Linea zkEVM by ConsenSys is a network that is gaining popularity and has recently launched on mainnet. The project has received a significant amount of funding (even more than competitor zkSync) – over $725 million from companies such as Microsoft, SoftBank, Temasek, and others.

This amount of funding has generally signaled an airdrop for many other projects, so many crypto participants are excited about Linea’s potential. In this blog, we’ll outline the key details you need to know about Linea as well as highlight the tasks you can complete to potentially position yourself for a lucrative Linea retrodrop.

What is Linea?

Linea presents itself as a “developer-ready zkEVM rollup for scaling Ethereum dapps”. zkEVM stands for “zero-knowledge Ethereum Virtual Machine”. This means that it is an EVM-compatible blockchain (existing Ethereum dapps can be deployed seamlessly) that uses zero-knowledge proofs to scale the work of recording transactions on Ethereum’s mainnet.

As ThirdWeb explains, this is significant because:

“Ethereum nodes only have to process the succinct proof of the computations and state instead of the computation itself. They can then update the state of the Ethereum chain based on minimal, but provably legitimate data.

This massively cuts down the need for computation on the Ethereum network. As a result, zkEVMs deliver unmatched scalability to Ethereum applications while offering lower computation costs and the best security and decentralization.”

This robust technology has both users and developers excited about Linea’s potential to help scale Ethereum’s infrastructure. With the recent mainnet launch, ecosystem hype is reaching all-time-highs:

In just one month, Linea Mainnet has seen 150 partners deploy dapps, 100,000 weekly active users, and more than 2.7 million transactions. 🌐

— Linea (@LineaBuild) August 18, 2023

We’re so grateful for the support of our community ✨https://t.co/N2NHXdYvMa

Below are the official links for Linea online properties. Remember to always be vigilant when completing the airdrop tasks listed below and to only use URLs for the official projects we have listed. Scammers will often use links that look very similar to an official project’s domain as a way of tricking crypto users into connecting their wallets to malicious smart contracts. Stay safe and always check links twice.

- Linea Official Domain: https://linea.build/

- Twitter: https://twitter.com/LineaBuild

- YouTube: https://www.youtube.com/@LineaBuild

- Forum: https://community.linea.build/

- Discord: https://discord.gg/consensys

- Mirror (Blog): https://linea.mirror.xyz/

How to Get the Linea Airdrop

In the video above we outline some of the most basic tasks you can complete to potentially qualify for Linea’s retrodrop. These include:

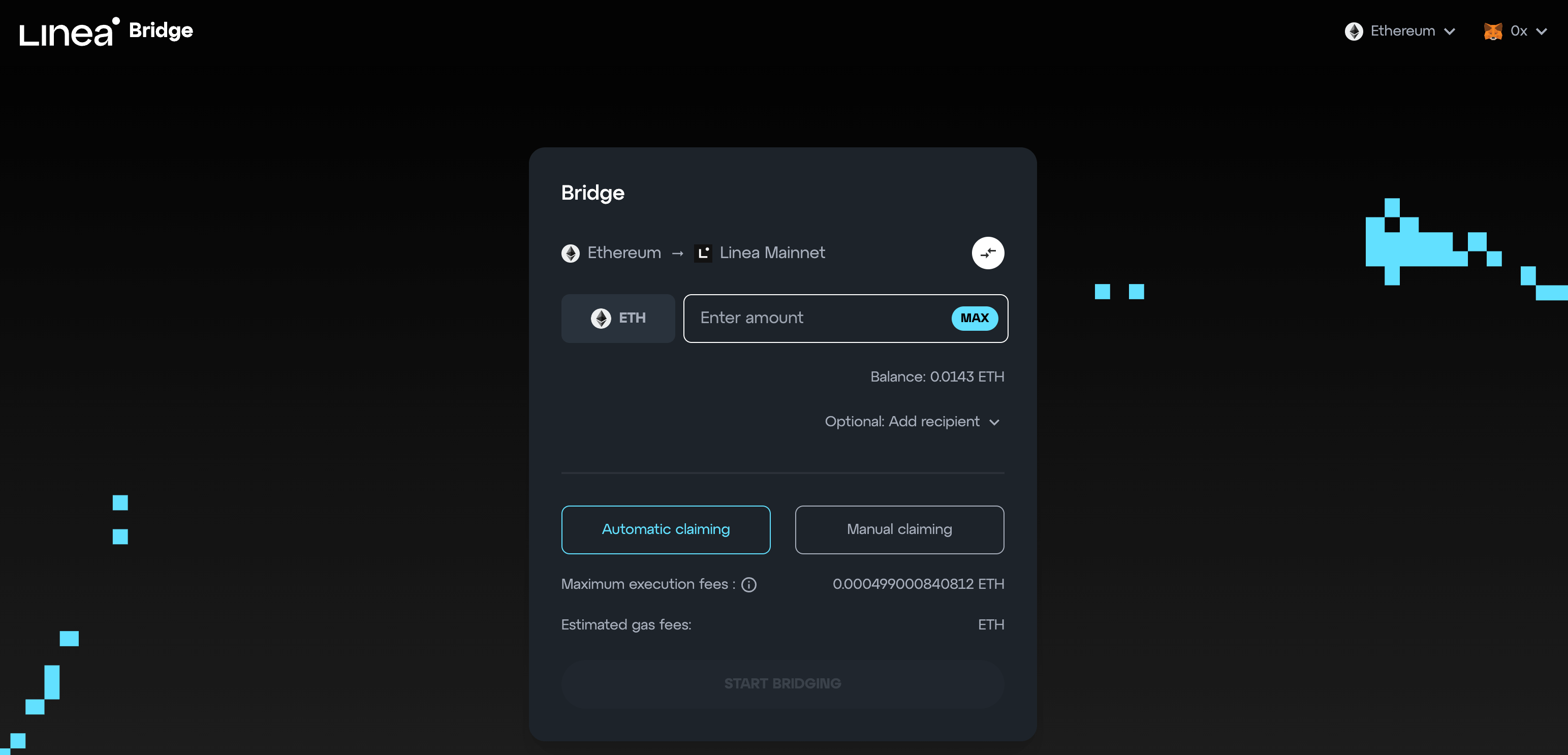

Using the Official Linea Bridge

The official Linea bridge provides a way to transfer funds from Ethereum to the Linea zkEVM mainnet. Here’s how you can do it:

- Visit https://bridge.linea.build/

- Enter the amount of ETH you want to transfer

- Choose “automatic claiming” and click on “start bridging”

Keep in mind that using this bridge might involve some costs, especially for Ethereum gas fees.

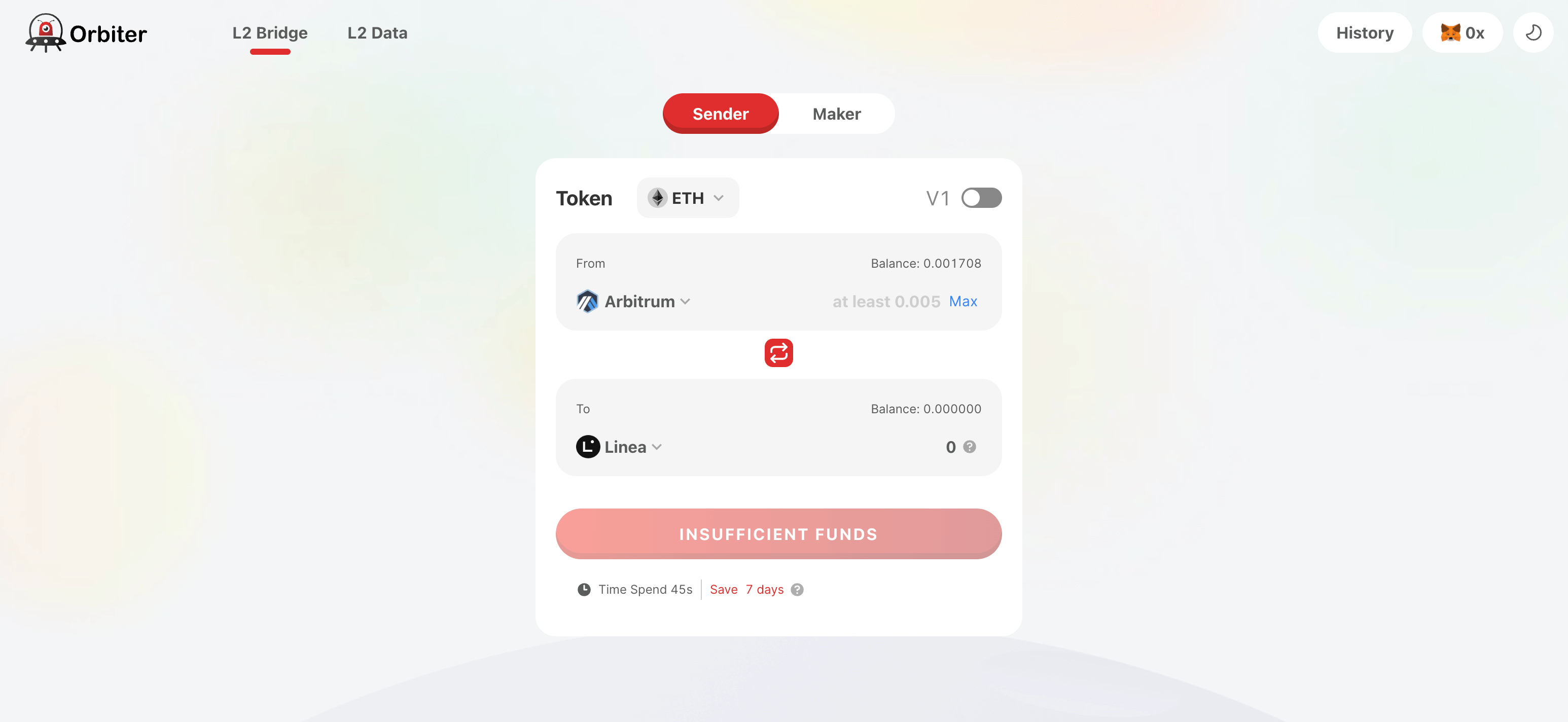

Utilizing the Orbiter Bridge

The Orbiter bridge enables you to transfer tokens between different L2 chains, including the Linea zkEVM mainnet. This may be a far more cost-effective option than using the Ethereum mainnet bridge if you already happen to have funds on an L2. To use the Orbiter bridge:

- Visit https://www.orbiter.finance/

- Select your source network (e.g., Arbitrum) and the destination network (Linea zkEVM Mainnet)

- Confirm the transfer and the associated gas fees

- Switch to the correct network in your MetaMask wallet and proceed with the transaction

Remember that this process involves real crypto transactions and may also incur gas costs.

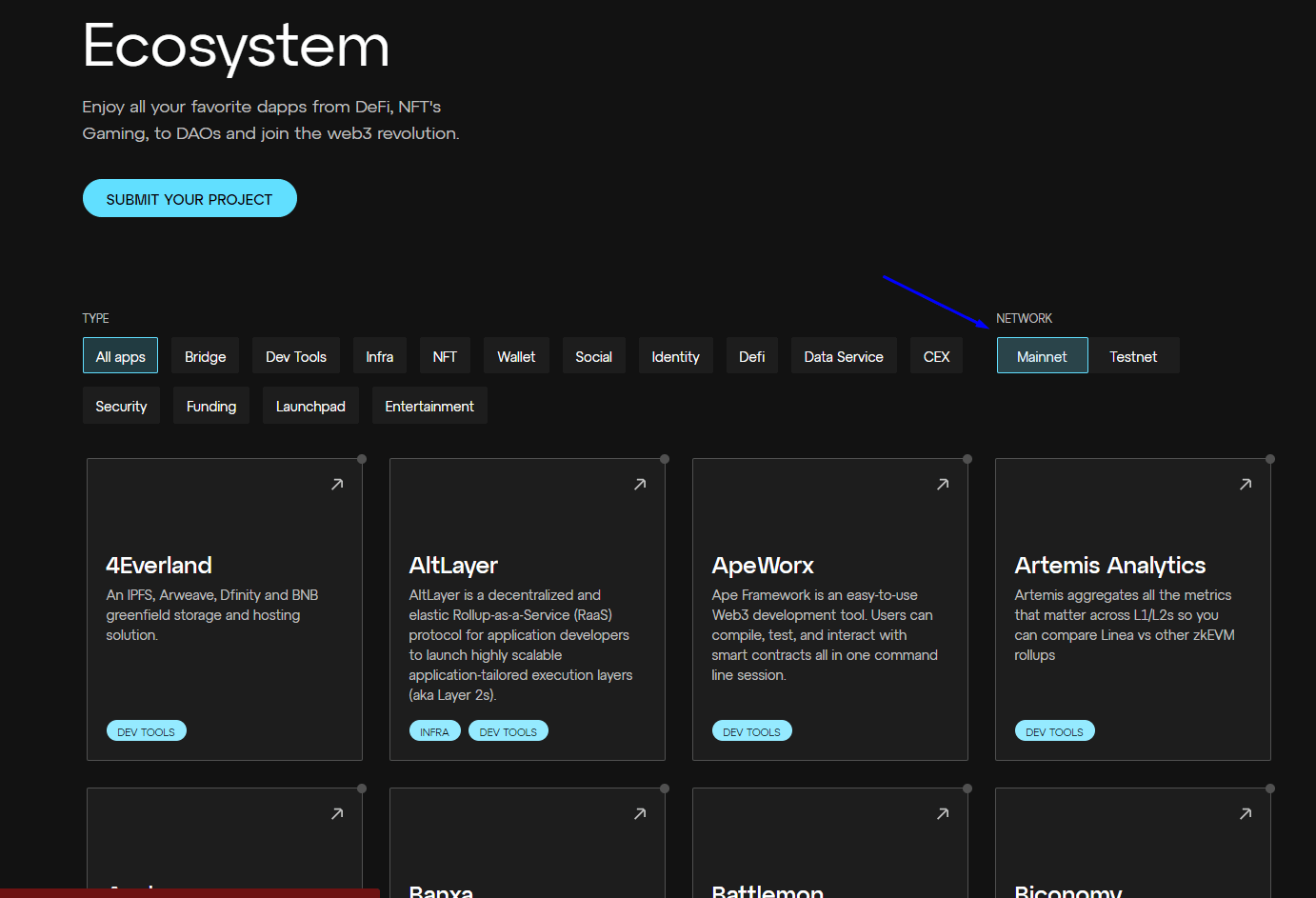

Linea zkEVM Dapp Retrodrop Guide

The videos above detail some of the more advanced steps you can take to position yourself for a potential Linea airdrop by interacting with the network’s established dapps:

To explore the Linea zkEVM mainnet apps, follow these steps:

- Visit Linea’s apps site https://linea.build/apps

- Toggle between mainnet and testnet apps

- Browse the list of apps available on the mainnet

- Look for apps like bridges, DeFi platforms, and dexes

These are some of the top Linea mainnet dapps we recommend interacting with:

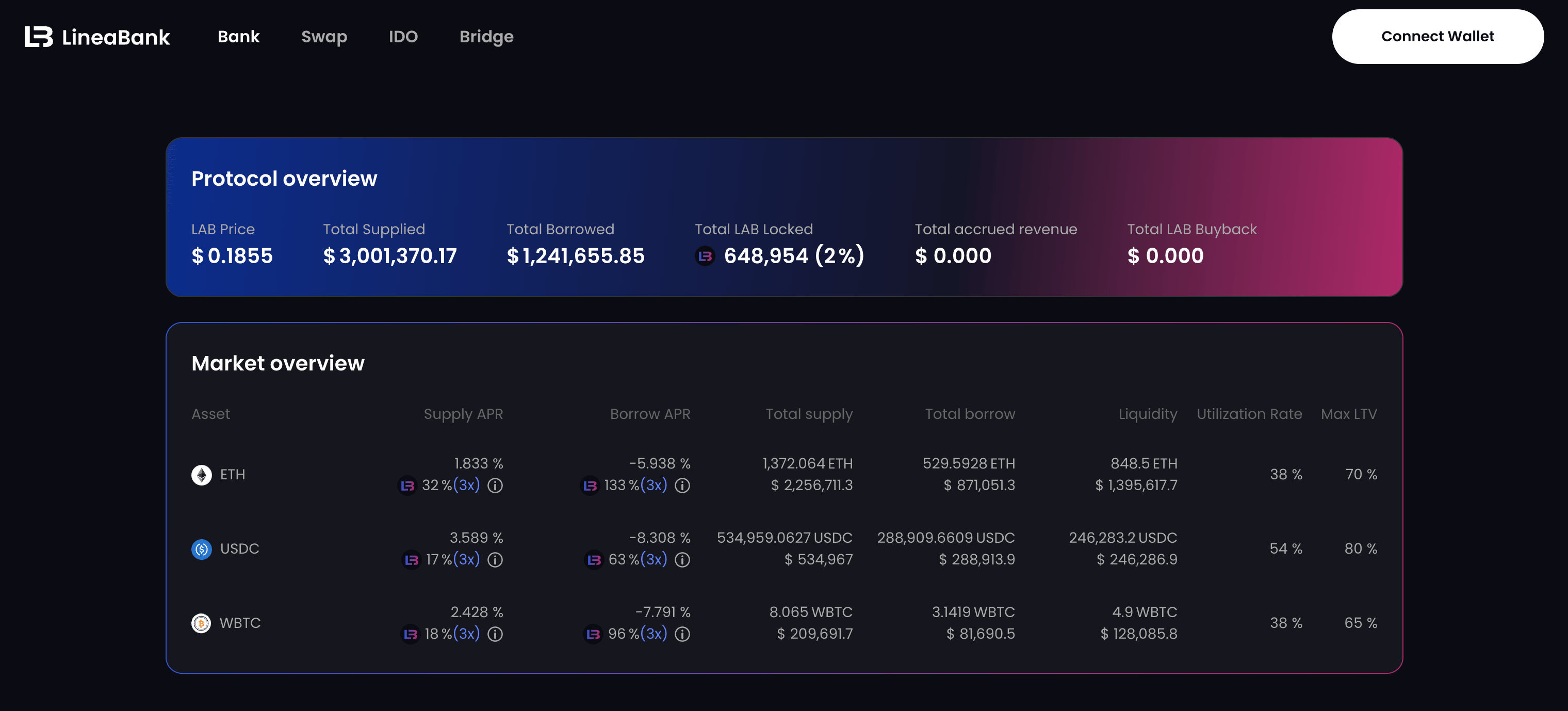

LineaBank

LineaBank is a lending protocol native to the Linea zkEVM rollup. Here’s how to get started:

- Navigate to https://lineabank.finance/

- Connect your wallet and switch to the Linea zkEVM mainnet

- Explore the interface and consider supplying ETH for lending

- Earn a yield farming APR and receive additional rewards in the form of native tokens

- Use the supply market to deposit assets and confirm the transaction through MetaMask

- Alternatively, borrow against your assets for ETH

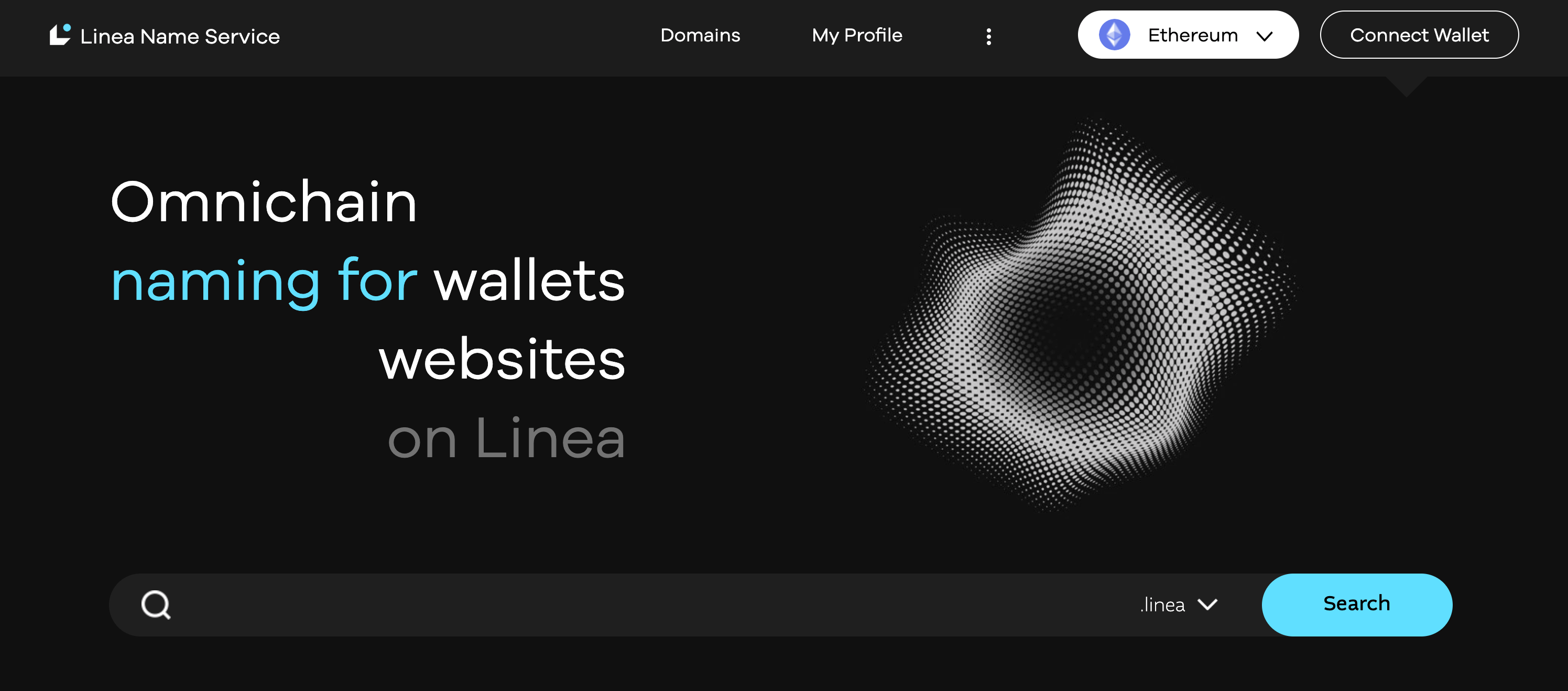

Linea Name Service

Another app to explore is Linea Name Service which offers an omnichain address name service using LayerZero (this is a bonus task since it also has the potential of qualifying you for a LayerZero airdrop). To complete this task you’ll need to:

- Connect your wallet and browse available domains

- Register a domain by selecting the desired duration and confirming by purchasing with ETH

- Complete the transaction within MetaMask

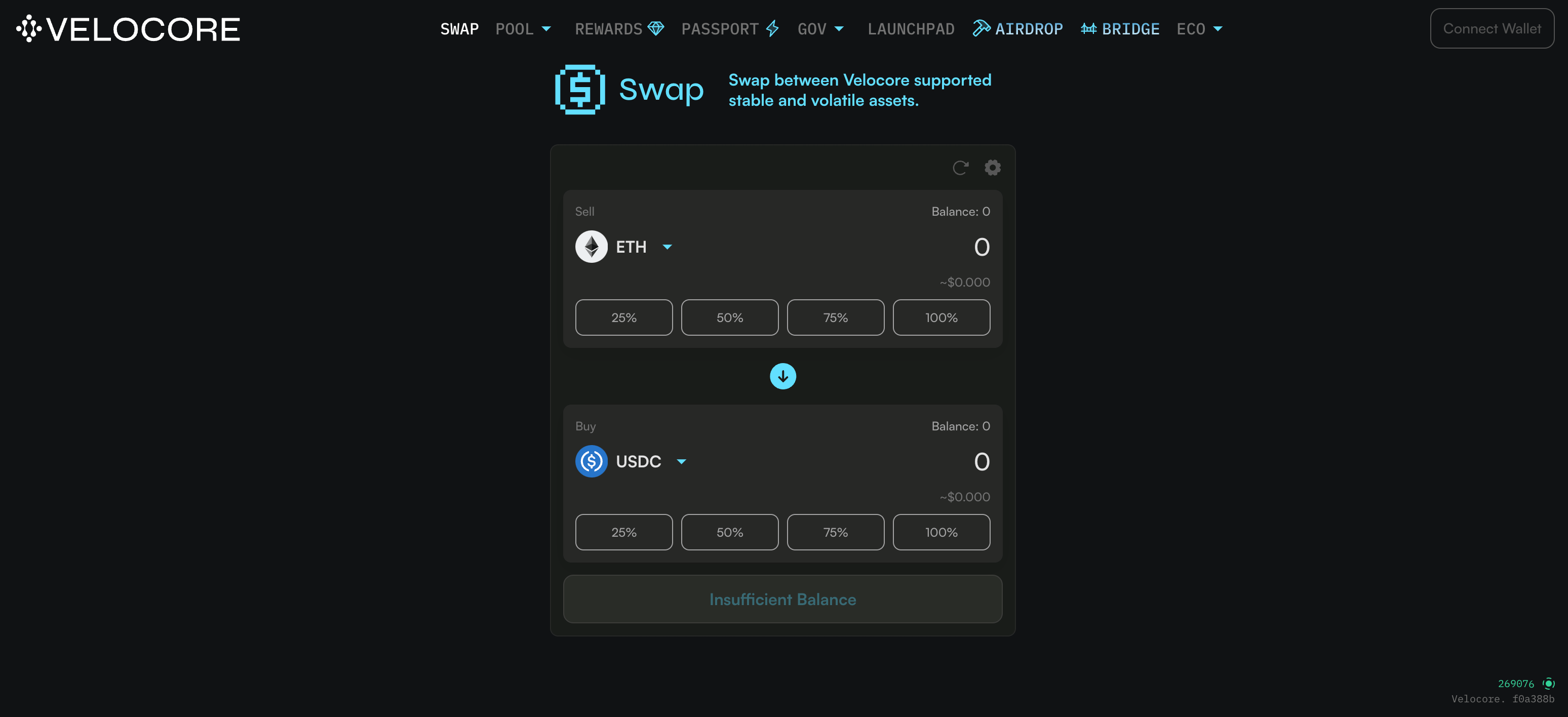

Velocore

Velocore offers the potential for its own dapp governance token airdrop as well as helping you to qualify for the Linea airdrop. Here’s what you need to know:

- Velocore is launching on both zkSync ERA and Linea zkEVM

- For Linea, utilize this domain https://linea.velocore.xyz/swap

- Use the standard swap interface

- Enter the number of tokens you want to swap and be mindful of slippage

- You can also provide liquidity to various pools if you’re interested in yield farming

- Be cautious of low liquidity in some pools

- Use the multi-swap function to add or remove LP in one step

- After completing tasks, ensure that you also keep track of your progress via their Passport quest: https://linea.velocore.xyz/passport/overview

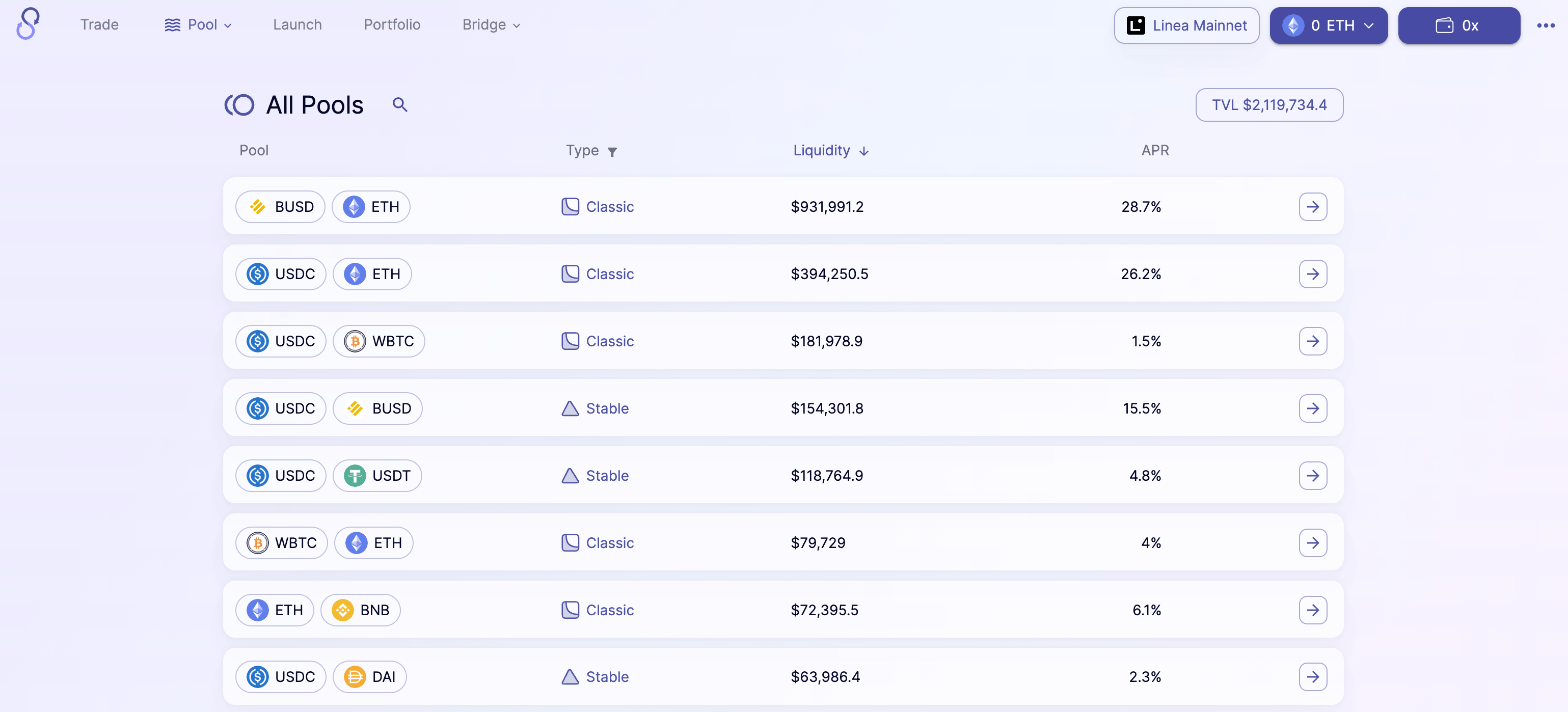

SyncSwap

SyncSwap, the biggest zkSync Era DEX, has recently launched on the Linea mainnet as well. With its full suite of products (swap, liquidity pools, farms) now live, users have a wealth of options to make transactions on Linea, enhancing airdrop chances, and earning passive income.

Currently, SyncSwap has $2.3 million in total value locked, showcasing its popularity and reliability. To maximize your airdrop chances we recommend:

- Making swaps using the DEX

- Trading between ETH and ceBUSD (the main stablecoin on the DEX with high liquidity

- Add liquidity to SyncSwap liquidity pools

Note, the best way to bridge ceBUSD into Linea for use on SyncSwap is via the Celer bridge which can be found here: https://cbridge.celer.network/.

Staying Safe While Airdrop Hunting

Interacting with the Linea zkEVM mainnet presents exciting opportunities for potential airdrops. By following the steps outlined in this guide and staying informed about developments in the ecosystem, you can maximize your chances of participating effectively in this dynamic space.

However, while the Linea airdrop could be hugely promising, it’s also essential that you avoid projects that could leave your portfolio REKT via hacks and scams.

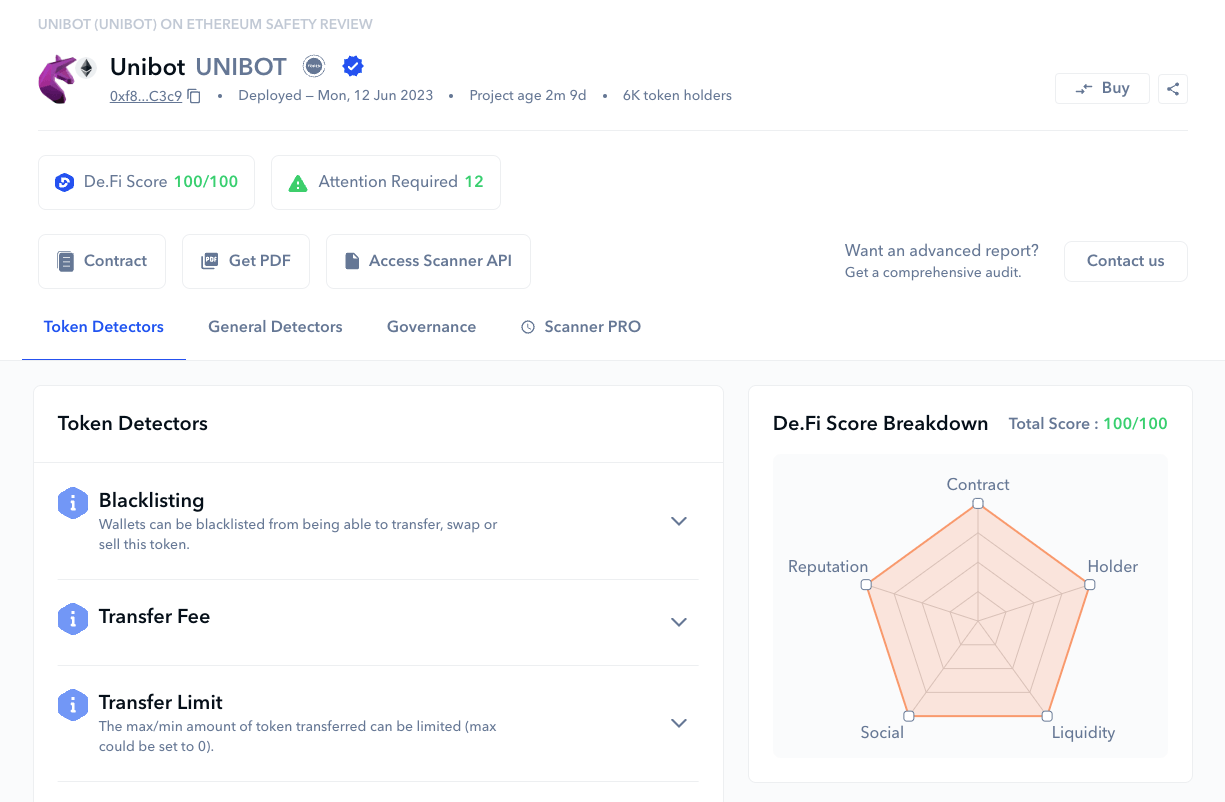

With this in mind, our superpowered DeFi dashboard offers helpful tools to keep you safe. Scanner, our free smart contract audit tool, functions as an instant intelligent evaluation. Users can quickly and effortlessly assess the safety of smart contracts across a wide range of EVM chains.

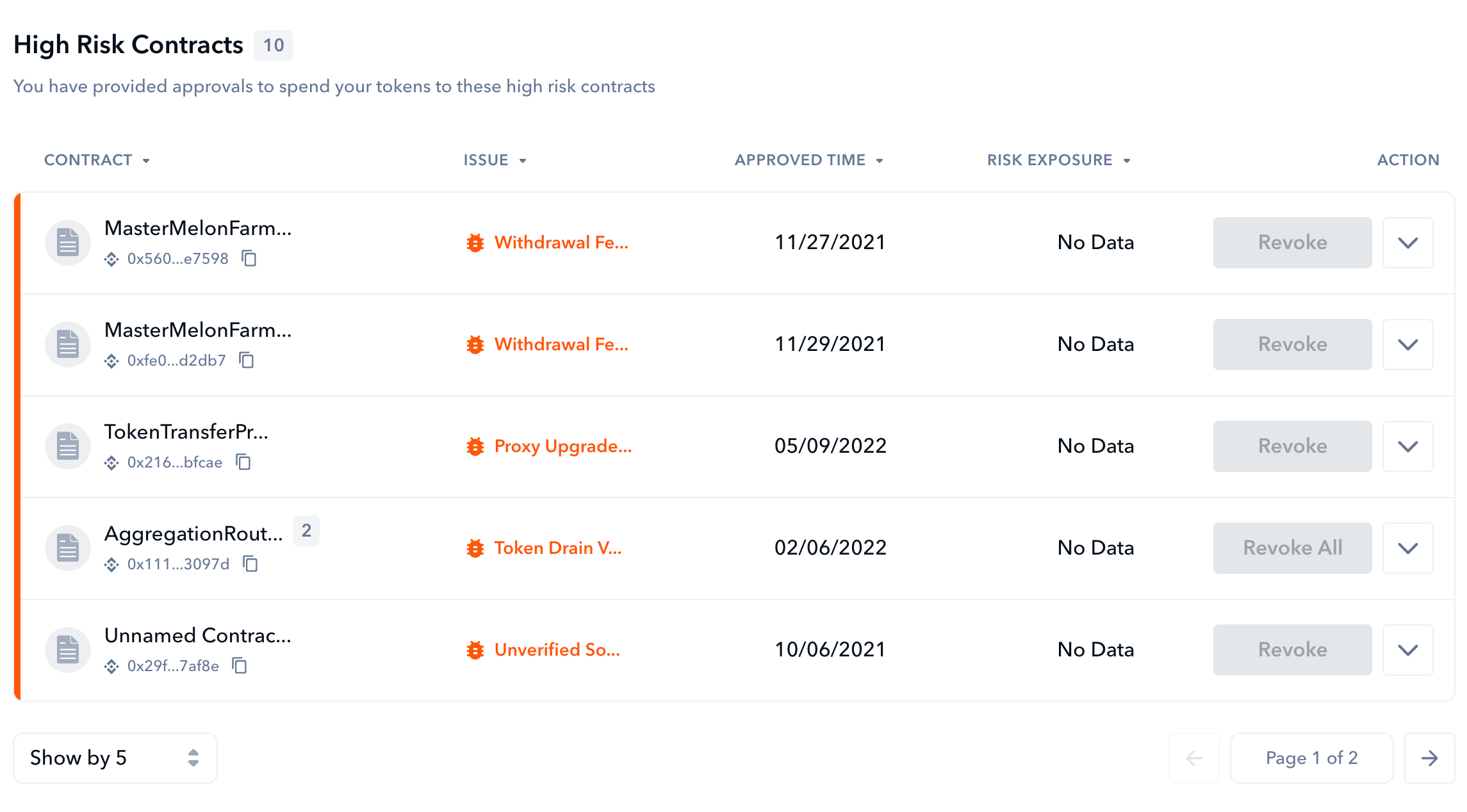

We also offer Shield, a tool to monitor and revoke crypto wallet permissions. It automatically scans your wallets for high risk tokens/NFTs/approvals and notifies you in case there are any.

Make sure to follow our De.Fi Security account on Twitter as well to stay up-to-date on breaking DeFi exploits. Your Linea airdrop rewards are only as valuable as the security you use to protect them. Stay vigilant and protect your gains!