Elephant Money, a stable coin platform that uses the TRUNK token became a victim of the flash loan attack, which manipulated a token price oracle leading to a loss of $22.2 million:

We are pausing the Reserve which will disable Stampede and the minting/redeeming of TRUNK.

We are working with our partners at Certik /InsurAce to investigate this attack.

ACTION YOU SHOULD TAKE

– DO NOT SELL

– DO NOT ANSWER DMS

– YOUR FUNDS ARE SAFUhttps://t.co/h6Cnz1ANw6 pic.twitter.com/zoSC3qofIO

— Elephant Money (@ElephantStatus) April 12, 2022

In the official post-mortem, Elephant Money stated a loss of $11.2m, not taking into account that 30,414 billion $ELEPHANT tokens were also stolen which sums the total losses to the above values:

Reserve Exploit: Live Updates

We are investigating a coordinated exploit by several bad actors in the space against the HERD.medium.com

Elephant Money Stable (TRUNK) is partially collateralized by BUSD at 75% guaranteed. TRUNK passively hardens its collateralization ratio of the remaining 25% on the dollar as the Elephant Money ecosystem grows. So, what was done by the attacker exactly to turn the attack?

The attacker exploited the $TRUNK token’s redeem mechanism, modified the price oracle to enable token return, and stole ELEPHANT from the unverified Treasury contract.

The attack analysis

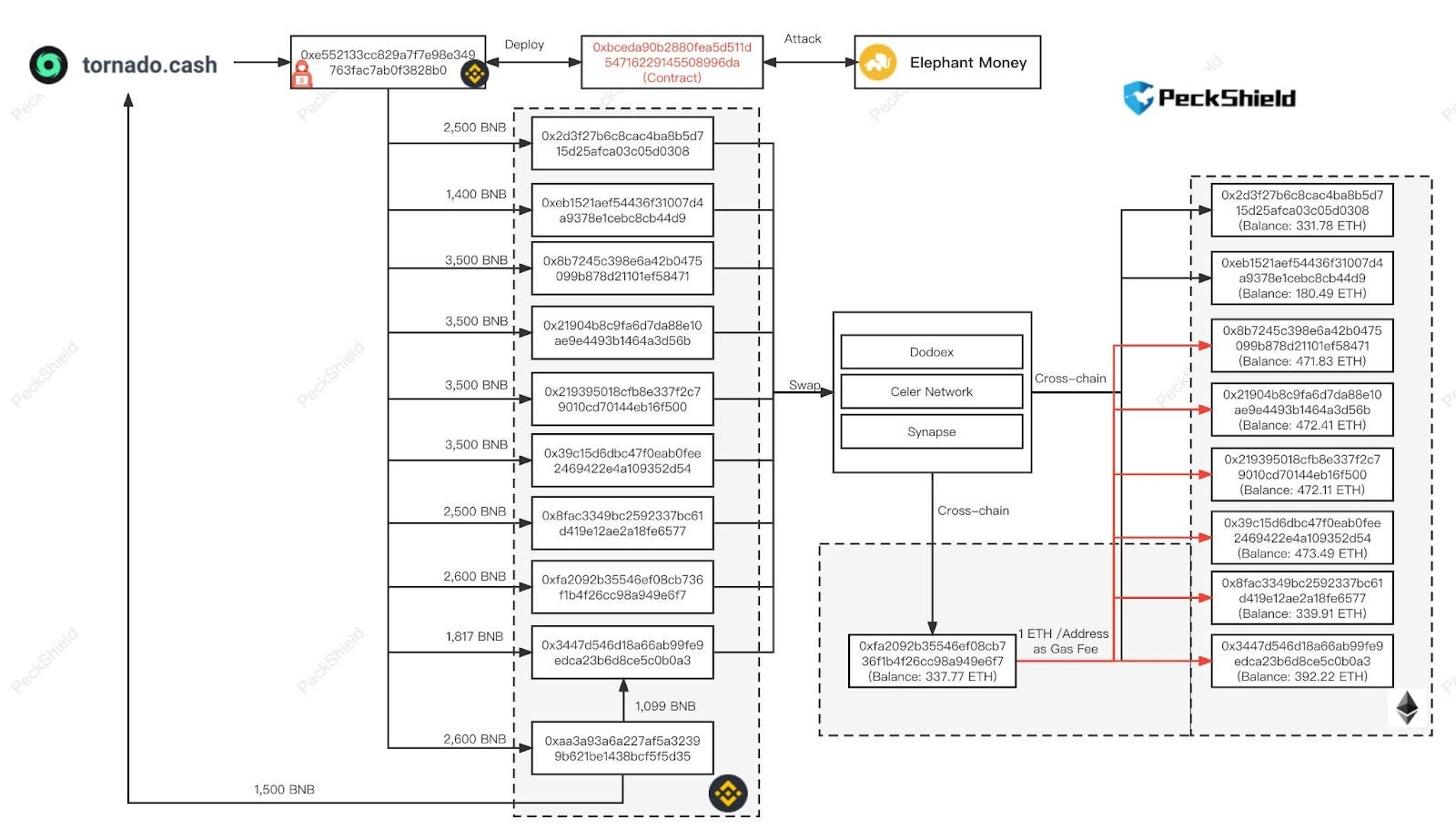

The attacker’s address was initially funded via Tornado Cash:

https://bscscan.com/tx/0xf678370cf3ee8d5df5ae319577b46bf3834ec6ffb44f2c1ebe86ed702b0b22a2

At first, using the flash loan, the attacker borrowed 131,162 WBNB and 91,035,000 BUSD The attacker then exchanged the 131,162 WBNB for 34,244 ELEPHANT Token.

The example transaction:

https://bscscan.com/tx/0xec317deb2f3efdc1dbf7ed5d3902cdf2c33ae512151646383a8cf8cbcd3d4577

In order to mint new TRUNK tokens, BUSD should be deposited in the minting contract. Once the contract receives BUSD, it swaps them to WBNB which in turn uses to buy back ELEPHANT tokens and increase their market value.

Since the attacker received ELEPHANT tokens with increased market value, he swaps them back to WBNB, resulting in 34,244 ELEPHANT exchanged on 163,782.82 WBNB

In the next step, the attacker redeems TRUNK for 36,987.33 WBNB and 66,884,140.12 BUSD. After repaying the flash loans of 131,162 WBNB and 91,035,000 BUSD, a profit of $4M was realized by the attacker.

The attack proceeded by making several cycles of the same actions.

Stolen funds were distributed between a bunch of external addresses. The whole picture was tracked by PeckShield:

The list of addresses where the funds were sent and now lies there:

- 0x8B7245C398E6a42b0475099b878D21101eF58471 472 ETH

- 0x21904B8C9Fa6D7da88E10Ae9e4493B1464A3D56b 472 ETH

- 0xfa2092b35546ef08cb736f1b4f26cc98a949e6f7 337 ETH

- 0x8fac3349Bc2592337bc61d419E12AE2A18Fe6577 339.9 ETH

- 0x2d3F27B6c8CAc4ba8B5D715D25AfcA03c05D0308 331.7 ETH

- 0xEB1521aEf54436F31007D4a9378e1ceBc8cB44d9 180.4 ETH

- 0x39C15D6dbc47F0EAB0fEE2469422E4A109352d54 473.4 ETH

- 0x219395018CfB8e337f2c79010Cd70144Eb16F500 472.1 ETH

- 0x3447d546d18a66Ab99Fe9edca23B6d8ce5c0B0a3 392.2 ETH

At the time of writing, the TRUNK stablecoin price is recovered.

In the post-mortem, the team stated: “Strategic buyback of TRUNK has begun to fund the upcoming TRUNK Treasury. $391K of TRUNK has been purchased to date by the ELEPHANT Deployer:

https://bscscan.com/address/0x16e76819ac1f0dfbecc48dfe93b198830e0c85eb#tokentxns “

This attack shows how the asset peg tokens still have many vulnerabilities and are subject to various manipulations, which affect both protocols and their users.

The question arises as to their usefulness to the ecosystem in general and what benefits they can bring using such a vulnerable model, other than short-term returns with high investment risk. However, “apeing” has always been fun.

As always, stay safe and DYOR!

For more De.Fi updates you can visit us at:

🌐 **Website | 📱 [Telegram](https://t.me/DeDotFi** | 🐦**Twitter**

Don’t miss our latest Rekt stories:

Over $20m lost in early March: DeFi Rekt Stories

$20M Lost??? 13 REKT cases investigated: Early March recap!blog.de.fi

376M Lost in February: REKT Investigation

At the end of this month, our specialists counted a whopping 22 Rekt cases with a total amount loss of more than…blog.de.fi

Wormhole exploit: the second-largest DeFi hack ever

2nd place on the Rekt Databaseblog.de.fi