In the DeFi space, Uniswap has established its position as a cornerstone platform, revolutionizing how we think about trading and liquidity. However, as the DeFi ecosystem has expanded, the search for Uniswap alternatives has become increasingly relevant.

Users are on the lookout for platforms that offer lower fees, different user interfaces, or better integrations with the expanding variety of blockchain networks. This guide will highlight the top competitors in the space, with general summaries of their unique features and benefits.

What is Uniswap?

Official Website: https://app.uniswap.org/swap

X Profile: https://x.com/Uniswap

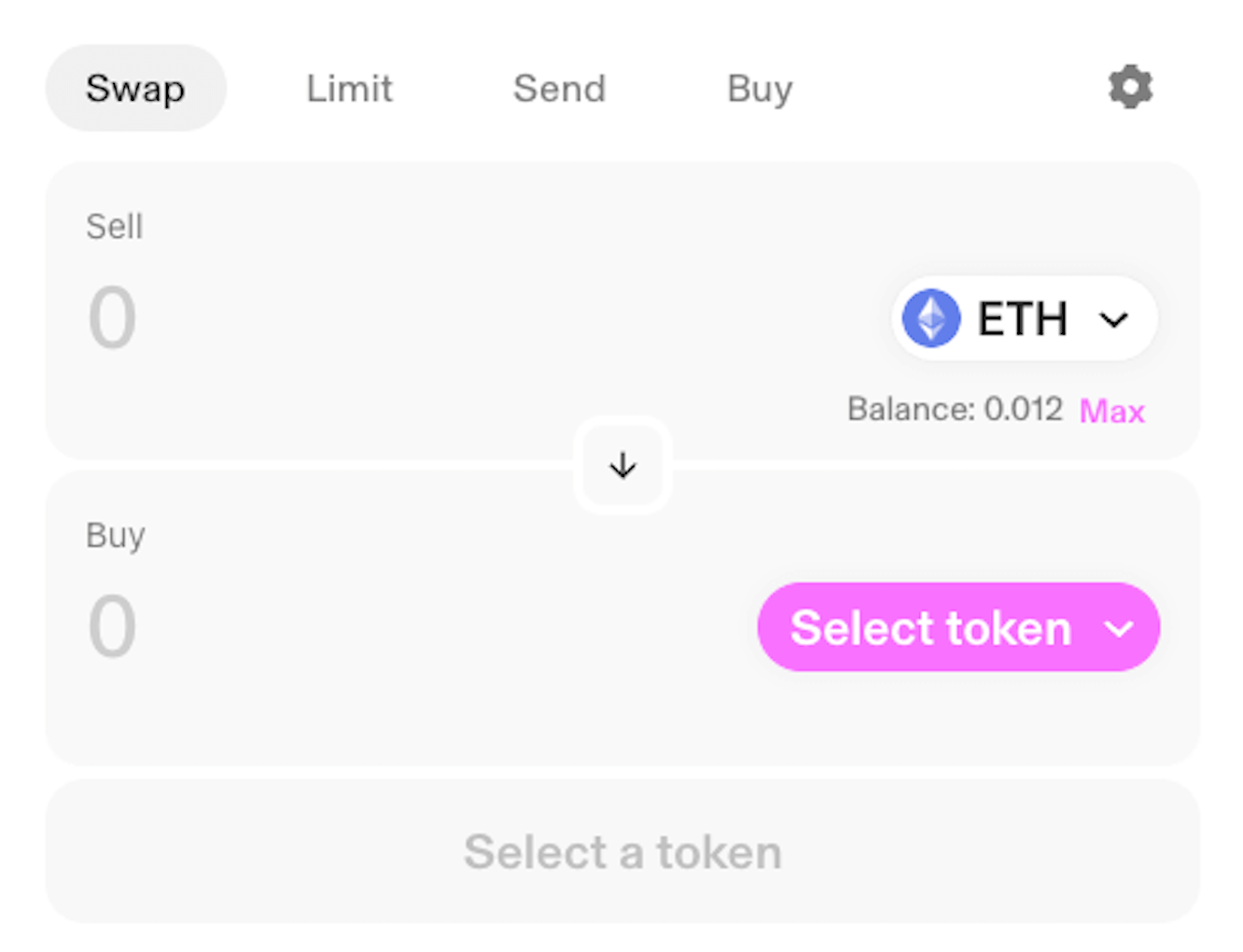

Uniswap is a pioneering decentralized exchange (DEX) that utilizes an automated market maker (AMM) mechanism to facilitate trading without the need for traditional order books. Since its inception, Uniswap has played a main role in the DeFi movement, offering a platform for seamless token swaps and liquidity provisioning.

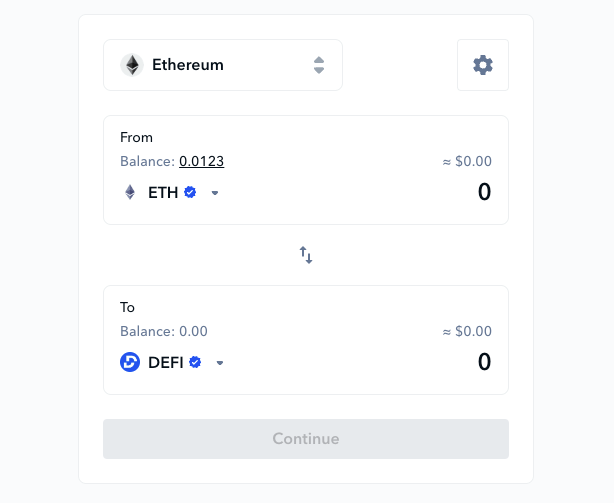

The simple, yet powerful, Uniswap DEX interface

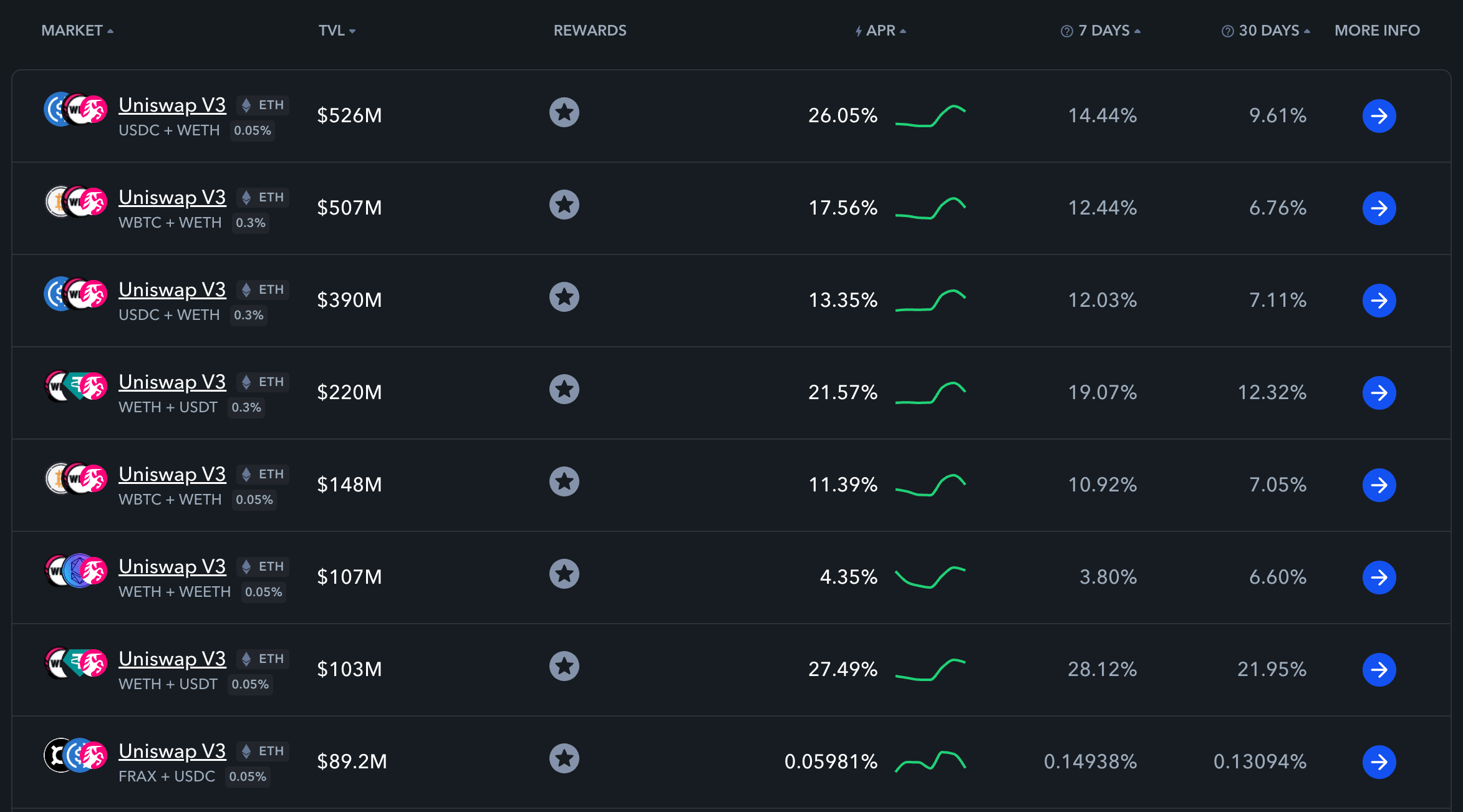

Its importance to DeFi cannot be understated, with billions in total value locked (TVL) and a significant daily trading volume. Yield farmers often turn to Uniswap when supplying their assets thanks to the robust volumes it attracts:

Uniswap V3 yield farming data from De.Fi Explore

Despite its dominance, the competition for Uniswap alternatives has intensified. Users seek platforms that might offer cheaper fees, better liquidity, an alternative UI, protection from MEV, or better integrations with emerging blockchain ecosystems.

Top Uniswap Alternatives

As we dive into the world of Uniswap competitors, it’s clear that the landscape is rich with innovative platforms each bringing something unique to the table. Below are some of the top alternatives, categorized based on their standout features.

IMPORTANT SAFETY NOTE: One of the most common methods of exploiting users in DeFi is to use a fake domain name for exchanges. All the exchanges listed below will have their official domain listed. DO NOT USE A DOMAIN THAT CLAIMS TO BE THE OFFICIAL WEBSITE BUT THAT DOES NOT DISPLAY THE OFFICIAL DOMAIN IN YOUR BROWSER. Doing so can result in a total loss of your crypto funds. Check, double-check, and triple-check to ensure you are using the right domain every time you complete a transaction on a decentralized exchange.

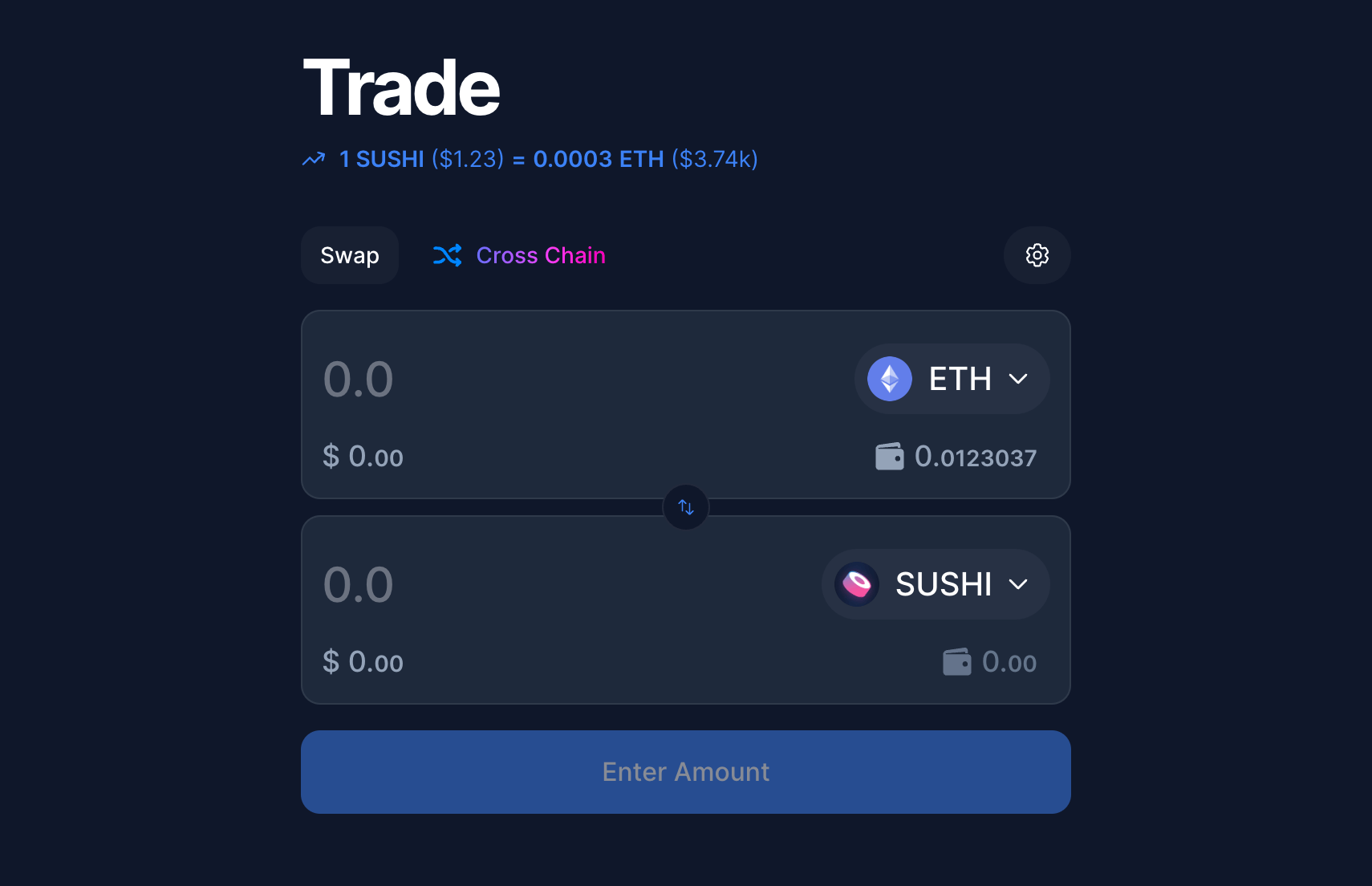

Best Overall Uniswap Alternative: SushiSwap

Official Website: https://www.sushi.com/swap

X Profile: https://x.com/SushiSwap

SushiSwap Yield Farming: https://de.fi/explore/protocol/sushi

SushiSwap, initially launched on the Ethereum blockchain as a decentralized finance (DeFi) protocol, has significantly broadened its horizons. Recognizing the growing demand for cross-chain interoperability and the need to cater to a wider audience, SushiSwap has evolved beyond its Ethereum roots to support multiple blockchain networks. This strategic expansion allows users to engage in the swapping, staking, and farming of assets across a variety of ecosystems, including but not limited to Arbitrum (ARB), Polygon (MATIC), and Avalanche (AVAX).

This multi-chain functionality positions SushiSwap as a versatile and accessible platform for users across different blockchains, seeking to leverage the benefits of DeFi without being restricted to a single network. By operating across these chains, SushiSwap addresses several key challenges in the DeFi space, such as high transaction fees on Ethereum, network congestion, and the siloed nature of blockchain ecosystems. It enables more efficient transactions, broader accessibility, and the opportunity for users to explore DeFi opportunities in emerging blockchain networks.

The protocol’s expansion into multiple chains has been facilitated through its use of bridges and wrapping, which allow for the seamless transfer and interoperability of assets between different blockchains. This not only enhances the user experience by providing more flexibility and options but also contributes to the overall liquidity and utility of the SushiSwap ecosystem.

SushiSwap’s multi-chain approach is complemented by its continued commitment to community governance. Holders of its native cryptocurrency, SUSHI, retain the ability to propose and vote on changes across all chains where SushiSwap operates, ensuring that the protocol remains adaptable and responsive to the needs of its diverse user base.

Best Uniswap Alternative Aggregator: De.Fi Swap

Official Website: https://de.fi/swap

X Profile: https://x.com/DeFi

De.Fi Swap is a liquidity aggregator. Its core functionality lies in its ability to route swaps through multiple liquidity pools and compare swap rates across a multitude of DEX platforms, ensuring that users are presented with the most favorable prices available in real time.

What separates De.Fi Swap from the competition, and indeed, what positions it as the best Uniswap alternative aggregator, is its expansive multi-chain support. De.Fi Swap has integrated support for a broad spectrum of blockchain networks, including the newest popular ecosystems like Arbitrum and Base, ensuring that users are not confined to the liquidity and assets of a single network or DEX. This multi-chain approach not only maximizes the opportunities for users to engage in swaps but also significantly reduces the barriers to entry for users operating across different blockchain environments.

Moreover, De.Fi Swap’s commitment to efficiency extends to its focus on minimizing transaction costs for its users. By aggregating swap rates and providing access to the most competitive prices across various platforms, De.Fi Swap plays a crucial role in helping traders save on gas fees and slippage. This emphasis on cost-efficiency, coupled with its user-friendly interface, makes De.Fi Swap the ideal tool for both seasoned traders and newcomers to the DeFi space alike.

Beyond mere DEX aggregation, De.Fi Swap’s architecture is designed with security and trust at its core. We offer our DeFi Scanner tool to help users assess the risks associated with the underlying smart contract of a destination token, allowing users to be fully aware before proceeding. This security-first approach reassures users that their trades are not only well-priced but also protected against the risks inherent in the DeFi ecosystem.

Overall, De.Fi Swap’s innovative aggregation technology, wide-ranging chain support, focus on cost-efficiency, and unwavering commitment to security offers a superior alternative to traditional DEX platforms like Uniswap.

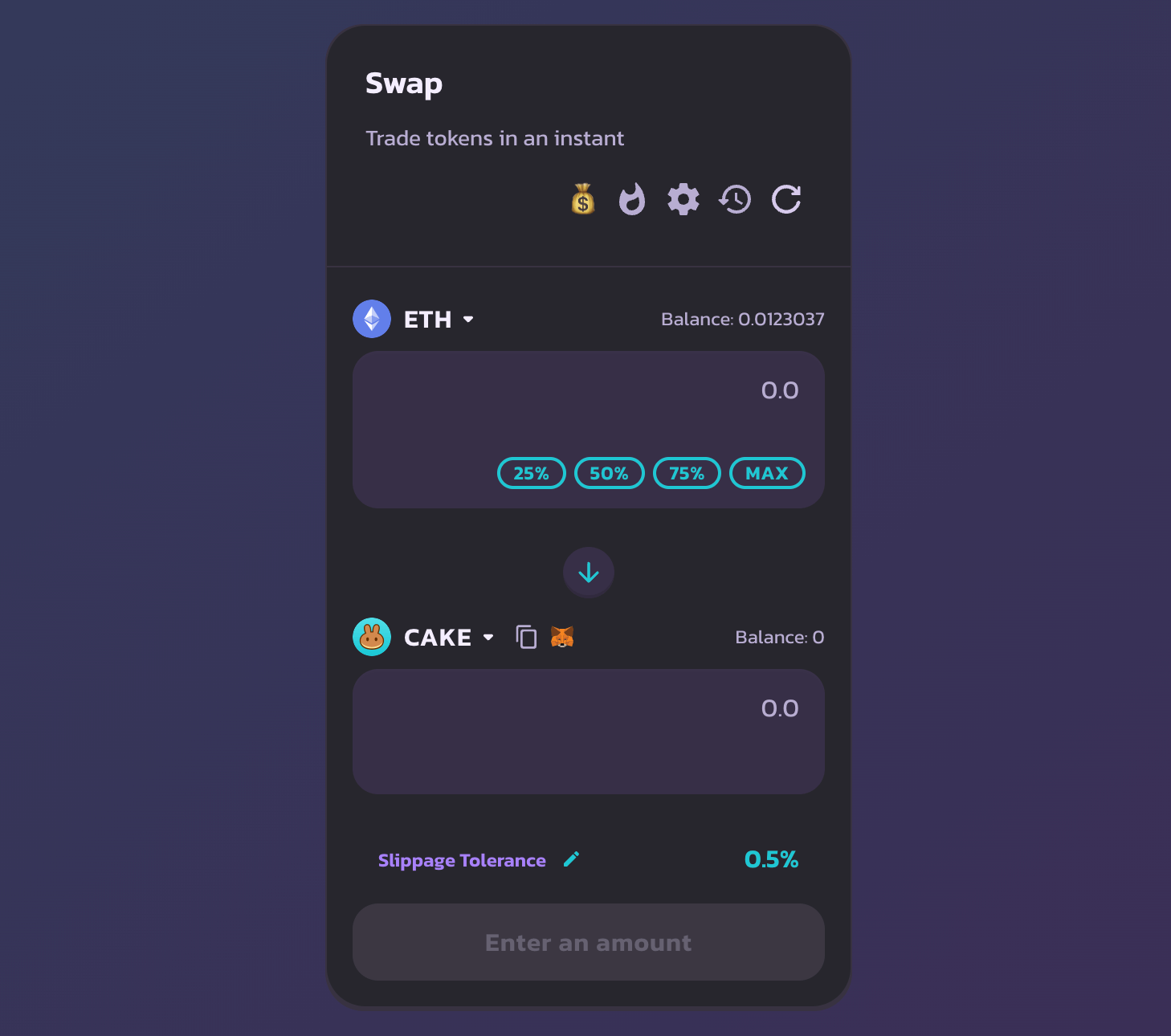

Best Uniswap Alternative for BNB Chain: PancakeSwap

Official Website: https://pancakeswap.finance/swap

X Profile: https://x.com/PancakeSwap

PancakeSwap Yield Farming: https://de.fi/explore/protocol/pancakeswap

As an alternative to Uniswap first launched in 2020, PancakeSwap capitalized on the efficiency and scalability of the BNB Chain, allowing for faster and more cost-effective transactions. Today, this efficiency is not just limited to the BNB Chain; PancakeSwap has broadened its horizons by integrating with multiple new chains, including zkSync Era, Linea, Base, Arbitrum, and the Aptos chain, among others. This multi-chain expansion significantly enhances user accessibility by offering a diverse range of ecosystems where users can engage in DeFi activities beyond Ethereum.

Beyond simple swapping features, the inclusion of a perpetuals exchange function further diversifies PancakeSwap’s trading options, providing users with the ability to engage in leveraged trading without an expiry date, a feature that appeals to both speculative traders and those looking to hedge their positions.

The platform employs an inflationary model for its native CAKE token, using it as an incentive mechanism to reward users for their liquidity contributions. This model contrasts with Uniswap, where liquidity providers earn a share of transaction fees without native token rewards. To counterbalance inflationary pressures, PancakeSwap implements deflationary measures such as token buybacks and burns, aiming to maintain the token’s value over time. The resulting higher yields enjoyed by liquidity providers have been credited with the ability of the platform to amass a high total value locked in a relatively short time.

PancakeSwap’s strategic focus on multi-chain support, combined with its trading and yield farming features, positions it as a Uniswap alternative that caters to a broad audience within the DeFi ecosystem. Its ability to offer a user-friendly platform with lower fees and diverse functionalities across various blockchain networks makes it an attractive option for users exploring Uniswap alternatives. As the DeFi landscape continues to evolve, PancakeSwap’s adaptability and commitment to community governance and innovation ensure its place as a leading DEX in the competitive DeFi market.

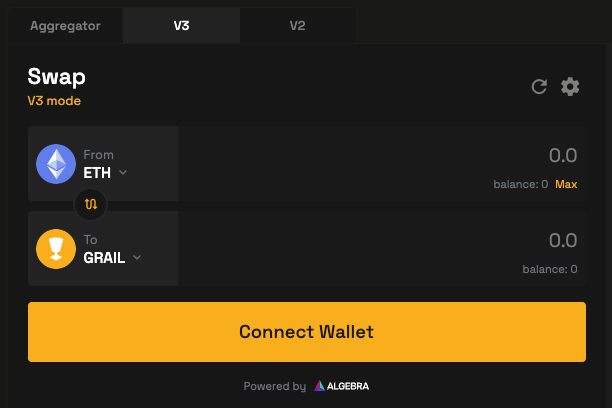

Best Uniswap Alternative for Arbitrum: Camelot

Official Website: https://app.camelot.exchange/

X Profile: https://x.com/CamelotDEX

Camelot Yield Farming: https://de.fi/explore/protocol/camelot

Launched at the tail end of 2022, Camelot has demonstrated remarkable growth, a testament to its innovative approach and the robust ecosystem it’s building on Arbitrum. When swapping for a token on Arbitrum, you’re very likely to find the best deals via Camelot.

The exchange’s rise is closely aligned with the advancements of Arbitrum itself, which stands as the largest Ethereum Layer 2 scaling solution and the fourth-largest blockchain by total value locked (TVL). Notably, Arbitrum has surpassed even Ethereum’s main network in transaction volume, highlighting the escalating demand for more efficient, scalable DeFi solutions.

A key moment for Camelot was the launch and subsequent public sale of the TROVE token, the governance token for the yield-bearing index protocol Arbitrove, also hosted on Arbitrum. The event significantly contributed to the spike in user and transaction numbers, showcasing Camelot’s capacity to facilitate major token events effectively.

Camelot employs a dual-token model, featuring GRAIL and a nontransferable, or locked, governance token, xGRAIL. Camelot’s approach to tokenomics and revenue redistribution builds upon otherwise inflationary tokenomics: In the case of xGRAIL, swap fee earnings are funneled back to xGRAIL holders, and a portion of these earnings is used to buy and burn GRAIL tokens. This mechanism not only rewards users but also maintains a constant buying pressure on the GRAIL token, supporting its market value and offsetting token inflation. Additionally, the introduction of the GRAIL bond market further enhances user investment opportunities, allowing the purchase of tokens at market discounts

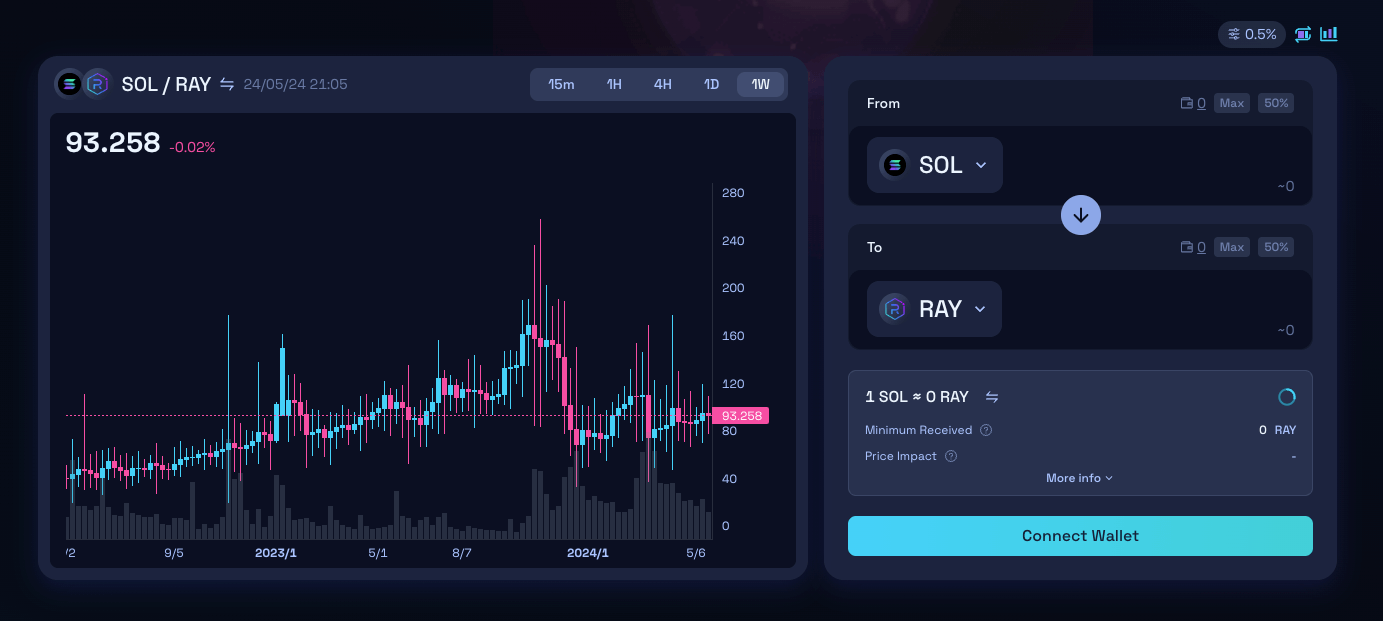

Best Uniswap Alternative for Solana: Raydium

Official Website: https://raydium.io/swap/

X Profile: https://x.com/RaydiumProtocol

Here we move on to the first Uniswap Alternative outside the EVM ecosystem. Raydium leverages Solana’s high-speed blockchain to offer rapid transactions and low fees.

Raydium functions as an essential liquidity provider for the Solana ecosystem. By leveraging an Automated Market Maker (AMM) model alongside Central Limit Order Book (CLOB) technology, Raydium allows liquidity to be shared across the ecosystem. This unique hybrid model ensures that liquidity providers on Raydium can contribute to a broader market, impacting the entire Solana DeFi landscape positively.

In addition to its primary trading functions, Raydium supports a range of DeFi activities, including yield farming and staking opportunities. Users can engage in these activities to earn additional rewards. The platform’s native token, RAY, forms the core of its ecosystem, offering holders governance rights and a stake in the platform’s future development.

Raydium’s commitment to innovation is evident in its continuous efforts to expand and improve its offerings. The platform regularly introduces new features and integrations that enhance user experience and broaden the scope of available DeFi products, thus ensuring that it remains an industry leader in the Solana ecosystem.

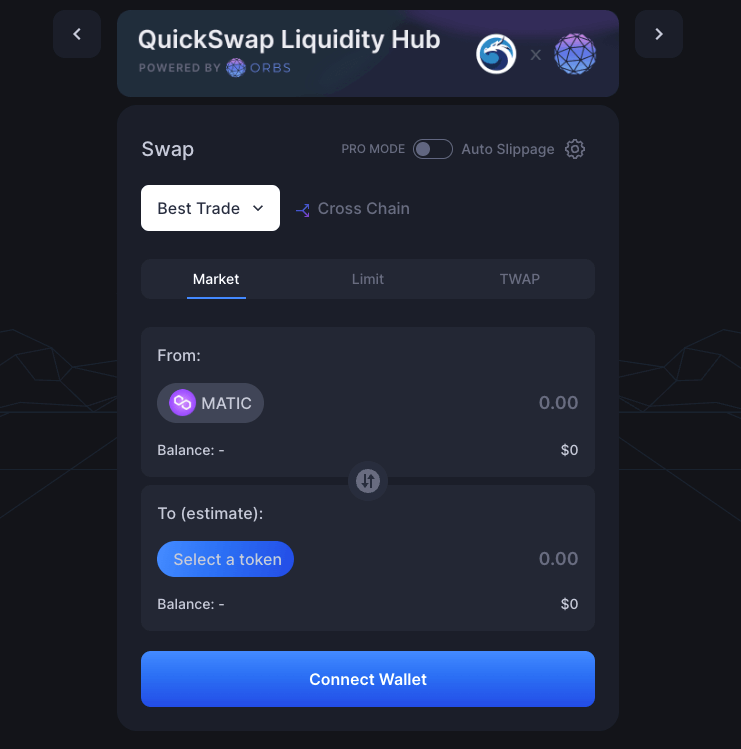

Best Uniswap Alternative for Polygon: QuickSwap

Official Website: https://quickswap.exchange/#/swap

X Profile: https://x.com/QuickswapDEX

QuickSwap Yield Farming: https://de.fi/explore/protocol/quickswap

QuickSwap offers an AMM platform on the Polygon network, focusing on low fees and fast transactions. Its native QUICK token incentivizes liquidity provision and governance participation. QuickSwap started as a Uniswap fork on Polygon but soon introduced new features such as perpetuals trading with its QuickPerps offering. Aside from Polygon, QuickSwap has also become a first mover in new ecosystems, with one example being Manta Pacific.

As a fork of the renowned Uniswap protocol, QuickSwap retains the trusted liquidity pool model while introducing the advantages of the Polygon network. This strategic move enables QuickSwap to offer an enhanced user experience, characterized by swift token swaps without the burden of Ethereum’s notoriously high gas fees.

The integration between Ethereum and Polygon is a cornerstone of QuickSwap’s functionality, allowing for the smooth transfer of assets across blockchains. This interoperability not only expands the trading possibilities for users but also contributes to the overall liquidity and dynamism of the DeFi ecosystem on Polygon.

QuickSwap’s innovative features, such as the Dragon Lair and Dragon Syrup, further distinguish the platform from its counterparts. In the Dragon Lair, users can stake their QUICK tokens — QuickSwap’s native governance token — to earn a share of the protocol’s transaction fees. This staking mechanism not only rewards users for their participation but also aligns their interests with the long-term success of QuickSwap. Additionally, the Dragon Syrup program offers stakers of dQUICK, QuickSwap’s interest-bearing token, the opportunity to earn extra yields from various projects traded on the exchange.

In sum, QuickSwap has positioned itself as the best-in-class Uniswap alternative on the Polygon network, offering a wide range of trading pairs, innovative staking options, and the efficiency of fast, low-cost transactions. Its commitment to solving the scalability issues of Ethereum while maintaining a secure and audited codebase makes QuickSwap an attractive platform for users looking to maximize their DeFi experience.

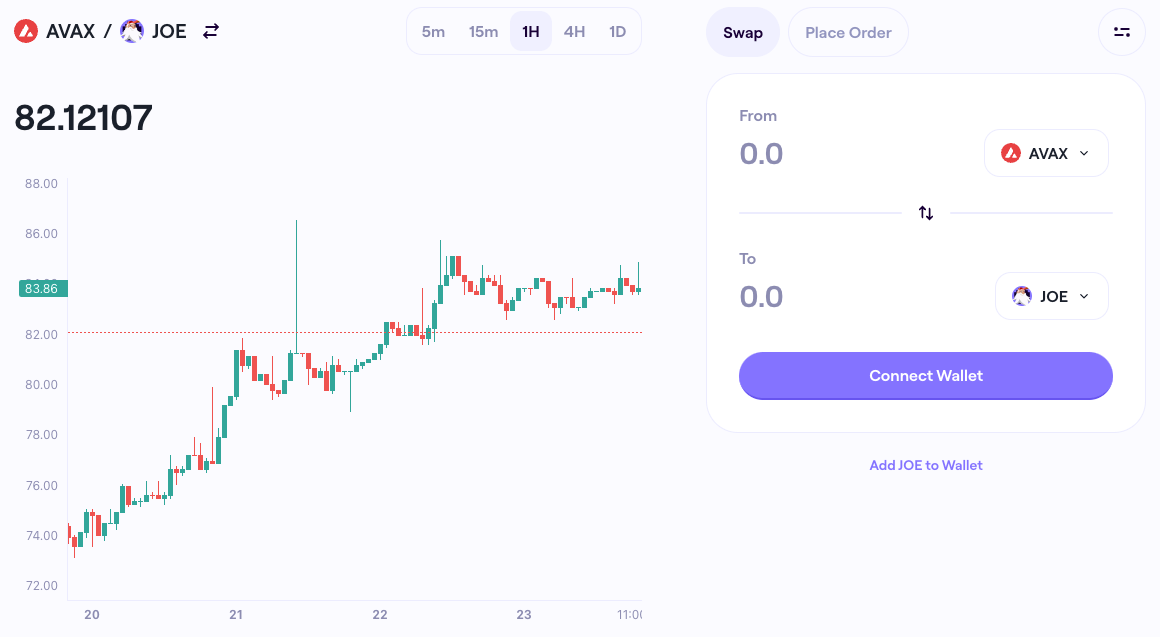

Best Uniswap Alternative for Avalanche: Trader Joe

Official Website: https://traderjoexyz.com/trade

X Profile: https://x.com/TraderJoe_xyz

Trader Joe Yield Farming: https://de.fi/explore/protocol/trader-joe

Trader Joe is the most prominent DEX on the Avalanche blockchain. Distinguished by its innovative Liquidity Book, Trader Joe offers a holistic platform where users can not only swap tokens but also engage in yield farming, and explore borrowing, lending, and even shopping for NFTs.

Launched on the Avalanche network and recently expanding to include Ethereum’s Layer 2 solution, Arbitrum, Trader Joe has grown its user base considerably since its launch. This expansion is part of a strategic move to embrace more networks, such as the BNB Chain, where it introduced its highly efficient AMM, the Liquidity Book. This technology is designed to maximize real yield generation for liquidity providers while minimizing swap costs for traders, setting a new standard in the DEX space.

Trader Joe’s unique approach to decentralized trading is underscored by its comprehensive service offering. Beyond token swaps, the platform delves into staking with its native token, JOE, yield farming, and an NFT marketplace, among other features. This multifaceted functionality positions Trader Joe as a central hub for DeFi activities on Avalanche and beyond, attracting a diverse range of users looking for a unified DeFi experience.

Central to Trader Joe’s ecosystem is the JOE token, which plays a role in governance, staking rewards, and yield farming incentives. Half of the JOE tokens are allocated to liquidity providers, fostering a vibrant community committed to the platform’s growth. The remaining tokens are strategically distributed among the treasury, developers, and project grants, ensuring a balanced ecosystem that rewards participation and innovation.

The introduction of Liquidity Book V2.1 marks another milestone for Trader Joe, enhancing the platform’s trading engine to simplify the process for depositors adding tokens to liquidity pools. With features like “auto pools” that manage depositors’ positions in high-yield pools to mitigate risk, Trader Joe is at the forefront of simplifying and optimizing the DeFi trading experience.

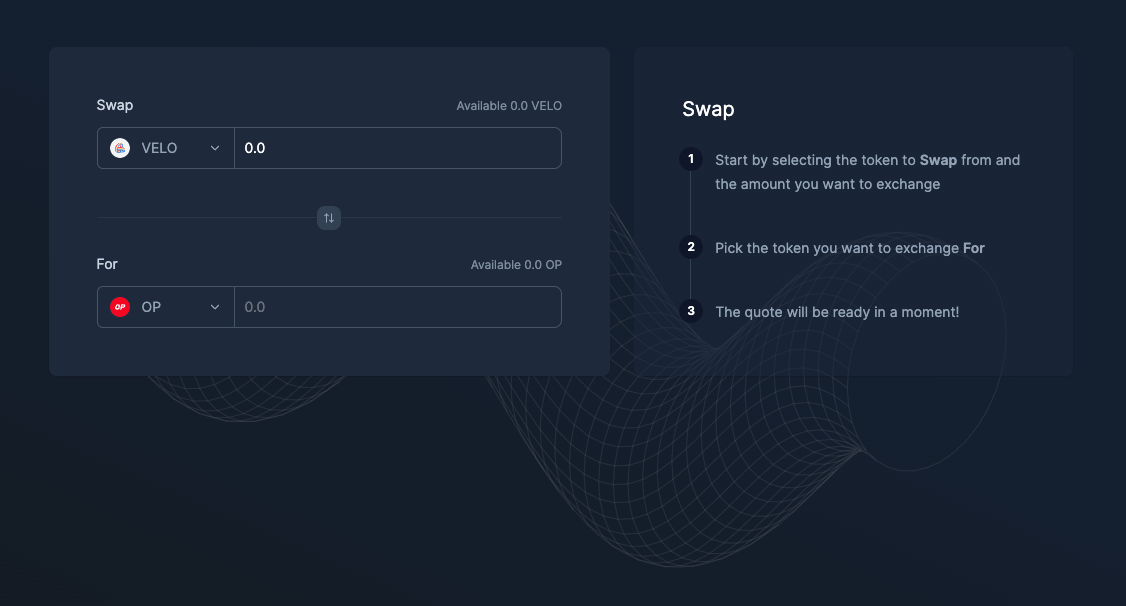

Best Uniswap Alternative for Optimism: Velodrome

Official Website: https://velodrome.finance/

X Profile: https://x.com/VelodromeFi

Velodrome Finance stands out as a dedicated decentralized exchange (DEX) on the Optimism network, prioritizing deep liquidity, reduced transaction fees, and minimal slippage for its users. As an Optimism-native platform, Velodrome directly contributes to the ecosystem’s growth by providing efficient trading solutions.

Velodrome utilizes the ve(3,3) mechanism, integrating liquidity mining with governance. This approach allows liquidity providers to stake VELO tokens, receive veVELO NFTs, and engage in governance while earning protocol revenues. The platform offers both stable and variable liquidity pools, ensuring efficient trade execution by evaluating the most effective routes and offers.

Unlike its contemporaries, Velodrome supports a variety of DeFi protocols on the Optimism network, such as Yearn and Synthetix, providing them with exclusive liquidity rewards. This wide range of support highlights Velodrome’s adaptability and its role in enhancing the DeFi infrastructure on Optimism.

Velodrome operates with a governance model centered around the VELO token, enabling user participation in platform decisions. Despite the anonymity of its team, Velodrome has cultivated an active community, evident in its substantial social media following and initiatives like the “Tour de OP” campaign, which promotes the Optimism network.

Velodrome’s commitment to security is affirmed by a comprehensive audit from CertiK, ensuring a reliable trading environment. The platform’s business model is characterized by its innovative transaction fee distribution and VELO token allocation, designed to sustain long-term growth and stability.

Velodrome differentiates itself with features such as the ve(3,3) mechanism and dual liquidity pools, which incentivize liquidity provision and reward participation. Its support for various DeFi protocols on Optimism and exclusive liquidity rewards further establishes Velodrome as a leading DEX on the network.

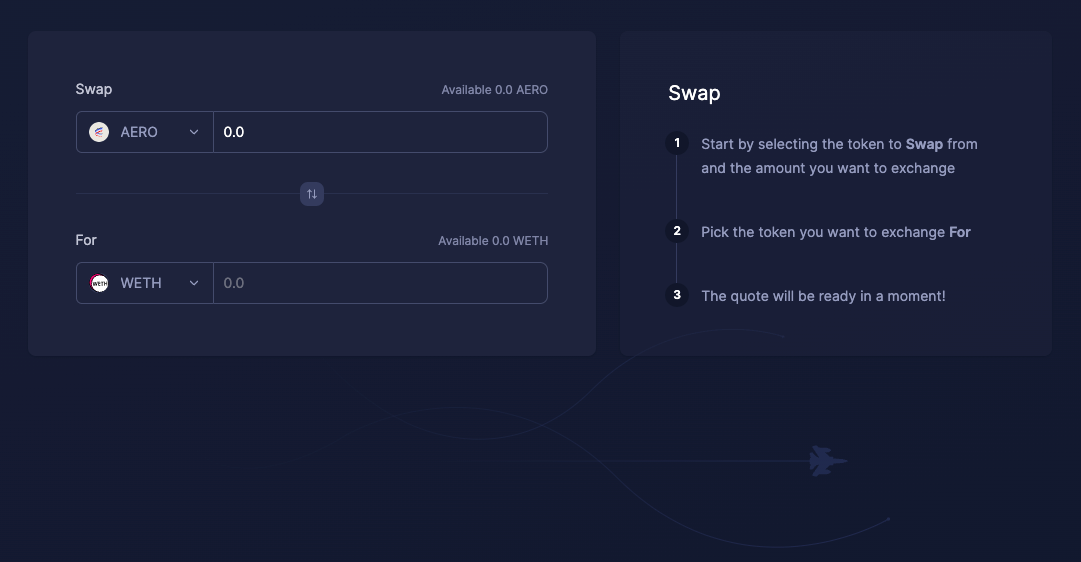

Best Uniswap Alternative for Base: Aerodrome

Official Website: https://aerodrome.finance/

X Profile: https://x.com/AerodromeFi

Aerodrome Yield Farming: https://de.fi/explore/protocol/aerodrome

Aerodrome Finance is the largest DEX by TVL on Coinbase’s Base blockchain. Leveraging the innovative Velodrome model, Aerodrome aims to enhance liquidity within the ecosystem by establishing partnerships with approximately 20 entities. Its commitment to facilitating specialized liquidity, simplifying voting mechanisms, and fostering an inclusive veNFT marketplace sets it apart as a Uniswap alternative with a focus on Base users.

A significant aspect of Aerodrome’s strategy involves its collaboration with the Base Team to develop a “public goods engine.” This initiative allocates a quarter of Aerodrome’s initial voting strength to Ecosystem Goods, ensuring essential asset liquidity. The generated fees from these asset pairs contribute to public goods funding (PGF) and voting, positioning the AERO token as the ecosystem’s cornerstone.

For protocols integrating with Base, Aerodrome offers several liquidity solutions. By leveraging veAERO, protocols can direct AERO emissions towards their specific zones, while veAERO holders benefit from the entirety of trading fees from their chosen pools. This symbiotic relationship not only incentivizes liquidity provision but also rewards active participation within the ecosystem.

Aerodrome’s launch strategy emphasizes sustainability and early adoption, starting with an initial allocation of 500M AERO tokens, 90% of which is reserved for veAERO. Key launch details include a 40% airdrop to VeVELO loyalists, a minimum participation threshold, and the use of certain fees to support PGF initiatives. These measures aim to ensure long-term commitment and foster ecosystem growth.

The AERO token serves multiple purposes within Aerodrome’s ecosystem. It can enhance incentives offered by partners, attract additional votes to critical liquidity zones, and ensure a stable start for AERO trades through pairing with USDC. The emission strategy of AERO follows a phased approach, promising rewards for veAERO holders and allowing them to influence the platform’s direction.

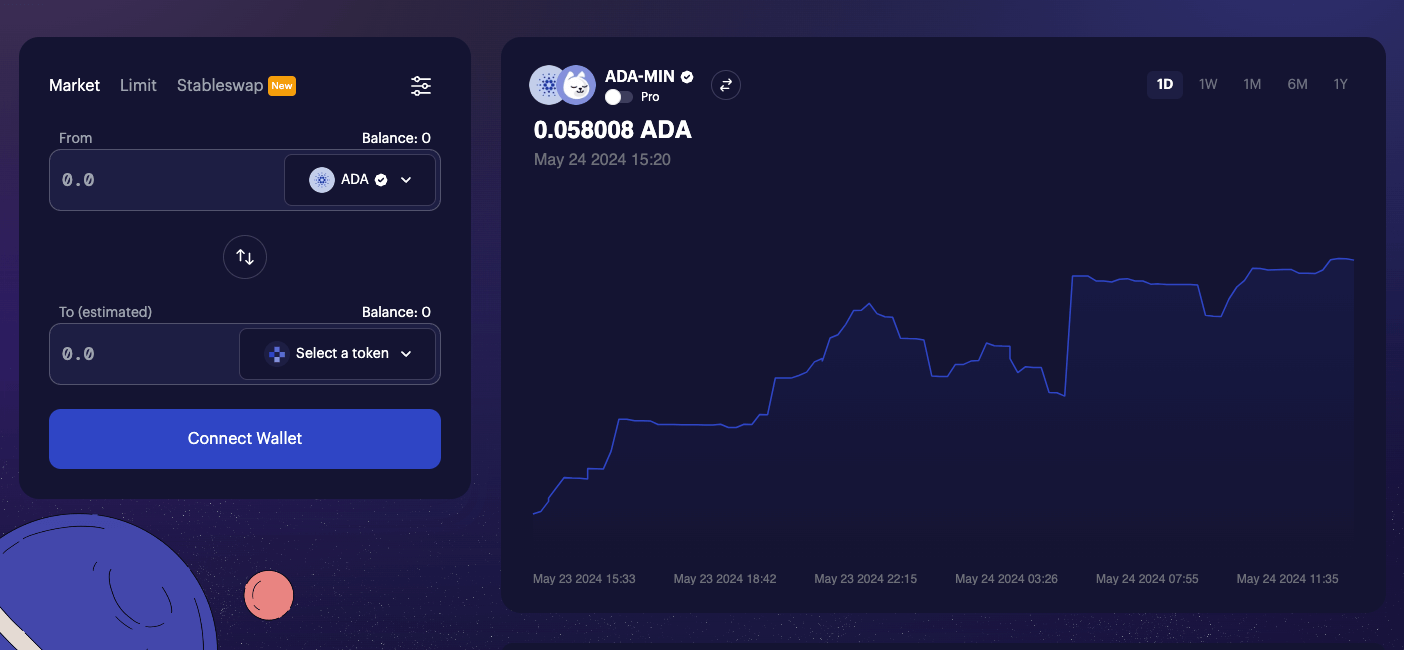

Best Uniswap Alternative for Cardano: Minswap

Official Website: https://app.minswap.org/swap

X Profile: https://x.com/MinswapDEX

If you are trading on Cardano, you will need to use a true Uniswap alternative, because this is yet another non-EVM ecosystem. Enter Minswap. Minswap is a decentralized exchange (DEX) on the Cardano blockchain designed to facilitate token swaps efficiently and at a lower cost. It distinguishes itself by offering a variety of liquidity pools, including stable pools, multi-asset pools, and pools with concentrated liquidity. This structure aims to optimize the trading experience for both traders and liquidity providers by ensuring deep liquidity and competitive rewards.

As a multi-pool DEX, Minswap introduces a versatile platform for trading a wide array of tokens directly on the Cardano network. The platform supports trading of popular tokens like MIN, AADA, PAVIA, WMT, DANA, SOCIETY, NMKR, MELD, LQ, and AGIX, catering to a diverse range of user interests and market demands.

One of the key features of Minswap is its democratic governance system, powered by the MIN token. Holders of the MIN token have the right to vote on protocol changes, allowing for a community-driven approach to decision-making. This ensures that the platform evolves in line with the preferences and needs of its user base.

Minswap also addresses the challenge of high transaction fees commonly associated with blockchain trading platforms. By leveraging the Cardano blockchain’s capabilities, Minswap offers users the ability to swap tokens with significantly lower fees compared to other networks. This makes it an attractive option for traders looking to minimize costs.

The exchange incorporates innovative solutions such as multi-function liquidity pools and multi-pool routing to enhance trading efficiency. These features allow Minswap to function as an on-chain price oracle, providing reliable price information and enabling trades to be routed through the most cost-effective liquidity pool available.

Furthermore, Minswap is committed to supporting stake pool operators (SPOs) on the Cardano network through its ADA delegation policy and fair initial stake pool offering (ISO). This approach not only contributes to the decentralization and security of the Cardano blockchain but also aligns with the platform’s goal of fostering a fair and inclusive DeFi ecosystem.

Minswap represents a comprehensive DeFi solution on the Cardano blockchain, offering efficient token swapping, diverse liquidity options, and community-driven governance. Its focus on low transaction fees, support for multiple assets, and contribution to the Cardano network’s health position it as a noteworthy alternative for users seeking to swap assets on Cardano.

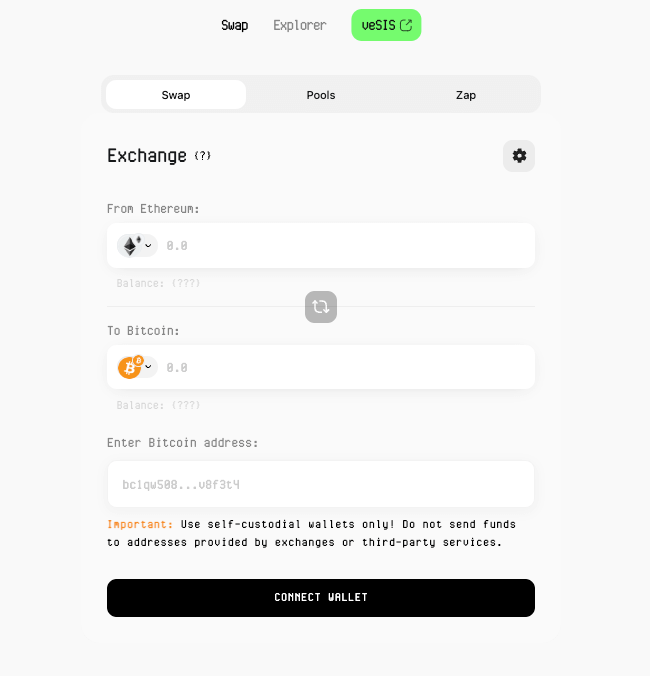

Best Crosschain Uniswap Alternative: Symbiosis

Official Website: https://app.symbiosis.finance/swap

X Profile: https://x.com/symbiosis_fi

Symbiosis is a cross-chain automated market maker (AMM), decentralized exchange (DEX), and interchain communication protocol. Designed to simplify and streamline the process of swapping assets and moving liquidity across different blockchain networks, Symbiosis offers users a seamless, one-click transaction experience that transcends the boundaries of individual chains.

At the heart of Symbiosis’s functionality is the innovative approach to cross-chain swaps. The protocol leverages liquidity pools to facilitate these operations, adapting and extending the foundational principles observed in Uniswap-like and Curve-like AMM models. These models have proven effective over time, but Symbiosis introduces a critical innovation: the inclusion of wrapped representations of source tokens within its liquidity pools.

This mechanism is essential for enabling arbitrageurs to balance the asset ratio across networks by engaging in both asset purchases on the open market and bridging scenarios. Specifically, arbitrageurs play a role in maintaining market equilibrium by exploiting price discrepancies, thus ensuring the stability and efficiency of the cross-chain exchange process.

Another key feature of Symbiosis is its relayers network, a peer-to-peer system with built-in crypto-economic incentives designed to ensure fast, accurate, and secure information transfer about cross-chain operations. This off-chain component of the Symbiosis protocol underscores the platform’s commitment to providing a robust and reliable cross-chain trading environment.

The governance of Symbiosis is managed through a decentralized autonomous organization (DAO), where users staking SIS tokens receive veSIS tokens that grant voting power and rewards. This governance mechanism ensures that the platform evolves according to the collective will of its users, fostering a genuinely community-driven development process.

Symbiosis’s commitment to supporting a wide range of blockchains is evident in its integration with both EVM-compatible and WASM blockchains. This inclusivity enhances the protocol’s appeal to a broad user base and reflects its ambition to serve as a universal cross-chain liquidity solution.

The launch of Symbiosis protocol V2 builds upon this, bringing enhancements to liquidity pools and further optimizing cross-chain operations. By addressing the challenges of uneven exchange directions and incentivizing total value locked (TVL) in stablecoin pools, Symbiosis V2 aims to refine the cross-chain swap experience and promote greater liquidity and efficiency across the DeFi landscape.

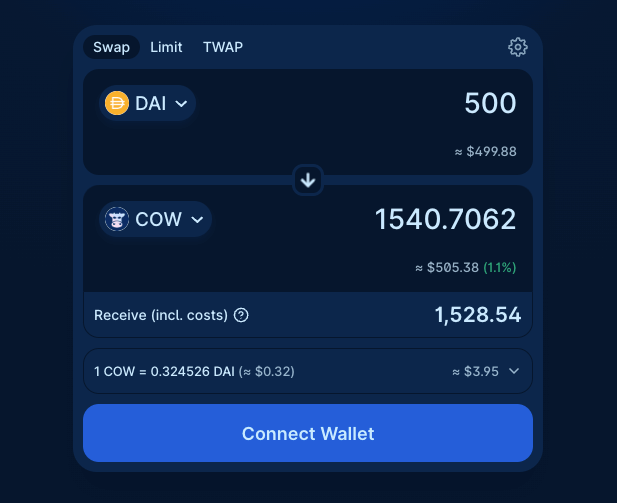

Best Uniswap Alternative for Preventing MEV: CoW Swap

Official Website: https://swap.cow.fi/

X Profile: https://x.com/CoWSwap

CoW Swap offers a unique solution to the issue of Maximal Extractable Value (MEV) in DeFi. Building on the Gnosis Protocol v2, CoW Swap introduces a trading interface that not only facilitates the buying and selling of tokens but does so with an approach aimed at minimizing users’ exposure to MEV.

Maximal Extractable Value has become a significant concern within blockchain ecosystems, particularly for Ethereum users. MEV refers to the profit miners or validators can make through their ability to arbitrarily include, exclude, or reorder transactions within the blocks they produce. This capability can lead to front-running, back-running, and sandwich attacks, where traders exploit others’ trades for profit, often at the expense of regular users. CoW Swap addresses this issue by employing gas-less orders and peer-to-peer settlement mechanisms that significantly reduce the opportunities for MEV extraction.

The core of CoW Swap’s approach lies in its order settlement process. Unlike traditional DEXs that execute trades immediately and directly on the blockchain, CoW Swap batches orders together and settles them in a way that obscures the details from potential MEV seekers. By aggregating orders and utilizing Gnosis Protocol’s solvers to find the most efficient way to fulfill them, CoW Swap ensures that transactions are executed at the best possible price without exposing users to the risks associated with MEV.

Furthermore, CoW Swap’s use of gas-less orders represents a leap forward in user experience. Participants can place orders without the need to spend gas upfront, a feature made possible by the protocol’s design, which defers gas costs to the settlement of trades. This system not only saves users on transaction fees but also contributes to a more equitable trading environment by leveling the playing field between high-frequency traders and regular users. The project is governed by the CoW Protocol token.

CoW Swap is the best Uniswap alternative for users concerned about MEV. Its settlement process, combined with gas-less orders and peer-to-peer trading, sets a new standard for secure and efficient token swapping. As the DeFi space continues to evolve, platforms like CoW Swap play a crucial role in addressing the challenges of MEV, making decentralized trading more accessible and fair for everyone involved.

Exploring DeFi With De.Fi

Now that we’ve explored various Uniswap alternatives, it’s clear that De.Fi stands out not just for its comprehensive exchange capabilities but also for its dedication to user education and security.

With tools like our DeFi Dashboard, yield farming explorer, and security features like Shield (token approval checker) and Scanner (free DeFi smart contract audit), De.Fi offers an ecosystem where users can safely and effectively navigate the DeFi space. Whether you’re a seasoned trader or new to DeFi, De.Fi provides the resources and tools necessary to maximize your DeFi experience.