Everyone knows about Ethereum on DeFi. But what about a Layer 1 alternative that is wholly designed for decentralised finance and programmable money?

Step forward the Terra (LUNA) network.

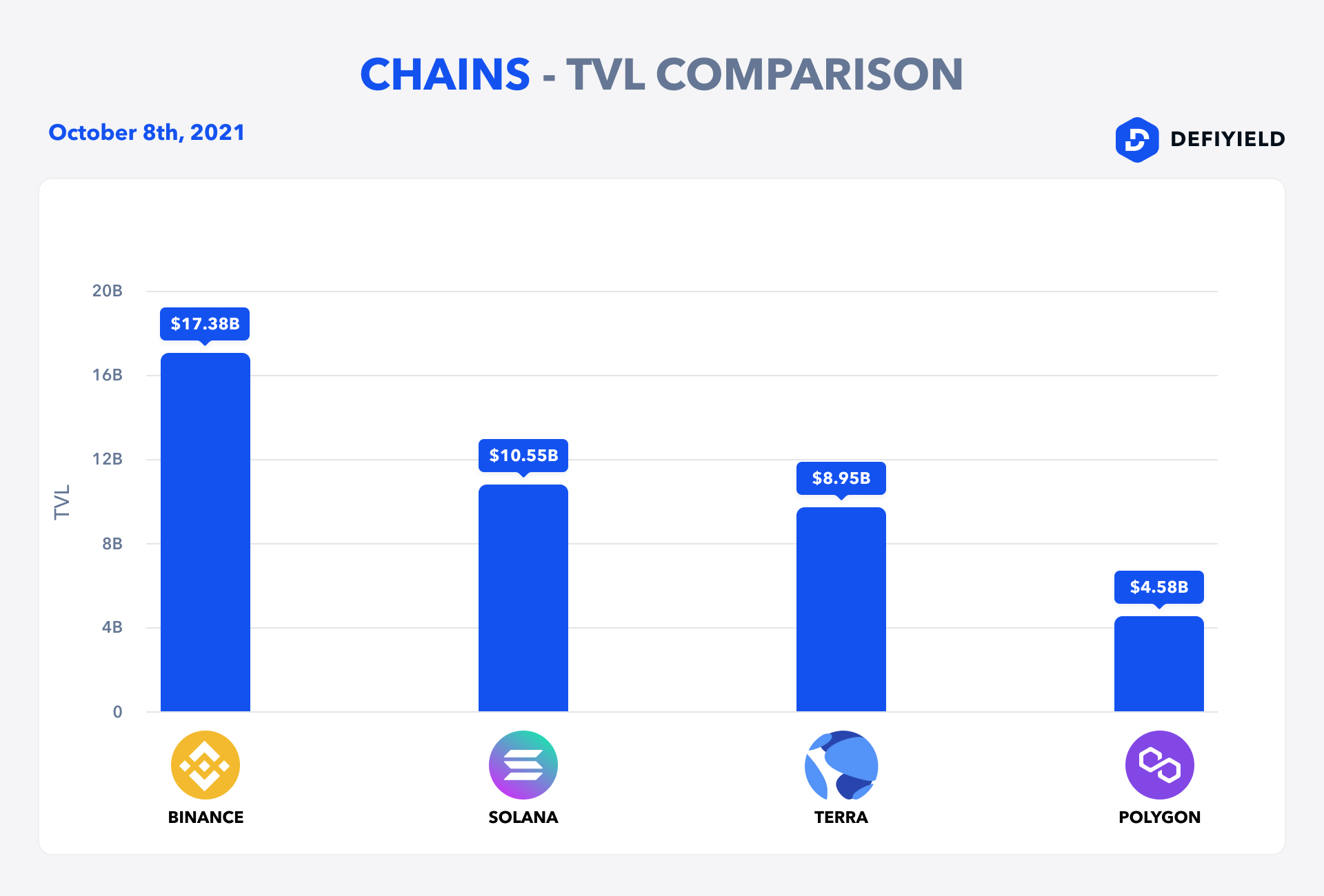

This relatively new protocol is one of the standout examples of Cosmos’s internet of blockchains in action. Dubbed “the DeFi hub of Cosmos”, Terra has a strong following across Asia and is emerging as one of the best places for intrepid Yield Farmers to explore.

In this ultimate guide to DeFi yield farming on the Terra (LUNA) network, we’ll run through the key features of the technology, which ecosystem partners you need to know, the DeFi wallets you can use and the best staking or yield farming opportunities that exist right now.

Table of Contents

What is the Terra (LUNA) Network?

Interoperability

Stablecoins

Anchor protocol

Mirror protocol

The Terra (LUNA) Ecosystem

Ecosystem Partnerships

Terra Bridge

Shuttle

Wormhole

Axelar

Injective Protocol

Intellabridge

Loop Finance

Terra (LUNA) Wallets

Staking and Yield Farming on Terra (LUNA)

Should I Use Terra (LUNA) for Yield Farming?

What is the Terra (LUNA) Network?

Terra (LUNA) is a decentralized financial protocol that claims to be “programmable money for the internet”.

It was created in January 2018 by co-founders Daniel Shin and Do Kwon with the ambitious goal of building a digital financial system independent of major banks and established fintechs. It also sought to leverage the potential of ecommerce in order to increase cryptocurrency adoption and was backed by the Terra Alliance, a group of ecommerce giants in Asia, to do so.

Terra (LUNA) is sometimes referred to as the “DeFi hub of Cosmos” and was built using the Tendermint Cosmos SDK (Software Development Kit). As a result, it incorporates the BFT-based (Byzantine Fault Tolerance) Proof of Stake consensus engine and, like all Cosmos-based blockchains, is designed to be plugged into the wider Cosmos network.

Terra supports smart contracts as part of its mission to be programmable money for the internet. It also uses the native LUNA token, a stablecoin protocol and an oracle system, with some of these key features explained below.

Interoperability

The worldwide adoption of blockchain technology cannot occur without interoperability and Terra was designed to run on multiple networks, connected by the Cosmos Inter-Blockchain Communication Protocol. At this time, Terra is available on Ethereum and Solana.

Stablecoins

The stablecoins offered by Terra are pegged to fiat currencies and are being used in the real world now, especially in Asia. Currently, there are around 20 different stablecoins circulating in the Terra ecosystem, the most established of which are UST (which is pegged to the US dollar) and KRT (which is pegged to the South Korean won).

Terra provides self-stabilizing stablecoins that are regulated through an elastic monetary supply mechanism. This involves the protocol adjusting the supply of an asset to help retain its value.

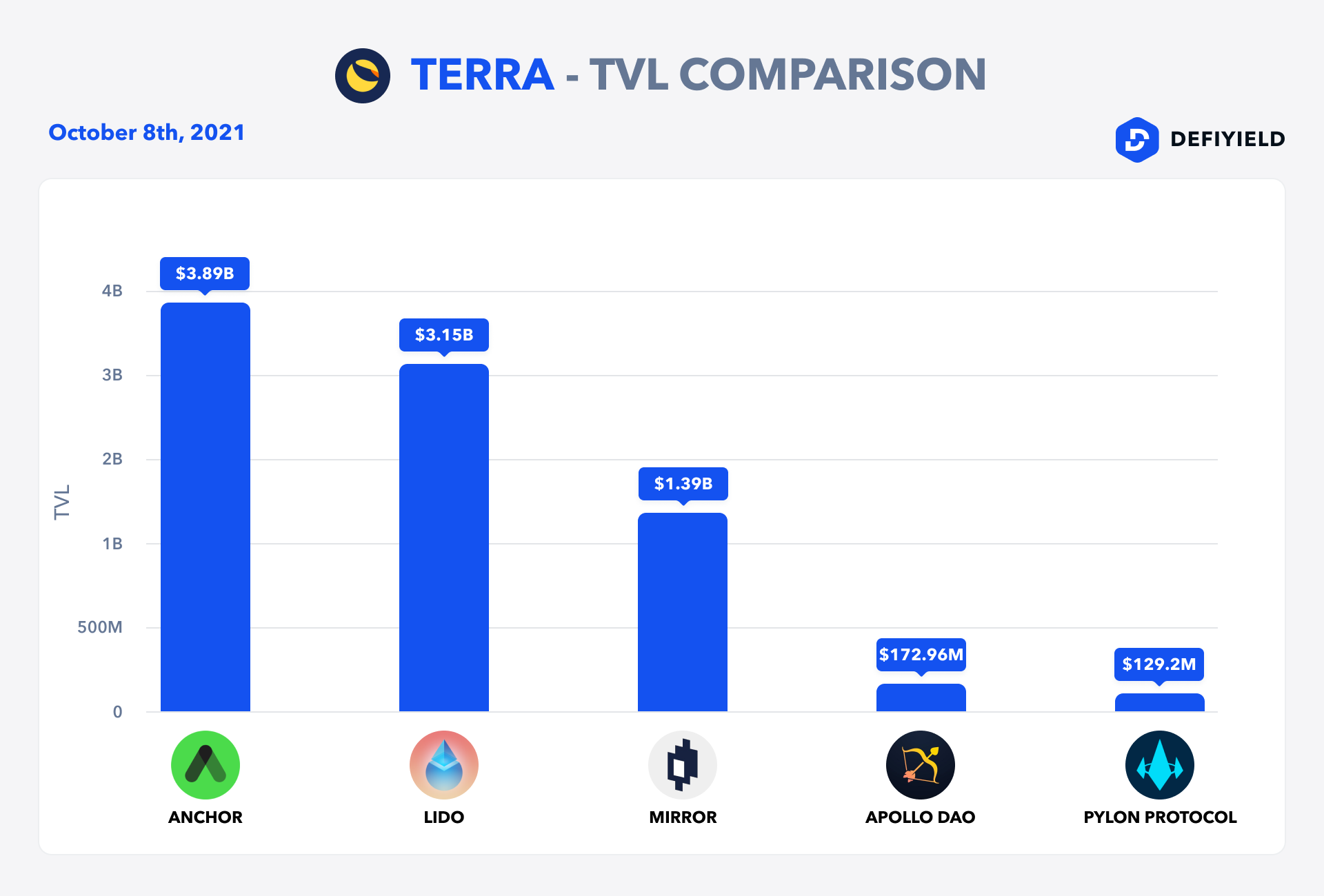

Anchor protocol

Stablecoin holders can earn rewards through the Anchor protocol. It offers:

- Instant deposits and withdrawals

- Short-term loans

- Stable yield farming gains.

It’s worth noting that Anchor has a 20% stablecoin interest rate.

Mirror protocol

Mirror is a relatively new product that was launched in December 2020. It allows users to generate digital representations of real-world assets, such as US equities and ETFs, and to trade these synthetic assets (known as mAssets).

What is the Terra (LUNA) Ecosystem?

Terra is believed to be one of the best protocols to build dApps on as it allows engineers to write smart contracts in Rust, Go or AssemblyScript. Apart from writing their own functionality, developers can also plugin more features using the protocol’s readily available oracles.

Some of the most well-known dApps in the Terra ecosystem include Saturn Money (A European user-focused interface for payments, savings and on/off ramps), Spar Protocol (a decentralized on-chain asset management protocol) and LoTerra (a decentralized lottery).

LUNA holders should also note how the token’s price is linked to the economic activity that occurs in the Terra network. That’s because the Terra stablecoins scale with demand. So, if activity increases and more stablecoins are minted to meet this demand, an equivalent amount of LUNA tokens are burned. This reduces the supply of LUNA tokens, which is likely to positively impact their price.

Here you can find a short recap from our community member on Terra’s influencers, protocols, upcoming protocols, nfts and more — https://t.me/de.fi/149794

Join our telegram for updates — https://t.me/DeDotFi!

Ecosystem Partnerships

As mentioned, Terra has been built using the Cosmos SDK because the founders believe interoperability is very important. This is also why Terra has established ecosystem partnerships, a number of which are noted below.

Terra Bridge

A web frontend that enables Terra assets to be sent easily to and from Ethereum and Binance Smart Chain.

Shuttle

A bridge to Ethereum and Binance Smart Chain.

Wormhole

A bridge between Terra, Ethereum and Solana being developed by Certus One.

Axelar

A bridge between Terra and other Layer 1 blockchains.

Injective Protocol

A decentralized derivatives trading protocol that utilizes Mirror assets.

Intellabridge

A bridge enabling decentralized mobile banking app “Kash”, which brings Mirror and Anchor to mainstream audiences.

Loop Finance

A Decentralized Exchange (DEX) that lists native Terra assets, ERC-20 tokens and SPL tokens.

What are the Terra (LUNA) Wallets?

You can use various wallets to access the Terra network for staking and yield farming, a few of which are listed below.

Software wallets

A web extension and downloadable software wallet, Terra Station allows you to access dApps powered by smart contracts on the Terra blockchain. It has been developed by the creators of Terra and is available for all operating systems.

A multi-platform (mobile, desktop extension and hardware), universal crypto wallet that was founded in 2017 by Eric Yu.

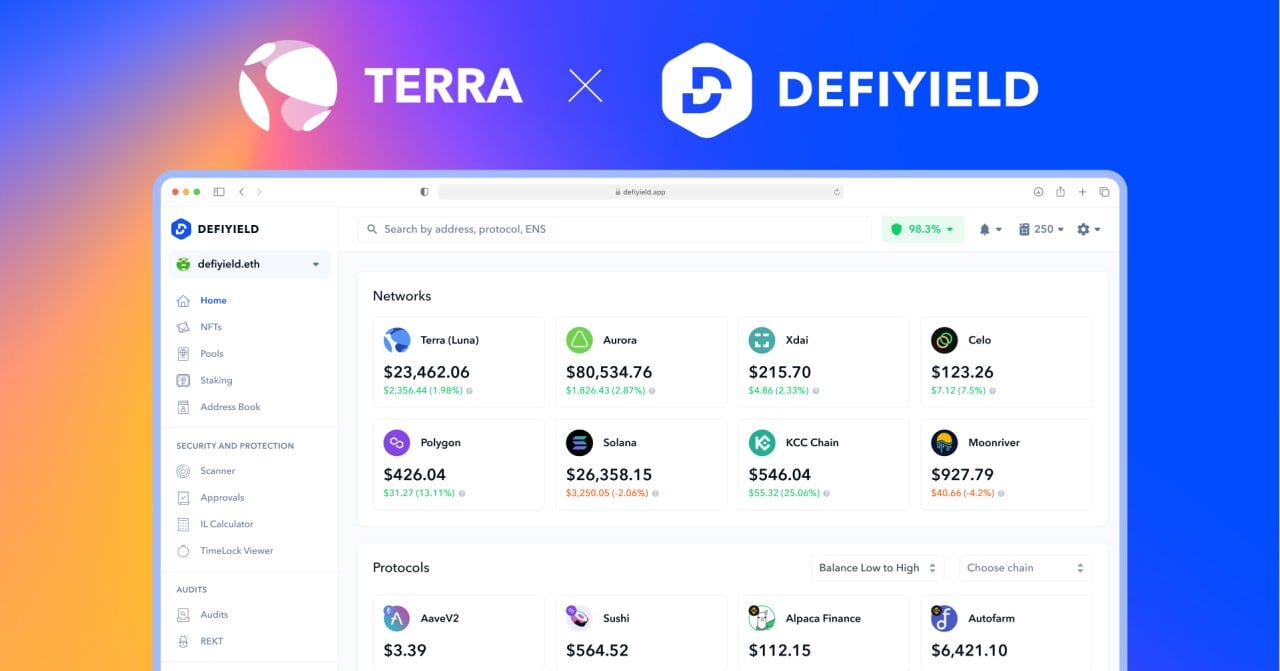

Track your Terra Portfolio on De.Fi

Terra available on De.Fi!

Track your portfolio including assets, pools and more!

⏩Connect your wallet to our DeFi portfolio tracker Super App.

Hardware wallets

**Ledger**

Ledger is one of the most well-known hardware wallets, which are used to safely store keys for accessing digital assets on blockchains. It was launched in 2014 by a team of eight.

**Trezor**

Trezor is another well known hardware wallet that supports LUNA. It was created in 2013 by Marek Palatinus.

Subscribe for more!

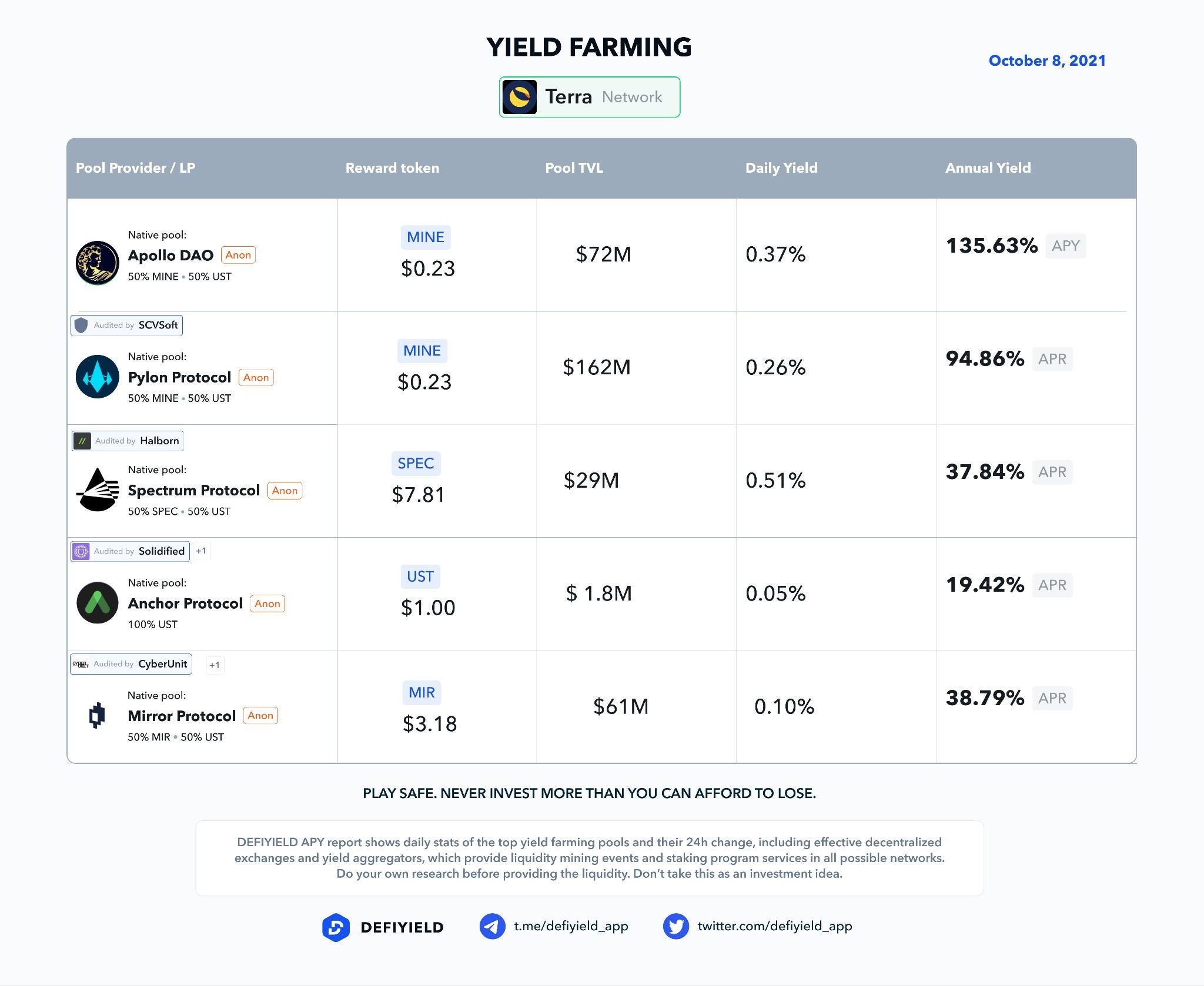

Staking and Yield Farming on Terra (LUNA)

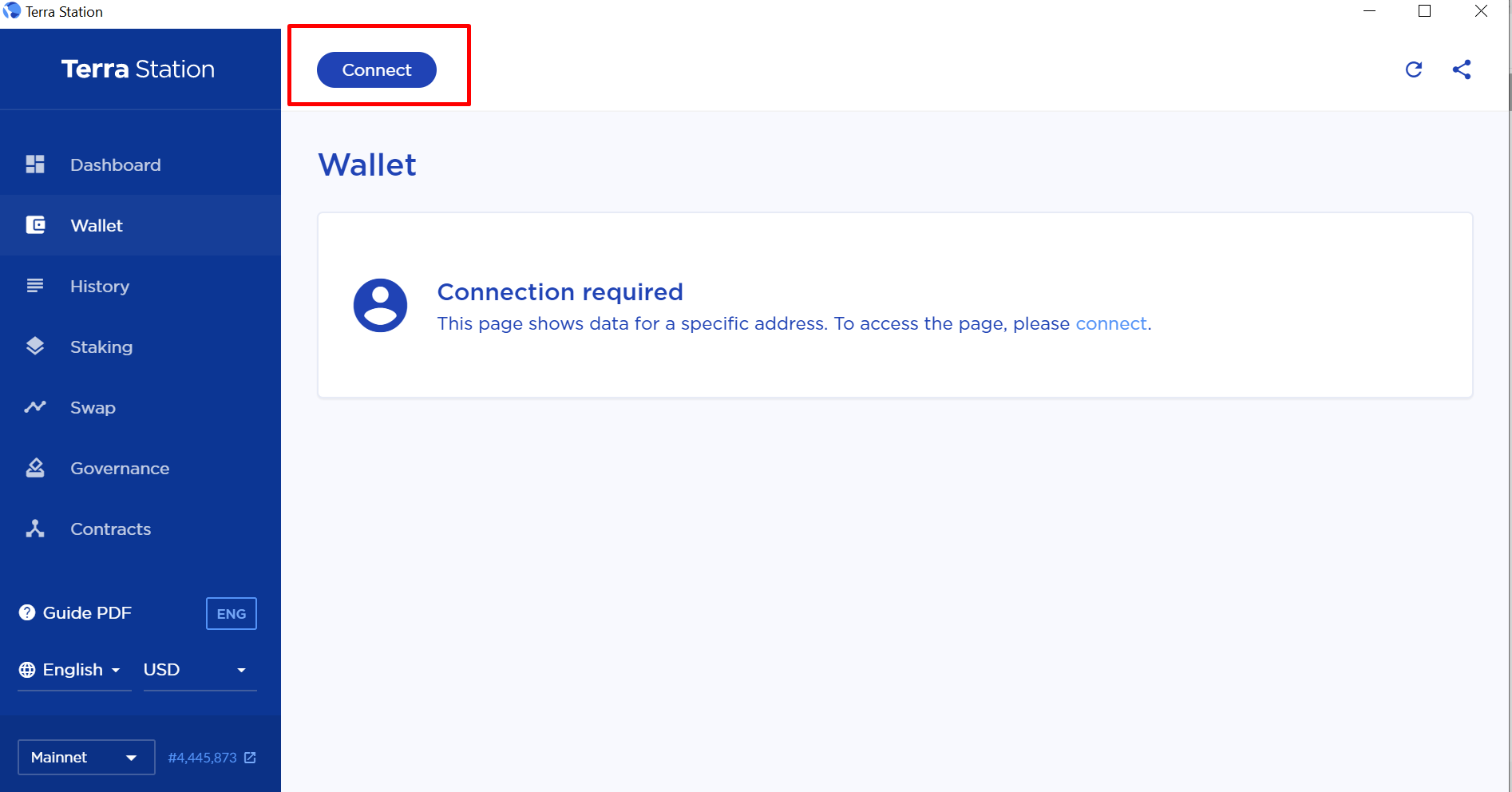

In order to stake on Terra, you will need to download and install the Terra Station wallet, which is an official application for holding LUNA tokens. This can be done through the official Terra website.

You will also need some LUNA tokens to get started with staking and yield farming. One way to do this is through the Kucoin exchange, where you can exchange USDT for LUNA. You can also buy the tokens directly with fiat currencies.

5 steps to stake on Terra Luna

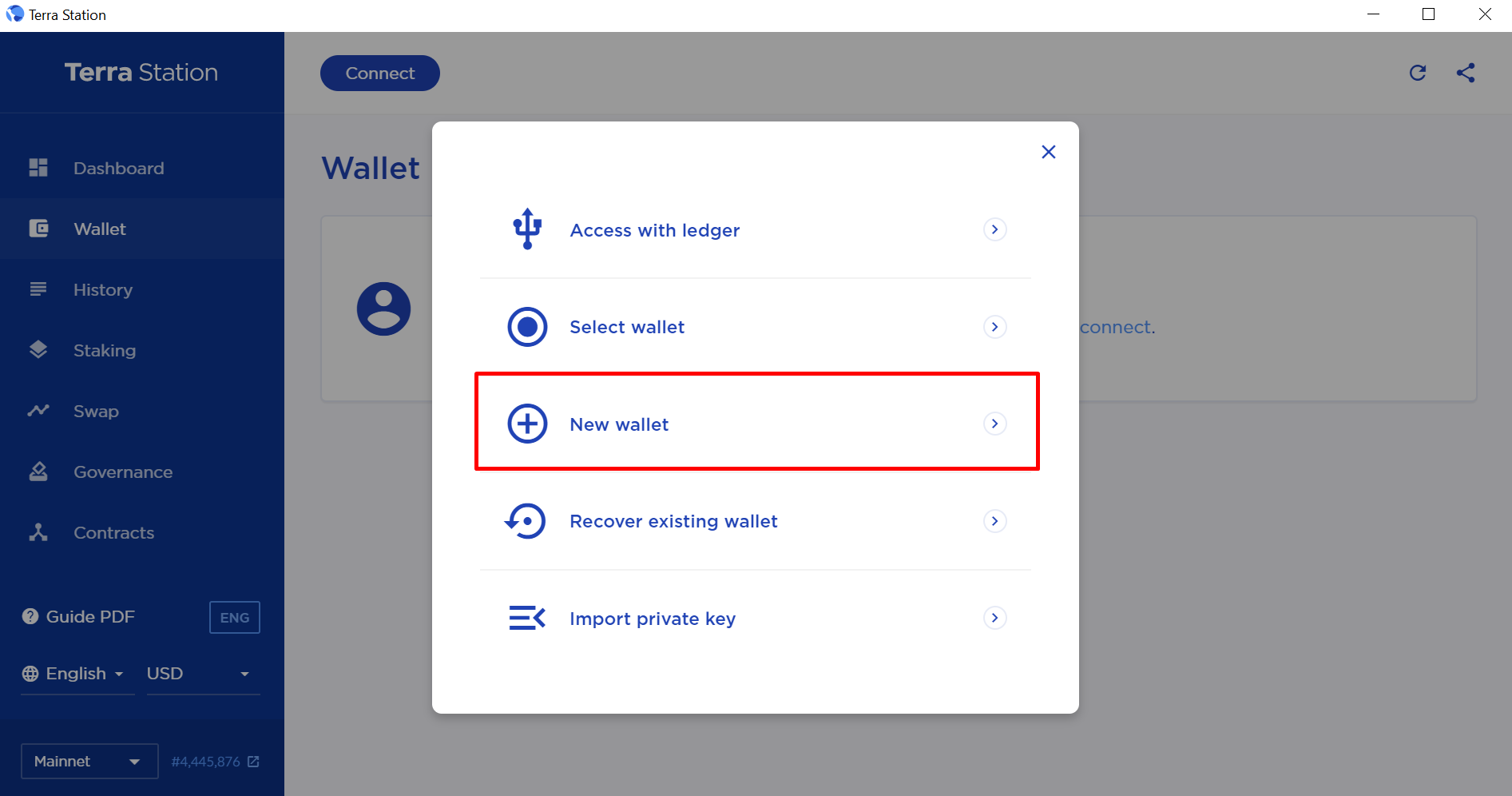

- Create a wallet on Terra Station.

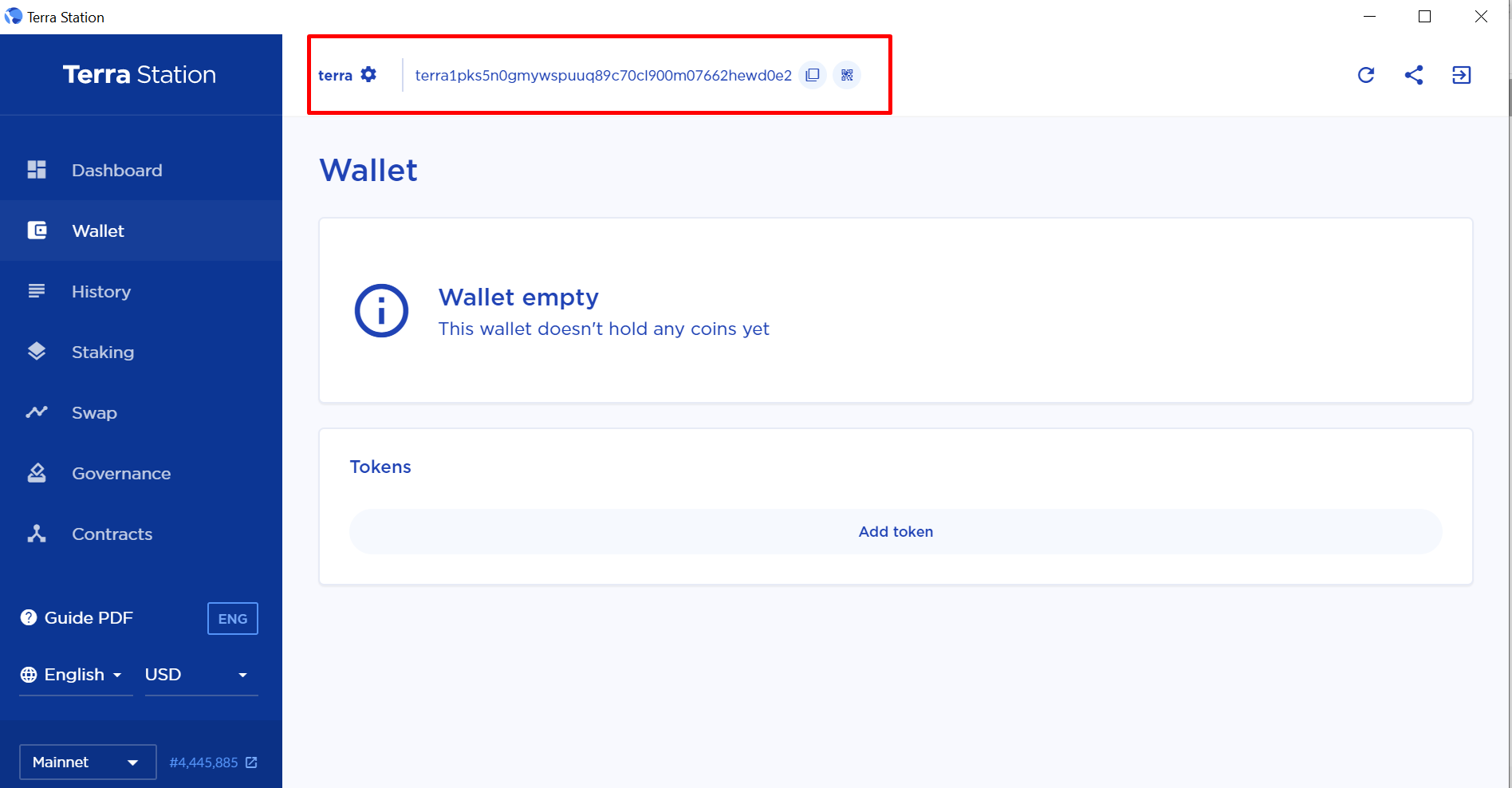

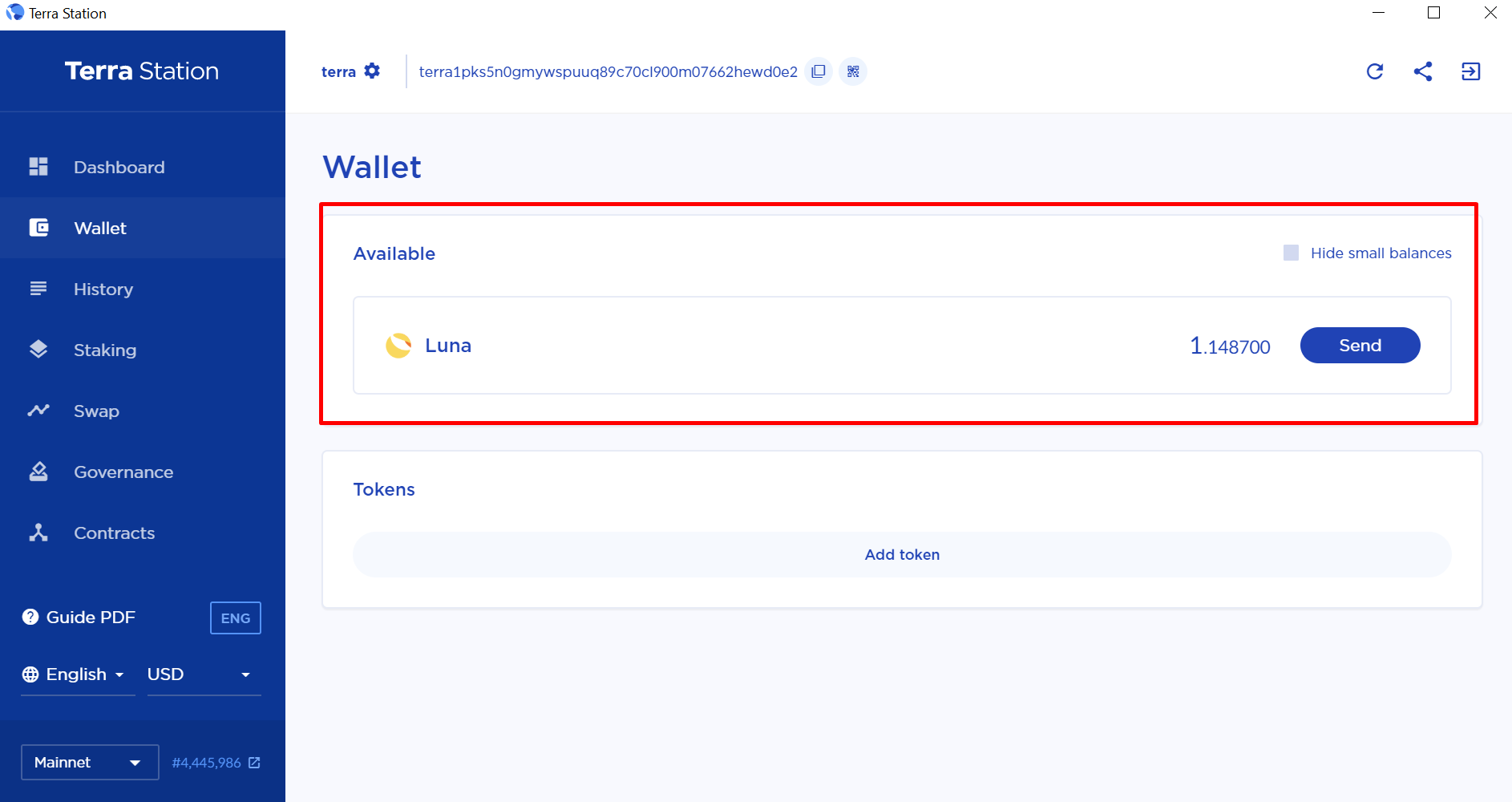

- Send your LUNA tokens to the wallet you have created. You can find the address at the top of the page.

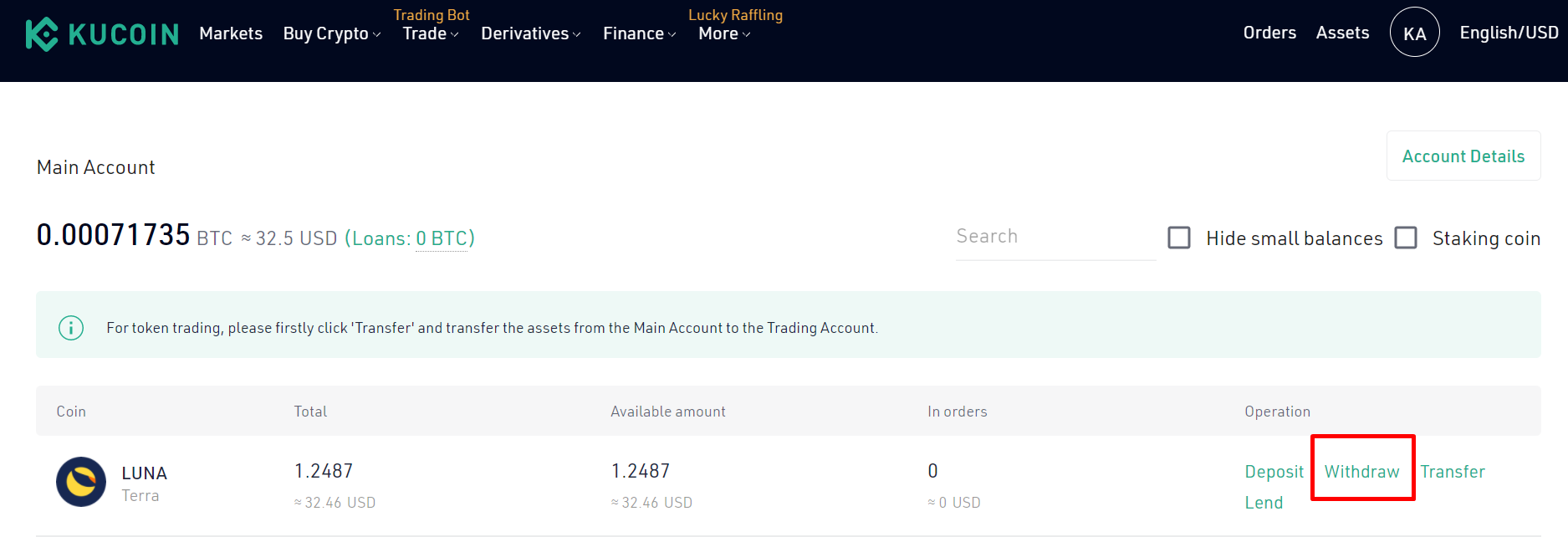

- Below, you will see an image that shows how to move your tokens from your Kucoin account to your Terra station wallet. To send the tokens, click on the Withdraw button.*

*If your assets are in your trading account, you will need to transfer them to your main account first.

- To make the transfer, enter the address for your Terra Station wallet and the number of tokens you would like to withdraw. Wait for the transaction to process and, once it is completed, you will see the LUNA tokens in your Terra station wallet (as shown below).

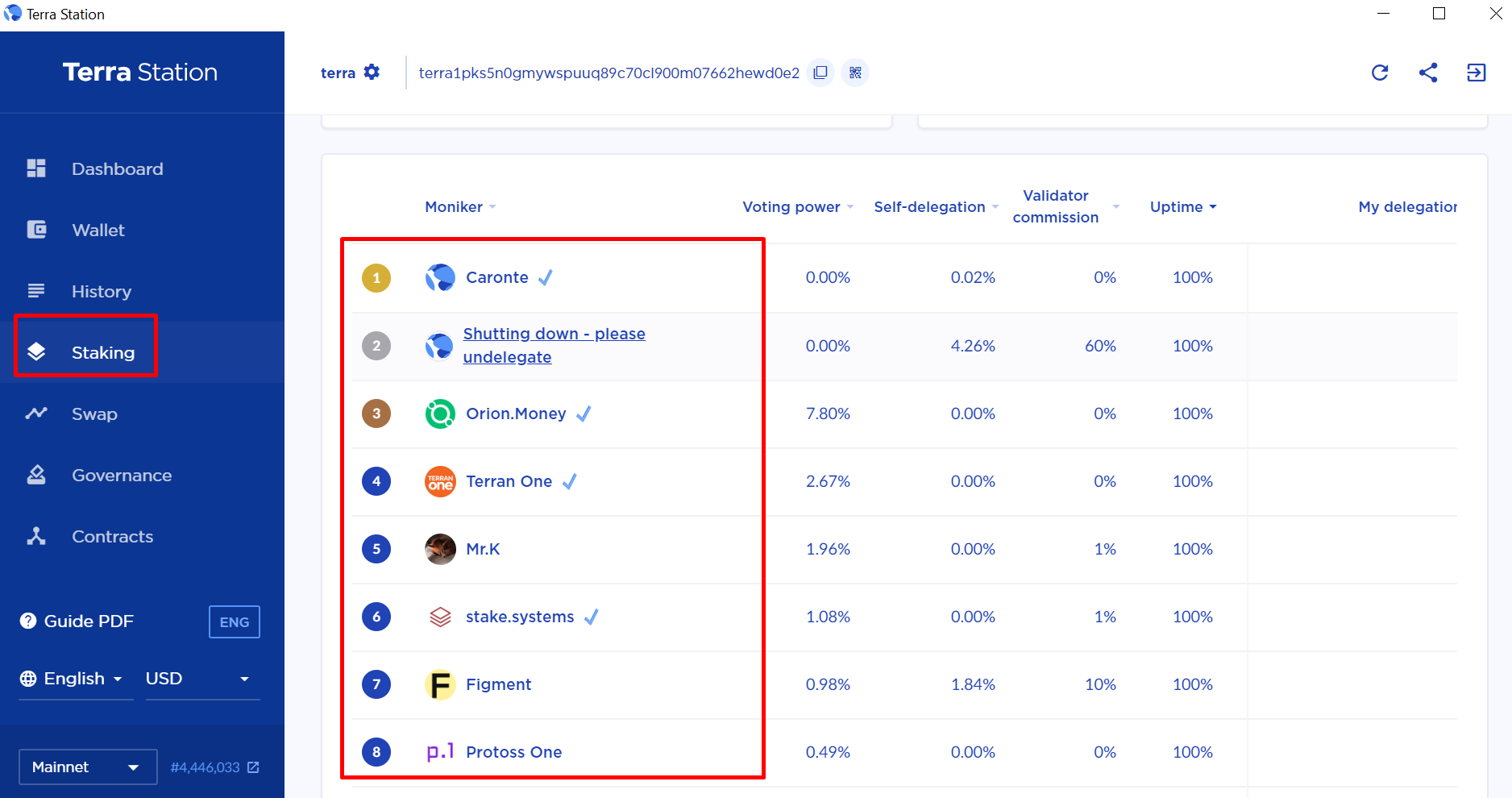

- Now you can proceed with staking. Go to the Staking tab in your Terra Station wallet and choose the validator you want to delegate your tokens to by clicking on their name. For the sake of this example, we chose the validator at the top of the list.*

- You may be unsure about delegating your LUNA tokens when staking. If that’s the case, here’s a couple of short answers to key questions you may have.

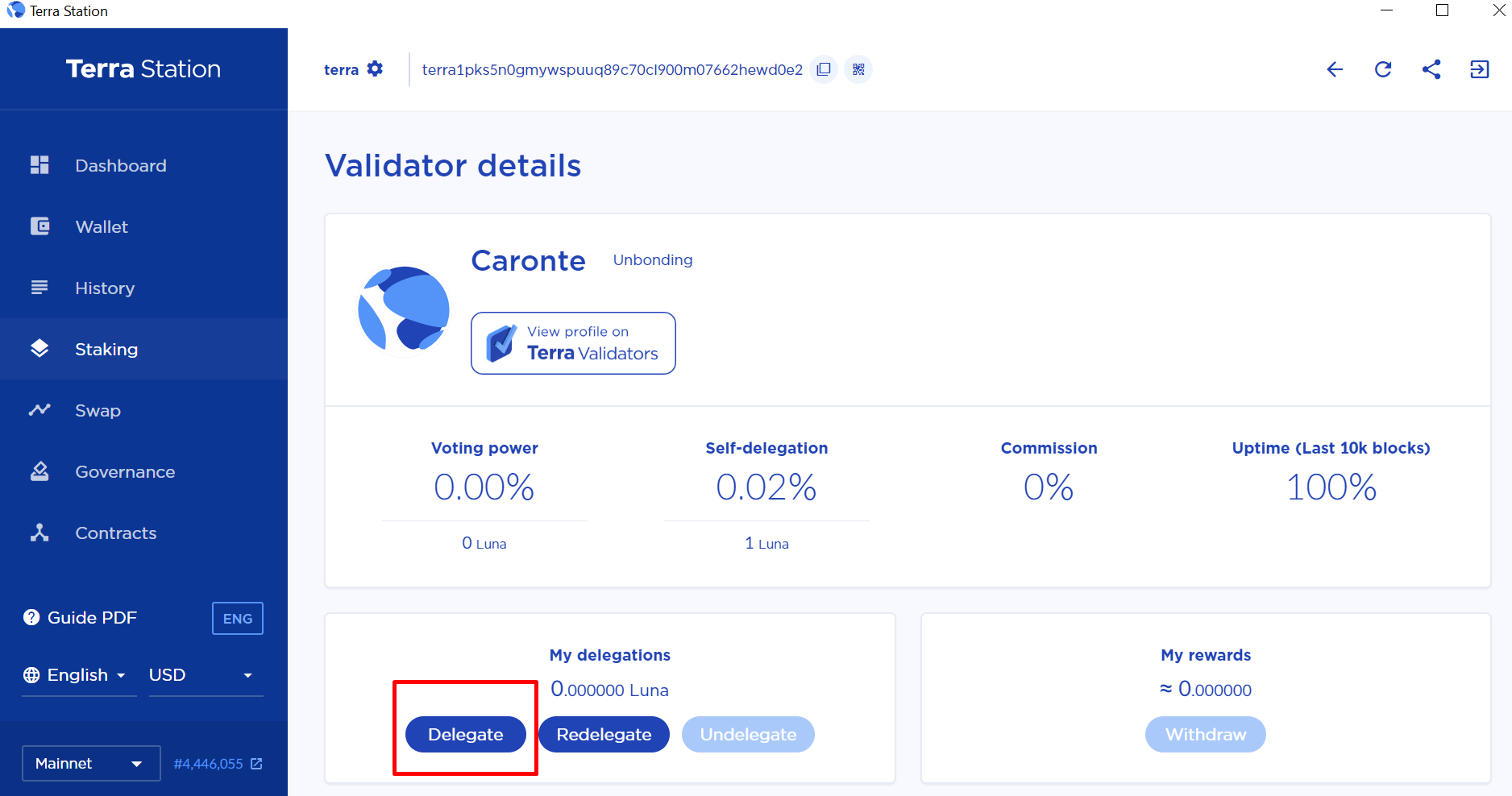

Is it secure to delegate LUNA tokens?

Keep in mind that, when you delegate your tokens, you are not transferring them to someone else. The assets are locked up, so they can’t be used elsewhere, but the validator cannot get their hands on them. For this reason, delegation should be seen as a relatively secure process.

What should I consider when choosing a validator?

Your profitability will largely depend on the uptime of the validator. If they experience significant downtime, the amount staked will be penalized, hurting you and the validator. You should therefore consider choosing a validator with a good track record in this area.

Another thing to consider is self delegation, which relates to whether the validator has some of their own LUNA staked. Generally, it’s best to choose a validator that does this.

How to self delegate on Terra (LUNA)?

1. Once you have chosen your validator, click on the Delegate button, as shown below.

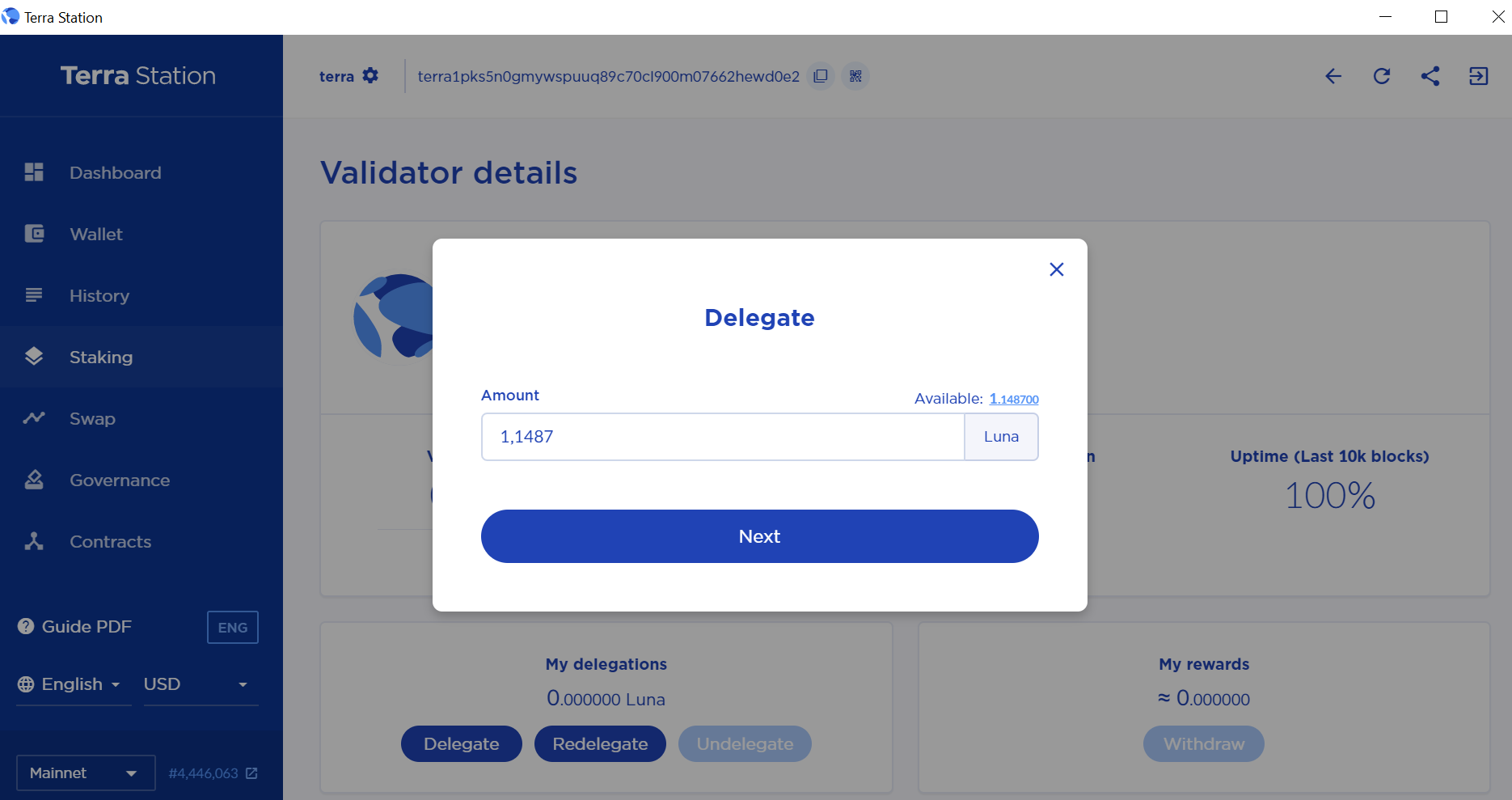

2. In the Delegate window that appears, enter the number of tokens you would like to delegate and tap Next.

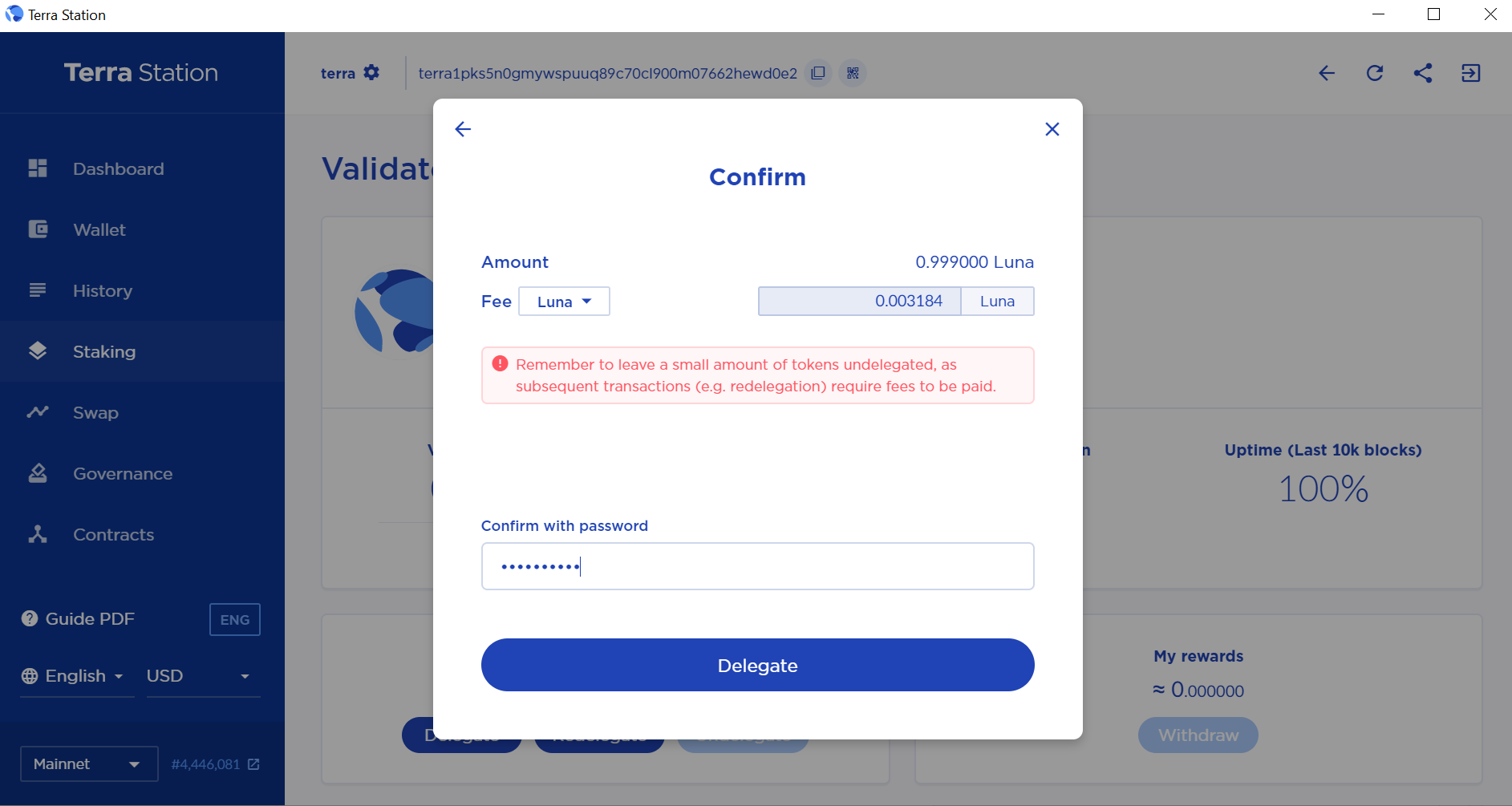

3. Enter the wallet password and click Delegate.

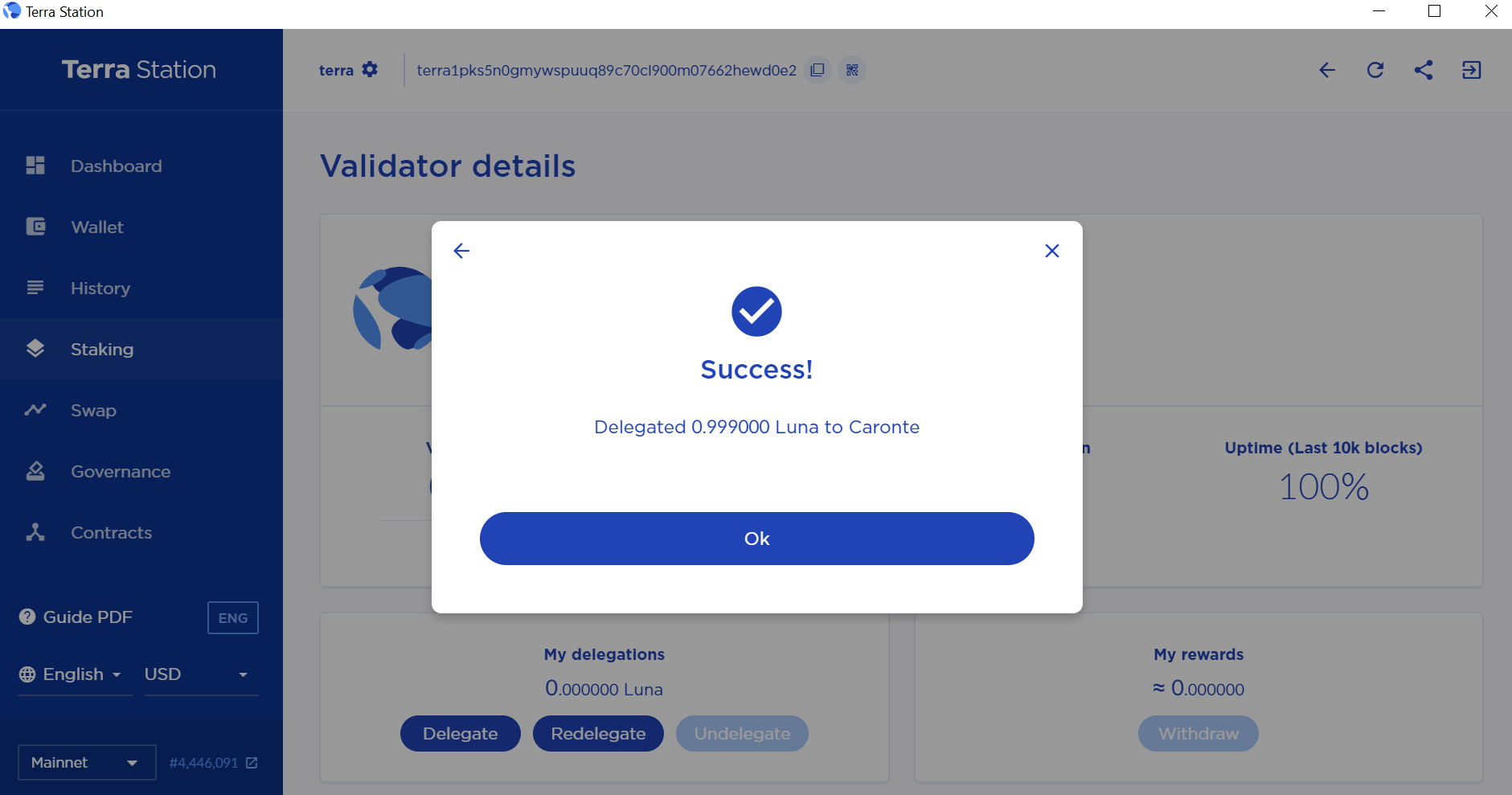

4. Wait a few seconds for it to process and you have successfully delegated your LUNA!

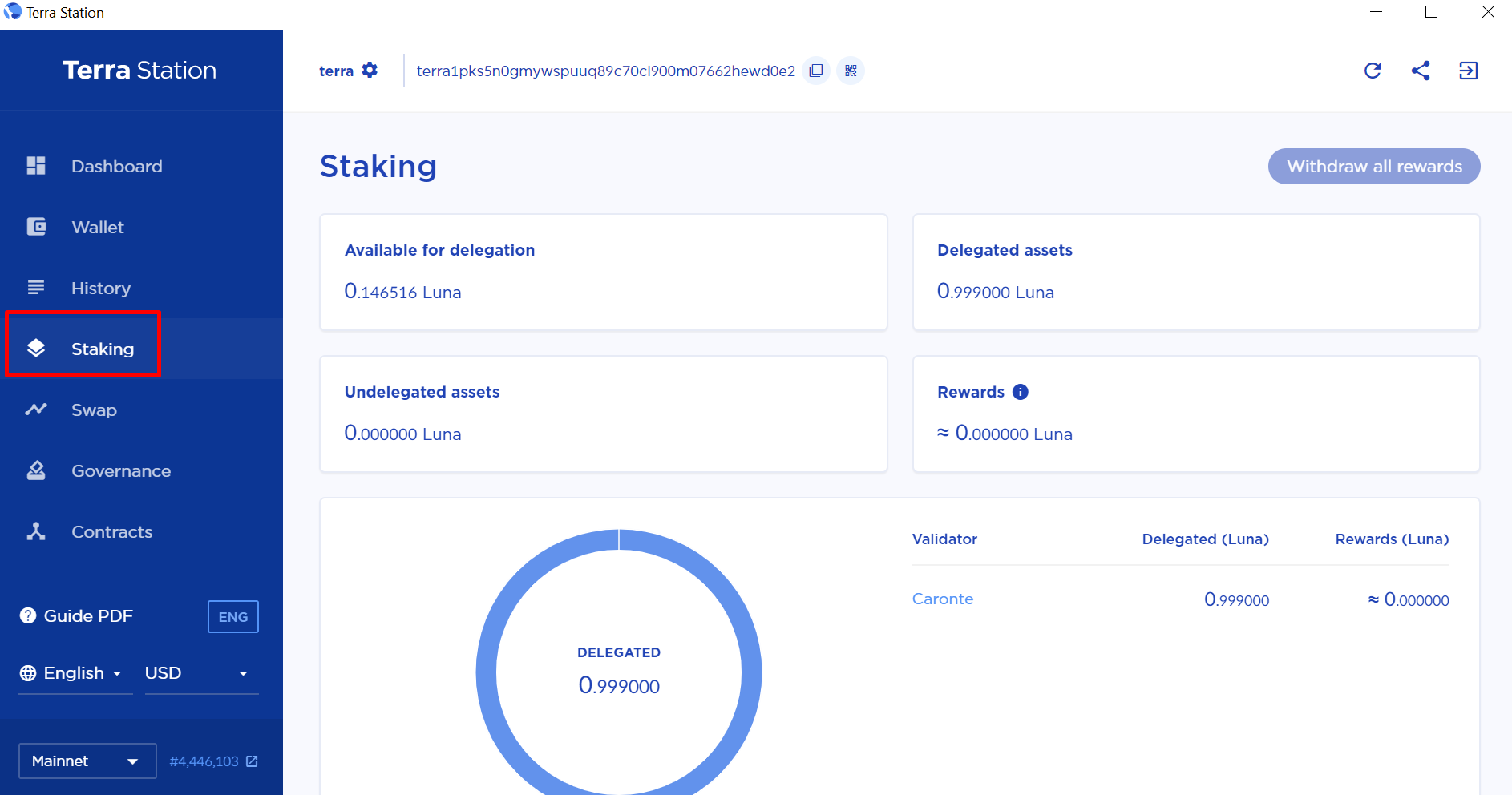

5. To check the rewards or general staking information, go to the Staking tab.

Should I Use Terra (LUNA) for Yield Farming?

If you believe that interoperability is the future of blockchain networks and that worthwhile yield farming can exist outside Ethereum, you need to start investigating the opportunities that exist within the Terra (LUNA) network.

This Layer 1 protocol is totally dedicated to a decentralized and independent financial system of the future, as well as having clearly established foundational technologies in place to enable this vision. Not only that, it had the backing of a major ecommerce consortium at its founding and has an established but growing community, which is based in Asia but spreading across the globe.

For yield farmers, the ability to stake through a validator you can trust is important so no penalties occur during assets being locked. You should also keep in mind the benefits that may come from the fact that the LUNA token’s value should be positively affected when activity on the network increases. Even now, the rewards for staking on Terra are more or less stable, being around 12% annually, although this depends on the size of your stake.

For all these reasons, we recommend staking on Terra, as no major risks have been identified so far.

Here you can check yield farming opportunities on other chains: de.fi/explore

However, it is crucial to remember that every cryptocurrency is volatile and subject to price decreases, and LUNA is no different. So, before jumping into staking, make sure you understand the market and its movements.

Check our other resources to stay safe and explore DeFi:

Revoke Wallet Permissions Tool

What is TVL (Total Value Locked) in DeFi?

Upcoming Crypto Airdrops for 2023

Smart Contract Audit Services

Free Smart Contract Audit Scanner

Crypto Hack & Scam Database

And join us on Twitter and Telegram!

Good luck in farming!