Overview

- Will Crypto Recover?

- Why Crypto Will Recover

- How to Prepare for Crypto’s Recovery

- Research Crypto Opportunities With De.Fi

Cryptocurrency has become a wild ride for investors, and the latest bear market, along with rising interest rates, has prompted many to ponder if the best days are in the past. Will it be possible for popular projects to recover and go back up?

While some analysts anticipate a potential downfall, steadfast crypto enthusiasts maintain unwavering optimism. Amidst the dizzying highs and disheartening lows, coupled with regulatory upheavals and innovative new tech, the future of this market remains a blend of uncertainty and excitement.

For daring investors at the intermediate or advanced level, this guide aims to shed light on the state of the current crypto climate. Will another epic crypto bull run emerge? Or will the market dwindle into obscurity? We’ll explore these questions by examining crypto’s history and the narratives that proponents believe will propel the industry forward.

Will Crypto Recover?

The Current State of the Market

First, let’s get one thing out of the way: The information in this blog is for educational purposes only and should not be construed as professional financial recommendations or advice to engage in investments. We recommend that you always DYOR (Do Your Own Research) before making any crypto investing decisions.

The world of cryptocurrency is volatile and unpredictable. It’s impossible to provide a definitive answer to the question: “Will the crypto market recover?”, or “Will Bitcoin ever recover?” Investing in crypto comes with inherent risks, and there is always a chance that the market may never fully recover.

As responsible crypto participants, we must acknowledge this possibility and urge investors to be prepared for all scenarios. Indeed, even while blue-chip coins like Bitcoin and Ethereum may recover and reach new all-time highs, the next crypto bull market will most assuredly look very different from those before it, and some of the coins that performed spectacularly in 2021 may fall by the wayside.

However, despite the uncertainties, participants within the industry remain bullish on the potential for crypto to recover. In this article, we will explore some of the top reasons why we believe the industry has a bright future, and how crypto has the potential to bounce back.

First and foremost, the underlying technology behind cryptocurrencies, blockchain, has proven its value and potential to revolutionize various industries. Blockchain technology offers transparency, security, and decentralization, which are increasingly sought-after features in a digitalized world. As more businesses and institutions recognize the benefits of blockchain, it is likely to drive the demand for cryptocurrencies, thereby fostering a potential recovery.

Secondly, the growing interest and adoption of cryptocurrencies by institutional investors and major corporations indicate a shifting perception and recognition of their long-term value. Institutions such as banks and asset management firms are gradually entering the crypto space, providing legitimacy and stability to the market.

The integration of cryptocurrencies into traditional financial systems through regulatory frameworks and infrastructure developments could contribute to a more robust and resilient market. When the CEO of the largest asset manager in the world starts talking about crypto as “digitizing gold”, it’s probably time to pay attention:

#Bitcoin is an International Asset. – Larry Fink, BlackRock CEO pic.twitter.com/WIVKITXYPj

— Michael Saylor⚡️ (@saylor) July 5, 2023

Moreover, the market has historically experienced cycles of highs and lows, with periods of consolidation followed by significant recoveries. While past performance does not guarantee future results, these cycles suggest that the crypto market has the potential to consistently rebound from downturns and regain momentum.

When Will the Crypto Market Recover?

Looking at the question of “will the crypto go up in 2023”, it is challenging to predict the exact trajectory with any certainty. While a 2023 crypto recovery is not impossible, external factors such as global economic conditions, regulatory developments, and technological advancements will play significant roles in limiting the market’s direction. 2023 may prove to be too soon for the market to bounce back. But the future still looks bright.

With continued innovation, increased adoption, and growing institutional participation, there is optimism that the crypto market will recover and see positive growth in the coming years. Most crypto experts look to 2024 and 2025 for a complete recovery and the return of industry-wide bull runs.

Looking for a quick breakdown? We have you covered on our YouTube channel

Why Crypto Will Recover

Crypto’s History of Recoveries

One of the reasons we remain optimistic about the potential for crypto to recover is its history of resilience. Throughout its relatively short existence, the crypto market has witnessed multiple cycles of bull markets, followed by bubble pops, and subsequent recoveries. Each time the market experienced a downturn, it eventually regained momentum and reached new heights.

For example, after the infamous bubble burst in 2017-2018, where the prices of many cryptocurrencies experienced a significant decline, the market eventually recovered. Bitcoin, the leading cryptocurrency, reached new all-time highs in 2020 and 2021, demonstrating its ability to recover from major setbacks.

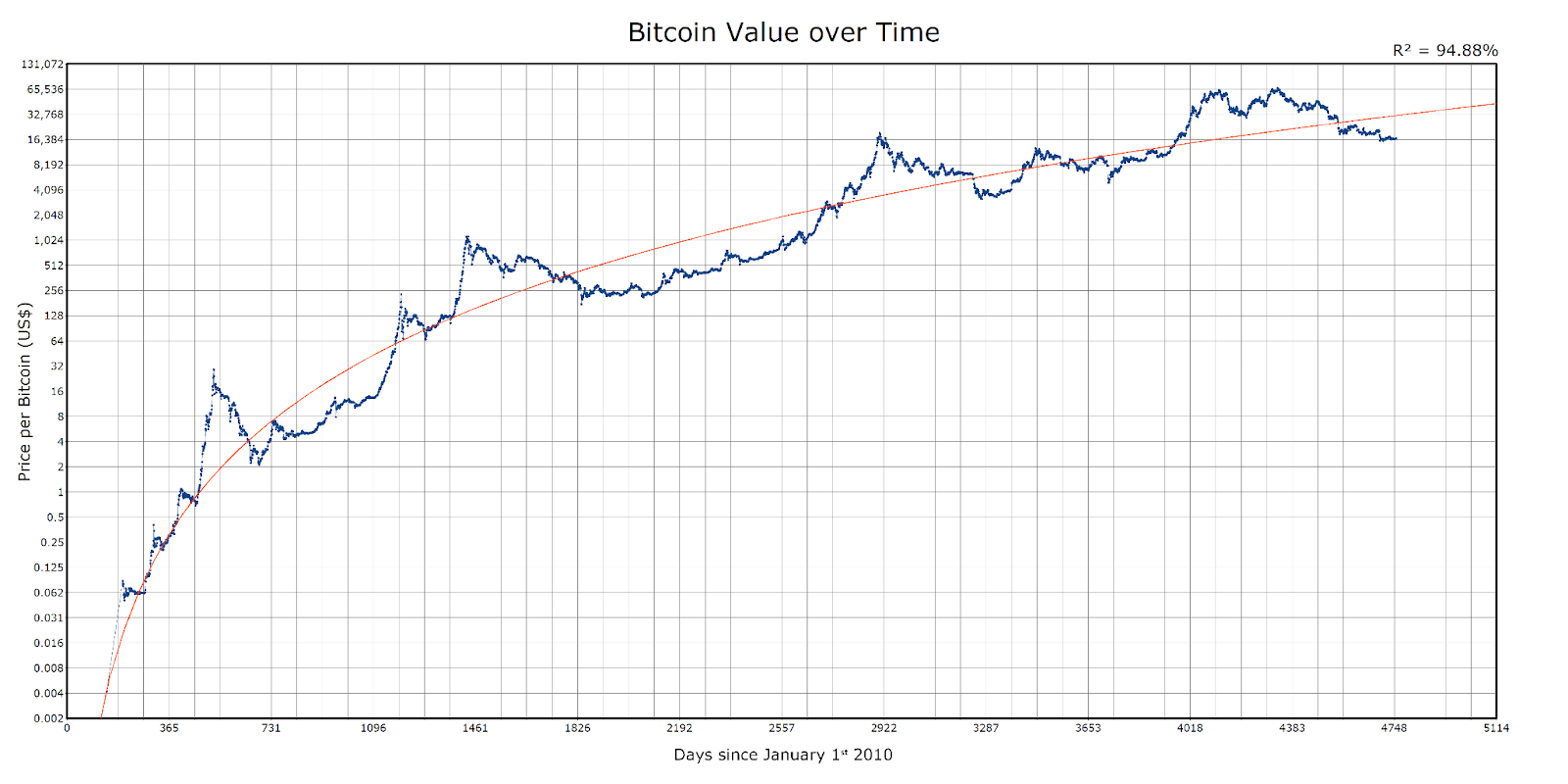

A logarithmic chart of Bitcoin’s price over time shows the full history of bubbles and recoveries (Source: Reddit)

These recovery cycles are often fueled by factors such as increased adoption, technological advancements, regulatory clarity, and growing investor confidence. The lessons learned from previous market cycles have led to improved infrastructure, enhanced security measures, and more sophisticated investment strategies.

The Developer Mindshare

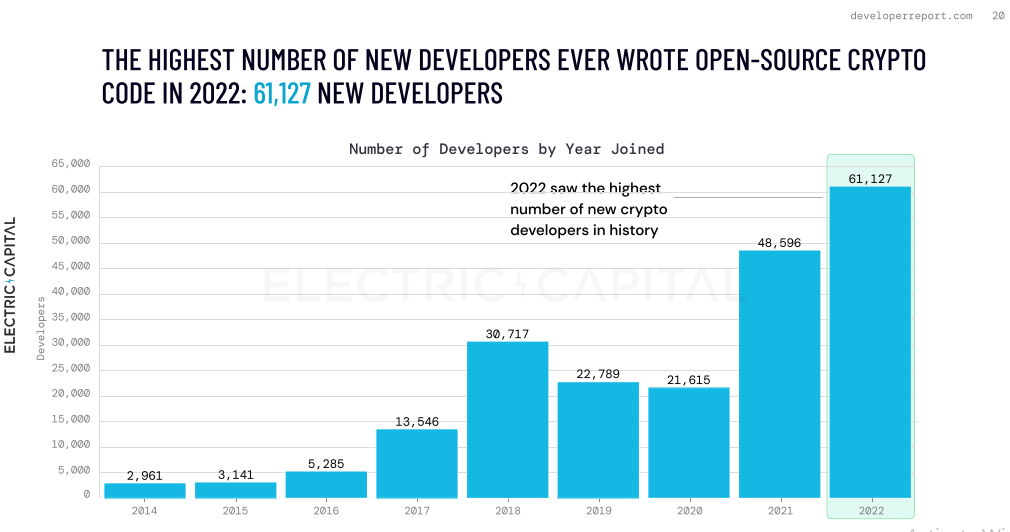

Another promising indicator of crypto’s potential recovery is the rapid growth in the number of developers working in the crypto and web3 space. According to data from ChainDebrief, there was a 5% increase in the number of active monthly developers in crypto in 2022. This brings the total to 23,343 developers actively contributing to the development of crypto projects.

Moreover, over 61,000 developers joined the crypto space for the first time in 2022, marking an all-time high. This surge in developer interest indicates the growing popularity and potential of web3 technologies.

The trend of network value to monthly active developers further supports the notion of recovery. As the value of crypto networks increases, so does the number of developers actively working on these projects. Despite a significant reduction in network value during the bear market of 2022, the number of active monthly developers only decreased by 11%. This signifies that developers remain committed to the crypto industry, even during challenging market conditions.

A closer look at the distribution of developers reveals that Ethereum and Bitcoin continue to attract a significant portion of the talent pool, accounting for 28% of all developers in crypto. Additionally, 50% of developers work within the top 200 ecosystems based on network value, highlighting the concentration of talent in projects with an established market presence.

The growing number of developers and their unwavering commitment to crypto and web3 technologies demonstrate that some of the brightest minds in the world are actively participating in and driving the industry forward. Their dedication to developing decentralized applications, improving tooling, and enhancing core protocols reinforces the belief that crypto has the potential to recover and continue its growth trajectory.

Crypto’s history of recoveries, coupled with the rapid growth in the number of developers working in the space, provides compelling reasons to believe in its potential. The lessons learned from past cycles and the influx of talented individuals into the industry contribute to an optimistic outlook. While there are no guarantees in the crypto market, these factors indicate that future growth and resilience are possible.

The Problem With Fiat

One of the factors contributing to the potential recovery of crypto is the growing concerns about the stability of traditional fiat currencies. In recent years, there has been a shift away from countries relying solely on the US dollar as the global reserve currency, with players like China and Saudi Arabia being notable examples of a shift to conduct trade in alternative currencies. This diversification of currencies reduces dependence on a single currency and increases the need for alternative financial systems.

Furthermore, there is a growing distrust in traditional governmental institutions and central banks, especially in the wake of global economic crises, political uncertainties, and division of opinion. Citizens and investors are seeking alternatives that are not subject to the same level of regulation and control.

The world’s population is becoming increasingly connected through the internet, leading to a more globalized society. This interconnectedness, combined with the advancements in blockchain technology, provides an opportunity for crypto to emerge as an attractive alternative to slow and highly regulated traditional currencies.

Crypto offers features such as decentralization, transparency, and borderless transactions, which align with the needs and preferences of a more digitally connected population. It provides individuals with greater control over their finances and the ability to participate in a global financial ecosystem.

Growing Use Cases

Crypto has experienced a significant expansion in its use cases over the past few years, moving beyond its original purpose of simply sending and receiving money. The technology has evolved to support a wide range of applications, opening up new possibilities across various industries.

One notable area of growth is the integration of crypto in gaming. Developers are leveraging blockchain technology to create decentralized gaming platforms where players can earn and trade in-game assets. This concept of GameFi combines gaming and decentralized finance, providing users with an immersive gaming experience while also enabling them to earn real value through their virtual assets.

The rise of non-fungible tokens (NFTs) has also revolutionized the way assets are represented and traded. NFTs have expanded beyond digital art to encompass a wide range of assets, including virtual real estate, music, collectibles, and more. This creates unique opportunities for artists, content creators, and collectors to monetize their work and engage with their audience in innovative ways.

Another exciting development is the emergence of Decentralized Autonomous Organizations (DAOs). These digital organizations operate on blockchain technology, enabling decentralized decision-making and community governance. DAOs allow individuals to participate in collective decision-making, allocate resources, and govern protocols or projects without relying on centralized authorities. This could well foster a new era of collaboration and innovation within communities.

Finally, as has been all the rage recently, a promising use case for crypto is its integration with generative artificial intelligence (AI). The combination of crypto and AI opens up new possibilities for incentivizing individuals to contribute data, train AI models, and utilize decentralized AI networks. Through crypto-powered systems, participants can be rewarded with tokens for providing data or training AI models, creating a decentralized marketplace for AI services.

This incentivization mechanism encourages broader participation, ensures the availability of diverse datasets, and fosters innovation in AI research. By leveraging crypto in AI, we can unlock the potential of decentralized and democratized AI models that are transparent, trustworthy, and accessible to a wider audience. This convergence of crypto and AI paves the way for a future where individuals are empowered to contribute to and benefit from the advancements in AI technology.

How to Prepare for Crypto’s Recovery

Use Crypto

When it comes to preparing for the next crypto bull run, one crucial aspect is to familiarize yourself with the basics of crypto and actively engage with the ecosystem. It may seem obvious, but many individuals who are new to the game tend to wait until after a bull run has already started to dive into learning about crypto. However, this approach puts them at a significant disadvantage.

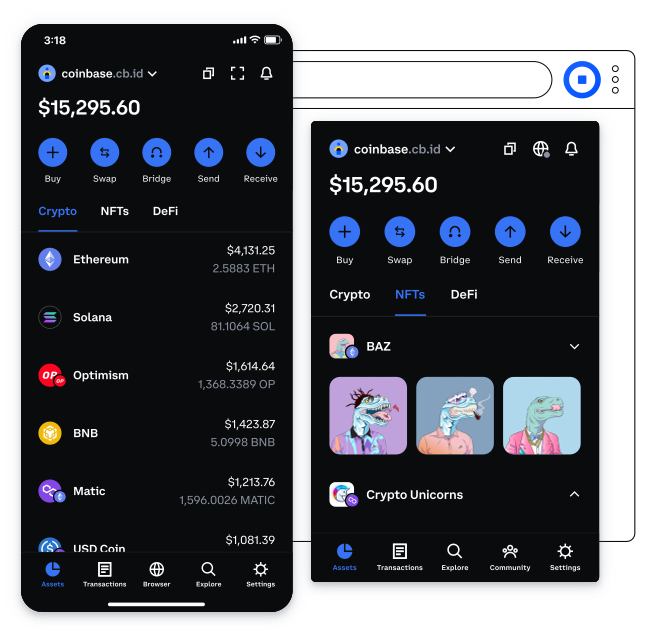

By using crypto and actively participating in the market during both bear and bull phases, you gain valuable experience and knowledge that will prove invaluable when the next bull run arrives. Start by familiarizing yourself with decentralized finance (DeFi), a rapidly growing sector within the crypto space. DeFi offers various financial services such as crypto swaps, lending, borrowing, yield farming, and decentralized exchanges.

Learning to use a trusted web3 wallet like Coinbase Wallet will ensure you can access the cutting edge of crypto opportunities

Furthermore, it’s essential to understand how to navigate centralized exchanges (CEXs) for buying and selling cryptocurrencies. Educate yourself on the different types of orders, trading pairs, and security measures implemented by reputable exchanges. Practice using these platforms with small amounts before committing significant capital.

Learning the basics of crypto during the bear market allows you to make informed decisions, spot potential opportunities, and manage risk effectively when the market enters a bull run phase. By staying up-to-date with market trends, understanding the mechanisms of different crypto assets, and actively engaging with the crypto community, you position yourself for success when the market conditions are favorable.

Build Capital With Airdrops

Crypto airdrops present an excellent opportunity for new crypto participants to build their capital base and position themselves for the next bull run. Airdrops involve the distribution of free tokens to holders of specific cryptocurrencies or participants who complete certain tasks or meet specific criteria.

Participating in airdrops not only allows you to accumulate tokens without significant financial investment but also provides insights into different projects and their potential. Research and stay informed about upcoming airdrops through reliable sources, including industry blogs and reputable crypto communities.

At De.Fi, whether it is a bear or bull market, we constantly monitor the crypto space for airdrops and offer valuable resources on this topic through our YouTube videos and blogs. Our content provides insights into the best airdrop opportunities, tips for maximizing returns, and strategies for participating effectively.

To make the most of airdrops, ensure you have a secure and diverse web3 wallet that supports the tokens you aim to receive. Take measures to protect your private keys and exercise caution to avoid falling victim to scams or phishing attempts related to airdrops.

By actively participating in airdrops, you not only have the chance to accumulate tokens that may appreciate significantly if crypto recovers, but you also gain firsthand experience in navigating token distributions and managing your crypto assets effectively in the DeFi space.

Learn Crypto Security

Ensuring the security of your crypto assets is paramount in the ever-evolving landscape of the crypto market. At De.Fi, we always emphasize the importance of safeguarding your funds, which is why we offer resources such as the De.Fi REKT Database of crypto hacks and scams. This database allows you to learn from past incidents and understand the risks associated with crypto investments.

In addition to utilizing the REKT Database, it’s crucial to implement tried-and-true security best practices to protect your wallets and investments. These practices include:

- Secure Wallet Management: Use hardware wallets, such as Ledger or Trezor, to store your cryptocurrencies offline in cold storage. These wallets provide an added layer of security by keeping your private keys offline and away from potential online threats.

- Two-Factor Authentication (2FA): Enable 2FA on all your crypto exchange accounts and wallets to add an extra layer of protection. This typically involves using an authentication app on your smartphone or receiving SMS codes for account access. Note, we highly recommend using an authentication app vs receiving SMS codes as sim swap attacks are still a major problem for many crypto platforms.

- Be Cautious of Phishing Attempts: Be vigilant and avoid clicking on suspicious links or providing sensitive information to unverified sources. Always double-check website URLs and ensure you are using legitimate platforms to transact and store your crypto assets.

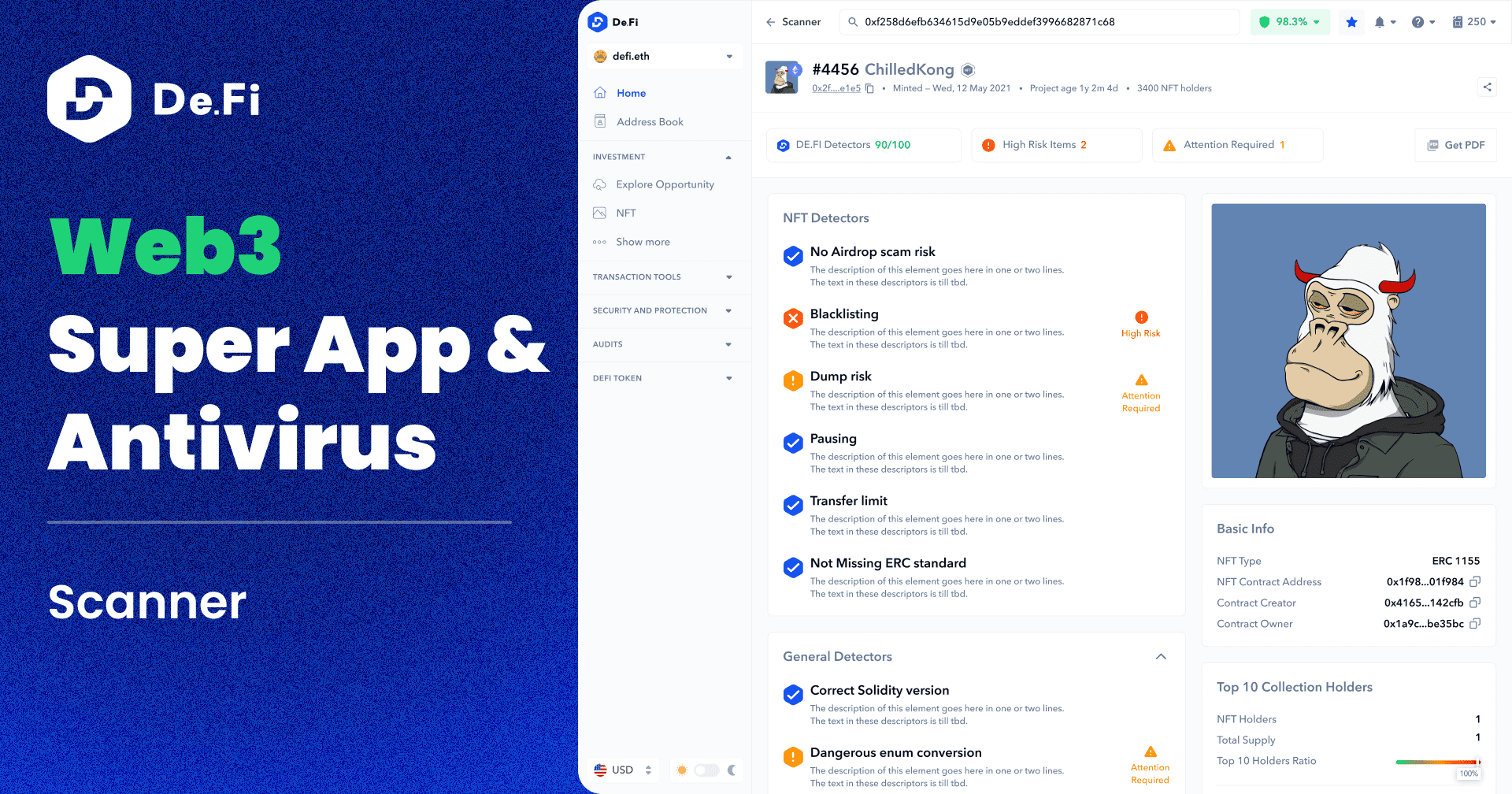

At De.Fi, we offer additional tools to enhance your security. Our Scanner free smart contract audit tool allows you to analyze and verify the legitimacy of smart contracts before interacting with them with just a search and a few simple clicks, reducing the risk of you falling victim to malicious contracts.

Meanwhile, our Shield tool further helps protect your wallet from exposure to such contracts. When you connect to our DeFi dashboard and utilize Shield, it will warn you if there is a potentially malicious contract and allow you to revoke permissions.

If you’re a crypto project interested in improving your security, we also offer comprehensive smart contract auditing services. Founded in the summer of 2020, the De.Fi team has grown alongside DeFi itself and is committed to building life-saving products that keep individuals and businesses safe.

Build a Network by Participating in the Industry

In the world of crypto, building a network of like-minded individuals can be invaluable. While following good influencers is a great starting point, having a network of friends exploring crypto alongside you offers even greater benefits. By connecting with others, you can watch each other’s backs, share knowledge, and discover new ideas.

To build your network, consider joining crypto-focused communities such as Discords, Telegram groups, and online forums. Engage in discussions, ask questions, and share your own experiences and opinions. Actively participating in these communities allows you to learn from others, gain insights, and stay updated on the latest trends and developments in the industry.

Additionally, attending crypto conferences and meetups provides opportunities to connect with industry professionals, thought leaders, and fellow enthusiasts. These events offer a platform for networking, learning, and fostering collaborations. Because crypto is still a relatively small industry, it can be remarkably easy to strike up conversations with like-minded individuals.

Remember to approach these interactions with an open mind, as the crypto space is diverse and dynamic. Engage the conversation, exchange ideas, and build relationships based on trust and shared interests. Your network can serve as a support system, helping you navigate the ups and downs of the crypto market and providing valuable insights and perspectives.

All in all, learning about crypto security and implementing best practices, as well as building a network within the crypto industry, are vital steps to prepare for the recovery of the crypto market. By prioritizing security and connecting with others, you position yourself for success, both in protecting your assets and staying informed about the evolving landscape of the crypto world.

Research Crypto Opportunities With De.Fi

Worried you’re NGMI? De.Fi is your ultimate companion for the crypto journey. We provide a comprehensive suite of tools and resources designed to empower crypto participants to track, discover, and audit their investments and the industry as a whole.

Our blog is a treasure trove of valuable insights, expert analysis, and informative articles on various aspects of crypto. It covers topics ranging from market trends and strategies to project reviews and industry news. Explore our blog to stay up-to-date and gain valuable knowledge.

For visual learners, our YouTube channel offers engaging videos that cover a wide range of crypto-related topics. From tutorials and educational content to interviews with industry experts, our videos provide a dynamic way to expand your understanding of crypto and its potential. You can also follow our main Twitter account for industry news as well as our De.Fi Security Twitter account for breaking exploit notifications.

Additionally, our site tools are designed to provide practical assistance in navigating the crypto market. Whether you need to track prices, find the best DeFi yields, or swap at the best prices, our tools are tailored to meet your needs and enhance your decision-making process.

By leveraging the resources available through De.Fi, you gain a competitive edge in preparing for crypto’s recovery. We aim to empower you with the knowledge, insights, and tools necessary to make strategic choices while navigating the ever-changing crypto landscape.