The rise of decentralized finance (DeFi) has created a growing need for tools that help users track and optimize their digital assets. One of the popular platforms fulfilling this need is DefiLlama, known for its extensive DeFi data analytics. However, many users are on the lookout for alternatives that offer more versatile features.

In this article, we cover De.Fi’s potential as a powerful DefiLlama alternative that stands out in the market for its portfolio management, yield tracking, and enhanced security features. We will explore how De.Fi stacks up and why it may be the superior choice for both experienced and new DeFi investors.

What is DefiLlama?

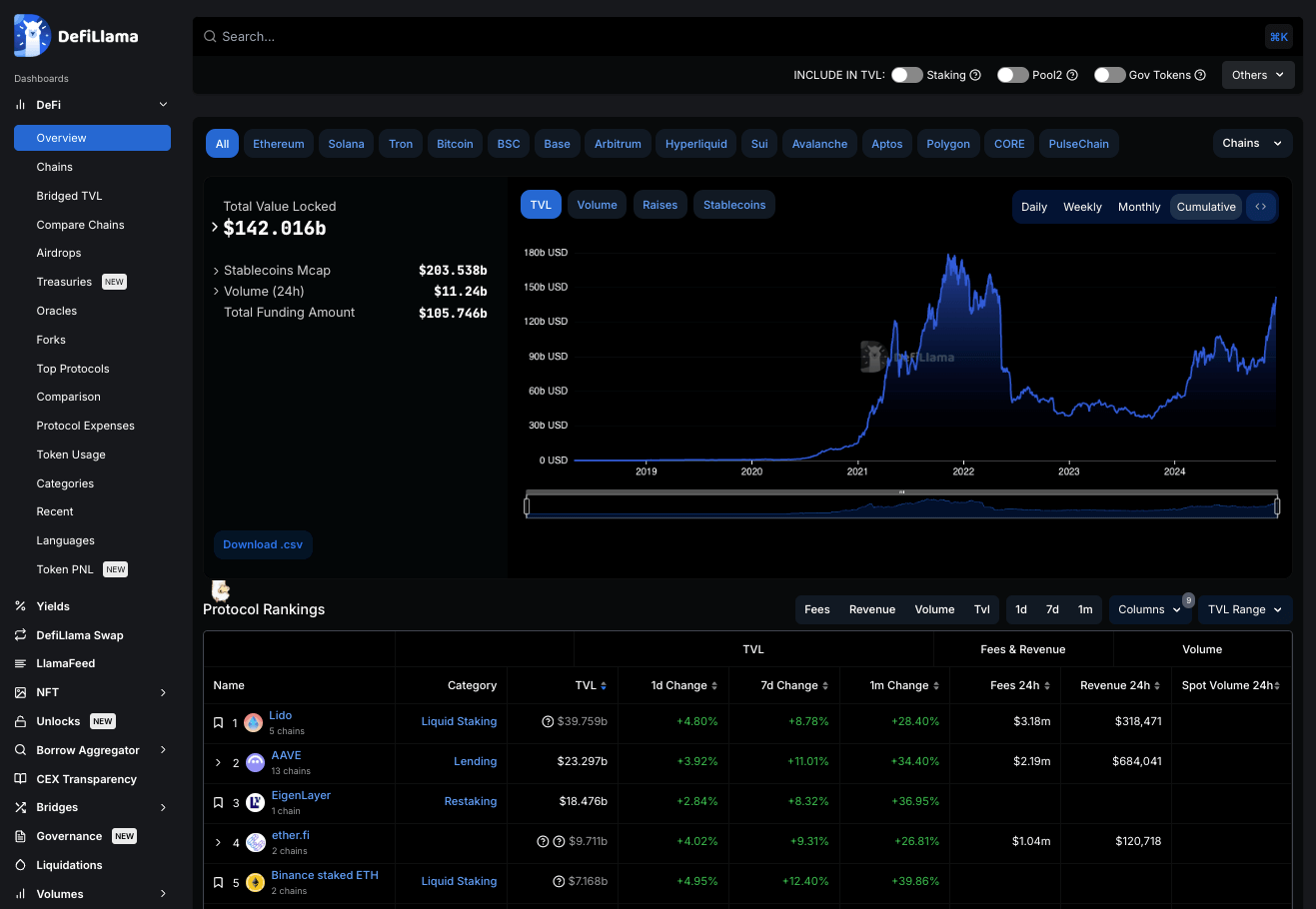

DefiLlama is a well-known DeFi data platform that consolidates key metrics such as total value locked (TVL), yield farming, and protocol revenues. Its popularity stems from the breadth of its blockchain coverage, supporting over 225 chains like Ethereum, BNB Chain, and Solana. DefiLlama helps users analyze DeFi protocols, monitor liquidity, and explore tokenless DeFi airdrops, making it an invaluable tool for those seeking real-time data on decentralized finance.

Beyond just TVL, DefiLlama also offers specialized tools like LlamaSwap, which aggregates decentralized exchanges (DEXs) to find the best trading rates. Its analytics make it easy to compare protocols, chains, stablecoins, and yields, positioning it as a leading player in the DeFi data space.

However, despite its extensive offerings, some users may find it limited when it comes to portfolio management and DeFi security, opening the door to platforms like De.Fi as a DefiLlama data alternative.

De.Fi: The Best DefiLlama Alternative

While DefiLlama excels at providing raw data, De.Fi goes several steps further by offering a complete suite of tools for tracking, managing, and optimizing DeFi portfolios. Let’s explore why De.Fi is the ultimate DefiLlama competitor and what makes it stand out as the best DefiLlama website alternative. De.Fi is more than just a data aggregator; it provides users with a complete suite of tools to manage, secure, and optimize their DeFi investments.

1. Explore Yields Tool

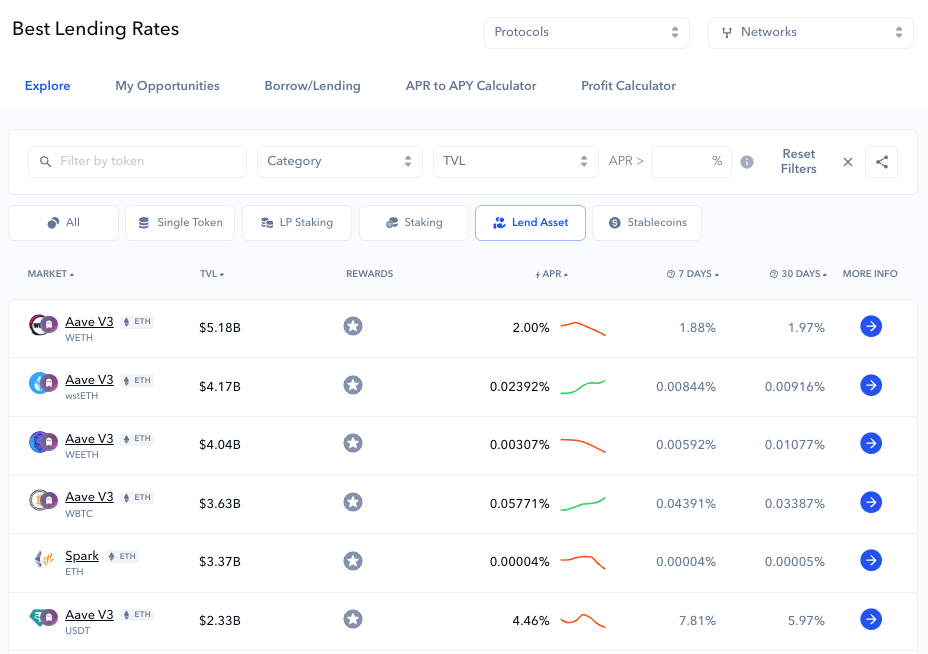

Lending rates in De.Fi Explore

De.Fi’s Explore Yields tool stands out as one of the platform’s most innovative features, offering an edge over many other DeFi tracking tools, including those provided by DefiLlama. This feature allows users to track yield farming opportunities across various DeFi platforms, much like DefiLlama, but with enhanced capabilities that cater to a wider range of user preferences.

One of the core advantages of De.Fi’s Explore Yields is the ability to filter and personalize yield searches by multiple factors, including token type, risk level, and liquidity. This level of customization enables users to fine-tune their strategies and find yield farming pools that align with their risk tolerance and investment goals.

Moreover, De.Fi supports a broader array of blockchain networks beyond the more mainstream options like Ethereum and Solana, extending its yield tracking capabilities to newer platforms such as Base. This multi-chain approach provides users with greater flexibility and more comprehensive insights into emerging DeFi opportunities.

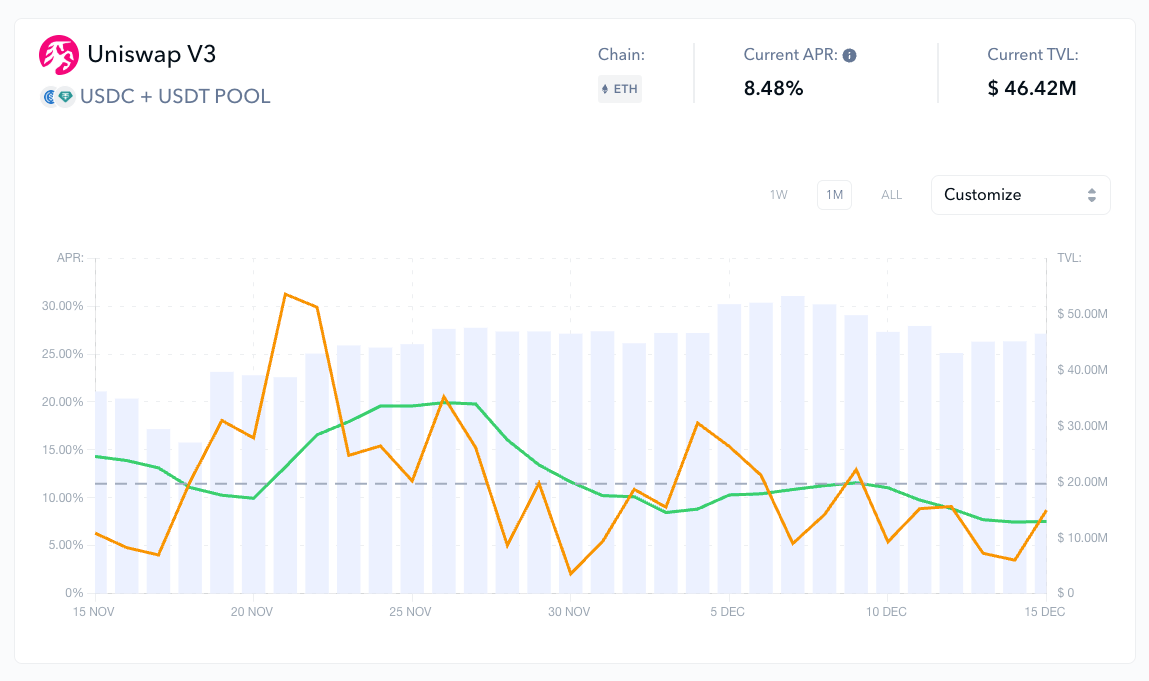

Historic USDC + USDT Uniswap liquidity pool data

The tool is also tightly integrated with De.Fi’s portfolio dashboard, offering users real-time updates on how their investments are performing. In addition, historical yield data over 7-day and 30-day periods allows users to track the sustainability of different yield strategies, equipping them with the information needed to make informed investment decisions.

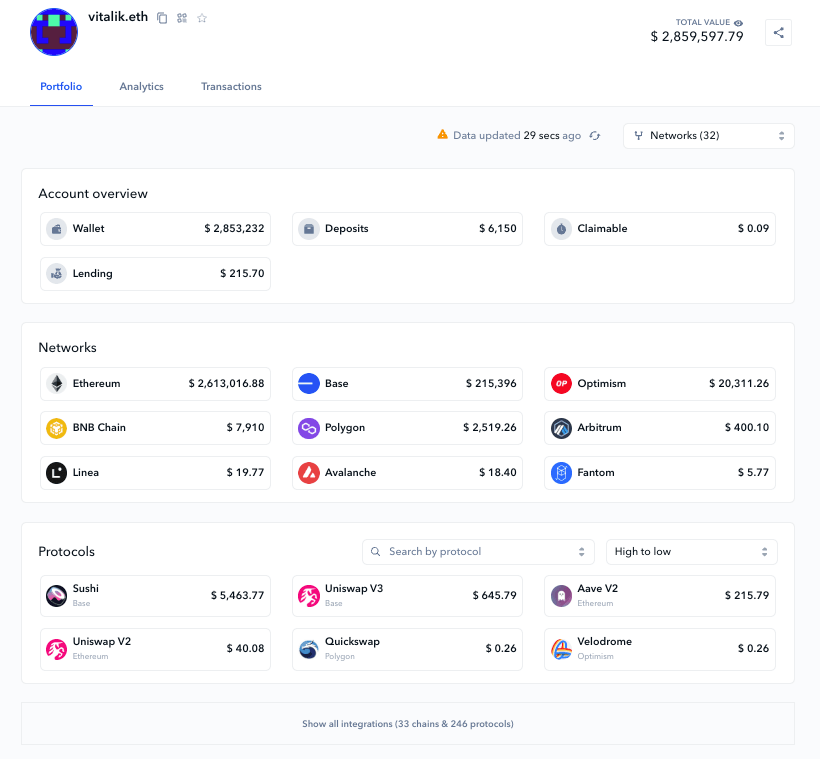

2. Comprehensive Portfolio Dashboard

De.Fi’s Portfolio Dashboard is a comprehensive tool that gives users a consolidated view of their entire DeFi portfolio, spanning multiple wallets and blockchain networks. Unlike DefiLlama’s LlamaFolio, which has more limited features, De.Fi’s dashboard provides a much broader scope, offering detailed insights into various assets, including tokens, staked positions, lending activities, and claimable rewards. This bird’s-eye view enables users to manage their DeFi assets efficiently, all from one central hub.

One of the standout features of De.Fi’s dashboard is its ability to track deposits, manage loans, and monitor rewards, streamlining the entire process into a single interface. Users can easily stay on top of their crypto holdings while gaining real-time updates on interest accrued or claimable rewards. Another valuable component is the transaction history feature, which allows users to sort and search their transactions—a particularly useful function for tax reporting and performance analysis.

Moreover, De.Fi integrates its Portfolio Dashboard seamlessly with its Explore Yields tool, enabling users to explore new investment opportunities while managing their existing portfolios. This real-time interaction between tools ensures that users can make informed decisions and quickly adjust their strategies without leaving the platform, making De.Fi an ideal DefiLlama data alternative for users who require a more robust and flexible portfolio management system.

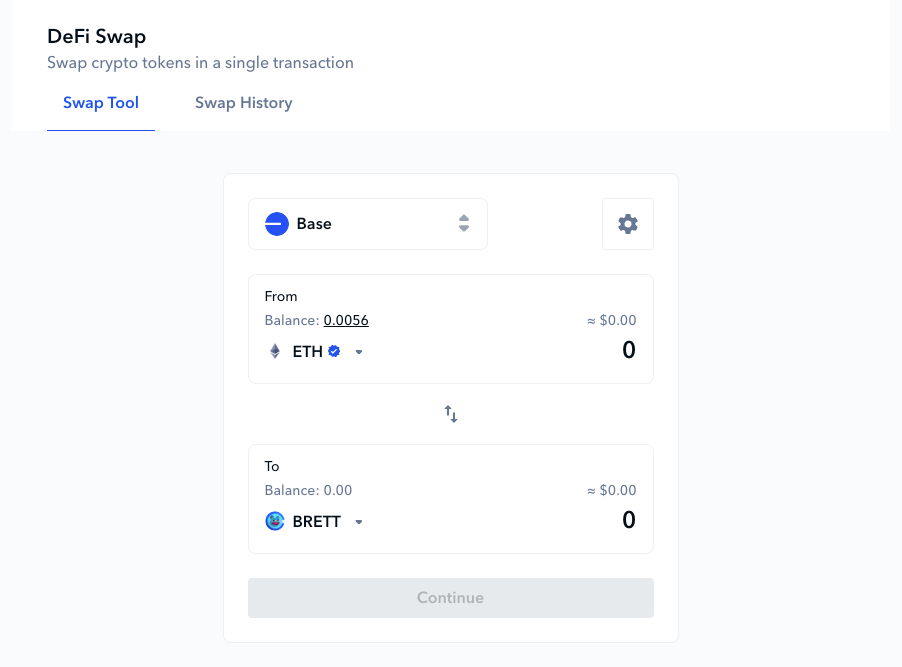

3. DeFi Swap Aggregator

De.Fi’s DeFi Swap Aggregator operates in a manner similar to DefiLlama’s LlamaSwap, offering users the ability to aggregate prices from multiple decentralized exchanges (DEXes) such as Uniswap, 1inch, and others. The purpose of both aggregators is to ensure that users receive the best possible swap rates by comparing prices across several platforms. However, De.Fi takes this functionality to the next level by tightly integrating the swap aggregator with its portfolio dashboard and market data.

This integration allows users to not only find the best rates but also seamlessly transition from analyzing their holdings to executing swaps without leaving the platform. For instance, if a user notices a favorable swap opportunity while reviewing their portfolio’s performance, they can execute the swap immediately within the same interface. This smooth interaction between tools ensures that users can respond to market changes quickly and efficiently, streamlining their DeFi activities.

Additionally, the DeFi Swap Aggregator works in tandem with De.Fi’s Explore Yields tool, allowing users to discover staking opportunities while managing swaps. Whether users are looking to exchange tokens or maximize yield farming, De.Fi’s platform provides an efficient, integrated solution that enhances the overall DeFi experience, making it a superior choice compared to other aggregators.

4. Enhanced Security Features

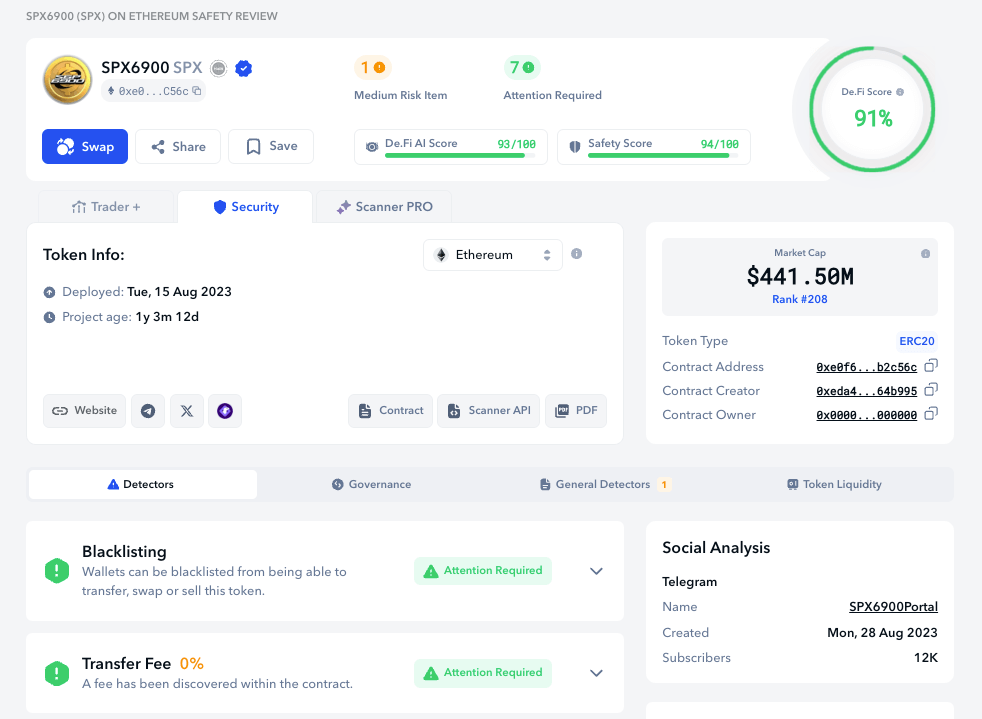

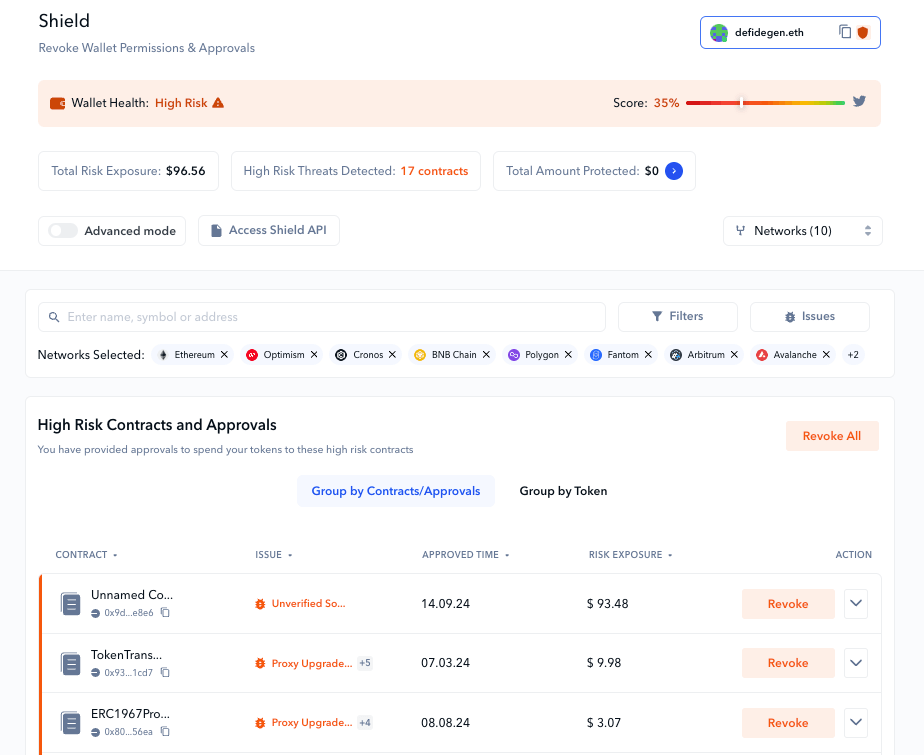

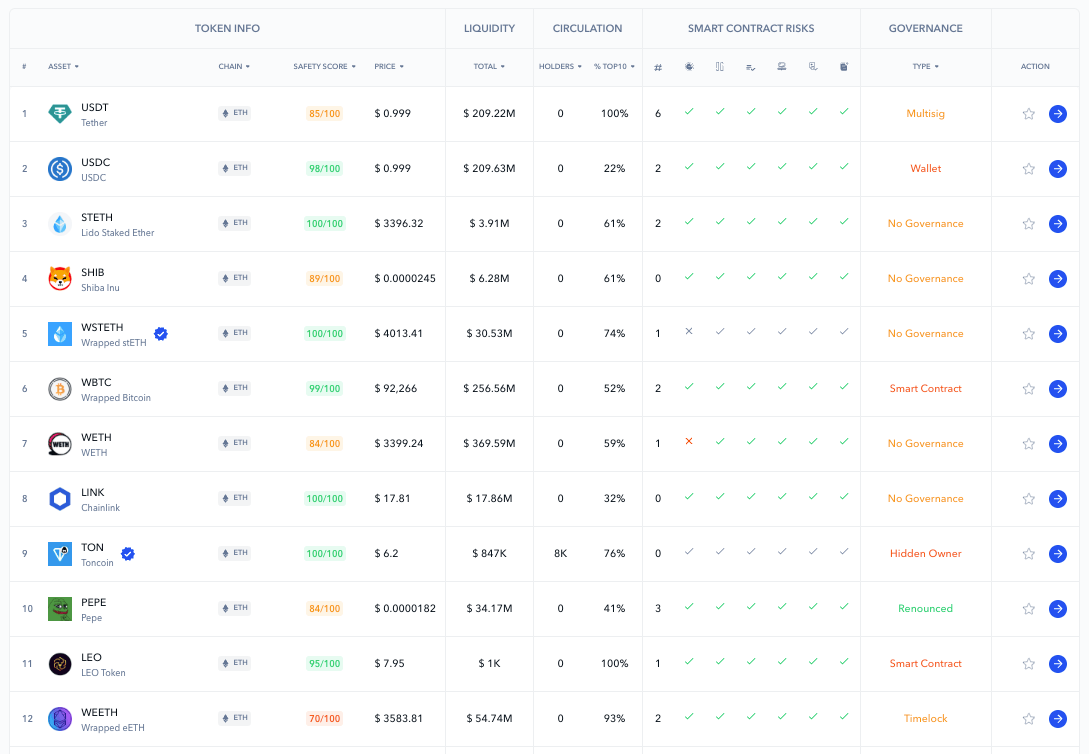

Security is a core strength where De.Fi significantly outperforms DefiLlama. De.Fi’s Web3 Antivirus Suite is composed of two powerful tools: the De.Fi Scanner and the De.Fi Shield, both designed to protect users from the inherent risks of interacting with DeFi protocols.

The De.Fi Scanner is a real-time auditing tool that enables users to analyze smart contracts across multiple blockchains. This tool identifies potential vulnerabilities like token liquidity issues, governance risks, and dump schemes, providing a comprehensive view of each contract’s safety profile. By scanning for these risks proactively, users can avoid interacting with unsafe or unstable protocols.

The De.Fi Shield adds another layer of security by giving users control over their token approvals. As DeFi users often grant smart contracts permissions to manage their tokens, the Shield allows them to monitor these approvals and instantly revoke access from any risky contracts with a single click. This feature is particularly important for users who want to mitigate risks associated with malicious or poorly managed protocols. Such granular control over token permissions is not available on DefiLlama, positioning De.Fi as a superior DefiLlama data vs De.Fi option for users prioritizing security.

Additionally, De.Fi enhances security with an AI-powered risk analysis tool that provides a detailed safety score. This score is calculated using key factors such as code quality, the longevity of the project, and the trustworthiness of the community, giving users an additional data point to assess the security of any DeFi protocol. These advanced security features make De.Fi a go-to platform for users who value both transparency and safety in their DeFi activities.

5. Crypto Market Overview

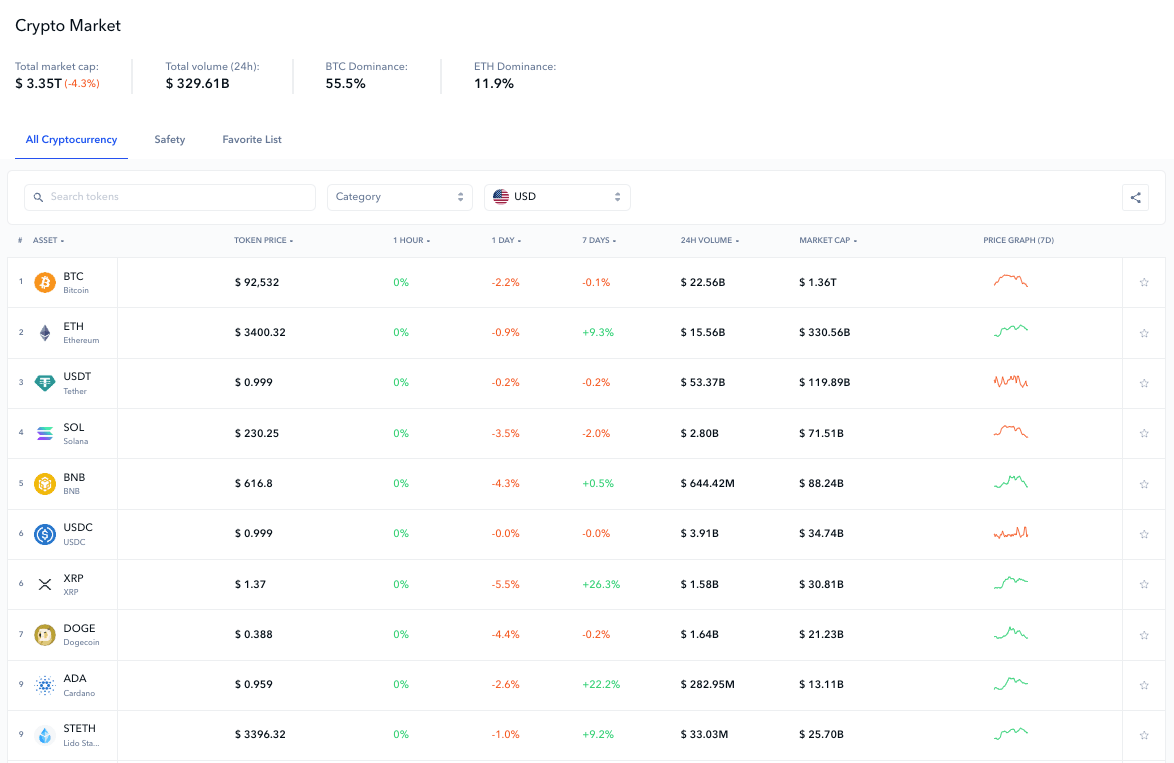

Another standout feature that makes De.Fi a superior DefiLlama website alternative is its Crypto Market Overview. This tool integrates traditional market data with DeFi-specific metrics, providing users with a holistic view of token performance.

The De.Fi crypto market overview page

It goes beyond just tracking total value locked (TVL) and yields, as DefiLlama does, by incorporating critical security information alongside financial data. This dual approach allows users to evaluate both the potential rewards and risks associated with any given token, making it a more comprehensive option for those who prioritize security as much as performance.

Crypto market security overview page

De.Fi’s token pages offer an in-depth analysis of each token, detailing liquidity levels, staking opportunities, and swap functionalities. De.Fi provides an expansive set of data points that cater to investors seeking both detailed performance metrics and security insights. Users can examine how tokens perform across multiple DeFi protocols, explore liquidity across different networks, and even access integrated swap options directly within the token page.

This level of detail, combined with the platform’s focus on security and usability, makes De.Fi a robust DefiLlama competitor. It empowers users to make informed decisions by offering a clearer, more comprehensive view of both the financial and security aspects of their DeFi investments.

Educating Yourself With De.Fi

In addition to its powerful suite of tools, De.Fi places a strong emphasis on education within the DeFi space, recognizing that informed users are better equipped to navigate the complexities and risks of decentralized finance.

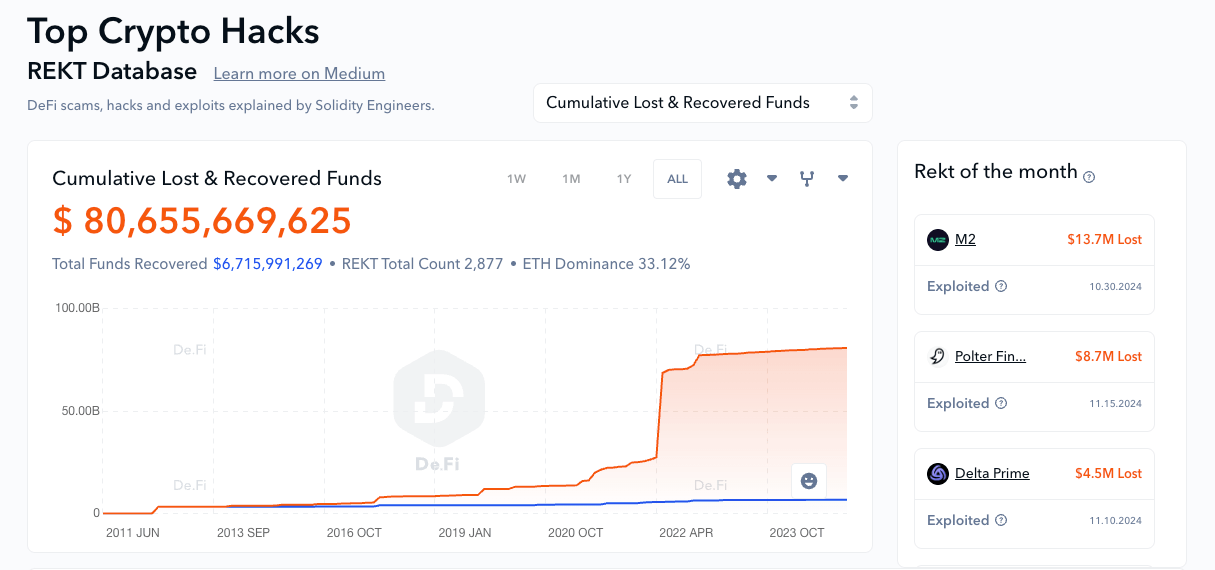

De.Fi’s commitment to education is most prominently seen through its Audit database and REKT database. These databases provide users with comprehensive reports on both current and past DeFi projects, allowing them to make well-informed decisions about where to invest or avoid risk. While DefiLlama offers a hacks and exploits database that tracks notable security breaches, De.Fi goes a step further by offering detailed research into the underlying causes of these breaches, potential protocol risks, and yield strategies.

The Audit database serves as a public good, containing rigorous analysis of DeFi protocols. This includes a breakdown of smart contract code audits, assessments of liquidity, governance models, and any identified vulnerabilities. Users can leverage this resource to gain a deeper understanding of the security and stability of various projects before committing their assets.

Meanwhile, the REKT database compiles an extensive list of historical hacks, scams, and exploits, giving users a clear view of potential pitfalls in the DeFi space and teaching lessons on how to avoid them. This comprehensive repository covers everything from rug pulls to protocol failures, offering invaluable insights for both new and experienced investors.

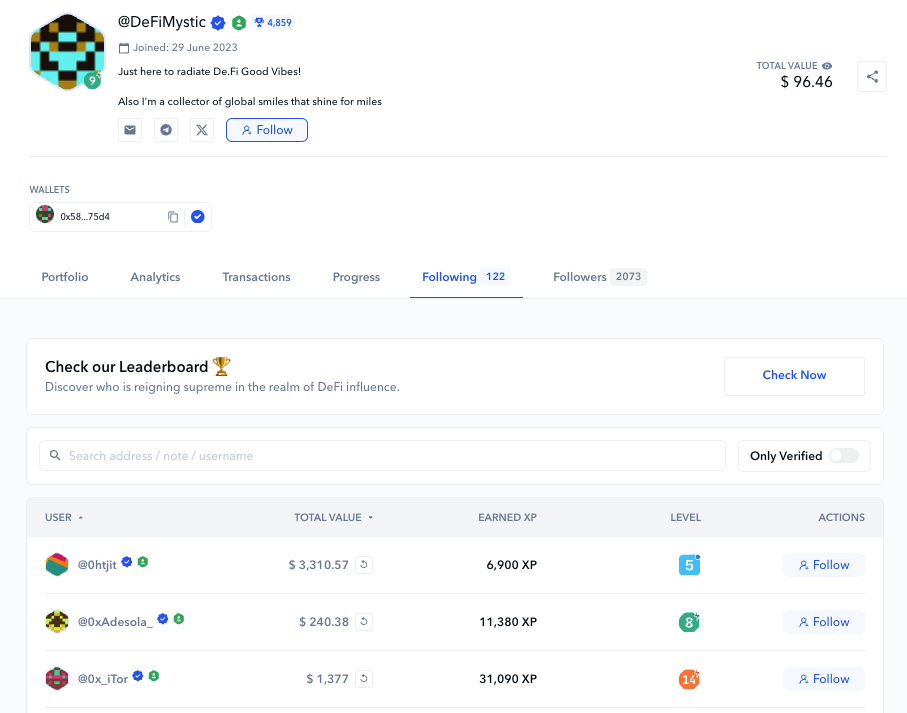

De.Fi also integrates SocialFi features, allowing users to tap into the collective intelligence of the DeFi community and discover valuable insights or “alpha” from fellow investors and enthusiasts. SocialFi, a blend of social media and decentralized finance, creates a network where users can share their experiences, yield strategies, security concerns, and other insights within the DeFi ecosystem.

Profile overview for @DeFiMystic

Beyond these resources, De.Fi actively fosters a vibrant community of users through its educational blog and social media channels. The blog covers a wide range of topics, from the basics of DeFi concepts to in-depth articles on the hottest narratives in the space, such as yield farming, staking, and liquidity provision. This educational content is updated frequently, keeping users informed about the latest trends and developments in DeFi.

Moreover, De.Fi’s presence on platforms like X (formerly Twitter) ensures that its users stay up-to-date with real-time updates on project developments, security news, and market shifts. This continuous flow of information positions De.Fi as a reliable educational resource within the DeFi space.

For users seeking to stay ahead of the curve and mitigate risks, De.Fi’s extensive educational resources provide a solid foundation. Whether you’re looking for in-depth protocol analyses, security updates, or tutorials on maximizing yields, De.Fi ensures that its users have the knowledge needed to navigate the DeFi landscape with confidence.

Get Started Today With De.Fi

For users searching for a more comprehensive DefiLlama website alternative, De.Fi offers a well-rounded solution that combines advanced portfolio management tools, real-time yield tracking, enhanced security features, and a wealth of educational resources. Whether you’re a seasoned DeFi investor or just starting your journey, De.Fi provides everything you need to manage, secure, and grow your digital assets effectively. Start exploring with De.Fi today and take control of your crypto investments like never before!