Osmosis is one of the most popular projects around at the moment.

According to DefiLlama’s table of Total Value Locked (TVL), Osmosis is now on 52nd place across chains with a TVL over $197 million and is one of a handful of projects that is riding the wave of interest that surrounds the Cosmos interoperability ecosystem.

That’s why we’ve written this ultimate guide, so you can find out all you need to know about the project and its technology, as well as the bridges, wallets, and yield farming opportunities that exist on Osmosis.

Check out our video on How To Yield Farm on Osmosis! 👇

What is Osmosis?

For the best explanation of what Osmosis is, a good place to start is the project’s official documentation, which states:

“Osmosis is an advanced automated market maker (AMM) protocol that allows developers to build customized AMMs with sovereign liquidity pools. Built using the Cosmos SDK, Osmosis utilizes Inter-Blockchain Communication (IBC) to enable cross-chain transactions.”

Osmosis was founded in 2021 by Sunny Aggarwal and Josh Lee. Sunny previously worked with Cosmos as a Research Scientist at Tendermint, the company behind the open-source software on which the Cosmos ecosystem is built. In October 2021, Osmosis raised $21 million dollars in a token sale led by Paradigm, the crypto venture capital firm.

As mentioned earlier, Osmosis is one of the projects benefiting from the increased interest in Cosmos and its ‘Internet of Blockchains’ concept. Essentially, the big idea behind Cosmos is to produce a consistent development and messaging framework called the Inter-Blockchain Communication (IBC) Protocol, which allows developers to build interoperable blockchains.

Each blockchain has its own specific functions and benefits, related to its target user group. In the case of Osmosis, the aim is to act as the main AMM between Cosmos-based blockchains. However, more than this, Osmosis aims to extend the use of AMMs beyond common token swap use cases.

“Our belief is that the design space of AMMs is still massively underexplored…we can expand them into automated algorithms for things we might not even think of today as market-making.” — Sunny Aggarwal, Founder of Osmosis

In terms of the specific features that Osmosis offers, some of the most important ones are:

Customizable & sovereign pools

Liquidity pools are self-governing and completely customizable through governance.

All key parameters are customizable, including swap fees, token weight, curve algorithm and time-weighted-average price (TWAP) calculations. Nothing in the Osmosis AMM is hard-coded, so liquidity providers can vote to change any pool parameter, including swap fees, token rates, reward incentives and curve algorithms.

New curves can also be easily created in the blink of an eye. This is important because it removes the need to create a new AMM if the model changes. Developers can simply deploy new curves and take advantage of the already existing liquidity in the ecosystem.

This unique functionality could enable the decentralized formation of token fundraisers, an options market or even interchain staking.

“Liquidity pools in Osmosis are designed to be highly customizable: fees, asset weights, and bonding curves are all design choices made and maintained by the pool’s creators. These parameters open up new opportunities for protocol-level improvements like superfluid staking.” — Messari Crypto Research

Superfluid staking

While previous projects have engaged in either yield farming to provide AMM stability or staking to maintain the protocol, Osmosis has chosen a totally unique approach called Superfluid Staking.

Essentially, Superfluid Staking is a groundbreaking innovation allowing OSMO, the Osmosis governance token, to be used for staking and liquidity provision at the same time, thus maximizing rewards without having to trade security for liquidity within the network.

Therefore, if a user provides liquidity and receives LP tokens in return, these can then be staked as well. In this way, the user generates yield from the LP rewards and from staking. Unlike traditional staking, where rewards must be claimed, Superfluid rewards are automatically added to the user’s balance — just like LP rewards.

Superfluid Staking is a solution that solves the liquidity problem by offering liquidity providers to earn staking rewards.

This not only boosts the overall network security of Osmosis but also expands the utility of the OSMO token.

Liquidity Provider (LP) incentives

In addition to the added incentive that superfluid staking provides, Osmosis also allows third parties to easily add incentive mechanisms to specific liquidity pools.

Frontier Osmosis Zone

Frontier Zone is Osmosis’s permissionless extension DEX, a playground where any token created and issued on the Cosmos network can be listed. This means that these tokens can be added to Osmosis Frontier without having a substantial liquidity contribution.

“Why Frontier? It is the best way for Osmosis to combine its commitments to permissionless listing on the one hand and superior UX on the other. It does this by allowing Osmosis to curate the primary front-end (app.osmosis.zone) for the best possible user experience, while at the same time allowing assets to appear permissionlessly on Frontier. Not only that, but the community will also get a chance to test the various bridging UX flows before voting on the canonical bridge for the primary front-end.” — official information From Osmosis.

In simple words, Frontier is the a freer version of the main DEX, where you have more tokens to ‘play with’:

- Bridged Ethereum assets

- Juno blockchain CW20 tokens

- Axelar Network Tokens

- Gravity Bridge Network Tokens

Info Osmosis Zone

It is a page, where you can connect your wallet, and view any information related to the chain, IBC, your pools, rates, prices, etc.

As the name suggest, this is an Info zone, that will help you to always stay in the know about the current state of the network and the available pools.

Osmosis in the News

June 9th, 2022 was the date for Osmocon, which marked the first birthday of Osmosis’s mainnet launch and took place in Austin, Texas. Osmocon’s events and panels covered grants, tooling, NFTs, dapps, design and bridges.

However, less encouraging events occurred just a day before, when reports emerged about a **$5 million exploit of Osmosis that led to developers halting the chain**.

According to reports, the Total Value Locked (TVL) on Osmosis dropped but the team tweeted that liquidity pools were not completely drained and developers were fixing the bug. From the exploitation, six users looted precisely $5 million. While two of them unintentionally made about $2 million and promised to return it in full, the remaining four have been silent and played anonymously to the looting.

While this was clearly not an event the Osmosis team wanted to happen, there has been better news about the ecosystem’s growth since then, including a partnership that involves **Axelar becoming a bridge to connect Osmosis with the Ethereum ecosystem**.

As far as partnerships go, Moonbeam, a Polkadot parachain, and Osmosis recently collaborated for enabling cross-chain token swap using the mentioned above Axelar’s infrastructure.

Osmosis Technology

As mentioned, Osmosis is a Cosmos-based blockchain. In this section, we describe some of the core Cosmos components it relies on and how they enable Osmosis to operate.

How Osmosis is built

Osmosis relies on the various components of the Cosmos ecosystem, including the Inter-Blockchain Communication Protocol, to work as an AMM across all Cosmos chains and to enable cross-chain transactions.

It’s worth revisiting the main architectural elements of Cosmos, in order to explain the Osmosis technology.

You can read more about this in The Ultimate Yield Farming Guide For Cosmos but the most important parts worth recapping are as follows.

Cosmos

Cosmos is the Internet of Blockchains, where developers can create interoperable and application-specific blockchains, which seamlessly communicate with each other and enable the transfer of tokens for minimal transaction fees.

Tendermint Core

Tendermint Core is a Byzantine-Fault Tolerant engine for building blockchains. It allows developers to write their applications in any language and then replicate the app globally. Transactions are immediately finalized once included in a block.

Governance

Osmosis governance is controlled by token holders using their $OSMO token to vote for proposals via public polls. An example of the result of a governance vote is shown below, indicating that the Osmosis community voted for the protocol to become carbon neutral.

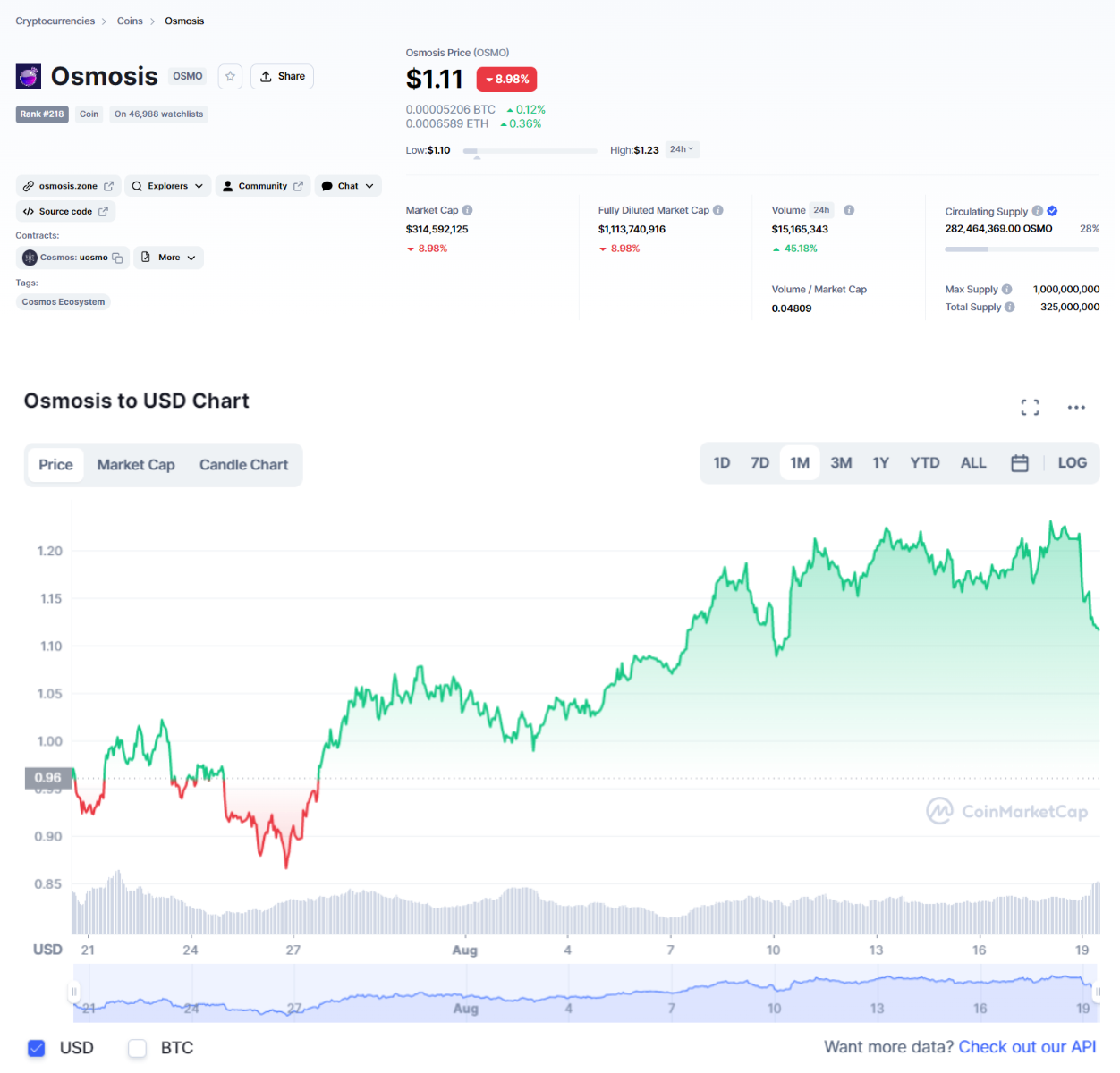

$OSMO Token

As mentioned, $OSMO is Osmosis’s native token. It is used in governance voting, staking, and yield farming as well as the fuel for transaction fees. The following figures for OSMO were correct as of 19 August 2022 (according to CoinMarketCap):

Current price: $1.12

Market Cap: $315,205,994

Fully Diluted Market Cap: $1,115,914,178

Circulating Supply: 282,464,369.00 OSMO

The Osmosis Ecosystem

Osmosis has a vibrant DeFi ecosystem that is growing and taking advantage of the interoperability features made possible by being part of the wider Cosmos ecosystem.

Osmosis Interoperability

Osmosis is a part of the Cosmos ecosystem and therefore connects to the many new and existing IBC-enabled blockchains that live within it.

Osmosis has integrated various projects and dApps already. These include CosmWasm, which brought advanced trading features and expanded the available functionality.

The project’s community is quite an active one, with admins responding regularly to questions posed on the official Telegram channel. On Twitter, there is a range of fanart, music, animations, and even tattoos dedicated to the project, which demonstrate the community’s commitment.

In terms of followers in August 2022, Osmosis has roughly 132k on Twitter, 17k on Telegram, and 19k on Discord.

Wallets for Osmosis

Like all Cosmos-based blockchains, there are various wallets you can use for accessing Osmosis but the example provided enables you to experience its staking benefits.

Keplr Wallet

Keplr is considered to be the Cosmos-based equivalent to MetaMask, the well-known Ethereum-based wallet.

Keplr is a browser extension and a web app that allows you to stake on Osmosis, vote in on-chain governance, and access interchain applications.

This wallet is a gateway allowing to access the IBC inter-chain transactions and swaps. Keplr also seamlessly supports the Ledger Nano S/X hardware wallet for added layer of security.

Bridges for Osmosis

The Inter-Blockchain Communication Protocol

The **Inter-Blockchain Communication Protocol (IBC)** is a fundamental part of how Cosmos-based chains communicate, as it is the protocol that relays messages between various independent chains. In simple worlds.

IBC is an inner bridge that connects different chains, allowing for a safe transfer of tokens between each other. With IBC, blockchains are not connected directly, but rather communicate via dedicated channels to which they send packets of data. The channels are connected to chains using smart contracts.

In order to use the IBC protocol, the Osmosis exchange will be the most direct use of the IBC. It is also possible to complete IBC transfers manually by using the Keplr wallet and selecting the channels to transfer assets between. Access to the actual IBC channels to move your tokens across chains can be found HERE IBC Channels.

The options available include bridges to other chains in the Cosmos ecosystem and bridges to major blockchains outside of it.

Gravity Bridge (Ethereum)

Ethereum is now connected to the Cosmos network via the Osmosis decentralized exchange and the Gravity Bridge, which was launched in January 2022.

Axelar (Ethereum)

A canonical EVM bridge that can help you bridge a list of tokens, including WETH, USDC, DAI, etc. In order to perform the bridging, please, refer to the official guide to make sure the process goes smoothly.

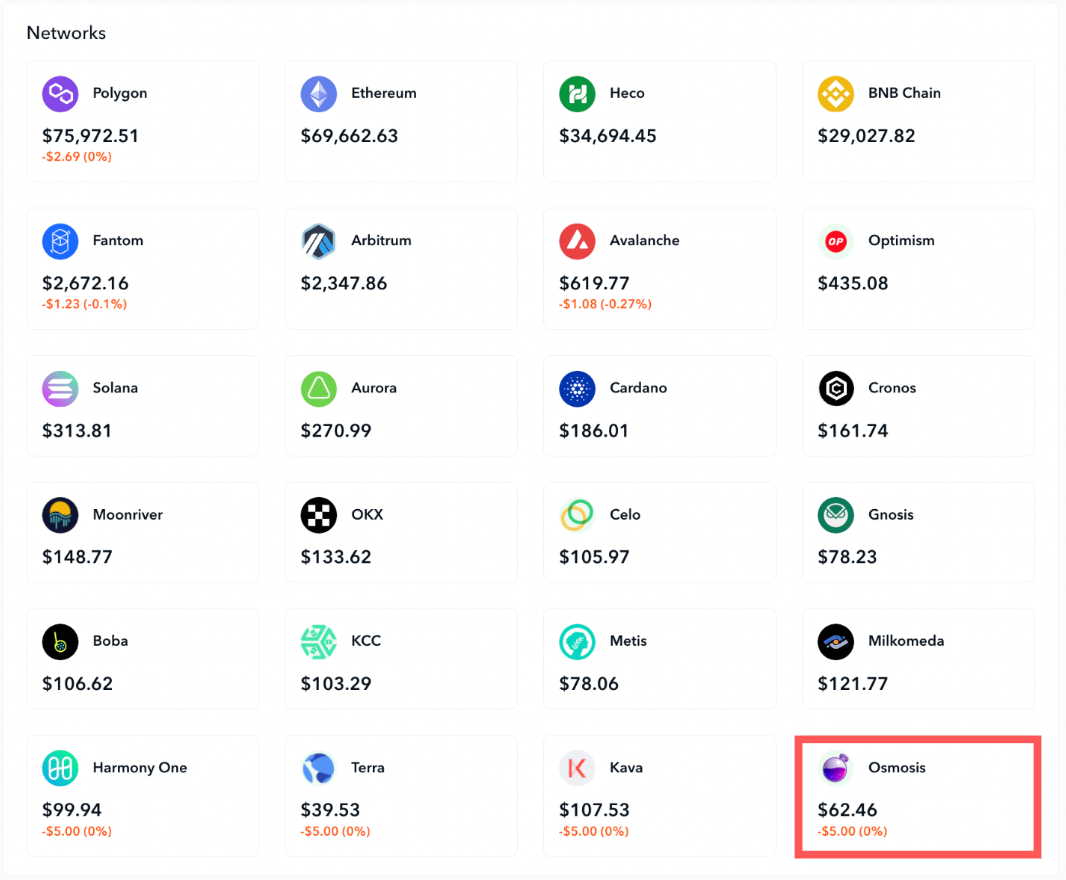

De.Fi on Osmosis

The good news is that Osmosis has already been integrated into De.Fi!

If you already have or are planning to use Osmosis, De.Fi is the best way to track your profit and loss, balances, prices and much more.

Our enhanced dashboard provides the most comprehensive user experience, so visit the De.Fi and connect your wallet now to get started!

Also, soon we are going to conduct some Twitter Spaces with Osmosis — how exciting is that? If you want to join the discussion, make sure you’ve subscribed to our Twitter!

Staking and Yield Farming on Osmosis

In this section, we are going to look at how you can yield farm on Osmosis.

👉 Setting Up

First, as mentioned earlier, you will need to install and set up your Keplr wallet, and fund it with some OSMO.

👉 Staking

The next thing that you would want to do is to go over to the Pools section on the Osmosis Zone website.

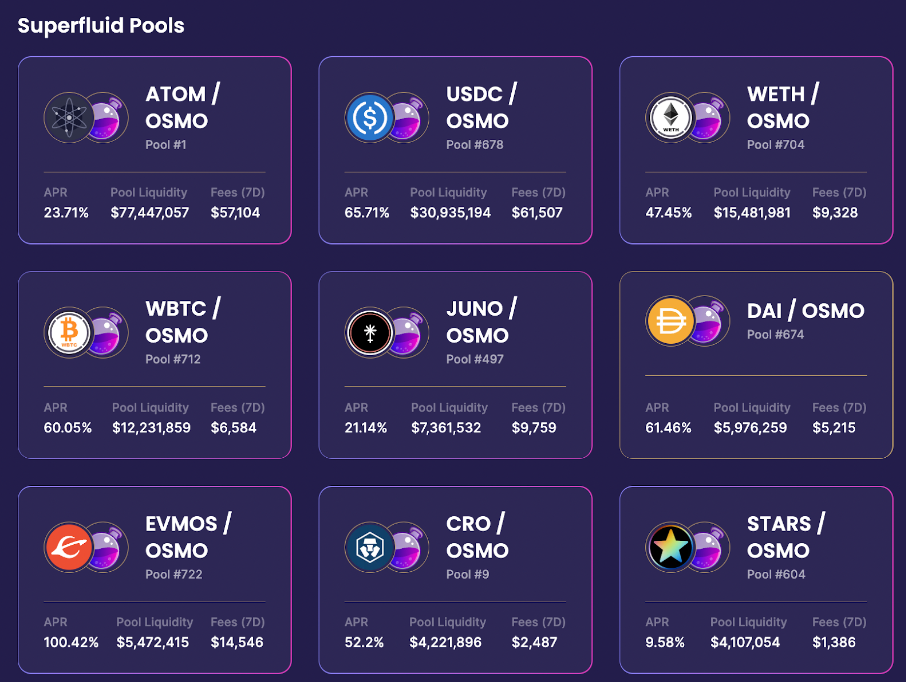

On this page, you will see various ‘Superfluid Pools’ — these are exactly the same concept as liquidity pools that you may have been familiar with in Ethereum-based DeFi.

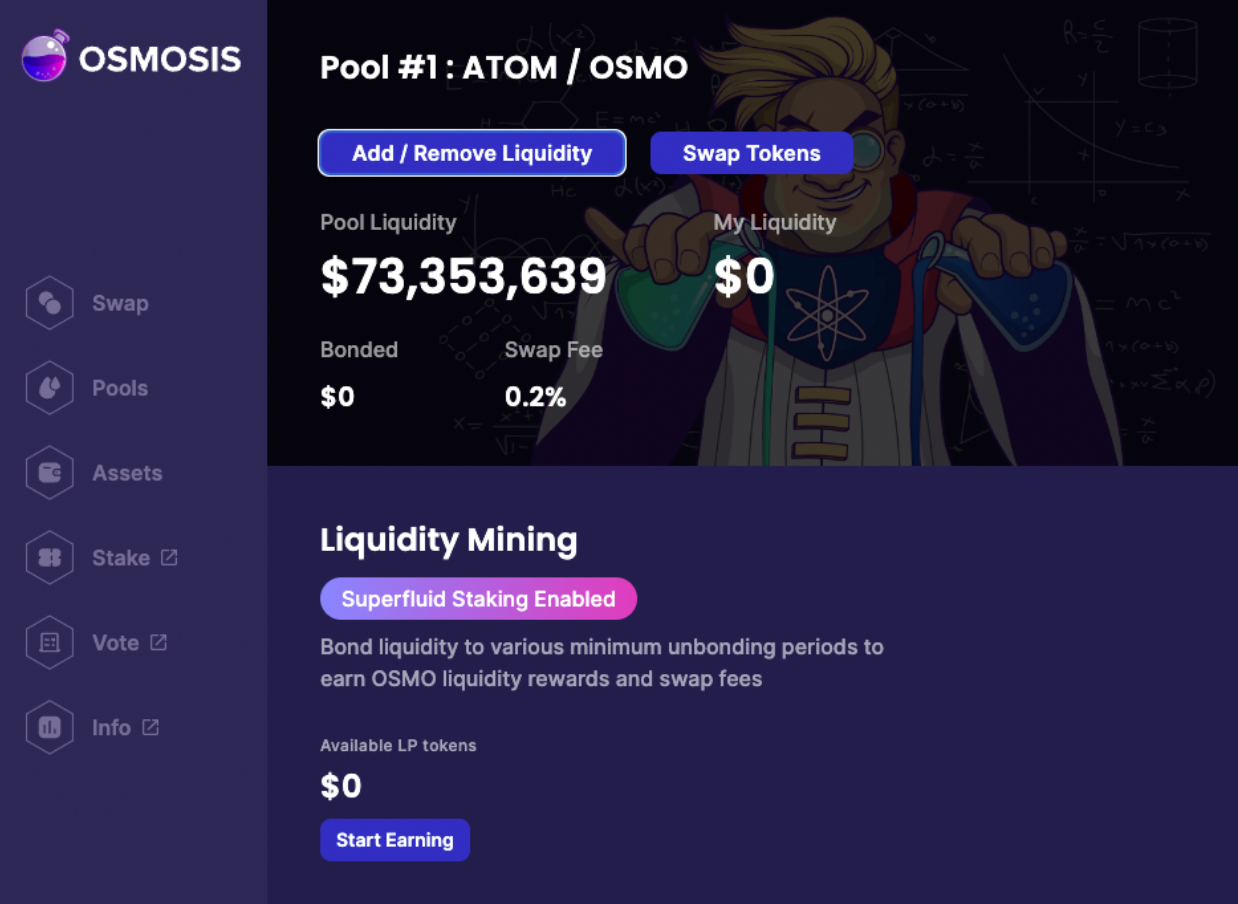

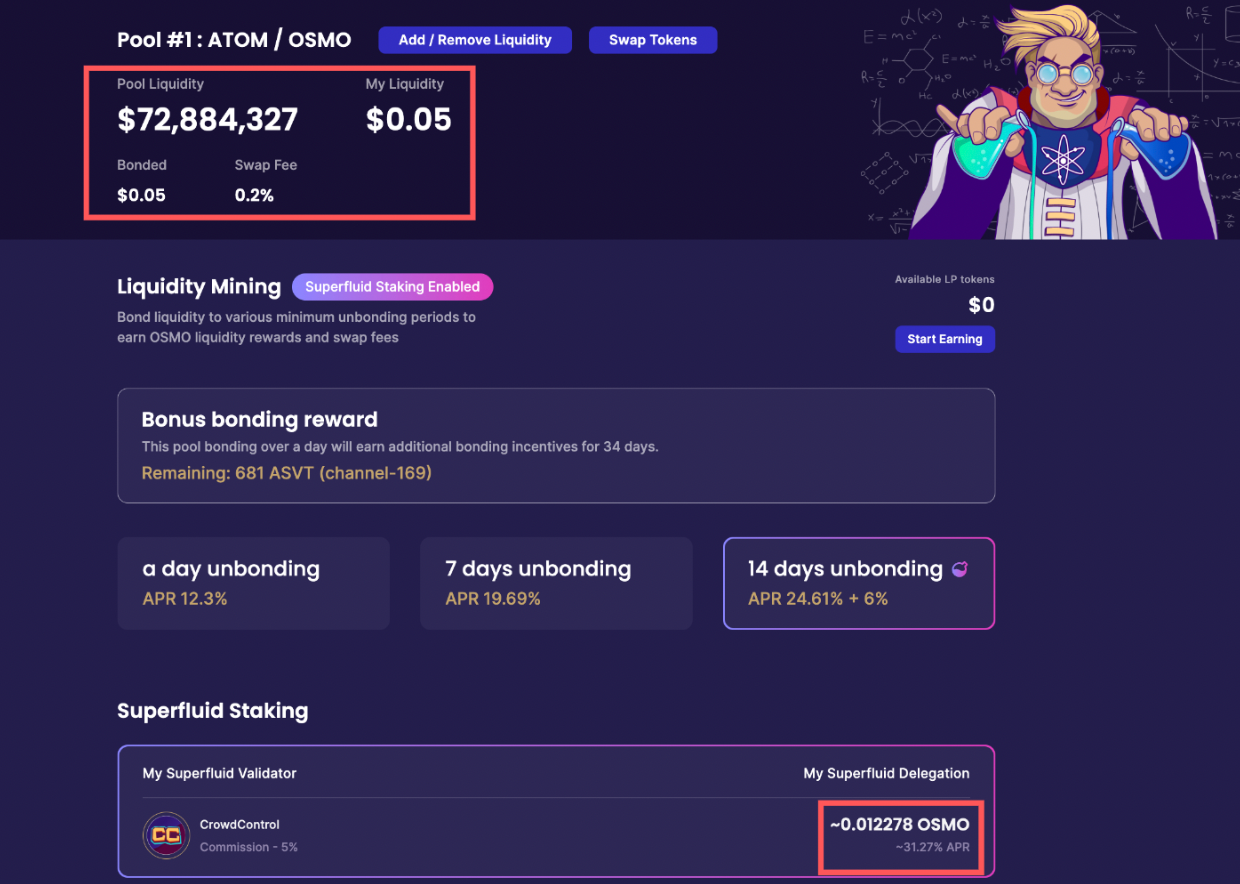

Let’s say for instance that you wanted to go ahead and farm OSMO through the ATOM-OSMO liquidity pool.

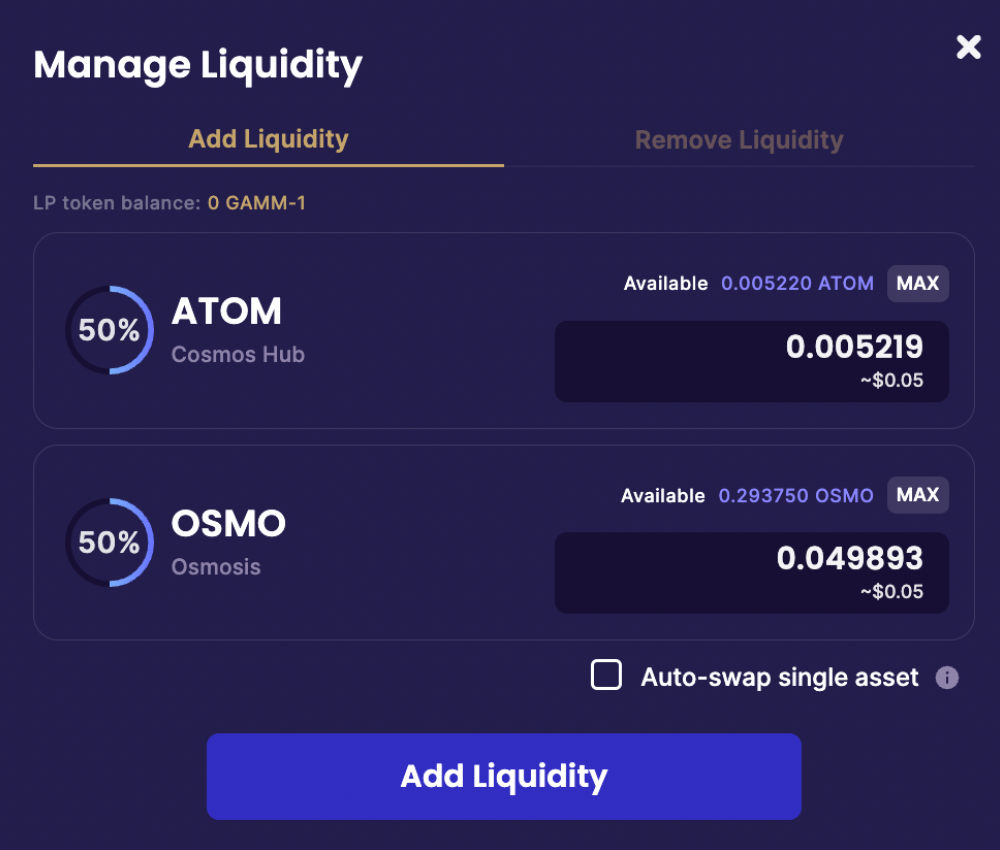

All you need to do now is to ensure that you have an equal value each in ATOM and OSMO tokens. You can then click on the ATOM-OSMO Superfluid Pool tab, and choose “Add/Remove Liquidity” at the top of the page.

You will then be able to deposit your ATOM and OSMO tokens into the liquidity pool, as you may have done on other yield farming platforms.

Once you have approved the transaction with your Keplr wallet, you should then be able to see your balance in “Available LP Tokens”.

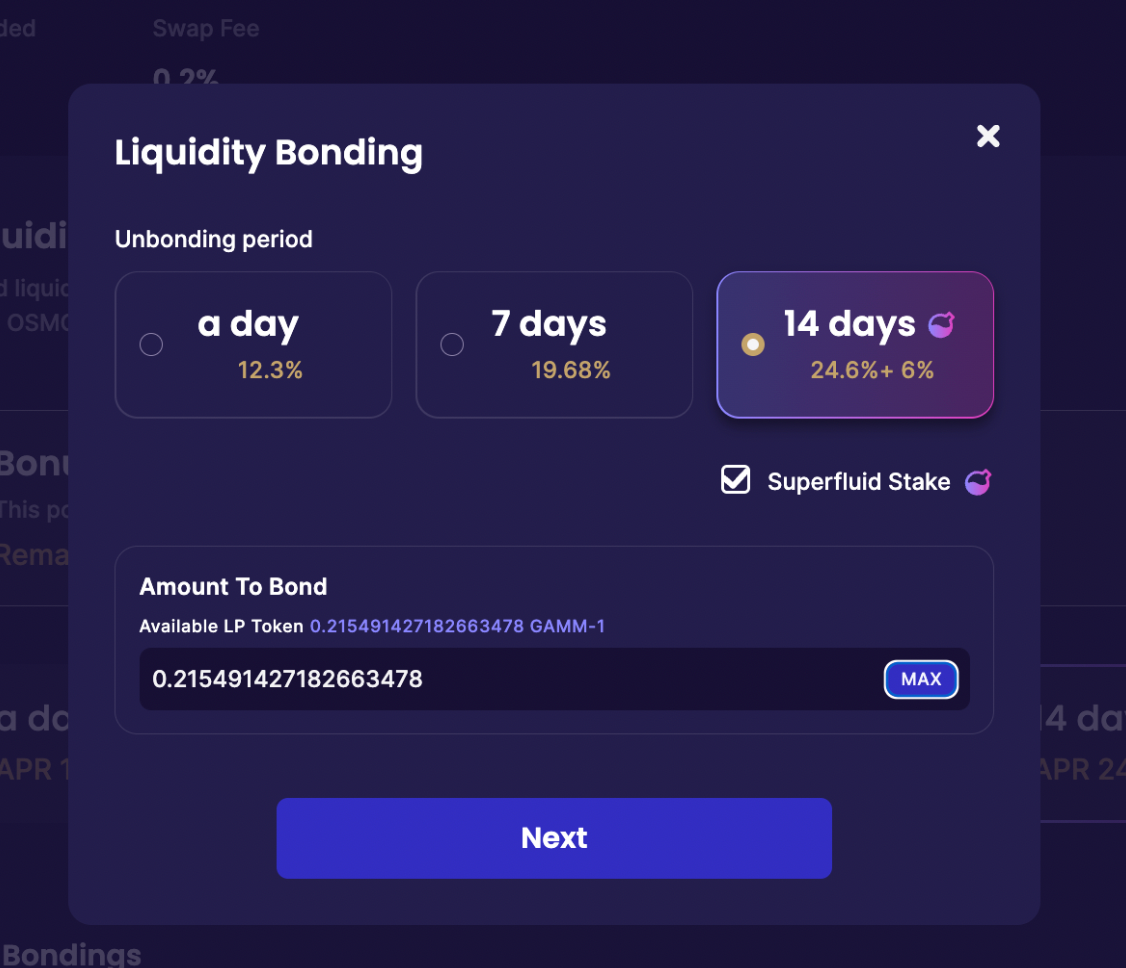

Below that, click on ‘Start Earning’ — a screen will then pop up asking you what you’d like your unbonding period to be. As you can see in the screenshot below, you can enjoy higher APRs if you choose a longer unbonding period — but remember, this means that you’ll need to wait 14 days after unstaking before you can move your funds.

There is no higher APR without higher risk!

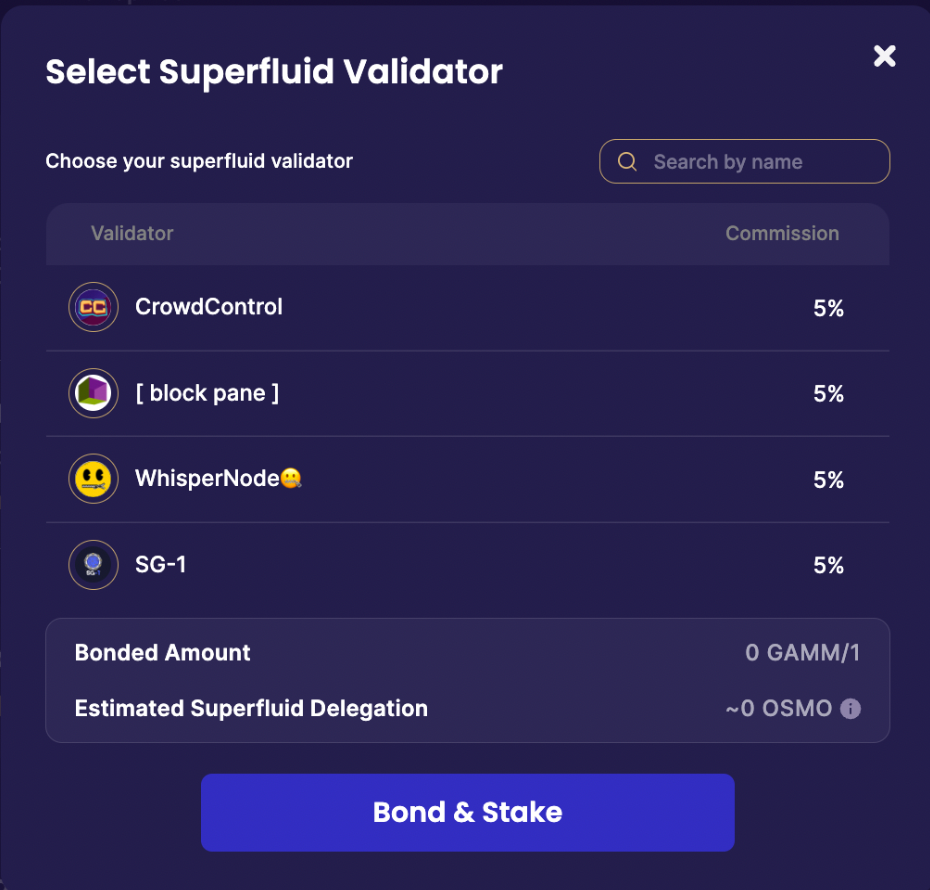

To stake your tokens, simply enter the amount you want to ‘Bond’, and then click Next. You will then be asked to choose a Superfluid Validator to stake with.

This is because we are dealing with a Delegated Proof of Stake blockchain, where transactions are validated by this select list of validators.

Each validator may charge a commission in exchange for allowing you to share in the validator’s rewards.

Now, all that’s left is to hit ‘Bond & Stake’, approve the transaction with your Keplr wallet, and you’re now earning yield!

Withdrawing your Funds

When you want to withdraw your staked funds, simply click on the farm that you have staked in initially. You should then be able to see your ‘Superfluid Staking’ balance with your chosen validator.

You may also see your bonding positions, in this case we have chosen the 14-day bonding option.

To initiate the withdrawal process, click on ‘Unbond All’. This will start the unbonding duration countdown, at the end of which, you will receive your LP tokens back in your wallet.

To break up your LP tokens and get your ATOM and OSMO back, go back to ‘Add/Remove Liquidity’, and proceed to remove liquidity.

Here you can check yield farming opportunities on Osmosis: https://de.fi/explore/network/osmosis

Should I use Osmosis for Staking and Yield Farming?

Osmosis is the first AMM in the Cosmos ecosystem and looks like a very promising project.

Its innovative design focuses not just on meeting the current AMM standards but surpassing them. As mentioned, this includes pioneering the concepts of customizable liquidity pools and superfluid staking, which are both attracting developers and users to the platform.

As a result, Osmosis has attracted users and the innovative design of the protocol, as well as the increased focus on Cosmos-based chains more generally, could see that increase in future.

However, as always, this is not investment advice and you should always do your own research.