DeFi Rekt Report October 2025: $38.6 Million Lost Across 9 Exploits

October 2025 saw a total of $38.63 million lost across nine distinct security incidents in both centralized and decentralized platforms.

In the dynamically evolving crypto landscape, safeguarding your investments against DeFi scams such as rug pulls has become increasingly important. Essential tools like the De.Fi Scanner, a potent rug checker for ETH, BNB Chain, and 10+ of the most popular EVM DeFi networks, can simplify this battle and help keep you safe from the most dangerous exploits.

Our scanner is designed to provide a comprehensive rug pull report that identifies potential red flags in a token’s contract, steering you clear of honeypots. In this blog we’ll cover exactly how to use this tool, delineating the steps you’ll use to generate a report and showing you how to properly interpret the findings.

The De.Fi Scanner automatically analyzes the potential risks associated with various smart contracts, tokens, and NFTs. This rug checker tool works seamlessly across the most popular EVM chains, including Ethereum and BNB Chain which dominate the DeFi sector. By following the steps below, you’ll be able to confidently avoid the most dangerous types of rug pulls:

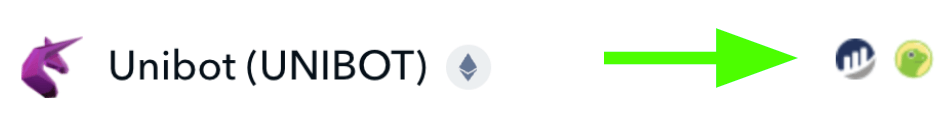

Begin by finding the contract address of the token you wish to analyze. This address is usually available on the project’s official website or social media channels. You can also find the token contract address by searching for the project via our crypto market page and then clicking on the Etherscan icon which will take you to a list of blockchain explorer links:

Click on any of these links to visit the official blockchain explorer for the token on a specific network. Copy the token address found there, then return to Scanner. You can enter the copied token address via the main search form:

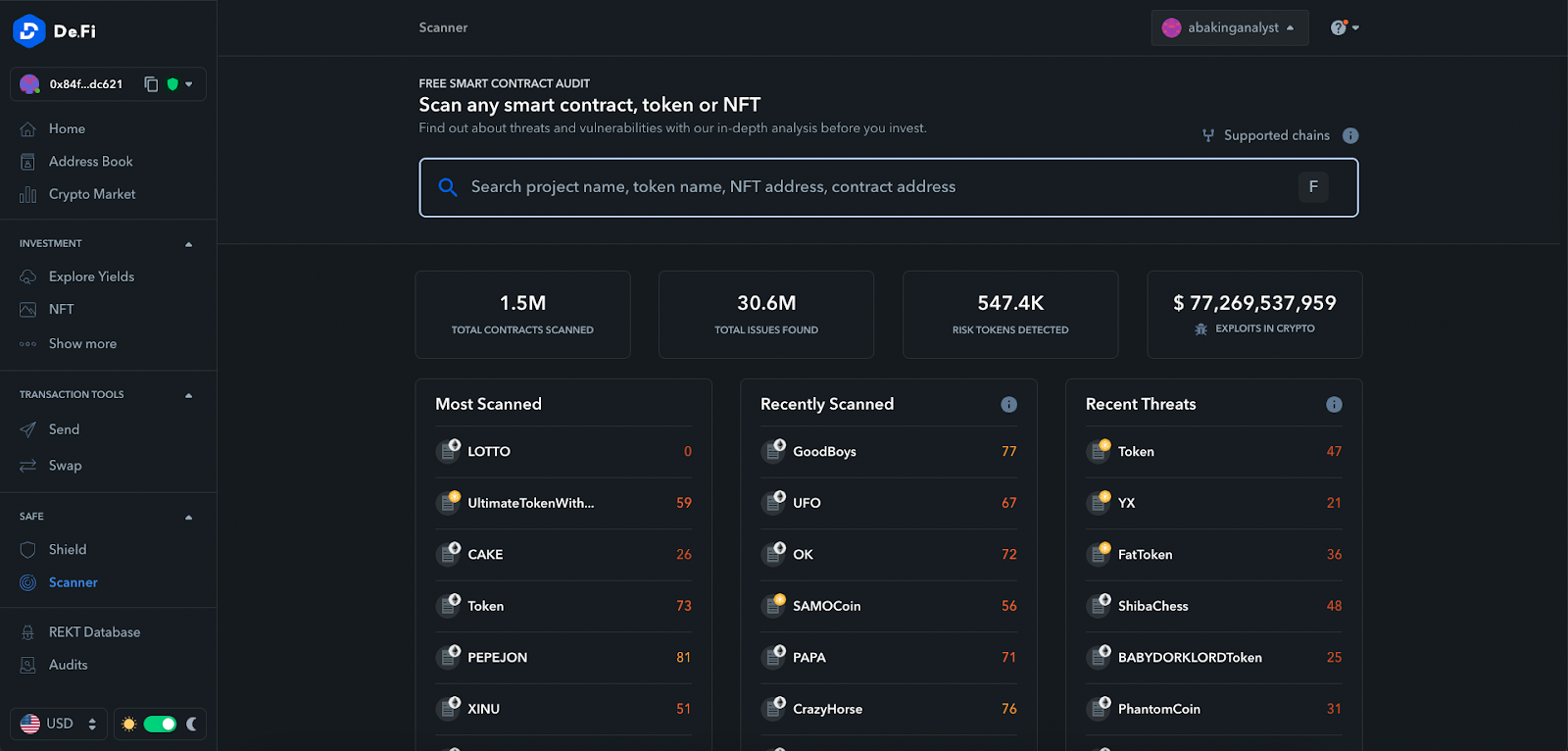

De.Fi Scanner landing page

Note: You can also search for tokens directly via the Scanner search bar, but due to the fact many tokens will use similar names it is a best practice to also double check all contract addresses vs official sources as well.

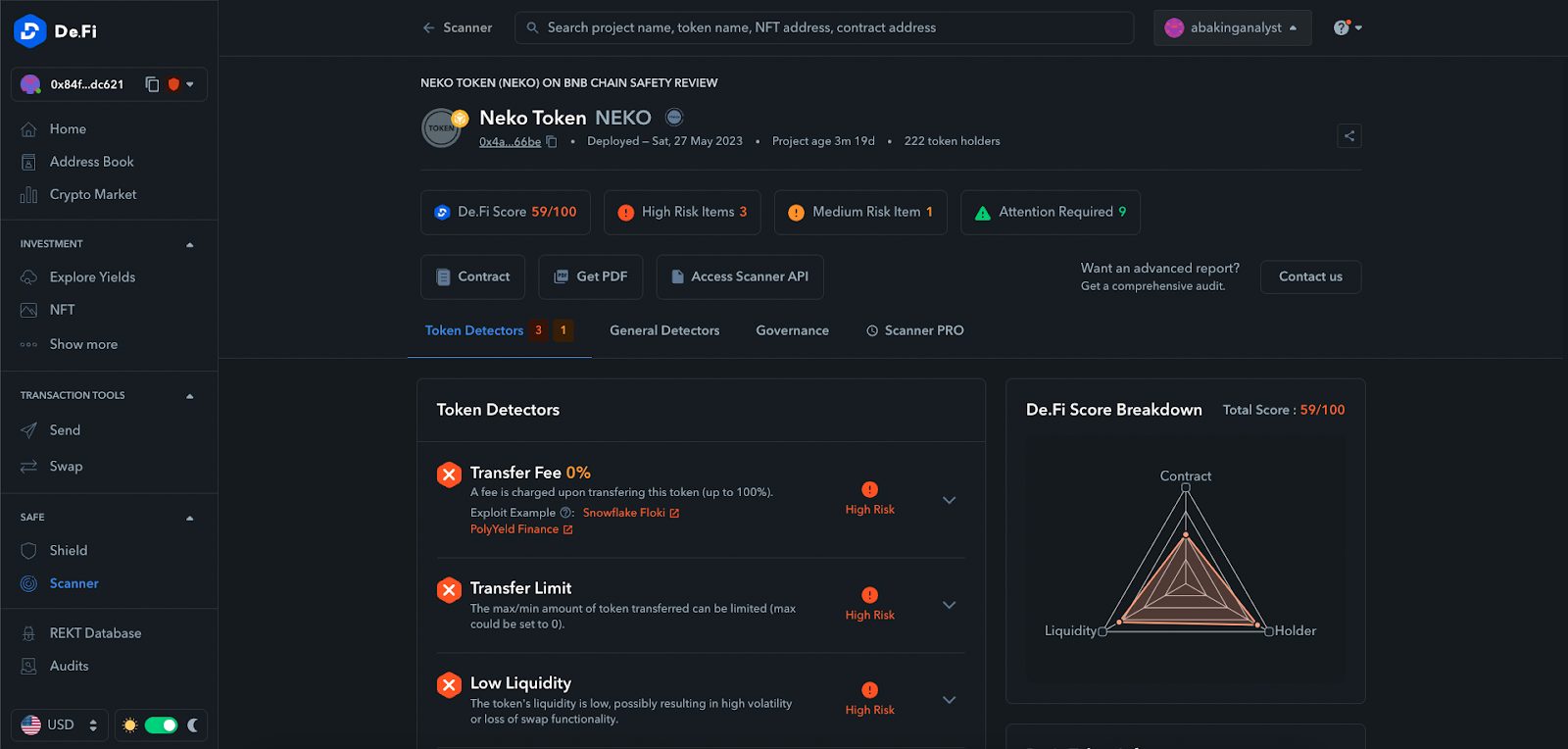

In a matter of seconds after entering the contract address and hitting enter, the scanner auto-audits the contract, providing you with a detailed rug pull probability report:

Scanner Neko Token Safety Report

Scanner’s comprehensive analysis flags potential issues and provides an overall “De.Fi Score” helping in rug pull prevention. It is vital to understand the most common red flags that indicate a probable rug pull. Some of these include:

Our rug checker tool not only aids in avoiding scams but also educates users on how to spot a rug pull, enhancing their understanding and promoting safer investment practices. To learn about the technical underpinnings of the report, we recommend reading our complete rug pull guide.

Remember, whether you are dealing with an EVM-based, the De.Fi Scanner is one of the most reliable tools in your arsenal. All of the following chains are eligible for analysis:

In conclusion, leveraging the De.Fi Scanner not only aids in rug pull prevention but also fosters a deeper understanding of the projects you are investing in, ensuring a safer DeFi landscape for all. Next, let’s dive deeper into understanding the intricacies of rug pulls and what the term means to the broader community.

Rug pulls are the most talked-about hacks and scams in crypto, but the “rug pull” term itself can easily be misunderstood. There are both specific technical delineations as well as more generalized usages that are common within the community.

Below we’ll cover a quick overview of these two perspectives: a more technical one involving DeFi exploits and a broader, softer approach used to describe a variety of scams or the sudden drop in a crypto asset’s value. Let’s delve deeper to understand these nuances.

From a technical standpoint, a rug pull refers to malicious maneuvers by project developers or insiders where they exploit the underlying smart contract’s programming or leverage their access to drain the funds invested in a project abruptly, leaving investors high and dry. These are a few of the common technical routes through which rug pulls can be orchestrated:

Mint function exploits: Developers may embed mint functions within the smart contract to create new tokens arbitrarily, leading to hyperinflation and the eventual crash of the token value.

Transfer fees: If there is a transfer fee and it can be set to 100% without any limits (or if it is already set to the maximum) users will lose their tokens when they attempt to transfer. In general, we consider the max acceptable transfer fee to be 5%.

Pausing and blacklisting: Some contracts have code that allows developers to directly control who can or cannot interact with the token at any time. These can be misused in worst-case scenarios to leave investors with a crypto asset that is impossible to trade.

MasterChef contract exploits: In some instances, developers exploit MasterChef contracts to allocate a higher number of tokens to themselves, creating a significant imbalance and facilitating a sell-off that crashes the token value.

Honeypots: When a honeypot scam is executed, contracts are set up to entice investors with promising returns. However, due to the contract’s design, users find themselves unable to withdraw their invested assets, realizing too late that they have been trapped in a deceitful scheme.

Liquidity removal: Because DeFi tokens traded on decentralized exchanges are dependent on liquidity pools to function, the removal of liquidity is akin to removing anyone’s ability to sell a token. Analyzing whether or not a token has locked liquidity or sufficient levels of liquidity can avoid this issue.

Beyond the structured avenues for rug pulls that exploit technical vulnerabilities, the term “rug pull” has a softer, more generalized usage in the crypto community. In this broader sense, a rug pull can refer to a variety of scams, misleading marketing tactics, or situations where there is a general sharp decline in a crypto asset’s value owing to speculative trades or other non-technical factors.

Pump and dump schemes: Groups artificially inflate the price of a low-market-cap coin to attract unsuspecting investors and then sell off their holdings en masse, causing the price to plummet, effectively “pulling the rug” from under investors’ feet.

False marketing: Projects can also deploy deceitful marketing strategies, creating hype around non-existent features or partnerships, thereby manipulating innocent investors into putting their money in a doomed venture.

Exit scams: This involves project developers or promoters disappearing suddenly without a trace, often after accruing substantial investments from the public.

Soft rugs: A soft rug refers to the practice of project administrators avoiding a complete exit scam, but instead putting in minimum viable work to appear as if they are trying to bolster the project. In reality, they are usually accepting treasury payment for their work and waiting to eventually close down the project because they “tried their best, but came up short”. This is an especially nefarious rug because many investors will be attracted by “active development” without realizing that no real effort is being put forward.

Understanding the multifaceted nature of rug pulls – both technical and general – equips investors with the knowledge to navigate the complex crypto landscape with a critical eye, aiding in rug pull prevention.

In the ever-evolving landscape of crypto investments, safeguarding your assets is paramount. The De.Fi DeFi dashboard stands as a beacon of security, offering an arsenal of tools and resources tailored for web3 users to fortify their defenses against the nefarious underworld of crypto scams.

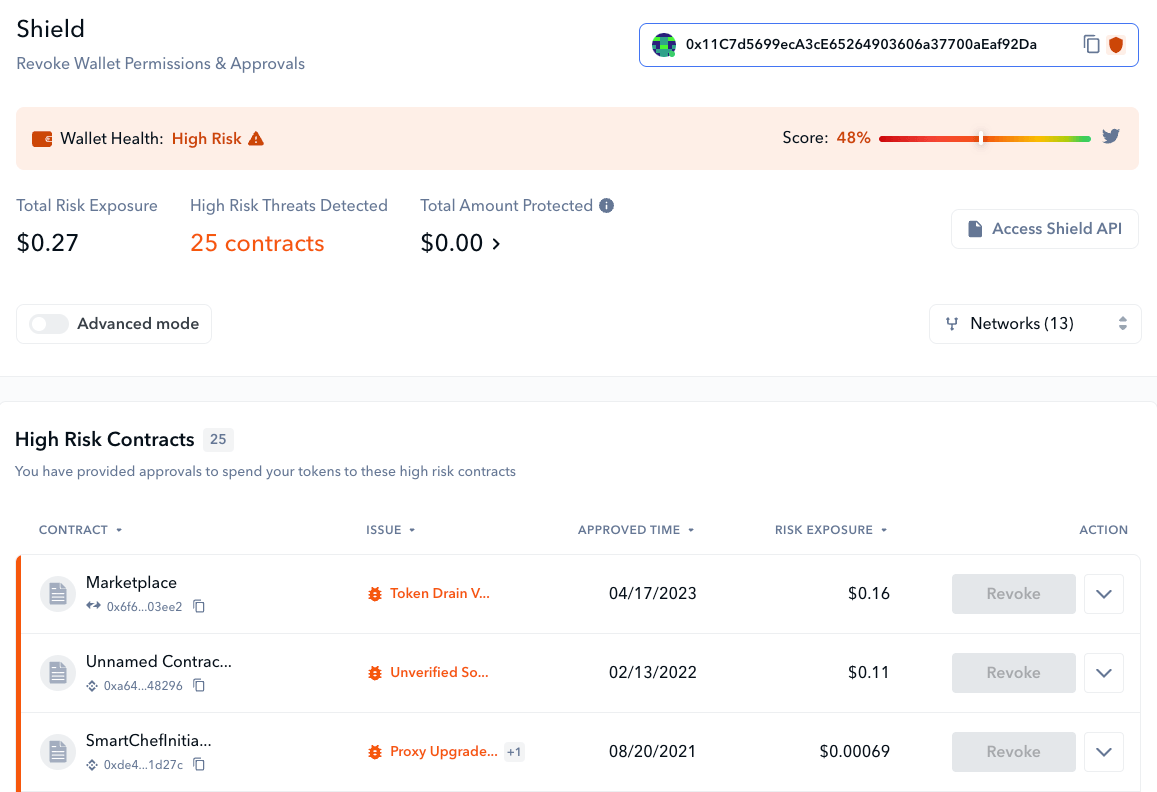

In addition to Scanner’s automated security detection, we also offer De.Fi Shield as an all-in-one wallet permissions manager. Connect your DeFi wallet and get a report within seconds regarding potentially harmful vulnerabilities. Once you’ve reviewed it, we allow you to revoke any suspect permissions with a single click, increasing your wallet’s overall level of security.

De.Fi Shield results page

Beyond our antivirus suite, you can actively improve your security knowledge through our REKT Database, Audit Database, YouTube channel, and De.Fi Security X profile. Make the informed choice; enhance your web3 safety with De.Fi’s robust ecosystem designed to help you navigate the crypto world with confidence and peace of mind.

October 2025 saw a total of $38.63 million lost across nine distinct security incidents in both centralized and decentralized platforms.

The third quarter of 2025 marked yet another turbulent period for the DeFi and wider crypto ecosystem, with $434,124,000 lost to exploits, scams, and security failures across both centralized and decentralized platforms.

June 2025 witnessed another alarming month for Web3 security, with a total of $114,768,000 lost during 11 separate attacks

May 2025 saw both DeFi and CeFi security once again under attack, with $275,953,000 lost across just 8 recorded incidents

April 2025 witnessed a large escalation in exploit volume and value, with a massive $5,919,684,000 being stolen in 10 confirmed events.

Q1 2025 marked one of the worst quarters in blockchain exploit history, with total recorded losses topping $2,052,584,700 across 37 incidents

© De.Fi. All rights reserved.