Most DeFi enthusiasts are eagerly anticipating the time when Ethereum has fully transitioned over to the Proof-of-Stake consensus algorithm and data sharding benefits that are commonly referred to as ‘Eth2’.

These changes promise to bring the scalability, gas efficiency and lower transaction fees that we all know will make the leading smart contract platform even more appealing for DeFi. If you can’t wait for those changes though, maybe it’s time to shift your focus to Harmony which has gained attention during the recent crypto bull run.

Harmony is a layer one blockchain that claims to provide all the benefits of Eth2 for users right now. It makes interoperability of assets and applications easy, includes a burgeoning ecosystem of development and a range of noteworthy staking, lending and liquidity options.

In this guide, we’ll tell you all you need to know to get started with yield farming on Harmony. It includes an overview of the network’s technology and ecosystem, the DeFi wallets you can use, how to make the most of the staking and yield farming opportunities available, and how to track everything with our DeFi portfolio tracker.

Table of Contents

What is Harmony?

How Harmony achieves scalability

The Harmony ecosystem

Sharding

Bridges

Bridge Harmony <> BSC or ETH

Anyswap Bridge

The ONE Token

Developers

Wallets

Metamask

How to add Harmony ONE to Metamask →

Getting the ONE Equivalent Address

Staking and Yield Farming on Harmony

Should I use Harmony for Yield Farming?

What is Harmony?

Harmony is a scaling solution with a difference.

It is an open and fast blockchain that, unlike many of its scalability peers, is a layer one rather than a layer two. As a layer one solution, it has its own security and settlement guarantees, which it claims make it much faster than any other solution.

In fact, Harmony says that this unique approach allows it to achieve two second finality. This means there’s no need for users to wait for two or three blocks to be sure their transaction is confirmed and is much faster than the seven days some solutions require to settle back on Ethereum. Not only is Harmony’s finality much quicker, the development team even says it is working towards one second finality.

Harmony’s founders first had the idea for an open platform to enable application development in 2017 while working on various large infrastructure apps for Web2 giants such as Google and Microsoft. The platform was officially founded in 2018 and the Mainnet was launched in June 2019.

Watch our interview with Harmony COO →

How Harmony achieves scalability

Harmony claims to bring all of the scalability promises of an Eth2 future into reality now. That means lower gas prices and transaction fees, on top of the energy savings that can be achieved by moving away from Proof of Work (PoW) consensus.

More specifically, it claims to achieve scalability with security and decentralization through a combination of PoS consensus and sharding.

There are 113 external validators at work, staking almost 40% of the token supply in the process, and a goal to reach thousands of unique validators in future. Part of the team’s strategy for making this happen involves ensuring that validators do not require any expensive hardware. For this reason, it is possible to run a validator on a Raspberry Pi even now.

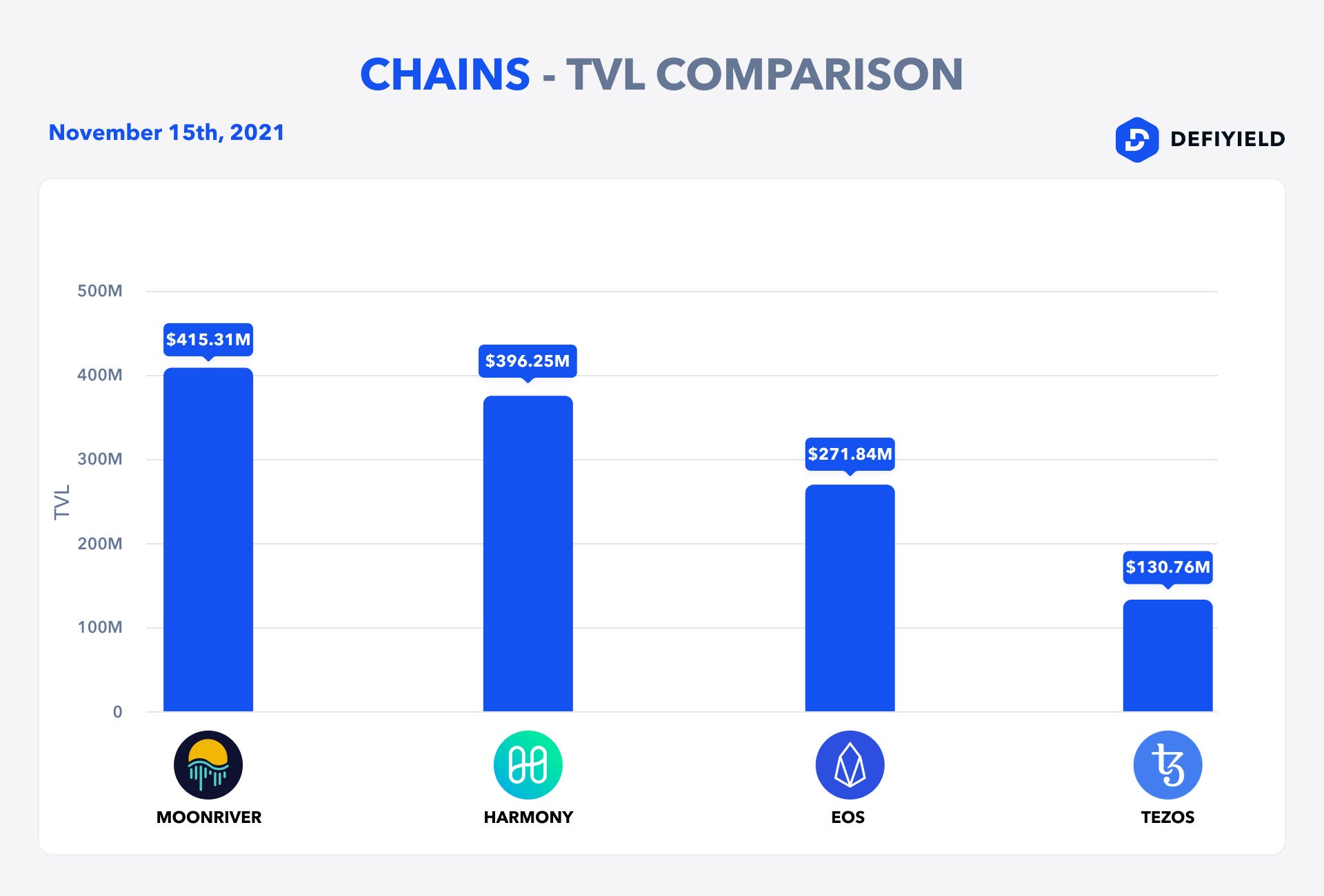

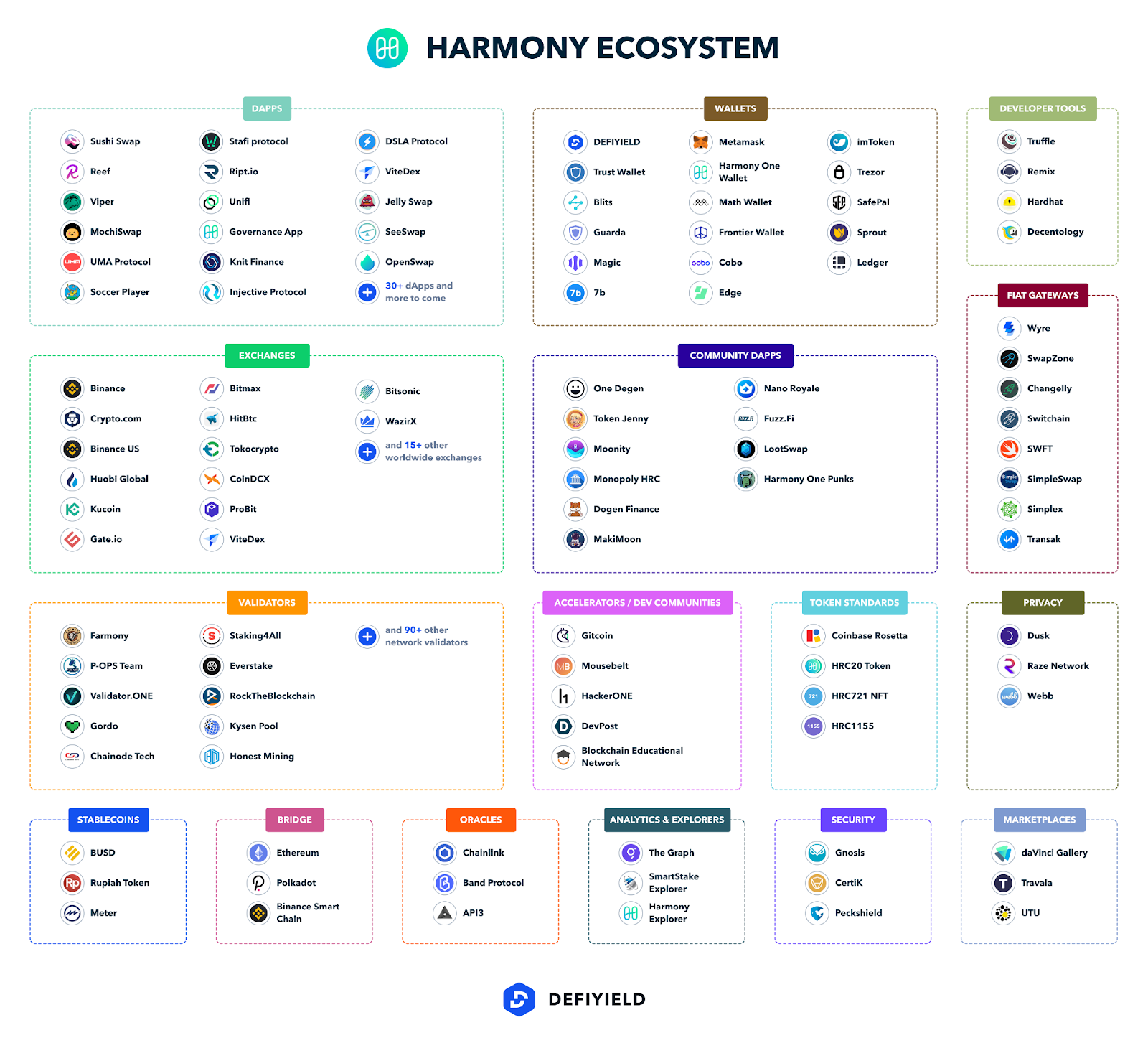

The Harmony ecosystem

Various elements of Harmony are worth understanding as they relate to the benefits it provides for yield farming, especially in terms of scalability, interoperability and token value accrual.

https://docs.harmony.one/home/general/ecosystem

Sharding

As mentioned, Harmony claims to provide the features of the Eth2 upgrades before they are available on Ethereum and one of these is sharding.

In fact, Harmony became the first sharded PoS blockchain in 2020. Essentially, sharding involves separating the mass of transaction data that the network has to process into smaller chunks, so they can be processed more efficiently. Right now, Harmony has four shards working in parallel.

The sharding does not change anything in terms of compatibility for developers, meaning applications built on Ethereum can be ported over to Harmony because it is fully compatible with the Ethereum Virtual Machine (EVM). All developers need to do is make a few minor edits to the chain ID.

Bridges

Developers can bring their applications over to Harmony through a range of trustless bridges.

Bridges for Ethereum, Binance Smart Chain and Bitcoin were launched in 2020 and the Terra bridge went live in 2021. The Terra bridge includes support for Terra USD (UST) and also brings fixed income capabilities to the Harmony ecosystem. Bridges to Cosmos and Polkadot are also planned in the development roadmap.

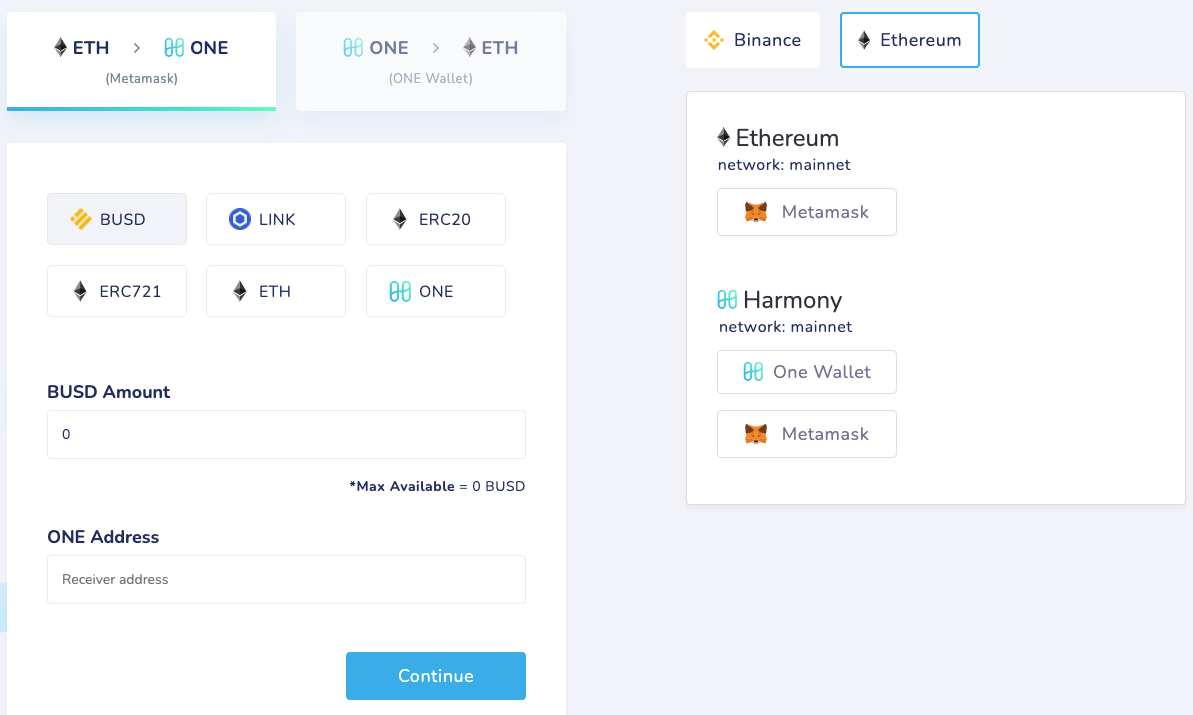

Bridge Harmony <> BSC or ETH

To bridge your tokens to ONE and from ONE to any other token, you can use various providers.

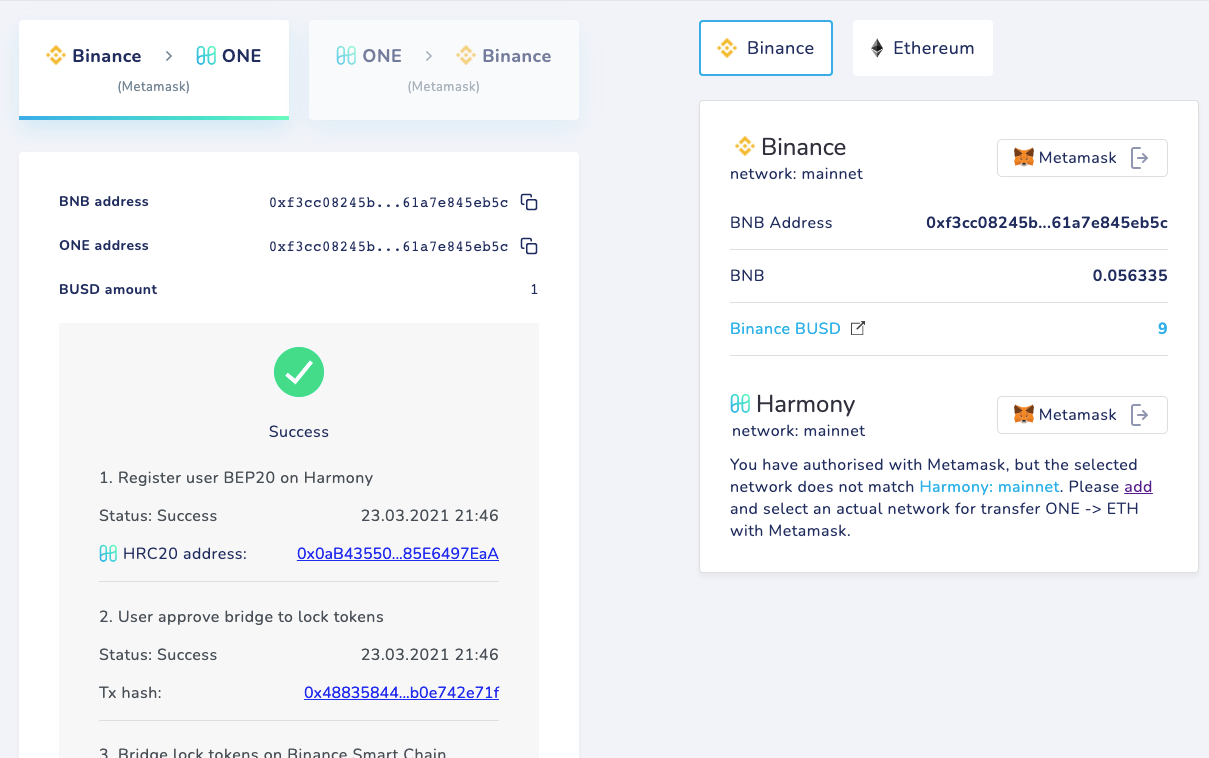

For example, to bridge tokens to ETH or BSC mainnet, you can use the official Harmony bridge — https://bridge.harmony.one/.

Connect both your Metamask and HarmonyONE Wallet, choose a token and navigate through the sequence of approving and bridging tokens.

If everything was done correctly, you will see a success pop up.

Anyswap Bridge

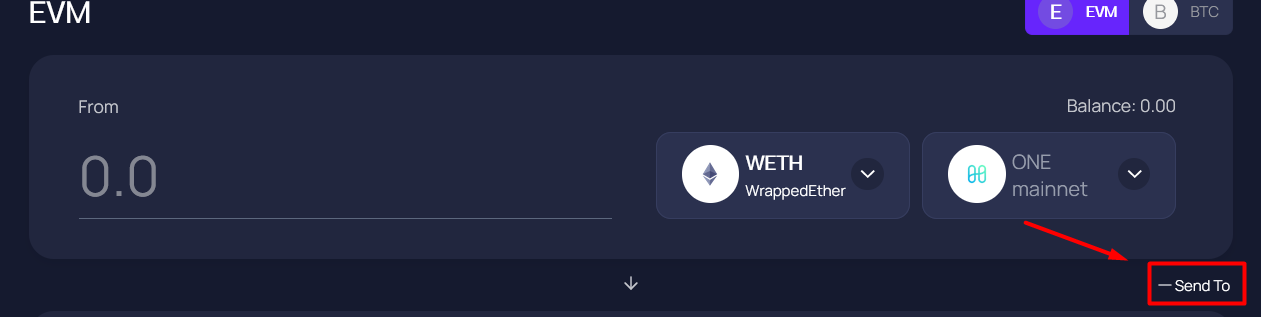

Another bridge you can use is Anyswap. With Anyswap you can Bridge Harmony ONE <> Matic (Polygon) Mainnet.

Go to https://anyswap.exchange/#/bridge and choose the appropriate chains.

Choose a wallet you want to send funds to and confirm the transactions.

These bridges allow users to bring any asset into Harmony and use it cross-chain to access any marketplace or Metaverse environment they choose. In this way, Harmony is also enabling the fast growing area of NFTs to become a cross-chain initiative.

The ONE Token

Harmony’s native ONE token can be used for staking, gas and storage fees, and for voting in on-chain governance.

Token price as for 10/26/2021:

Developers

Harmony is encouraging application, tooling and infrastructure development within the ecosystem through a series of bounty programs and grants. The first of these was announced in 2019 and the total amount of funds that Harmony is dedicating to these programs is currently $380m over four years.

Wallets

Metamask

How to add Harmony ONE to Metamask →

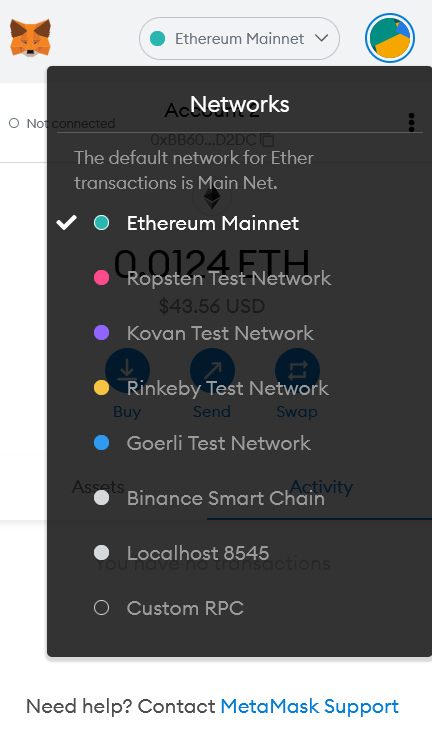

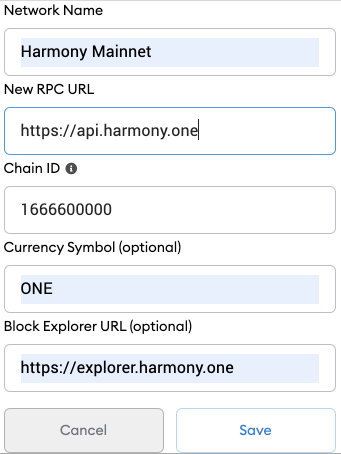

To add Harmony, just as any chain, you need to click on the network drop-down and choose “Custom RPC”.

Then, insert these information:

Network Name

Harmony Mainnet

New RPC URL

[https://api.harmony.one](https://api.harmony.one)

Chain ID

(use number only)

Shard 0: 1666600000

Currency symbol (optional)

ONE

Block Explorer URL (optional)

[https://explorer.harmony.one/](https://explorer.harmony.one/#/)

This is how the connection to the Harmony Shard 0 looks:

Example of the Harmony ONE address:

one13qamm7200lsfkevagykp0s54n7wmju4lqjwh6gc

Getting the ONE Equivalent Address

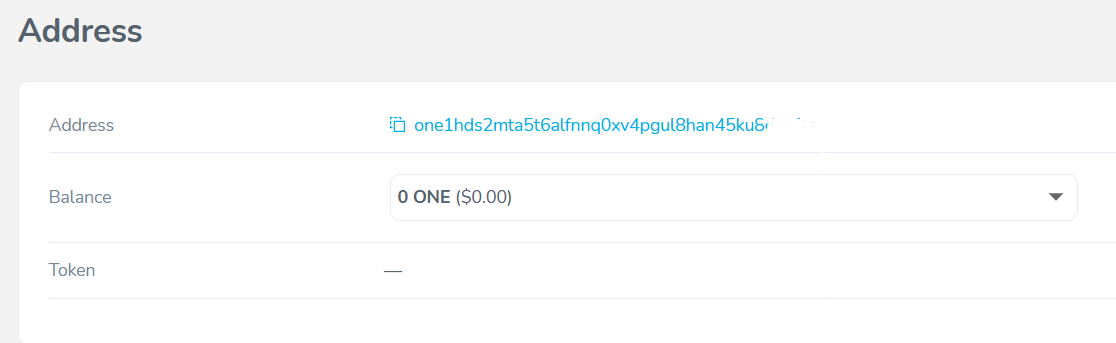

Since Metamask does not allow you to send transactions to addresses starting with “one1”, you have the equivalent 0x address of your ONE address. To find your ONE address follow these steps.

- Go to https://explorer.harmony.one/#/ (Mainnet) or https://explorer.pops.one/#/ (Testnet) and search for your address.

- Copy the ONE address format by clicking on the small icon right to the address.

To send a transaction on Metamask click on Send button and on next window copy paste the destination address starting with 0x, fill the amount you want to send, click on Next and then on Confirm.

1wallet

Harmony has developed the 1wallet to make it easy to earn returns on your crypto assets and not have to worry about seed phrases, losing your device, or hacker scams.

To achieve this, it has started by replacing the requirement to store seed phrases with the more user-friendly alternatives of Google Authenticator and social recovery. In addition, it has made attractive staking lending and liquidity yields available, including 20% for the first million users.

Ledger (Nano S)

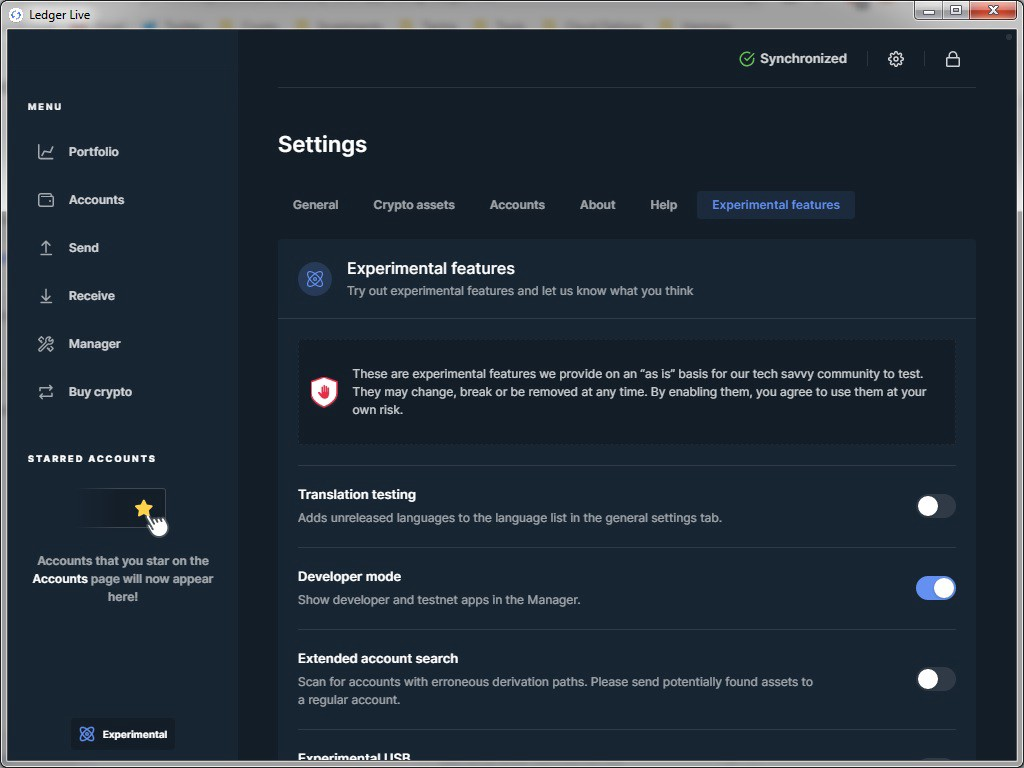

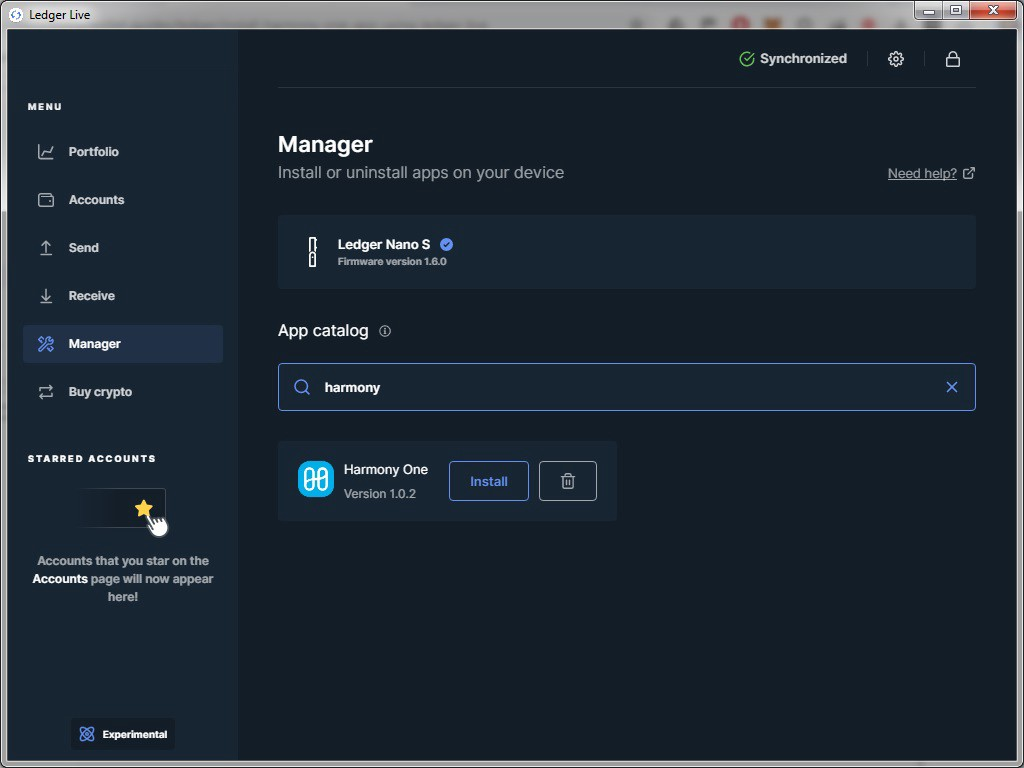

Ledger hardware wallet support for Harmony ONE. To install Harmony it you will need to switch to a developer mode.

- Open the Manager in Ledger Live.

- Connect and unlock your Ledger Nano S.

- If asked, allow the manager on your device by pressing the right button.

- Turn on developer mode in Manager : Settings => Experimental Features => Developer Mode, as shown below:

- Find Harmony ONE

- Click the Install button of the app. Your device will display Processing and then the app installation is confirmed.

Staking and Yield Farming on Harmony

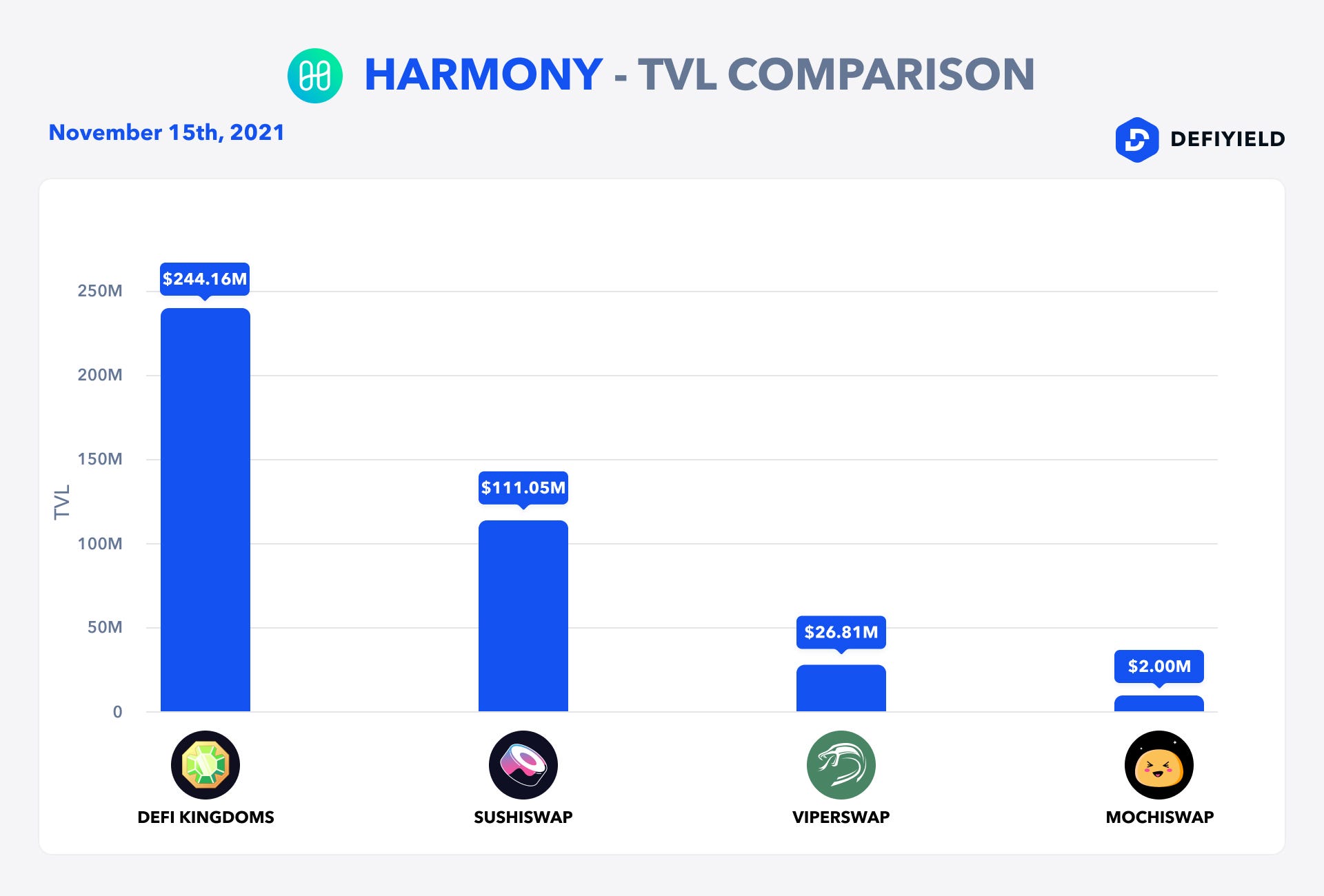

There’re different options for providing liquidity and staking on Harmony.

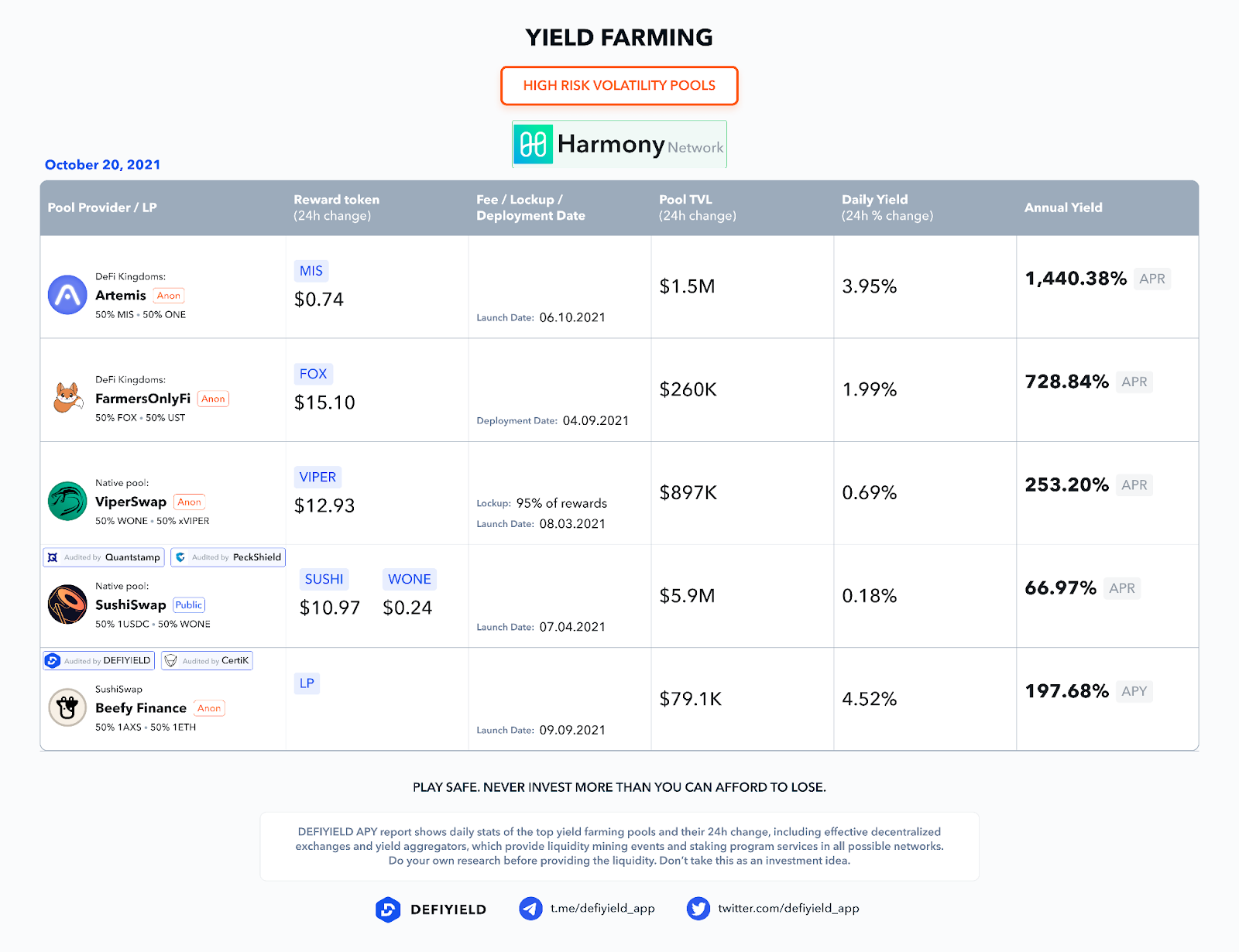

For example, ViperSwap (that we added to our dailyAPY the other day) LootSwap, OpenSwap, Daikiri Finance, and MochiSwap.

Some of the well-known protocols are available on Harmony as well. These are Curve, Beefy Finance, AnySwap, and SushiSwap.

In our guide we will cover providing liquidity on SushiSwap.

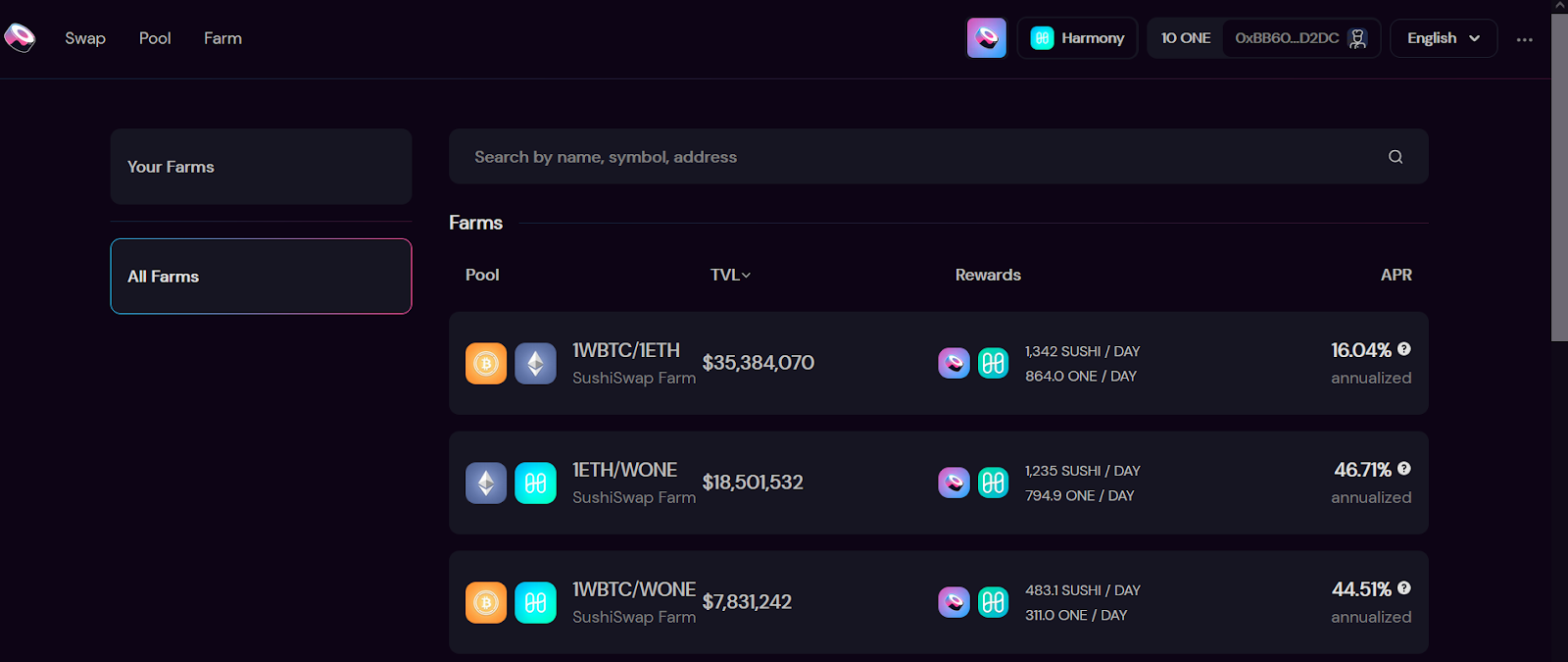

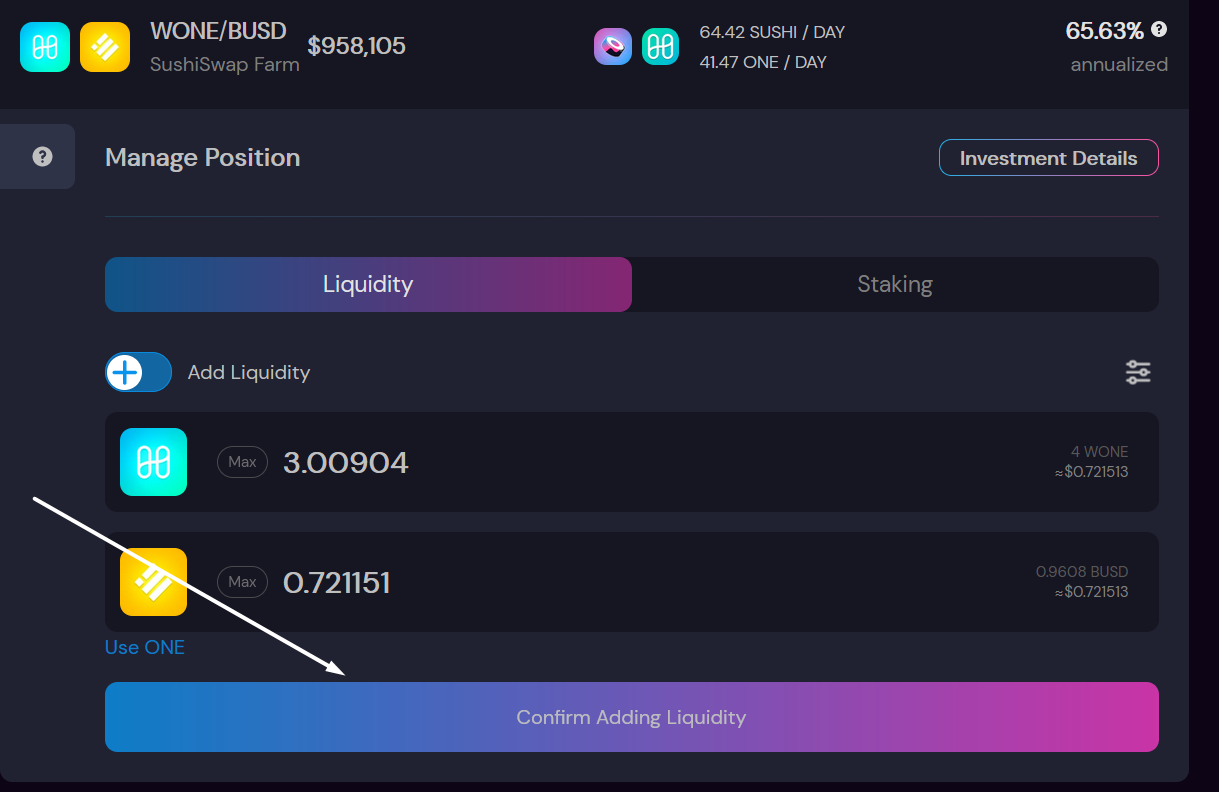

- Firstly, you’ll want to go to the “Farms” tab and choose the pool.

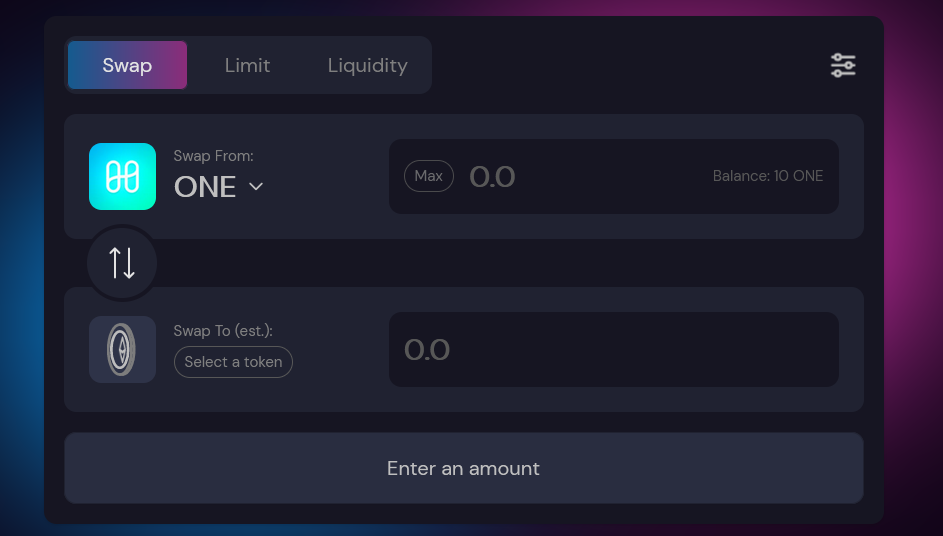

- Then, you’ll want to go to the Swap tab and swap your ONE to WONE (or any other token for the liquidity pool pair).

Why SushiSwap lists pools with WONE token but not ONE?

Sushi lists Sushi/WONE because the UI is meant for native ETH. You can use your ONE as well or convert it to WONE.

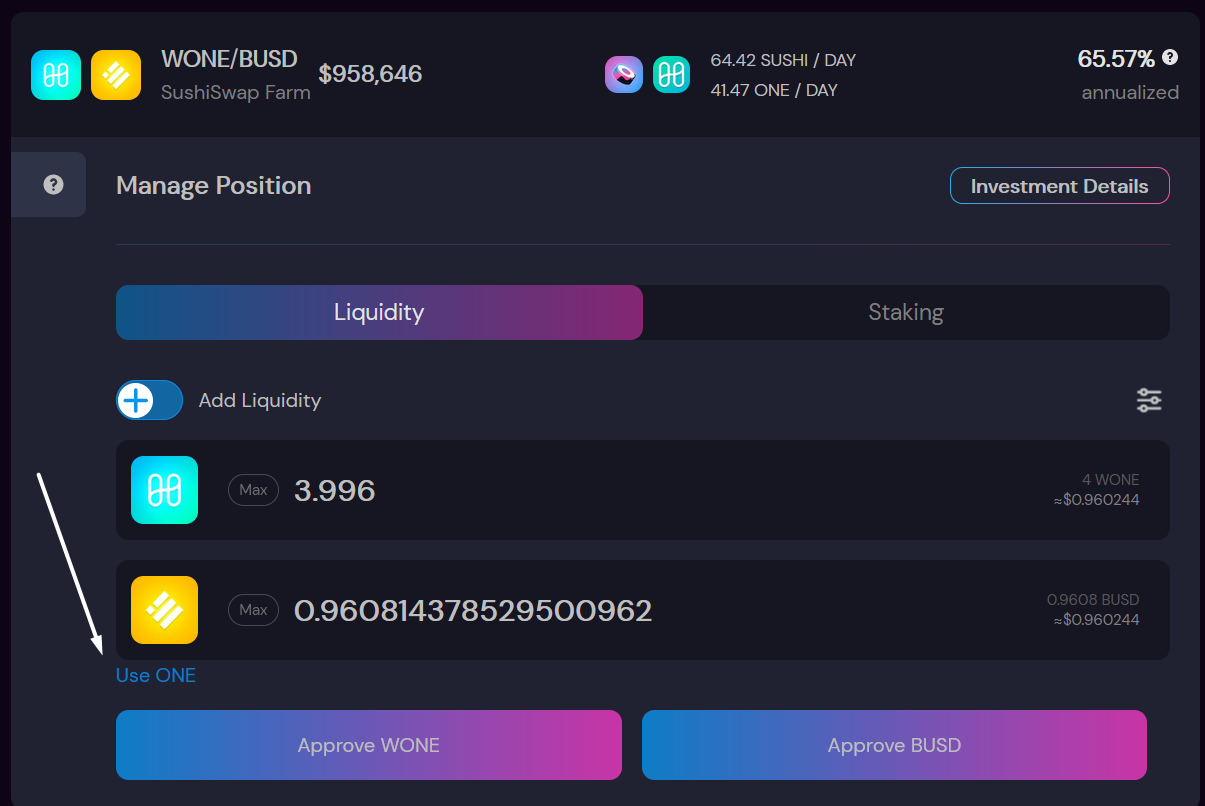

- Once you’re done with these preparation steps, you can get back to farms and choose the one that fits your criteria.Enter the among of WONE (or ONE — as you can see, you can choose which token to use under the pair) and amount of other token.

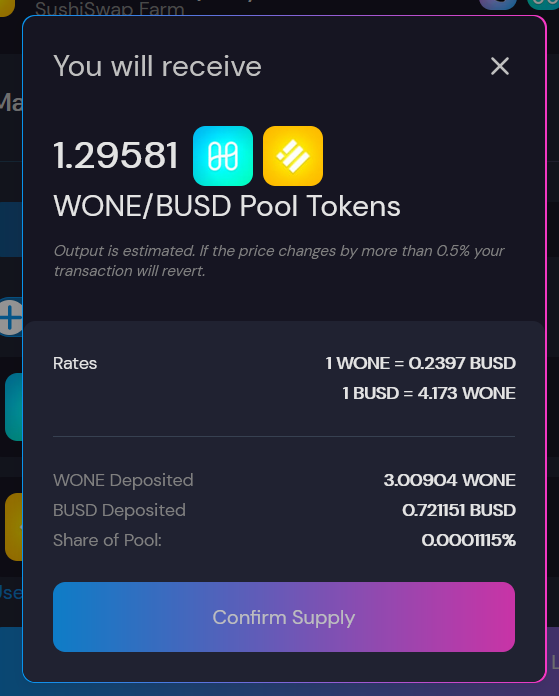

- Approve tokens and click on “Confirm adding liquidity”.

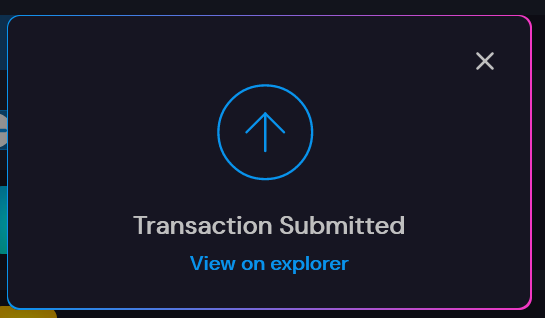

- Once you confirm all the transactions (hurray you went through it:), you will see the confirmation pop-up. You got your LP tokens.

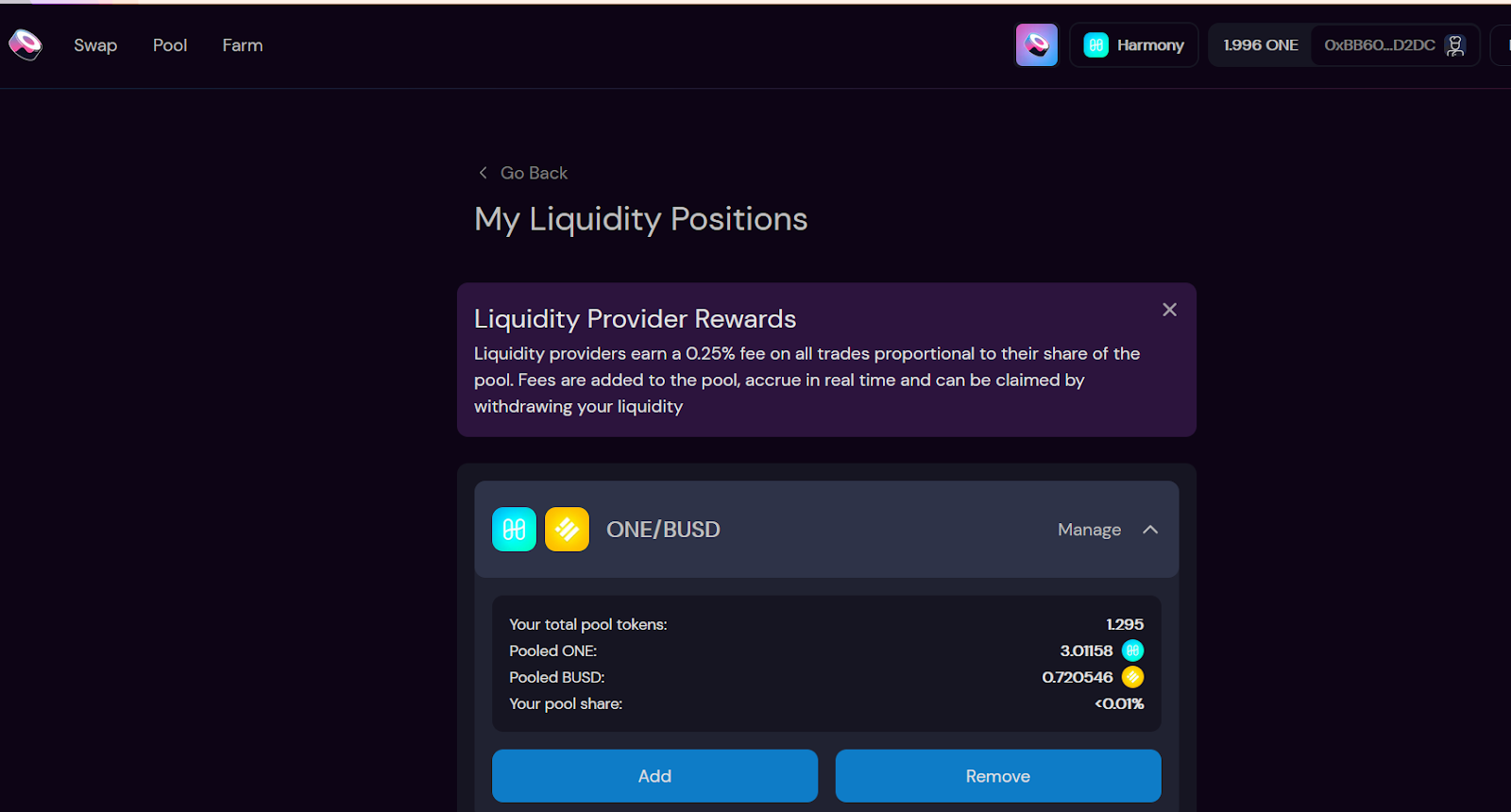

- To see your position, go to pools. Now, you can see your pool.

Should I use Harmony for Yield Farming?

Anyone who has any experience or interest in generating yield from their digital assets, will be able to see that Harmony has been specifically designed to appeal to them.

By making transactions fast and cheap, as well as focusing on cross-chain interoperability, the Harmony network is clearly going to appeal to anyone interested in finding the best yield farming opportunities and moving their digital assets to take advantage of them.

Furthermore, by making easy-to-understand staking, lending and liquidity provision opportunities available, as well as providing user-friendly wallet options, Harmony will appeal to anyone who likes the idea of yield farming but has been put off by the technical requirements.

For all of these reasons, Harmony looks like a great yield farming opportunity for all sorts of different users to take part in.

Here you can check yield farming opportunities on Harmony: https://de.fi/explore/network/harmony

Check our other resources to stay safe and explore DeFi:

Revoke Wallet Permissions Tool

What is TVL (Total Value Locked) in DeFi?

Upcoming Crypto Airdrops for 2023

Smart Contract Audit Services

Free Smart Contract Audit Scanner

And join us on Twitter and Telegram!

Good luck in farming!