Interoperability and scalability remain two of the crypto industry’s biggest issues, which is why there is so much attention given to protocols that try to solve these problems by merging the benefits of different blockchain networks.

That’s exactly what KAVA is trying to do. It is a uniquely architectured blockchain and lending platform that has recently gained a lot of momentum by developing a network that blends the benefits of Ethereum and Cosmos.

For DeFi users and yield farmers alike, this should sound like a very interesting proposition, which is why we’re focusing on Kava in our latest ultimate guide. In this guide, we will investigate Kava’s unique proposition and technology, as well as describing all the wallets, bridges and yield farming opportunities that exist on it.

What is Kava?

Kava calls itself a “lightning-fast Layer-1 blockchain”, with a co-chain architecture that combines Ethereum and Cosmos into “a single, scalable network”.

In doing so, Kava claims that it combines the flexibility and speed of Ethereum smart contract development with the interoperability of the Cosmos SDK into a single network. In terms of its consensus engine, Kava is powered by Tendermint.

“Ethereum is still where the vast majority of developers and protocols are but Cosmos is growing fast and it offers so much more in terms of scalability and interoperability. Bringing the best of both ecosystems together on Kava just makes sense for our goal to add 100 protocols this year.” — Scott Stuart, CEO of Kava Labs

Kava Network went live in 2020 and was developed by Kava Labs, a for-profit foundation started by Ruaridh O’Donnell, Brian Kerr and Scott Stuart.

In its early stages, Kava was considered more of a cross-chain DeFi protocol than a Layer-1 network and this was partly down to the prominent role that Kava’s USDX stablecoin plays. Users can take out USDX loans by providing collateral and also deposit funds to support the lending system, for which they receive token rewards.

This lending functionality is just one side of Kava’s appeal, with the other being Kava’s unique co-chain architecture and the benefits this provides for dApp developers.

Interoperability

As mentioned, Kava offers great interoperability capabilities, with Ethereum and Cosmos acting as co-chains. This feature allows developers to build in whichever environment they want, without sacrificing access to the users and assets of the other.

https://twitter.com/kava_platform/status/1519801928712024064

Optimized scalability

As Kava has been built on top of the Cosmos network and is powered by a very fast Tendermint Core consensus engine, it can support a heavy flow of users, transactions and even projects built on top of it.

Ecosystem growth

Kava is very keen to attract developers into the Kava ecosystem and has many incentive programs designed for this. The Kava team goes directly to some of the top projects on its co-chains to encourage them to use Kava and thereby drive ecosystem growth.

https://twitter.com/kava_platform/status/1499558362555588611

“The Kava Network is the only protocol building a seamless execution environment for Cosmos and Ethereum…while also rewarding builders with direct ownership of the network.” — Sushi team

Kava in the News

Looking at the headlines, there’s been some good news and some not so good news for Kava during 2022. Probably the most notable event that will stick in users’ minds longer than most was the issues it had as a result of the Terra ecosystem implosion.

Specifically, the value of the USDX stablecoin depegged and fell to $0.65 in early May. According to Scott Stuart, CEO of Kava Labs, this probably occurred as a result of UST collateral liquidations. USDX has since largely returned to its $1 peg because, unlike UST, USDX is not an algorithmic stablecoin.

In more positive news, Kava has announced a number of partnerships and incentive programs aimed at increasing development and usage. In March, it was announced that the Kava DAO voted to allocate $750M to on-chain developer incentives through its Kava Rise program.

In May, it was announced that Sushi is deploying on Kava to unlock a new suite of DeFi products as part of this Kava Rise program. Also in May, it was announced that Kava has launched liquid staking and an ETH bridge, as well as NFT and GameFi incentives.

In June, Kava announced that Kava 11 will officially launch on August 31. Kava 11 is expected to feature even greater interoperability and position Kava as an L1 of choice — among other things, the release introduces Metamask support for all Kava transactions, liquid staking, Protocol Owned Liquidity, and Kava Earn.

Kava’s Technology

The following section provides an overview of the key parts of Kava’s technology, including the chains it interacts with and the main features users can benefit from.

How Kava is built

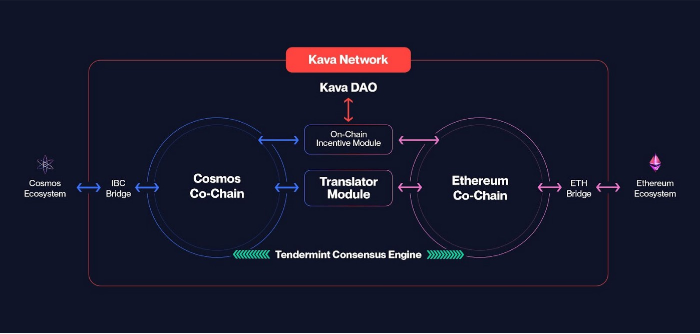

As mentioned, Kava is famous for its co-chain architecture. It allows developers to build and deploy their projects using either the EVM or Cosmos SDK execution environments, with seamless interoperability between the two.

This approach allows the project to tap into the talented developers that build both for the Cosmos ecosystem and the Ethereum ecosystem. The Translator Module connects the two execution environments of the co-chains, allowing them to work together seamlessly at scale.

The Ethereum Co-Chain

This is an EVM-compatible execution environment that empowers Solidity developers to ensure their dApps benefit from the scalability and security of the Kava Network.

The Cosmos Co-Chain

The Cosmos co-chain is a highly-scalable and secure Cosmos SDK blockchain that connects Kava to the 35+ chains and $60B+ of value in the Cosmos ecosystem, via the IBC protocol.

Cosmos SDK and Tendermint Core

The Kava Network is built using Cosmos-SDK, an open-source framework for building public Proof-of-Stake blockchains, which means it benefits from the Tendermint Core consensus engine and Cosmos modularity.

Using the Tendermint Core consensus engine means that Kava Network relies on a Byzantine Fault Tolerant consensus engine designed to support Proof-of-Stake systems.

The main benefit of Cosmos modularity is that, as new open-source modules are developed for the Cosmos ecosystem, the Kava Network can quickly implement any that are desirable. For instance, the Inter Blockchain Communication (IBC) module enables all Cosmos-SDK blockchains to communicate and was integrated by Kava in January 2022.

If you want to learn more about specific elements of Cosmos technology, you can also check out our Ultimate Yield Farming Guide For Cosmos.

Kava Governance

The project is run by KavaDAO — an autonomous organization made up of Kava stakers and validators. It operates a democratic model that determines how the project functions and develops. Also, KAVA holders are able to use their tokens to vote for proposals.

$KAVA Token

Kava’s main token is $KAVA. As of 26th August 2022, the token’s price was $1.77, with a circulating supply of 250,874,925 and a market cap of $441,901,125 (according to CoinMarketCap).

The KAVA token is used for security, governance and incentives.

In terms of security, the top 100 nodes validate blocks by a weighted bonded stake in KAVA tokens. Validators earn KAVA as block rewards and risk losing KAVA as a result of strict slashing conditions, such as failing to ensure high uptime and allowing double signing of transactions.

When it comes to governance, users can use their KAVA tokens for voting to determine the future of the project. The KAVA token is also used to vote on proposals related to the Kava SAFU Fund and treasury allocation, such as reward payouts for incentives programs.

Finally, in terms of Incentives, a portion of KAVA emissions is used to encourage ecosystem growth. The tokens are distributed among the top projects on each co-chain, in order to encourage healthy competition and attract new developers.

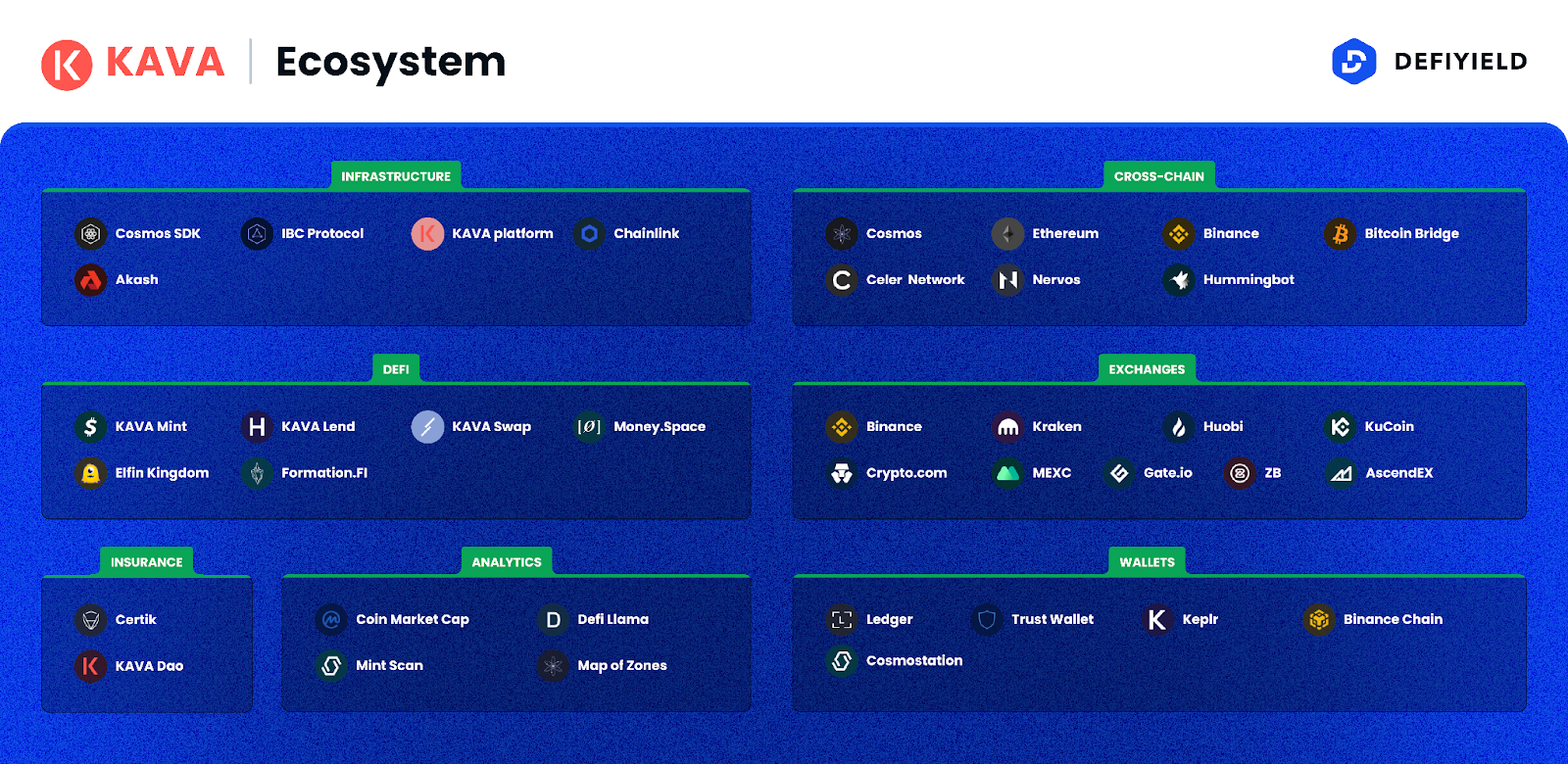

The Kava DeFi Ecosystem

Kava is actively encouraging the development of its ecosystem with incentives and grants. In the following section, we look at the Kava ecosystem, including interoperability with other blockchain protocols, partnership agreements and community metrics.

Kava Interoperability

Interoperability is a key part of Kava and has been from its launch. At first considered a cross-chain DeFi hub, it is now positioned as a Layer-1 protocol that links two of the most popular existing blockchain networks, Ethereum and Cosmos.

On the Ethereum side, Kava includes Kava EVM, an EVM-compatible smart contract execution platform. A local Kava development environment for Solidity smart contract deployment can be set up and users can utilize EVM-compatible wallets, such as MetaMask, to interact with Kava.

On the Cosmos side, modules can be developed using the programming language Go and the containerization tool Docker. Also, the Javascript SDK allows browsers and node.js clients to interact with Kava.

Kava for Developers

Kave provides a number of benefits that are aimed at attracting developers.

These include flexible development on the two most-used, permissionless execution environments in the world, via the Ethereum Co-Chain or the Cosmos Co-Chain. Developers can deploy Solidity smart contracts that interoperate with Cosmos SDK protocols in the same network, thereby connecting their project to the assets and users on both chains.

Furthermore, Kava’s incentive model aims to draw in the best developers and projects in every Web3 vertical, including DeFi, GameFi and NFTs.

Kava Partnerships

The Kava Pioneer program is encouraging devs to start joining the ecosystem. Quite a few projects have joined recently, including Governor DAO, which joined with the stated mission of enabling all projects on Kava to deploy a “human gate” against bots and whales.

https://twitter.com/Governor_DAO/status/1519775904351670272

Other partnerships include Moonfarm Finance, Mushroom Finance and many more.

https://twitter.com/kava_platform/status/1519343128204914689

https://twitter.com/kava_platform/status/1519760132577583112

Kava Community

Kava seems to run an open community, with admins regularly answering questions and providing additional details, and little noticeable negativity towards the project. At the end of August 2022, Kava had over 192k followers on Twitter, over 22k members on Telegram and over 8k Discord members.

Wallets for Kava

Kava offers a number of well-known and established wallet options for users to choose from.

MetaMask

The most well-known and established digital wallet, MetaMask was initially designed for Ethereum and can be configured to work with the Kava EVM.

Trust Wallet

A mobile wallet officially supported by Binance, Trust Wallet is one of the most popular wallets in the industry. It was founded in 2017 by Maksim Rasputin and Viktor Radchenko.

Math Wallet

Math Wallet is a multi-platform crypto wallet that supports a lot of chains, including Kava. It’s available for the Chrome, Brave and Edge browsers, and can be set up as a browser extension.

Keplr Wallet

Keplr Wallet is a browser extension wallet for Cosmos. You can use it to stake KAVA, vote on governance proposals and access interchain applications or assets.

Bridges for Kava

Kava’s interoperability focus means that connections to the Ethereum and Cosmos networks can be made easily but there are still some specific bridges worth mentioning.

Multichain (Ethereum & BNB Chain)

In June 2022, it was announced that Multichain had launched on Kava, enabling users to bridge assets from the Ethereum and BNB blockchains directly onto the Kava network.

Force Bridge (Nervos)

In November 2021, a partnership between Kava and Nervos was announced. Although no specific update has been released since, the bridge will enable CKB tokens to be used on Kava.

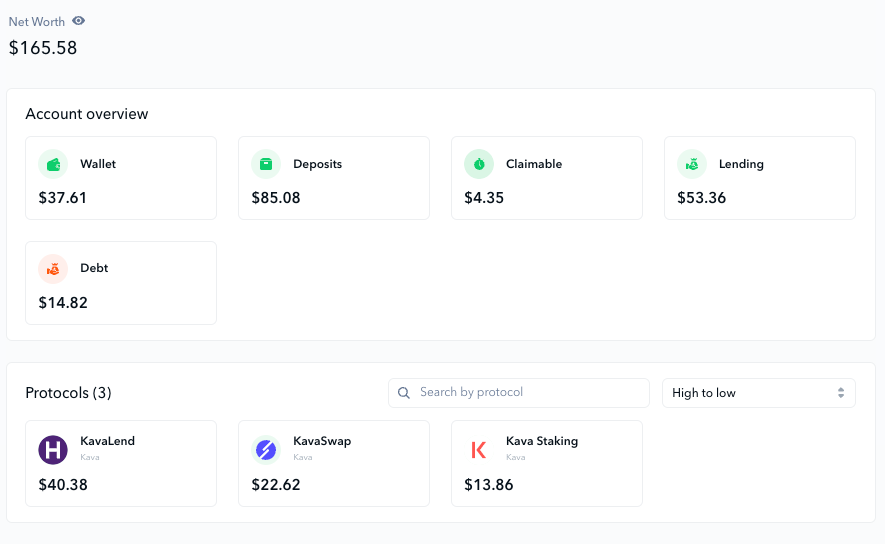

Kava on De.Fi

Great news for Kava fans! We have already integrated it into our comprehensive dashboard https://de.fi/

You can use De.Fi to manage your KAVA and control your other digital assets, helping you to make better decisions and move quickly via our complete DeFi management toolset. Simply connect your wallet and start using the dashboard right now.

Staking Kava

You can Delegate your Kava tokens to a validator and enjoy staking rewards.

To stake Kava, you will need a compatible wallet. In this example, we will be using TrustWallet. We also assume you have already deposited your KAVA tokens to the wallet.

The next step would be to click on ‘More’, and then click on ‘Stake’.

After you do this, you should be able to then choose a Validator as shown above.

Once you choose a validator, you can then input the desired amount of KAVA tokens you would like to delegate, and then proceed to stake your KAVA tokens for yield.

Yield Farming on Kava

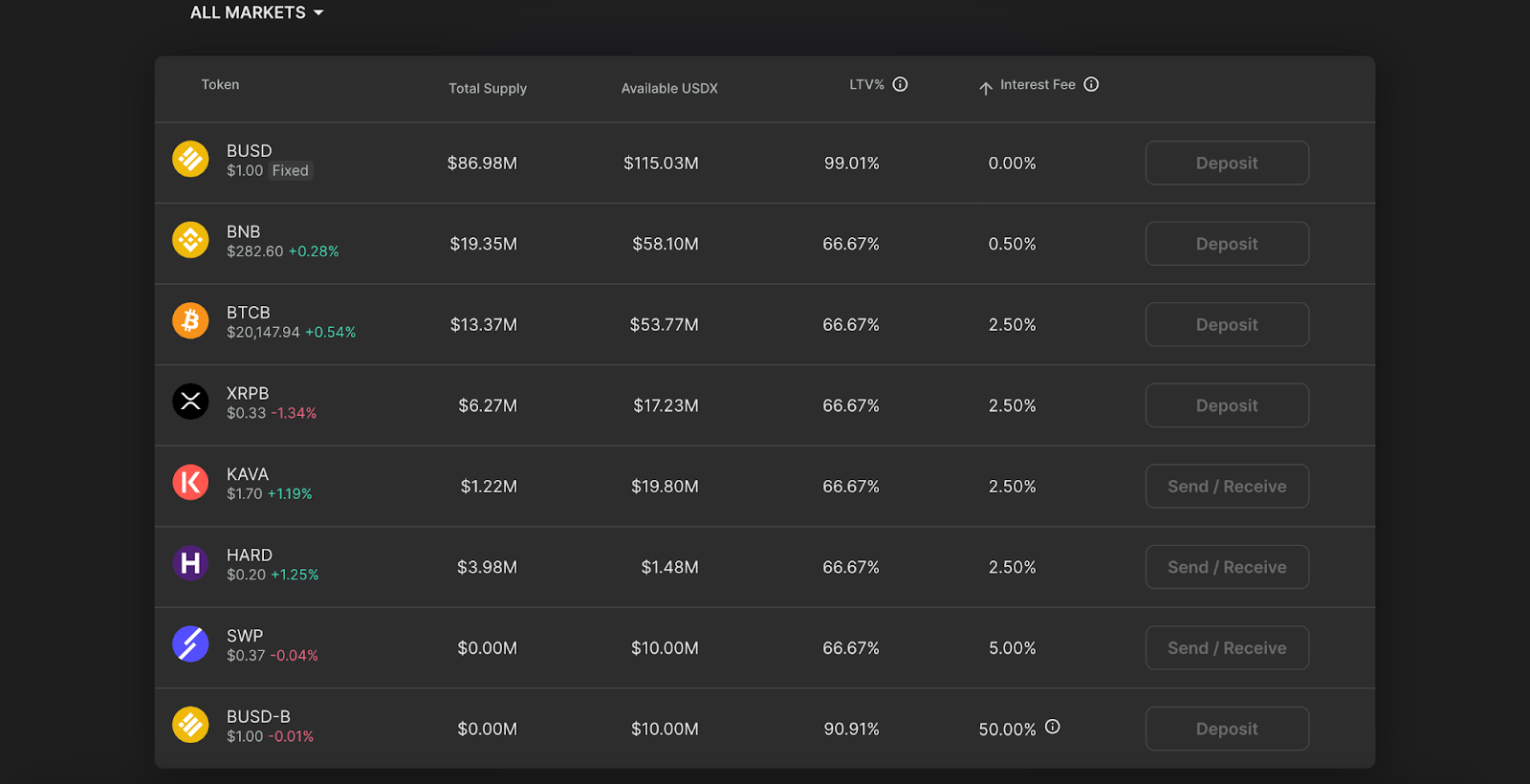

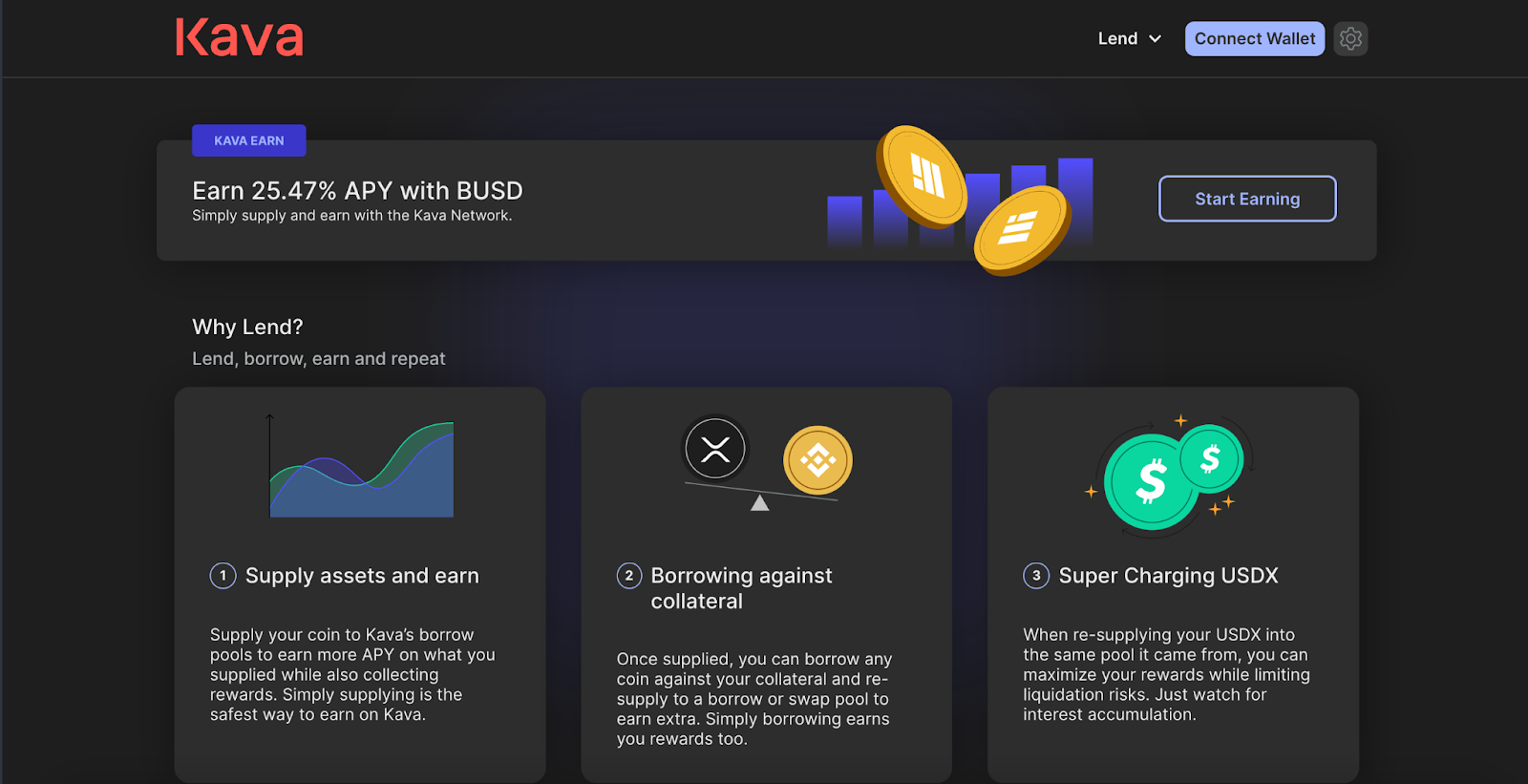

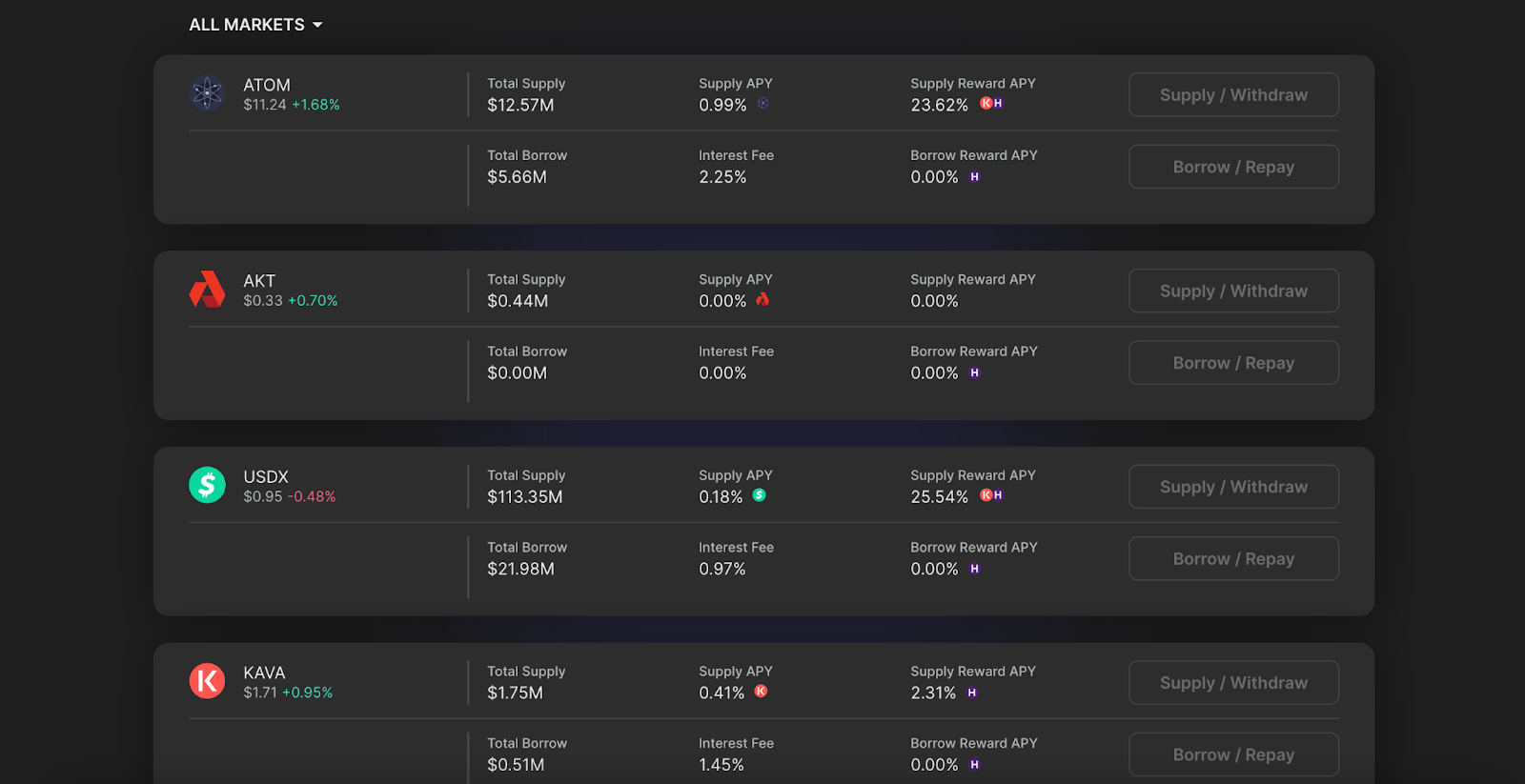

Kava Lend is the main place to yield farm on the Kava network. This is a decentralized lending platform, just like Aave or Compound, running on Kava.

As can be seen from the screenshot above, there are several ways of earning yield.

The first would be by directly supplying assets for lending, and earning interest for doing so. If you are familiar with existing lending protocols on Ethereum-based ecosystems, you will feel right at home. Simply hit ‘Supply/Withdraw’ as shown in the interface below to stake your tokens in a lending pool, and earn the displayed reward APY. This reward is paid out in KAVA tokens and HARD tokens, which are native to the Kava Lend platform.

The other way to earn yield would be to mint USDX using other crypto as collateral. You are basically borrowing the USDX stablecoin, and then lending that USDX out for interest. This would be most profitable if rates for USDX are considerably higher than for other cryptocurrencies.

Here you can check yield farming opportunities on Kava: de.fi/explore

Should I use Kava?

It seems that Kava has promise and a chance to grow. The Co-chain architecture may well attract developers to the Ethereum and Cosmos co-chains, while offering incentives along the way that help the ecosystem to expand and grow.

Users can earn an APY based on their stakes and can also make a profit based on the lending options available. Furthermore, they can get easy access to a multi-currency lending platform, with the additional opportunity to access rewards and incentive programs.

However, as always, this is not investment advice and you should always do your own research before making any investments.