DeFi Rekt Report October 2025: $38.6 Million Lost Across 9 Exploits

October 2025 saw a total of $38.63 million lost across nine distinct security incidents in both centralized and decentralized platforms.

In the ever-evolving world of decentralized finance (DeFi), understanding and managing your DeFi wallet security settings is crucial. This is primarily done via token approval parameters.

MetaMask is one of the most commonly used DeFi wallets, and users most often encounter token approvals in the wallet via the “MetaMask custom spending cap” prompt.

This article will delve into the significance of token approvals, the role of MetaMask custom spending caps in managing these approvals, and how tools like De.Fi Shield can assist in managing these settings. Our journey will cover everything from the basics of token approvals to the intricate details of setting and managing spending caps in MetaMask.

Token approvals are a fundamental aspect of interacting with decentralized applications (dapps) in the web3 domain, especially when dealing with ERC-20 tokens and their equivalents on other blockchains like BEP-20 on BNB Chain.

When you engage with a dapp that requires access to your tokens, you must grant token approvals to the dapp’s smart contract. This approval mechanism is essential for the dapp to interact with your tokens — for example, when adding tokens to a liquidity pool or executing a trade.

The criticality of token approvals lies in their specific nature. If you authorize a dapp to access your USDT tokens, for instance, the approval is limited to USDT alone, and to the amount that you define. This precision ensures that only the specified tokens can be accessed by the dapp, safeguarding your other assets.

In most cases, granting a token allowance that exceeds your immediate transaction needs is convenient. It saves time by avoiding the need to grant permission repeatedly for each transaction. This pre-approval of a certain number of tokens enhances the user experience, making web3 interactions smoother and more efficient.

But keep in mind, these permissions are extremely powerful and can control your wallet’s funds even if you do not approve a specific transaction. This can lead to a nightmare scenario of losing access to your funds under the following circumstances:

You grant approvals to an untrustworthy smart contract: Token approvals are the main attack vector for crypto phishing scams. If you’ve approved a malicious smart contract to be an unlimited spender of a token, your entire balance will likely be wiped out nearly instantly after the approval is confirmed.

You grant approvals to a smart contract which is eventually compromised: If a contract that you’ve interacted with before has a vulnerability and is hacked, the hackers may find a way to transfer all tokens from users who have previously granted token approvals to the breached contract. An example of this was the infamous Multichain bridge hack:

Multichain, a cross-chain bridge, said that an important vulnerability affecting WETH, PERI, OMT, WBNB, MATIC, AVAX was discovered and fixed. If the user has authorized, remove any approvals of the 6 tokens asap. Otherwise the assets will be at risk. https://t.co/wGIVduM1WR

— Wu Blockchain (@WuBlockchain) January 17, 2022

This is especially dangerous because many dapps prefer to request these unlimited token approvals from users so that they don’t have to call approve() repeatedly. While this is gas efficient, doing so leaves users exposed to a high level of risk. This is where the concept of custom token spending caps in MetaMask (and other DeFi wallets) becomes key.

MetaMask custom spending caps are a vital feature within the wallet designed to enhance user control and security over token allowances. When you grant a dapp access to your tokens for transactions, MetaMask provides you with the option to set a specific limit to the amount of tokens the dapp can use. This feature plays a crucial role in safeguarding your assets from potential risks associated with dapp vulnerabilities or malicious exploits.

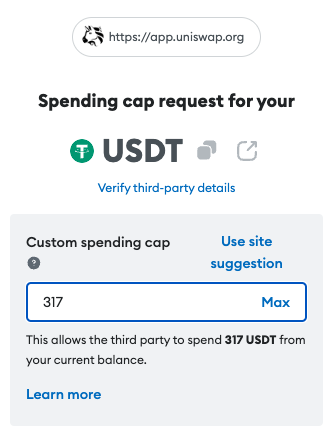

When you initiate a token transaction in MetaMask, a window appears prompting you to approve the token allowance. Here, you have the option to set a custom spending cap.

This interface is intentionally designed to give you more visibility and control over your token allowances. Instead of automatically defaulting to the amount suggested by the dapp, which often is set to the maximum or an ‘infinite’ amount, you can input a limit that you are comfortable with. The choices include entering a custom value, selecting ‘Max’ which denotes your account’s current token balance, or ‘Use default’, which is the amount proposed by the dapp.

The importance of setting a MetaMask spending cap cannot be overstated. It acts as a personalized safeguard, ensuring that only the amount of tokens you are willing to transact with is accessible, thereby minimizing the risk of loss in case of a security breach in the dapp.

When utilizing custom spending cap settings in MetaMask, there are best practices that you should adhere to to ensure maximum security for your digital assets:

Firstly, it’s advisable to grant approvals that are just sufficient for the trades or transactions you are executing. This means setting the spending cap to an amount that covers your current transaction needs, without excessively overestimating the allowance.

In some cases, you might consider granting unlimited approvals, especially if you frequently interact with a particular dapp that you trust. However, even with trusted applications, there may be a risk they can be compromised. Therefore, only grant unlimited approvals if you have a high degree of confidence in the security of the application.

A key security best practice is to consistently check and manage your different custom spending cap token approvals in MetaMask. This regular audit of your approvals ensures that you are aware of which dapps have access to your tokens and in what amounts. It’s important to remember that even the most trusted apps can become vulnerable to hacks, for instance through a rogue developer or a malicious proxy contract.

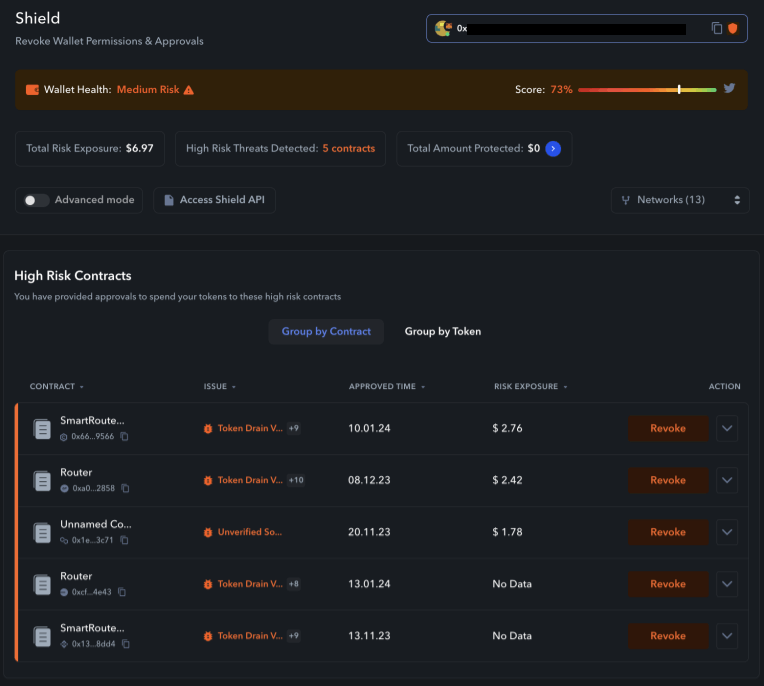

De.Fi Shield quickly generates an overview of your spending caps and risk exposure

By adopting these best practices for managing your MetaMask token spending cap, you significantly enhance the security of your transactions in the DeFi space. Regularly reviewing and adjusting your spending caps according to your transactional needs not only provides peace of mind but also fortifies your defense against potential unauthorized token accesses.

With De.Fi Shield, monitoring and revoking access to token approvals is incredibly simple if you deem a contract to be too risky. In the next section, we go through the details of how you can do just that.

As you can probably tell by now, managing your MetaMask spending caps is an integral part of maintaining security and control over your digital assets. This is where De.Fi Shield emerges as a premier tool, offering robust features to monitor and manage your MetaMask spending caps effectively.

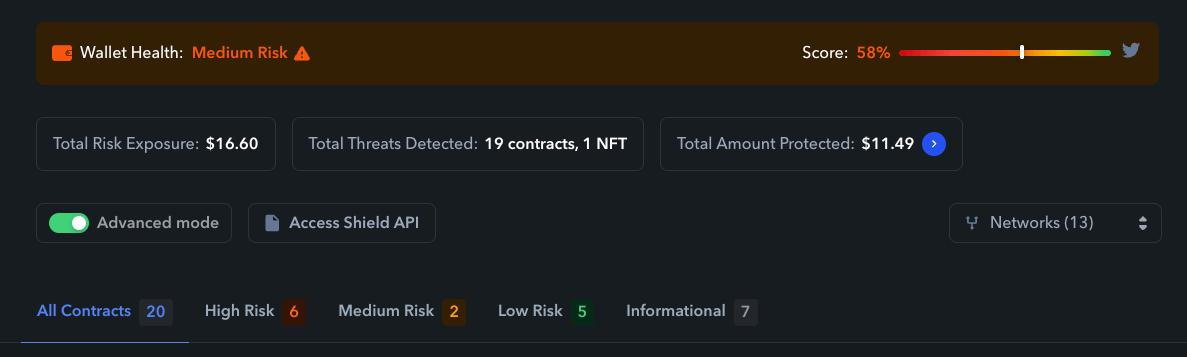

De.Fi Shield stands out in its ability to categorize different token allowances based on risk levels. It classifies these allowances into four distinct categories: “High Risk,” “Medium Risk,” “Low Risk,” and “Informational.” This categorization is based on a variety of factors, including the reputation of the dapp, the amount of token access granted, and historical security incidents associated with the dapp.

High Risk: These are approvals that could potentially expose your assets to total loss. They might include unlimited allowances to less-known or new dapps.

Medium Risk: Smart contract functions that might not be immediately dangerous but deserve caution.

Low Risk: These are typically issues that are unlikely to lead to loss of funds.

Informational: These designations provide you with information on contracts you have approved that do not follow best coding practices, without immediate risk implications.

One of the standout features of De.Fi Shield is its ability to apply filters to your spending cap views. This means you can tailor the interface to show only the information relevant to your needs. Whether you want to focus on “High Risk” allowances or view all the tokens with active approvals, the filter option enhances your user experience by simplifying navigation and data interpretation.

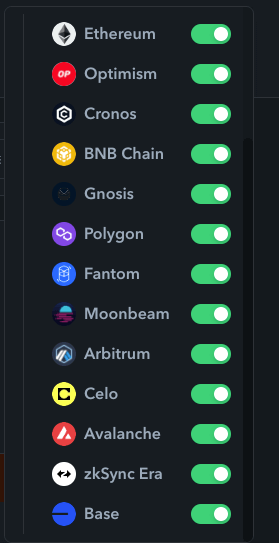

Just like the De.Fi dashboard, De.Fi Shield supports multiple blockchain networks. This feature ensures that you have a comprehensive view of your token approvals across various chains, making it a one-stop tool for managing your DeFi activities, regardless of the network you prefer.

De.Fi Shield doesn’t just stop at showing your current allowances; it also provides detailed reports on potential exploits and vulnerabilities, with links to the De.Fi REKT Database of historic crypto hacks and scams.

These reports are exhaustive, covering the nature of the exploit, the level of risk it poses, and recommended actions. Such detailed insights empower you to make informed decisions about your token allowances and potential risks.

For those looking to build security features into their own DeFi solutions, De.Fi Shield offers DeFi API features for automated protection. This functionality allows for the integration of De.Fi Shield’s capabilities into third-party DeFi asset management platforms.

In essence, De.Fi Shield stands as a comprehensive, user-friendly, and highly functional tool for managing MetaMask spending caps. Its sophisticated risk assessment, multi-chain support, detailed reporting, and interoperability features make it a must-have for any DeFi user looking to safeguard their digital assets effectively.

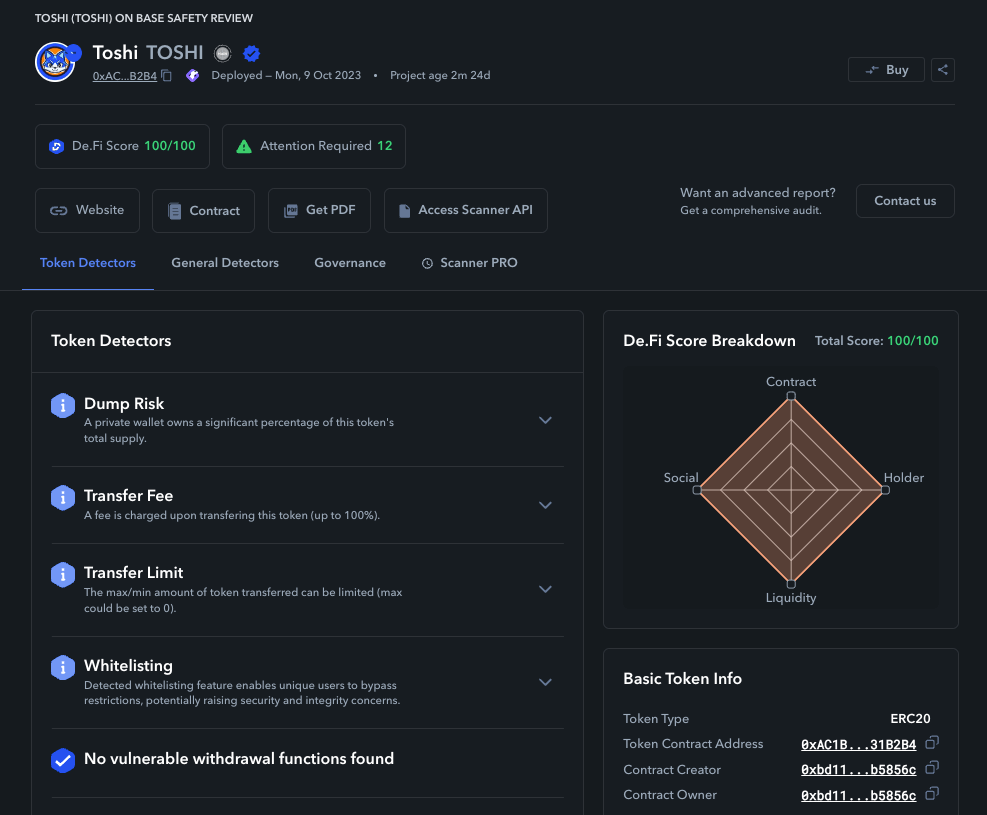

If you are the type of investor to take a proactive approach to security, the De.Fi Scanner free token scanner tool serves as an invaluable tool to mitigate risks. Before engaging with any contract or dapp, users can utilize the De.Fi Scanner to scrutinize and identify potentially risky contracts.

De.Fi Scanner results for Toshi on Base

This proactive approach allows traders to detect vulnerabilities or suspicious elements in a contract, significantly reducing the risk of falling prey to scams or exploits. By integrating the De.Fi Scanner into their due diligence process, traders can navigate the DeFi world with greater confidence and security.

While tools like De.Fi’s Scanner and Shield are critical in safeguarding your DeFi journey, the first line of defense always comes down to common sense and vigilance. One of the simplest yet most effective practices is to avoid clicking on unknown links. Phishing attempts, where malicious actors disguise harmful links as legitimate ones, are all too common.

Consider the situation below from the much anticipated Dymension airdrop. The official Dymension account posted an announcement regarding the link, then scammers posing as the official account (see the @layol_loyal account posting as Dymension) lurk in the Twitter comment section trying to get people to click on a link to a wallet drainer:

Always verify the authenticity of a website before interacting with it. Bookmarking sites that you know are trustworthy can prevent accidental visits to harmful or fake websites. Usually, you can double check for a project’s legitimate domain by finding its official profile on social media and seeing what they reference there. Even Google results can be filled with ads for fake domains, so be vigilant.

Additionally, exercise caution with direct messages, especially those containing links or requesting sensitive information. Remember, reputable sources or platforms will never ask for your private keys or seed phrases. Being cautious about the information you share on forums and social media is also advisable, as publicly disclosing your holdings or investment strategies can make you a target for scammers.

While De.Fi’s tools provide a robust security infrastructure, complementing them with basic internet safety practices significantly enhances your protection against the myriad of risks in the DeFi space.

De.Fi offers a suite of DeFi portfolio tracking tools designed to enhance the security of your DeFi experience. From the De.Fi Scanner’s preemptive contract audits to the control offered by De.Fi Shield over your spending caps, these resources are tailored to safeguard your digital assets against the unpredictable and high-stakes nature of investing in web3.

Additionally, De.Fi’s commitment to education and community support is evident in its online resources. Our blog and X profile offer a wealth of knowledge, ensuring that users are not only equipped with the best tools but also the understanding needed to navigate web3 successfully.

Whether you are a seasoned investor or new to the DeFi world, De.Fi provides the necessary resources to protect your investments, allowing you to confidently engage with the expanding universe of crypto opportunities.

October 2025 saw a total of $38.63 million lost across nine distinct security incidents in both centralized and decentralized platforms.

The third quarter of 2025 marked yet another turbulent period for the DeFi and wider crypto ecosystem, with $434,124,000 lost to exploits, scams, and security failures across both centralized and decentralized platforms.

June 2025 witnessed another alarming month for Web3 security, with a total of $114,768,000 lost during 11 separate attacks

May 2025 saw both DeFi and CeFi security once again under attack, with $275,953,000 lost across just 8 recorded incidents

April 2025 witnessed a large escalation in exploit volume and value, with a massive $5,919,684,000 being stolen in 10 confirmed events.

Q1 2025 marked one of the worst quarters in blockchain exploit history, with total recorded losses topping $2,052,584,700 across 37 incidents

© De.Fi. All rights reserved.