Managing assets across multiple wallets and blockchains can quickly become overwhelming in the fast-evolving world of crypto. Whether you’re an investor, trader, or DeFi enthusiast, you likely hold assets across various chains, platforms, and wallets. This is where effective crypto wallet tracking becomes essential.

In this guide, we’ll explore how to track multiple crypto addresses using De.Fi, the best tools and features available, and why De.Fi stands out as the ultimate solution for managing a cross-chain portfolio.

What is Wallet Address Tracking?

Wallet address tracking is the process of monitoring and managing digital assets held in one or more wallets. Each crypto wallet has a unique address, which serves as an identifier on its specific blockchain network. By tracking wallet addresses, users can monitor their holdings, transactions, and the performance of their assets.

With the rise of multichain ecosystems like Ethereum, Solana, Cosmos, and others, it’s common for users to hold assets in multiple wallets, often across different blockchains. Tracking multiple crypto addresses is crucial for investors to maintain a comprehensive view of their holdings. Whether it’s for personal finance management, tax reporting, or portfolio analysis, the need to track multiple wallets is growing in importance. Many users find themselves managing several wallets due to security practices, specific use cases, or simply being involved in multiple blockchain ecosystems.

How to Track Multiple Wallets With De.Fi

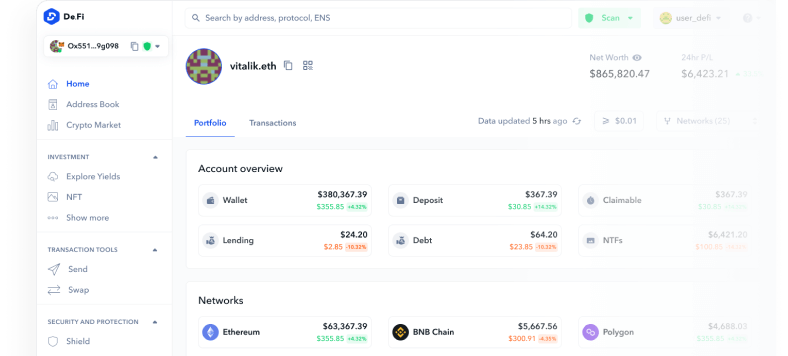

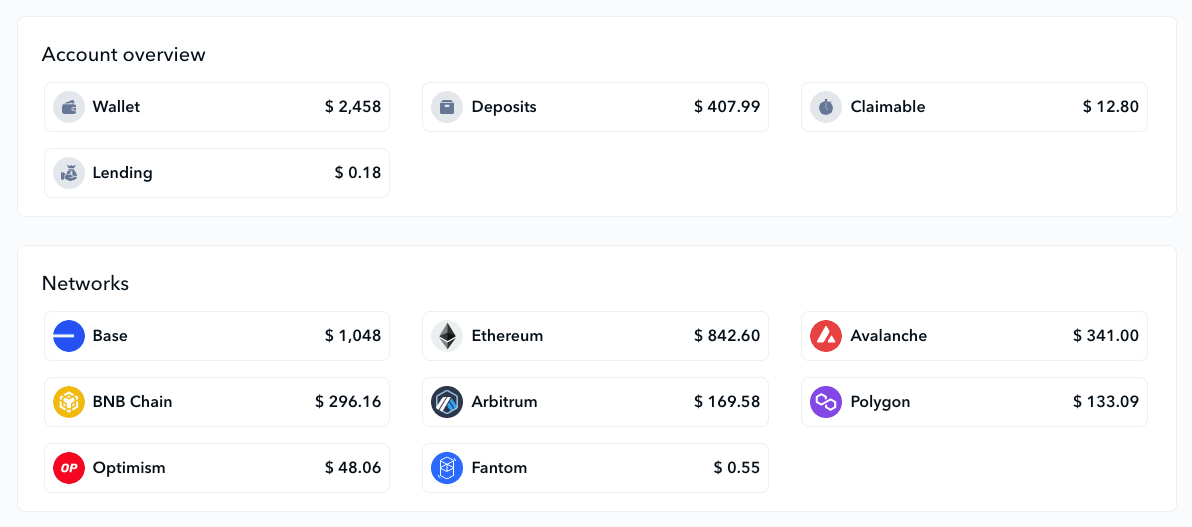

A standout feature of the De.Fi Portfolio Tracker is the ability to create address bundles, allowing users to group multiple wallet addresses and view all their assets as one unified portfolio. This is a game-changer for those managing multiple wallets or involved in yield farming across various protocols. Additionally, users can monitor holdings from connected centralized exchange accounts, providing even greater flexibility.

4/ Now, make a bundle of all of your web3 wallets and CEX accounts: we will fetch data about all of your positions in a single dashboard.

— De.Fi | De.Fi World 2024, Bangkok Nov 11th (@DeFi) July 29, 2024

🚨 Important: please make sure that you only allow “Enable Reading” for API restrictions! pic.twitter.com/cPS4Dq4hG0

By consolidating these addresses into bundles, users gain a comprehensive, real-time view of their entire portfolio, simplifying the analysis of their overall investment strategy. The process of tracking multiple wallets through De.Fi is made effortless thanks to its intuitive interface and robust Address Book feature. Here’s a step-by-step guide to get you started:

Sign Up or Log In to De.Fi: Start by navigating to the De.Fi dashboard. If you’re a new user, sign up for a free account. Existing users can simply log in to access the dashboard.

- Access the Address Book Feature: Once logged in, head to the “Address Book” tab on the left-hand sidebar. This feature allows you to save multiple wallet addresses from different blockchains in one place.

Add Wallet Addresses: Click on the “Add Address” button. De.Fi supports a wide range of blockchains, including EVM (Ethereum, Binance Smart Chain, Polygon, etc.), Solana, Cardano, Cosmos, and Tezos. Enter the public addresses for each of your wallets, and De.Fi will automatically import your data.

Create Address Bundles: For users managing several wallets across different chains, the “Address Bundles” feature is a game changer. To create a bundle, simply group multiple wallet addresses together. This allows you to view and manage the collective assets of these addresses as a unified portfolio.

While the basic version of De.Fi provides a solid set of tools, upgrading to De.Fi Pro unlocks a suite of premium features. De.Fi Pro users benefit from more detailed analytics, priority support, and enhanced security solutions, offering unparalleled protection for your assets.

Additionally, De.Fi Scanner PRO integrates advanced AI algorithms with cutting-edge blockchain technology to offer unparalleled protection against smart contract threats and crypto scams. By joining the waitlist, you’ll be among the first to access this next-level security solution and ensure your assets are safeguarded with the most advanced tools available.

The Best Tracker for Multiple Crypto Addresses

De.Fi makes tracking multiple wallets not only efficient but also incredibly comprehensive. Users can monitor assets across centralized exchanges, yield farming protocols, and liquidity pools—all from the same platform. This holistic view of your assets enhances your ability to make well-informed decisions, giving you the strategic edge you need in the fast-paced world of DeFi. Our app addresses the complexities and dynamic nature of managing assets across the decentralized finance spectrum.

In a domain where asset diversification not only spans various tokens but also across multiple blockchains, the need for a comprehensive tool to consolidate and track these assets becomes indispensable. This is where the De.Fi Portfolio Tracker positions itself as an essential DeFi tool for both novice and veteran participants in the DeFi ecosystem.

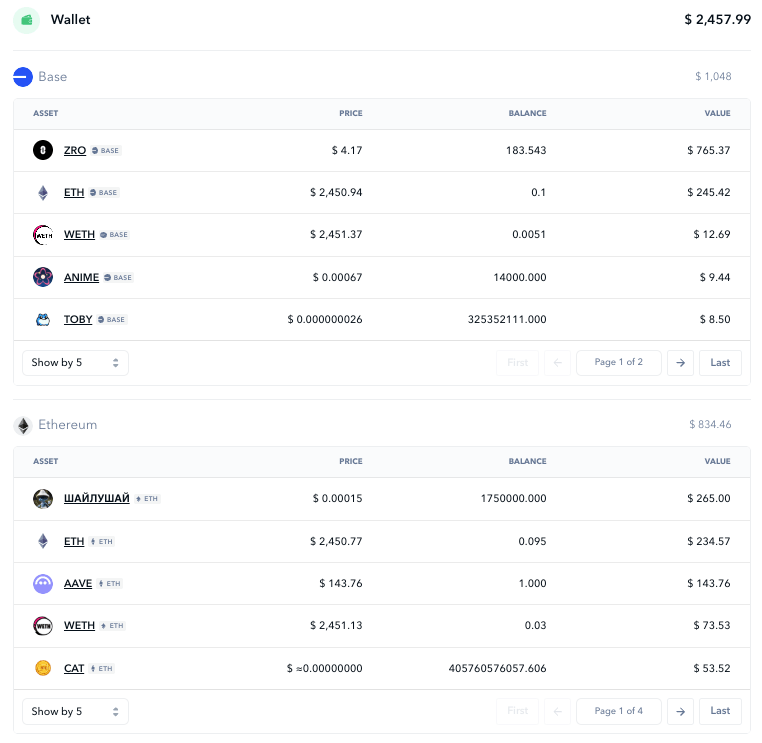

List of Assets on Different Networks

One of De.Fi’s primary goals is to cater to the diverse needs of the entire crypto community. The Portfolio Tracker is a testament to this commitment, supporting over 44 networks and 280 protocols, including all major networks such as Ethereum, Arbitrum, Solana, Cardano, Polygon, and Cosmos.

Assets across multiple chains in the De.Fi portfolio dashboard

This extensive network support means that no matter where your assets are held, De.Fi can track them. For users engaged in yield farming, staking, or trading, this feature is indispensable. The ability to seamlessly track assets across multiple chains—especially in a fragmented DeFi space — positions De.Fi as the ideal tool for serious investors looking for comprehensive and efficient portfolio management.

Comprehensive “Portfolio” and Historic “Transactions” Dashboards

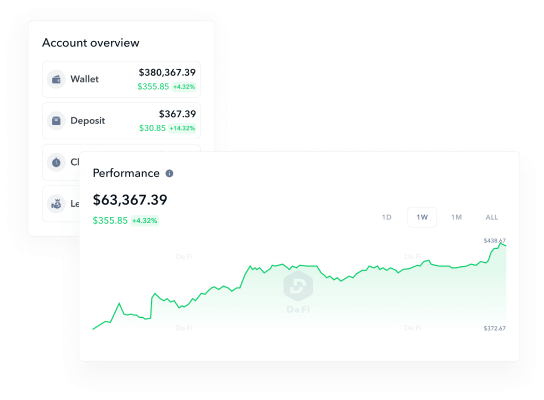

The De.Fi “Portfolio” is a wonder in itself, presenting a meticulously designed dashboard that segments assets into clear categories: Wallet, Deposits, Claimable, and Lending. They come together to offer a rich view of your financial standing:

Wallet: Get a real-time snapshot of your available funds, providing an up-to-the-second view of your liquid assets.

Deposits: A detailed rundown of your staked assets across various protocols, aiding in insightful strategy formulation and asset management.

Claimable: A user favorite, this feature showcases awaiting rewards or airdrops that your wallets qualify for. Never miss out on opportunities that you may have previously overlooked.

Lending: Gain insights into loaned crypto assets, expected returns, and prevailing interest rates. A section designed to keep your lending ventures profitable and secure.

The historic “Transactions” dashboard retains a detailed log of all past activities, offering a comprehensive view whenever you wish to revisit your transaction history. This is especially helpful for tax-conscious users who want to meticulously track all activity for reporting purposes.

Robust Antivirus Features: Scanner and Shield

In such a rapidly developing industry as crypto, hacking remains a widespread problem and a significant barrier to widespread adoption. At De.Fi, we take security seriously and offer a comprehensive approach with our Crypto Antivirus Product Suite, designed to act as your personal financial bodyguards in the DeFi space.

Our suite is made of two equally powerful tools, Scanner and Shield. One covers you when you need to research a new asset to invest in, while the other double-checks to confirm that previous transactions did not leave your wallet vulnerable.

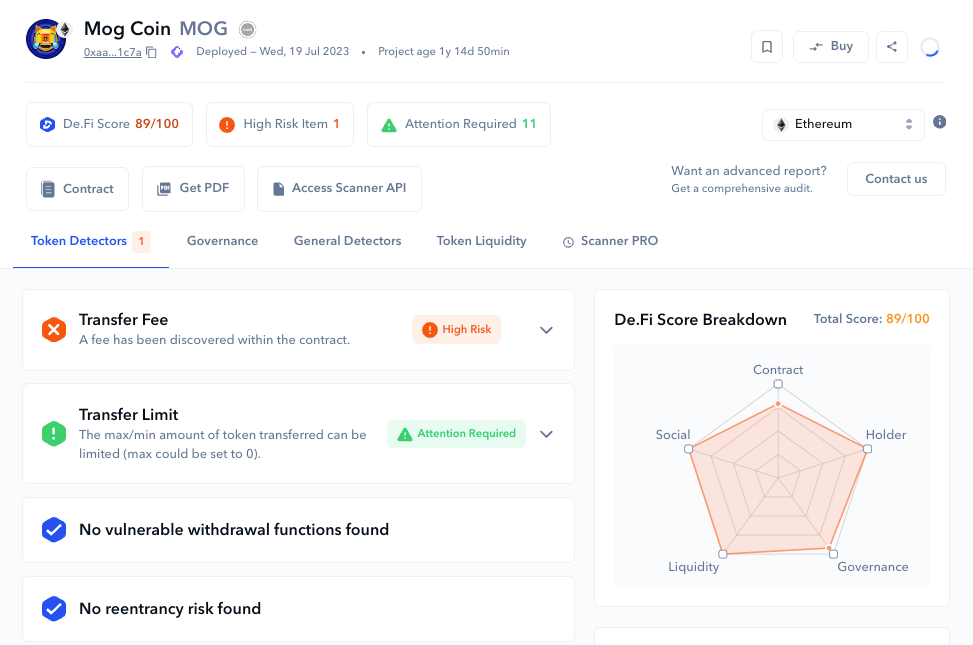

De.Fi Scanner

DeFi Scanner is the best free smart contract auditor in the industry. Plug in the address of any smart contract, token, or NFT and you’ll receive a full report analyzing the code and highlighting whether or not there are worrisome signs you should take note of.

MOG analysis via De.Fi Scanner

With more and more users venturing towards the Wild West of on-chain trading, having a crypto asset scanner within your DeFi dashboard of choice is a no-brainer. With De.Fi, you’ll only be a few clicks away from auditing any.

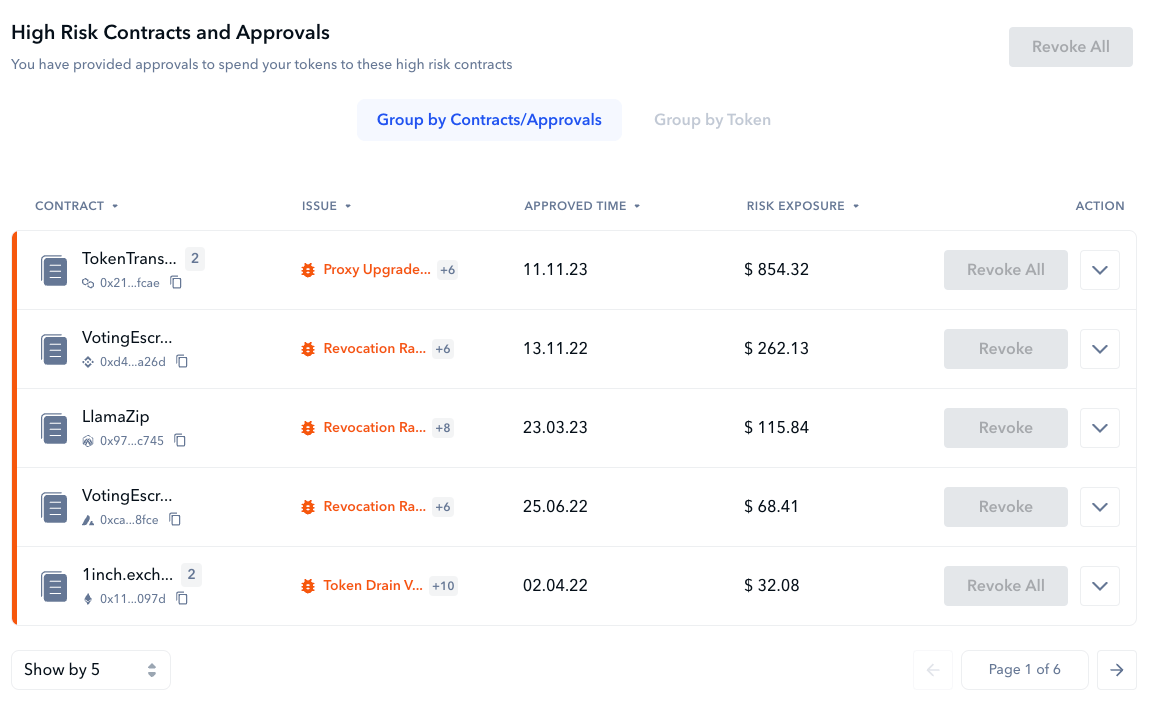

De.Fi Shield

One of the most common ways that people get REKT in DeFi is by granting wallet permissions to malicious or poorly coded smart contracts. Shield is an all-in-one wallet permissions manager that defends you from falling victim to these exploits. Connect your DeFi wallet and get a report within seconds regarding potentially harmful vulnerabilities.

A sample De.Fi Shield report

Once you’ve reviewed your custom report, we also allow you to revoke any suspect wallet permissions with a single click, drastically increasing your portfolio security. If you want true peace of mind for your crypto assets, there’s no reason to use a tracker that doesn’t have robust security measures such as these built-in.

CoinMarketCap of Security

At De.Fi, we’re committed to staying ahead of the curve by bringing innovative solutions to the way users interact with the crypto market. That’s why we’ve developed the De.Fi Coinmarketcap of Security suite, a cutting-edge resource that combines innovative security tools, such as the De.Fi Scanner, a multi-layer solution that is capable of performing a comprehensive technical audit and liquidity analysis of any token in just a few seconds, combined with the market page of over 5,000+ tokens with pricing & market cap data updated in real-time.

The Crypto Market page on De.Fi is a comprehensive resource for anyone involved in DeFi. It provides an extensive overview of different tokens, including their current prices, market capitalizations, and additional relevant data. This feature is particularly beneficial for users looking to make informed decisions about their DeFi investments.

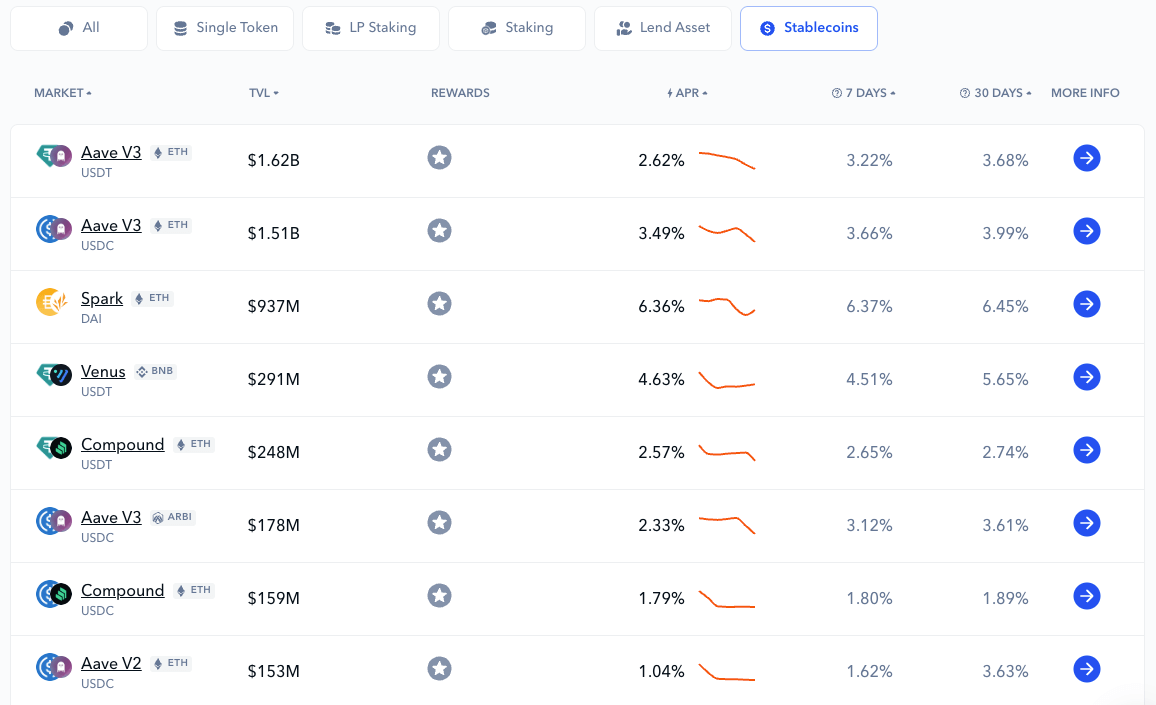

Integration with Explore Yields

The Explore Yields section of De.Fi is a top destination for yield farmers and degen enthusiasts seeking how to put their money to work. This feature is seamlessly integrated into the De.Fi dashboard, enabling users to effortlessly locate and assess yield farming and staking options across a wide range of DeFi platforms.

Explore Yields Stablecoin Data

The tool organizes opportunities based on various metrics, including asset allocation, Total Value Locked (TVL), yield rates, and historical data. It also allows users to sort by chain, protocol, and type of activity, offering a personalized investment plan that helps optimize portfolios efficiently.

Additionally, De.Fi provides advanced tools such as the Crypto Profit Calculator, which forecasts potential gains from investments in Bitcoin, Ethereum, and tokens across 40+ blockchain networks. Users can also utilize the APR to APY Calculator to better understand the potential returns on their investments.

De.Fi’s Complete Suite

Beyond its tracking and security tools, De.Fi is dedicated to educating the crypto community. The platform provides an extensive range of resources, including:

Audit and REKT Databases: De.Fi offers in-depth research on hacked and exploited projects to keep the community informed and protected by offering Audit and REKT databases as public goods. These resources provide users with in-depth research on a wide range of DeFi projects, helping to evaluate the safety and integrity of various platforms.

- Educational Blog: De.Fi’s blog (you’re on it now!) features weekly articles covering everything from fundamental crypto concepts to the latest DeFi trends. Whether you’re a beginner or an experienced user, the blog is a key resource for staying informed.

Social Media Channels: With an active presence on Twitter through @DeFi and @De_FiSecurity accounts, De.Fi regularly shares tutorials, the latest developments, security insights, and trends about the Web3 world.

By following De.Fi on all these channels, users can stay ahead of the curve in both DeFi opportunities and best practices for safeguarding their assets. We encourage visitors to leverage these resources to the fullest, nurturing a path of continuous learning and safe exploration of the on-chain universe.

Worried you’re NGMI? Wondering how to keep your capital safe until the next bull run? De.Fi stands tall as the beacon of reliability, versatility, and educational prowess in the decentralized finance landscape. Enhance your crypto journey and protect your assets with De.Fi.