When you spend some time in Ethereum DeFi, you’re bound to notice that there are two forms of Ethereum available: ETH and wETH. This article will detail the difference between wETH and ETH, particularly in DeFi scenarios. By grasping these concepts, DeFi pioneers can better navigate and leverage the opportunities within this innovative financial landscape.

What is ETH?

Not surprisingly, Ethereum or ETH is one of the first cryptocurrencies that beginners will hear of. ETH is the #2 cryptocurrency by market cap and one of the pioneers of decentralized applications (dapps) and smart contracts. Launched in 2015, Ethereum introduced the ability to execute smart contracts onchain and opened up the ability of crypto investors to execute more than just simple financial transactions in a decentralized manner.

The Ethereum.org homepage

ETH is the native token on the Ethereum blockchain. It is used to pay for transaction fees (often referred to as “gas”) on not just Ethereum, but a gamut of Layer 2s such as Optimism, Arbitrum, Base, and more. When the Ethereum chain shifted to the Proof-of-Stake consensus mechanism after the ‘Merge’, the ETH token also began securing the Ethereum chain, with stakers needing to commit 32 ETH to become eligible as a validator.

As a blue-chip cryptocurrency, ETH plays a central role across not just Ethereum, but the wider DeFi ecosystem too, by acting as both a medium of exchange and a form of collateral. ETH is often deployed in lending, borrowing, and yield farming protocols, and is used as collateral for various native DeFi stablecoins like DAI.

ETH is regularly also deployed in “liquid staking“, wherein users can stake their Ethereum tokens to secure the blockchain while receiving a ‘Liquid Staking Token’ or LST in return, thus allowing users to enjoy liquidity and redeploy said LST in another DeFi pool for greater yield. This staking play is supported by various protocols such as Lido and Rocket Pool, allowing staked ETH to remain functional and earn multiple rewards.

In a more recent development, ETH has been used in “restaking”; this is where ETH and its LST derivatives can now be deployed to not only secure the chain but also secure other protocols simultaneously. This allows investors to stack one source of yield on top of the other while enabling the function of more DeFi protocols. Key players in this space include Eigenlayer, KelpDAO, and EtherFi.

What is WETH?

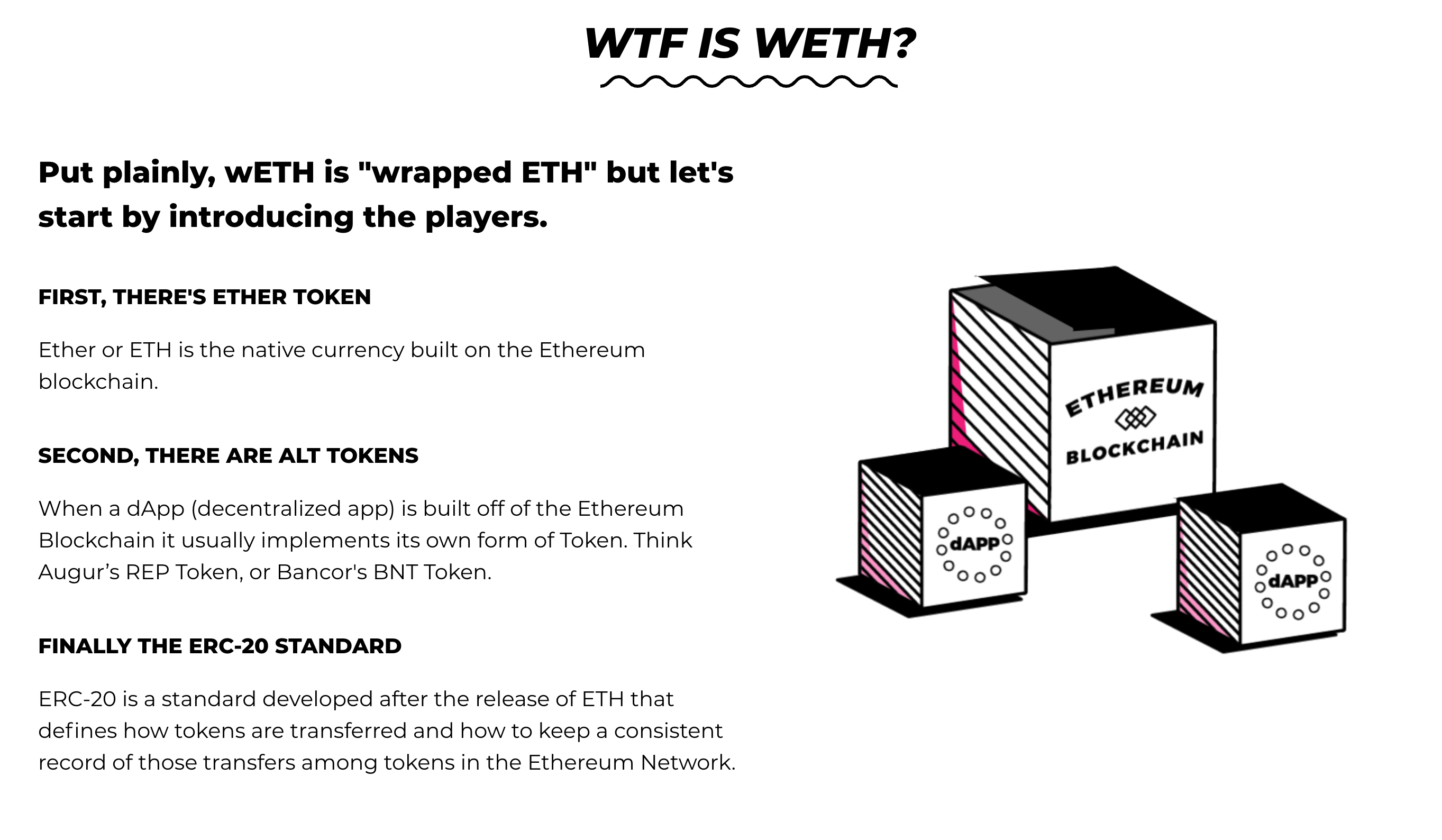

Wrapped Ethereum, or wETH, is ETH wrapped as an ERC-20 token. This means that wETH is exchangeable 1-for-1 with ETH, and has the same value when traded on a DEX.

This wrapping is necessary because the original ETH, by design, does not comply with the ERC-20 standard, which is a typical prerequisite for tokens to be deployed in popular dapps and associated smart contracts on the Ethereum network.

wETH explainer from weth.io

The entire idea of wETH is to provide an interoperable placeholder of value equivalent to ETH that could be used across most, if not all, dapps. Many decentralized exchanges (DEXs), lending platforms, and yield optimizers are built to only accept ERC-20 tokens due to their standardization and ease of integration. wETH therefore enables holders to interact with these platforms, while being assured that their assets will remain pegged to the value of ETH.

Once ETH is wrapped into wETH, it can be used just like any other ERC-20 token: traded, swapped, and locked in smart contracts, hence providing essential liquidity to various DeFi projects.

Wrapping ETH into wETH is straightforward. Users deposit ETH into a smart contract where it is held, and an equivalent amount of wETH is minted. This process is reversible; wETH can be “unwrapped” at any time by sending it back to the smart contract, which then returns the equivalent ETH.

How to Convert ETH to WETH

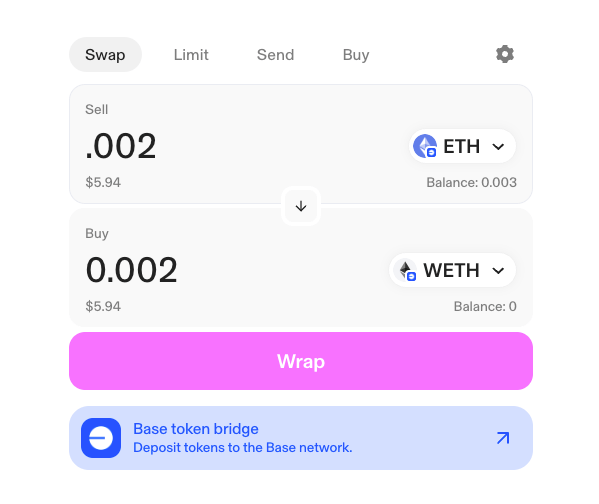

By swapping ETH for wETH, you gain access to opportunities in the many DeFi applications that need ERC-20 compatibility. Normally, this conversion can be done via a DEX like Uniswap.

If you are looking to convert ETH to wETH, you simply need to follow several steps:

1. Connect your wallet to a decentralized exchange (DEX): Access the swap page of a DEX like Uniswap, and connect your EVM wallet, before switching to the correct network. You do not necessarily need to be on the Ethereum chain to do this; Uniswap can wrap and unwrap ETH on Layer 2s such as Optimism or Arbitrum as well.

2. Choose ETH and wETH: In the swap interface (https://app.uniswap.org/swap), select ETH as the source token and wETH as the destination token. Uniswap will detect that you are trying to perform a Wrap. To confirm this to the user, the “Swap” button should then automatically update to “Wrap”.

3. Enter the amount of ETH you wish to wrap into wETH

4. Confirm the transaction: Review the transaction details, including any associated fees, approve the token spend and then confirm the transaction on your wallet.

Once confirmed, you will receive wETH in exchange for your ETH. This wETH can then be used across various DeFi platforms that may not support native ETH.

History of WETH

In 2017, wETH was launched by the 0x team. Its purpose was to solve the issue of DEXs and dapps not being able to work interoperably on Ethereum because they use versions of ‘receipt tokens’ for trading and liquidity provision.

It was the early days of crypto, and many DEXs had their own unique token standards. Because of this, it was hard for users to shift assets from one platform to another. wETH came into existence with the aim of making a more uniform and compatible system by producing a tokenized form of ETH that was easy to trade and integrate with other dapps.

The first wETH contract was deployed on the Ethereum mainnet in 2018.

Later, wETH found more applications in the DeFi world. It became a key trading partner on many known DEXs such as Uniswap, SushiSwap, and Curve. Also, various DeFi protocols and apps started accepting wETH like lending platforms Aave or Compound as well as yield farming protocol Yearn Finance.

How to Find the Best WETH and ETH Yields

To take full advantage of yield opportunities in DeFi, one must understand how to find the best yields for ETH and wETH. Both forms of the Ether token provide investment opportunities of their own. De.Fi provides you to this end with a tool specifically designed for this purpose: The De.Fi Explore Yields feature.

De.Fi’s Explore Yields is designed to help investors and DeFi enthusiasts navigate through the myriad of earning opportunities available for both ETH and wETH. This tool aggregates real-time data from various DeFi platforms to present the most lucrative staking, lending, and liquidity providing options. Here’s how you can use the Explore tool to maximize your returns:

1. Accessing the Tool: Start by visiting the De.Fi DeFi dashboard platform and selecting the Explore yields tab in the left-hand sidebar. This free tool is accessible to anyone looking to boost their investment returns, even in sideways or stagnant markets, by finding high-yield opportunities.

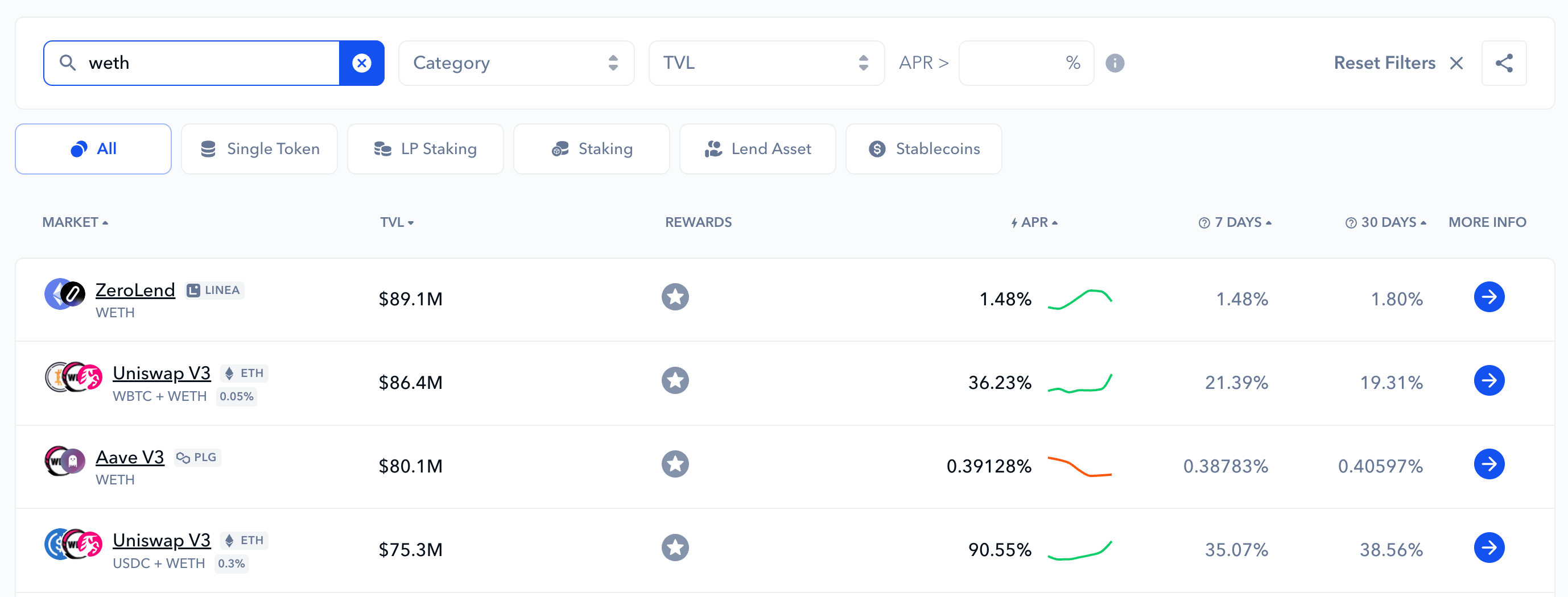

2. Searching for Yields: Once you are on Explore Yields, you can filter results based on the type of asset you’re interested in, which in this case would be ETH or wETH. To do this, simply scroll down to the filter bar that you can see located just above the list of farms or opportunities. You can then enter the respective token ticker symbol to filter for opportunities containing a particular token. For example, this search could yield pools that include wETH:

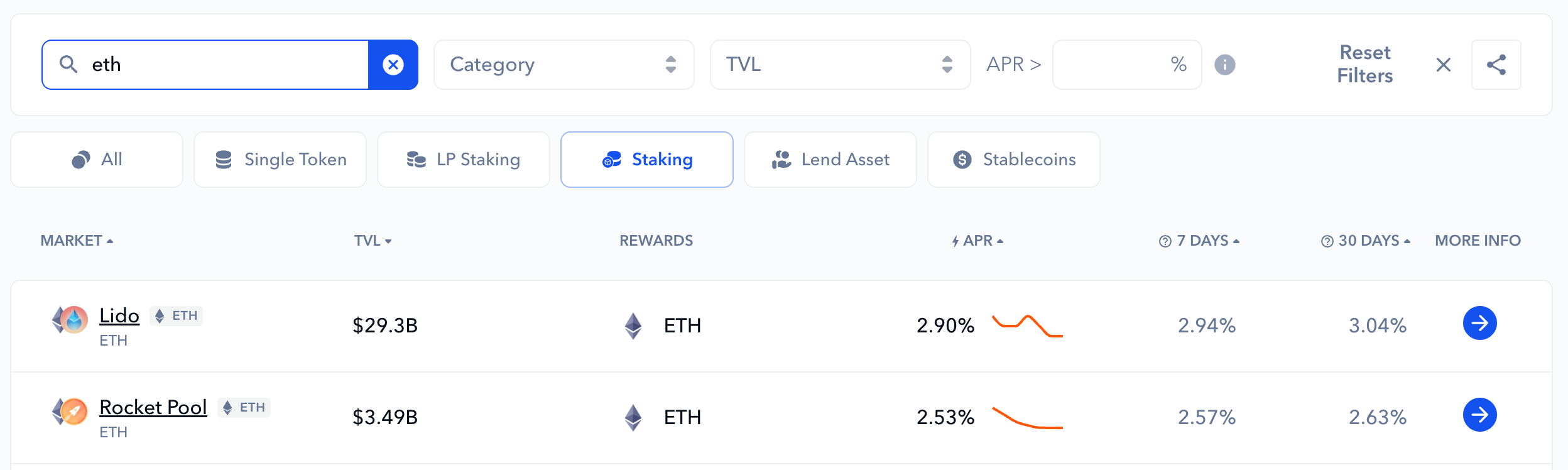

De.Fi data on the best wETH yields

3. Comparing Opportunities: De.Fi’s Explore Yields displays a variety of yield-generating opportunities from different DeFi protocols across EVM as well as non-EVM chains. You can view details like the expected annual percentage yield (APY), Total Value Locked (TVL), and other relevant metrics. For ETH, this might include staking yields on platforms like Lido or Rocket Pool. For wETH, this could involve liquidity pools on Uniswap or lending opportunities on Compound.

ETH yield data for Lido and Rocket Pool

4. Understanding Wrapped ETH vs ETH Yields: When you’re comparing wETH vs ETH in terms of yields, it’s vital to consider how your tokens are deployed, and where the returns will originate from. wETH often participates in liquidity pools and trading pairs, potentially offering different yield rates compared to ETH staking options. This is of course higher risk; for example, you may be exposed to impermanent loss if you pair your wETH with another token in a liquidity pool. A comparison of different options will help you decide where to allocate your assets for optimal risk-reward.

5. Making Informed Decisions: If you are looking for sustainable yields, you can do further due diligence on a pool by clicking the ‘More Info’ button, denoted by the blue arrow on the right-most column. Detailed analytics and historical yield data provided by the Explore tool can then be leveraged to make informed decisions.

6. Staying Informed: The De.Fi platform not only helps in finding the best yields but also keeps you updated with the latest changes in APYs and new opportunities as they arise. Sign up for the De.Fi newsletter on the Explore Yields page and receive regular tips on how you can pivot your strategies to maintain high returns.

By leveraging tools like De.Fi’s Explore Yields, you can maximize your returns on ETH and wETH investments more effectively. This understanding enables both newbie and experienced investors to capitalize on opportunities within DeFi, ensuring that their digital assets are working as hard as possible, especially given the risks we are already taking by investing in crypto.

Staying Safe While Using DeFi

Any DeFi investor worth their salt will know that security is, and has always been, an issue in DeFi. This requires a proactive approach to protecting your assets – with advanced security features, De.Fi’s Scanner and Shield suite addresses this and provides the end user with a streamlined solution. This combination of user-friendliness and in-depth features makes it an ideal way to evaluate ETH vs wETH investment opportunities while protecting one’s hard-earned assets.

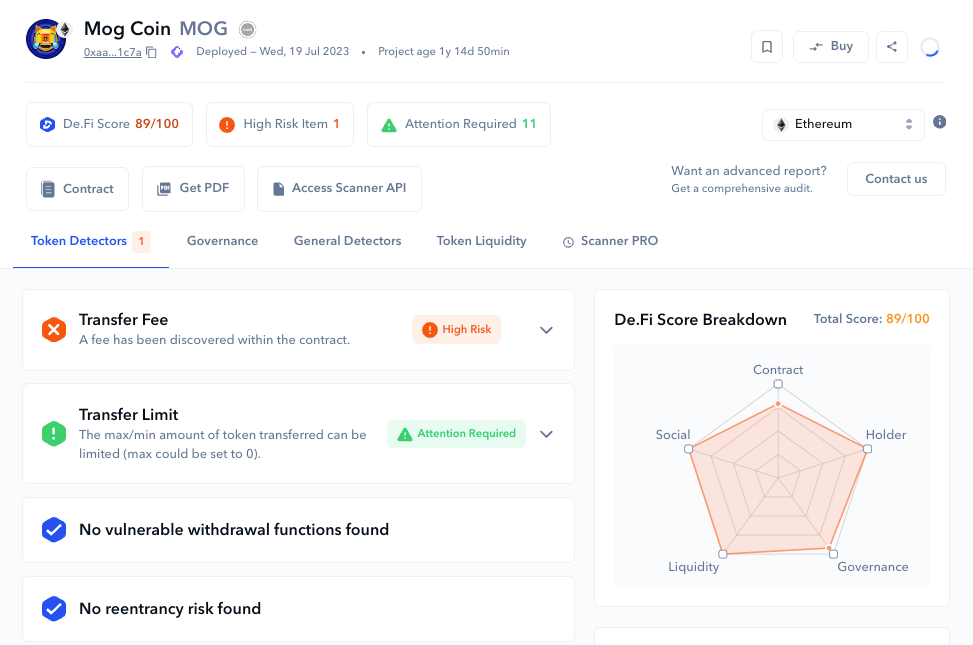

De.Fi’s Scanner allows users to self-audit smart contracts deployed on supported chains, a task that until recently was only possible with professional audit firms. With the Scanner, anyone can now enter a smart contract address and receive a real-time, rapid, security audit of the underlying contract.

MOG on Ethereum Scanner results

In addition to viewing the smart contract code, the scanner also evaluates other issues, such as token liquidity and dump risk, to provide a more holistic view of a particular token or contract. The Scanner feature set is continually being upgraded with newer additions including the DeFI AI Score, which just launched on Ethereum – it uses artificial intelligence algorithms to analyze on-chain activity related to contracts and then grade the contracts against various qualitative factors such as Sybil activity, organic behavior, etc.

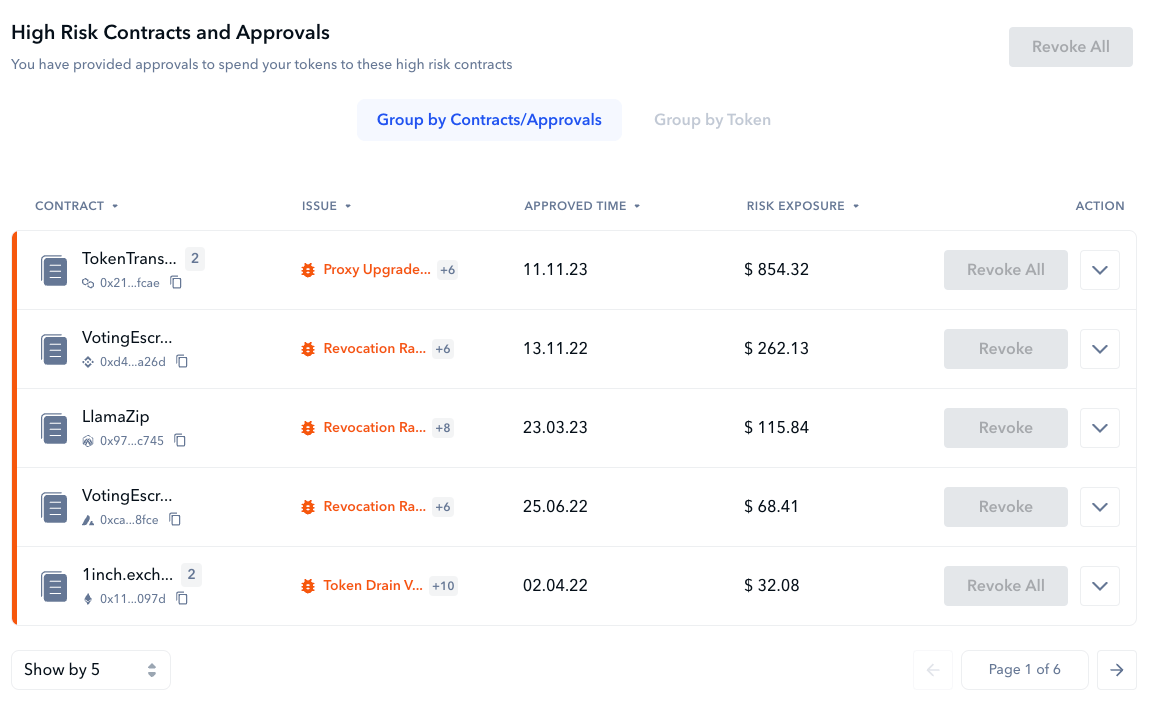

De.Fi’s Shield, on the other hand, allows users to check their wallets regularly to assess whether they have been exposed to risky contracts while engaging in day-to-day investment activities. Shield not only provides users with information about potential threats categorized by risk level but also allows them to conveniently revoke their rights to these potentially malicious contracts with a single click.

Along with antivirus components, De.Fi’s cryptocurrency market page takes a security-first approach with features that can best be understood as the CoinMarketCap of security. This page displays market information as well as details of how secure the various tokens are. This integration of safety knowledge and financial details allows users to choose wisely, taking into account possible returns from price increases, as well as the risk associated with these tokens.

Explore Web3 With De.Fi

Overall, De.Fi offers an advanced dashboard with pro-grade tracking tools, industry-leading security functionality, and extensive training aids. No matter if you’re a skilled investor or a fresh face in the cryptocurrency world – De.Fi has everything you need to explore, protect, and enhance your investments in one place.

Besides trying to maximize profits, getting educated is perhaps the most important factor in exploring the cryptocurrency market securely. De.Fi recognizes this need and provides a regular feed of educational resources. Core to this is an audit database and REKT database that provides users with in-depth research and analysis of various DeFi projects and platforms. These databases transparently inform on the safety and integrity of covered protocols and serve as a public good that enhances the overall security of the cryptocurrency community.

Beyond the app itself, De.Fi’s commitment to education extends to its digital presence on a variety of media platforms. The De.Fi blog is a knowledge repository updated weekly with articles covering a wide range of topics, from basic cryptocurrency concepts to the most popular cryptocurrency-related training articles. The blog is complemented by an active X feed that provides continuous updates via our main De.Fi profile and dedicated De.Fi Security profile. Watching these channels not only gives you alpha but also keeps you safe in the wild world of crypto.