This blog is a guest post from the mempool experts at Blocknative.

If you have ever interacted with a decentralized exchange or DeFi protocol on any blockchain, you have likely created an MEV opportunity that others have exploited. MEV stands for Maximal Extracted Value. And it refers to the value derived from controlling transaction inclusion and ordering.

Most MEV is benign and, in fact, necessary for free markets to achieve equilibrium and the proper functioning of decentralized financial systems. But in the worst case, MEV can lead to less favorable settlement terms for end-users.

Any time you transact on a DEX or DeFi protocol, you should be aware of MEV risk and take action to protect yourself. We will explore how to protect yourself in a later section.

Slippage in DeFi

Slippage, in the context of DeFi trading, refers to the discrepancy between the expected price of a trade and the price at which it is executed. It is the difference between what you intend to pay or receive for a trade and what you end up paying or receiving. Slippage can occur due to various factors, and understanding them is crucial for any crypto trader.

Three primary factors influence slippage: Liquidity Pool Size, Market Volatility, and Trade Size. Let’s explore each:

How Liquidity Pool Size Impacts Slippage

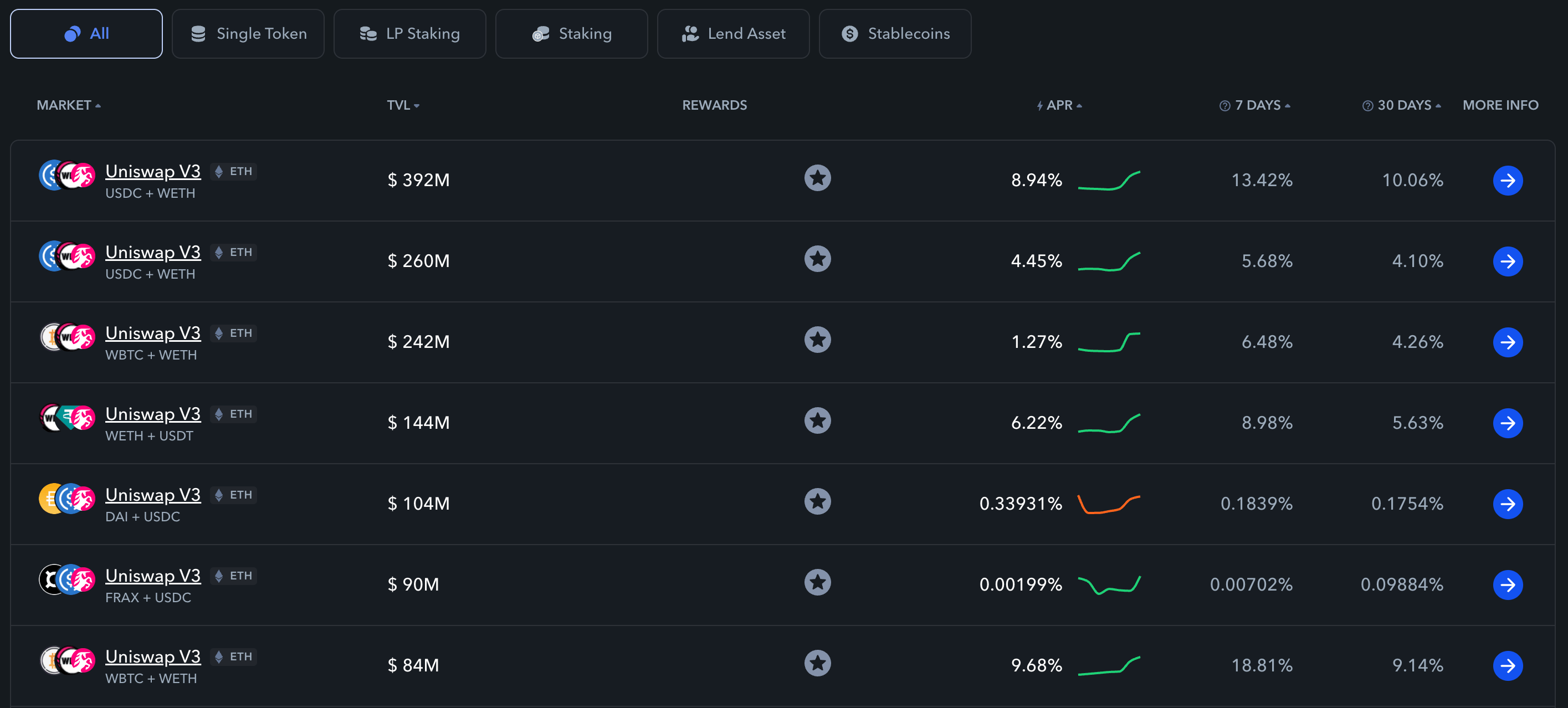

Liquidity pool size plays a pivotal role in determining the extent of slippage. In a larger liquidity pool, more tokens are available for trading, which means that large trades are less likely to impact the price significantly. DeFi platforms with substantial liquidity pools tend to have lower slippage, making them more attractive to traders.

The De.Fi Explore Yields page allows you to sort specific liquidity pools by TVL

How Market Volatility Impacts Slippage

Market volatility, characterized by sudden and unpredictable price fluctuations, can exacerbate slippage. In highly volatile markets, the gap between the expected and executed price of a trade widens, leading to increased slippage. Traders should exercise caution when navigating turbulent market conditions and consider employing risk management strategies.

How Trade Size Impacts Slippage

The size of your trade also influences slippage. Larger trades are more likely to experience slippage because they can exhaust the available liquidity in a pool, causing the price to move unfavorably. To manage slippage effectively, consider breaking down large trades into smaller chunks or exploring alternative trading strategies.

The Risks of Slippage in DeFi

High slippage can pose significant risks to DeFi traders, including financial loss and impacted trading strategies.

Experiencing high slippage can result in substantial financial losses, especially for those executing large trades. When the executed price significantly deviates from the expected price, traders may find themselves on the losing end of the trade.

High slippage can disrupt trading strategies, forcing traders to deviate from their intended plans. This can lead to frustration and suboptimal trading outcomes. To mitigate this risk, traders must adapt their strategies to account for potential slippage.

The Role of Wallets in Orderly Settlement

In the world of digital finance, DeFi wallets serve as the fundamental tools for managing, storing, and transferring cryptocurrencies. These secure digital repositories play a pivotal role in ensuring smooth and organized transactions, enabling users to send and receive various digital assets with ease.

Today, many wallets default to sending transactions to the public Mempool. But this is quickly changing – private transactions have grown ~5% to over 15% of Ethereum transactions in the last year. And many wallets are now starting to support Private Transactions natively.

But many Wallets still believe that users should decide which if any, Private Endpoints to use and require opt-in. This often requires users to select which Private RPCs to choose from.

As the cryptocurrency ecosystem continues to grow and evolve, the role of wallets remains central to maintaining the integrity of transactions, promoting financial autonomy, and fostering a more decentralized and orderly financial landscape.

How to Protect Your Transactions

In the dynamic world of DeFi trading, slippage is a concept that traders cannot afford to overlook. It can significantly impact the outcome of your trades and your overall profitability.

Users who are looking for an easy solution to the MEV should consider aggregators like Blocknative’s Transaction Boost – which enables you to submit to one or more private RPC endpoints at once. Transaction Boost leverages Blocknative’s powerful mempool observability platform so users always know the status of their in-flight transactions.

Now you can add Transaction Boost to your @MetaMask wallet in a few simple clicks 🥳.

— Blocknative | mempool.eth 🔮 (@blocknative) October 13, 2023

Add the endpoint here: https://t.co/WsfY2u58lA pic.twitter.com/X1mz0y3aLm

By understanding the factors influencing slippage, recognizing associated risks, and harnessing the power of aggregators, you can navigate the cryptocurrency maze with greater confidence and achieve better trading results. So, embrace these tools and knowledge and embark on your DeFi trading journey with a strategic edge.

Tracking Your DeFi Trading With De.Fi

In addition to making sure you’re knowledgeable about the potential risks of MEV and slippage, it’s important to track your DeFi transactions. De.Fi makes this easy with our DeFi portfolio tracker. Create your profile today and track all your addresses in one place. Make sure to use our free smart contract scanner and wallet permissions revoke tool as well to ensure your DeFi security bases are covered. Get started today!