Yield farming on Celo — everything is covered in this ultimate guide, including a project overview, wallets, and yield farming opportunities

Celo has big plans and big investors to back them.

It wants to build a financial system for everyone, using a mobile-first approach to make cryptocurrencies more user-friendly and less volatile. It is also a platform that supports smart contracts for dApps to power all manner of socially-oriented financial services. Plus, it has the backing of major investors like Jack Dorsey to help it get there.

Clearly, there’s a lot to explore about the potential of the Celo ecosystem both now and in the future. In this guide, you’ll find overviews of the platform and benefits, the key technical features of its architecture and all you need to know about the staking and yield farming opportunities that exist.

Table of Contents

What is Celo?

Celo Architecture

Technology features

$CELO Token

The Celo Ecosystem

CELO ON De.Fi

Wallets for Celo

Yield Farming on Celo

Should I use Celo for Staking and Yield Farming?

What is Celo?

Celo is a blockchain platform with a mobile-first approach that aims to make financial dApps and crypto payments accessible.

It is focused on addressing user experience and price volatility, which it sees as two key blockers to crypto adoption. To achieve this, it is building a global payment infrastructure for cryptocurrencies, which uses phone numbers as public keys and stablecoins for transactions.

“Celo’s mission is to make financial tools open to people all over the world and the team has spent a huge amount of time doing user testing across the globe in cities, refugee camps, and rural areas to make sure they are building something people really need.” — Arianna Simpson, a16z

The main benefits of Celo include:

- Sending, spending and earning crypto from your mobile phone

- Building dApps and assets that move across chains, carriers and countries

- Using crypto like everyday money on a platform designed for real-world use

Celo was founded in 2017 and early CELO holders include prominent venture funds, C-level operators, academics and experts across a wide range of fields, including Jack Dorsey, Reid Hoffman and Naval Ravikant.

“We now have the technology to create a better financial system, a rich ecology of digital assets and products that allow individuals and organizations to transact and manage risk.” — Rene Reinsberg, Celo Co-Founder

Celo Architecture

Celo is a proof-of-stake blockchain that is open-source, EVM-compatible and governed by owners of the network’s native token, CELO. It supports the development of smart contracts and decentralized applications, and will include the Celo wallet, which powers a mobile-first payment system.

Technology features

The Celo protocol allows applications to use a range of stable value currencies to make transactions and perform computations. The Celo Wallet app will allow users to manage accounts and make payments securely.

Some of the key features of Celo include:

Stable value currencies

Native support for multiple ERC20-like stable currencies pegged to fiat currencies

Accounts linked to phone numbers

Secure, decentralized mapping of phone numbers that allows wallet users to send and receive payments with existing contacts.

Transaction fees in any currency

Users can pay transaction fees in stable currencies so they don’t need to manage balances in different currencies.

Immediate syncing on slow connections

Support for users with high latency, low bandwidth or high-cost data tariffs.

Full EVM-compatibility

Celo includes a programmable smart contract platform that is compatible with the Ethereum Virtual Machine (EVM).

Self Custody

Users have access to and full control of their funds and account keys, with no dependence on third parties.

Consensus mechanism

Celo uses a Proof of Stake mechanism called the Byzantine Fault Tolerance (BFT) to keep the network in sync.

The network’s contributors include:

Light clients

These are applications running on a user’s mobile device, such as Celo’s mobile wallet.

Validator nodes

These are computers who participate in Celo’s consensus mechanism by validating transactions and producing new blocks.

Full nodes

These are the bridge between validator nodes and light clients, taking requests and forwarding transactions.

Developers

Celo has been designed to make life easy for developers building for smartphones around the world with a number of developer-centric features.

Coding in Solidity

Celo is EVM-compatible, so it’s easy for developers to build and port their dApps across.

An established toolkit

Celo is interoperable with MetaMask, other popular Ethereum tools and native mobile dApps.

Bridges

You can bridge assets from Ethereum, Polygon and Solano to Celo using the bridges described below.

Optics Bridge

Optics, which stands for OPTimistic Inter-chain Communication Standard, is the most well-known Celo bridge. It is a protocol for gas-efficient and trust minimized interoperability.

Allbridge

Allbridge is a cross-chain solution that lets users transfer assets between Celo and other blockchain networks.

Moss

Moss is a bridge that lets you convert your Celo to Ether and vice versa.

Stablecoins

A key feature of Celo is its ability to operate stablecoins like cUSD, which offer efficiency, transparency and relief from volatility.

Celo uses a programmatic reserve to keep the stable value asset pegged. This involves overcollateralization of reserves with CELO and other cryptocurrencies, such as Bitcoin and Ethereum. In future, Celo will allow CELO holders to propose and vote on the creation of new stablecoins that mirror other fiat currencies.

Governance

Celo uses a formal on-chain governance mechanism to manage and upgrade the protocol, with all changes needing to be agreed by CELO holders.

A quorum threshold model is used to determine whether a proposal passes and the change procedure follows the proposal, approval, referendum and execution process. At present, the Celo governance smart contract that manages changes is owned by a multi-signature wallet. Over time, this will be owned by CELO holders acting as a DAO.

$CELO Token

CELO is the native token of Celo. It is a utility token that enables users to participate in network consensus, pay for on-chain transactions and vote on governance decisions.

As of 23 December 2021, CELO has a maximum supply of 1,000,000,000, a price of $4.80 and a current market cap of $1,756,430,559 (according to Coinmarketcap data).

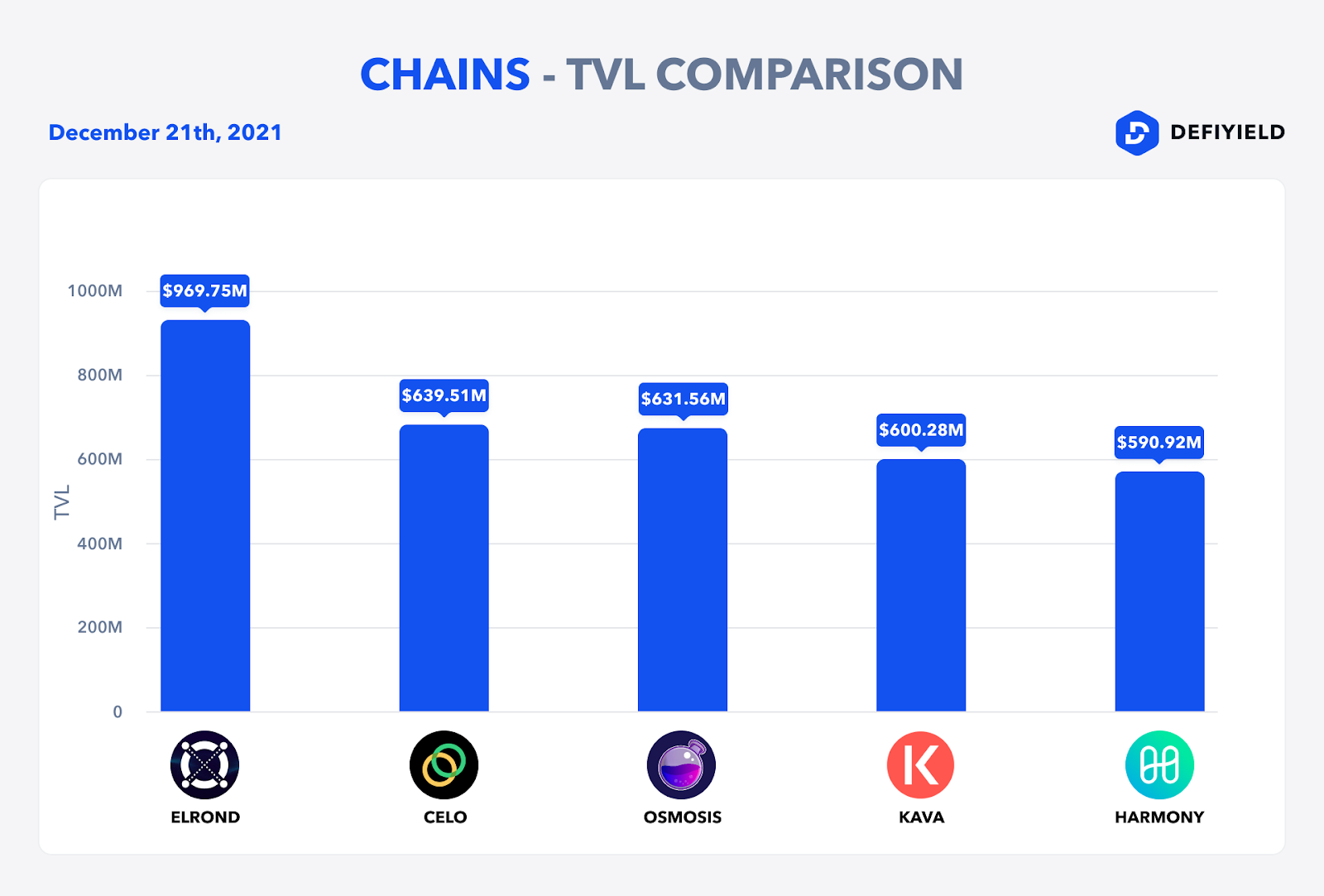

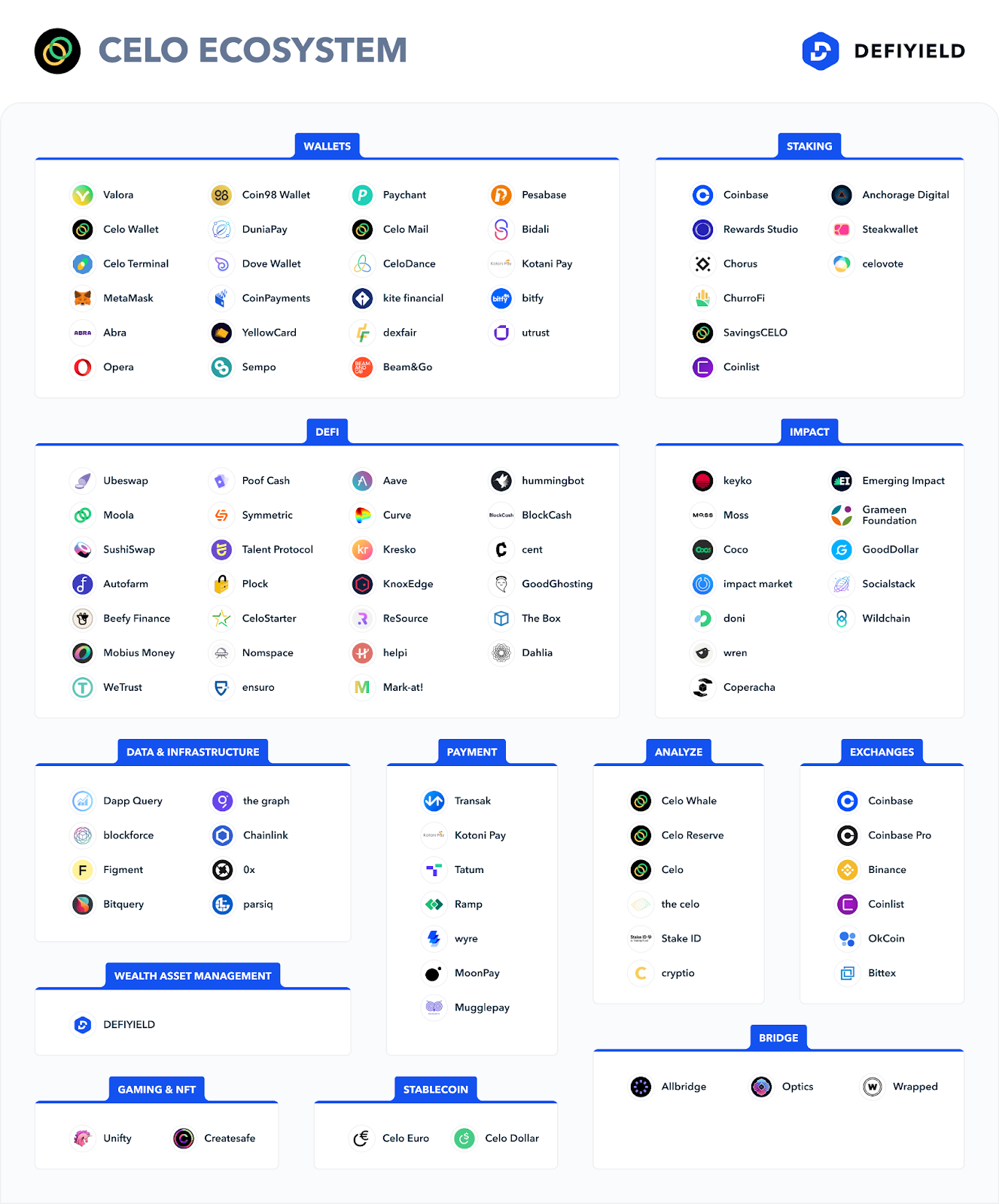

The Celo Ecosystem

Celo’s mission is to “build a financial system that creates the conditions for prosperity — for everyone”. As a result, many of the dApps built on Celo have a social or community aspect to them, such as contributing to a universal basic income scheme or crowdfunding social causes.

Celo’s growing ecosystem of over 1,000 projects, partners and developers is supported by millions of CELO owners around the world.

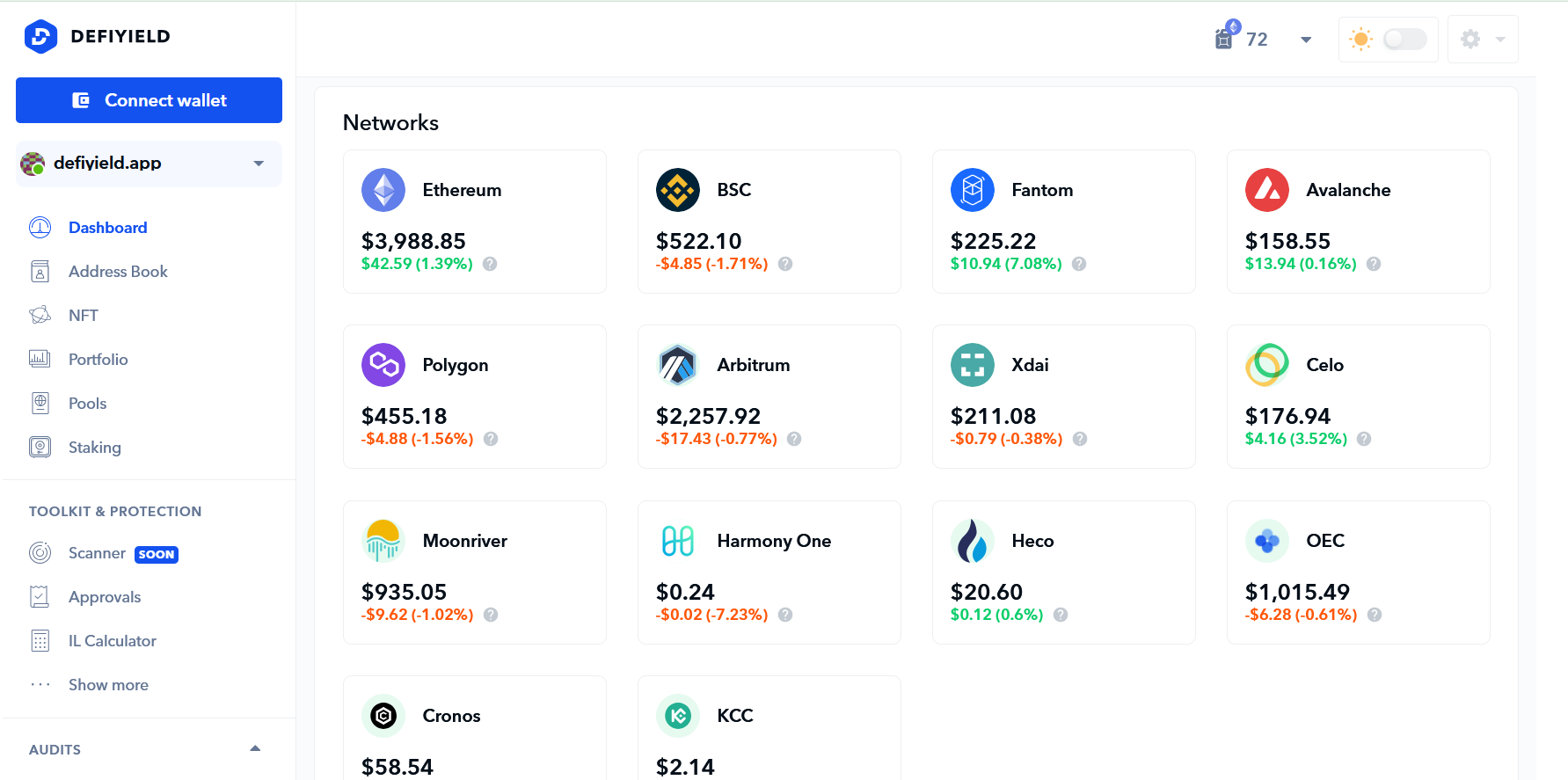

CELO ON De.Fi

Smart investors have a diverse portfolio!

Don’t miss the opportunity to profit off the growing chains — track your Profit and Loss, prices, balances, pools, and more on https://de.fi/dashboard !

Wallets for Celo

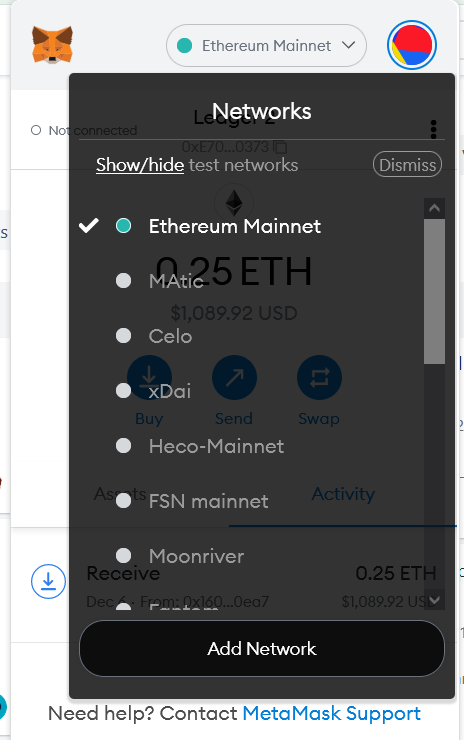

Metamask

Metamask supports Celo as well as many other networks.

To add Celo Netowork to Metamask you need to go the Networks section in the extension and choose “Add Network’’.

Then you need to insert these details:

Network Name: Celo (Mainnet)

New RPC URL: https://forno.celo.org

Chain ID: 42220

Currency Symbol (Optional): CELO

Block Explorer URL (Optional): https://explorer.celo.org

And you’re done! Here you can find an official tutorial from the Celo team.

Celo Wallet

Celo developed its own wallet. It uses the phone verification model. To be able to use the wallet and create an account, a user must be invited through their phone number by a verified user. The inviter will send an invitation code to the invitee, which they can later redeem upon downloading the app.

Here you can find the detailed explanation of the Celo Wallet usage.

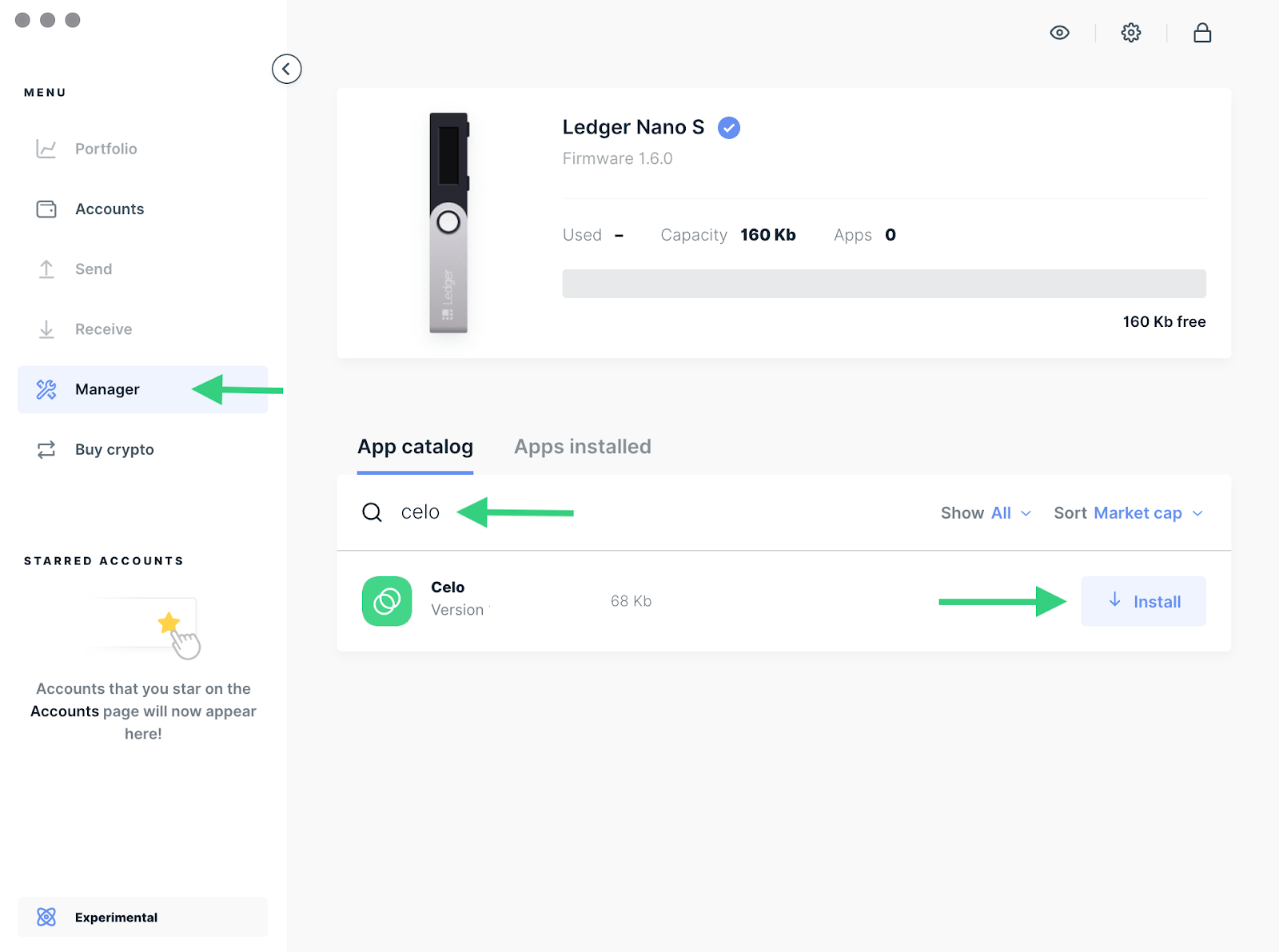

Ledger

Here you can find an official tutorial on how to add Celo to your Ledger. Simply install it in the wallet manager.

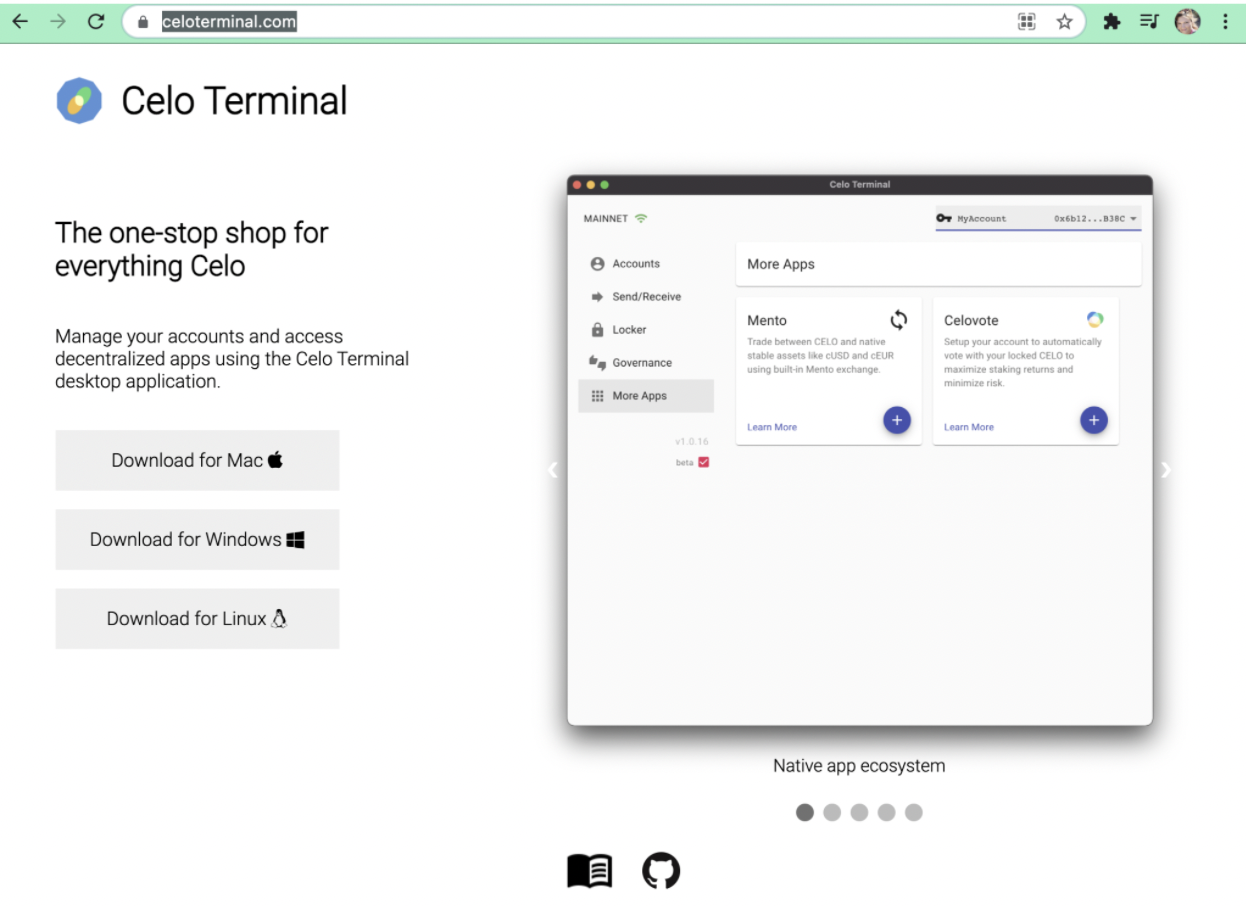

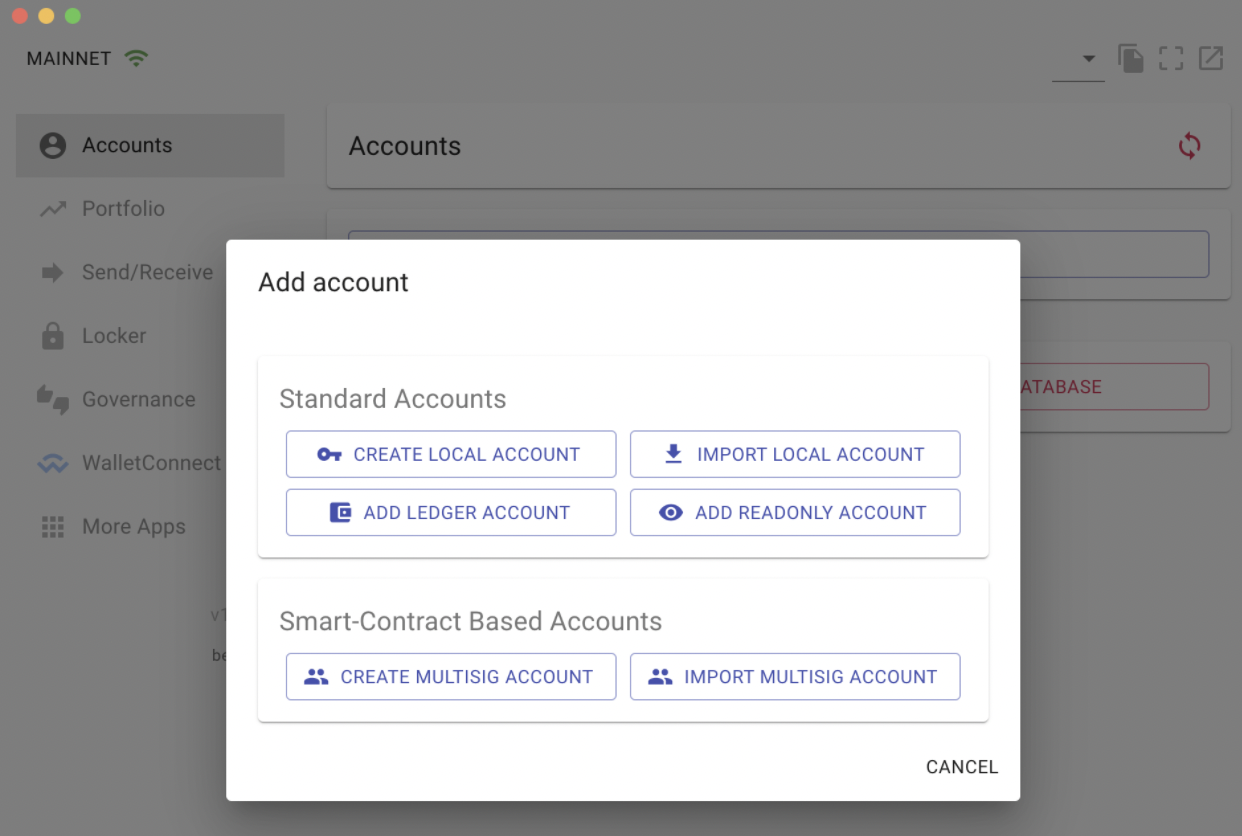

Celo Terminal

You can download the Celo Terminal application to create a Celo account.

You can create a new account with it or connect your Ledger account.

Celo Web Wallet

You can use Celo Web Wallet to operate on Celo Network as well. Simply create a new account or use the Ledger one.

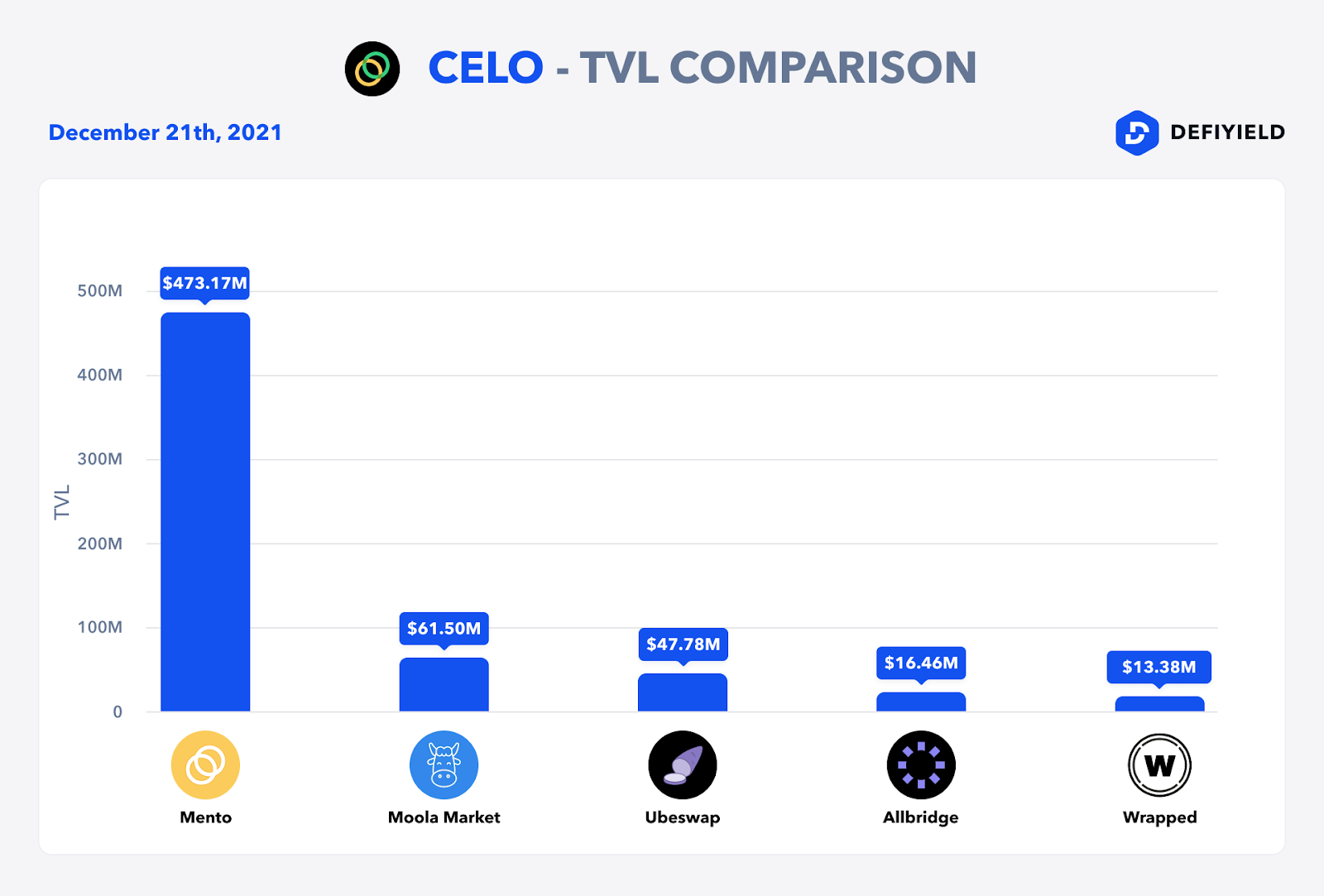

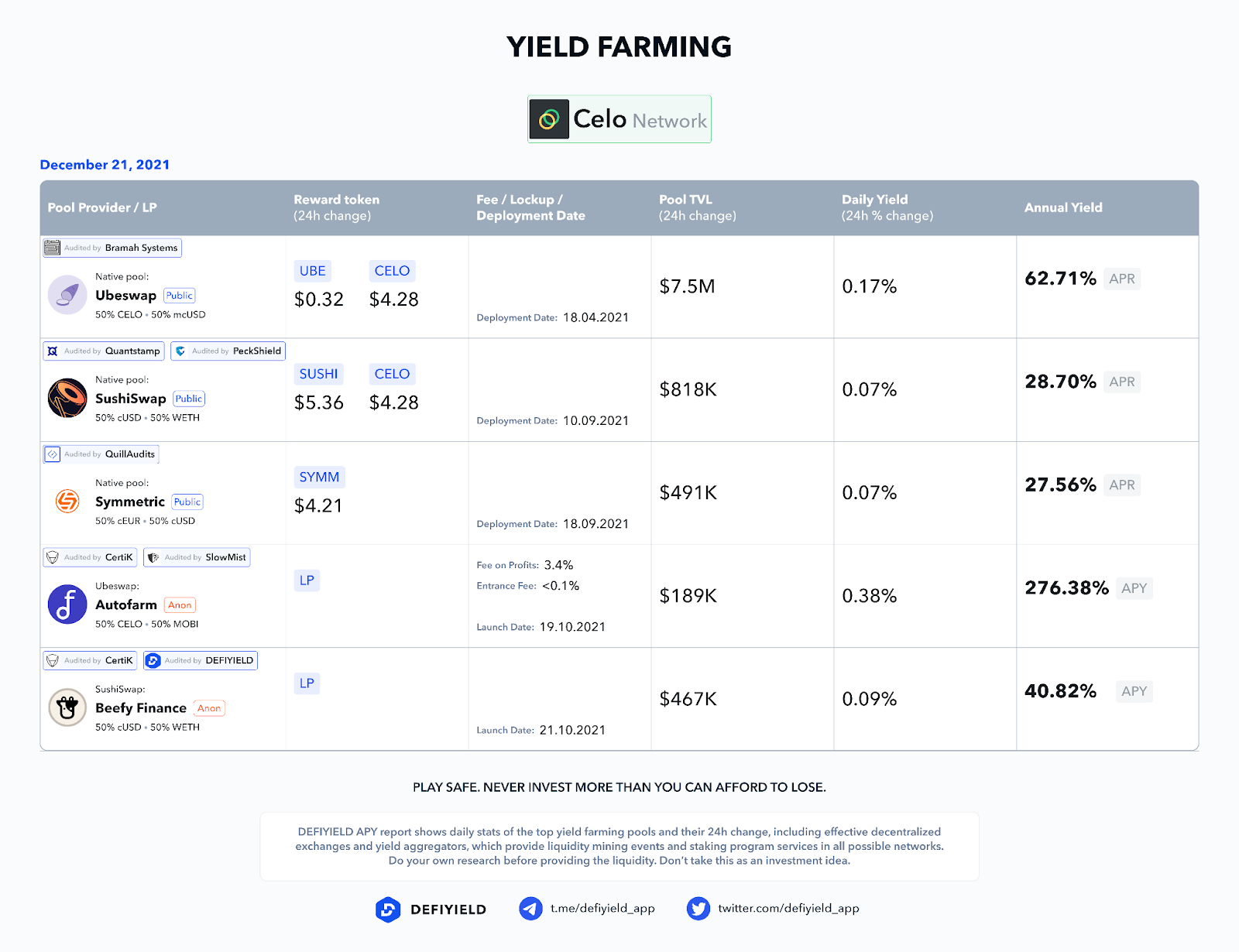

Yield Farming on Celo

There are different options for Yield Farming on Celo. These include but are not limited to SushiSwap, Ubeswap and more.

We will cover Yield Farming with Ubeswap today.

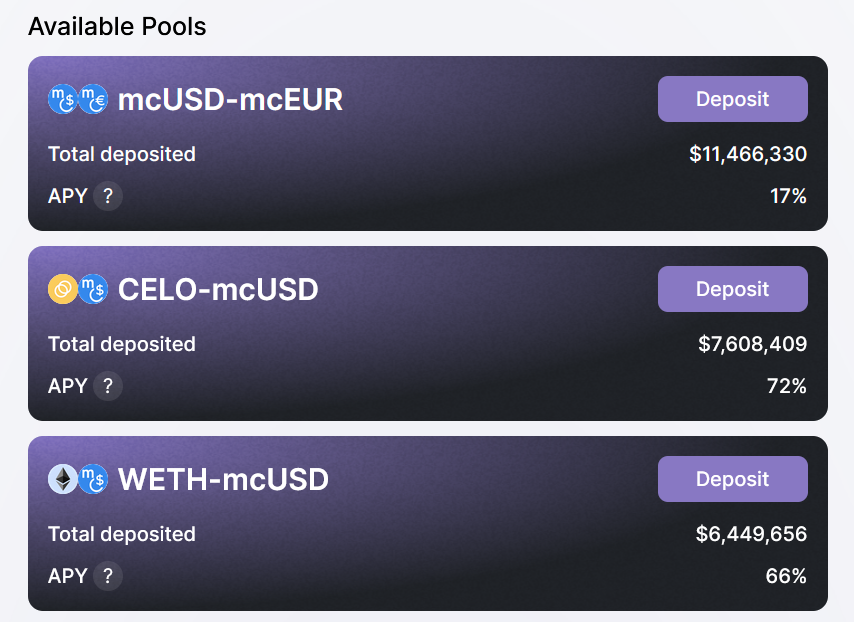

- After bridging tokens to Celo and acquiring the native token for gas, go to https://ubeswap.org/ and launch the app.

- Choose a farm you want to invest in.

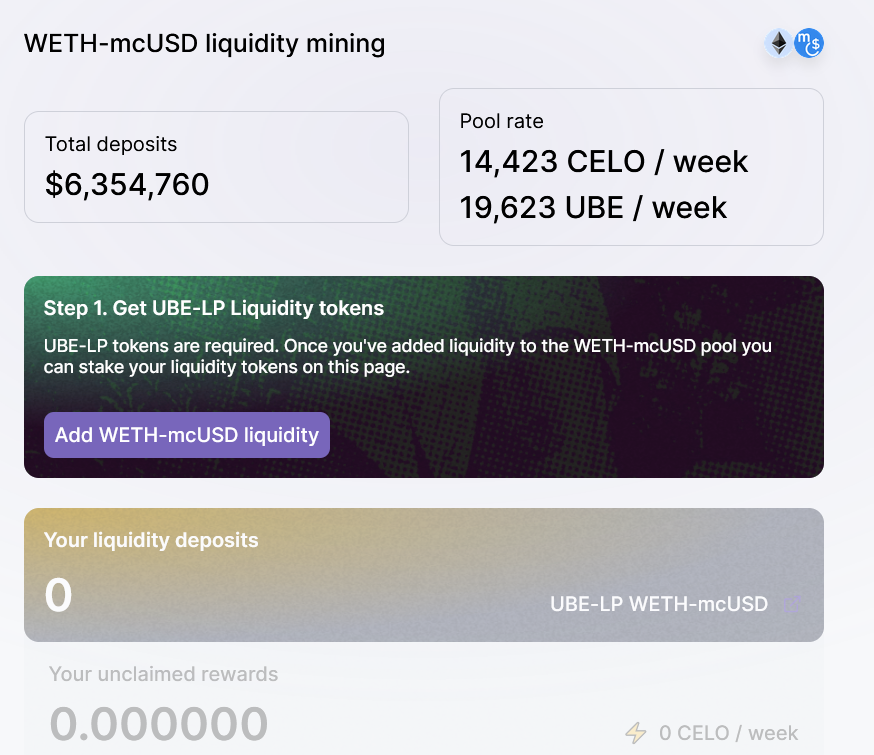

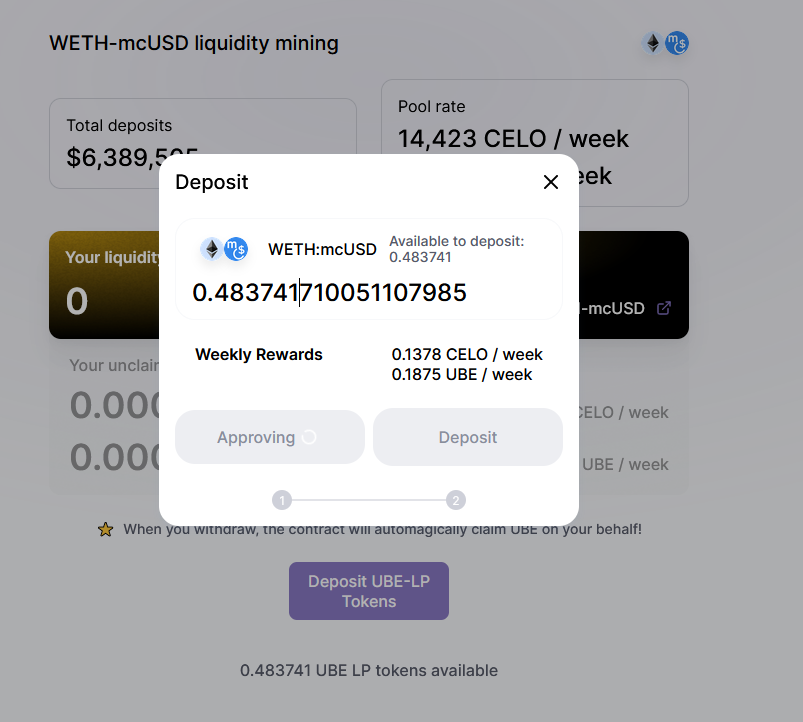

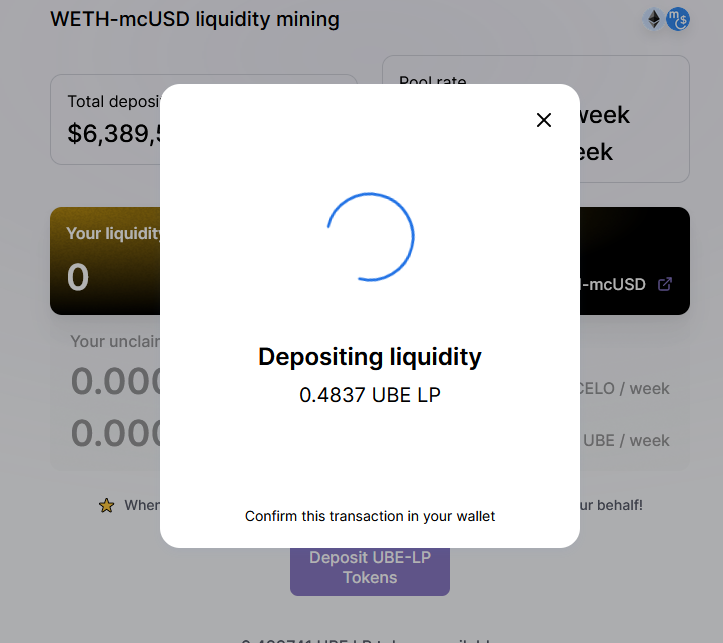

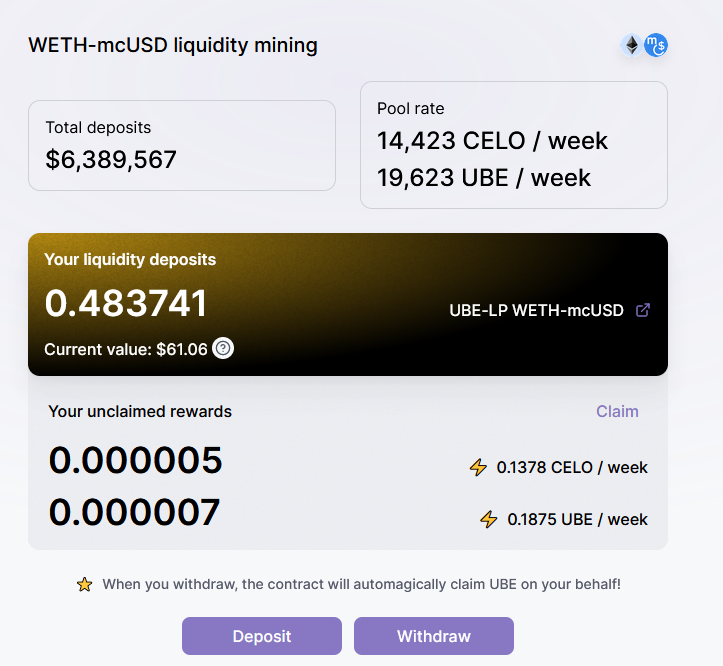

We will go with the WETH-mcUSD pool.

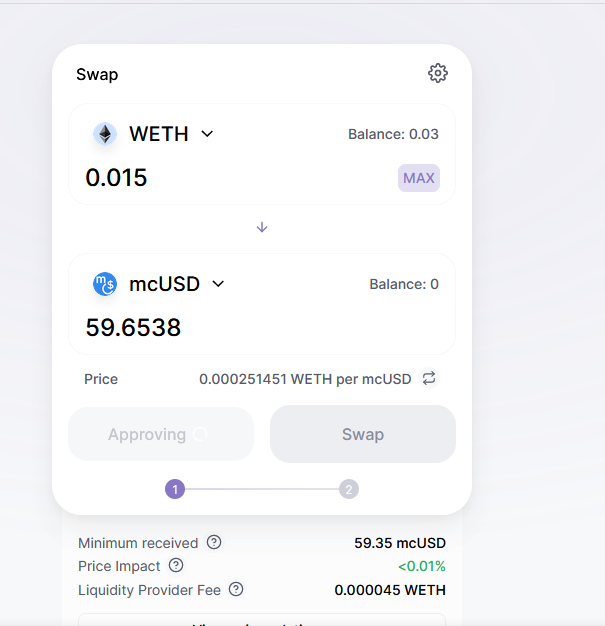

- Firstly, you need to get the needed tokens — swap your tokens according to the chosen pool.

- Then, go to the pool page.

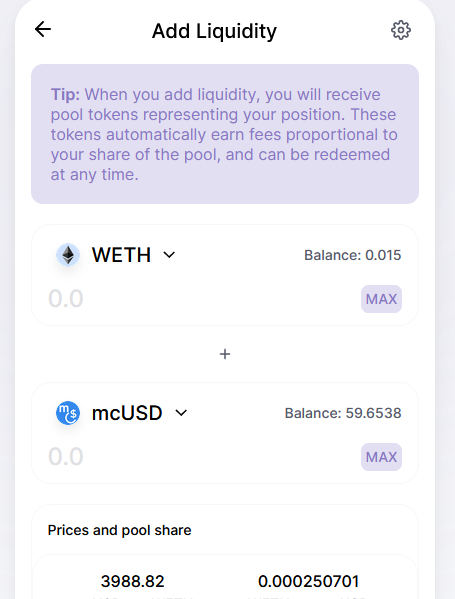

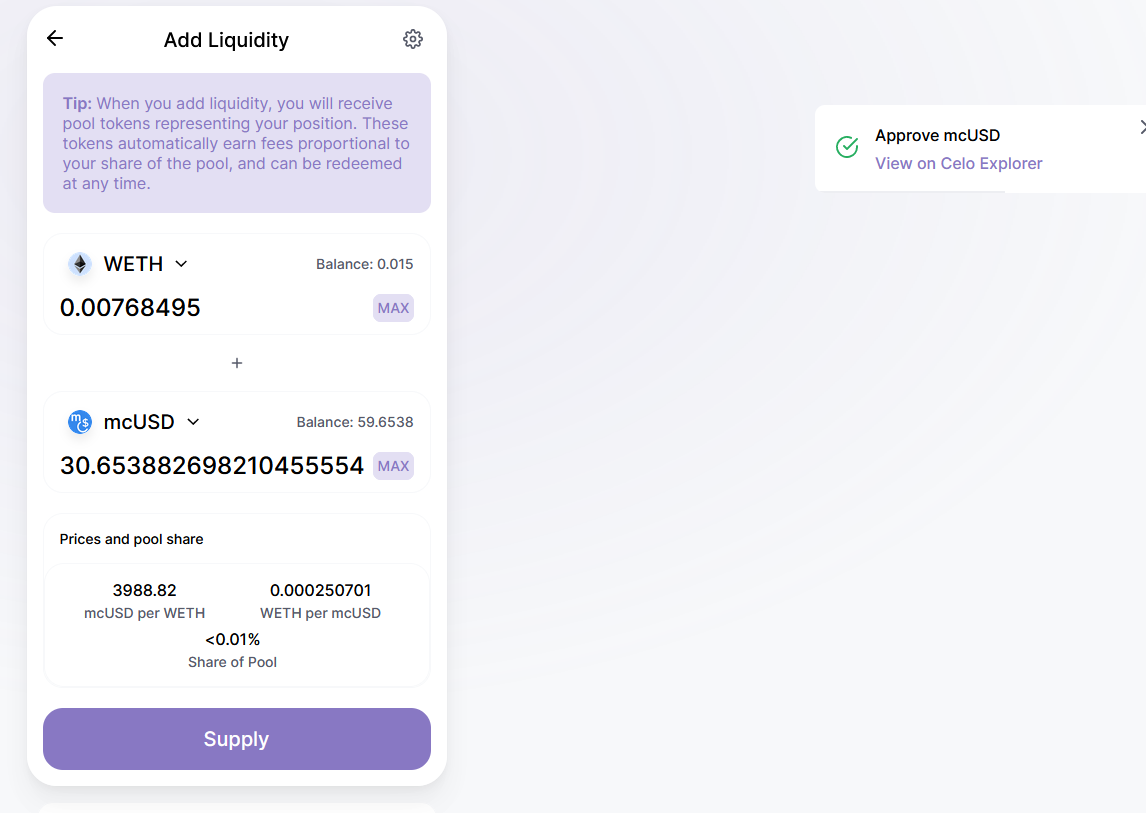

- Click on “Add WETH-mcUSD” and add liquidity.

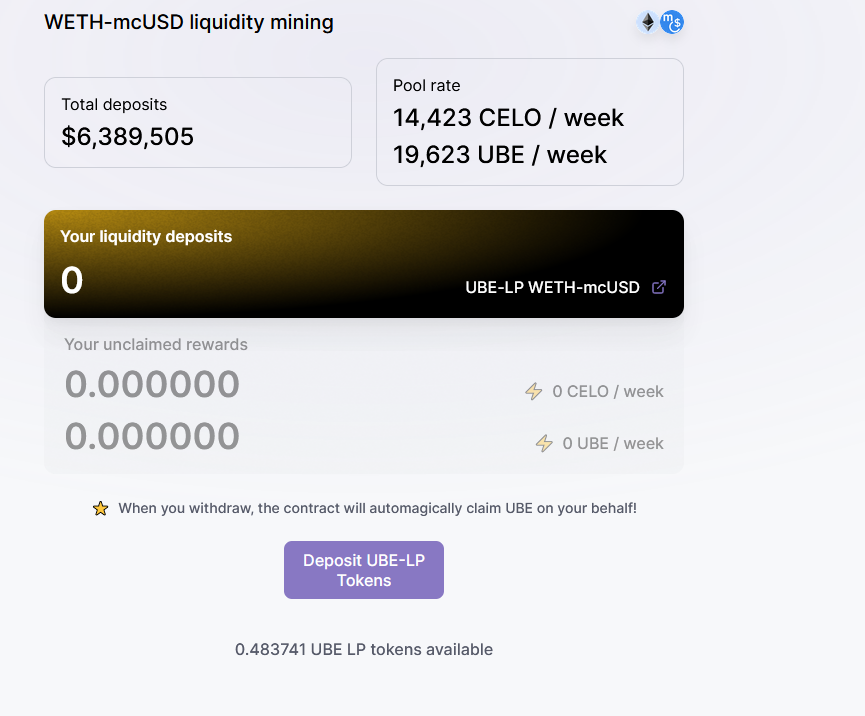

- Go to the farm and deposit your LP tokens.

- Congrats! You’re a liquidity provider and yield farmer on Celo!

Should I use Celo for Staking and Yield Farming?

When you first heard about Celo network, you probably heard about its mission and values-led approach. This wouldn’t have necessarily made you think there are lots of yield farming opportunities available.

However it shouldn’t be forgotten that Celo is a Proof-of-Stake blockchain at its core, which comes with the same incentives built into it as other blockchains with staking opportunities.

Furthermore, because of its mission to build a financial system for everyone, it is hardly surprising that part of Celo’s system provides yield farming opportunities as well. It’s clear that the Celo ecosystem is growing and that this alternative network is backed by some important investors who will try to ensure this continues.

For all these reasons, Celo looks like an interesting arena for inquisitive yield farmers to explore.

Here you can check yield farming opportunities on Celo: https://de.fi/explore/network/celo

However, as always, you should not consider this investment advice and should always do your own research first.

Check our guides:

Tezos Ultimate Yield Farming Guide [Infographics]

Solana Network Ultimate Yield Farming Guide [Infographics]

Fantom Network Ultimate Yield Farming Guide [Infographics]

Huobi ECO Chain Ultimate Guide for Yield Farming

Polygon Network Ultimate Guide for Yield Farming

Binance Chain Ultimate Guide for Yield Farming

EOS Ultimate Yield Farming Guide

Arbitrum Ultimate Guide [Infographics]

The Ultimate Yield Farming Guide For Terra Blockchain (Luna) [Infographics]

The Ultimate Guide to Avalanche Network

Ultimate Guide to Yield Farming on Harmony (with infographics)

Ultimate Guide to Tron Network [Infographics]

The Ultimate Yield Farming Guide For Moonriver Network

And join us on Twitter and Telegram!

Good luck in farming!