Let’s begin! There’s no doubt that Cardano is a blockchain that divides opinions more than most.

While its supporters say it is one of the most methodically-built protocols out there, its detractors believe that the slow progress it makes with feature development meanigation project, its technology and the wallets or bridges you can use, as well as the staking and yield farming opportunities that exist on Cardano.

Note: Looking for a quick summary of how to discover the best Cardano DeFi opportunities? Check out our helpful YouTube video:

What is Cardano?

Cardano is a proof-of-stake blockchain platform that is founded on peer-reviewed research and“What Cardano seeks to do is build a scalable system, an interoper

Cardano is described as ‘a third-generation protocol’ and ‘a blockchain platform for changemay, as well as the few, and bring about positive global change’. Its official website states that Cardano wants to restore trust in global systems and bring a new standard in technology.

Cardano was founded by Charles Hoskinson, a co-founder of Ethereum who left the project after falling out with Vitalik Buterin. After leaving Ethereum, Hoskinson started IOHK, a blockchain-engineering company that is focused on buid in 2017. It was funded through an ICO that took place at various points between 2015 and 2017.

Apart from IOHK, Cardano is also backed by Emurgo, a Japanese venture capital firm, and the Caased in Switzerland that oversees and encourages the development of the Cardano ecosystem.

Cardano plans a full launch of its technology in five stages, which are all named after famouse took place from 2017 and the Goguen stage is currently underway

Cardano’s Architecture

Cardano uses a version of Proof-of-Stake (PoS) called Ouroboros to secure the network and manage the block production process. It uses a programming language called Haskell for development, which it describes as a functional programming language, and another language, called Plutus, for building stricter contracts.

As mentioned, Carrocess. It consists of two layers, the Cardano Settlement Layer and the Cardano Computation Layer, which aim to achieve performance that can support global applications, systems and business use cases. Nodes in the Cardano system are responsible for validating blocks, adding blocks to the chain and distributing transactions.

Some of Cardano’s key technology features are outlined below.

Ouroboros

Ouroboros is Cardano’s Proof-of-Stake consensus mechanism, which claims to be eaders confirm transactions and produce blocks, which are then approved by input endorsers.

Plutus

Plutus is the native smart contract language for Cardano. It is a Turing-complete language written in Haskell. Therefore Plutus smart contracts are effectively Haskell programs.

Rosetta

Rosetta is a general-purpose integration framework, which includes an open source specification and a set of tools, to help developers integrate with blockchain.

Marlowe

Marlowe is a domain-specific language for writing and executing financial contracts. Ispecific knowledge.

Governance

On-chain goo Improvement Proposal. Then network participants will use their staked $ADA, Cardano’s native token, to vote on these proposals and influence the future direction of Cardano.

$ADA Token

The native token of Cardano is ADA, which can be used for staking and will play a role in on-chain governance decisions, once that feature of the Cardano network is enabled.

As of 28 April 2022, ADA has a price of $0.844140, a current market cap of $27,046,795,751 and a max supply of 45,000,000,000 (according to CoinGecko data).

The Cardano Ecosystem

As mentioned, the Cardano Foundation is responsible for overseeing and encouraging the development of the Cardano ecosystem.

Also, IOHK has partnered with various universities for blockchain research and Cardano has developed partnerships with organizations across the world, in.

The Cardano community includes an Ambassador Program, which was established in 2018. It aims to drive adoption of Cardano, to promote awareness and to educate the wider community.

Wallets for Cardano

Cardano users can access wallets that are unique to the Cardano ecosystem.

Eternl Wallet

A Cardano light wallet, previously known as ccVault.

It allows the sending and receiving of Ada and native tokens, as well delegating your Ada to 1 of over 3000 staking pools.

Daedalus Wallet

Daedalus describesports all major desktop operating systems and runs on Windows, macOS, and Linux.

Yoroi Wallet

Yoroi is a light wallet for Cardano that describes itself as ‘simple, fast and secure’. It is an Emurgo product that has been engineered by IOHK.

Nami Wallet

Nami is a brobased wallet extension to interact with the Cardano blockchain and is non-custodial. It can be used to send and store multiple assets, to dre are some options available for DeFi users who are willing to investigate further.

To get to Cardano, you will firstly need to bridge to Milkomeda and after that to Cardano.

For that, you can use Connext Bridge.

Ardana (NEAR)

Ardana is described as Cardano’s stablecoin hub rather than a bridge and it announced last year that it was partnering with NEAR to make cross-chain asset transfers possible.

Milkomeda (Ethereum)

Technically, Milkomeda is an EVM-compatible sidechain on Cardano but many supporters see this as the closest thing to a bridge for allowing ERC-20 tokens to be used on Cardano.

De.Fi on Cardano

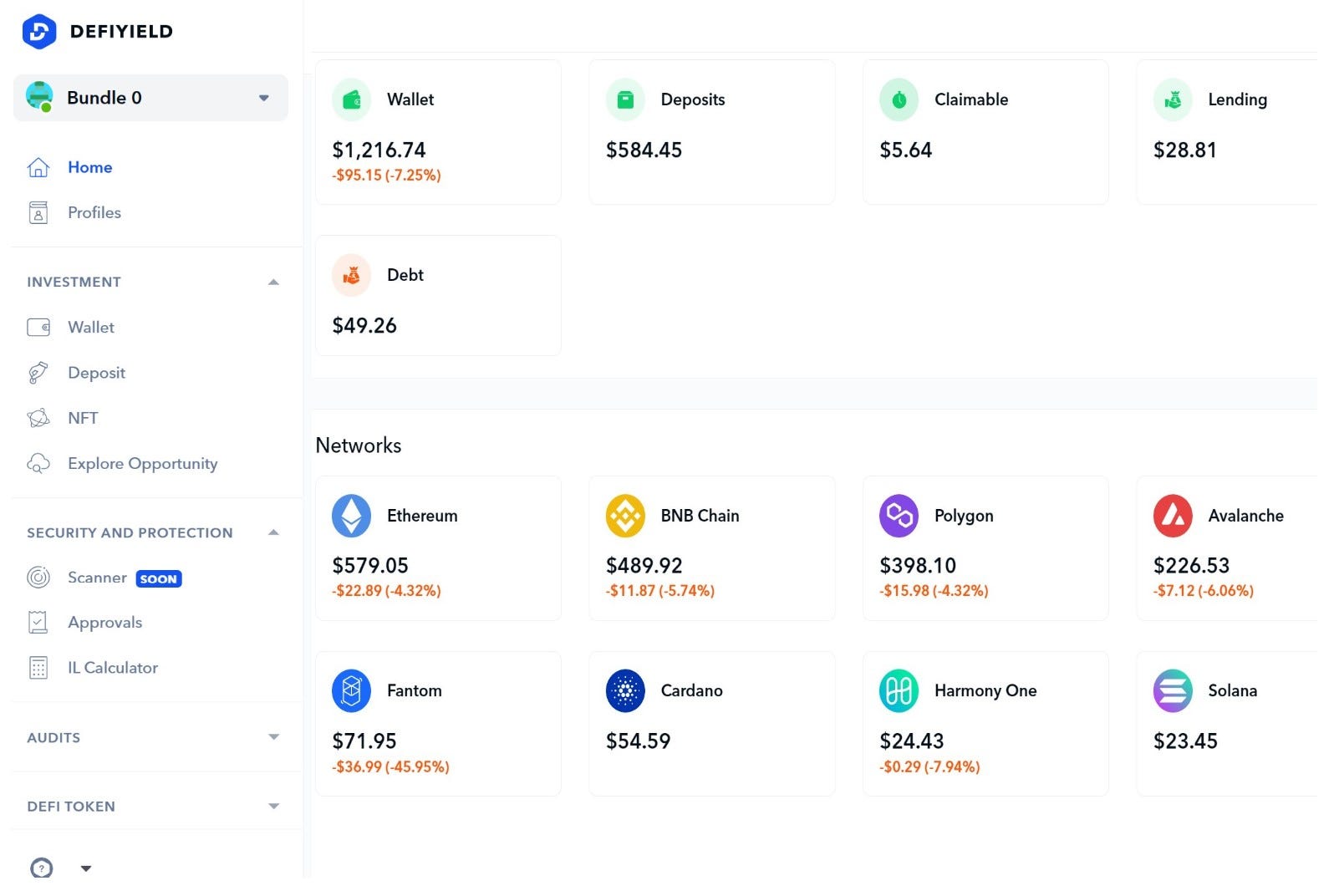

The great news for DeFi users and yield farmers is that Cardano is available on De.Fi!

You can track your Cardano DeFi profits and losses, balances, prices and much more. Our enhanced dashboard provides the most comprehensive user experience, so visit our app and connect your wallet now to get started — https://de.fi/

DeFi Staking and Yield Farming on Cardano

Cardano is actively evolving, offering more and more investing opportunities.

If you immemany exciting opportunities there are.

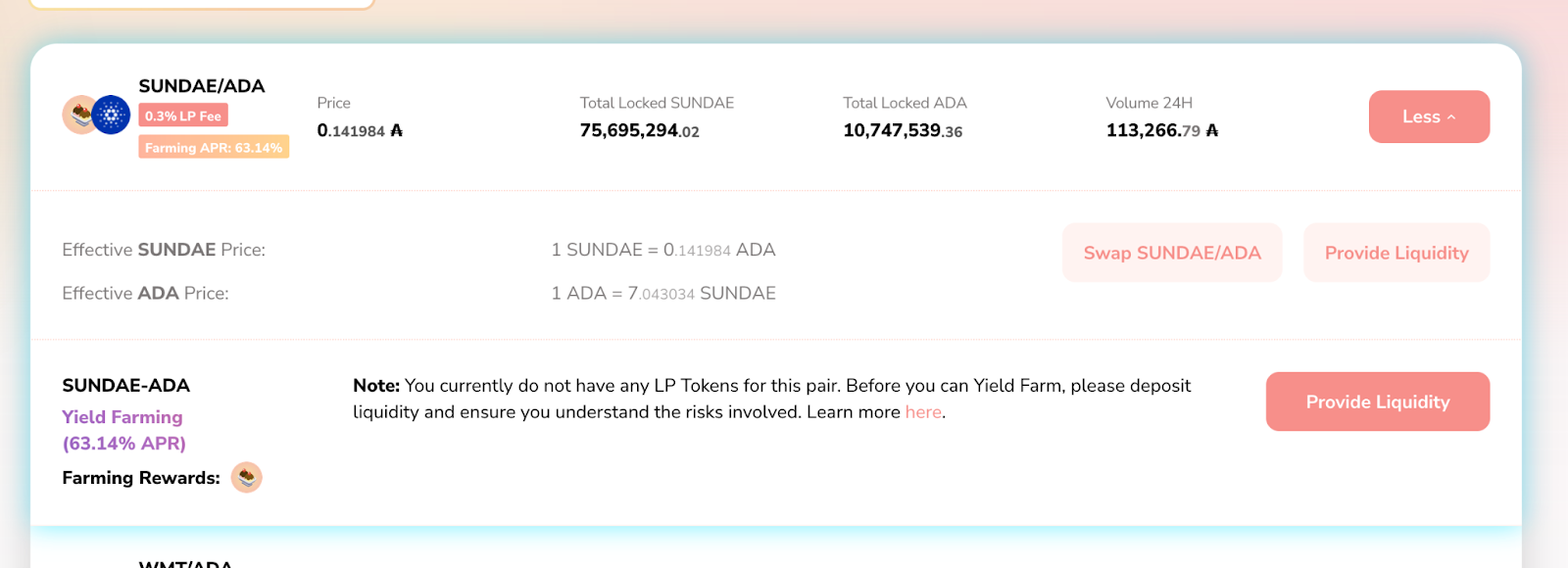

Today, we will discover SundaeSwap Protocol that is a DEX with profitable Yield Farming OppDefillama data.

Firstly, you will want to open the SundaeSwap site and launch the application.

Choose the Farm you want to invest in.

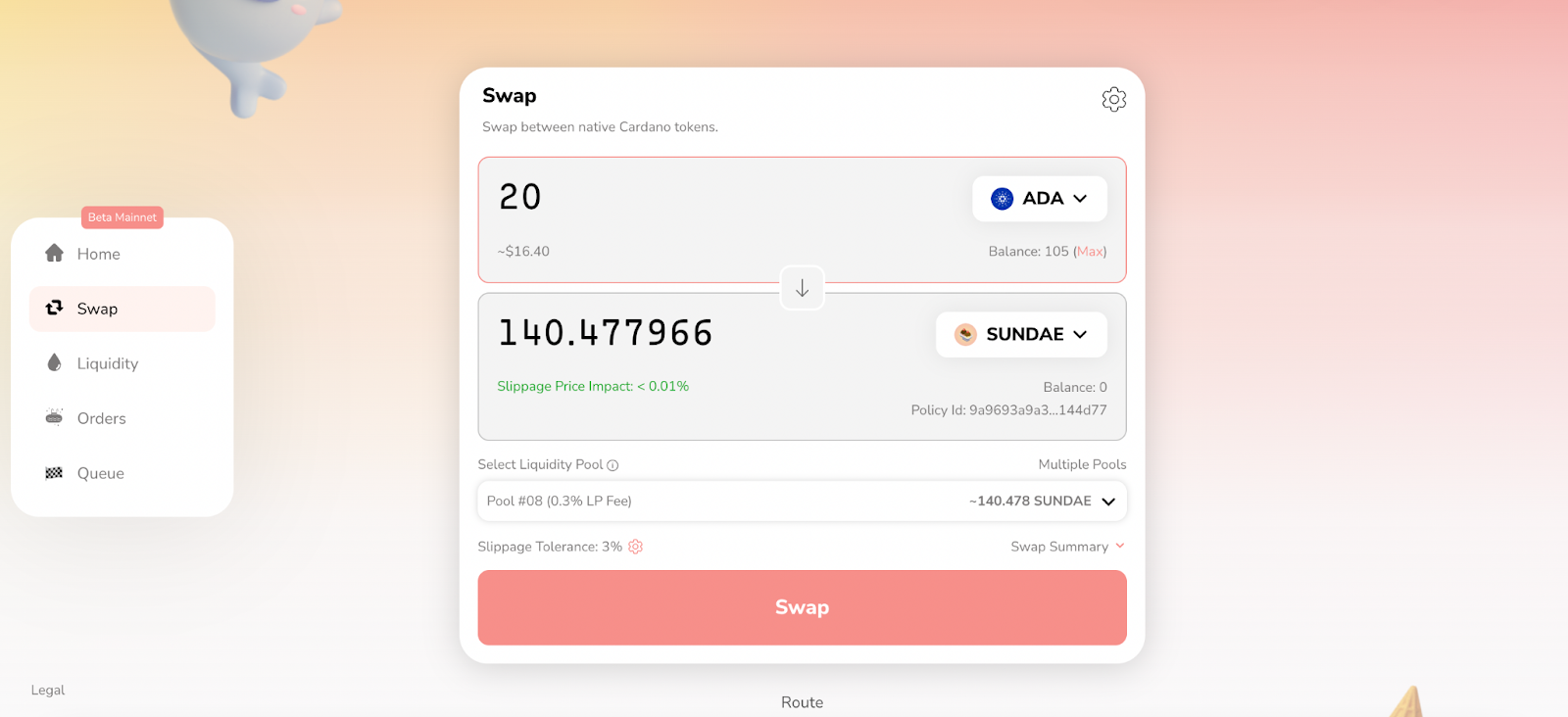

We will need to get LP tokens for the pair, therefore we will want to go and swap the tokens.

Then, go to the “Liquidity” tab and provide liquidity with the chosen pair in order to get L

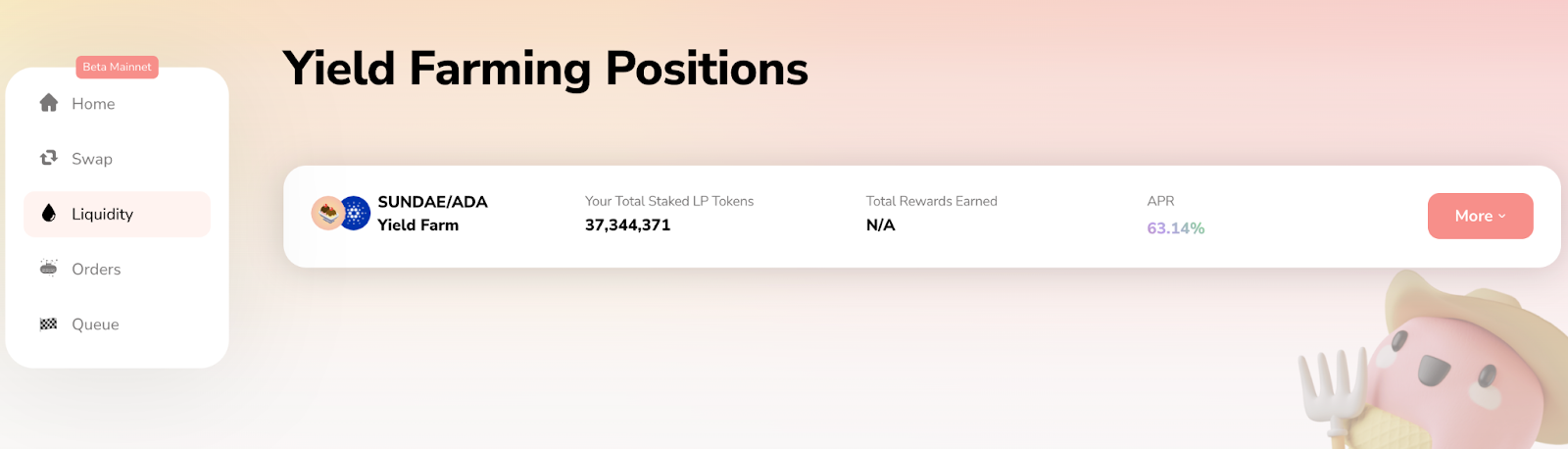

Now, you will be able to see your position in the “Liquidity” tab.

To Yield Farm, you can simply click “Stake LP tokens”.

This will lock your tokens for 30 days.

Now, you will see your yield farming position below the liquidity one.

Staking

Besides Yield Farming, you can do staking on Cardano.

For example, you c

Simply choose where you want to delegate your tokens and confirm the transactions.

De.Fi FOR CARDANO

Now you can tr

Once you click on Cardano network, you’ll then be able to view all the Yield Farming protocols in your wallet. From there you’ll be able to view tokens, pools, and all assets available for each.

From here you can click on each and see a detailed breakdown of your deposits. For example, if you click on Deposits, you can view a pull-down menu that shares a detailed summary of your holdings.

The proprietary Agher APY. The Cardano network uses the Ouroboros Algorithm, a Proof-of-stake (PoS) algorithm, leading to lowered energy costs and faster transaction processing.

Should I use Cardano for DeFi Staking and Yield Farming?

While Cardano is often maligned by other crypto communities for what they see as its slow progress, the blockchain protocol that was founded by Charles Hoskinson does seem to gradually roll out various features it has promised.

The latest of these is stak a feature than a bug and therefore, if you sit in this camp, you will probably also agree that the opportunities available are worth investigating.

As you can see, by providing your liquidity to the ADA Yield Farming, liquidity pools, your opportunities to earn passive income will increase as more usercts are an extra incentive for the liquidity providers to look at the Cardano DeFi Ecosystem, completely on-chain to keep all of this activity automated, safe, and secure — the very definition of a trustless process within DeFi.

Here you can check yield farming opportunities on Cardano: https://de.fi/explore/network/cardano

Just remember, as always, this is not investment advice and you should always do your own research first.

Good Luck Farming!