Money market systems are fundamental to DeFi and Venus Protocol is no different.

It is built within the BNB Chain DeFi ecosystem and allows users to lend, borrow and mint stablecoins to use as they see fit. In this way, it is similar to the Maker and Compound protocols that are so key to Ethereum and Venus Protocol holds a similar position in the BNB ecosystem.

With so many DeFi users expecting a crypto bull run in alternative blockchains due to Ethereum’s high fees, Venus Protocol is an important project to understand and make the most of. That’s why we’ve written this ultimate guide, which includes all you need to know about the project, its key features, wallets, bridges and DeFi yield farming opportunities.

Subscribe to get the hottest updates here https://join.de.fi/ 🔥

What is the Venus Protocol?

Venus Protocol is a lending and stablecoin protocol built on BNB Chain. It describes itself as “universal money markets” that enable “simple and powerful community-driven finance for the entire globe”.

VAI, which is the first Venus stablecoin and is pegged to USD, is backed by a basket of BEP-20 assets, with BEP-20 being the token standard for BNB Chain. Users can lend and borrow from the Venus pool of assets, as well as supply collateral for the minting of VAI through overcollateralized positions.

“Venus helps in bridging the gap between traditional financial lending and decentralized protocols on top of blockchains. It enables anyone to utilize a high-speed and low transaction cost blockchain to supply collateral, earn interest, borrow against that collateral, and mint stablecoins on-demand within seconds.” — Joselito Lizarondo, Founder of Venus Protocol

Interest rates in Venus’s money market system are set by the protocol and based on demand for the underlying collateral. Lenders receive an annual compound interest rate or APY that is paid per block and borrowers pay interest on the amounts they borrow.

A key difference between Venus and other money market systems is that users can supply collateral to the market not only to borrow other assets but also to mint synthetic stablecoins, using over-collateralized positions that protect the protocol.

Some of the key features and benefits of Venus Protocol include:

- Over-collateralized lending where users can borrow assets whose value is lower than that of the assets supplied.

- Earn interest by supplying supported collateral assets to the protocol.

- The ability to mint VAI, the protocol’s default synthetic stablecoin pegged to the value of 1 USD.

Venus has stated that it chose BNB Chain because of the fast, secure and low cost transactions that it offers, as well as the deep network of wrapped tokens available on BNB Chain.

“Venus’s money market and stablecoin issuance platform can bring DeFi access and yield to CeFi users to a larger extent.” — CZ, Founder and CEO of Binance.

Due to a large liquidation, Venus Protocol suffered a $77M loss on bad debt in May 2021 but chose to cover the system shortfall by deploying the Venus Grants Program.

Venus Protocol’s Architecture

Venus Protocol was originally developed by the team behind Swipe, which provides card infrastructure for crypto, by forking Compound and Maker with the goal of bridging the gap between traditional lending and decentralized finance.

As it is built on BNB Chain, it relies on the underlying blockchain’s Proof-of-Staked-Authority, a consensus mechanism designed to enable fast block creation and low fees.

Venus Protocol’s technology enables key functions that are crucial to its money market system.

Lending

Users can earn a variable yield on their assets, based on how much that asset is used by the protocol. Assets are pooled into smart contracts and depositors receive vTokens to represent their collateral, which can be redeemed for the underlying collateral.

Borrowing

Venus provides the option for borrowing, based on overcollateralized lending. Borrowers pledge collateral before borrowing, with loan rates determined by how much the protocol uses these assets. If collateral values fall below a given level, the liquidated collateral is used to pay off any outstanding debt, while any remaining collateral is returned to the user.

Stablecoins

Users can mint a synthetic stablecoin called VAI using the collateral value of vTokens from prior deposits. Interest rates are determined by the protocol’s governance process, while the price of VAI relies on market forces because minting and redemption are fixed at $1.

$XVS Token

The native token of Venus Protocol is XVS. It is used to vote on governance decisions, product improvements, new collateral and changes to the system’s parameters.

As of 25 March 2022, XVS has a price of $8.00, a current market cap of $97,538,727 and a max supply of 30,000,000 (according to Coinmarketcap data).

The Venus Protocol Ecosystem

In February 2022, the Venus community launched a grants program to help foster innovation within the Venus ecosystem.

Several million dollars of XVS has been made available for a whole range of projects, including development of alternative frontends and applications, developer tooling, code audits and bounties, as well as educational materials, events and hackathons.

Wallets for Venus Protocol

As Venus Protocol exists on the EVM-compatible BNB Chain, a number of well-known wallets can be used to interact with it.

MetaMask

MetaMask is the most popular web and mobile cryptocurrency wallet. It was originally designed for use with the Ethereum blockchain and can therefore be configured for BNB Chain as well.

Trust Wallet

A mobile wallet that lets users store BEP20, ERC20 and ERC721 tokens. Viktor Radchenko is the founder and CEO of Trust Wallet, which was acquired by Binance in July 2018.

Bridges for Venus Protocol

As Venus Protocol exists on BNB Chain, the Binance Bridge is the most obvious choice for bridging assets cross chain to use with Venus Protocol.

Binance Bridge

Binance Bridge is a cross-chain bridging service that aims to increase interoperability between blockchains. It lets you convert coins into wrapped tokens to be used on BNB Chain, including BTC, ETH, USDT and many more.

Venus Protocol on De.Fi

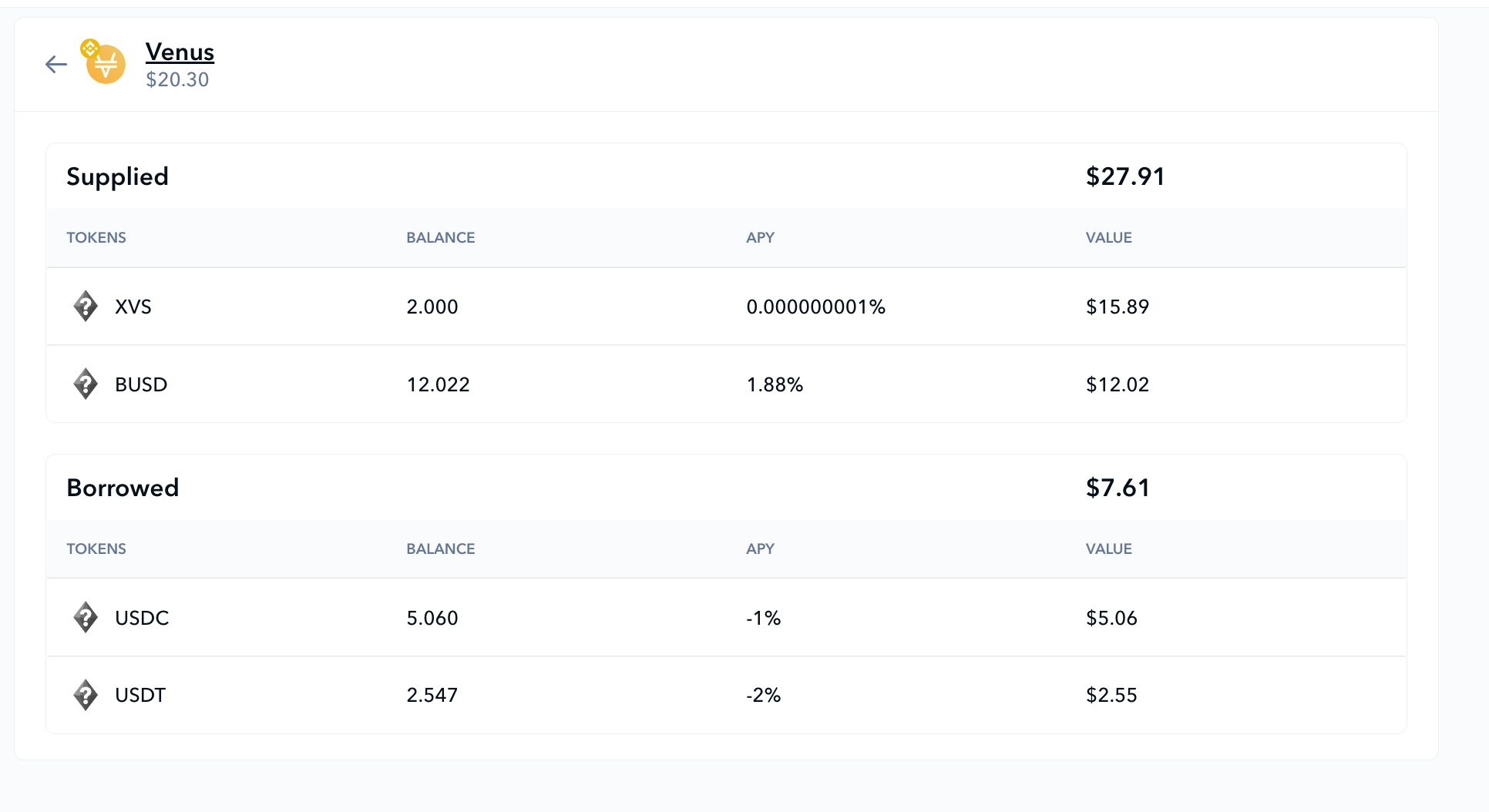

In January 2022, Venus Protocol was integrated into De.Fi.

That means you can track your profit and loss, balances, prices and much more on Venus Protocol using De.Fi!

Our enhanced dashboard provides the most comprehensive user experience, so visit our DeFi tracker app and connect your wallet now to get started .

Investing on Venus Protocol

Venus is one of the most popular lending-borrowing protocols, so in this guide we will go through the Lending process.

Firstly, you want to go https://venus.io/ and click “Launch the app”.

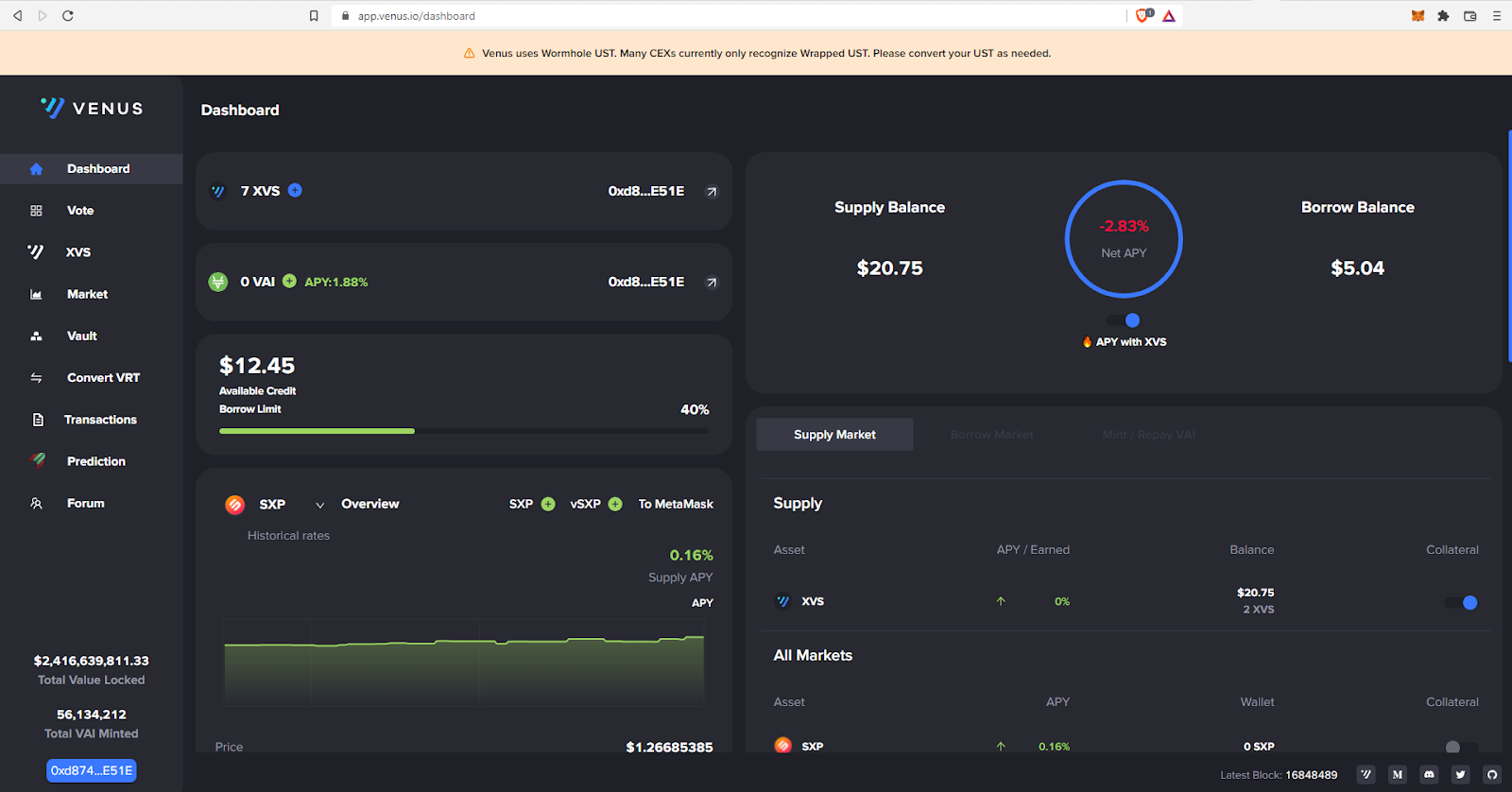

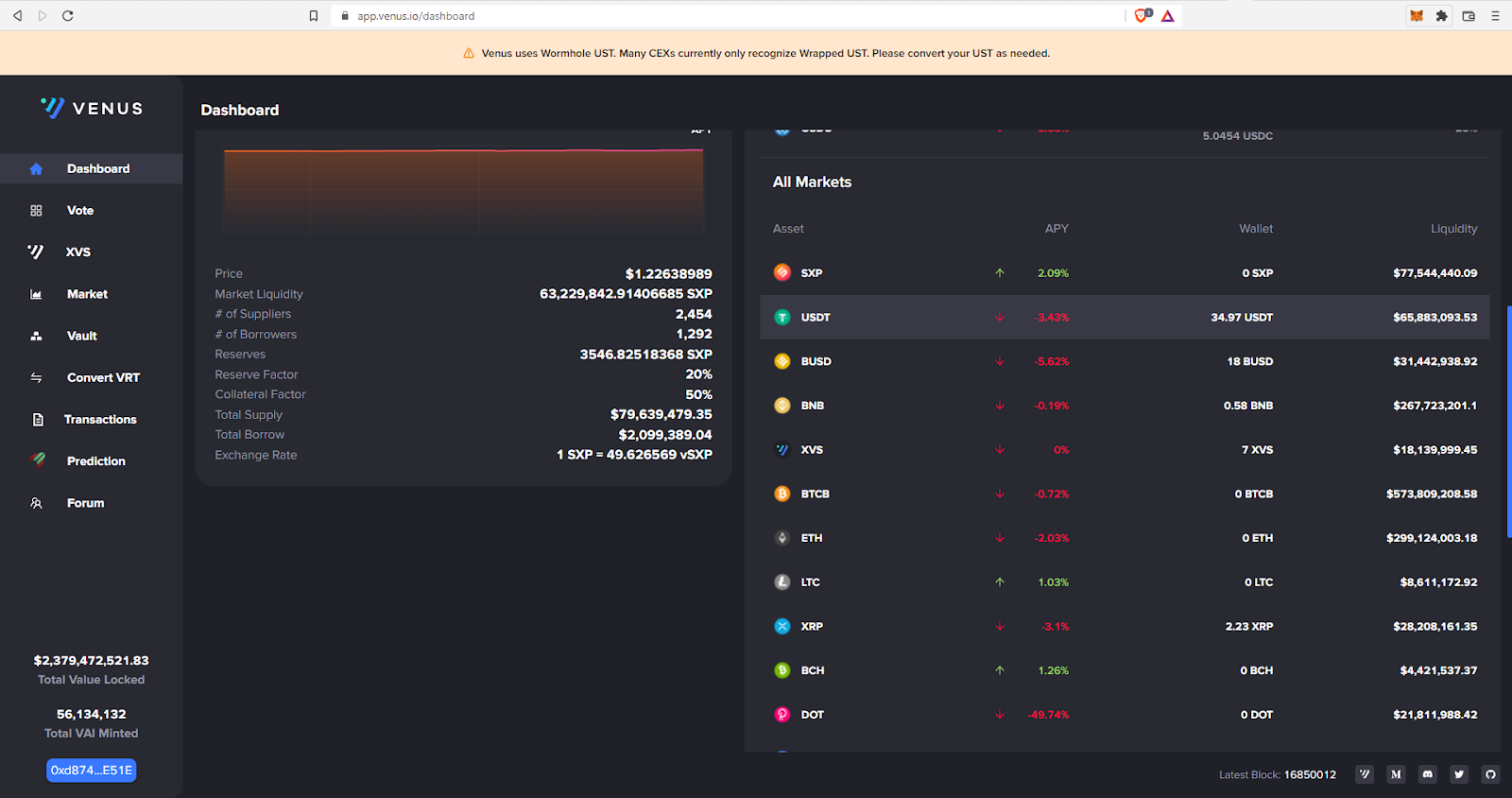

You will see the main screen with your investments including your supply and borrow balances.

In the list at the right you can choose an asset for supplying (to use it as a collateral).

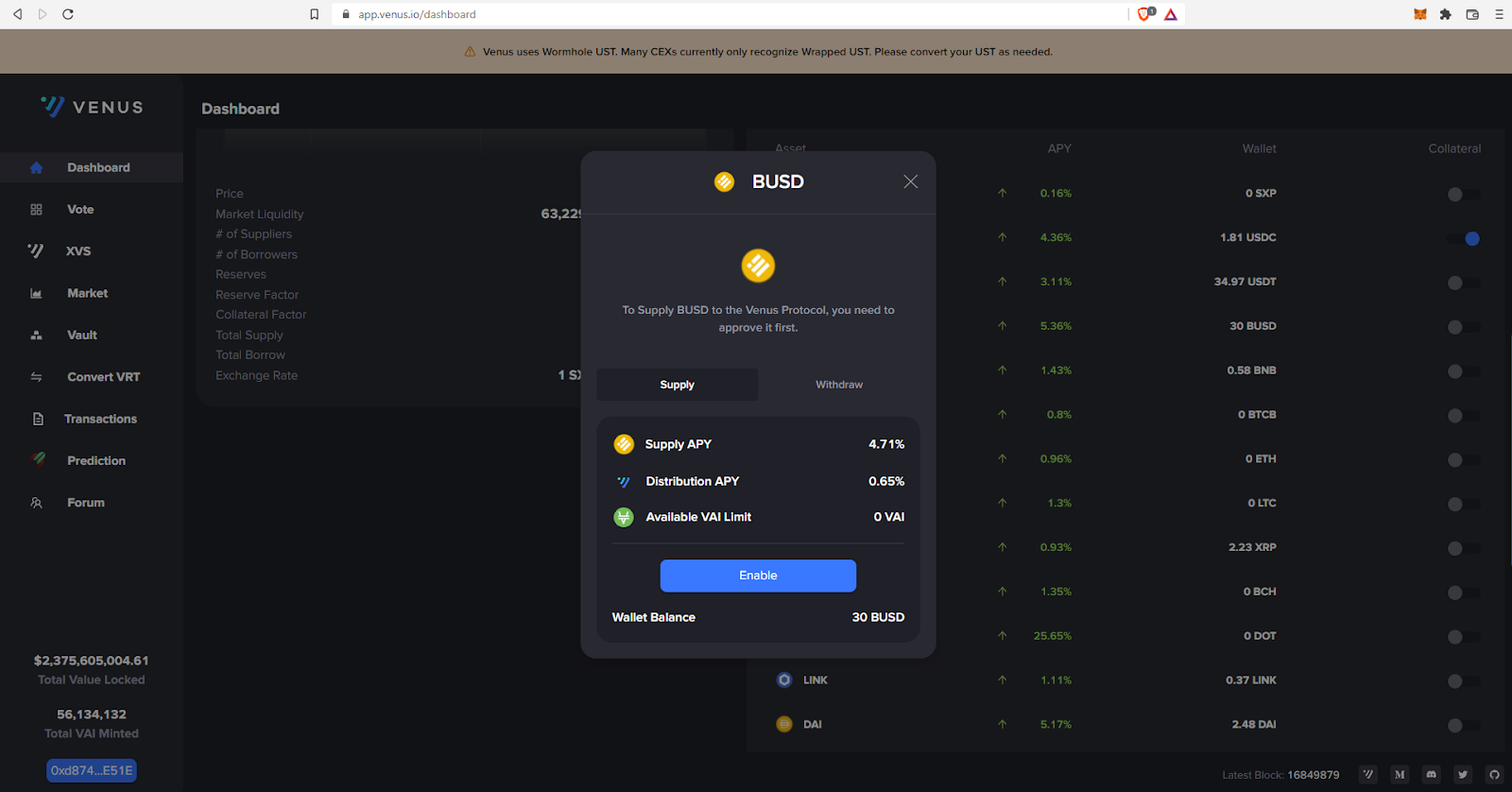

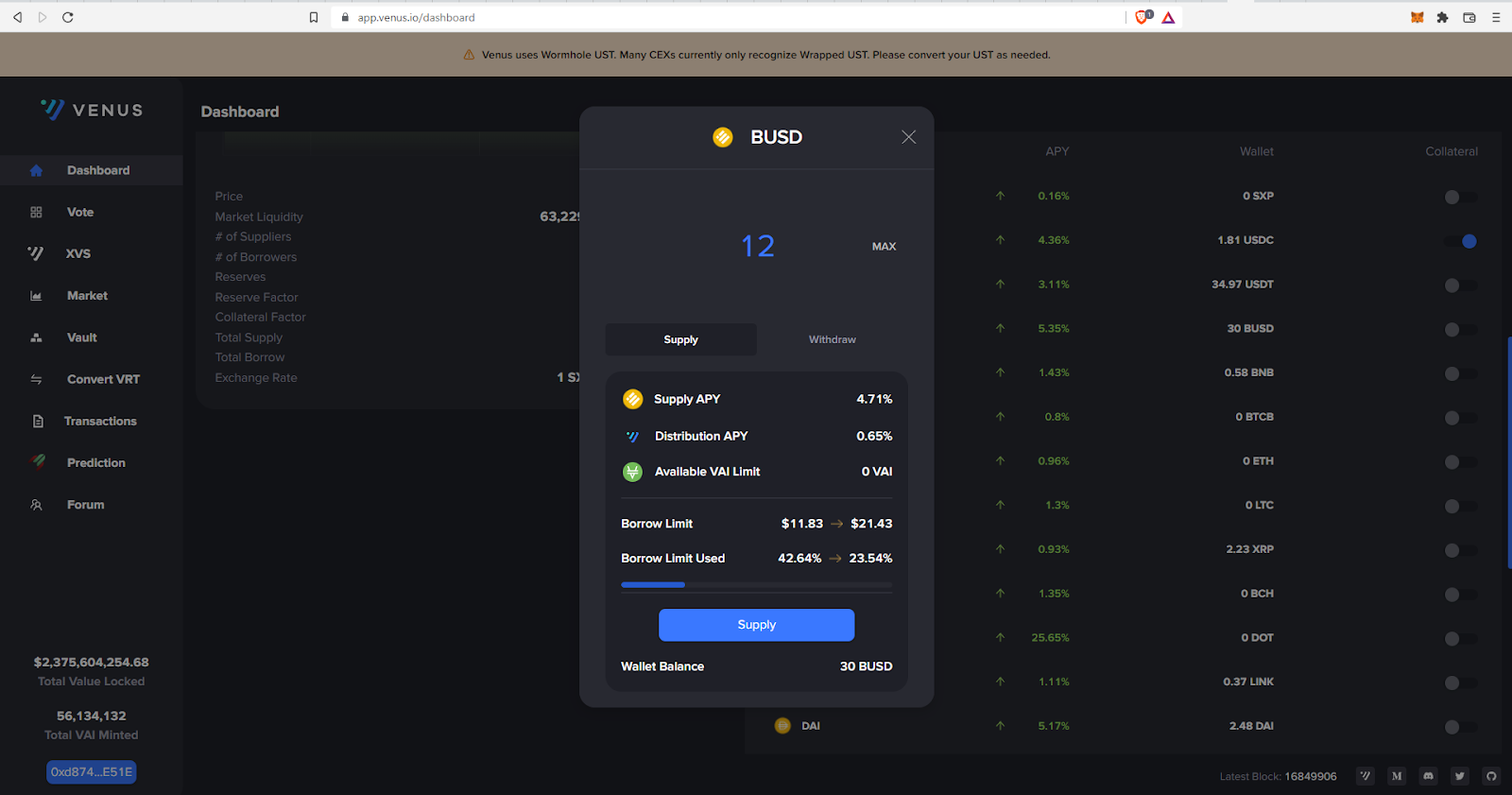

We will go with supplying BUSD. Simply by clicking on the asset in the list, you can Enable (Approve for spending) and supply the token.

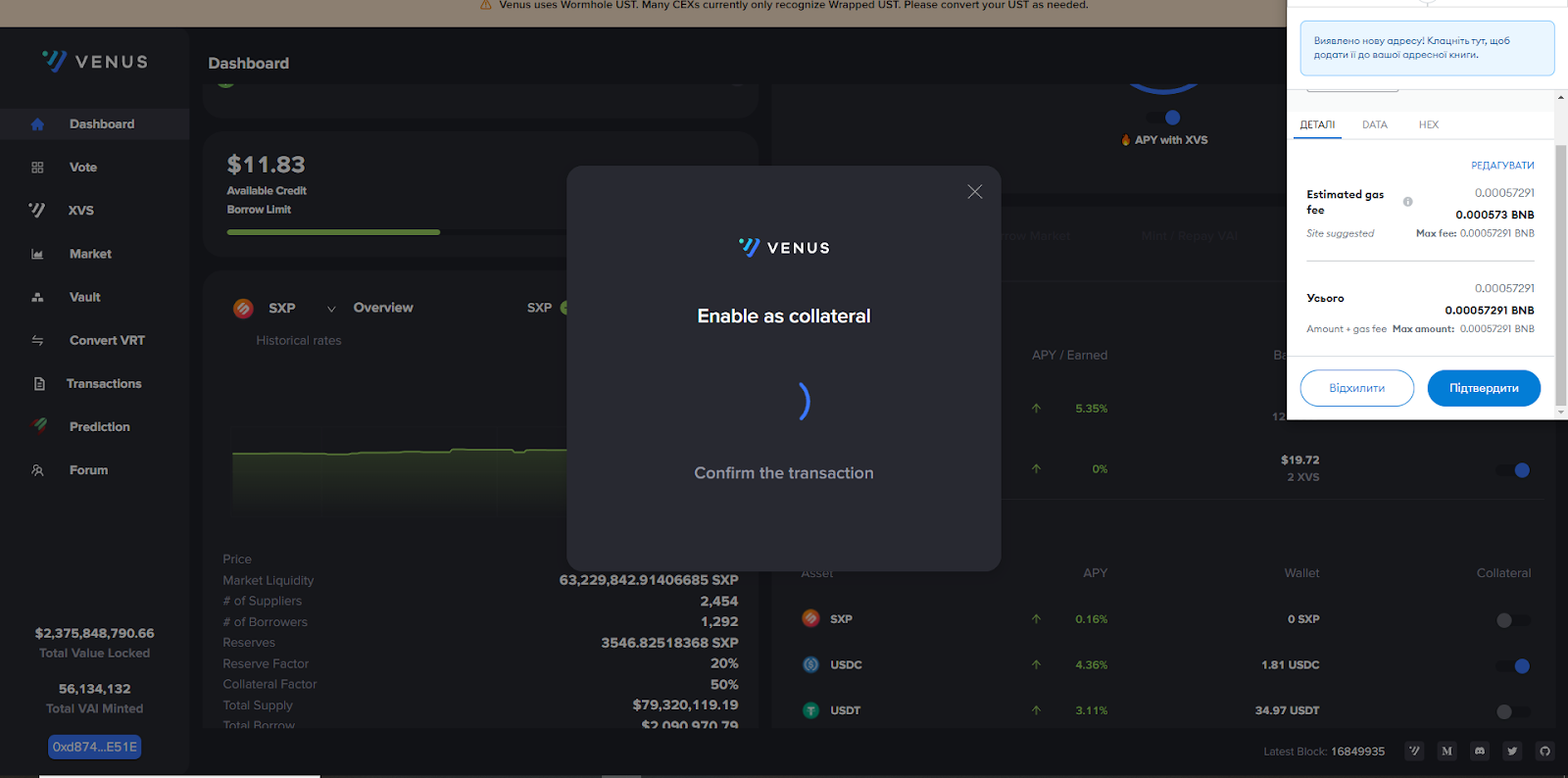

Remember, there’re 2 transactions at the beginning of interaction with the protocol using any token. Firstly, you approve the token for spending, and secondly you actually deposit the token.

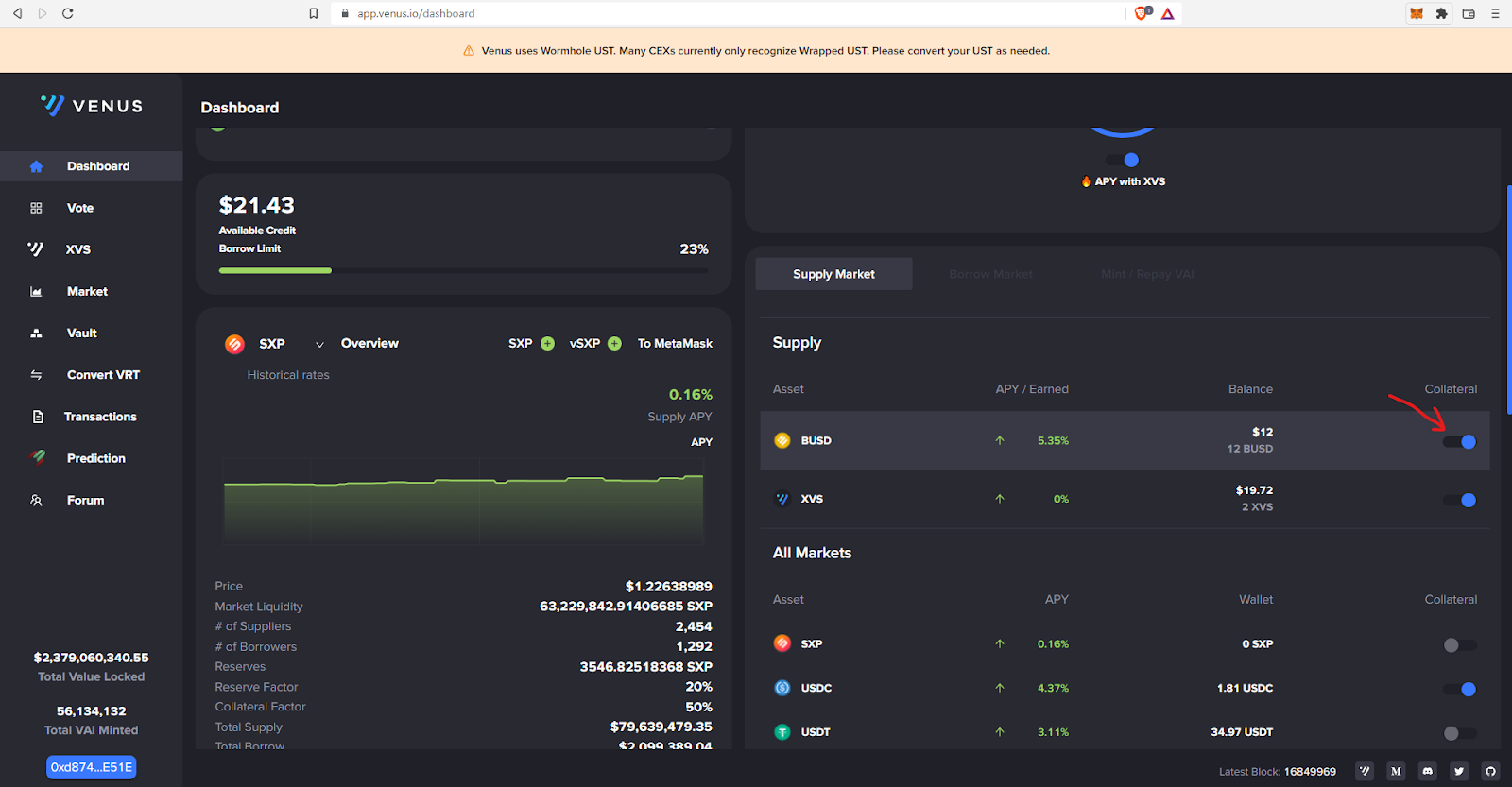

After confirming all the transactions in Metamask (or your preferred wallet), you will see your tokens in the list of supplied assets.

By toggling the switcher you can enable or disable the assets for collateral.

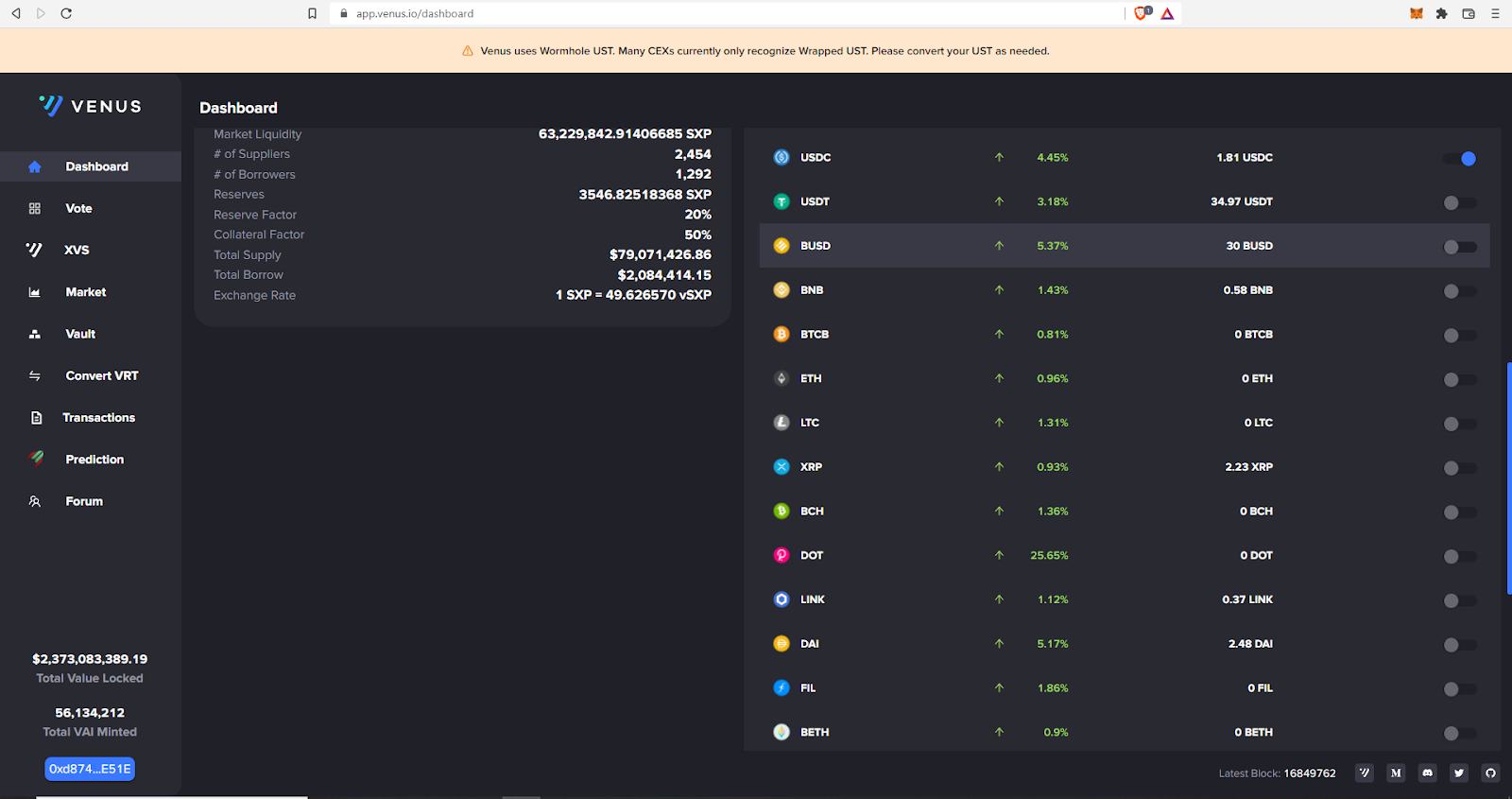

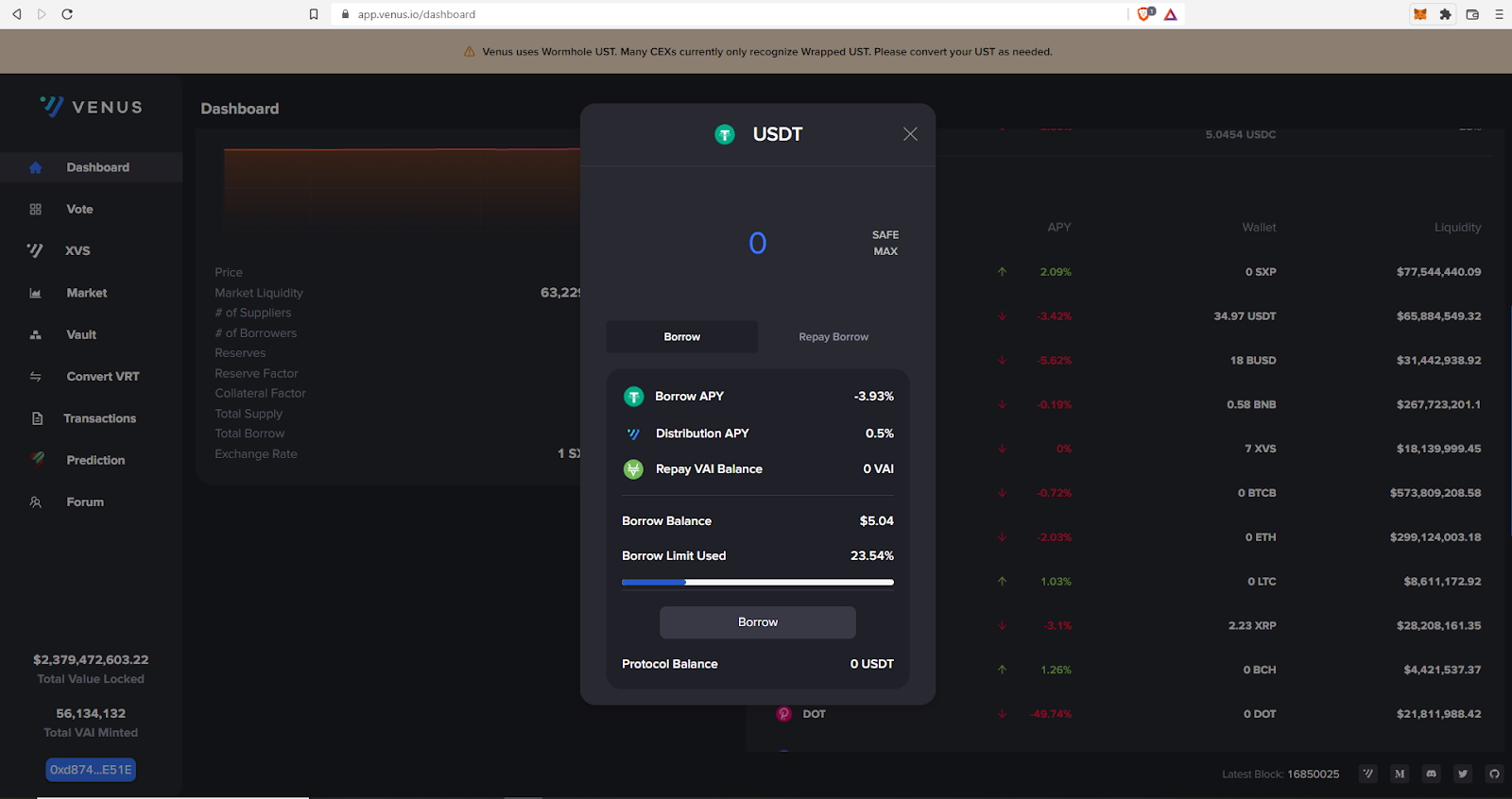

For borrowing, go to the Borrow tab and choose one of the assets.

We will go with borrowing USDT.

After confirming your transactions, you successfully borrowed assets.

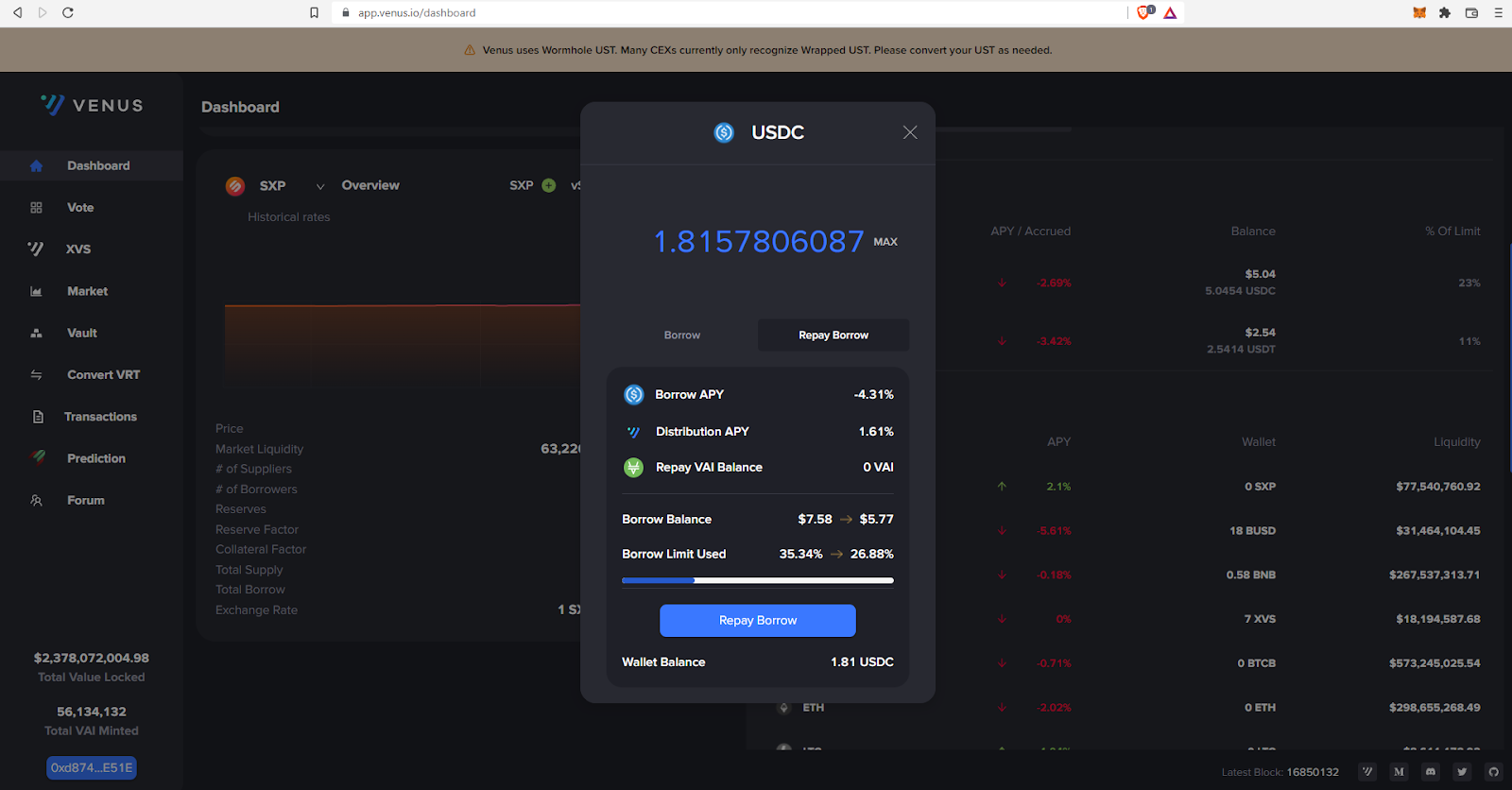

On the same dashboard you can easily repay the borrowed assets.

Here you can check yield farming opportunities on Venus Protocol: https://de.fi/explore

Should I use Venus Protocol for Making Profit?

As money market systems that allow users to lend, borrow and mint assets are such a fundamental part of all DeFi ecosystems, anyone with an interest in BNB Chain really should get their head around how Venus Protocol works.

Most yield farmers are familiar with Maker, Compound and Aave on Ethereum, and Venus does a very similar job on BNB Chain. Therefore, if you’re interested in the opportunities that exist on this fast and low-fee chain, Venus Protocol is one to know.

Just remember, as always, this is not investment advice and you should always do your own research first.

Check our other resources to stay safe and explore DeFi:

What is TVL (Total Value Locked) in DeFi?

Upcoming Crypto Airdrops for 2023

Smart Contract Audit Services

Crypto Hack & Scam Database

Free Smart Contract Audit

Revoke Crypto Wallet Permissions Tool