As an investor in DeFi, choosing the right decentralized exchange (DEX) for your trades is something you’ll need to address relatively early. Many new entrants compare Uniswap vs PancakeSwap, two pioneering and popular DEXs in the space.

This article will dissect the differences between Uniswap and PancakeSwap, their fee structures, native tokens, and community-driven philosophies. By delving into their history, governance, and unique features, we aim to equip you with the knowledge to navigate these DEXs effectively.

Uniswap vs PancakeSwap Overview

Uniswap and PancakeSwap both offer distinct advantages depending on user priorities, such as fees, available tokens, and network preferences. Below is an overview highlighting key differences:

| Uniswap | PancakeSwap | |

| Official Domain | Uniswap.org | PancakeSwap.finance |

| X Profile | Uniswap X Profile | PancakeSwap X Profile |

| Available Chains | Ethereum Polygon Optimism Arbitrum Base BNB Chain Celo Avalanche | Ethereum BNB Chain zkSync Era Linea Base Arbitrum opBNB Polygon zkEVM Aptos |

| TVL | $6.3 Billion | $2.2 Billion |

| Open Source | Uniswap GitHub | PancakeSwap GitHub |

| Official Reddit | Uniswap Reddit | PancakeSwap Reddit |

This comparison not only shows the difference between Uniswap and PancakeSwap but also reflects the unique ecosystems they operate within. Uniswap, known for its pioneering role in DeFi, runs strictly on EVM blockchains and boasts a higher total value locked (TVL), indicating robust liquidity. It originally launched on Ethereum and is heavily intertwined with the primary ETH L1 and L2 rollup ecosystem.

Meanwhile, PancakeSwap, originally launched as a Uniswap competitor, but focused on BNB Chain. This offered lower transaction fees—a significant consideration when assessing PancakeSwap fees vs Uniswap. It has since expanded to multiple new chains, such as Base, Linea, and zkSync. It has also expanded beyond the EVM ecosystem, covering the Aptos chain. However, BNB Chain continues to be the main source of volume for PancakeSwap.

Ultimately, there is a good deal of overlap, and the choice between Uniswap or PancakeSwap often comes down to user preferences. If you prefer to use Ethereum-centric chains, Uniswap usually has higher volume and better liquidity. If you prefer BNB Chain, PancakeSwap is likely your best choice.

Uniswap Overview

Uniswap is possibly the most well-known DEX in the DeFi space. It popularized the Automated Market Maker (AMM) model, allowing for decentralized trading by using liquidity pools instead of the traditional order book model. This has since become a feature widely adopted across the DeFi ecosystem, with Uniswap forks and similar DEXs being present on pretty much every blockchain ecosystem today.

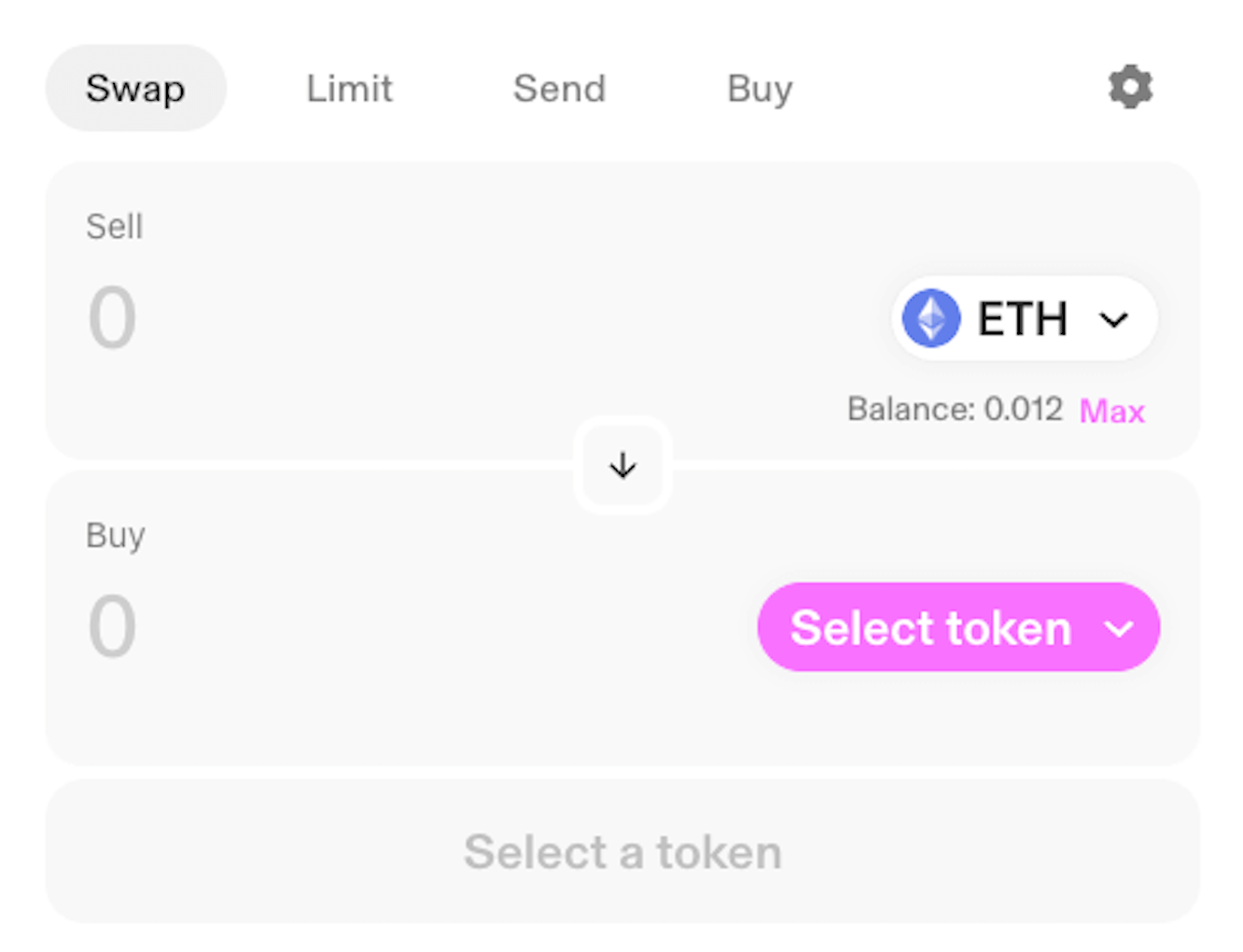

The iconic Uniswap swap interface

The protocol’s governance structure is another key part of the project, with the UNI token granting holders the ability to participate in crucial protocol decisions, promoting a decentralized and democratic governance model. This is further enhanced by the Uniswap Foundation, which steers the protocol towards a future where the community’s voice plays a central role.

Uniswap’s journey has been characterized by innovation, and adapting to the evolving landscape of DeFi. Uniswap V1 was a game-changer in the space, pioneering the AMM model for decentralized token swaps. The subsequent V2 upgrade introduced direct ERC-20 to ERC-20 swaps, eliminating the need to go through the native Ethereum token and thereby reducing costs, friction, and complexity for users. Additionally, V2’s fee accumulation system allowed liquidity providers to earn a share of the transaction fees, a feature that provided an incentive for users to contribute to the liquidity pools.

The launch of Uniswap V3 was yet another step forward, introducing the concept of concentrated liquidity. This feature granted liquidity providers control over the price ranges in which their capital was active, enabling them to earn higher returns by focusing on specific segments of the market where they anticipated more activity.

Tiered fees were another innovation of V3, offering multiple fee levels to better represent the varying degrees of risk between different trading pairs. These fee levels allowed liquidity providers to align their potential returns with their risk appetite, effectively creating a more efficient and flexible financial environment.

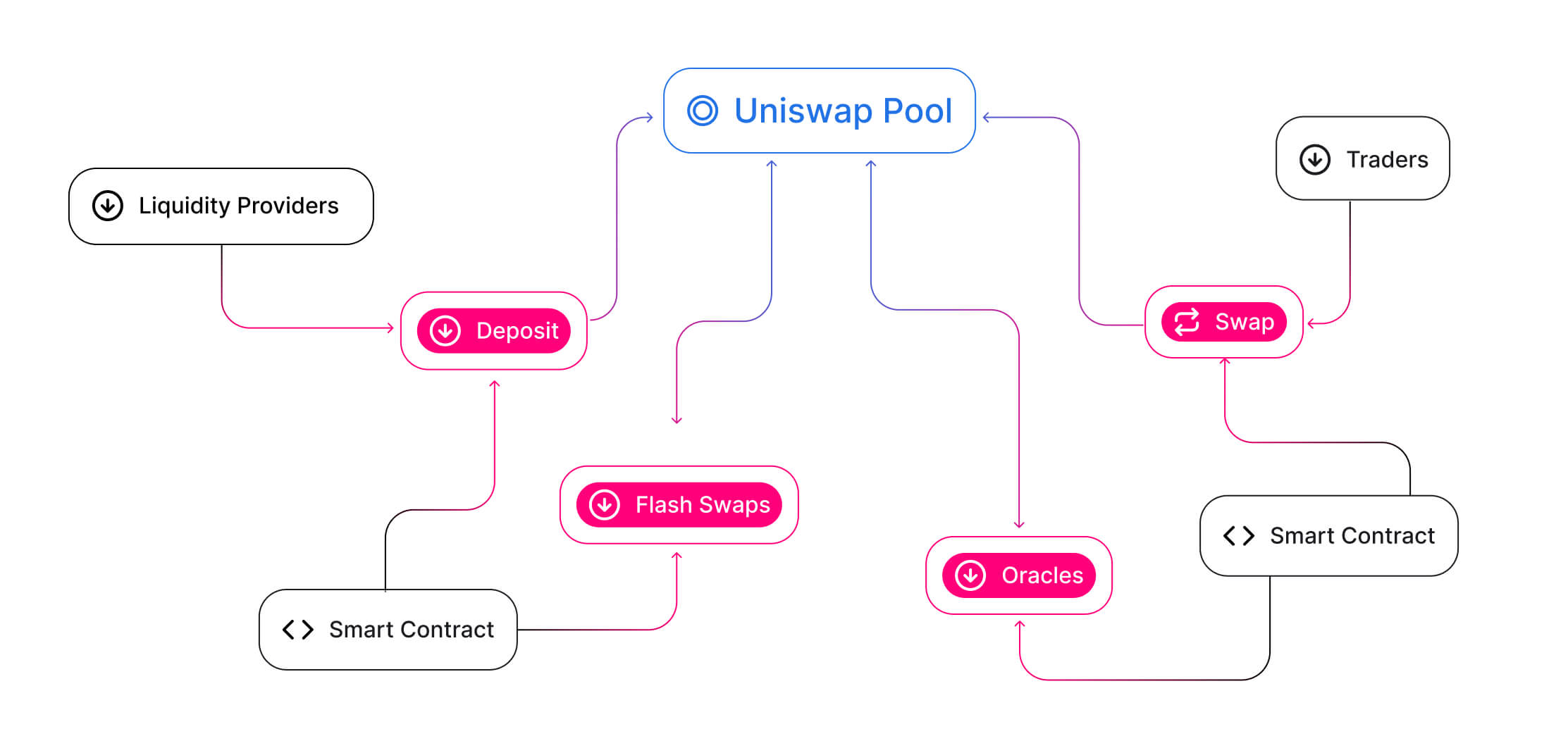

Uniswap Ecosystem Participants

Such enhancements not only kept Uniswap’s status as a leader in DeFi relevant but also allowed providers to actively manage their risk-reward ratio. By selecting their desired price ranges, liquidity providers could target higher yields within more volatile price movements, taking on higher risk against the potential for greater rewards. This new development showcased Uniswap’s commitment to advancing the functionality and user experience of DEXs.

Uniswap’s mission of creating a broad-reaching and interoperable DeFi experience is evident in its support for multiple blockchains, including Ethereum, Polygon, Optimism, and Arbitrum. This multichain support not only underscores Uniswap’s dedication to user accessibility but also enhances its resilience in a highly competitive market.

With its substantial total value locked (TVL) and cumulative trading volume, Uniswap has established itself as a mainstay in DeFi, setting the industry standard for decentralized exchanges.

PancakeSwap Overview

PancakeSwap serves as a major DeFi DEX and is a competitive alternative to other DEXs like Uniswap. Launched originally on the Binance Smart Chain (BSC), PancakeSwap has since expanded to accommodate a wider selection of networks, thus addressing one of the DeFi community’s critical demands: broader accessibility.

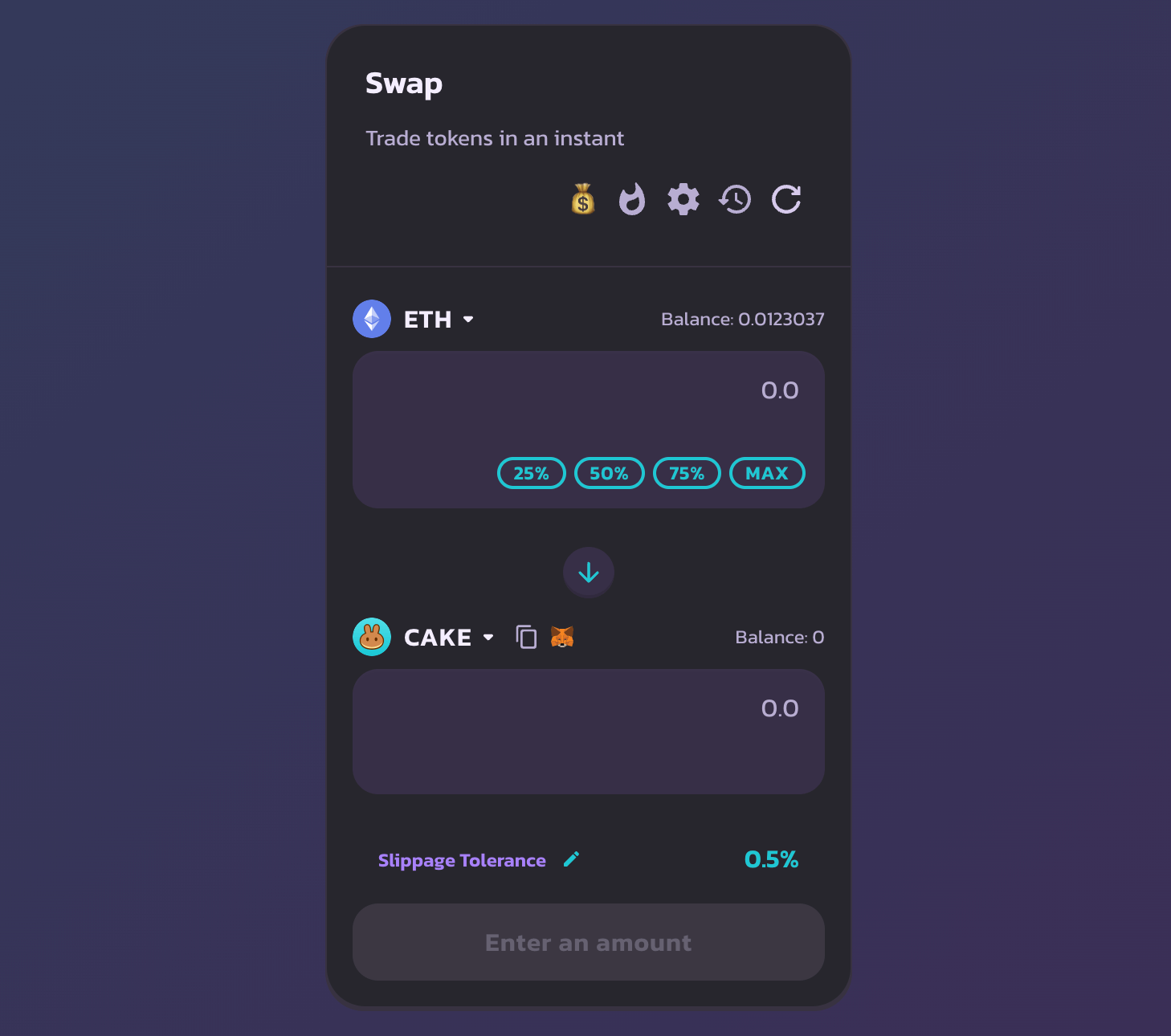

Swapping on PancakeSwap

The platform’s governance is handled by the CAKE token, which allows holders to participate in decision-making processes. Despite the core team’s anonymity, this governance model has facilitated a trustless environment where decisions are made in a decentralized manner.

PancakeSwap has released several updates, each adding layers of innovation and user-centric features. For instance, PancakeSwap V2 introduced improved liquidity pools and optimized yield farming strategies, encouraging more users to engage with the platform. These versions have been crucial in maintaining PancakeSwap’s relevance and appeal in an ever-evolving market.

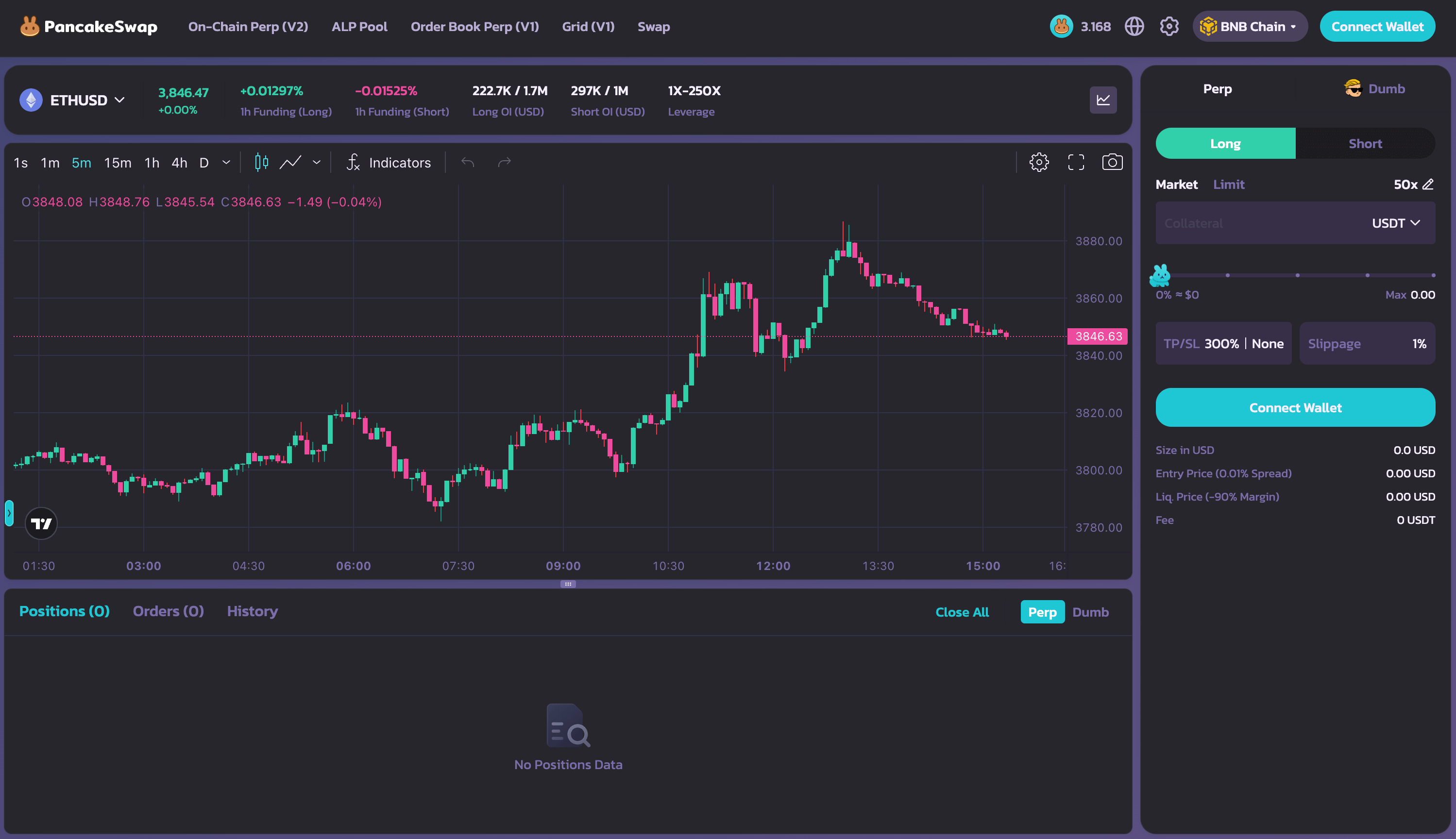

PancakeSwap’s recent introduction of a perpetuals exchange function marked a significant expansion of its features. Perpetual contracts on PancakeSwap allow traders to take leveraged positions on the future price of cryptocurrencies without an expiry date, providing flexibility that’s not available in spot trading. This function caters to both speculative traders looking for quick profits and hedgers seeking to mitigate their risk exposure over longer periods.

PancakeSwap Perps Interface

Moreover, PancakeSwap’s tokenomics around the CAKE token further highlights its innovative approach within DeFi. The token is inflationary by design, which at first glance might seem counterintuitive. However, this inflation serves a purpose: it is used as an incentive mechanism to reward users who provide liquidity to the platform’s pools.

By staking their liquidity provider (LP) tokens in ‘Farms,’ users can earn CAKE rewards. These ‘Farms’ are strategically designed to encourage the provision of liquidity across a range of assets, thereby ensuring depth and stability in the platform’s markets. This is as opposed to Uniswap, where providers are not rewarded with native tokens, but with trading fee revenues only.

The inflationary model is balanced by various deflationary mechanisms such as CAKE buybacks and burns, which are intended to offset the downward pressure on the token’s price due to the increasing supply. This dynamic creates an equilibrium that aims to sustain CAKE’s value over time.

In comparison to Uniswap, PancakeSwap’s approach can be seen as more aggressive in attracting and maintaining liquidity. The ‘Farms’ provide a clear financial incentive for users to lock in their funds, thus bolstering the platform’s liquidity and trading volumes.

The dual features of leveraged trading through perpetual contracts and incentivization through inflationary rewards set PancakeSwap apart in the DeFi space. While Uniswap relies on its established reputation and wider chain coverage, PancakeSwap differentiates itself with these aggressive growth strategies, appealing to a user base that is yield-focused and more inclined towards innovative DeFi functionalities.

What are Decentralized Exchanges (DEXs)?

Decentralized exchanges (DEXs) are a core building block of the DeFi ecosystem. They function as platforms that allow users to trade cryptocurrencies directly with one another without the need for an intermediary or custodian. Unlike traditional centralized exchanges, which are operated by a single entity that holds users’ funds, DEXs provide a peer-to-peer trading environment facilitated by blockchain technology.

This peer-to-peer model is key because it enhances security and transparency, giving users full control over their funds at all times. Trades on a DEX are executed using smart contracts, self-executing contracts with the terms of the agreement directly written into code, which mitigates the risk of theft or loss due to exchange hacks — a common issue with centralized platforms.

The importance of DEXs as financial plumbing in DeFi is clear – They are crucial in creating an open and inclusive financial system where anyone with an internet connection can access financial services like trading, lending, and borrowing.

Using Pancakeswap & Uniswap with De.Fi

For DeFi enthusiasts and investors who regularly engage in token swaps using platforms like PancakeSwap and Uniswap, the ability to manage and track these transactions is paramount. De.Fi offers a solution with its comprehensive portfolio tracker, a tool tailored to streamline the oversight of DeFi activities.

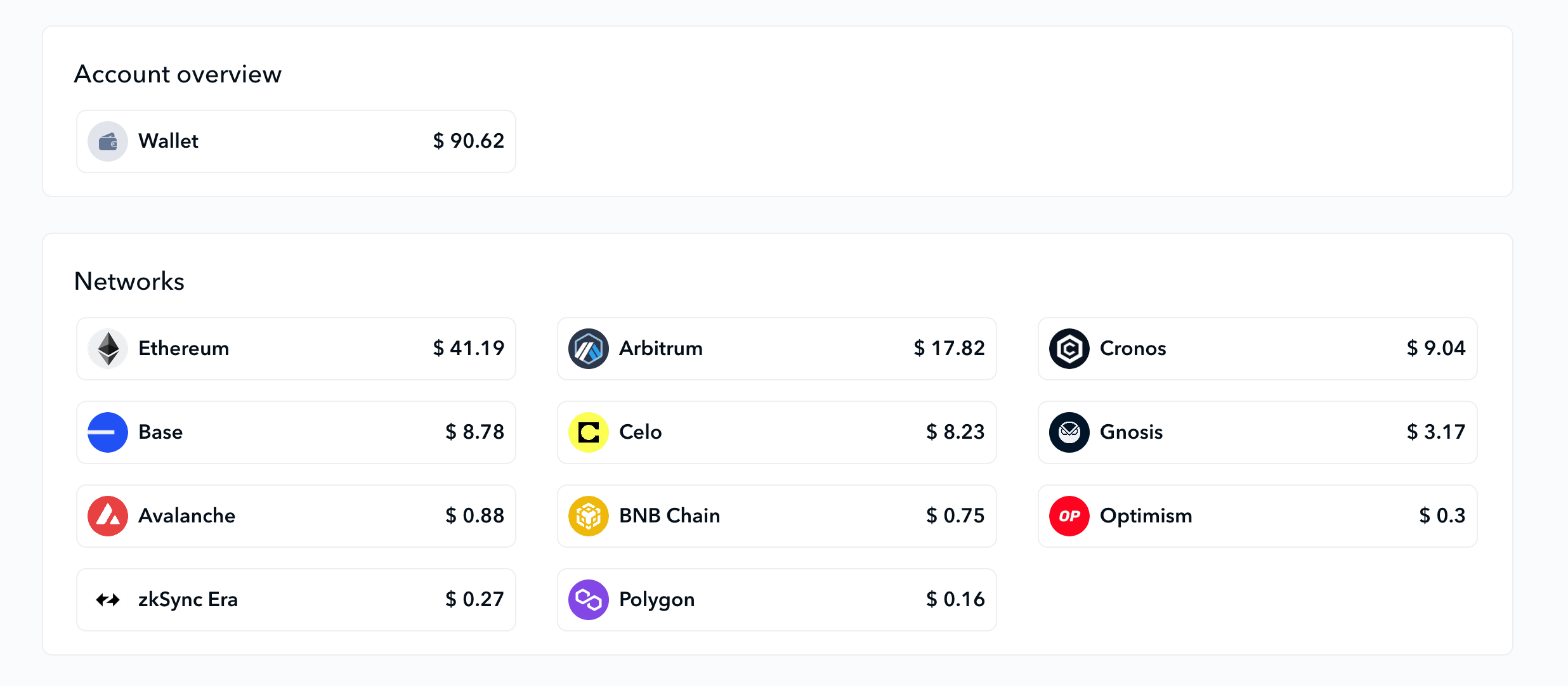

Sample De.Fi Account Overview

This DeFi portfolio tracker is more than just a ledger of past transactions or assets held; it’s a real-time dashboard that provides insights into transaction patterns, asset distribution, and the performance of investments. Users can see the trajectory of their DeFi strategies, viewing assets across multiple chains, thus allowing them to adjust their approaches in response to market movements and portfolio growth. This level of monitoring and analysis is crucial in the volatile and often unpredictable DeFi market, empowering users to maximize their returns and minimize their risks with data-driven strategies.

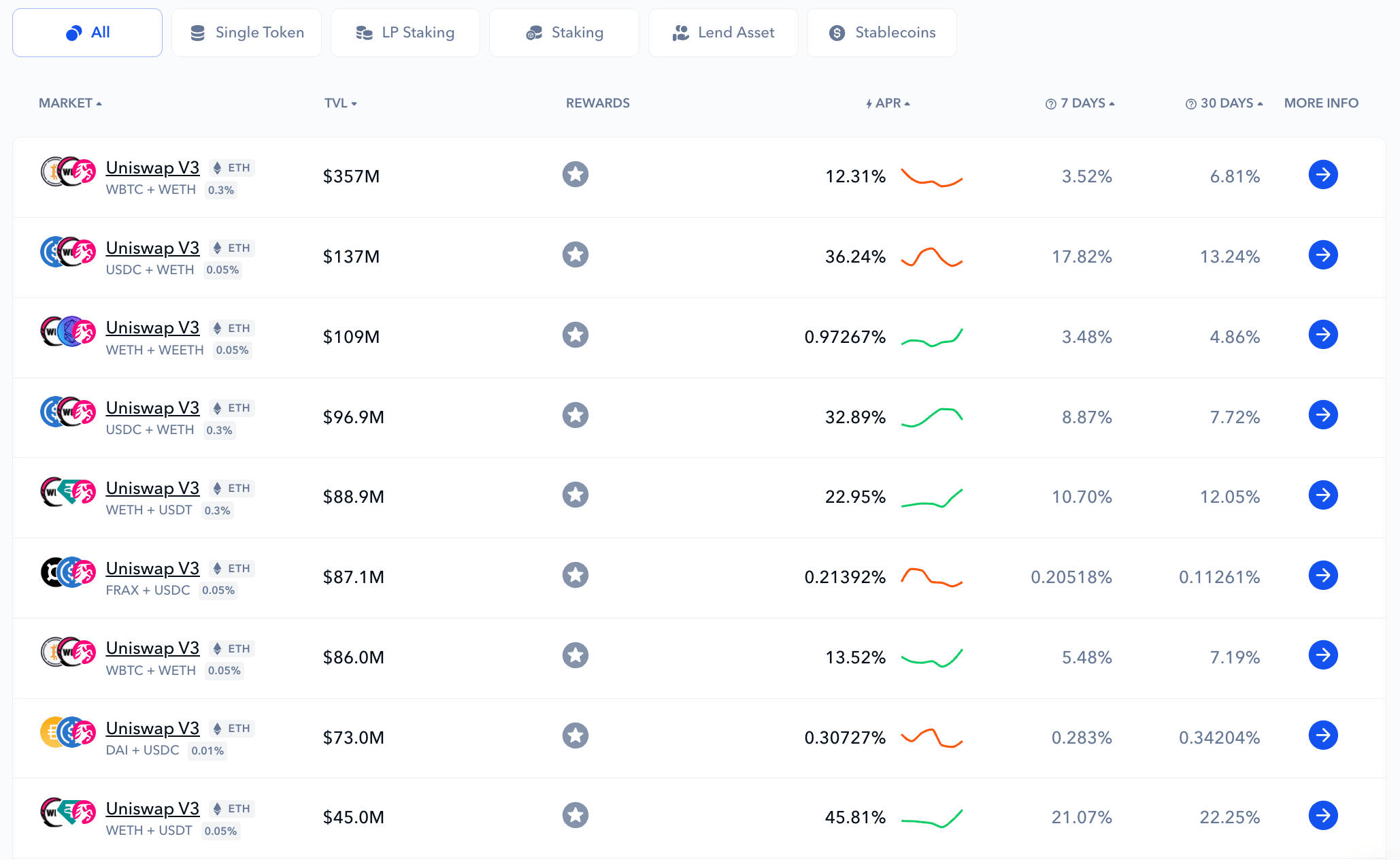

Liquidity providers on PancakeSwap and Uniswap are the backbone of the DeFi ecosystem, supplying the capital necessary for the exchanges’ AMM systems to function. Recognizing their critical role, De.Fi has developed the yield farming ‘Explore’ tool, an advanced feature that identifies and presents yield farming opportunities across both platforms. It’s a real-time resource that continuously refreshes to provide the latest, most relevant data. This dynamic tool is essential for liquidity providers looking to diversify or maximize their yield strategies.

Uniswap Yield Farming Data on De.Fi Explore

Once liquidity providers commit their capital, monitoring becomes key. De.Fi’s portfolio tracker offers a comprehensive view of their investments, displaying real-time performance, accrued returns, and associated risks. It’s an ecosystem that not only facilitates the discovery of new farming opportunities but also provides a meticulous tracking system to manage and optimize one’s DeFi portfolio effectively.

The integration of De.Fi’s advanced tracking utilities with PancakeSwap and Uniswap creates a powerful synergy for users. This combination facilitates an enhanced DeFi experience by providing a rich toolkit for portfolio management. De.Fi’s analytics enable users to delve deep into the performance metrics of their token swaps and liquidity provisions. In a sector where markets shift rapidly, having access to De.Fi’s real-time, comprehensive data analysis ensures users can make swift, informed decisions.

De.Fi Swap: PancakeSwap + Uniswap Alternative

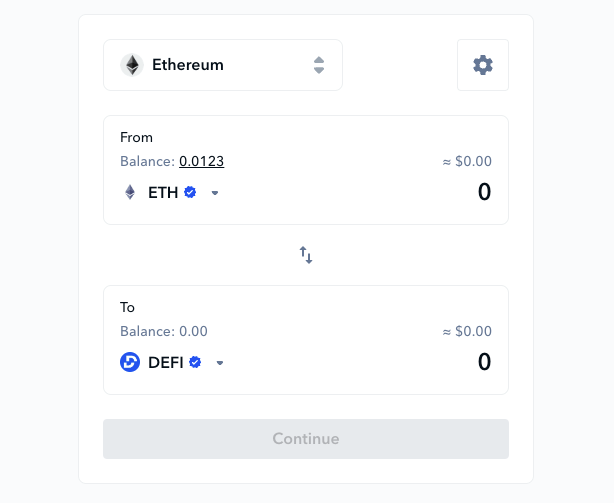

For those who would like an alternative to the traditional DEX model of Uniswap and PancakeSwap, De.Fi Swap, our liquidity aggregator, is a fantastic option. Its core functionality lies in its ability to route swaps through multiple liquidity pools and compare swap rates across a multitude of DEX platforms, ensuring that users are presented with the most favorable prices available in real time.

The De.Fi Swap Interface

What separates De.Fi Swap from the competition is its expansive multi-chain support. De.Fi Swap has integrated support for a broad spectrum of blockchain networks, including the newest popular ecosystems like Arbitrum and Base, ensuring that users are not confined to the liquidity and assets of a single network or DEX.

This multi-chain approach not only maximizes the opportunities for users to engage in swaps but also significantly reduces the barriers to entry for users operating across different blockchain environments.

Moreover, De.Fi Swap’s commitment to efficiency extends to its focus on minimizing transaction costs for its users. By aggregating swap rates and providing access to the most competitive prices across various platforms, De.Fi Swap plays a crucial role in helping traders save on gas fees and slippage. This emphasis on cost-efficiency, coupled with its user-friendly interface, makes De.Fi Swap the ideal tool for both seasoned traders and newcomers to the DeFi space alike.

Overall, De.Fi Swap’s innovative aggregation technology, wide-ranging chain support, focus on cost-efficiency, and unwavering commitment to security offers a superior alternative to traditional DEX platforms like Uniswap and PancakeSwap.

Staying Safe with DEXs

In the decentralized world of finance, where the security of transactions directly correlates to the tools and precautions one employs, staying safe while using DEXs like Uniswap and PancakeSwap is crucial.

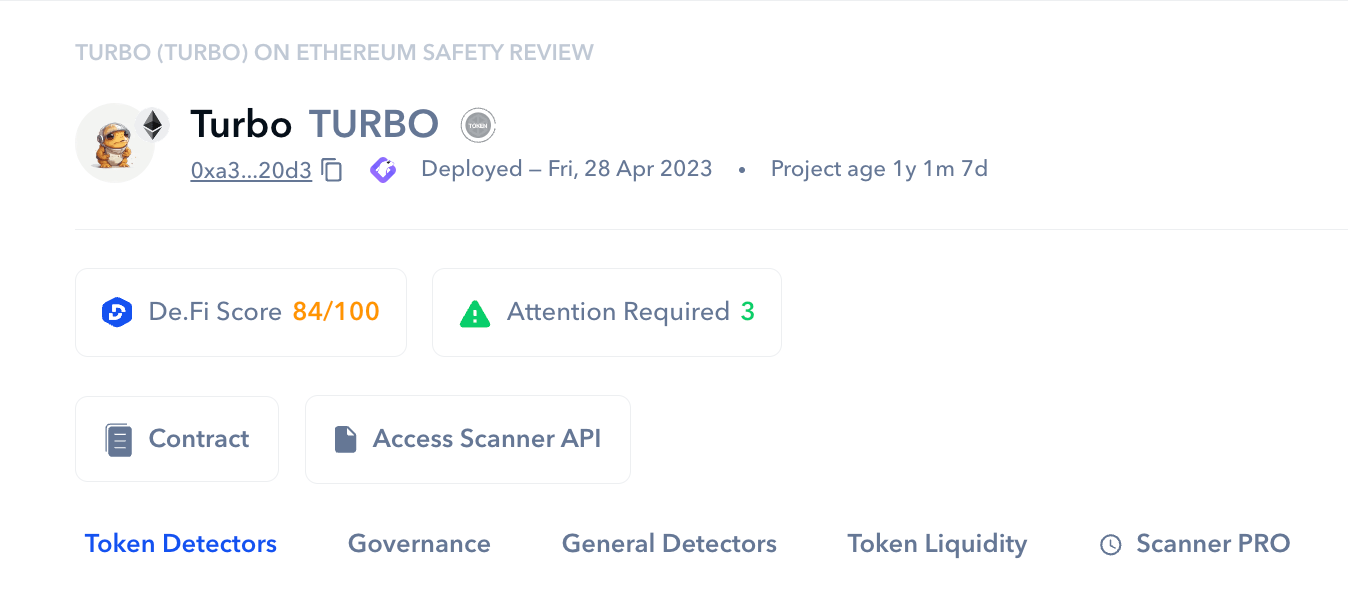

The De.Fi Scanner tool serves as an automated auditor, meticulously examining tokens before any swapping occurs. By leveraging this tool, users can proactively safeguard their investments against potential scams and vulnerabilities associated with new or less-known tokens.

De.Fi Scanner Results for TURBO on Ethereum

The De.Fi Scanner’s capabilities extend well beyond the analysis of smart contract risks—it delves into the tokenomics and liquidity aspects of tokens as well. This comprehensive evaluation ensures that users are not just avoiding technical pitfalls but are also making informed decisions based on the economic design and market depth of the tokens they intend to swap.

By assessing the token’s distribution, supply mechanisms, and the liquidity available in its pools, the De.Fi Scanner provides a holistic safety check that is crucial in today’s complex DeFi environment. This detailed insight empowers users to navigate DEXs with a higher degree of confidence and security.

De.Fi is Your Home for DeFi

With tools like our DeFi Dashboard, yield farming explorer, and security features like Shield (token approval checker) and Scanner, De.Fi offers an ecosystem where users can safely and effectively navigate the DeFi space. Whether you’re a seasoned trader or new to DeFi, De.Fi provides the resources and tools necessary to maximize your DeFi experience.