De.Fi Bundles, De.Fi AI Score, Scanner Advanced Tab & AI Agent and MORE! - June Development Recap

June was a month of big releases and improvements across...

As we move into the second half of 2023, De.Fi, the Web3 SuperApp, has been forging ahead.

Some key achievements of the past two weeks include the successful integration of two new protocols: QuipuSwap and Youves. Additionally, our efforts extended to in-depth exploration and analysis of a whopping 110 scams that occurred within the second quarter of the year.

Furthermore, De.Fi’s evolution hasn’t gone unnoticed in the wider crypto ecosystem, with notable coverage from esteemed platforms like CoinTelegraph, TradingView, and TechCrunch, among others.

Let’s delve into a detailed recap of the significant developments that transpired at De.Fi in the latter half of June 2023, as we continue on our journey to transform the world of decentralized finance.

Integration of QuipuSwap and Youves Protocols

Last week marked a significant step forward for De.Fi as we successfully integrated two new protocols into our platform: QuipuSwap and Youves. We’re delighted to extend a warm welcome to both of them into our burgeoning DeFi ecosystem. Both these integrations play a vital role in enhancing our SuperApp’s functionality, which significantly benefits the Tezos community.

QuipuSwap, an open-source Automated Market Maker (AMM) protocol, offers a user-friendly interface for seamless Tezos token exchanges. With the integration of QuipuSwap into De.Fi, users can now effortlessly track their QuipuSwap balances and positions. Furthermore, they can explore and capitalize on new yield opportunities with QuipuSwap tokens ($QUIPU), paving the way for a more robust investment experience.

In addition, we are thrilled to have Youves, the premier synthetic assets provider on Tezos, as part of the De.Fi ecosystem. With Youves now integrated into our SuperApp, users can aggregate and manage all their assets in one place. This includes their Tezos wallets, wallets from 44+ other chains, and Centralized Exchange (CEX) accounts. The integration allows for simultaneous tracking of all positions, providing a comprehensive and cohesive view of users’ financial portfolios.

These integrations not only expand the capabilities of De.Fi’s SuperApp but also contribute significantly to making decentralized finance more accessible, secure, and profitable for the Tezos community and beyond. Visit de.fi/explore to learn more and take advantage of these features!

Report: $204M Stolen in Q2 2023

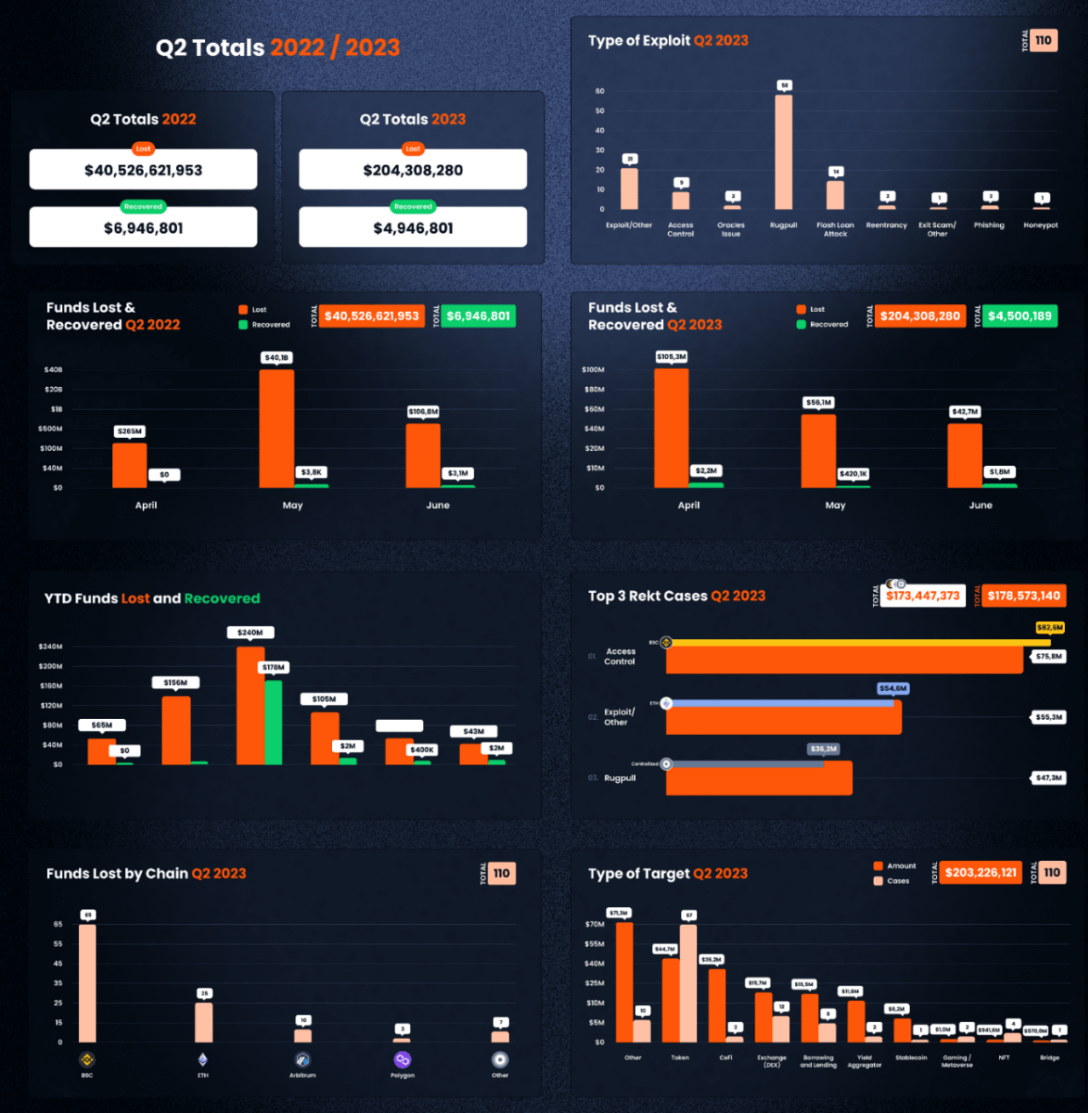

In the second half of June, our Research Department carried out a comprehensive on-chain investigation into all of the 110 scams and hacks that transpired in Q2 2023.

The thorough probe has led to the identification of new trends adopted by scammers as well as the detection of new methods of scamming. We would like to share some of the investigation’s crucial findings:

Firstly, it is important to note that the total amount of crypto lost in Q2 2023 was less than 1% of the total loss in Q2 2022. This indicates an improvement in the overall security within the crypto ecosystem and a reduction in successful scamming and hacking attempts.

Regarding the blockchain platforms that were most targeted by hackers, the top three chains with the most hacks in Q2 were BNB Smart Chain ($BSC), Ethereum ($ETH), and Arbitrum ($ARB). These platforms, although diverse in their offerings, were the most affected, indicating a need for improved security measures.

Meanwhile, the most significant hack of Q2 was that of the Atomic Wallet, with $35 million stolen.

Our Research Department’s detailed findings and additional insights can be found in the comprehensive report.

The completion of this investigation enables us at De.Fi to enhance our preventive measures, improve our security standards, and better equip our users against potential scams and hacks. The insight from this research will also be invaluable in influencing and improving practices across the crypto industry.

De.Fi Media Mentions

Our comprehensive research on the scams and hacks in Q2 2023 has garnered attention and recognition from the world’s leading financial technology publications, further amplifying the findings and insights generated by De.Fi’s research team.

Cointelegraph, a major blockchain news outlet, utilized our research data in their article, which can be accessed here.

Investing.com, a global financial market news and analysis website, also highlighted our findings in their cryptocurrency news section. You can read the full article here.

Additionally, TradingView, a platform for traders and investors, echoed our research data in their news segment. To delve into the details, check out the full article.

TechCrunch, a leading technology media property, also featured our research data in their coverage. The detailed article can be found here.

Coin Bureau a well-known reliable source for crypto news and valuable educational content that keeps everyone up to date on important matters in the Web3 space has featured De.Fi in 2 articles this month. 1st How to Protect Yourself from Pump-and-Dump Scams and 2nd Reliable ways to check Blockchain Audits and Stay Safe.

Last but not least, Outlook India, one of India’s most widely read English magazines, also highlighted our research findings in their cryptocurrency news coverage. You can read their full article here.

Beyond the media, there was also a new project launched that is using our DeFi API, TrustScore. TrustScore aggregates info on crypto projects so that users can spot legitimate web3 platforms that are worth investing in (not scams). Check them out!

The widespread recognition and application of our research data underscore De.Fi’s leading role in enhancing transparency, security, and integrity in the decentralized finance landscape.

As the Crypto market gets back on the front foot, we will continue to bring you the latest narratives and alpha in the Crypto space, while equipping you with all the tools you need as an early investor in Web3.

June was a month of big releases and improvements across...

The end of May brought important updates across...

The start of May was filled with key updates and powerful...

The second half of April brought a lot of...

April started with innovation, milestones, and new...

March was a busy and impactful month for the De.Fi Ecosystem. We launched a ...

© De.Fi. All rights reserved.