They say the future is interoperable — where everything is interconnected. This might be true, and the next project we want to overview is the one that helps make that true.

Today, we are looking into Milkomeda and everything it concerns. Keep on reading to learn what this project brings to the table!

Check out our video – Everything you MUST know about Milkomeda

What is Milkomeda?

Milkomeda is an L2 protocol that aims to interconnect several leading blockchains while offering an alternative solution to their scaling. By leading blockchains, we mean Cardano, Solana, and Algorand, for now.

As you can see the project focuses on non-EVM projects, aiming at bringing them to mass adoption, by offering EVM-based sidechains.

How does it work?

Milkomeda sidechain enables interoperation by creating sidechains that are connected to the respective L1 chains. They will use their cryptocurrency as their base asset, however, and in such a way bring more exposure to the project and the token itself.

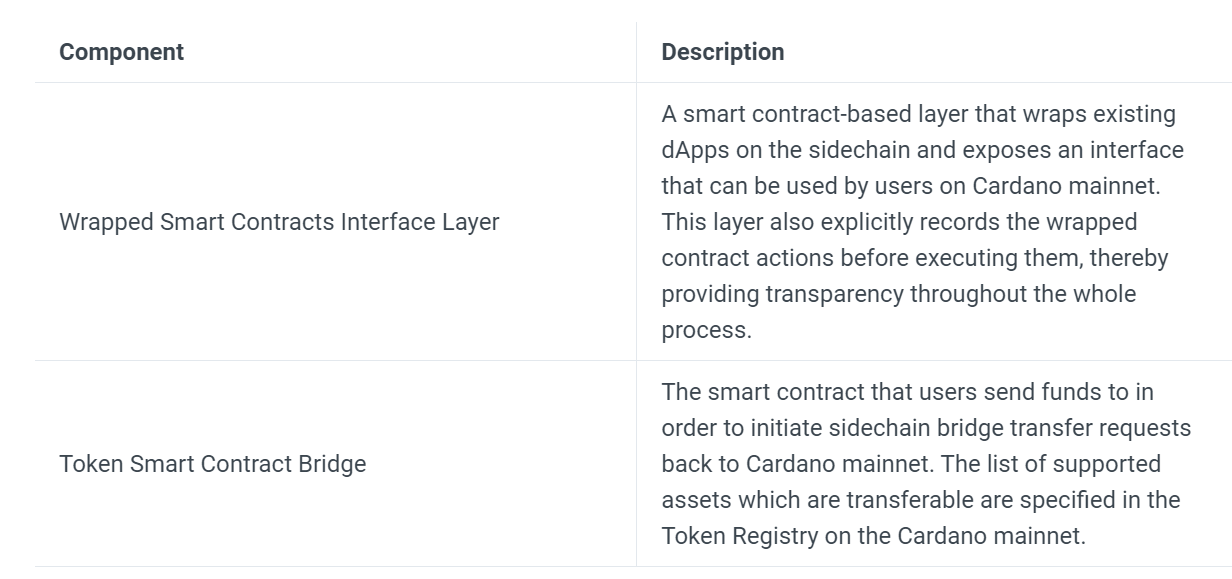

Regarding DApps, developers can deploy a smart contract on the sidechain from the connected virtual machine or from the blockchain. This smart contract will become available for the L1 chain users, who can interact with it on the sidechain.

Let’s take the Cardano blockchain, for example — Milcomeda is already connected to it. This means that Cardano users can seamlessly use smart contracts that are based on other chains and written in coding languages other than Plutus.

The Milkomeda protocol offers several sidechains, which will allow developers to write smart contracts in the languages they are familiar with, for example, Solidity, and deploy them on multiple chains. This means they don’t have to learn Haskel and Plutus to build on top of Cardano, thus lowering the barrier to entry for developers, and increasing their number on Cardano. This way MIlkomeda boosts the growth of the L1 network — in this case Cardano.

Milkomeda provides non-EVM ecosystems the ability to inherit key elements such as rollups and Solidity support from EVM-based ecosystems.

As far as security goes, multi-chain deployed code has the same security properties, eliminating the need to do individual audits per chain.

“Milkomeda protocol offers non-EVM based blockchains numerous benefits, targeting everyone from end-users to developers. Integration into new ecosystems benefits the L1 blockchain’s native currency as it gains usefulness as the base asset of the sidechain. Users will have the opportunity to try out dApps written in previously unsupported smart contract language, deployed on a sidechain, and coordinated directly from the main chain via wrapped smart contracts.” — states the team in their official documents.

The team

The company is called dcSpark, and it creates products and solutions for cryptographic projects. Apart from Milkomeda, they are working on other projects like Flint (A multichain Web3 wallet), and Urbit Visor / UV Ecosystem (which allows transforming your web browser into a first-class Urbit client).

If you want to learn more about the company, please visit their **website**.

Investors

Milkomeda’s Architecture

Features

Scalability: Milkomeda can scale to hundreds of transactions per second without sacrificing long-term decentralization.

Security: Our aim is to leverage the power of rollups for all chains, with audits at key points in the roadman to ensure the security of the protocol.

User Experience: We collaborate with wallets to ensure the experience of moving assets to Milkomeda is a breeze.

Interoperability: Solidity (EVM) support will come first, followed by Cairo and others.

Portability: Code once, deploy everywhere without sacrificing security.

Developer Experience: Developers can draw directly on all of the tooling and resources of Ethereum.

Governance

In terms of the Cardano sidechain, which is called Milkomeda C1, also affectionately referred to as “Milkodano”, is governed by its users on Cardano through the Milkomeda DAO.

To participate, users must use the Cardano blockchain and will be incentivized to vote through rewards.

Aspects managed by the DAO include:

- Adding or removing validators

- Launching new sidechains

- Reducing or increasing required collateral amounts

- Punishing malicious validators

- Spending treasury funds to fund the growth of existing sidechain ecosystems

- Deciding which stake groups the wrapped ADA is delegated to

- Accepting tokens on the sidechain (by adding them to the sidechain token registry)

- Verifying and accepting new wrapped contracts (after developer audit)

Sidechain Architecture

Tokens

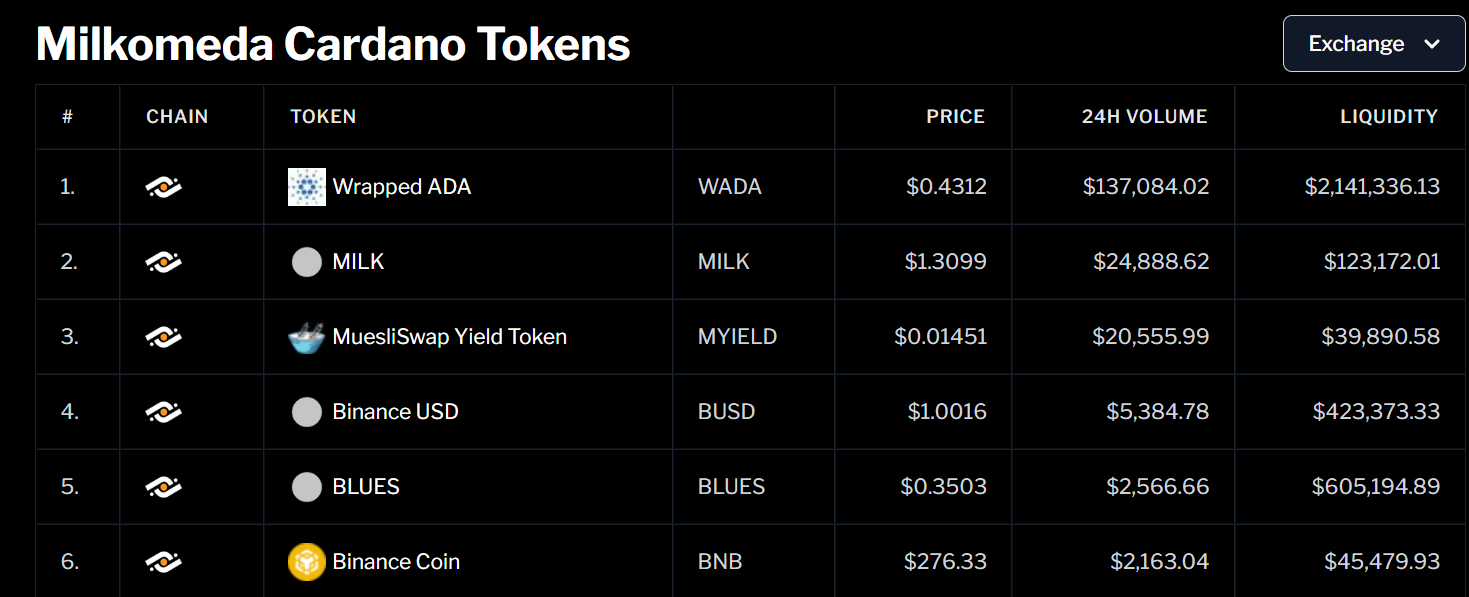

Milkomeda doesn’t have a native token. On the Cardano sidechain, is MilkADA, with which fees will are paid for using the sidechain.

MilkADA is the base asset on the Milkomeda C1 sidechain. When you move ADA to Milkomeda, you receive MilkADA.

Apart from MilkADA, there is another token called “Wrapped ADA” or WADA. Wrapped ADA is an ERC20 token that functions the same as WETH on Ethereum.

Apart from that, there is a list of other tokens that operate on the chain.

The Milkomeda Ecosystem

Milkomeda actively incentivizes new projects to be built on top of its C1 chain, for instance through its DAO hackathon!

**https://twitter.com/Milkomeda_com/status/1563204333021253633**

Apart from the DAO hackathon, Milkomeda is also offering an insane grant program for Blockchain gaming, offering $15,000.

**https://twitter.com/Milkomeda_com/status/1558091260769972226**

Currently, the project’s TVL ranks at $9,872,934 (as of 8/29/2022).

Partnerships

Being all about interoperation and collaboration, it would be weird if Milkomeda wasn’t partnering with other protocols.

For instance, it is in collaboration with API3: API3 will be making the API3 Alliance, the largest selection of data providers in Web 3.0, available for dapp developers on Milkomeda.

Also, with Symbiosis: Symbiosis has created a bridge between its native token SIS and milkADA (mADA) to help make any-to-any swaps from Ether (ETH) to mADA and back. The SIS-mADA pool is on OccamX: app.occam-x.fi/pool.

A couple of projects are collaborating with Milkomeda for sidechain integration into the Cardano blockchain. One of them is Paribus, a cross-chain borrowing and lending protocol for NFTs.

Community

Medium: 800

Twitter: 42,9K

Discord: 8.6K

Wallets for Milkomeda

Since there is no native token in Milkomeda, in this section we will discuss which wallets you need to use to operate the C1 sidechain.

First of all, you will need a Cardano wallet, with some ADA on it. For instance, Flint.

Flint Wallet is a Chrome extension that serves as a convenient go-to light wallet for DeFi and NFTs. The current version of Flint allows users to enable “Milkomeda mode” to send transactions to the Milkomeda C1 sidechain. Install Flint Wallet by visiting the following link while using the Chrome browser and clicking the “Add to Chrome” button: Install Flint Wallet.

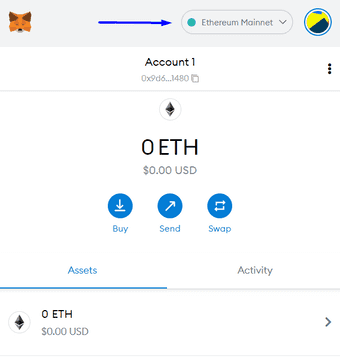

The next step is to obtain an address on the Milkomeda C1 sidechain where we can receive our MilkADA. For now, we recommend using MetaMask for this step. In order to add the chain to Metamask, follow the next steps:

Select the network dropdown at the top right of the MetaMask screen.

From the dropdown list, select “Add Network” and enter the following:

Network Name: Milkomeda Cardano (C1)

New RPC URL: https://rpc-mainnet-cardano-evm.c1.milkomeda.com;

Chain ID: 2001

Currency Symbol (Optional): MilkADA

Block Explorer URL (Optional): https://explorer-mainnet-cardano-evm.c1.milkomeda.com

Bridges

There is a native Cardano Unwrap bridge that you can use for moving MilkADA back to Cardano mainnet.

There is also a bridge explorer where you can easily find all the wrapping/unwrapping stats, TVL, average wrapping time, etc.

De.Fi on Milkomeda

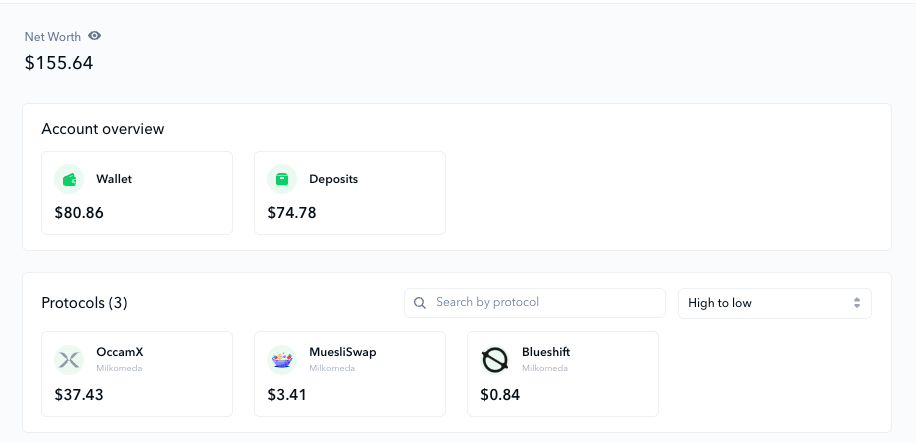

The good news is, that Milkomeda is already integrated into the De.Fi dashboard!

Track your profit and loss, balances, prices, and much more using De.Fi! Our enhanced dashboard provides the most comprehensive user experience, so visit our app and connect your wallet now to get started — **https://de.fi/**

What’s more? We had the Biggest Cardano Twitter Space on August 31st where people had the chance to participate in a discussion with Milkomeda, MuesliSwap, SundaeSwap, MlnSwap, Mend and VyFinance.

If you missed it, you can now listen the space here 👇 **https://twitter.com/i/spaces/1LyxBoXyjlPKN**

Staking and Yield Farming on Milkomeda

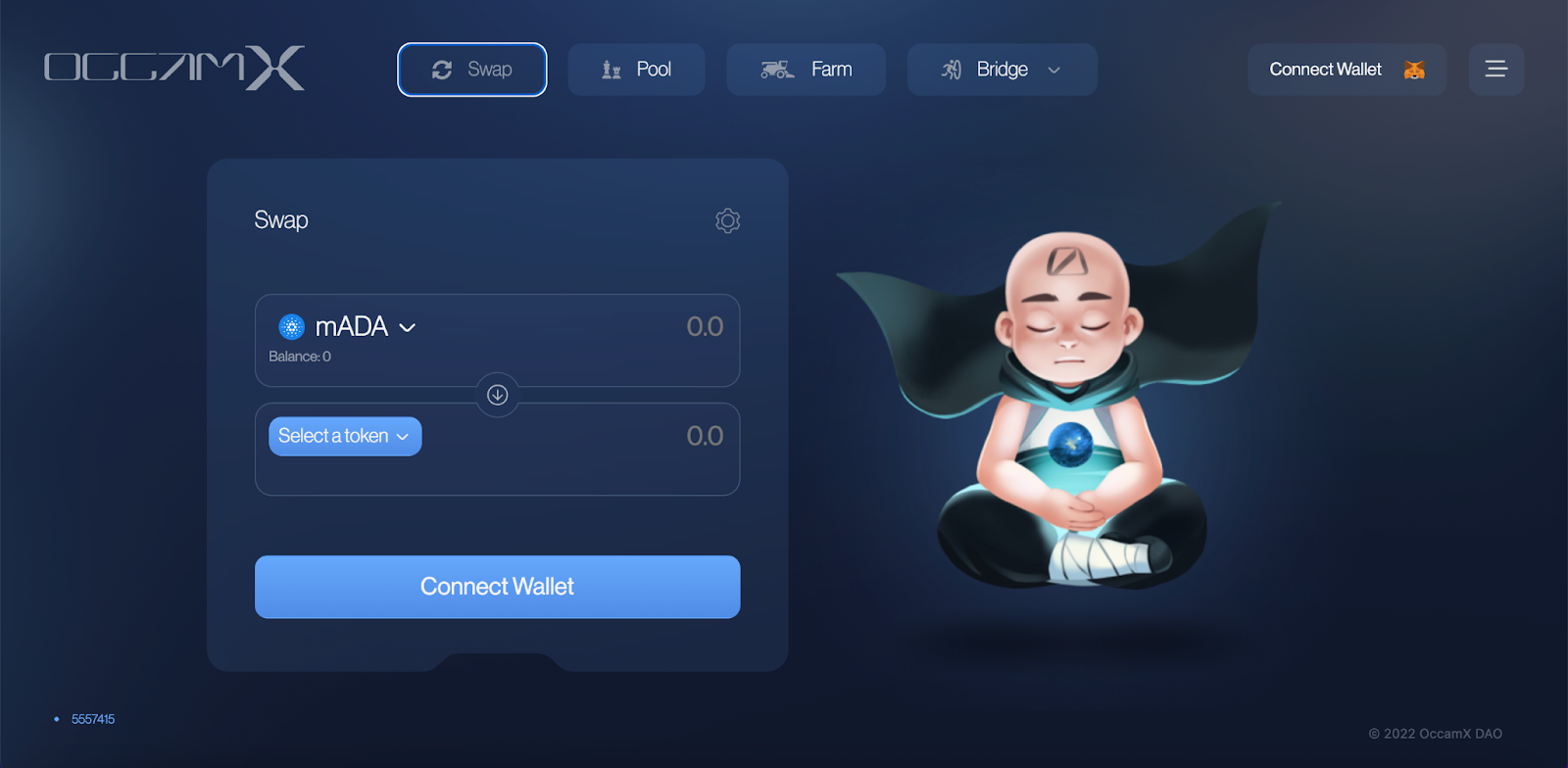

You can yield farm on Milkomeda C1 with a number of Yield Farms, such as OccamX and MilkySwap. In the example shown below, we have a look at how you can yield farm on OccamX. We assume in this instance that you have already bridged your assets through to Milkomeda C1.

- Go to OccamX and connect with the Milkomeda C1 Chain.

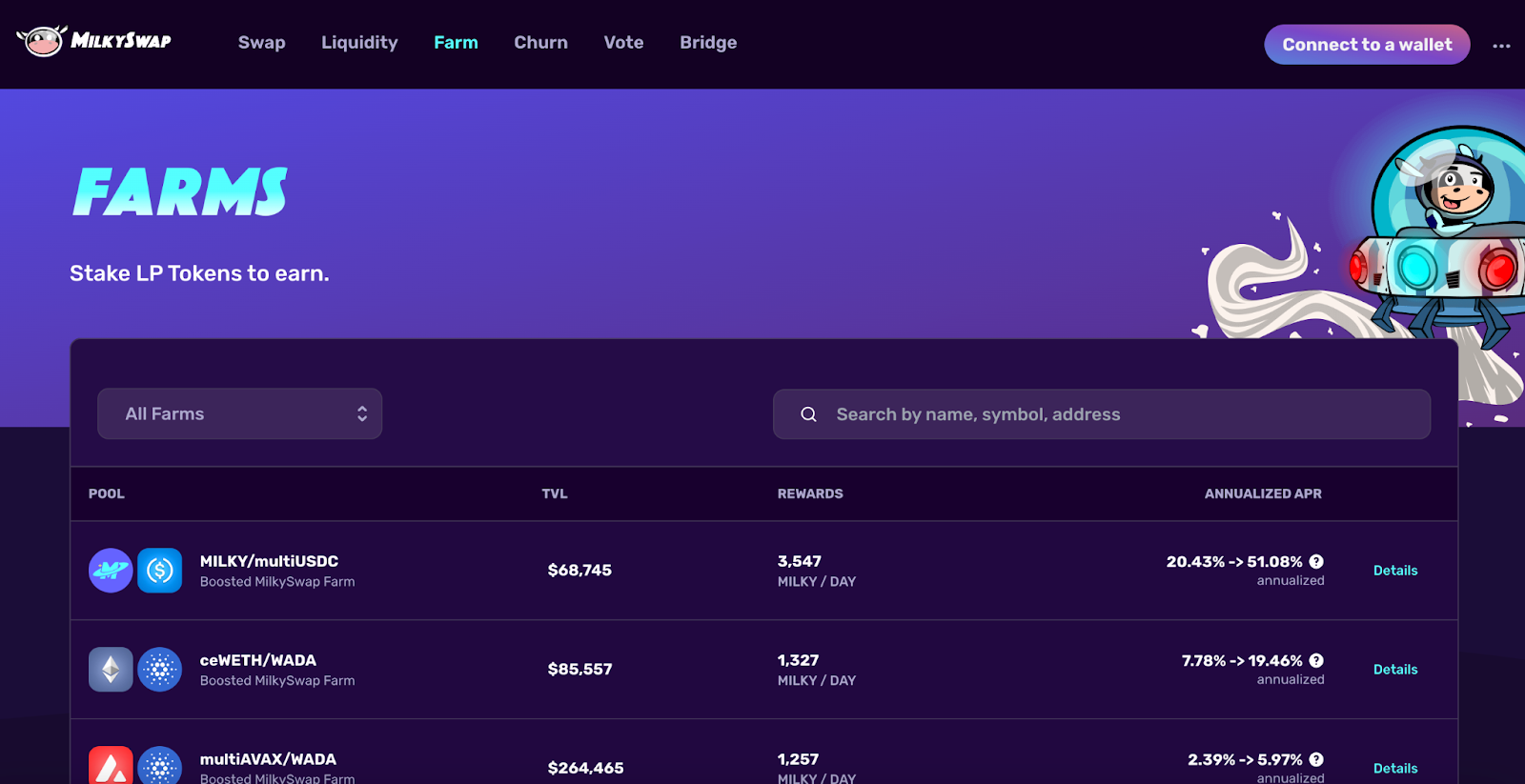

- As can be seen from the image below, there are a wide variety of farms available. Browse through the list and choose your asset pair.

- Obtain the assets you’d like to farm with, using the Swap tab as shown below.

- Once you have your required tokens, go over to the Pool tab to add your liquidity. In this example, we are obtaining some mADA/multiUSDC liquidity pool tokens.

- Finally, you can click on the farm of your choice, and stake your LP tokens to the farm. You are now ready to earn yield!

- For OccamX, do note that rewards will only be claimable when the total value locked milestone has been reached. As of September 2022, this has been set at $250m.

- If you’d like to claim your rewards immediately, consider using MilkySwap instead. The process is the exact same as in OccamX.

Should I use Milkomeda for Staking and Yield Farming?

If you are interested in getting exposure to Cardano, and would like to earn some yield in the meantime, Milkomeda yield farming looks to be a great play. As you can see from both the farms mentioned above, most farming pairs include WADA as one of the tokens, meaning you would be investing in ADA by default by depositing in these pools.

The added bonus is that gas fees are low while transaction speed is high, making Milkomeda a great place to start yield farming if you have a smaller portfolio.

Here you can check yield farming opportunities on Milkomeda: https://de.fi/explore/network/milkomeda-c1

Bottom Line

Milkomeda is a project that is growing in popularity at a very high rate, and understandably so. Their project brings benefits to developers that can build dApps in their preferred language, and users alike, who can now try dApps that were previously unsupported. The potential is there, and the general audience seems to have high hopes for the project.

As always though, this is not investment advice and you should always do your own research first.

And join us on Twitter and Telegram!

Good luck in farming!