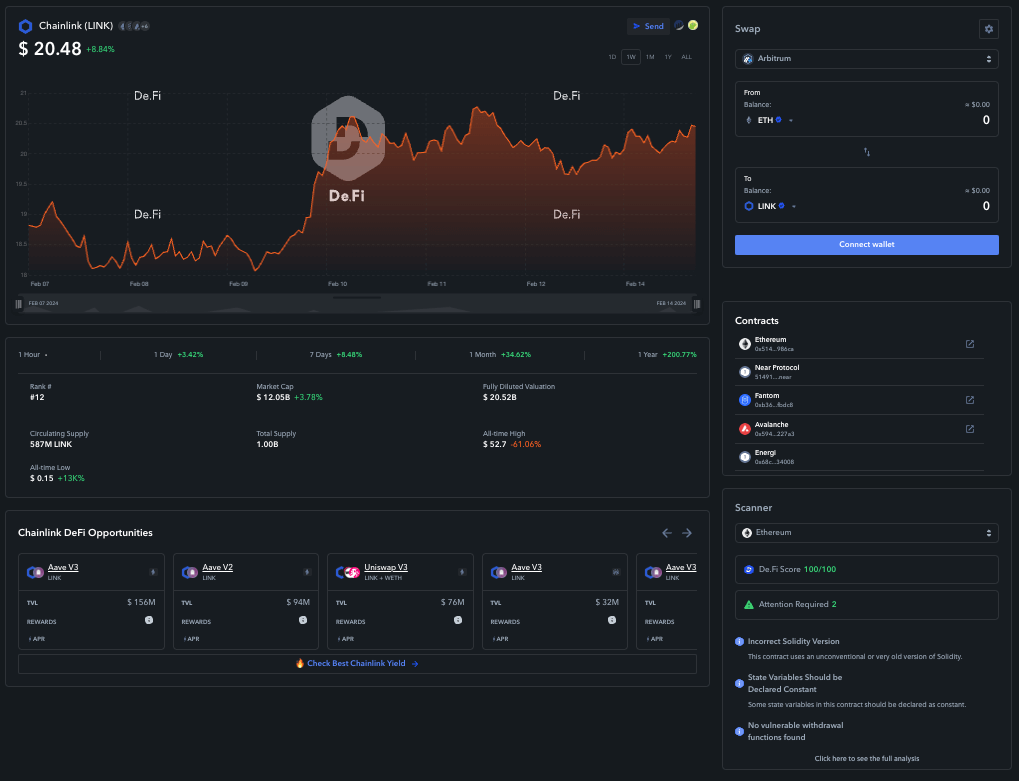

De.Fi Shield

The De.Fi Shield is another DeFi security tool in the De.Fi Web3 Antivirus Suite. It’s designed to empower users in auditing their token approvals within the decentralized finance ecosystem. This tool is important because it addresses a common vulnerability in DeFi interactions: the risk associated with token permissions granted unknowingly or without a full understanding of their implications.

Understanding De.Fi Shield

The De.Fi Shield serves as a safeguard, enabling users to systematically review and manage the approvals they’ve granted to various smart contracts and dapps over time. Given the permission-based nature of blockchain transactions, users often grant access to their tokens for trading, staking, or participating in DeFi protocols. However, without diligent management, these permissions can pose significant security risks, especially if they’re linked to malicious or abandoned projects.

How De.Fi Shield Works

Shield operates by scanning for all existing token approvals linked to a user’s wallet. All you need to do in order for the scan to commence is to connect your wallet to the platform. It meticulously compiles a list of these approvals, presenting them in an easy-to-understand format.

This visibility allows users to identify which smart contracts have access to their tokens and to what extent. More importantly, it enables users to revoke any permissions that are no longer needed or that pose a potential security risk, thereby tightening their DeFi security posture.

Data Points and Advanced Reports

The De.Fi Shield tool provides several critical data points to users, including:

- The identity of the smart contract or dapp that has been granted approval

- The specific tokens and the amount of tokens that the approval encompasses

- The date of approval, offering insights into the recency and relevance of the permission

- Risk assessment, highlighting any known vulnerabilities or associations with high-risk projects

For users with a De.Fi account, access to advanced reports is available, offering an even deeper layer of analysis. These reports include detailed historical data on token approvals, patterns of approvals that may indicate phishing attempts, and recommendations for maintaining optimal security practices.

Why De.Fi Shield Is Essential

Maintaining control over token approvals is key to ensuring that they do not get stolen. The De.Fi Shield empowers users to take proactive steps in securing their digital assets against unauthorized access and potential exploitation. By providing a comprehensive overview of token permissions and facilitating the revocation of risky approvals, Shield plays a pivotal role in enhancing the overall security framework of DeFi participants.

Detailed reports ensure that users stay informed

In conclusion, De.Fi Shield addresses the challenge of managing token approvals—a task often overlooked by users amid their many DeFi interactions. By integrating Shield into their DeFi toolkit, users can ensure a higher degree of safety for their digital assets, allowing them to navigate the DeFi ecosystem confidently and securely.

TRY SHIELD NOW

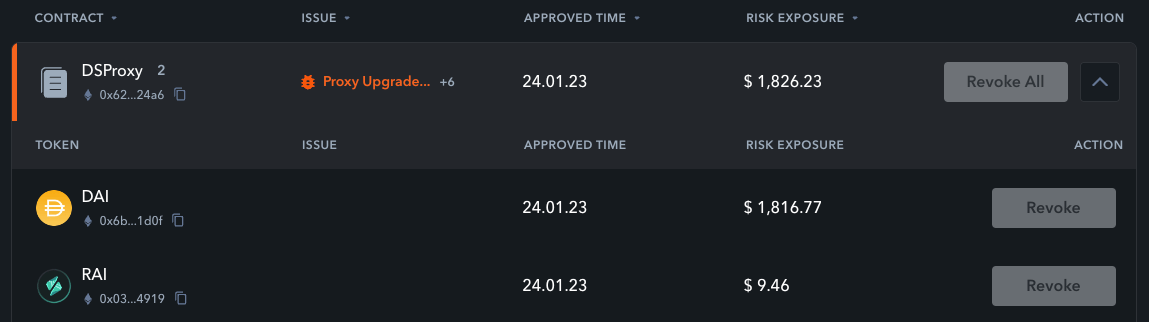

Crypto Market Page

The Crypto Market page on De.Fi is a comprehensive resource for anyone involved in DeFi. It provides an extensive overview of different tokens, including their current prices, market capitalizations, and additional relevant data. This feature is particularly beneficial for users looking to make informed decisions about their DeFi investments.

Detailed Token Insights

On the Crypto Market page, each token is allocated a dedicated page that covers a variety of critical data points. Users can access detailed information on market capitalizations, current prices, fully diluted valuations (FDVs), circulating supply, and more. This array of data ensures that investors have all the necessary information to assess the potential value and performance of a specific token.

Critical DeFi ecosystem tokens like Chainlink can be investigated on a granular basis

Moreover, the page highlights yield farming opportunities, offering insights into how users can potentially earn returns on their investments through various DeFi protocols. This aspect is crucial for those looking to optimize their earnings within the DeFi ecosystem.

Scanner Ratings and Contracts

An integral feature of the Crypto Market page is its inclusion of Scanner ratings. These ratings provide a quick glance at the security and reliability of each token based on comprehensive analyses.

Users can also view contracts directly, allowing for an in-depth understanding of the token’s operational framework. This level of transparency is vital for DeFi security, ensuring that users can trust the tokens they choose to invest in or interact with.

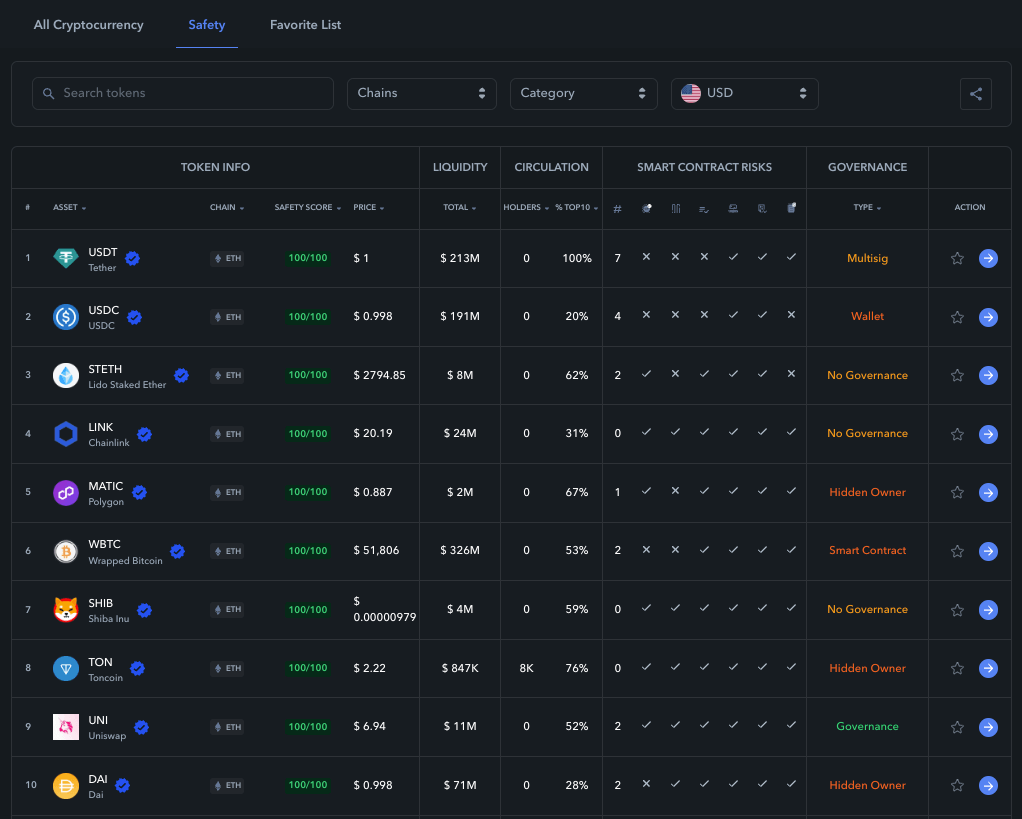

Crypto Market Safety Tab

One of the standout features of the Crypto Market page is the “Safety” tab. This offers at-a-glance security rating information for hundreds of the most popular tokens. By presenting security ratings alongside traditional financial metrics, De.Fi bridges the gap between financial performance and security, emphasizing the importance of both in the DeFi space.

View the security of hundreds of tokens at a glance

This approach not only aids users in making more secure investment choices but also promotes a culture of security within the DeFi community. By prioritizing tokens with high security ratings, investors can contribute to a safer DeFi environment.

Educate Yourself With De.Fi

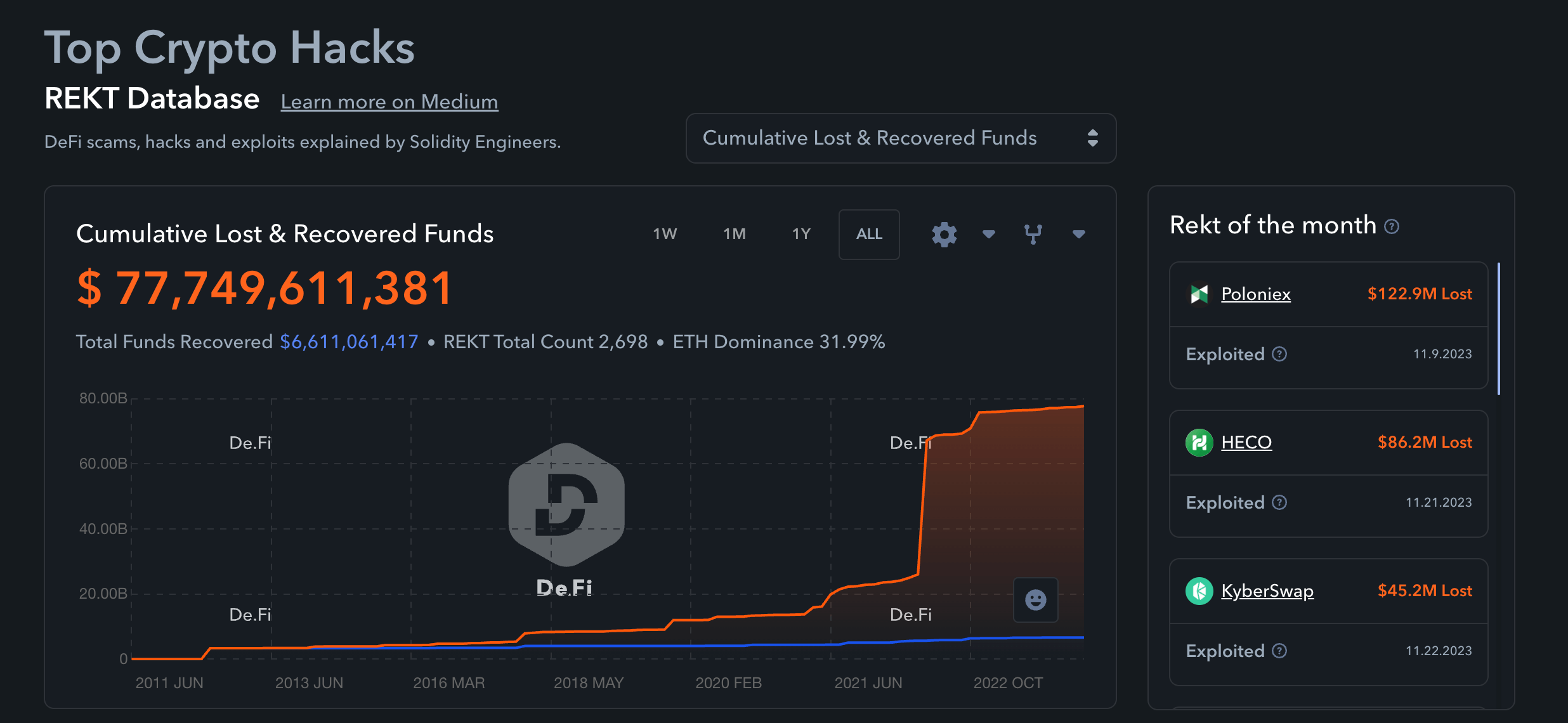

In an industry as young as DeFi, staying informed and vigilant is crucial. De.Fi offers a comprehensive suite of resources designed to educate and protect users in this dynamic environment. At the heart of these offerings are the Audit Database and REKT Database. These databases provide in-depth research and analysis, serving as a public good to enhance safety within the crypto community.

The Audit Database provides one of the industry’s largest collections of free audits of smart contracts and DeFi protocols, highlighting potential vulnerabilities and offering insights into their security postures. Meanwhile, the REKT Database compiles incidents of hacks, scams, and other security breaches, presenting detailed case studies that users can learn from to avoid similar exploits.

Explore cumulative losses overall or in fine detail

Furthermore, De.Fi maintains a robust blog featuring new articles every week. These cover a wide range of topics, from basic DeFi concepts to advanced security practices, ensuring there’s valuable information for everyone, regardless of their experience level.

Additionally, De.Fi’s presence on the X platform extends its reach, providing followers with timely updates on DeFi developments, security alerts, and educational content. There are two accounts to follow, @DeFi and @DeFi_Security.

By leveraging these resources, users can significantly enhance their understanding of DeFi, learn about the latest security measures, and stay up-to-date on new opportunities and risks. Whether you’re a seasoned investor or new to the space, De.Fi’s educational tools and databases are indispensable for navigating the DeFi ecosystem safely and effectively.

Get Started With De.Fi

Incorporating De.Fi’s dashboard into your crypto investment routine is a strategic first step in advancing your web3 journey.

Track your assets across various networks, find the best opportunities available, and stay informed about your investments’ performance. With De.Fi, you also have the tools at your fingertips to explore yields, audit contracts, and safeguard your digital assets with unprecedented ease.

Don’t wait to take control of your DeFi experience—explore De.Fi now and transform your digital life.