Solana is one of the most talked-about blockchain networks right now, so it’s no surprise that yield farmers are also looking at it for new opportunities.

Like many other networks that have appeared in recent years, Solana is looking to solve the problems of scalability and slow transaction processing that have hampered first and second generation blockchains. It aims to solve these issues by introducing a new consensus protocol called Proof-of-History (PoH), which doesn’t rely on timestamping.

Solana’s progress has led to a number of high profile backers getting behind it and a growing ecosystem of projects choosing to build on its foundations. In this guide, you will discover the main technological principles that fuel the Solana network and learn how to stake or yield farm on it.

Table of Contents

- What is Solana?

- Solana Network Infrastructure

- Solana Innovations

- The Solana Ecosystem

- Solana Wallets

- Supported App Wallets

- Supported Web Wallets

- Staking on Solana

- 5 Steps to begin Yield Farming on Solana With Raydium

- Should I use Solana for yield farming?

What is Solana?

Solana is a high performance blockchain based on three consensus protocols, called Proof-of-Stake (PoS), Proof-of-History (PoH) and enhanced Proof-of-Replication (PoRep).

PoH seeks to significantly increase transaction processing speeds and improve security compared to the sharding solutions that other blockchains use. On Solana, developers have been able to sustain a throughput of 50,000 Transactions Per Second (TPS), with 200 physically distinct nodes running GPUs on the Solana Testnet.

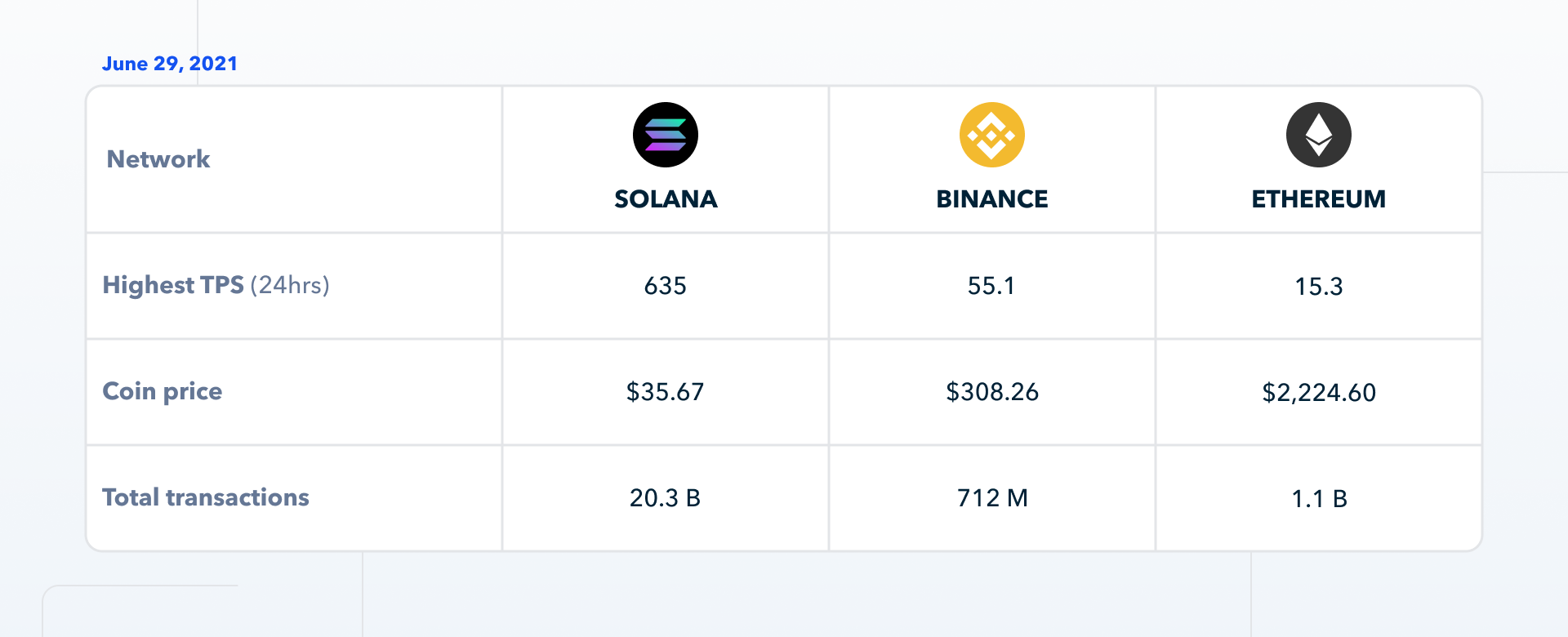

Below, you can see some high-level comparisons to other well known Layer 1 blockchains.

Solana has a very complex infrastructure, which relies on participants it refers to as leaders, validators, archivers and replicators. It introduces new solutions that remove bottlenecks related to hardware components, including SSDs, CPUs and GPUs, in order to increase the overall network performance. Solana also uses horizontal scaling and can store petabytes of data that are rapidly accessible.

Solana is very suitable for decentralized applications due to its proprietary runtime that can process smart contracts in parallel mode. The network implements a new approach to the mempool problem, which processes transactions before the PoH algorithm manages them. Overall, the Solana network stands out because it can process and store data at high speeds, while using enhanced consensus protocols at all levels to ensure security.

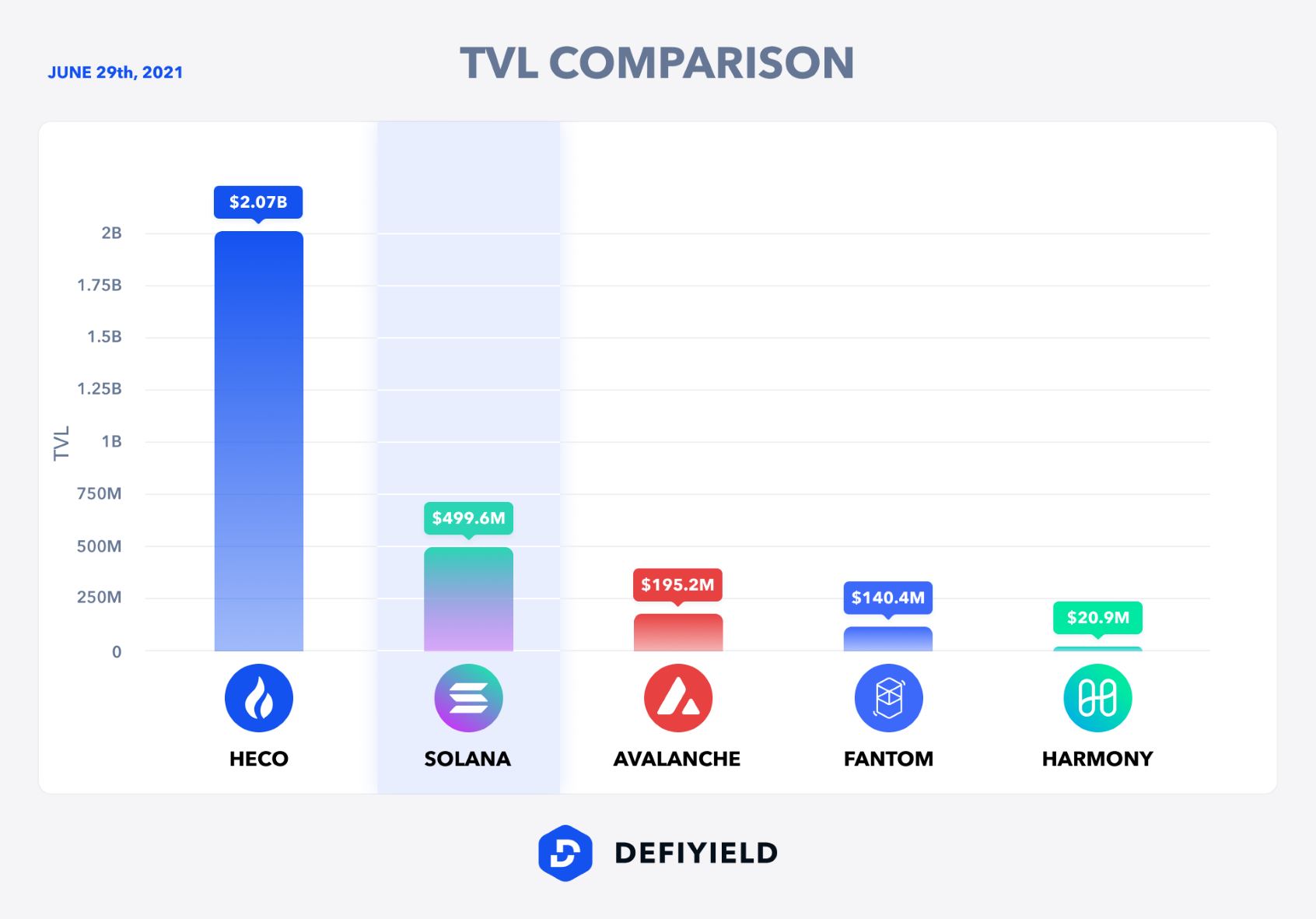

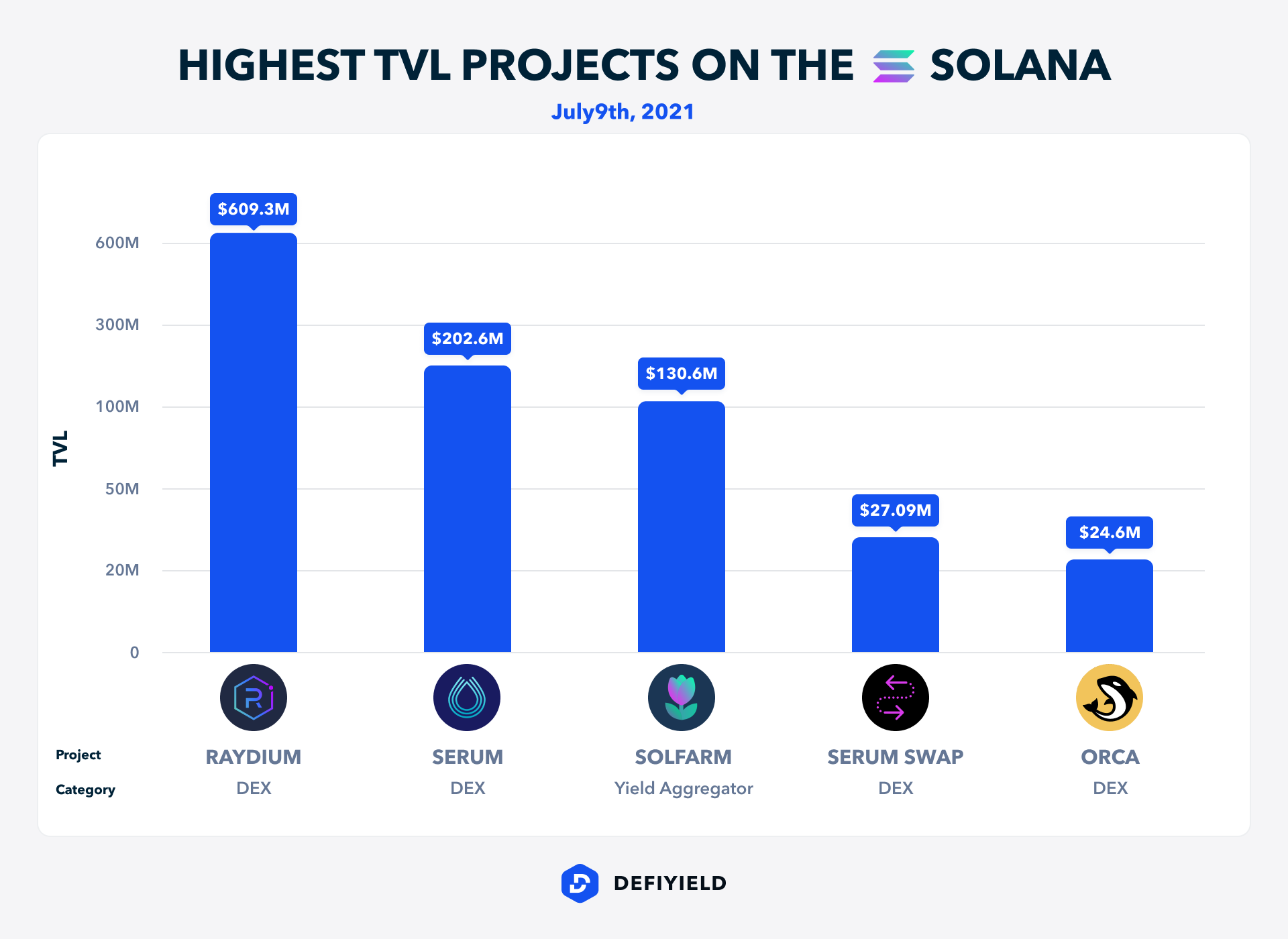

In the image below, you can see how Solana compares to other established networks in terms of the TVL (Total Value Locked) on each.

Solana Network Infrastructure

In Solana, network operations are processed by validator nodes that run high-end hardware capable of processing a large number of transactions.

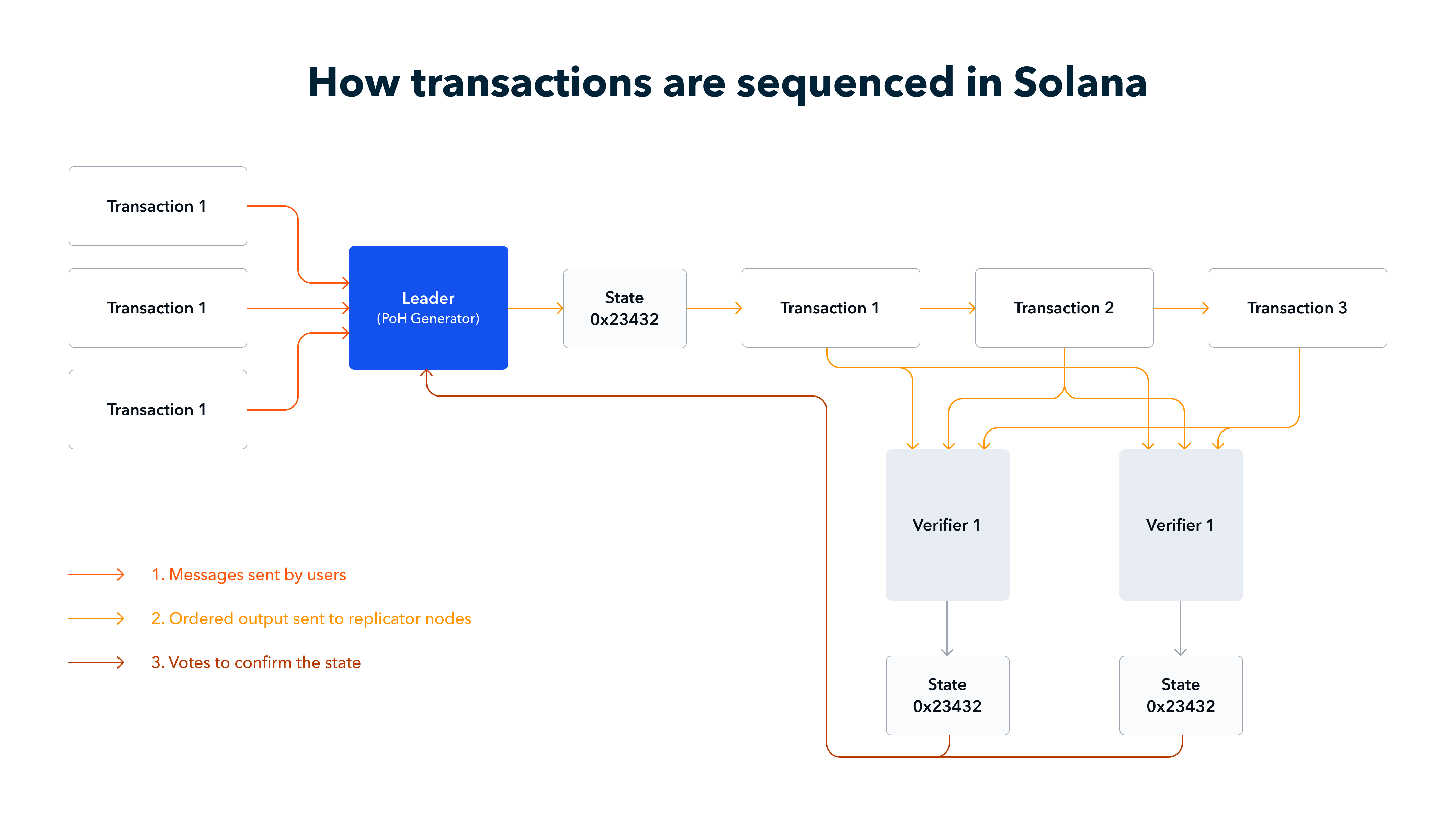

One of the main reasons why transaction processing is different on Solana is because of the PoH algorithm, which introduces a decentralized clock. The decentralized clock does not rely on timestamps but instead relies on hashes appended to a list, which connects them back to previous hashes.

In order for all network participants to have the same decentralized clock, a leader is elected by validators using the PoS algorithm. This leader processes incoming transactions and orders them by generating PoH sequences in the form of sha256 hashes that are appended to the list.

These ordered PoH sequences are then transferred to Replicator Nodes, which then send the sequences to Validator Nodes, which verify and sign the transactions. The overall effect of this sequence is that Validator Nodes can process transactions much faster and therefore increase network throughput.

In the image below, you can see how transactions are sequenced in Solana.

PoH also allows for additional data to be carried in transactions when it is input in an Event data structure, as long as it is hashed along with the previous hash to ensure the integrity of the previous sequences.

In order to elect a leader, the PoS algorithm assesses the staked weight across all Validators on the network. If an elected leader fails, the PoS algorithm allows for a new leader to be chosen by the network, based on the highest voting power and public key address.

The final part of Solana’s consensus model is the PoRep algorithm, which allows for petabytes of data to be stored securely. The original PoRep algorithm had a major flaw that made it possible for a node to stream the encryption and delete it as it is hashed. The new algorithm combats this by forcing Archive Nodes to generate proofs that are verified by Validator nodes.

If you wanna stay safe and be up to date — subscribe to our newsletter! We will send you our DeFi Security Handbook straightaway. In the ebook we explain how to stay safe, what are we paying attention to while performing smart contract audits and what should you do to not get REKT by crypto hacks & scams. You can expect insights, interesting content and updates from us.

Solana Innovations

Alongside its unique network infrastructure model, Solana has a number of other technical innovations that are worth noting.

Turbine

A block propagation protocol that allows huge blocks to be transferred to a large number of validators following the same principles as the BitTorrent UDP protocol.

Gulf Stream

A protocol that forces validators and clients to send transactions to an expected leader (who hasn’t been elected yet) ahead of the time. Transactions are processed faster using this method, since they are not stored in the memory of validators.

Sealevel

A runtime that allows smart contracts to be processed in parallel using Nvidia CUDA cores.

Pipelining

This method introduces a special mechanism that improves transaction processing by dividing a Transaction Unit into four elements. Data Fetching is performed at the kernel level, Signature Verification at the GPU level, Banking at the CPU level and Writing at the kernel space.

Cloudbreak

An algorithm that uses a proprietary data structure capable of processing transactions and indexing them at the same time.

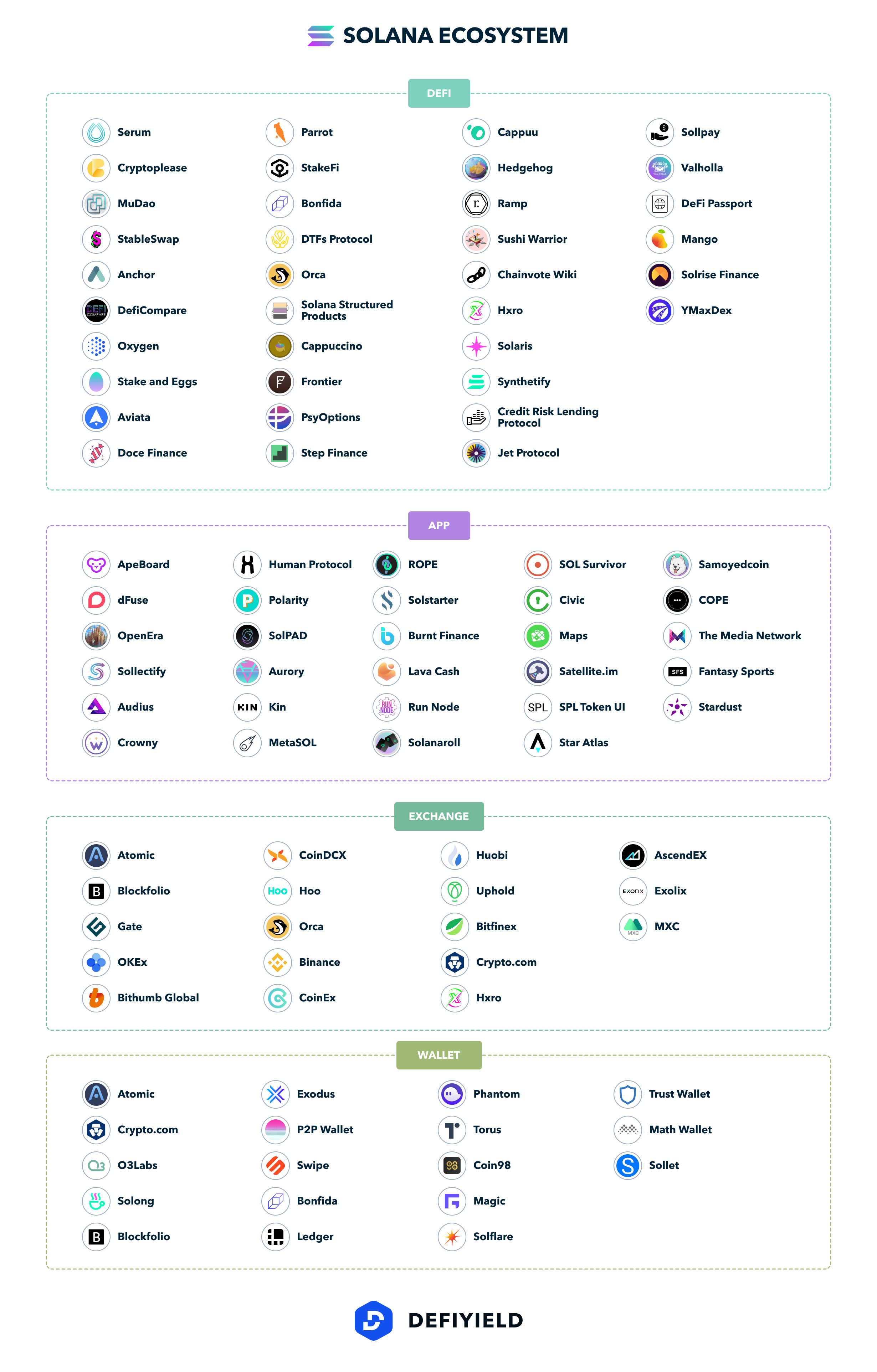

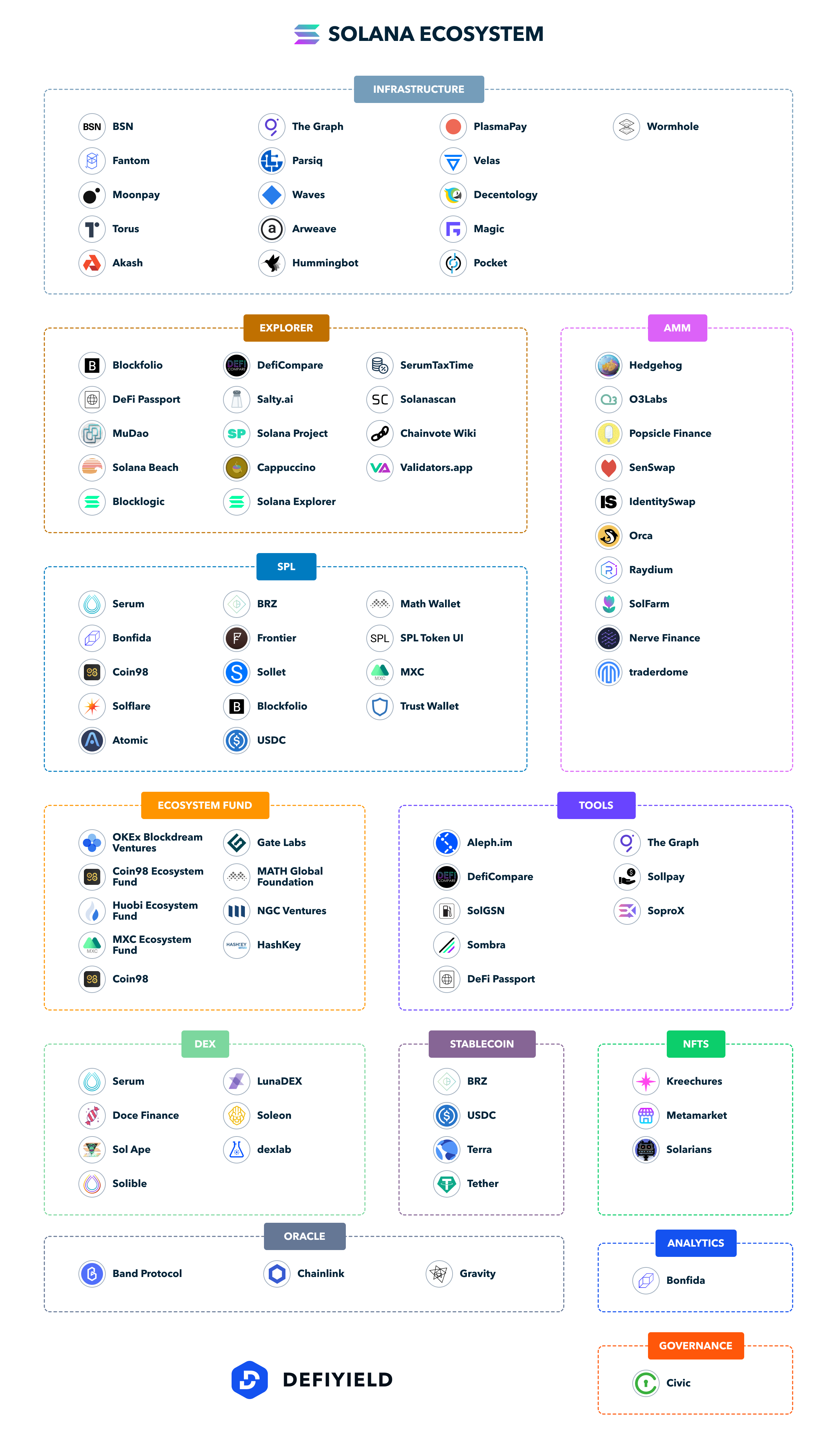

The Solana Ecosystem

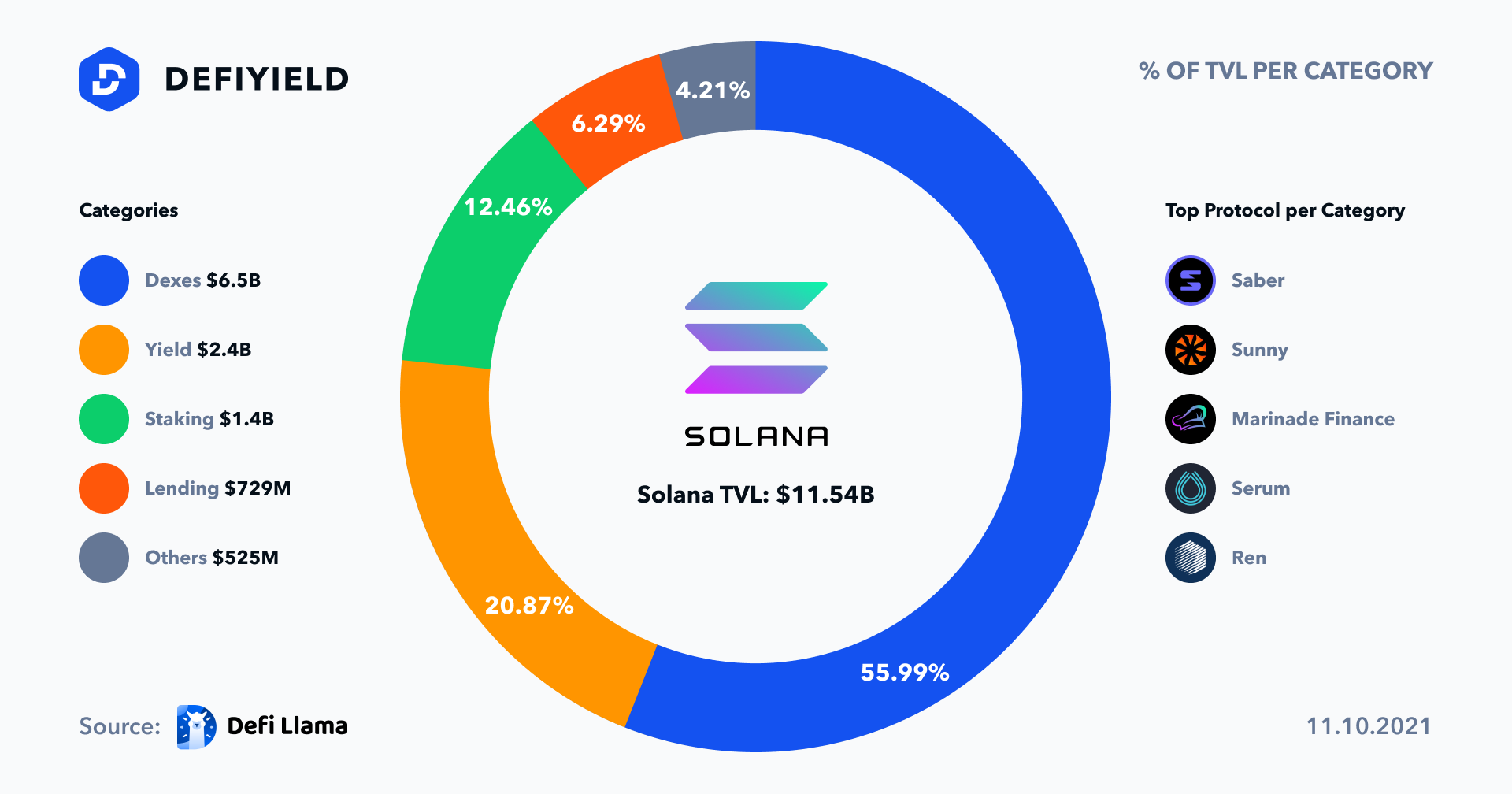

Over the last few years, numerous projects have chosen to build their solutions on the Solana Network and this has resulted in an increasingly vibrant and diversified ecosystem.

In the image below, you can see a quick overview of this.

Solana Wallets

The official Solana documentation provides information about which wallets are available. We also have a full guide to the best Solana wallets. These can be divided into Supported App Wallets and Supported Web Wallets.

Supported App Wallets

**Exodus**

This wallet can be downloaded on your mobile and desktop device. It has already integrated with the Trezor hard wallet.

The Wallet is available for iOS and Android mobile devices. You can freely operate with your SOL tokens using the Trust Wallet application.

**Coin98**

You can use this wallet for managing your SOL tokens as well. Available for iOS and Android mobile devices.

Please note, the Supported App Wallets mentioned above do not support direct interaction with the dApp. They are only used for portfolio management and transfer operations.

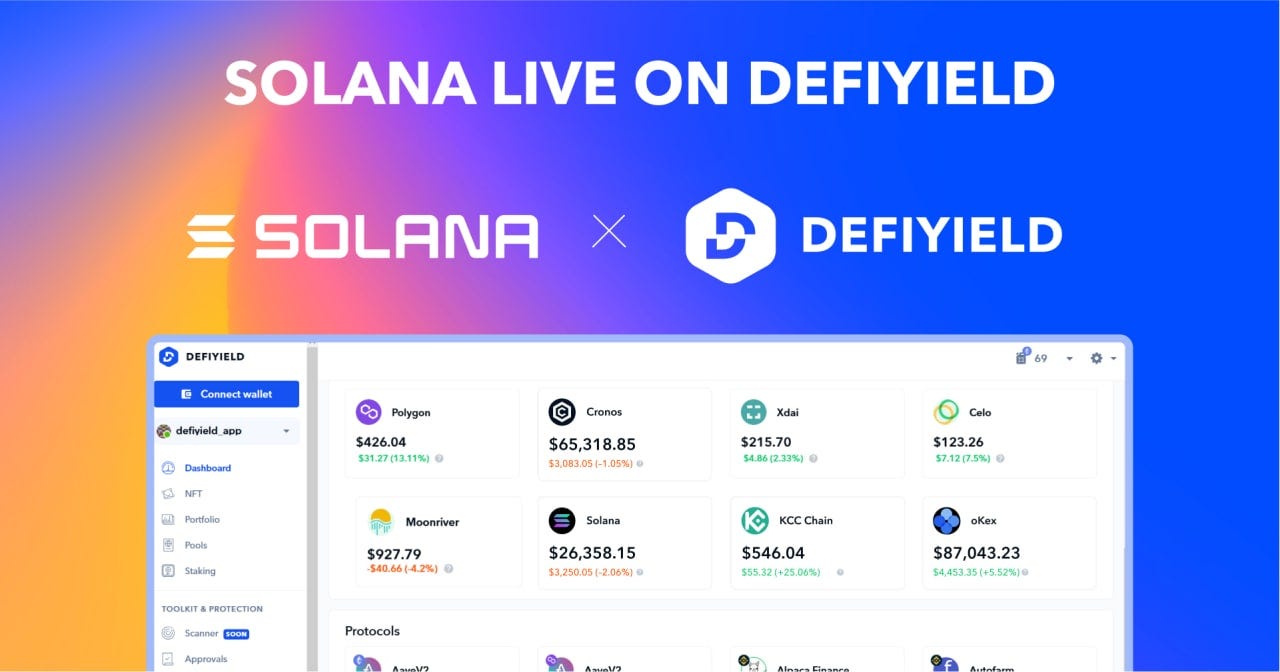

Solana Integrated on De.Fi

EXCLUSIVE FEATURE ALERT 🔥🤩

Now you can manage your EMV-compatible chains investment along with Solana ones!

Connect your wallet and see the magic of our all-in-one DeFi wallet tracker🥳

Supported Web Wallets

Phantom is a Chrome extension for accessing and interacting with dApps deployed on the Solana blockchain. It works a bit like the Metamask wallet, so UX will be familiar to most users. Use invite code DEVDOCS to get access to the wallet functionality.

This wallet is easy to use. It allows you to safely access your digital wallet and manage your tokens. Below, we talk about this solution in a bit more detail.

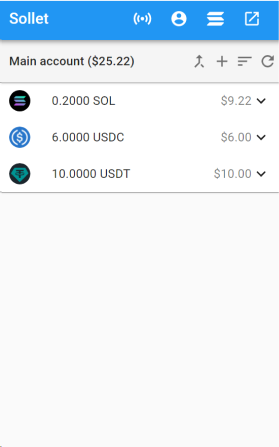

**Sollet**

To make interactions with Solana easier, the Sollet wallet can be used across a variety of different dApps. In this guide, we will use Sollet to stake and yield farm. Sollet is only available for Chrome browsers and can be downloaded as an extension. Once the wallet has been installed, a seed phrase will be generated. Save it in a safe place.

If you wanna stay safe and be up to date — subscribe to our newsletter! We will send you our DeFi Security Handbook straightaway. You can expect insights, interesting content and updates from us.

Staking on Solana

At the moment of writing, the Nominal Reward APY is 11.5% per staked SOL.

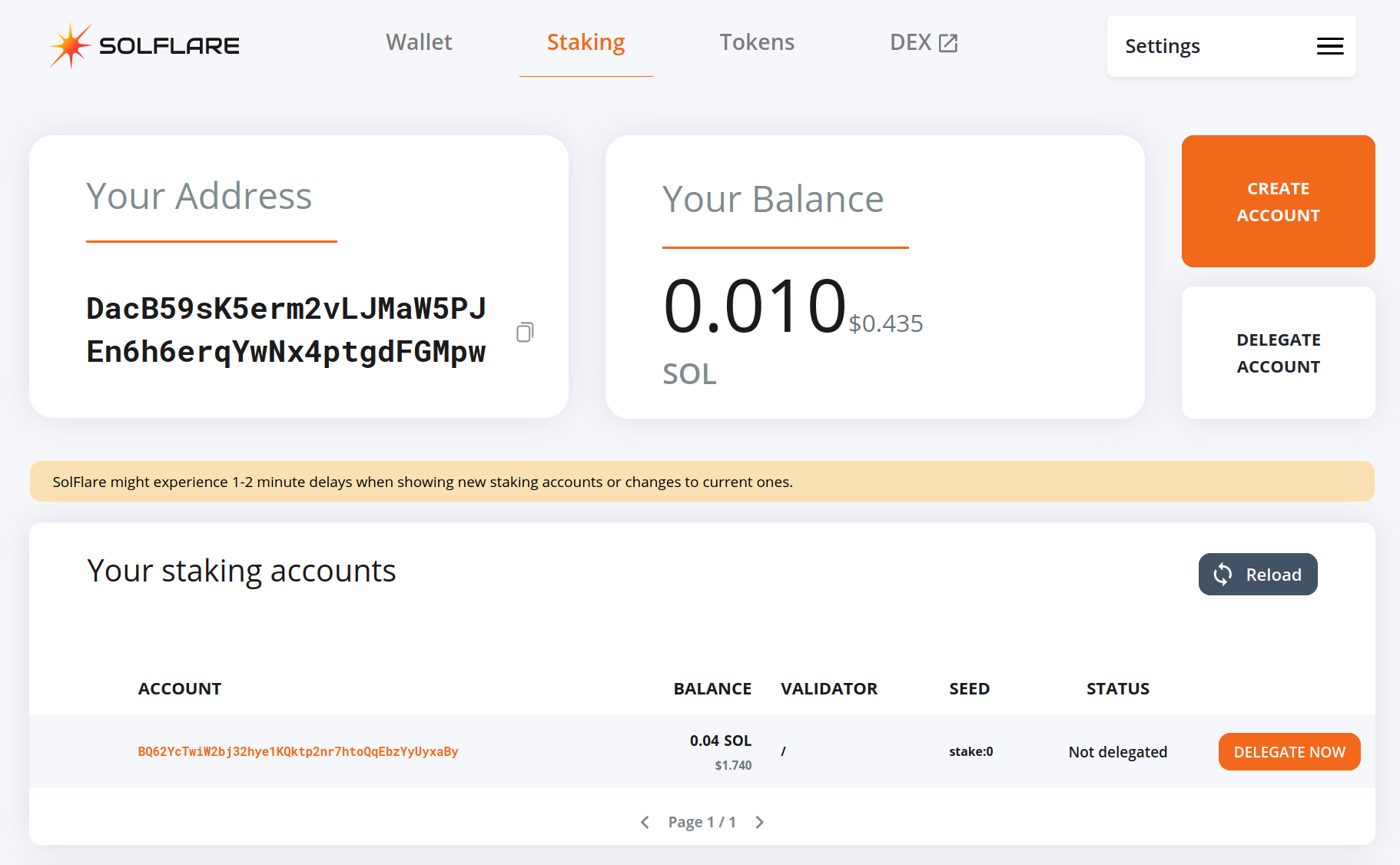

If you want to stake SOL, navigate to https://solflare.com/ and click on the ‘Create a New Wallet’ button. The service also supports the Ledger Nano implementation for staking.

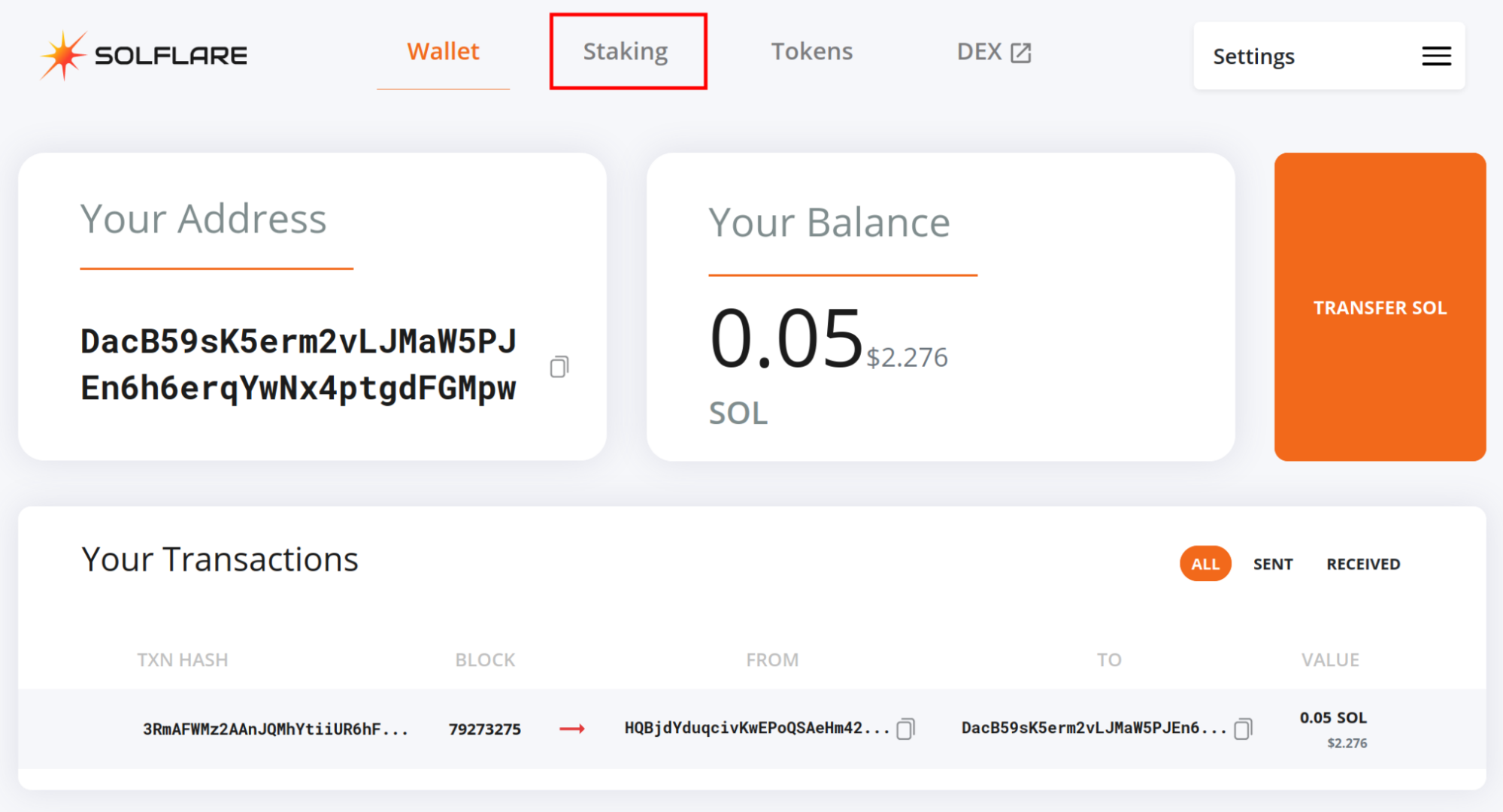

Go through all the required steps, ensuring that the keystore file is saved in a safe place. The keystore file is used later on to access your account and, if you lose it, you won’t have access to your funds.

Once the account has been accessed, click on the ‘Staking’ button.

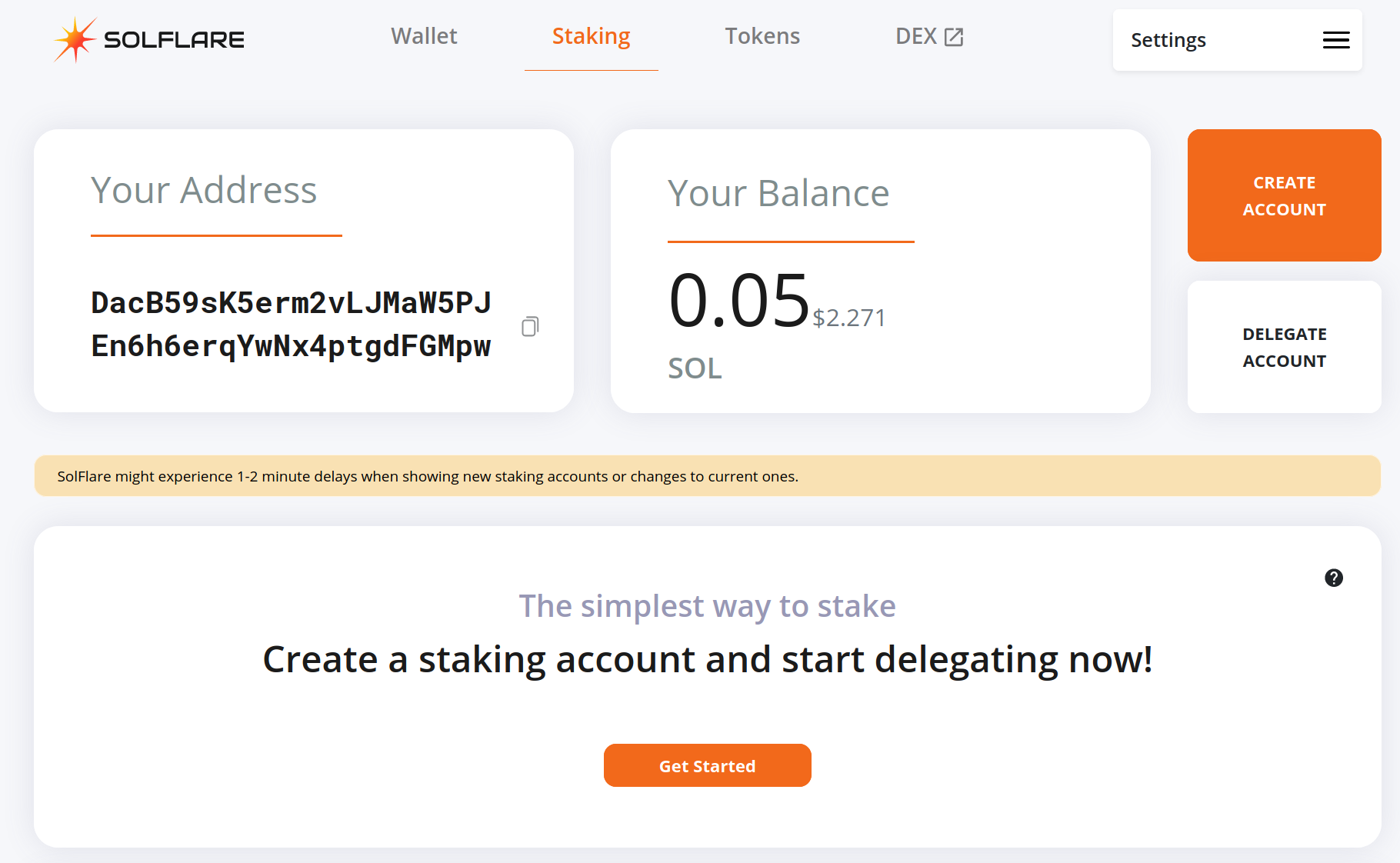

To stake SOL you need to create a Staking Account by clicking on the ‘Get Started’ button.

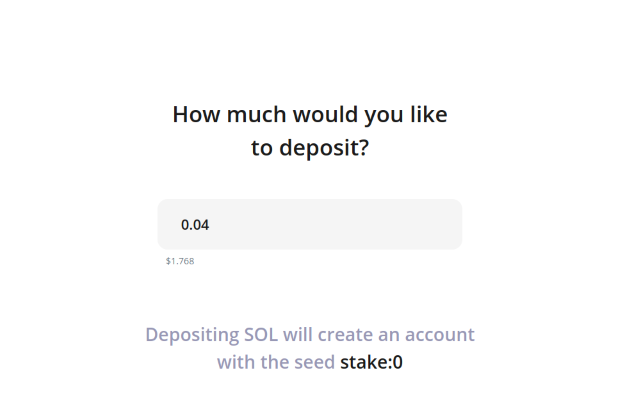

Choose the amount that you want to stake and proceed.

Create a secure password and confirm your operation.

Usually, SolFlare might experience 1–2 minute delays when showing new staking accounts or changes to current ones. In our case, it took about a half an hour to get our account displayed on the dashboard.

Once an account has shown up on the dashboard, click on the ‘Delegate Now’ button.

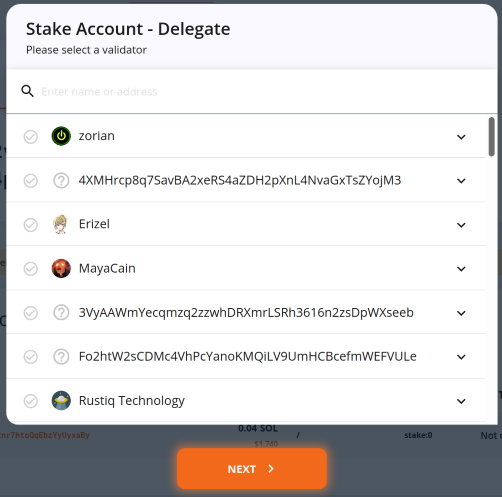

Choose the desired validator from the list and confirm your operation.

Now you have successfully staked your SOL and will receive rewards to your staking account soon.

DeFi Yield Farming on Solana With Raydium

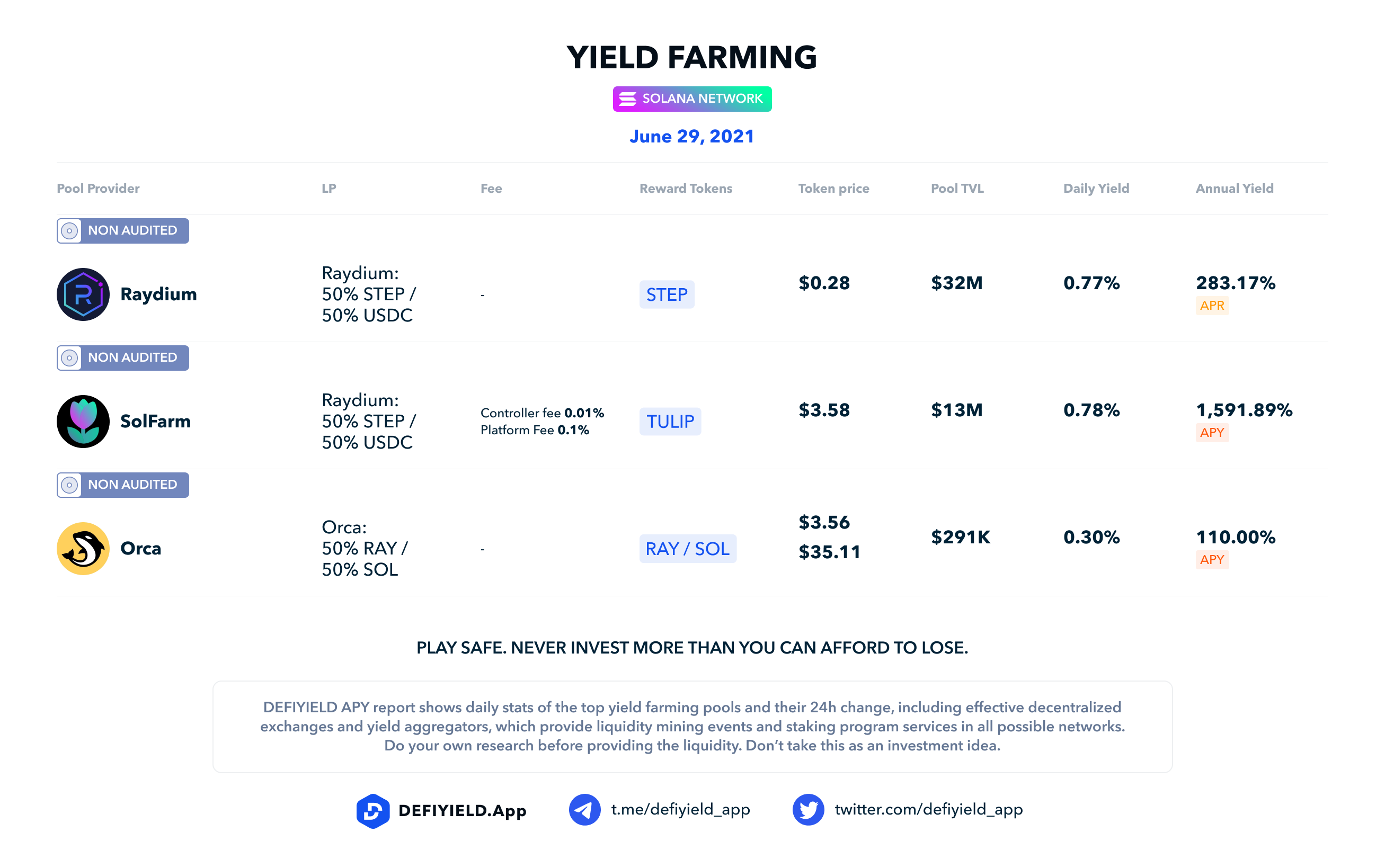

As Solana is widely adopted, the Total Value Locked across different DeFi yield farming projects steadily grows.

The Raydium AMM supports the following Solana markets:

- SOL/RAY

- SRM/SOL

- SOL/USDT

- SOL/USDC

For the purpose of this guide, we will stick to providing liquidity for the SOL/USDC pair. Please note that different markets provide different rewards in the form of fees. To learn what options the platform provides, vist the Pools page.

As mentioned previously, you have to install the Sollet wallet to interact with Solana DeFi dApps and this is a necessary first step for yield farming on Solana.

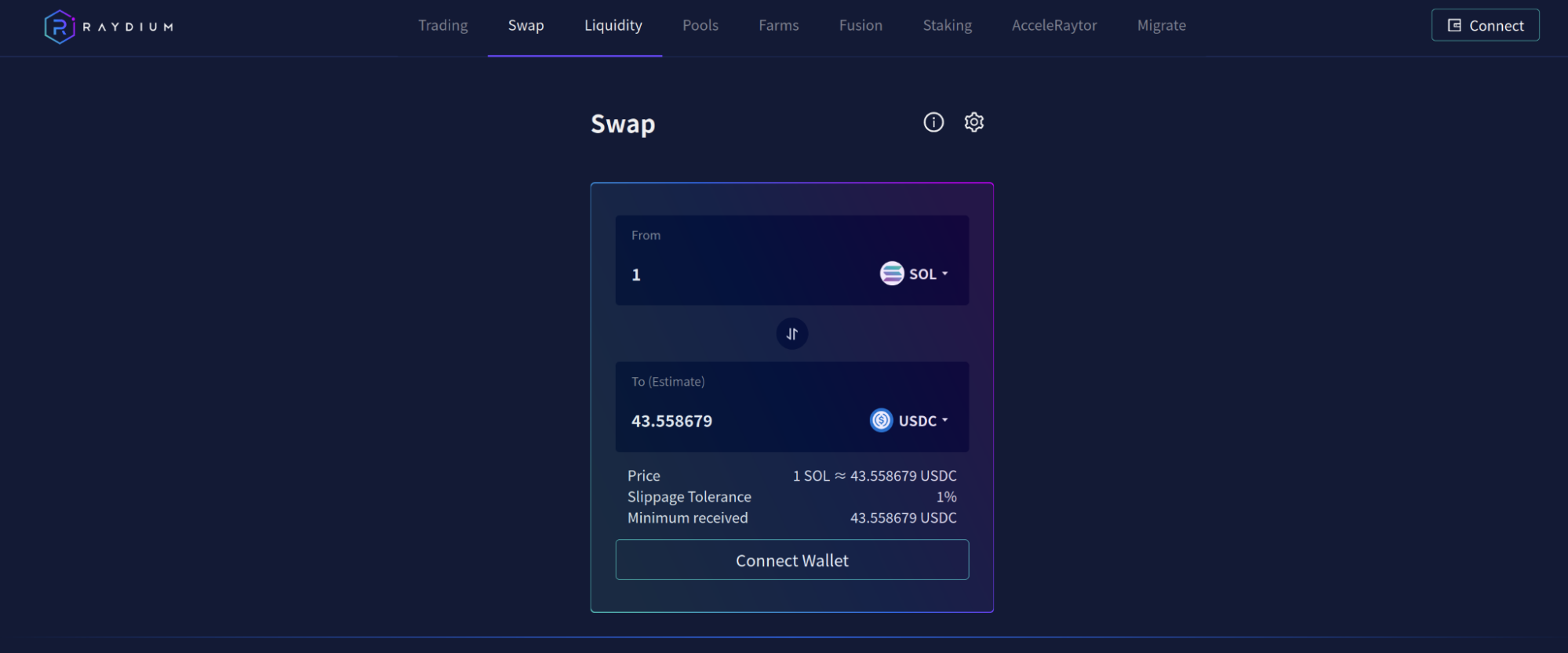

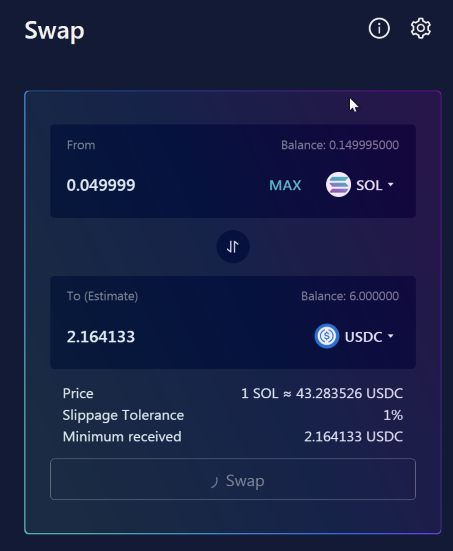

- To get USDC tokens, open up the Raydium swap page, click on the ‘Connect Wallet’ button and check that you are happy with the slippage rate that has been set automatically.

- Choose the desired pair to make the swap and confirm your operation.

- Then move to the Liquidity section and set the desired amount of SOL/USDC that you want to provide to the liquidity pool.

Note, that by choosing the maximum amount of SOL, the system may display a message that states you have insufficient balance, where in fact you can have many SOL tokens. To fix this, simply choose to input fewer tokens.

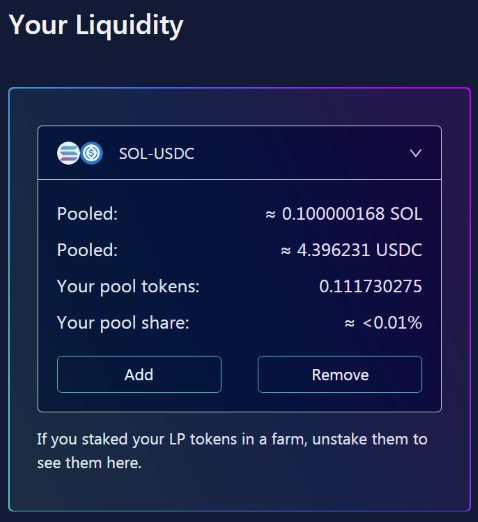

When you are providing liquidity, the system automatically weights the proportion of SOL to the other token that you want to provide. Once you have chosen your desired pair and token amounts, confirm your operation by clicking the ‘Supply’ button.

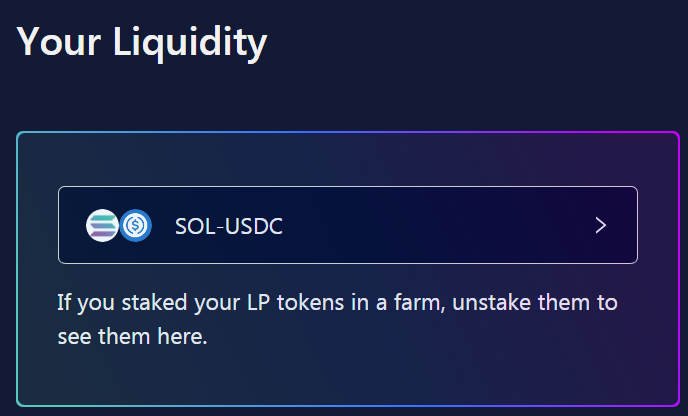

- Once tokens have been successfully provided to the pool, they will show up right below the ‘Add Liquidity’ section on the same page.

- By clicking on the staked pair, you are able to add more liquidity or remove what you have already staked.

Should I use Solana for yield farming?

Solana is a blockchain network to watch, with significant backers, a growing ecosystem and yield farming opportunities.

For DeFi yield farming that goes beyond the basic Ethereum opportunities, you will definitely want to pay attention. Who knows whether DeFi on Solana will be around for the long-term but it certainly looks like it has all the right ingredients.

It’s another exciting opportunity, so give it a go and let the De.Fi community know what you think!

Here you can check yield farming opportunities on Solana: https://de.fi/explore/network/solana

Check our other resources to stay safe and explore DeFi:

Upcoming Crypto Airdrops for 2023

Free Smart Contract Audit

Revoke Crypto Wallet Permissions Tool

And join us on Twitter and Telegram!

Good luck in farming!