KuCoin is now an established cryptocurrency exchange that many crypto investors will have used or at least heard of. Less well known is the KuCoin Community Chain but, for intrepid yield farming enthusiasts, these sorts of new opportunities are often the most exciting.

KuCoin Community Chain was built by fans of KuCoin as an alternative to poor performance and expensive public chains. It launched its mainnet in 2021 and has been growing its ecosystem of projects, wallets and bridges ever since.

In this guide, you’ll find all you need to know about these areas and more, including the features, benefits and architecture of KuCoin Community Chain, as well as the staking and yield farming opportunities that exist.

What is the KuCoin Community Chain?

KuCoin Community Chain (KCC) claims to be a decentralized public chain with high performance.

KCC was built by fans of KuCoin, a centralized cryptocurrency exchange with a long-term goal of full decentralization, and its token, KCS. It was designed to solve the low performance and high cost issues that the fan community saw in other public chains, so they could access a faster, more convenient and lower-cost alternative.

KCC has the following key features:

- Compatible with Ethereum and ERC-20 smart contracts, with low migration costs

- KCS as the only core fuel and native token for KCC, making it attractive to KCS holders

- 3 second blocks, with faster transaction confirmation and higher chain performance

- Proof-of-Staked-Authority (PoSA) consensus for high efficiency, security and stability

The mission of KCC is to accelerate the flow of value around the world without boundaries.

“KCC represents a key step towards decentralization beyond the integration of open-source blockchain communities.” — Johnny Lyu, CEO at KuCoin Global

KuCoin Community Chain’s Architecture

KCC has introduced a PoSA consensus mechanism in order to achieve low transaction costs, low transaction delay and high transaction concurrency.

As the name suggests, PoSA is a combination of Proof-of-Stake (PoS) and Proof-of-Authority (PoA). KCC claims this consensus algorithm is more efficient, secure and robust.

It supports up to 29 validators. To become a validator, you must submit a proposal and wait for other active validators to vote on it. If more than half the active validators have voted, you will be eligible to become a validator. Any address can stake to a validator address and, once the validator’s staking volume ranks in the top 29, it becomes an active validator in the next epoch.

Active validators take turns to mine blocks. If a validator fails to mine a block on time during their round, other active validators who have not been involved in recent blocks will randomly perform the block-out.

Blocks are produced every three seconds in order to accelerate transaction confirmation and increase chain performance.

$KCS Token

The KCS token is the native token for KCC. It can be used to pay gas fees.

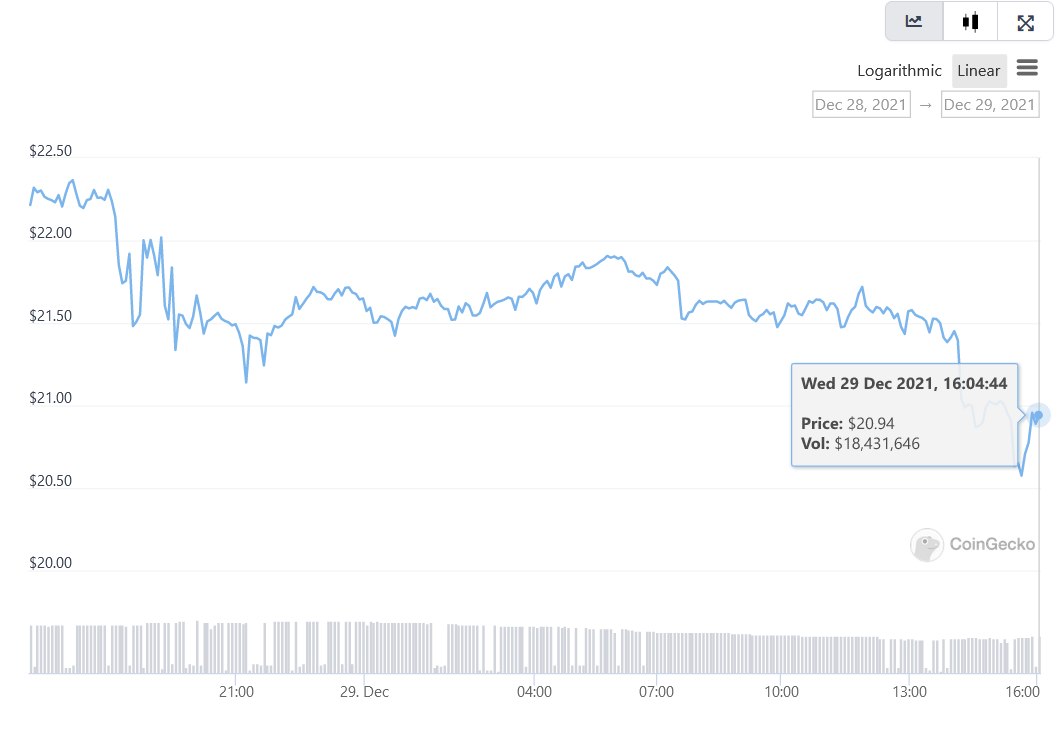

As of 22 December 2021, KCS has a maximum supply of 166,729,977, a price of $21.49 and a current market cap of $1,662,060,764 (according to CoinGecko data).

The KuCoin Community Chain Ecosystem

The KuCoin Community Chain ecosystem includes exchanges, wallets, community, NFT and yield generation projects, as well as much more.

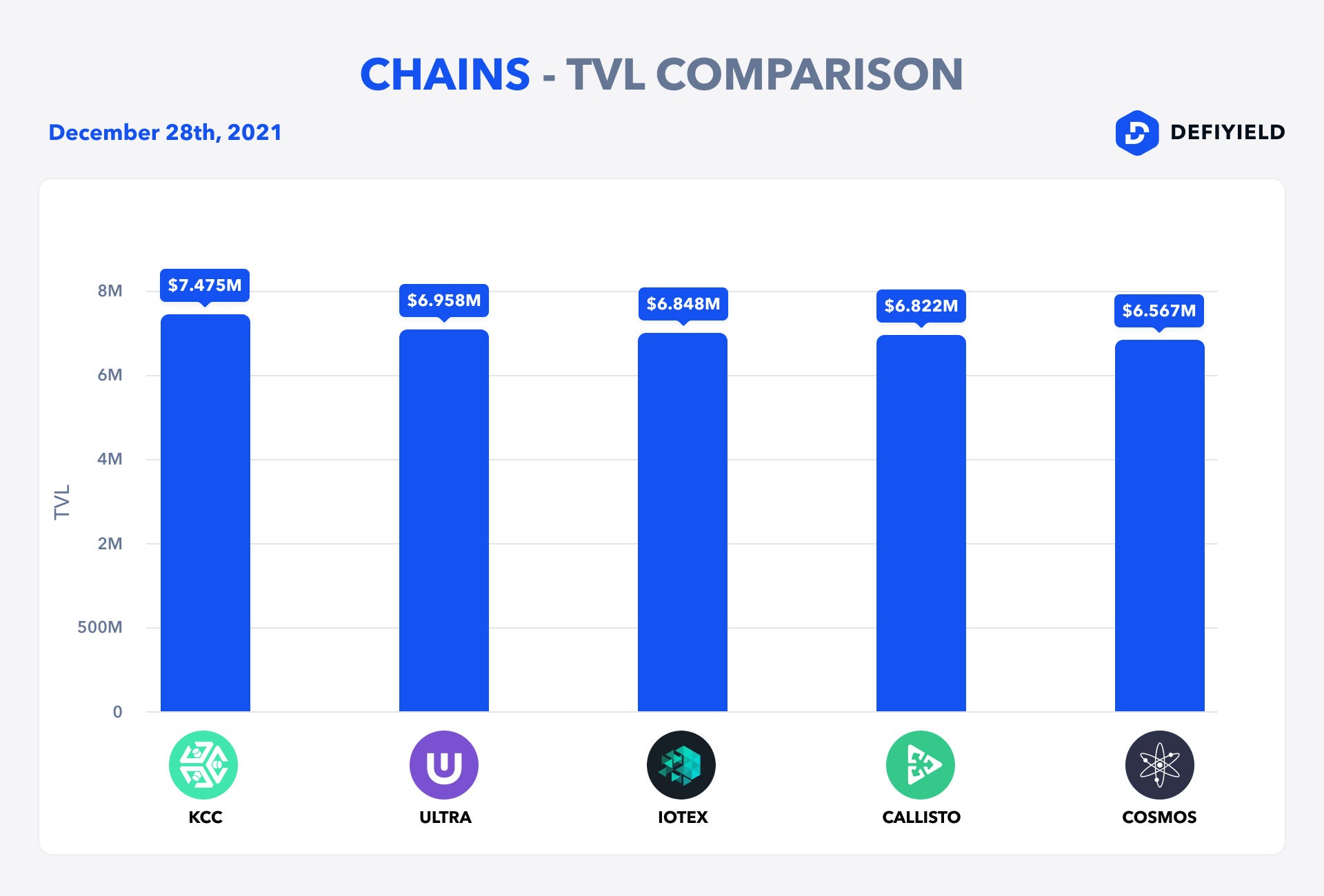

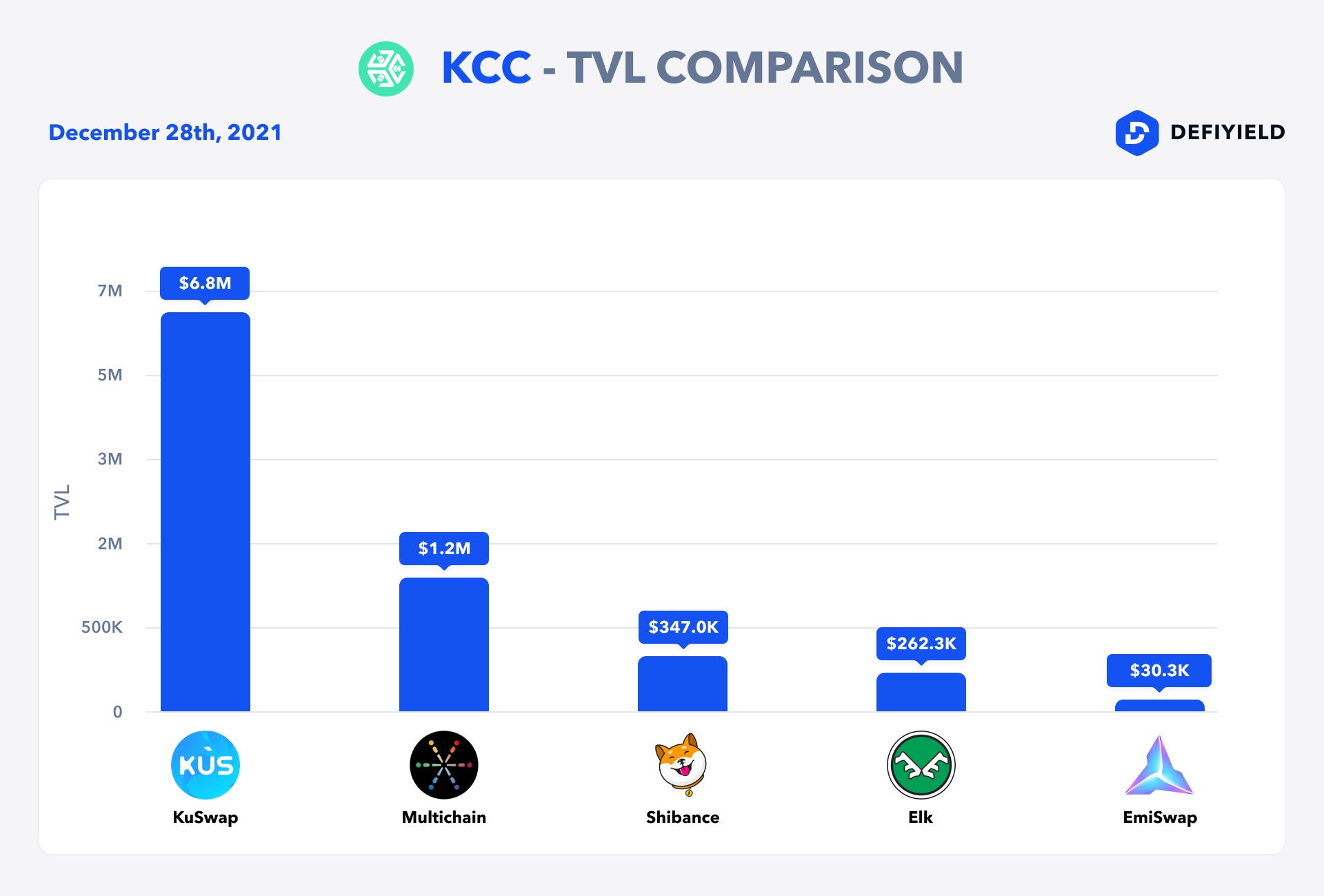

According to the KCC ecosystem dashboard, there is over $47 million of value locked in the ecosystem. The top projects in the ecosystem are MojitoSwap, KuSwap, Alpha DAO, Vixen Punks and KuKitty.

Wallets for KuCoin Community Chain

There are a few wallet options available for KCC, including well-known wallets that can be configured for this purpose.

MetaMask

MetaMask is the most popular web and mobile cryptocurrency wallet, originally designed for using the Ethereum blockchain. It can be configured to work with KCC too.

To add Kucoin Community Chain to Metamask, click “Add Network” and insert this details:

Chain Name: KCC-MAINNET

Chain ID: 321

Symbol: KCS

RPC URL: https://rpc-mainnet.kcc.network

Explorer URL: https://explorer.kcc.io/en

MathWallet

MathWallet is a multi-platform crypto wallet with mobile, desktop, hardware and extension functionality, which can be used to send and receive tokens on KCC.

Coin98

Coin98 is a multichain non-custodial wallet that can be used to manage everything from DeFi to NFTs. It can be used to set up a KCC wallet too.

Bridges for KuCoin Community Chain

There are a couple of bridges that already exist for transferring assets from well-known EVM-based blockchains.

KCC Bridge (Ethereum)

The KCC Bridge is the main bridge between KCC and Ethereum, which can be used to transfer a range of popular assets, such as stablecoins, between chains.

KCC Pad Bridge (Binance Smart Chain)

KCC Pad is an IDO launchpad for the KCC network that has also developed a bridge to Binance Smart Chain for transferring assets.

De.Fi on KCC

De.Fi Announcing the Kucoin Community Chain Integration 🦾🤩

Track your Profit and Loss, balances, prices, and more on KuCoin Community Chain! We enhanced our dashboard to provide the most comprehensive experience.

Simply connect your wallet and see the magic — https://de.fi/🦾

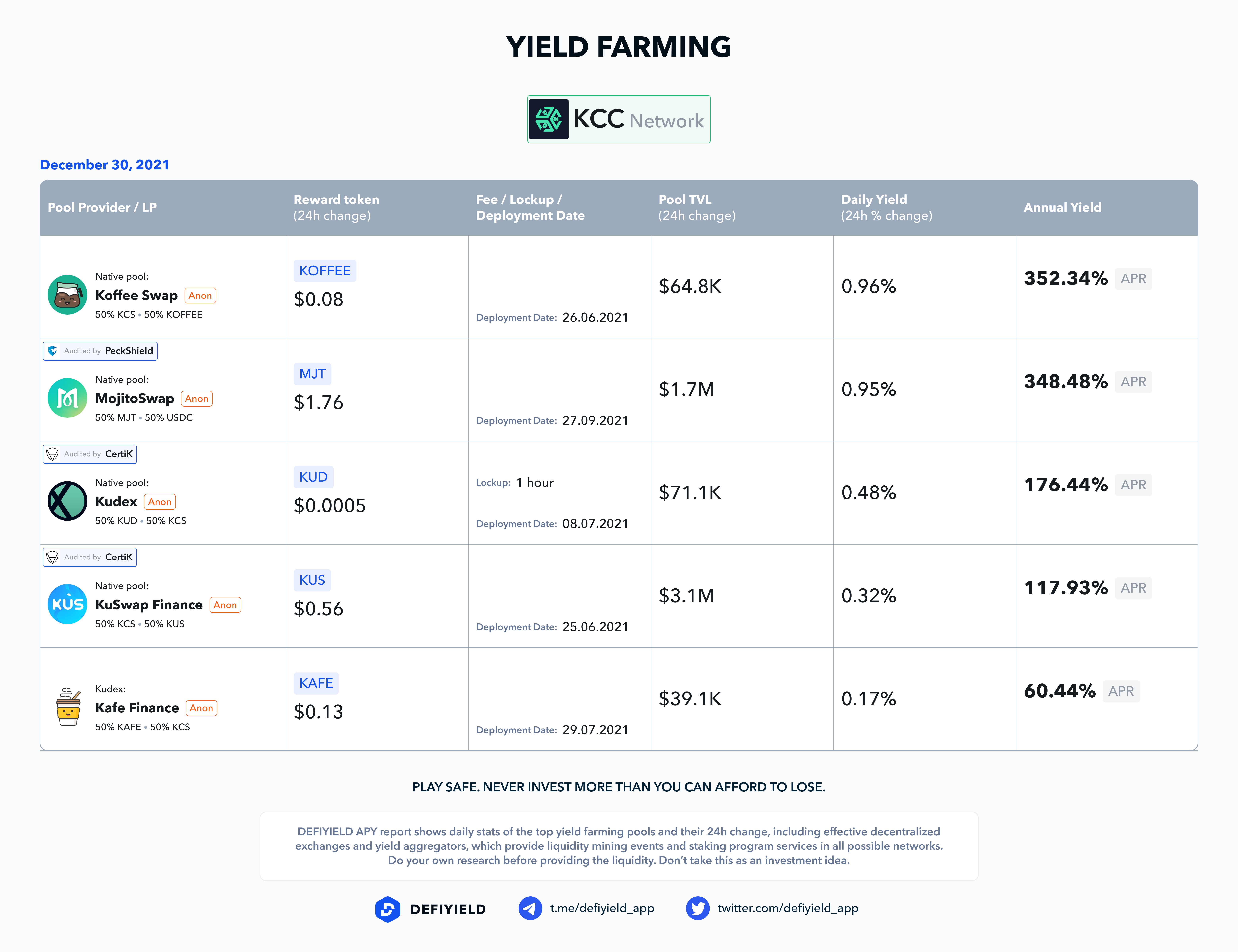

Yield Farming on KuCoin Community Chain

Before doing Yield Farming you will need to bridge your assets.

KCC Bridge gives you some KCS for fees.

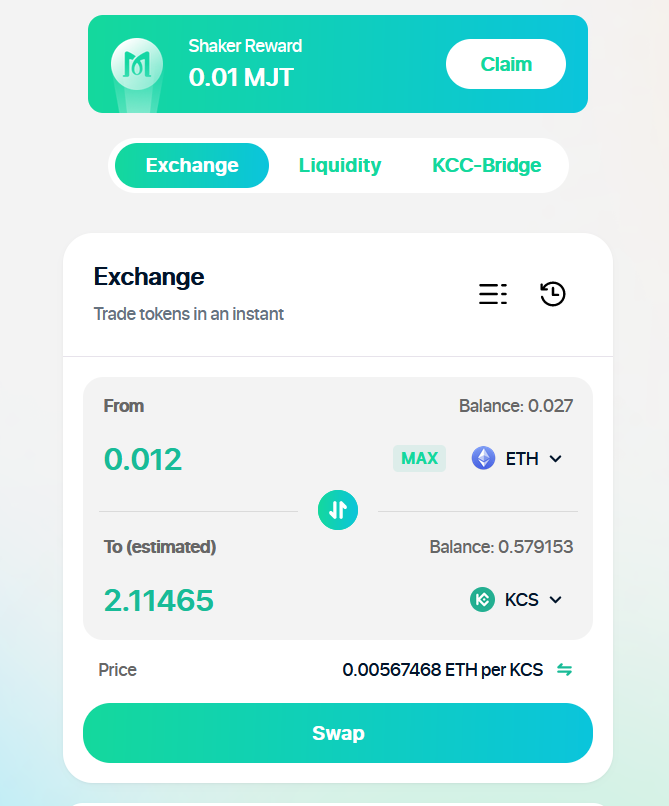

After you’ve bridged to KCC, you can choose a farm you want to invest in and get needed tokens.

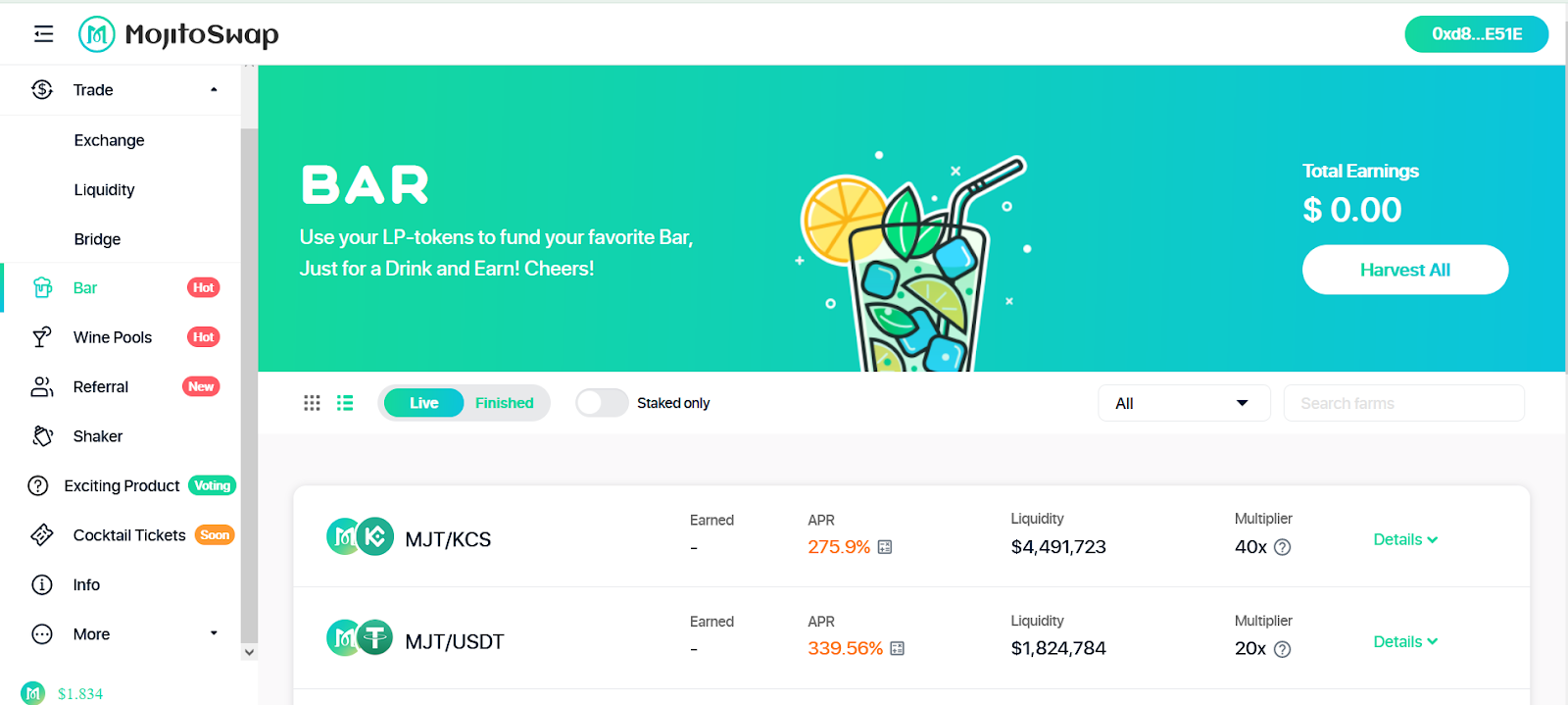

There’re a lot of different YIeld Farming dApps that you can use. Today, we will go with Mojitoswap.

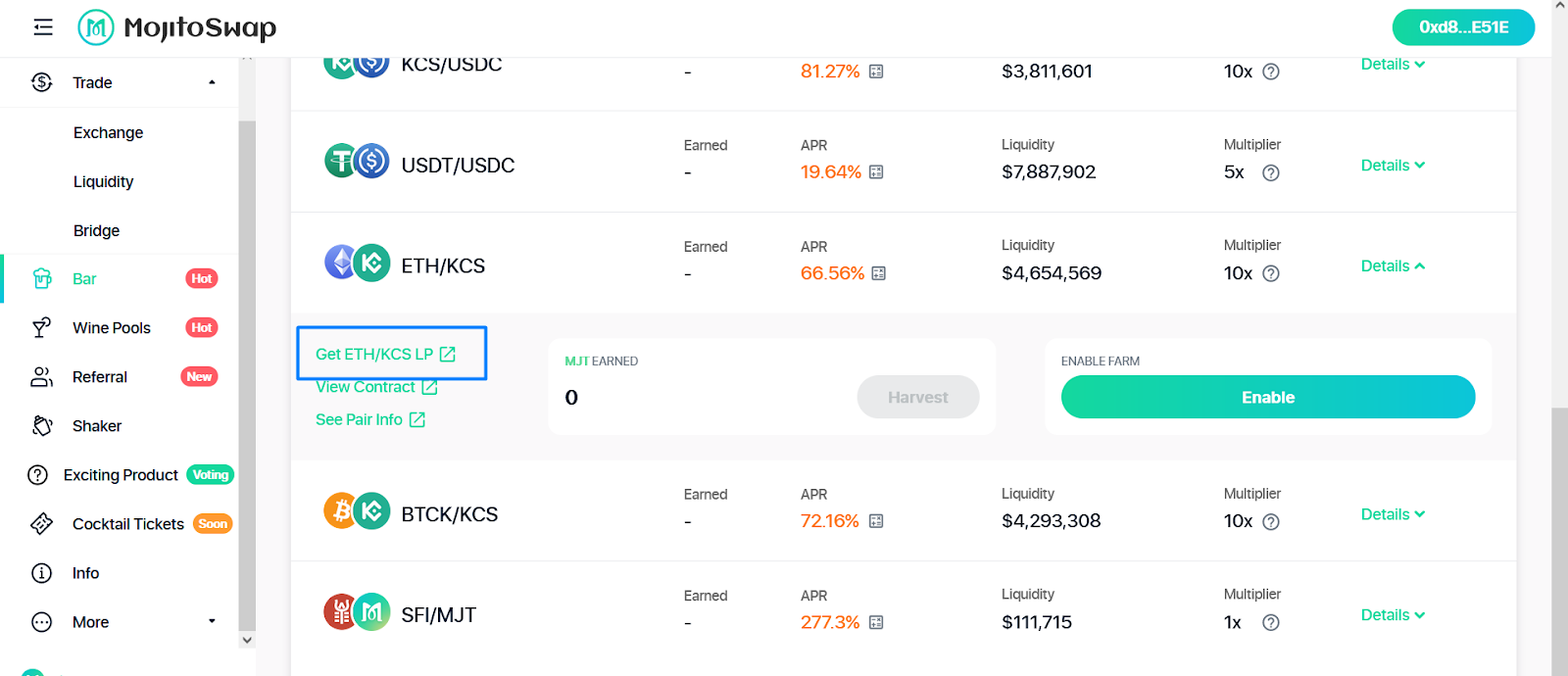

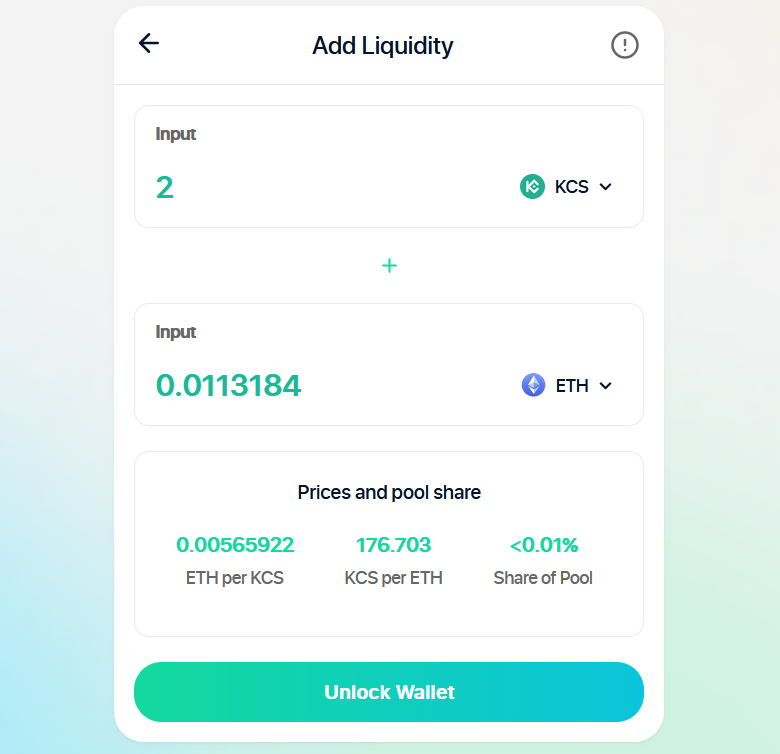

Let’s choose ETH/KCS pool.

- Swap the tokens

- Choose the farm and get LP-tokens.

- Add liquidity

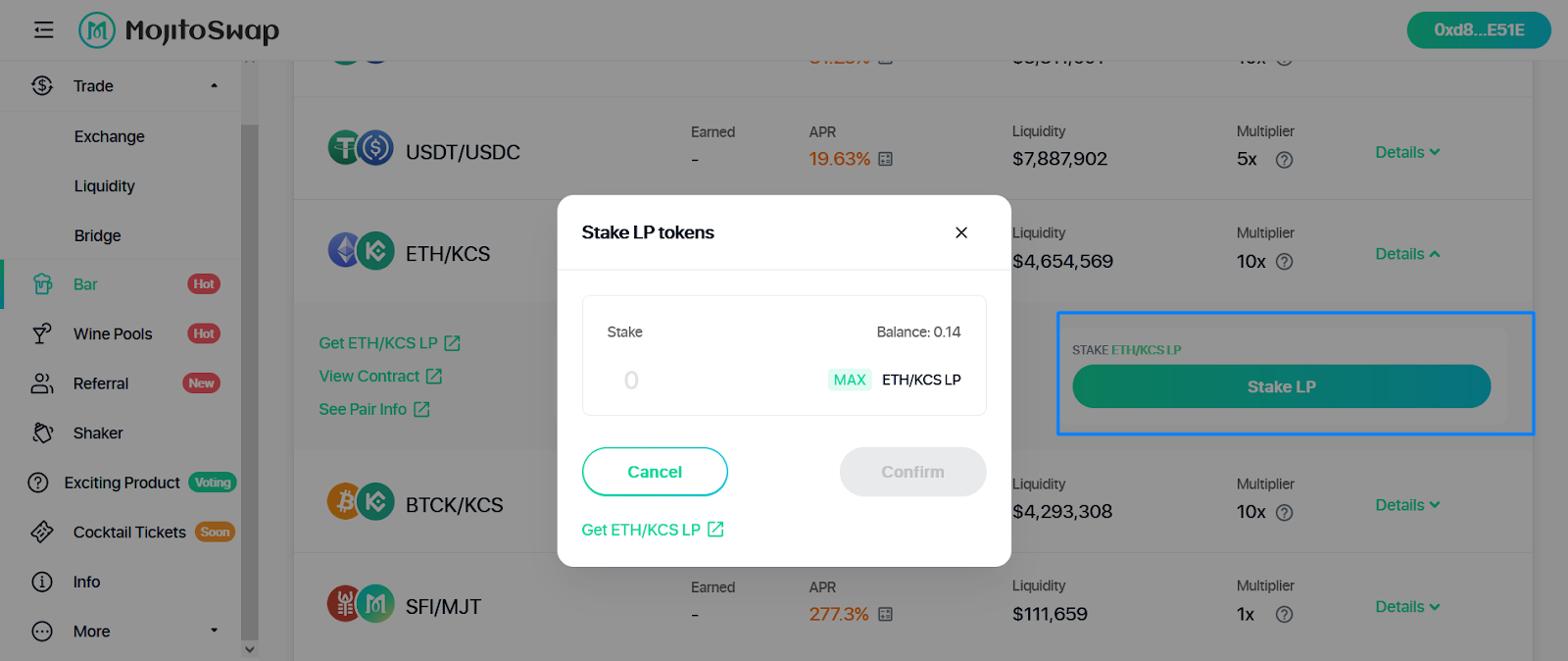

- Go back to the farms and click “Stake LPs”

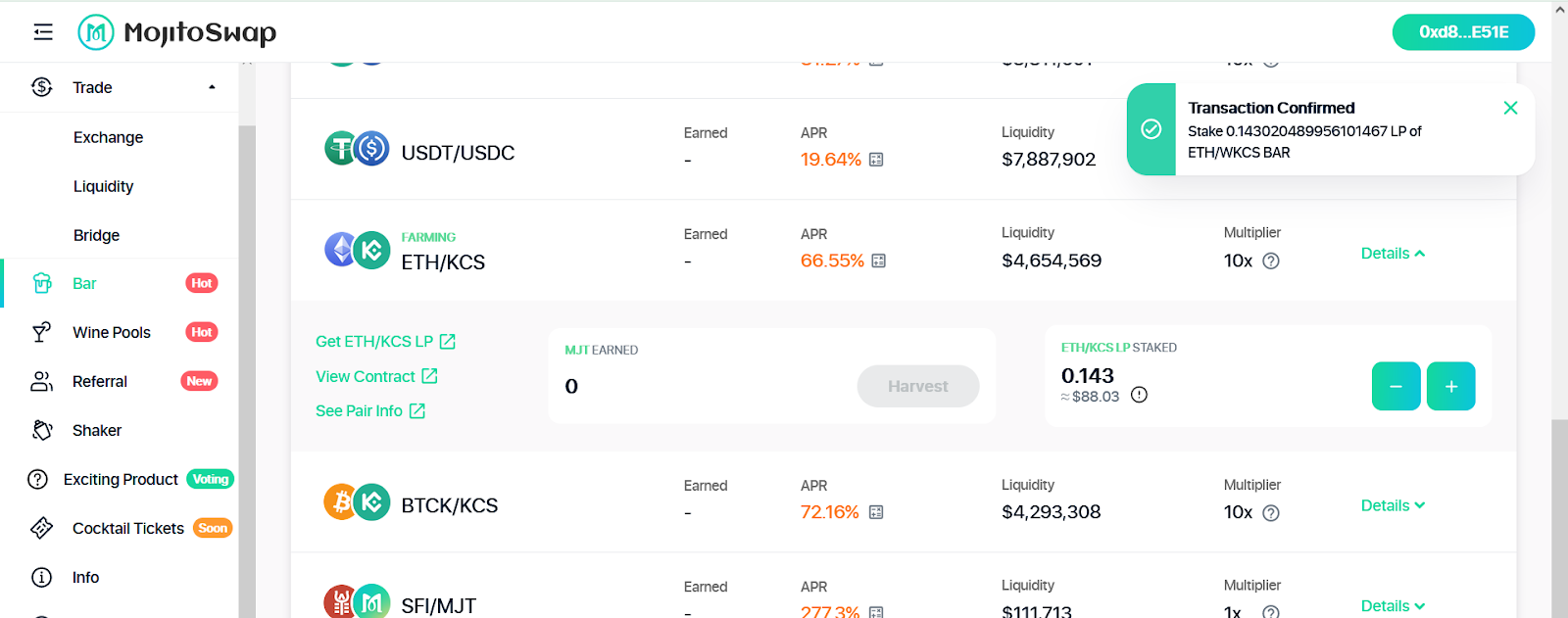

- Confirm the transaction

- Now you’re a yield farmer on KCC.

Should I use KuCoin Community Chain for Staking and Yield Farming?

For any KuCoin exchange users and especially for KCS holders, the KuCoin Community Chain certainly looks like an opportunity to investigate.

With its aims to achieve high performance and low transaction costs, anyone holding the KCS token can start to put their digital assets to work within its growing ecosystem. It is also fully compatible with Ethereum and has a growing number of bridges to key EVM-compatible chains, so the range of yield farming opportunities is likely to increase even more over time.

Here you can check yield farming opportunities on KuCoin Community Chain: https://de.fi/explore/network/kcc

However, as always, this is not investment advice and you should always do your own research first.

Check our guides:

Tezos Ultimate Yield Farming Guide [Infographics]

Solana Network Ultimate Yield Farming Guide [Infographics]

Fantom Network Ultimate Yield Farming Guide [Infographics]

Huobi ECO Chain Ultimate Guide for Yield Farming

Polygon Network Ultimate Guide for Yield Farming

Binance Chain Ultimate Guide for Yield Farming

EOS Ultimate Yield Farming Guide

Arbitrum Ultimate Guide [Infographics]

The Ultimate Yield Farming Guide For Terra Blockchain (Luna) [Infographics]

The Ultimate Guide to Avalanche Network

Ultimate Guide to Yield Farming on Harmony (with infographics)

Ultimate Guide to Tron Network [Infographics]

The Ultimate Yield Farming Guide For Moonriver Network

The Ultimate Yield Farming Guide For Celo

And join us on twitter and telegram!

Good luck in farming!