Some people may not have realized yet that Gnosis Chain is the new rebranded name of xDai Chain.

But the proposed token merger has occurred and the underlying chain functionality was not impacted. That’s why now is the perfect time to read our latest guide covering Gnosis Chain.

You’ll find all you need to know about the chain, its architecture and ecosystem, as well as wallets, bridges and yield farming opportunities.

What is Gnosis Chain ?

In 2021, the xDAI and GnosisDAO communities voted to combine their ecosystems and create the Gnosis Chain, which is an Ethereum forerunner-companion that addresses scaling issues through solid engineering.

Gnosis Chain is the associated execution-layer EVM chain for stable transactions. It uses the xDai token and includes a wide-ranging group of projects and users. xDai was the first Ethereum sidechain solution that had a US dollar-pegged stable coin as a native token that was used for transactions and fees.

“Our goal for Gnosis Chain is to offer 100k gas at $0.01. How can we achieve that? A combination of technical innovation and tradeoffs in favor of low gas costs.” — Martin Koppelmann, Founder of Gnosis.

Gnosis Chain is focused on preserving privacy and therefore its overall approach can be summarized as trying to ensure transactions are fast, cheap, private and secure.

In addition to providing stable, low-cost, and optimized transactions, the Gnosis Beacon Chain (GBC) infrastructure will be available to support important Ethereum updates, including EIP implementations. Gnosis Chain will merge with the GBC exactly like Ethereum will merge with the Ethereum Beacon Chain.

The GBC offers a new consensus opportunity for Gnosis Chain. Currently, Gnosis Chain uses a delegated Proof of Stake (DPOS) consensus mechanism called POSDAO. It is secured by 16 validators, including Giveth and Protofire.

With the Gnosis Chain / GBC merge, a more diverse and distributed validator set will bring consensus to the chain. Initially, modified client implementations (Prysm/Lighthouse) will support faster blocks and a wider validator community.

The UI for GBC deposits is active and a set of validators (100K+ and counting) is now proposing and attesting blocks. For live updates, check out the dashboard right here.

The xDAI token

The main goal of introducing the xDAI token as a stablecoin was to remove volatility from transaction fees. xDai Chain (now Gnosis Chain) sought to build on this stability in order to make the project cheaper, more reliable and therefore more scalable than other options.

The GNO token

GNO is a key part of the chain’s security and governance processes.

It is used for staking on the Gnosis Beacon Chain, providing rewards to network validators, and for participating in governance on the Gnosis Forum. Essentially, this dual system involves a user completing a transaction using the xDAI stablecoin to pay predefined fees and also being able to earn staking rewards in the form of the mGNO token.

mGNO is a metatoken for GNO, similar to a wrapped token like WETH. However, where WETH is wrapped 1:1 with ETH, mGNO is wrapped 32:1 with GNO. There are 32 mGNO to each GNO. mGNO is the staking token used by validators in the Gnosis Beacon Chain.

Gnosis Chain’s Architecture

One of the key components of Gnosis Chain’s architecture is its consensus mechanism, which is called Proof of Stake Decentralized Autonomous Organization (POSDAO).

It allows for the creation of an unlimited number of Ethereum sidechains with their own coins and is designed to allow the network to scale horizontally. Each new sidechain can then be used for whatever purpose it requires, including stablecoins that mirror other fiat currencies, NFT creation, DeFi, gaming and much more.

These sidechains are run on dedicated nodes, with the different types described below.

Delegator nodes

These are nodes designed for average users looking to make some passive income by delegating their stakes to candidates they support.

Candidate nodes

These nodes are designed to enable users to compete to become Validators.

Validator nodes

These are the candidate nodes that have been selected by the POSDAO algorithm to secure the network.

The Gnosis Chain Ecosystem

With the Ethereum mainnet having experienced high transaction fees for a long time, it’s hardly surprising that projects are looking for cheaper alternatives. This is one of the main reasons why developers are attracted to deploying their projects within the Gnosis ecosystem.

Infrastructure

There are many projects building interoperable infrastructure with low-cost transactions within the Gnosis ecosystem, including:

1Hive: DAO with a Community Currency and DEX on Gnosis Chain.

Aragon Connect: Deployed by 1Hive, it provides DAO governance and proposal functionality.

RaidGuild, which provides:

Colony DAO framework: An organizational tool for DAOs.

Origin Trail: Universal, collaborative and trusted data exchange for supply chains.

Streamr: Real-time data streams with scalable crowdsourced data sets.

Orchid: Pay-per-use VPN.

Swarm: A global p2p network tasked with storing and distributing all of the world’s data.

Tornado: Private transactions on xDai.

DAppNode: Node provisions & infrastructure support.

Partnerships and co-operations

As mentioned, Gnosis Chain has been backed by a number of established projects throughout the time it was known as xDai Chain. This includes Gnosis, which is involved in the token merger and has deployed all of its applications to xDai. These include:

CowSwap Protocol, a top-ten Ethereum DEX by volume.

Gnosis Safe Multisig, a wallet holding more than $1 Billion in assets.

Gnosis Zodiac, Cross-chain DAO interface and much more.

Other important partnerships worth mentioning are with those Chainlink, for native oracle integration, and HOPR, an incentivized testnet for privacy-based mixnet.

Wallets for Gnosis Chain

There are a number of wallet options available to users when interacting with Gnosis Chain.

Coinbase Wallet

Coinbase Wallet is a well-known mobile and web extension wallet that allows you to manage crypto and NFTs stored on multiple chains.

imToken

An Ethereum and Bitcoin wallet launched in 2016, it includes a built-in exchange, DApp browser and support for various cryptocurrencies.

Poketto Cash

The first xDai mobile wallet, which is available for both iOS and Android.

Ledger

One of the most established hardware wallet options, which was launched in 2014.

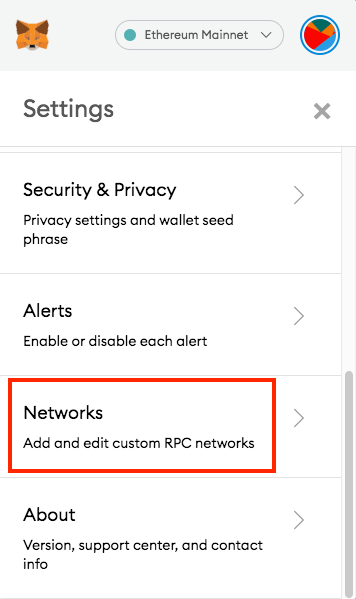

MetaMask

This browser and mobile wallet is one of the most popular wallets around. It can be used to store your tokens.

How to use Gnosis Chain with Metamask

Click on the “Account” button, as shown in the image below.

Go to “Settings” at the bottom of the image below.

Click on “Networks”, as highlighted below.

Then click “Add Network”, fill in the details shown below and save.

Network Name: xDai

New RPC URL: **https://rpc.xdaichain.com/**

Chain ID: 0x64

Symbol: xDai

Block Explorer URL: **https://blockscout.com/xdai/mainnet**

Bridges for Gnosis Chain

The xDAI ecosystem includes a number of bridges that allow you to transfer assets between popular chains, including:

- xDai Bridge: Dai transfers between Ethereum and xDai.

- OmniBridge: ERC20 transfers between xDai, Ethereum, BSC, POA & testnets.

- Hop Exchange: Bridge between Ethereum, xDai, Polygon, Optimism and Arbitrum.

- xPollinate: Stablecoin bridge between xDai, BSC, Polygon, Fantom, Arbitrum and Avalanche.

- cBridge: USDC and USDT transfers between Ethereum, xDai, Polygon, Avalanche, OKEx, BSC, Arbitrum, Fantom, Optimism and Heco.

- oPortal: USDT bridge between Ethereum, xDai, Polygon, OKEX, BSC, Harmony, Avalanche, Fantom and Heco.

- ARTIS Bridge: A TokenBridge implementation connecting the ARTIS and xDai chains.

- ELK Bridge: Transfer ELK between xDai, Avalanche, Polygon, Fantom, BSC and Huobi Eco.

- Poly.Network: Cross chain transfers that include moving assets to Gnosis (xDai) chain.

- Mt Pelerin Bridge Wallet: MPS security token transfers between Ethereum and xDai with a built-in swap button.

- XP.Network: Multi-chain bridge with NFT focus.

- Prism Network: Cross-chain ecosystem.

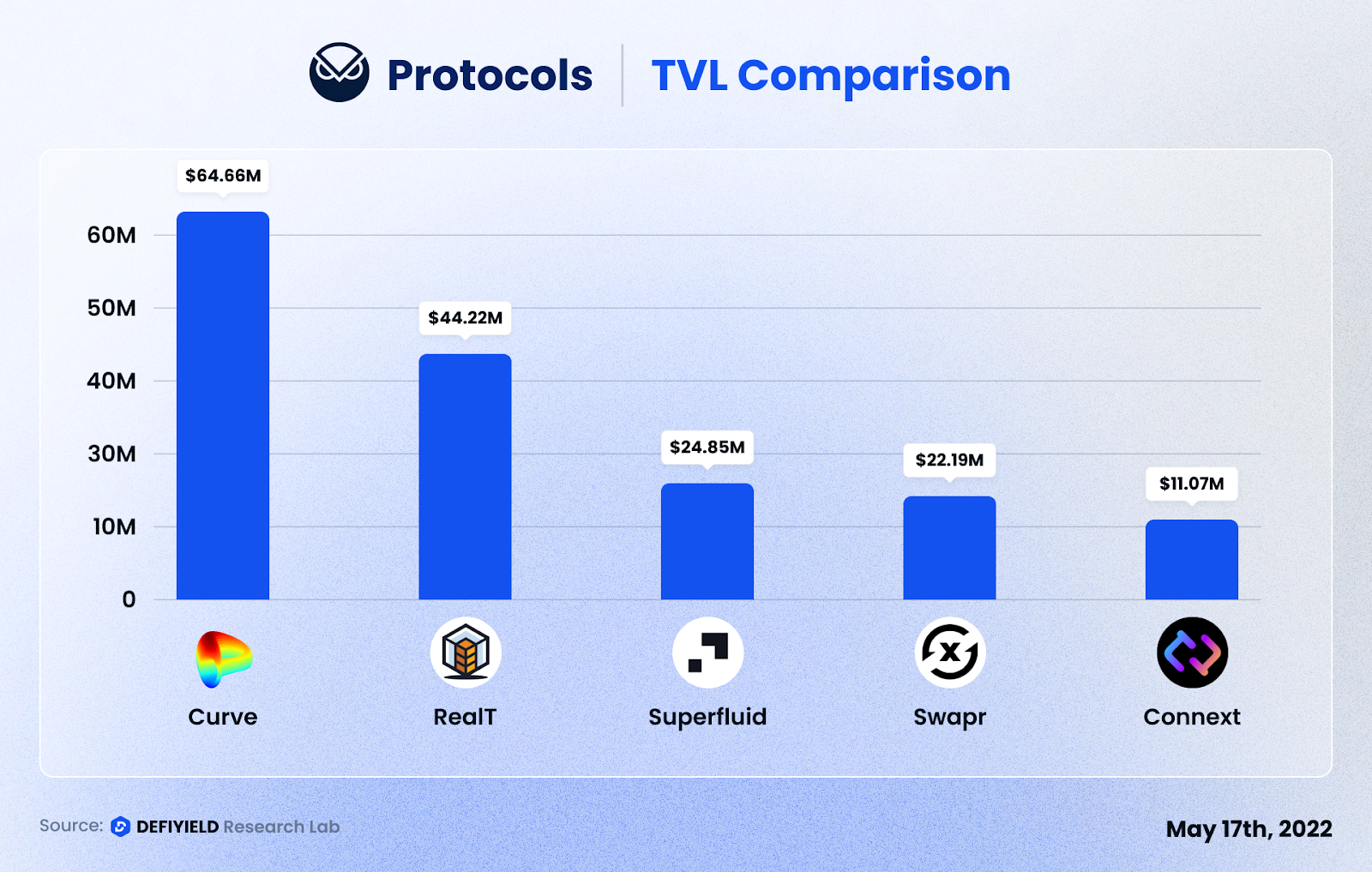

De.Fi on Gnosis Chain

Track your profit and loss, balances, prices and much more on Gnosis Chain using De.Fi!

Our enhanced dashboard provides the most comprehensive user experience, so visit our app and connect your wallet now to get started — https://de.fi/

Staking and Yield Farming on Gnosis Chain

There are both staking and yield farming opportunities available on Gnosis Chain, as described below.

Also, many DeFi applications on Gnosis Chain allow you to trade, lend, borrow and add to various liquidity pools. Some examples include HoneyComb (XCOMB), Sushiswap (SUSHI/STAKE) and Component Finance (CMP).

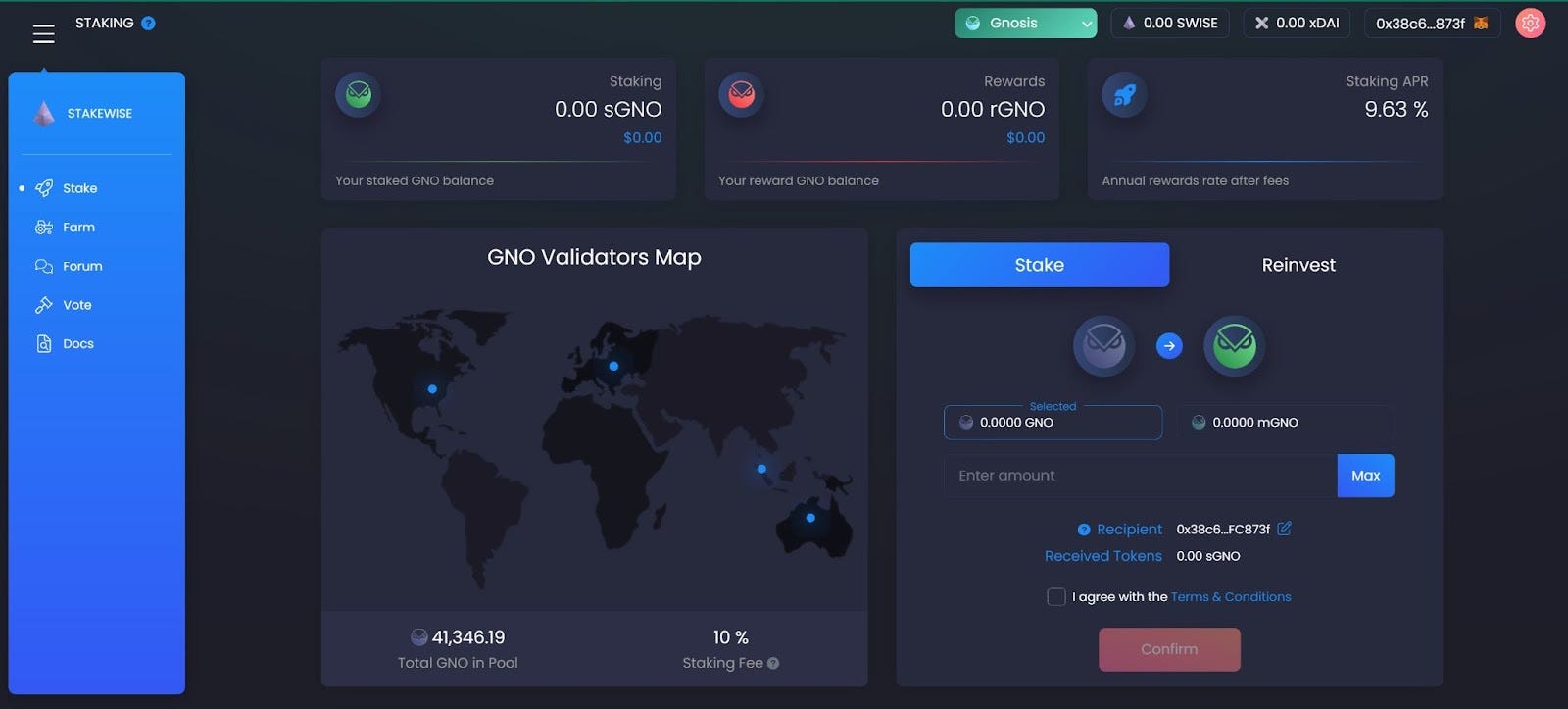

Staking on Gnosis Chain

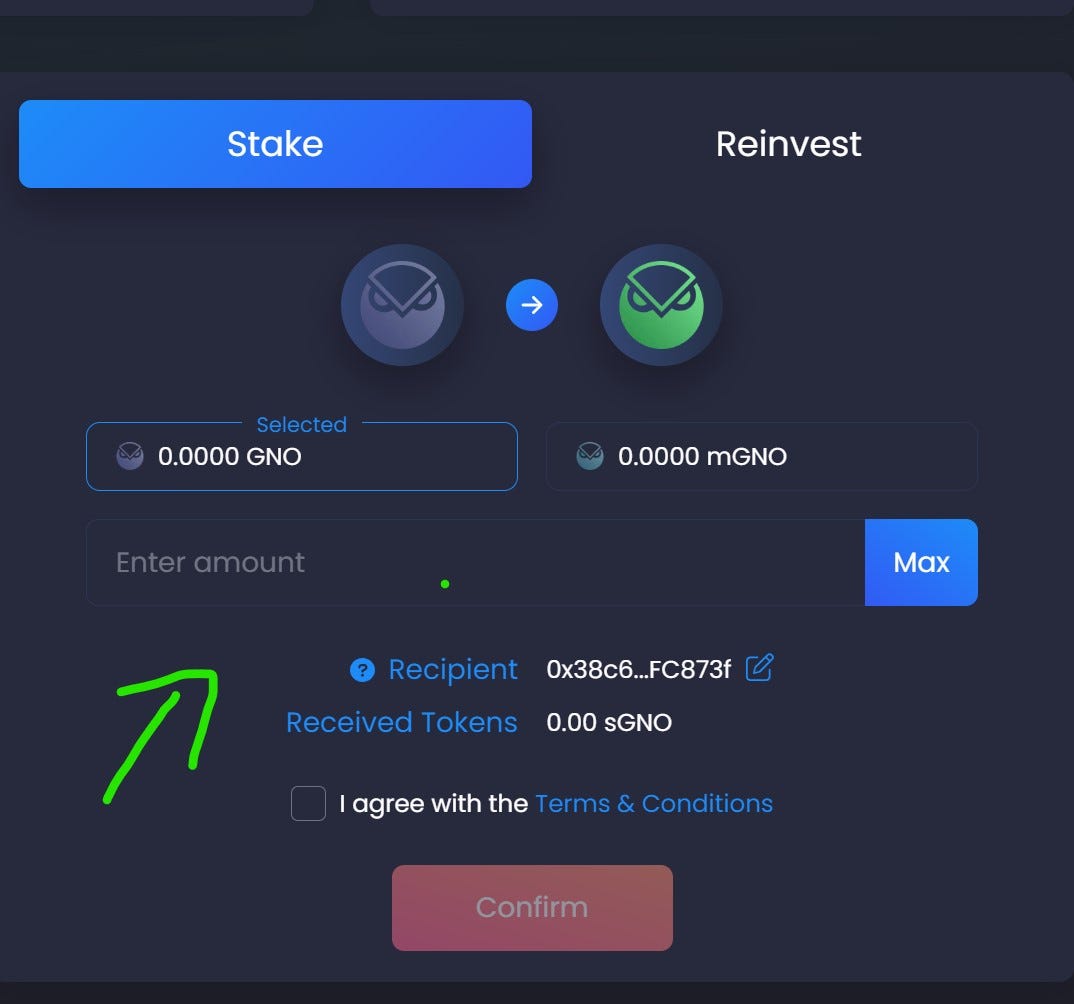

It’s time to explore staking on Gnosis Chain. We are happy to inform you that users can now mint sGNO when they stake GNO / mGNO tokens and earn up to 18% APR wherever they go in the ecosystem. Let’s take a look at Stakewise for instance, staking rewards accrue daily in rGNO tokens, which can be reinvested back into the GBC for a compounding effect.

To receive sGNO and start staking, users must deposit their GNO or mGNO through the StakeWise dashboard. Follow these steps:

Step 1. First Head to https://app.stakewise.io, you will see an icon on the top right-hand corner where you can connect your wallet. Click here, select your wallet and connect.

Step 2. Be sure to switch to the Gnosis Beacon Chain network by clicking on the network button. If you do not have the network connected yet, you can go here to Add Gnosis Chain.

Step 3. Enter the deposit amount into the Stake interface here. Check off the box for, agree with terms and conditions. Then click confirm.

Step 4. Your wallet will also prompt you with a confirmation, be sure to confirm the deposit transaction in your wallet

Once you have completed these steps, you have started staking!

Please note that your wallet must be connected to the Gnosis Chain network.

Yield Farming on xDAI

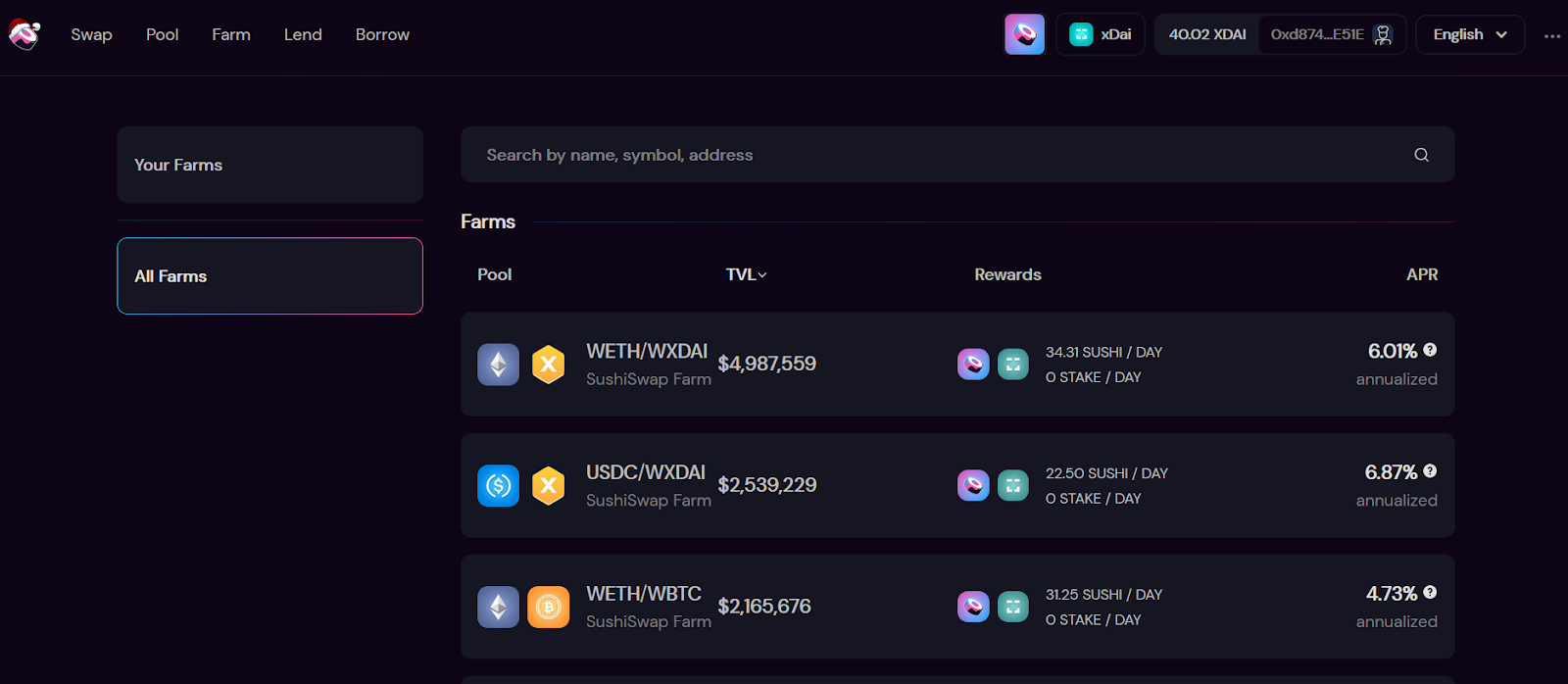

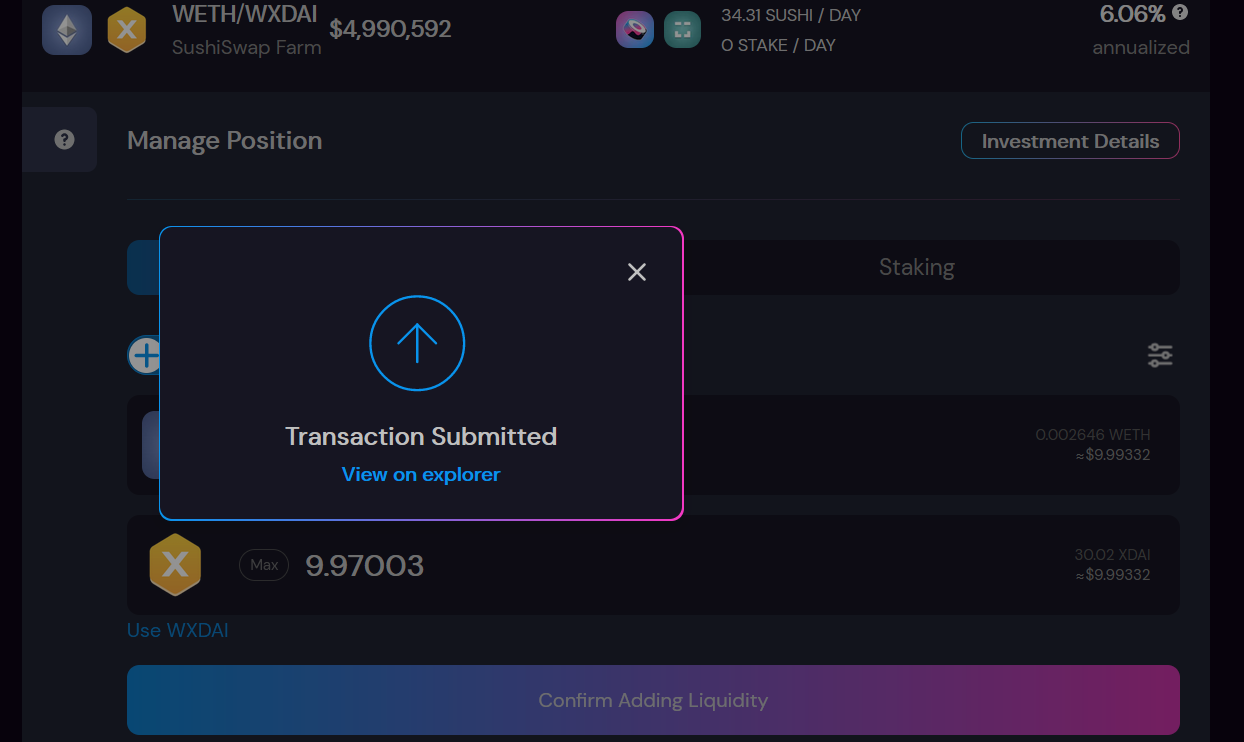

You can yield farm on xDAI with Sushi and this is the example we run through in the steps below. In this example, we have assumed that you’ve already bridged your assets to the Gnosis Chain.

- Go to SushiSwap and connect with the Gnosis Chain.

- Choose a farm, as shown in the image below.

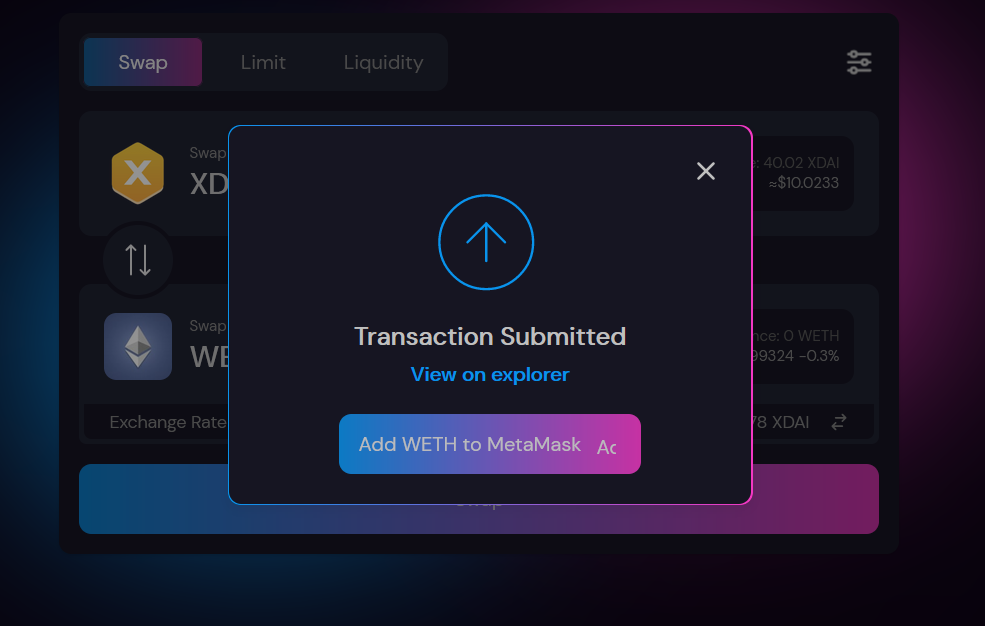

- Swap the tokens you need, as shown in the two steps below.

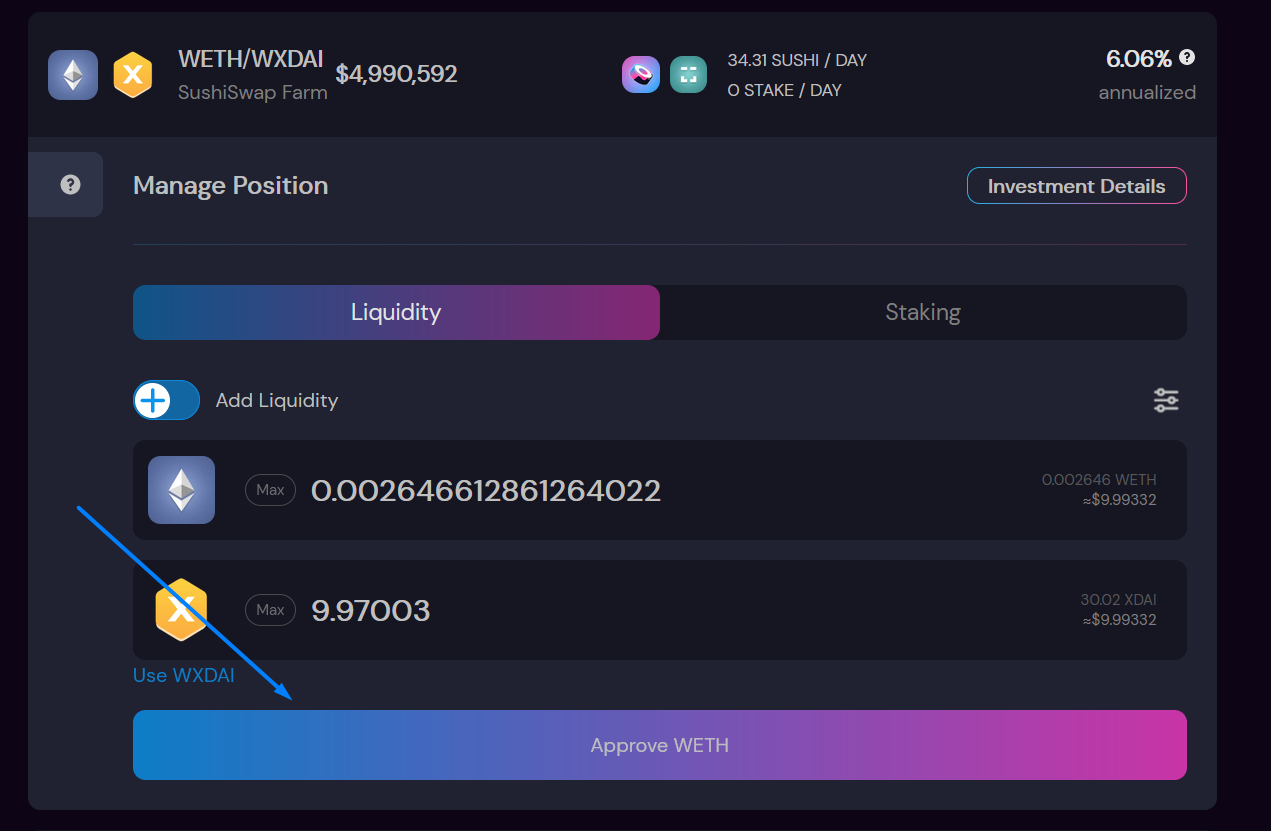

- Once you have the required tokens, go to your chosen farm to start staking (see below).

- Check the details of the transaction and then confirm it, as shown below.

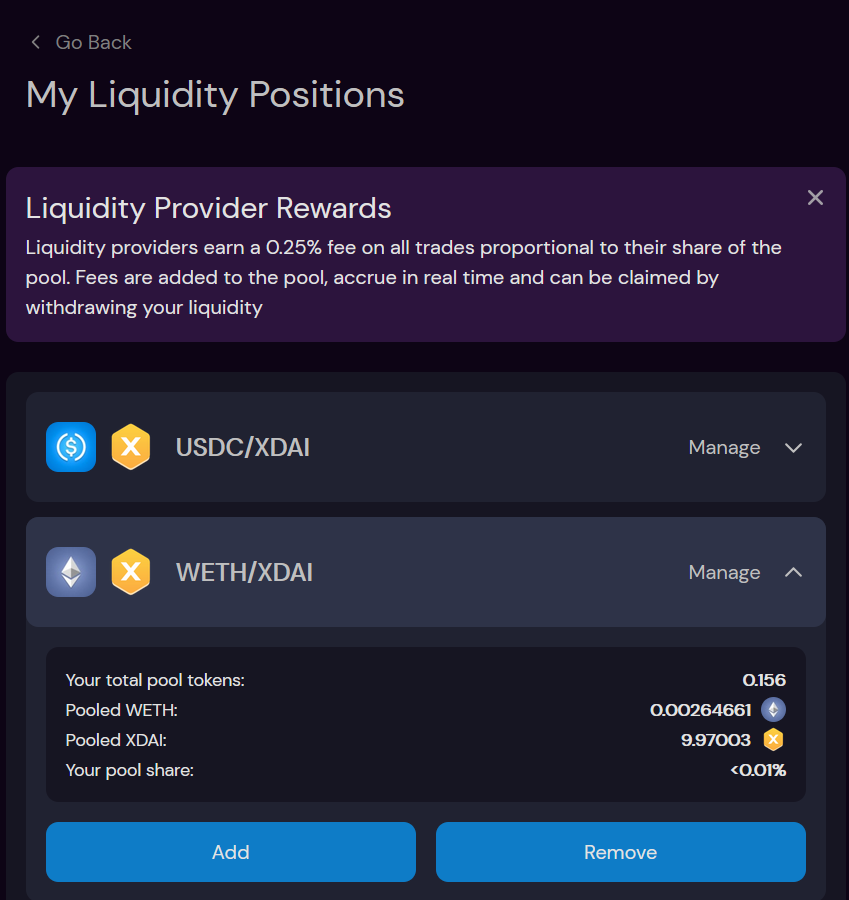

- You can then view your liquidity position, add to it or remove from it, by accessing the Pools table and using the interface shown below.

Here you can check yield farming opportunities on Gnosis chain: https://de.fi/explore/network/gnosis

Should I use Gnosis Chain for Staking and Yield Farming?

There are clearly a range of interesting staking and yield farming options on Gnosis Chain for farmers to investigate, which you would expect from a chain specifically designed to keep costs low and to solve the issues of interacting with the Ethereum mainchain.

Gnosis Chain is clearly riding off the scalability issues that Ethereum faces currently and it seems sensible to assume that layer two and sidechain solutions such as Gnosis Chain will prosper for as long as these issues persist.

Whether this attractive differentiator continues when Ethereum’s scalability issues are solved is anyone’s guess. However, we do know that Gnosis Chain has committed to providing scalability and is preparing to integrate into the Ethereum 2.0 infrastructure. The stablecoin element of Gnosis Chain also adds another advantage to the project’s position when it is being assessed by inquisitive yield farmers.

As always though, this is not investment advice and you should always do your own research first.