Today, De.Fi turns 1, and it’s quite amazing to reflect on how much progress we have made in such a short amount of time.

In this article, we’ll look back to when it all began, the major milestones we’ve hit along the way, and the future that awaits. We also want to celebrate our 1st anniversary by saying thank you to everyone who has helped build and support De.Fi along the way.

For those of you who, like us, are excited about what the next year holds, one of the most significant announcements we will make soon is about the De.Fi token. More on that later, but first, let’s look back and reflect on what has been a truly incredible year.

Looking back at a year of amazing growth

One year ago, we reflected on a major crypto crash that had affected the whole crypto market and looked ahead to see what opportunities would emerge. One year on, and we’re doing the same thing!

While some things are the same, some are totally different, and that’s because of our many major achievements in the last year. These include:

- De.Fi is now established as the safest and most accessible DeFi yield farming ecosystem available.

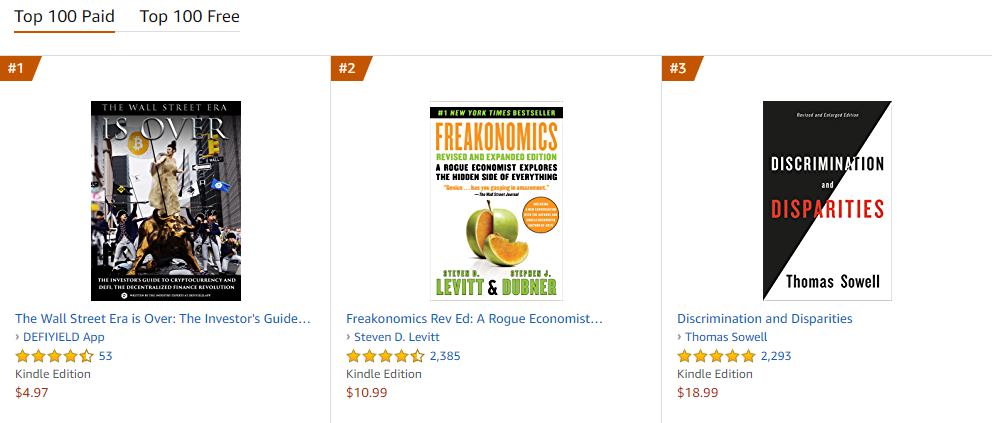

- We published the No1 Amazon bestselling DeFi bible, an investor’s guide to cryptocurrencies and DeFi.

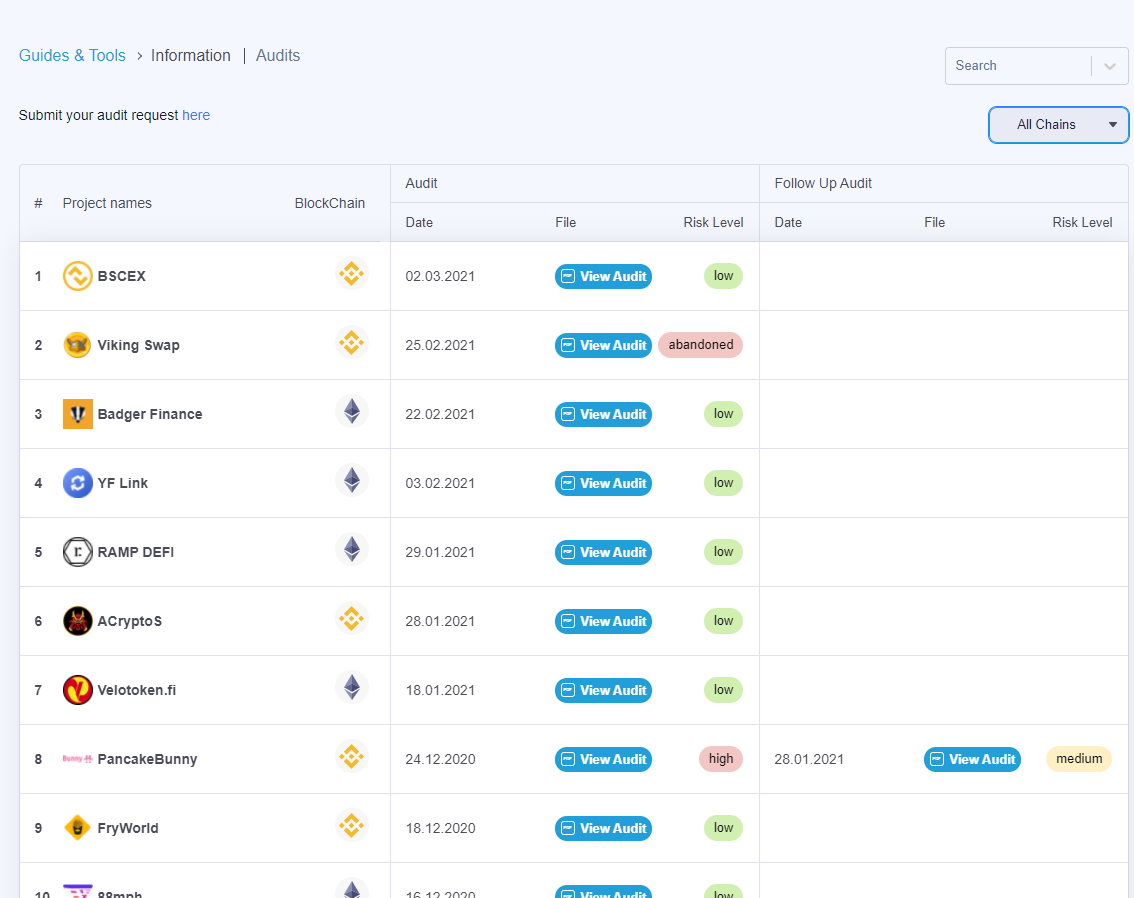

- We’ve opened access to the world’s first web archive of smart contract audits to help keep DeFi users safe.

- Our open community for DeFi advice and yield farming has grown to over 5,600 members.

Decentralized Finance evolves at breakneck speed, and we’ve had to work hard to keep up. That will never change, and nor will our core principles. These were taking shape a year ago, but they have solidified over time and are now the convictions we live by.

Firstly, we want to help users succeed in DeFi by generating the best yields from their digital assets. At the same time, we aim to keep users safe by helping them to avoid scams and malicious contracts. In combination, these two goals help us to move closer and closer to our main vision — onboarding as many people as possible into the DeFi revolution.

The major milestones on our journey

Looking back at the last year, we have realized how fast it has gone by and how much we’ve achieved in this short time. Below, you’ll see a brief summary of some of the major milestones we’re passed on our journey.

June 2020

By the end of Spring 2020, after the market had suffered a very sharp plunge, we recognized that digital asset prices were beginning to recover and that the DeFi space showed significant technological and economic growth. However, at the same time, we also noticed a wide range of security issues arising, which malicious actors could exploit to steal funds from thousands of users.

We knew we couldn’t let this stand.

Therefore, we identified two important opportunities for helping the emerging DeFi community. Firstly, we would launch a series of tools that would arm ordinary users with sufficient security against hackers. Furthermore, we would develop software to increase yield farmers’ returns by automating the mundane processes involved in continuous asset relocation across pools.

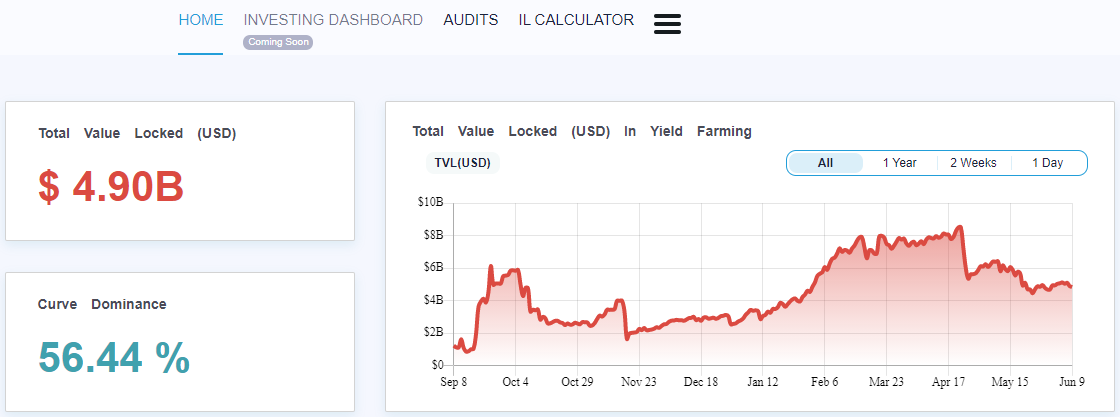

Our excitement at developing these groundbreaking ideas led us to work on these projects full time, even when the Total Value Locked (TVL) in DeFi was less than 1 billion.

Today, the TVL of DeFi is around 100 billion.

July 2020

After an enormous effort by the team, we launched our first APY Aggregator service, which collected financial metrics across different yield farming pools. This enabled ordinary users to start yield farming, not just well-known pools but also the new pools that offer higher returns.

De.Fi Aggregator is now very well-known as a place where users can go to find comprehensive financial information. In fact, De.Fi has reached more than 1 million users in just one year.

August 2020

By this point, yield farming had started to mature, and De.Fi took the initiative to unite all interested parties in one place. Our Telegram group was created at this time and has now brought together over 5700 users to interact and share useful content.

Obvious shilling or advertising is removed from the group almost immediately so that users have a space to exchange information and discuss interesting topics. Currently, it is the largest Telegram group related to yield farming.

September 2020

We knew that there was a big difference between paid and independent security audits, and we knew De.Fi could play a part in improving how DeFi users incorporated them into their investment research.

Essentially, we knew that a paid auditor’s report could always be influenced by the financial incentive they received for producing it. In contrast, an independent auditor would almost always be motivated to perform this sort of in-depth work because of their commitment to meeting the community’s needs when it requested a specific audit.

Therefore, we set out to become the leading independent and community-driven security auditors. As a result, De.Fi has independently audited more than 40 projects, which has enabled the DeFi community to improve its understanding of projects that users interact with daily.

October 2020

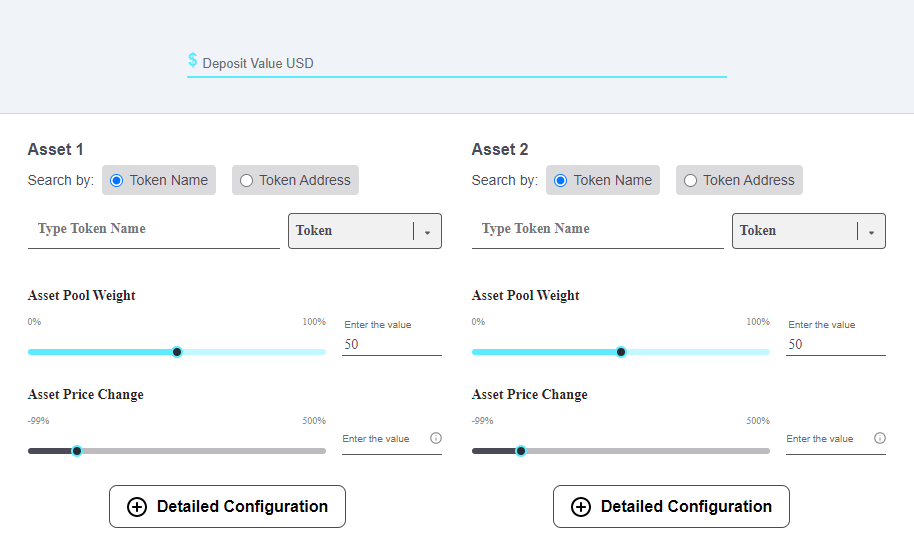

The financial calculations that are needed to stay on top of decentralized finance returns are numerous and complex. Therefore, we decided to release the most advanced Impermanent Loss Calculator available to help users make important calculations and avoid unnecessary losses.

We also released a detailed guide outlining the main principles for calculating impermanent loss, as well as the mistakes users often make that can lead to impermanent loss errors.

November 2020

In the auditing process, we were able to expose several DeFi projects that had malicious code in their smart contracts, which might negatively affect many users. Malicious projects include Alpha Homora, Compounder, and a few others.

It became clearer and clearer how, even where projects conducted seemingly perfect marketing campaigns that increased their trustworthiness within the community, this did not mean they were honest with users. In fact, they intentionally left vulnerabilities in their smart contract code to perform rug pulls and other unlawful actions.

December 2020

After just half a year, we had released a range of tools that became very popular amongst the DeFi community. These included:

- APY Aggregator

- Basic Earnings and Reward Dashboard

- Advanced Impermanent Loss Calculator

- Approved Contracts Tool

- Cancel/Speed Up Ethereum Transactions Tool

- Gas Cost tracker

- Timelock Contract Viewer

February 2021

In the new year, the DEFYIELD team decided to start developing a multi-dimensional security system based on machine learning called De.Fi Safe. This system would be designed to combat all malicious projects and actors intent on exploiting smart contract weaknesses to steal user funds.

As we were increasingly able to analyze smart contracts automatically, we wanted to develop this tool to perform independent, smart contract audits, which would not be influenced by the financial incentives that motivate most auditing firms.

April 2021

After a year of hard work, we had gained significant experience within decentralized finance and the security domain in particular. Therefore, we decided to share this experience with the community by releasing what some are now referring to as the ‘DeFi Bible.’

‘The Wall Street Era is Over: The Investor’s Guide to Cryptocurrency and DeFi, The Decentralized Finance Revolution’ is now a No1 bestseller on Amazon.

May 2021

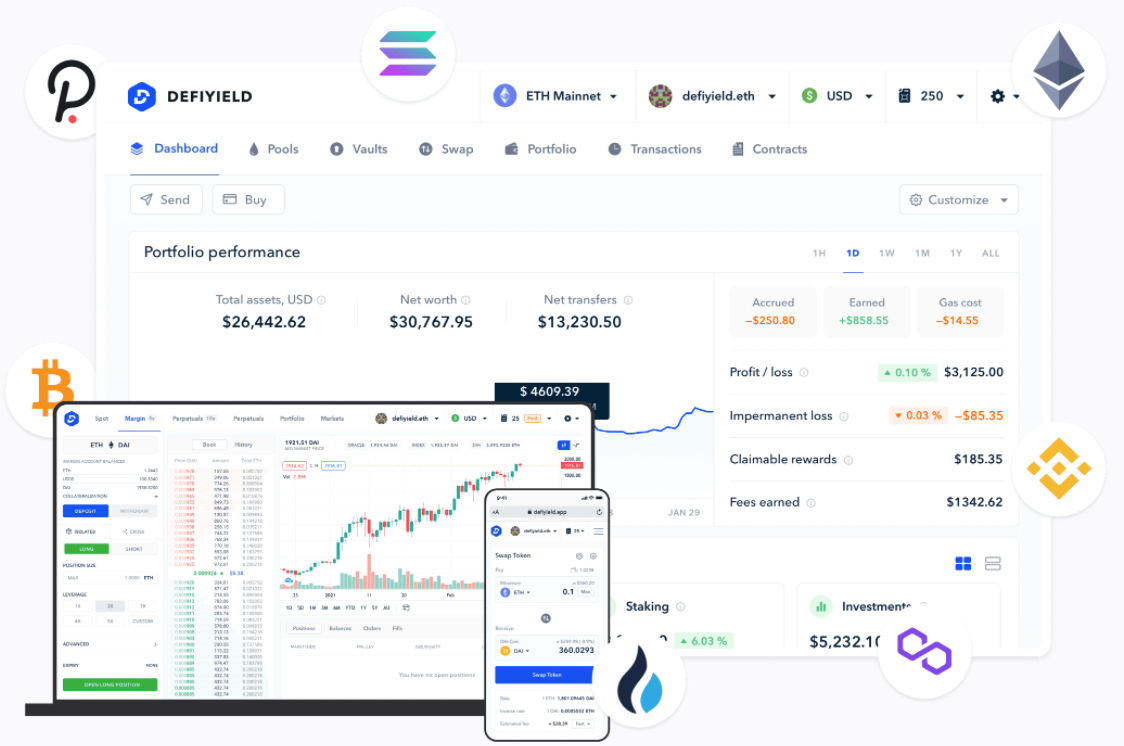

We launched the De.Fi Asset Management Platform, which includes various tools to optimize anyone’s experience of DeFi and their yield farming returns.

As yield farmers often have to interact with numerous pools spread across different protocols, it can be tough to track all the financial metrics held in various places. We resolved this problem by introducing special dashboards for Pools and Vaults that keep track of the user’s assets and provide a detailed financial overview.

Furthermore, the service provides full transaction history, tools for adding or removing liquidity across pools, token staking and unstaking, as well as a range of other important features that yield farmers need. Users can interact with these services using popular wallets, such as Metamask, Ledger, Trezor, Coinbase Wallet, and WalletConnect.

June 2021

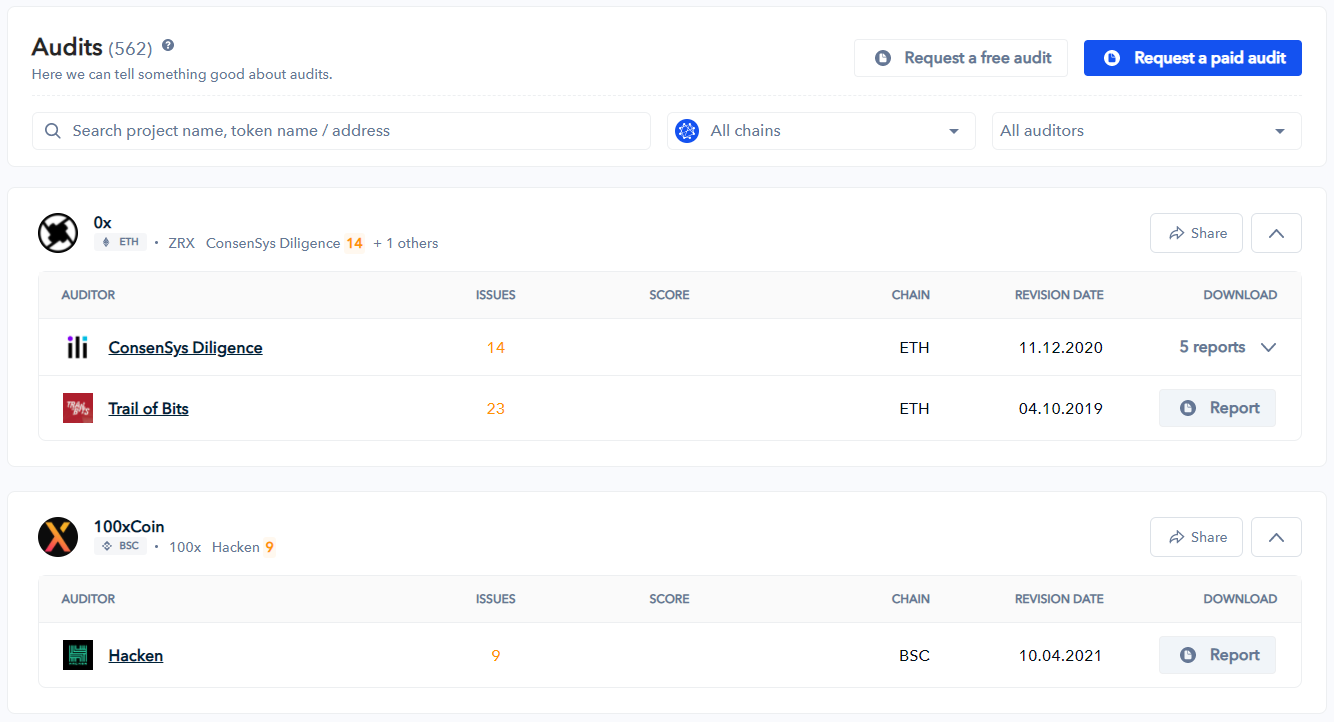

By this time, the DeFi world was starting to realize that all popular DeFi projects had to be verified carefully by different auditors.

From our experience, it is a nontrivial task for an ordinary user to get comprehensive information related to a specific project. Therefore, we decided to make this process as efficient as possible for DeFi users by giving them access to the World’s First Web Archive of Smart Contract Audits.

This is where any DeFi user can go to find a large number of audits from different auditors. They can quickly locate specific issues that a particular project may have and cross-reference security reports from different auditors to examine these issues in more detail.

What’s next? The De.Fi token

And so we are here, at the start of Summer 2021, with a year of amazing growth behind us and a future full of promise ahead.

Looking back, we would like to reiterate our thanks to everyone who has been with us on this journey, building with us and supporting all we do to help make DeFi a safe and accessible opportunity for anyone. Looking ahead, we are just getting started, and there’s so much more exciting news to come, including….

The De.Fi token!

This is an early announcement of an idea that is in development but which has crystallized over time. Essentially, the complex infrastructure of De.Fi Safe and other services require a utility token that can be used across the ecosystem to open up access to products and incentivize certain user actions.

The De.Fi token will be released soon with a lot more detail about what it is, why it’s needed, and how you can gain access to it, so stay tuned for more information!

Check our guides:

Solana Network Ultimate Yield Farming Guide [Infographics]

Fantom Network Ultimate Yield Farming Guide [Infographics]

Huobi ECO Chain Ultimate Guide for Yield Farming

Polygon Network Ultimate Guide for Yield Farming

Binance Chain Ultimate Guide for Yield Farming