Many investors in the cryptocurrency market eagerly search for clues about the next crypto bull run, hoping to capitalize on the potential profits it can bring. In this article, we will explore the concept of a bull run, the influence of Bitcoin halvings, and address the question of when the next bull run might occur.

While it’s important to note that predicting bull runs is nearly impossible, we will provide insights into how investors can prepare themselves for macro gains in the market and make smart investment decisions. Additionally, we will emphasize the evolving nature of the crypto market and how you can find opportunities beyond the traditional Bitcoin-focused cycles.

Note: The information in this blog is for educational purposes only and should not be construed as professional financial advice. We recommend that you always DYOR (Do Your Own Research) before making any crypto investing decisions.

When Is the Next Crypto Bull Run?

A bull run usually is used to describe a period of significant price growth and market excitement in the crypto industry. 2021 is the most recent example of a widespread crypto bull run, but there were also huge bull runs in 2013 and 2017.

While the exact timing of this phenomenon remains uncertain, experts have identified potential catalysts that could drive the market forward. One such catalyst is the Bitcoin halving, an event that occurs approximately every four years and reduces the number of new bitcoins miners can mine by half. This process, ingrained in the Bitcoin protocol, limits the total supply of bitcoins to 21 million. The next halving is projected to take place in or around April 2024, creating anticipation for a potential surge in prices and market activity.

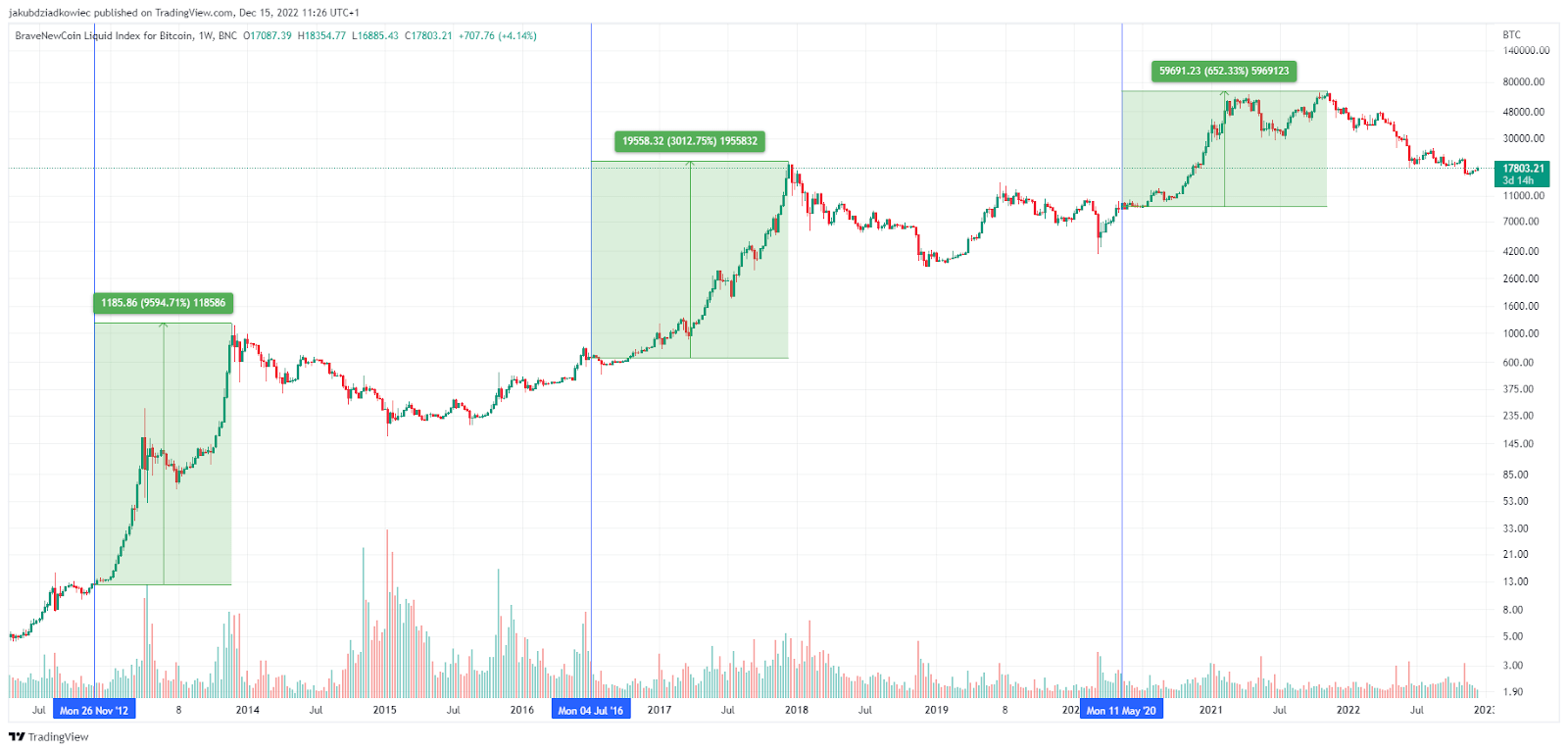

In the past, Bitcoin halvings have occurred the year before large crypto bull runs. The bull runs in 2013, 2017, and 2021 all occurred after Bitcoin halvings in 2012, 2016, and 2020. If this pattern continues, one would expect the next crypto bull run in 2025 after the 2024 halving.

A history of post-halving price action

While halvings have clearly shown a correlation with overall market price action, the industry has also grown far beyond a Bitcoin-only focus.

2021 was the most recent crypto bull run and it showcased the transformative power of the industry, with the more advanced cryptocurrencies behind DeFi, NFTs enterprise blockchain tech, and web3 taking center stage. Factors such as institutional adoption, acceptance by major brands, and the inflation fears brought on by low-interest rates during the COVID-19 pandemic contributed to the bullish market sentiment. Additionally, increased online activity during the pandemic created favorable conditions for the crypto market to gain momentum and attract new investors.

As the industry looks ahead to the next crypto bull run, experts highlight various factors that could shape its trajectory. One significant trend is the growing emphasis on the utility of crypto protocols. Investors are becoming more discerning, focusing not only on speculative value but also on how cryptocurrencies can be practically utilized in real-world applications. This shift reflects the industry’s maturation and the need for projects that solve real problems and deliver tangible benefits to users.

In addition to the Bitcoin-halving narrative, the crypto market has expanded to include numerous coins and tokens with unique cycles and trends. This diversification means that some of the best opportunities exist beyond Bitcoin and other large-cap coins like Ethereum or Ripple. Investors willing to conduct thorough research can identify promising projects that may not necessarily follow the broader trends of the major coins.

While the four-year cycle theory is widely accepted, it is essential to acknowledge that the crypto market is complex and influenced by various factors. Predicting the exact timing of the next crypto bull run remains challenging. Investors must stay informed, continuously monitor the market, and leverage the tools provided by the decentralized finance (DeFi) ecosystem to make informed investment decisions.

As the crypto industry evolves, the concept of a bull market extends beyond a specific time frame. The notion of a “crypto bull market” encompasses periods of overall market growth and increased investor enthusiasm. While precisely timing bull runs is impossible, the industry is poised for continued growth and innovation.

Investors should remain vigilant, conduct thorough research, and be prepared for market fluctuations. The evolving nature of the crypto market, combined with the potential catalysts discussed, highlights the importance of staying informed and agile in the pursuit of successful investments.

Are Halvings Necessary for Bull Runs?

Although Bitcoin’s halvings have historically played a significant role in triggering bull runs, the crypto market has evolved considerably, and the influence of halvings on market trends is subject to change. Today, the market is characterized by a multitude of coins and tokens, each with unique characteristics and cycles that operate independently of Bitcoin. This diversification has created opportunities for growth and profit beyond the realm of Bitcoin and its halvings with robust subcategories like DeFi yield farming and NFT art.

For instance, recent times witnessed a significant bull run for a coin called Pepe, while most other coins remained relatively stagnant. This exemplifies how market dynamics have shifted, allowing independent projects to experience growth and success regardless of Bitcoin’s influence. Investors who are willing to invest time and effort into researching and understanding different projects can discover potential winners that are not solely reliant on Bitcoin’s halvings.

Moreover, the maturation of the crypto industry has led to a gradual decrease in the correlation between Bitcoin’s halvings and broader market trends. While Bitcoin will always maintain its significance, the market as a whole is becoming less reliant on the influence of halvings. This shift underlines the importance of conducting comprehensive research to identify investment prospects that align with individual investment goals and risk tolerance.

Early investors in Pepe saw price gains of over 50x (CoinGecko) in May 2023

Furthermore, it is worth noting that the crypto market is not isolated from macroeconomic factors. The interplay between global economic conditions and the crypto market can significantly impact bull runs and crypto bull markets. Factors such as inflation, interest rates, geopolitical events, and regulatory developments can influence market sentiment and shape investor behavior. Understanding and monitoring macroeconomic indicators and trends is essential for gaining insights into potential catalysts and timing of the next bull run or crypto bull market.

So, while Bitcoin’s halvings have indeed traditionally been significant events tied to bull runs, the crypto market has evolved to encompass a diverse array of coins and tokens with their own cycles and trends. This diversification provides opportunities for growth and profit beyond Bitcoin’s influence. As the market matures, the correlation between halvings and broader market trends is likely to diminish.

Consequently, conducting thorough research, understanding project fundamentals, and monitoring macroeconomic factors become crucial for identifying investment prospects that align with individual goals and risk tolerance. By staying informed and adaptable, investors can position themselves favorably to capitalize on the ever-evolving crypto market and navigate the timing of the next bull run.

How to Prepare for the Next Crypto Bull Market

As the crypto market continues to evolve and investors eagerly anticipate the next bull run, it is crucial to be well-prepared and equipped to capitalize on potential opportunities. By taking proactive steps and adopting a strategic approach, you can position yourself for success. Here are some key aspects to consider when preparing for the next bull run:

1. Use Crypto to Gain Hands-On Experience

One of the most important steps in preparing for the next bull run is to gain hands-on experience with cryptocurrencies. Many newcomers to the crypto space make the mistake of waiting until a bull run has already started to learn the basics. However, this approach puts them at a significant disadvantage.

To effectively navigate the market and make informed investment decisions, it is essential to familiarize yourself with the fundamentals of crypto during the bear market. Take the time to learn about decentralized finance (DeFi) protocols, understand how to use centralized exchanges (CEXs), and become comfortable with both buying and selling cryptocurrencies.

By actively engaging with crypto during quieter market periods, you can develop a solid foundation of knowledge and practical skills that will serve you well when the next bull run arrives. This way, you’ll be better equipped to navigate the complexities of the market and take advantage of potential profit opportunities.

2. Get Involved on Multiple Chains

The crypto landscape has become increasingly diverse, with multiple chains offering unique opportunities beyond the traditional Bitcoin and Ethereum ecosystems. To maximize your chances of success, it is essential to get involved and explore various chains.

Research and familiarize yourself with different blockchain platforms, such as BNB Smart Chain (BSC), Solana, Polkadot, and Avalanche, among others. Each chain has unique features, TVL, projects, and growth potential. By understanding the strengths and limitations of different chains, you can identify promising projects and investment opportunities.

The above is just a sampling of the chains integrated by De.Fi. With over 50+ networks, we can help you explore the entirety of the crypto ecosystem.

Keep in mind that some of the best opportunities in the next bull run may arise on chains outside of the well-established Bitcoin and Ethereum networks. These emerging chains often offer lower transaction fees, faster transaction times, and innovative features that attract developers and investors alike.

However, be sure to conduct thorough research before investing in projects on new chains. Evaluate factors such as the project’s team, technology, market demand, and community support. Diversifying your investments across multiple chains can help mitigate risks and increase your exposure to potential growth.

By getting involved on multiple chains and expanding your knowledge beyond the dominant cryptocurrencies, you position yourself to capitalize on emerging opportunities and stay ahead of the curve in the next bull run.

In the crypto market, knowledge is power. It is crucial to invest time and effort in conducting thorough research. This includes analyzing projects, studying market trends, and staying informed about the latest developments in the crypto industry.

Research potential investment opportunities by evaluating factors such as the project’s whitepaper, team composition, roadmap, partnerships, and community engagement. Look for projects that solve real-world problems, have a clear value proposition, and demonstrate long-term viability.

Stay updated with news from reputable sources, follow influential figures in the crypto space, and engage with online communities to gain insights and perspectives. Participating in forums, social media groups, and Discord channels can provide valuable information and help you stay ahead of the curve.

Additionally, keep an eye on market trends and industry dynamics. Understand the impact of regulatory changes, technological advancements, and macroeconomic factors on the crypto market. By analyzing and interpreting these trends, you can make informed investment decisions and adjust your strategy accordingly.

3. Build Capital With Airdrops

Crypto airdrops present new participants in the crypto space with an excellent opportunity to build their capital base in anticipation of the next bull run. These events involve the distribution of free tokens to holders of specific cryptocurrencies or participants who complete certain tasks. By participating in airdrops, individuals can acquire tokens at no cost, potentially reaping significant profits when those tokens increase in value during a bull run.

At our platform, we are dedicated to providing industry-leading insights on airdrops, ensuring that you are well-informed and positioned to take advantage of these opportunities. Our DeFi YouTube videos and blogs cover a wide range of topics related to airdrops, including how to find legitimate airdrop campaigns, participate effectively, and manage your acquired tokens.

As industry experts, we offer valuable tips and strategies to help you maximize the benefits of airdrops. From explaining the process of wallet setup to discussing airdrop aggregators and tracking platforms, our content provides step-by-step guidance and practical advice. We pride ourselves on staying up-to-date with the latest trends and developments in the airdrop space, ensuring that you have access to the most relevant information.

By following our YouTube videos and blogs, you can become well-versed in the world of airdrops and seize opportunities to build your capital base, positioning yourself for success in the next bull run.

4. Learn Crypto Security

In the world of cryptocurrencies, security is of paramount importance. The volatile and decentralized nature of crypto markets can expose participants to risks if proper precautions are not taken. At our platform, we prioritize educating individuals about crypto security and equipping them with the knowledge and tools to protect their assets.

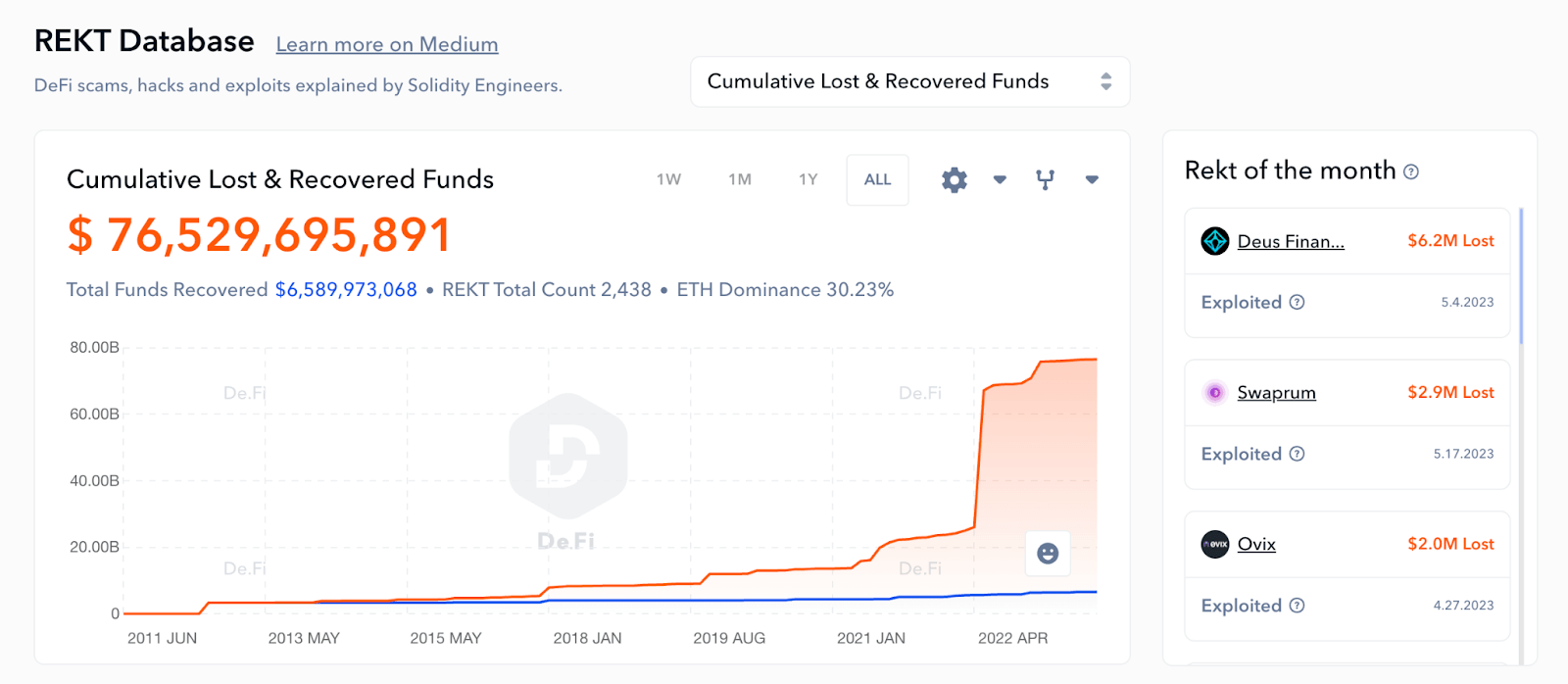

To understand the potential dangers and volatility associated with crypto, we encourage readers to explore our REKT crypto hack & scam database. This comprehensive resource provides insights into past incidents where individuals suffered significant losses due to security breaches, scams, or market volatility. By reviewing real-life examples, readers can grasp the importance of implementing robust security measures and making informed decisions.

In addition to the REKT Database, we provide information regarding tried-and-true security best practices in the crypto space. These include securing your private keys in offline wallets, enabling two-factor authentication (2FA) for exchanges and wallets, using hardware wallets for added security, and regularly updating software and firmware. By following these practices, you can significantly reduce the risk of unauthorized access and protect your crypto assets.

Our platform offers detailed guides and tutorials on how to implement these security measures effectively. We walk you through the process of setting up hardware wallets, enabling 2FA, and choosing reputable wallet providers. Our goal is to empower you with the knowledge and tools necessary to safeguard your investments in the crypto space.

We also offer a completely free smart contract auditor, professional smart contract auditing services, and a crypto wallet revoke permissions tool. By prioritizing crypto security and implementing sound practices, you can navigate the market with confidence and minimize the risks associated with crypto assets.

5. Get a Hardware Wallet

When it comes to ensuring the security of your crypto assets, one of the most crucial steps is acquiring and properly utilizing a hardware wallet. A hardware wallet is a physical device designed to securely store your private keys offline, away from potential online threats. By using a hardware wallet, you significantly reduce the risk of unauthorized access and keep your crypto assets safe.

There are several reputable hardware wallet options available in the market. Some popular choices include Ledger, Trezor, and KeepKey. Each hardware wallet has unique features, pros, and cons. Ledger, for example, offers a wide range of wallet options, including the Ledger Nano S and Ledger Nano X, providing support for various cryptocurrencies. Trezor is another trusted brand known for its simplicity and security features. KeepKey, on the other hand, provides a sleek and user-friendly design.

To purchase a hardware wallet, you can visit the official websites of these brands or trusted retailers. Take into consideration factors such as price, supported cryptocurrencies, ease of use, and additional security features when choosing the right hardware wallet for your needs. It is also recommended to buy directly from the manufacturer or authorized resellers to avoid counterfeit products.

Once you have acquired a hardware wallet, it is crucial to follow the manufacturer’s instructions and set it up properly. This includes generating a secure recovery phrase, enabling PIN protection, and installing the necessary software or applications. Take the time to familiarize yourself with the wallet’s interface and features to ensure that you can effectively manage your crypto assets.

By investing in a hardware wallet and learning how to use it correctly, you can gain peace of mind knowing that your crypto assets are stored in a highly secure offline environment. For a brief walkthrough, you can check out our guide to Ledger, one of the most popular hardware wallets.

6. Find a Trustworthy Group of People to Follow

In the fast-paced world of crypto, staying updated with the latest trends, news, and insights is vital, especially during a crypto bull run. To ensure you are well informed, it is essential to find a trustworthy group of influencers and thought leaders to follow. These individuals can provide valuable insights, analysis, and predictions that can help you navigate the market successfully.

When identifying influencers to follow, focus on those who have a strong track record of objective analysis and reliable information, rather than jumping on the next hype train. Look for individuals who have established themselves as industry experts and have demonstrated a deep understanding of the crypto market.

During the crypto bear market, take the time to evaluate various influencers, their content, and the quality of their insights. Prune your list to include only those who consistently provide valuable and reliable information. Engage with their content, participate in discussions, and ask questions to further deepen your knowledge.

Additionally, consider joining reputable crypto communities or forums where you can connect with like-minded individuals who share valuable insights and discuss market trends. Engaging with such communities can provide a broader perspective and access to collective intelligence.

By following trustworthy influencers and being part of reliable communities, you can stay updated on the latest developments, identify emerging trends, and make informed decisions during the next crypto bull market.

7. Build a Network by Participating in the Industry

In the ever-evolving world of crypto, building a network of like-minded individuals can be a valuable asset. While following trustworthy influencers is important, having a network of friends who are also exploring crypto at the same time as you can provide additional benefits. By actively participating in the industry and engaging with others, you can watch each other’s backs, share new ideas, and collectively navigate the crypto bull market.

To expand your network, consider joining relevant communities and platforms where crypto enthusiasts gather. Discord channels, social media groups, and specialized forums are excellent places to connect with individuals who share your passion for crypto. Engage in discussions, ask questions, and contribute your insights to these platforms. Don’t be shy about sharing your own opinions and experiences; doing so can spark valuable conversations and attract like-minded individuals.

/r/cryptocurrency is one of the biggest crypto discussion forums online

By actively participating in the industry, you expose yourself to different perspectives and diverse ideas. Engaging with others allows you to stay informed about the latest trends, projects, and market insights. It also provides an opportunity to learn from experienced individuals and gain new perspectives on crypto-related topics.

Collaboration within your network can lead to mutual benefits. By watching each other’s backs, you can share knowledge, insights, and warnings about potential scams or market pitfalls. This collaborative approach helps create a supportive environment where everyone can learn and grow together.

Remember to maintain a sense of skepticism and critical thinking while building your network. Not all information or advice may be reliable, so it’s crucial to conduct your own research and exercise discernment. Surrounding yourself with individuals who value transparency, integrity, and a commitment to learning will enhance your overall experience in the crypto bull market.

Potential Trends for the Next Crypto Bull Run

In general, crypto bull runs tend to exhibit certain trends, with specific sectors outperforming others. It is often the case that new sectors emerge and flourish, while others from previous cycles never recover. As such, in anticipation of the next bull run, it is essential to identify potential trends and sectors that show promise for significant growth. Here, we explore the top trends that have taken hold in the crypto industry over the past year or so.

1. AI Crypto

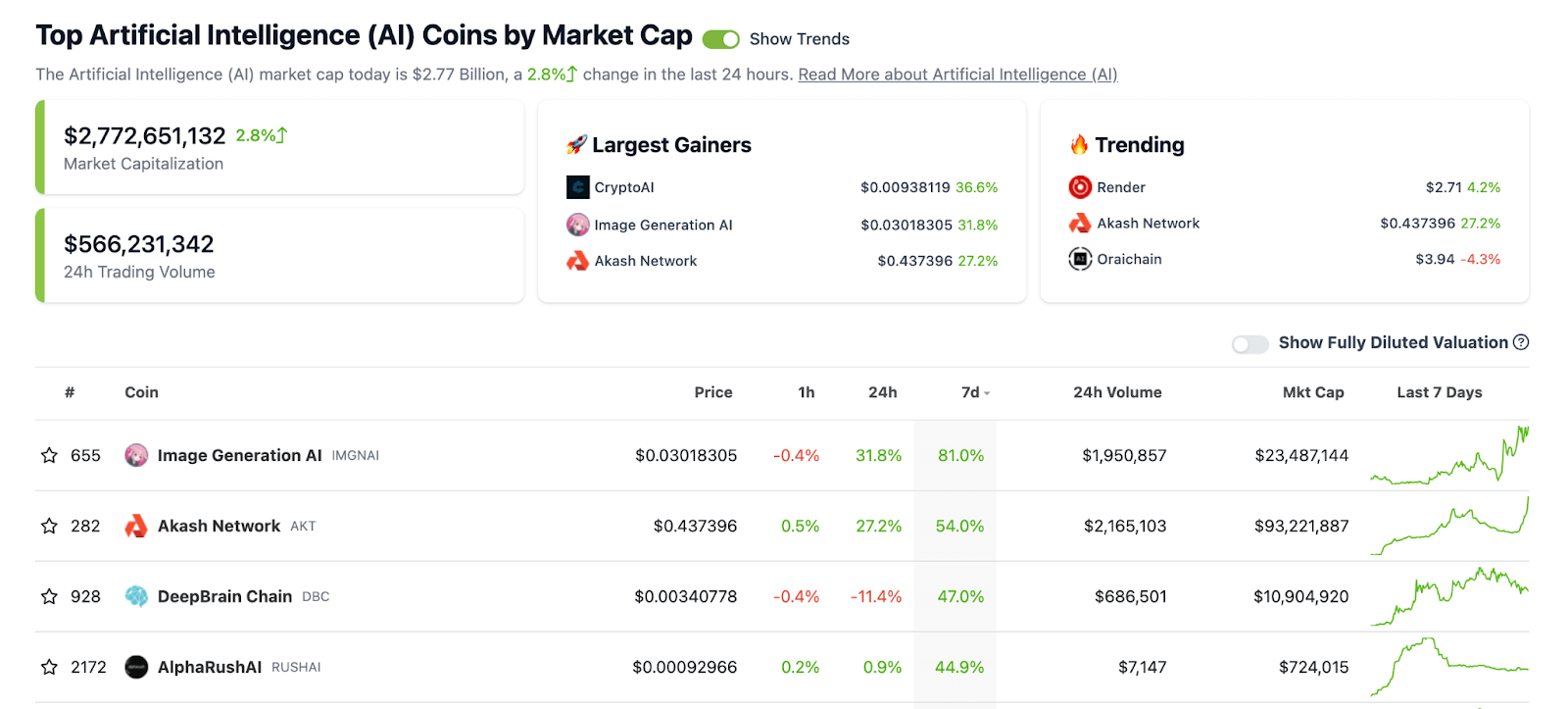

As consumer AI continues to gain traction, there is growing speculation about the potential synergy between crypto and AI coins. The intersection of these two technologies presents an exciting opportunity for innovation and disruption. AI-powered cryptocurrencies aim to leverage artificial intelligence to enhance various aspects of the crypto ecosystem, such as trading algorithms, data analysis, and predictive models. Several projects in this space are worth keeping an eye on.

Track trending AI coins with CoinGecko

For instance, SingularityNET is an AI marketplace built on blockchain that enables developers to monetize their AI algorithms. It aims to create a decentralized network of AI agents capable of interacting with each other, leading to new insights and breakthroughs. Another project is Ocean Protocol, which focuses on unlocking data for AI by utilizing blockchain technology. It allows individuals and organizations to share and monetize data while ensuring privacy and data security. These projects showcase the potential for AI and crypto to collaborate, opening up new possibilities for innovation and economic growth.

2. GameFi

While GameFi gained some popularity in 2021, it did not experience a major breakthrough. However, this sector has the potential to flourish during the next bull run, similar to how NFTs gained momentum in 2021 after a period of initial exposure.

GameFi combines blockchain technology, decentralized finance (DeFi), and gaming, offering players the opportunity to earn rewards and generate income through gaming activities. This emerging sector aims to disrupt the traditional gaming industry by introducing play-to-earn models, in-game asset ownership, and decentralized economies within virtual worlds.

Several projects in the GameFi space are worth monitoring. Axie Infinity, a blockchain-based game, gained significant attention in 2021 as players could earn income by breeding, battling, and trading virtual creatures known as Axies.

Another project, Gala Games, explores the concept of owning and monetizing in-game assets, providing players with unique experiences and financial opportunities. There are even projects trying to gamify IRL actions like poidh.

As the GameFi sector evolves and gains more traction, it has the potential to attract a larger user base and contribute to the overall growth of the crypto market. It is important to note, however, that due to the fickle and trend-driven nature of the entertainment industry, expect most projects to be high-risk investments.

3. Ethereum Layer 2s

Ethereum Layer 2s have become a prominent topic of discussion as the Ethereum network looks to scale and address its scalability challenges. Layer 2 solutions aim to alleviate network congestion and high transaction fees by processing transactions off the main Ethereum blockchain, while still maintaining a strong connection and interoperability with it.

Two notable types of Layer 2 solutions are Optimistic rollups and ZK rollups. Optimistic rollups, such as Optimism and Arbitrum, function by bundling multiple transactions together and submitting a summary of these transactions to the Ethereum mainnet. This approach significantly reduces transaction costs and increases throughput. Projects like Optimism and Arbitrum have gained attention for their potential to enhance Ethereum’s scalability without sacrificing decentralization or security.

On the other hand, ZK rollups, which employ zero-knowledge proofs, offer an alternative approach to scaling Ethereum. ZK rollups like zkSync Era, Linea zkEVM, and Starknet aim to achieve high scalability by aggregating transactions into a single proof that is then published on the Ethereum mainnet. These proofs ensure the validity of the transactions while providing a high level of privacy and efficiency.

By adopting Layer 2 solutions, Ethereum can scale its network and accommodate a larger number of transactions, making it more efficient and cost-effective. These solutions have the potential to unlock new possibilities for decentralized applications (dApps), decentralized finance (DeFi), and other use cases built on the Ethereum ecosystem.

4. DAOs

While DAOs (Decentralized Autonomous Organizations) had some notable achievements in 2021, such as Constitution DAO, they are still in the early stages of their potential. However, the growth and innovation within the DAO ecosystem have attracted significant attention from industry insiders. DAOs represent a new paradigm for organizational structures, enabling decentralized decision-making and community governance.

There are several exciting DAO projects to keep an eye on. Juicebox, for example, is a platform that empowers individuals and communities to create and manage their own decentralized organizations. It provides a suite of tools and smart contracts that facilitate governance, voting, and resource allocation within DAOs. Another noteworthy project is DAOstack, which focuses on enabling scalable and collaborative decision-making through decentralized governance frameworks.

These projects highlight the potential of DAOs to revolutionize traditional organizational structures by leveraging the power of blockchain technology and decentralized consensus. By eliminating centralized authority, DAOs aim to create transparent and community-driven decision-making processes.

As the DAO ecosystem continues to evolve, it is important to monitor advancements and innovations within this space. The growth of DAOs presents exciting opportunities for individuals to participate in community governance, contribute to decision-making, and shape the direction of projects and initiatives.

5. Meme Coins

The recent successes of meme coins like Pepe and the long-standing presence of Dogecoin demonstrate that meme coins have the potential to deliver substantial gains to investors. However, researching and evaluating meme coins can be a unique challenge due to their rapid development and unconventional nature. Unlike traditional projects, meme coins often lack detailed roadmaps and follow different dynamics driven by online communities and viral trends.

When exploring meme coins, it is crucial to exercise caution and conduct thorough due diligence. Pay attention to factors such as community engagement, developer activity, and the overall sentiment surrounding the project. While meme coins can bring significant gains, they also carry inherent risks due to their speculative nature and the potential for market manipulation.

Stay informed about emerging meme coins through social media platforms, online communities, and dedicated forums where users discuss and share information about these projects. Engaging with the community and monitoring the sentiment can provide valuable insights into the potential growth and risks associated with specific meme coins.

Remember that investing in meme coins should be approached with caution and only with funds that you are willing to risk. Diversify your portfolio and maintain a balanced investment strategy that considers both established cryptocurrencies and meme coins.

Prepare for the Next Bull Run With De.Fi

When gearing up for the next crypto bull run, it’s essential to leverage the power of De.Fi. De.Fi offers a comprehensive suite of tools that enable crypto participants to track their crypto wallets, discover new opportunities, and gain valuable insights into the industry.

At our platform, we are committed to providing the best resources for crypto enthusiasts to prepare for upcoming bull runs in the crypto market. Our blog is a valuable source of educational content, covering various topics related to crypto investments, market trends, and strategies. It offers in-depth analysis and expert opinions to help you make informed decisions.

In addition, our DeFi YouTube channel is dedicated to sharing informative videos that delve into the intricacies of the crypto space. From tutorials on utilizing De.Fi platforms to interviews with industry experts, our videos provide valuable insights and tips to enhance your understanding and preparedness for the next bull run.

Furthermore, we offer a range of tools on our website that empower investors to track market prices, explore the best DeFi yield farm APYs, and analyze performance metrics. These tools enable you to stay updated on the latest trends, monitor your investments, and make data-driven decisions.

Prepare for the next crypto bull run with De.Fi and equip yourself with the industry’s best tools and information to make informed decisions.