For anyone with an interest in how blockchain consensus mechanisms have evolved to become more scalable and efficient, Algorand is a project you will probably be aware of.

Founded in 2017 by MIT professor Silvio Micali, Algorand has developed into a blockchain that seeks to be the foundation on which decentralized and traditional finance can converge. Furthermore, its unique Pure-Proof-of-Stake consensus aims to ensure that the economic incentives remain aligned with the needs of all participants, rather than just a small elite.

As the ecosystem is starting to grow and DeFi is becoming real on Algorand, now is the perfect time to dig deeper into this growing network. In this guide, you’ll find all you need to get started and learn about the project, technology, bridges, wallets and other key features.

What is Algorand?

Algorand styles itself as “the blockchain for FutureFi”. It states that decentralized and traditional financial models are converging and Algorand is here to power this change.

More specifically, it is a secure, scalable and decentralized digital currency and smart contract platform. It uses a unique Proof-of-Stake (PoS) consensus algorithm called Pure-Proof-of-Stake (PPoS), which aims to achieve immediate transaction finality in order to power large payment and financial networks.

“Algorand’s overarching goal is providing a truly decentralized, public, permissionless network that scales perfectly and eliminates the performance drawbacks of first-generation blockchains.” — Silvio Micali, Founder of Algorand

Some of its main benefits are as follows:

Decentralized — no central authority or single point of control, with a unique committee of users selected randomly and secretly to approve every block.

Permissionless — a single class of users, with no gatekeepers approving use of the blockchain and all participants able to read blocks and write transactions.

Open-source — publicly available to audit, use and build on. Algorand is founded on the principles of transparency, inclusivity and collaboration.

Algorand was founded by Turing award winner and MIT professor Silvio Micali. It is backed by a range of well-known crypto funds and investors, including Meltem Demirors, the Chief Strategy Officer at Coinshares.

A test network for the protocol was launched in July 2018 and its mainnet was launched in June 2019, when it also raised $60 million from the first sale of its native ALGO token.

“There is a great and serious vision, and a professional, dedicated team at work here.” — On Yavin, Founder and CEO of research and analysis firm Cointelligence

Algorand’s vision is one of “a world where everyone creates and exchanges value efficiently, transparently and securely”. Its mission is to develop:

- Global trust through decentralization

- Simple designs that drive adoption by billions of people

- Elegant technology that eliminates barriers to prosperity for all

The Algorand Foundation assists with the growth and development of Algorand by building trusted, public and permissionless infrastructure for the borderless economy.

Algorand’s Architecture

One of the key technological differences of Algorand compared with other blockchain networks is its use of Pure-Proof-of-Stake consensus. While this obviously involves staking, it has been designed so that every user can have some influence on the creation of new blocks.

In this way, it aims to tie the security of the network to the majority of participants, rather than just a small subset of users. This means that Algorand can tolerate an arbitrary number of malicious users, as long as honest users hold a super majority of the total stake in the system.

Algorand Nodes

There are two types of nodes working to optimize decentralization and transaction throughput:

Relay nodes — which allow for highly efficient communication paths.

Participation nodes — which propose and vote on blocks.

Any user is free to register as a relay or participation node and entities representing a range of organizations from different countries have already registered to do so.

Algorand Consensus

Alogrand’s Pure-Proof-of-Stake approach does not reward or punish validators like other Proof-of-Stake systems.

Instead, it randomly selects users to propose blocks and also selects a committee of users to vote on these block proposals. If a super majority of votes are from honest participants, the block is verified. This process allows Algorand to finalize blocks in seconds.

Algorand Governance

Algorand intends to leverage its Pure-Proof-of-Stake for an on-chain governance system. It takes a consensus approach to protocol changes, in order to enable continuous evolution of the protocol and eliminate potential hard forks that could fracture the community.

Proposed changes are posted on the blockchain and the community uses Algorand’s consensus protocol to vote on accepting or rejecting them. When accepted, the community agrees on the block where the change happens and everyone switches to the new protocol at the same time. Any user can participate in Algorand’s governance system.

$ALGO Token

The ALGO token is Algorand’s native token. It can be staked in order to incentivize network participation. It can also be used to power transactions or state changes.

As of 3 January 2022, ALGO has a maximum supply of 10,000,000,000, a price of $1.79 and a current market cap of $11,450,106,667 (according to CoinGecko data).

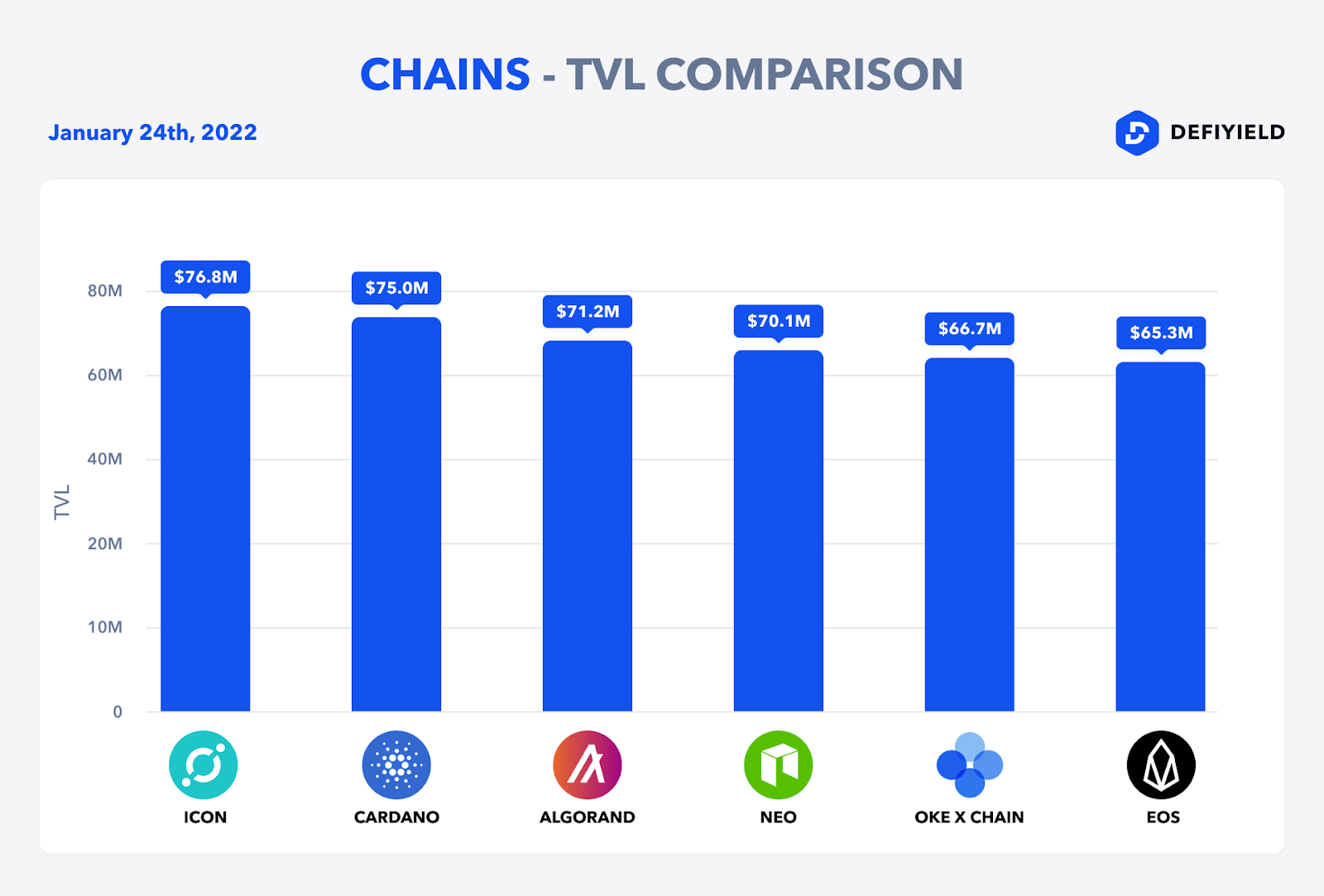

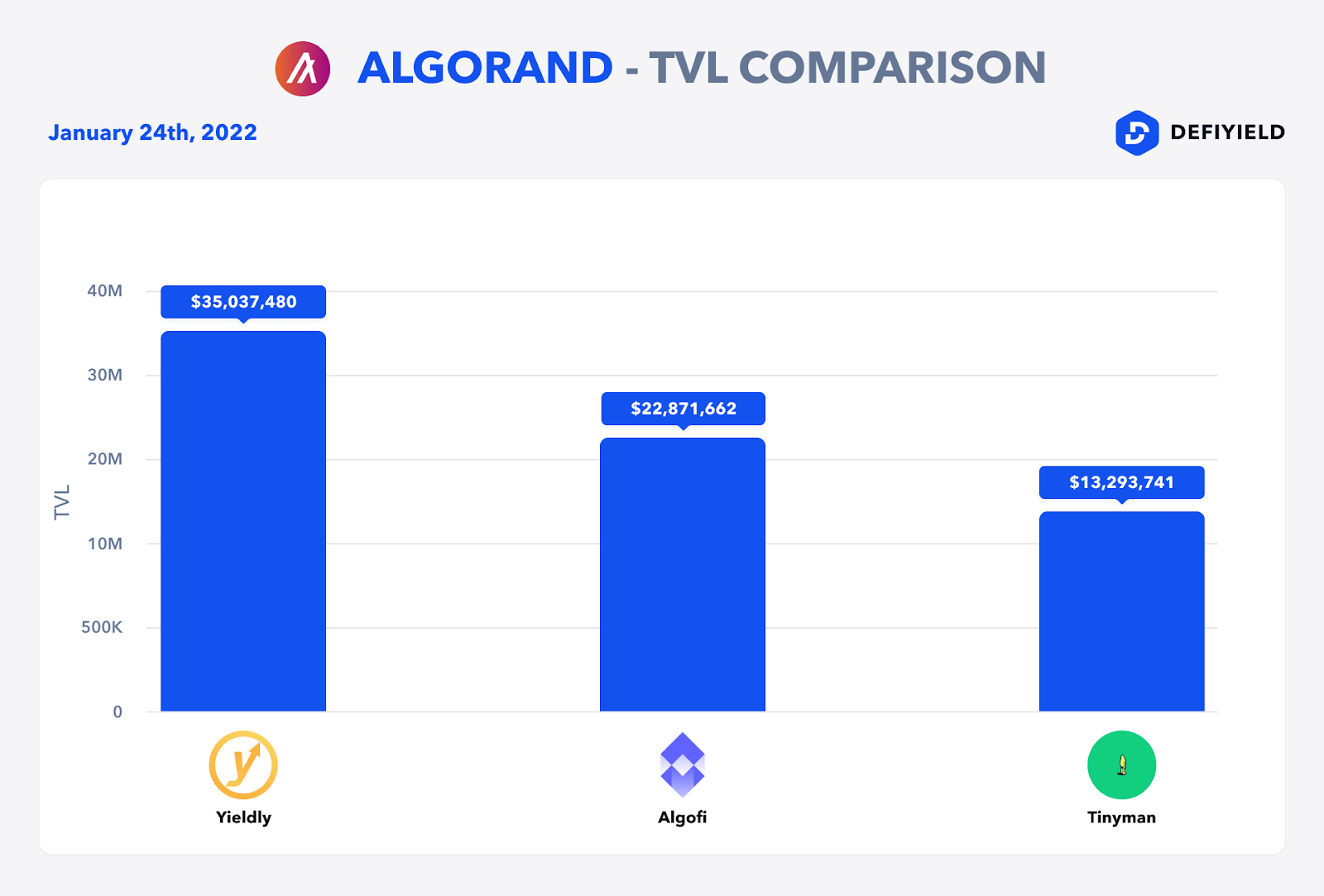

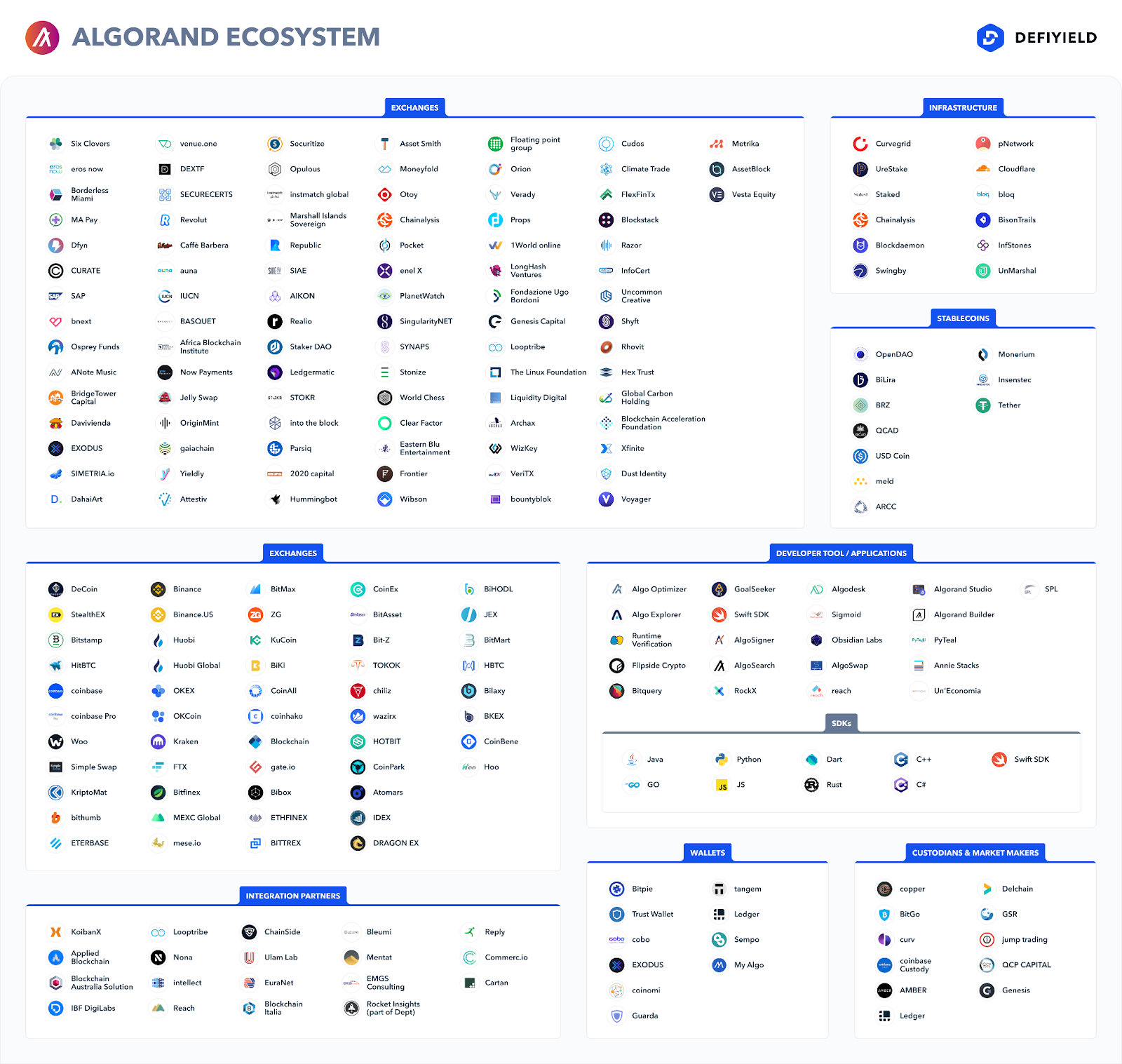

The Algorand Ecosystem

The Algorand ecosystem includes more than 500 organizations from around the world using the technology for financial products, protocols and exchanges of value across DeFi, financial institutions and governance. The Algorand developer portal also includes a range of IDEs, SDKs, APIs and other tools.

Furthermore, in December 2021, the Algorand Foundation announced a $3 million incentive scheme for Algofi, an Algorand-based DeFi platform that offers lending and borrowing services.

Algorand Partnerships

Algorand provides partners with additional resources to build out their blockchain initiatives. These include everything from small to large blockchain projects, as well as consulting firms, implementation partners and developer firms.

Probably the most well-known Algorand partner is CapGemini, the multinational technology and consulting firm.

Wallets for Algorand

There are various web, mobile and hardware wallets available for Algorand but some well-known EVM-compatible options, such as MetaMask, cannot be used.

Algorand Wallet

Algorand’s official wallet is a mobile wallet available for Apple and Android that has been built by the team behind the Algorand blockchain.

Ledger

One of the most well-known and popular hardware wallets available, Ledger can be used to hold and stake ALGO, Algorand’s native tokens.

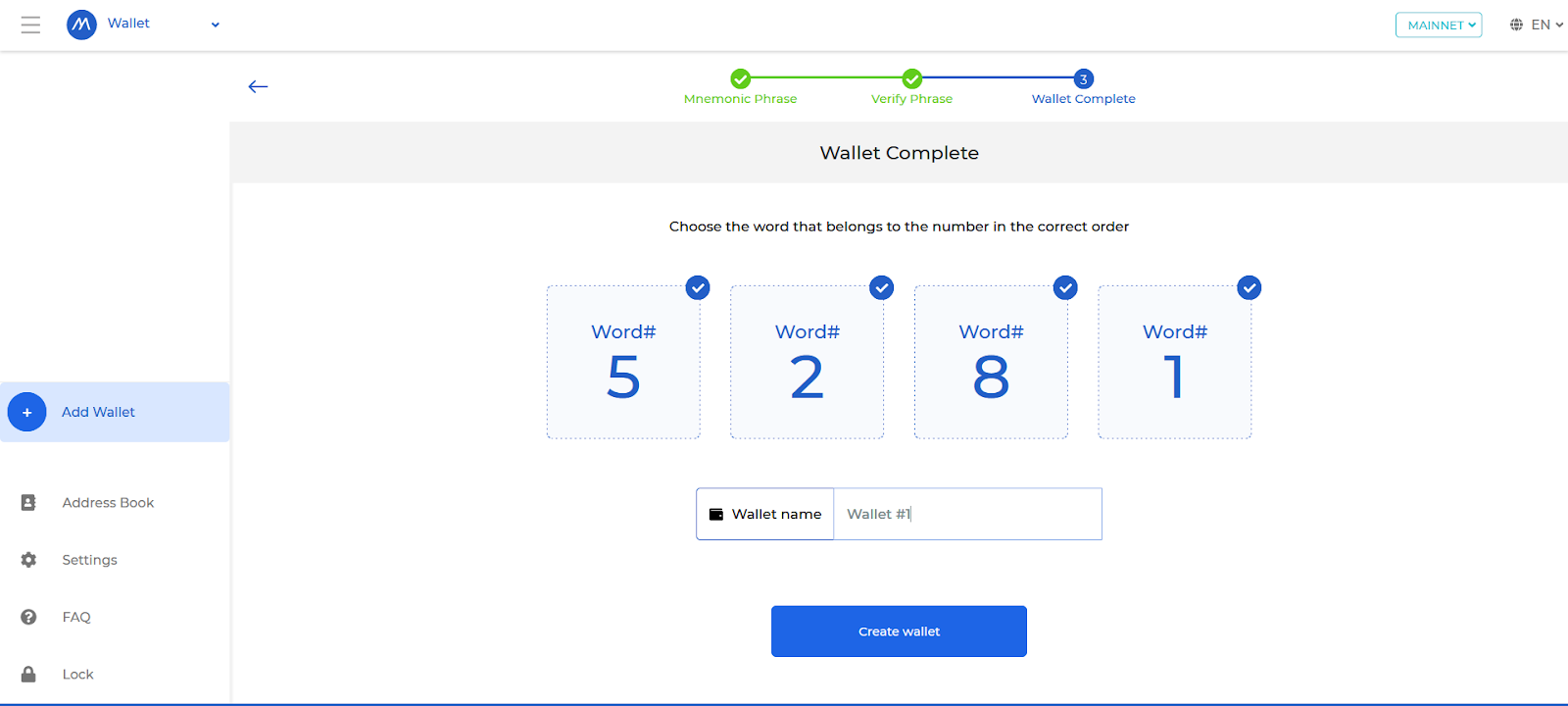

My Algo Wallet

My Algo Wallet is a web wallet for use with Algorand that has been built by Rand Labs. It can be used in conjunction with the Ledger hardware wallet too.

Atomic Wallet

Atomic Wallet is a web and mobile wallet that can be used to hold and stake a range of digital assets, including Algorand’s ALGO token.

Trust Wallet

Trust Wallet is a mobile wallet that supports multiple digital assets, including ALGO, for holding and staking.

Bridges for Algorand

The Algorand ecosystem is in the early stages of development when it comes to bridges and there are few available right now. However, the Algorand Foundation has established a $5m SupaGrant for token bridges that is designed to increase the options available.

Yieldly

Yieldy provides a suite of DeFi tools built for the Algorand blockchain. This includes a cross-chain bridge, which is in its early stages of development.

Staking and Yield Farming on Algorand

Yield Farming on Yieldly

You will need to firstly create an Algorang wallet to access the Algorand ecosystem.

We will go with My Algo Wallet.

- Go to https://wallet.myalgo.com/ and create a wallet.

Make sure you’ve saved your seed phrase and the password.

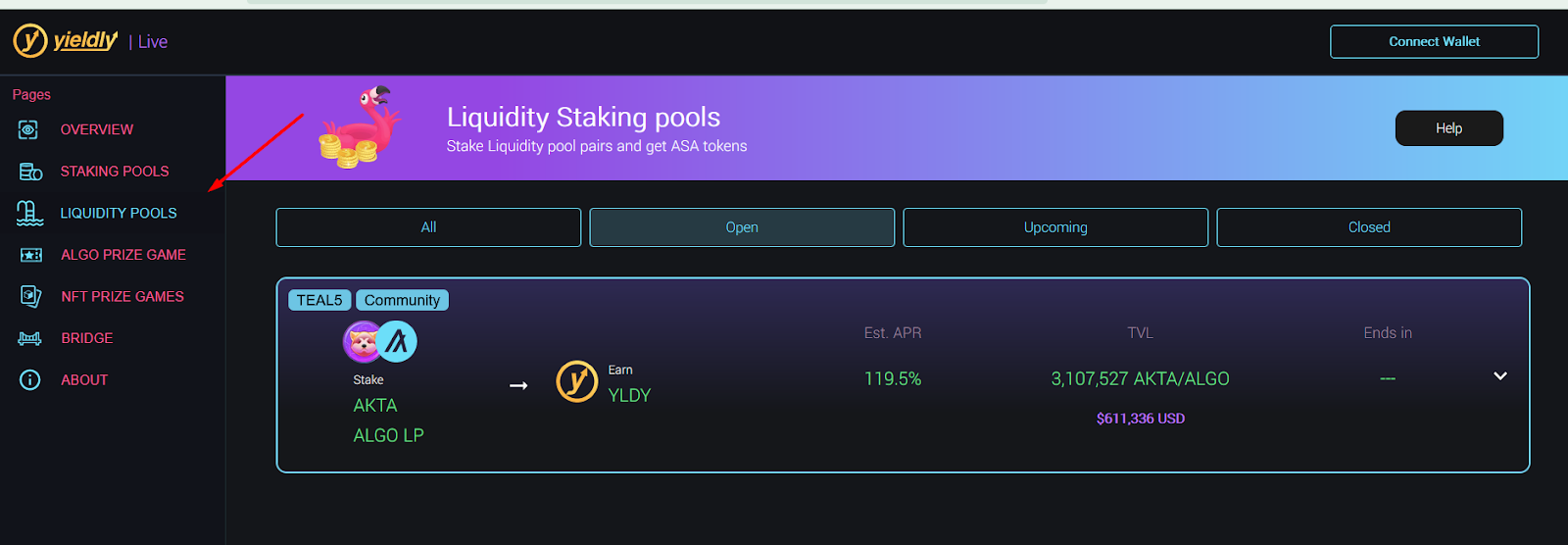

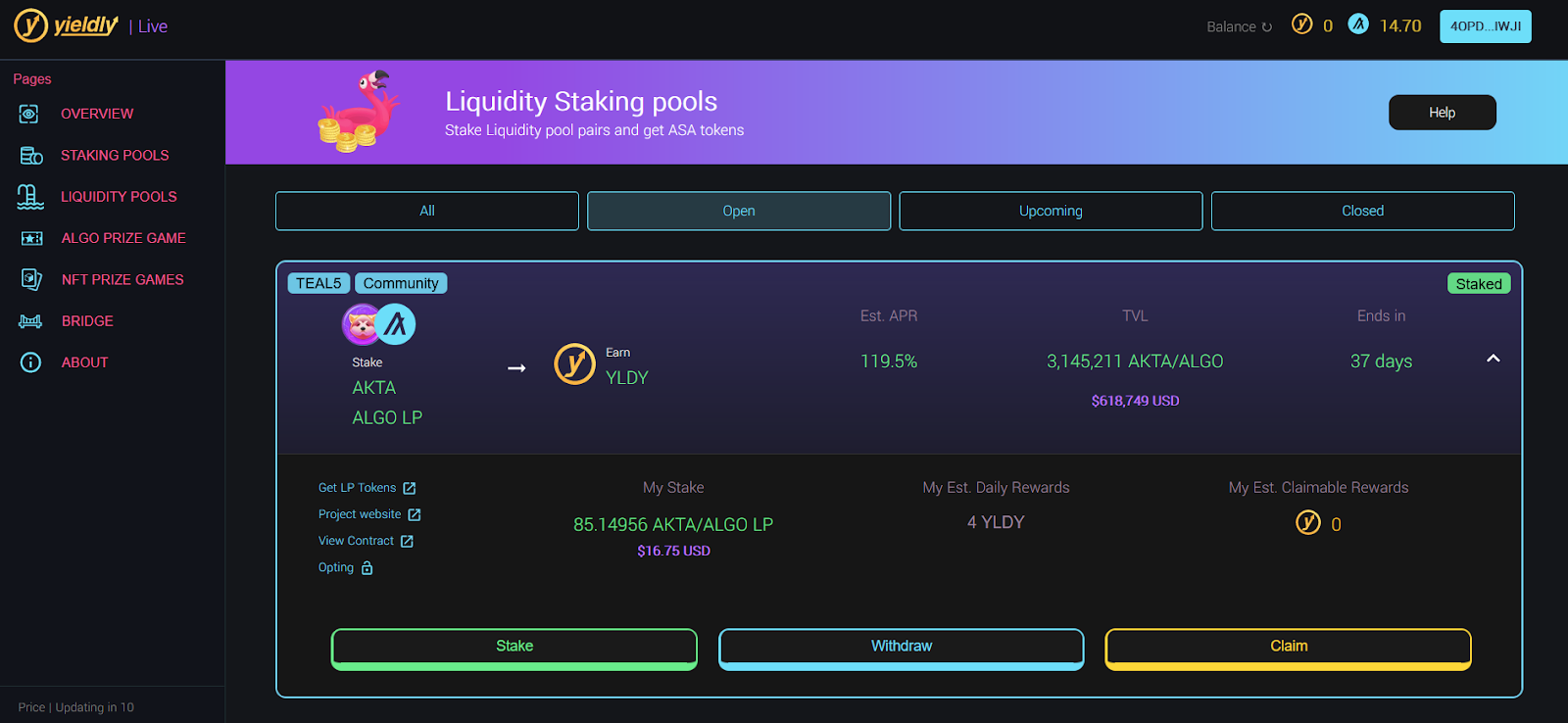

- There’re a lot of Yield Farming opportunities on Algorand. We will go with https://app.yieldly.finance/ . Open the app and navigate to “Liquidity pools”

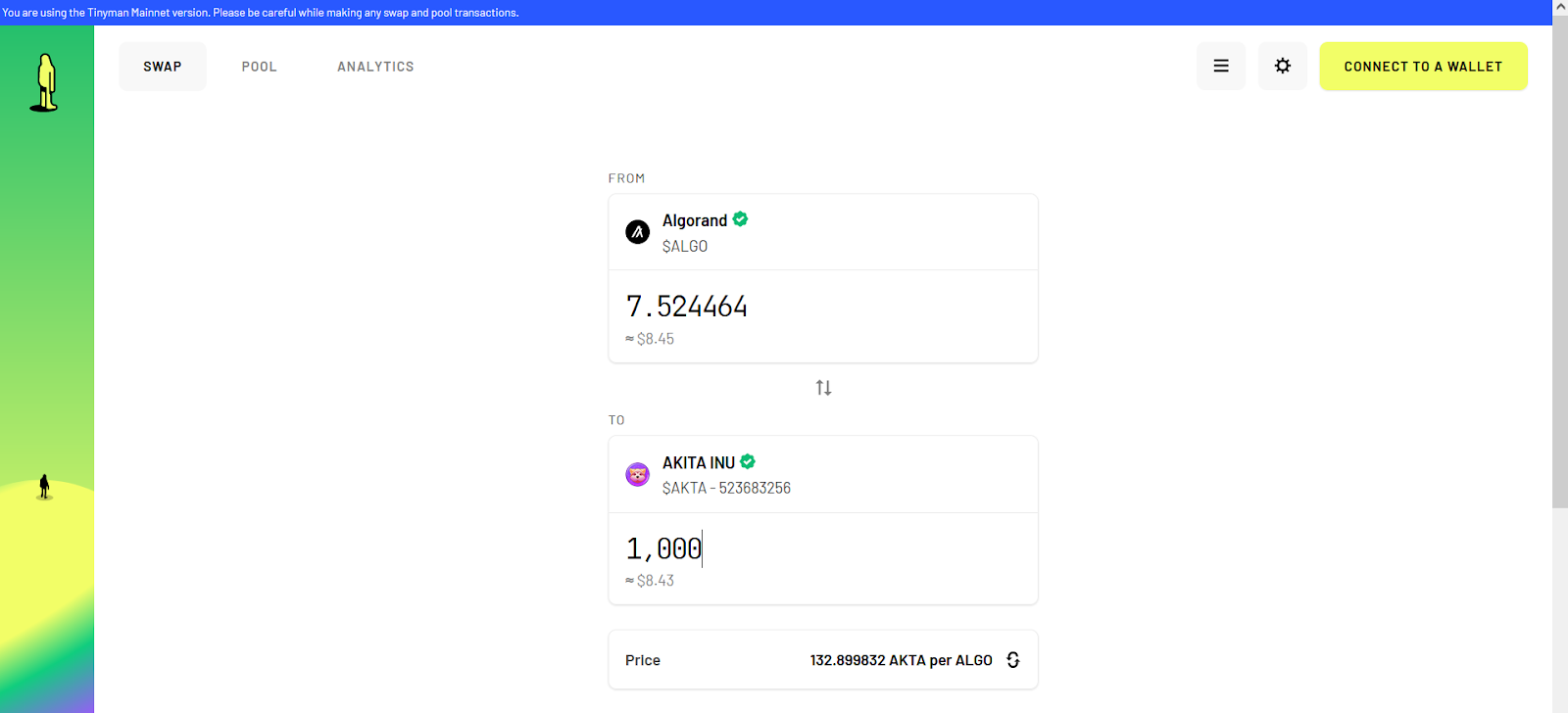

- Let’s assume, you’ve already gotten ALGO. It is listed on the majority of exchanges. To swap your ALGO you can go to https://tinyman.org/

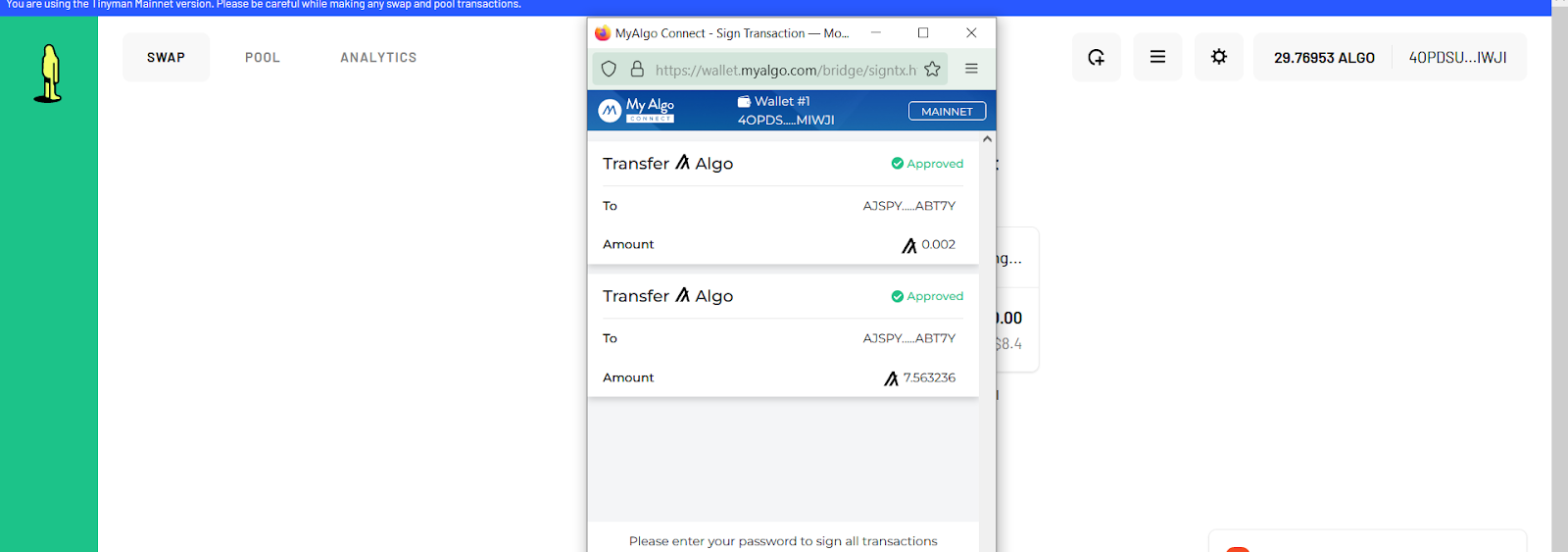

- Confirm the transactions and swap the tokens.

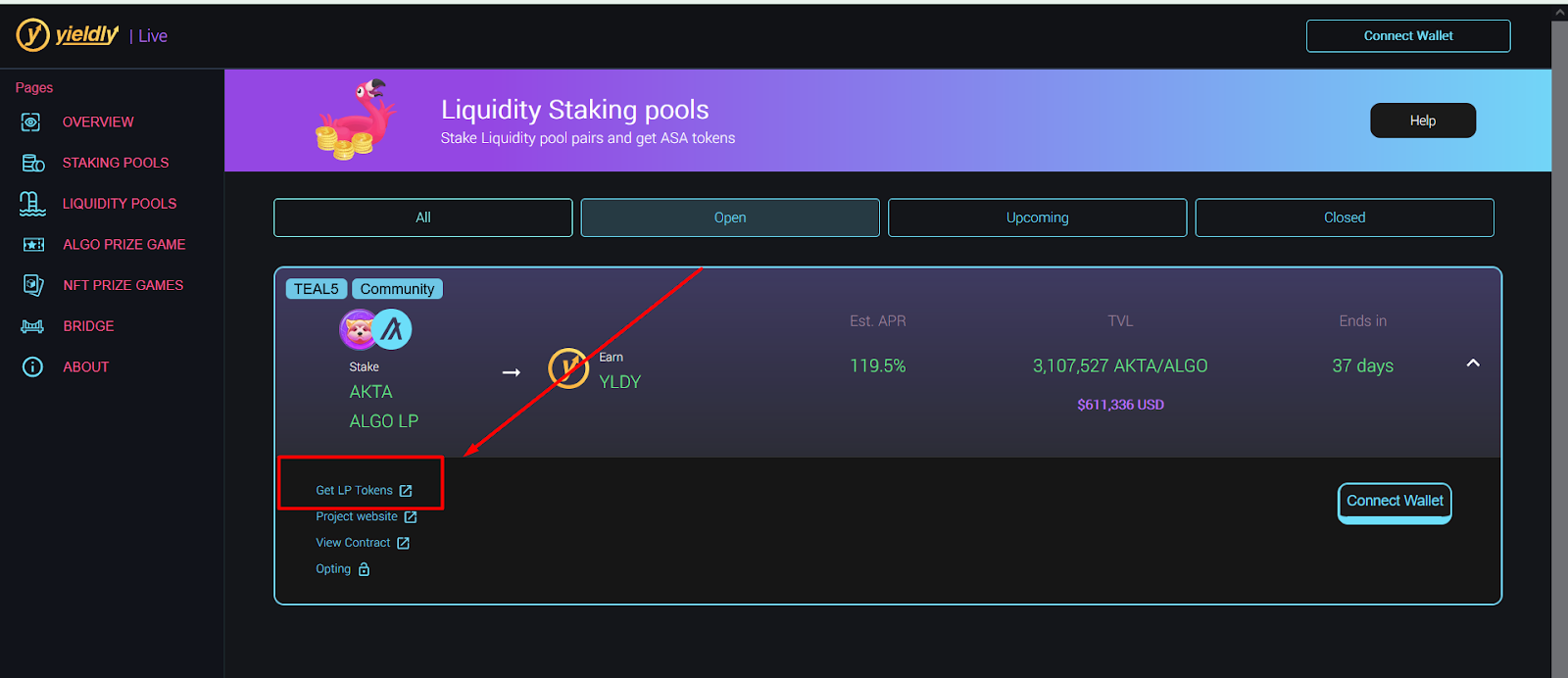

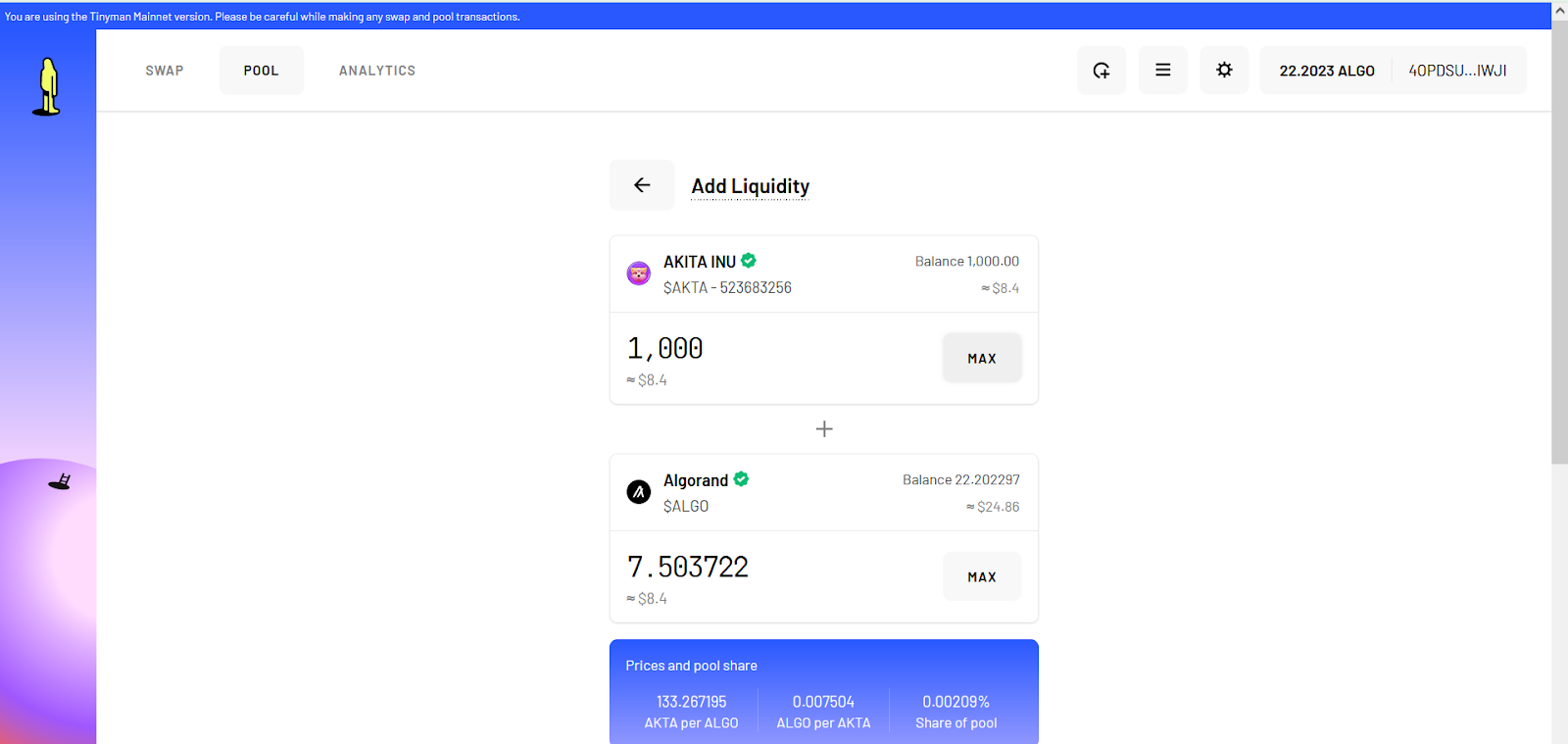

- Then, go back to Yieldly and click on “Get LP tokens”.

- Add liquidity to get LP tokens.

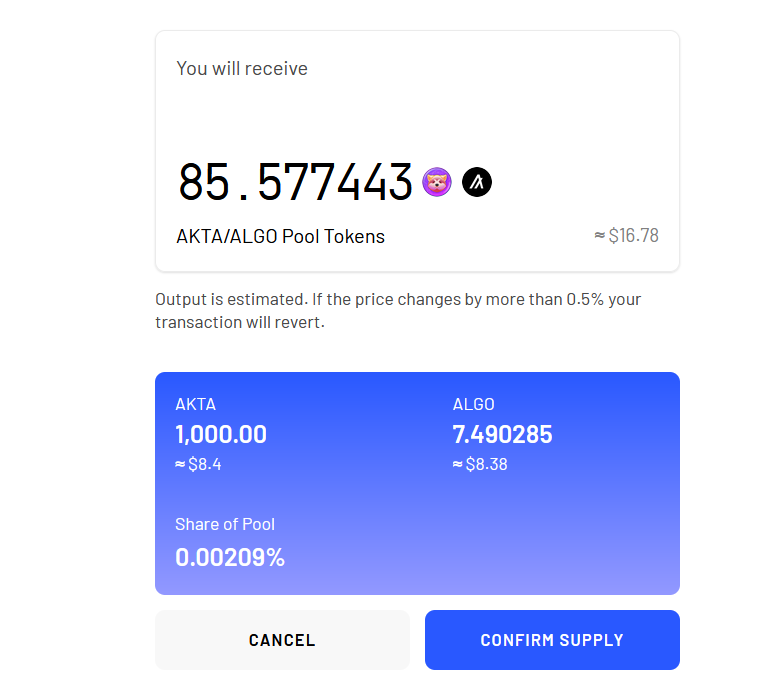

- Confirm supply

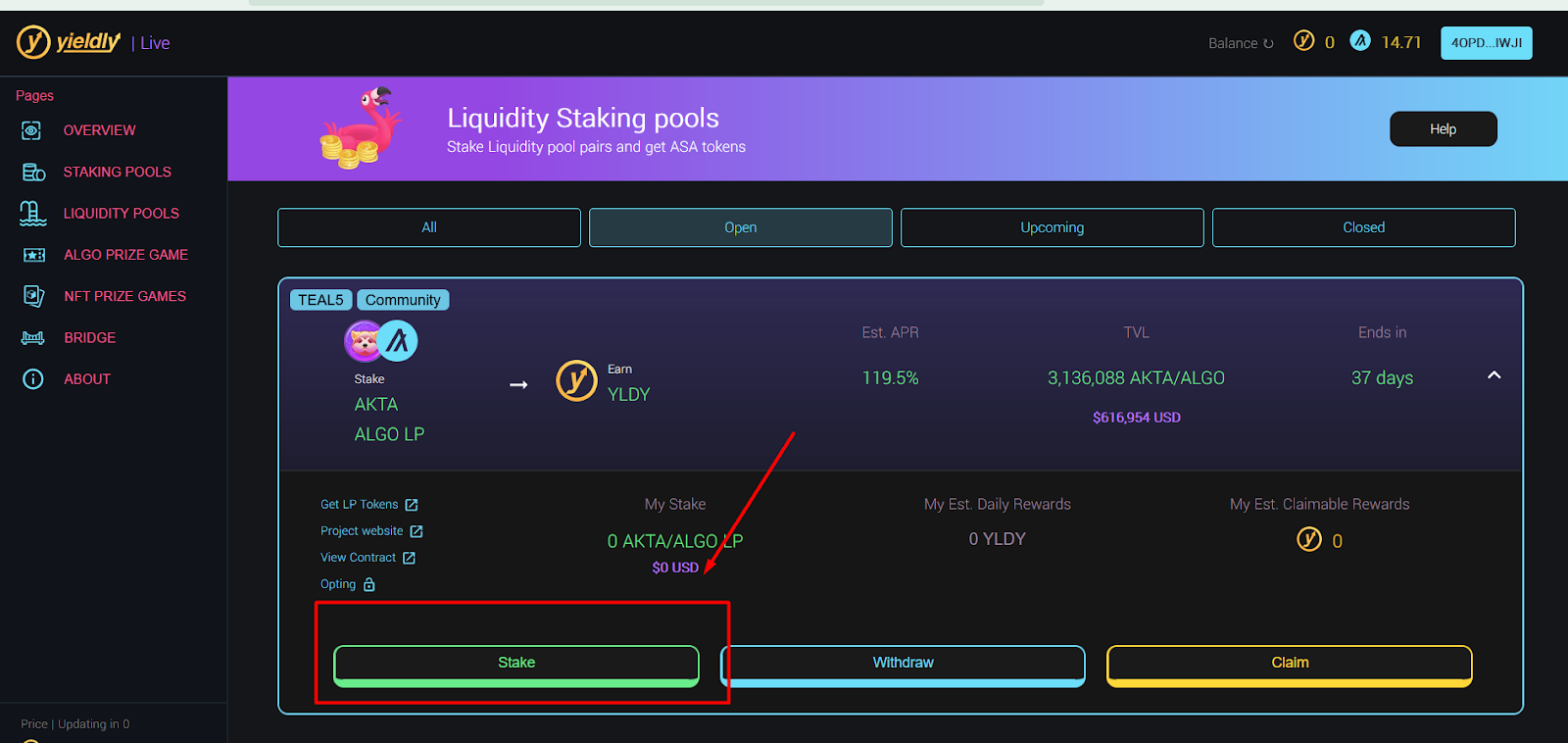

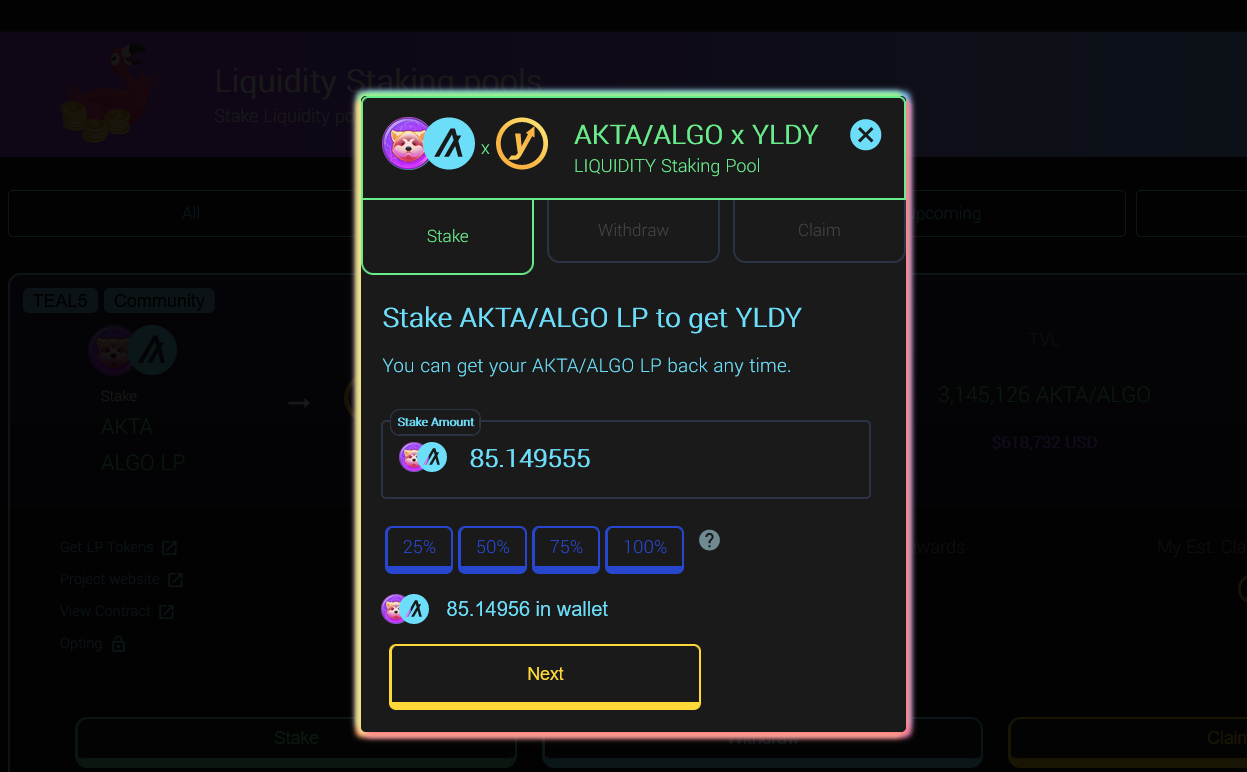

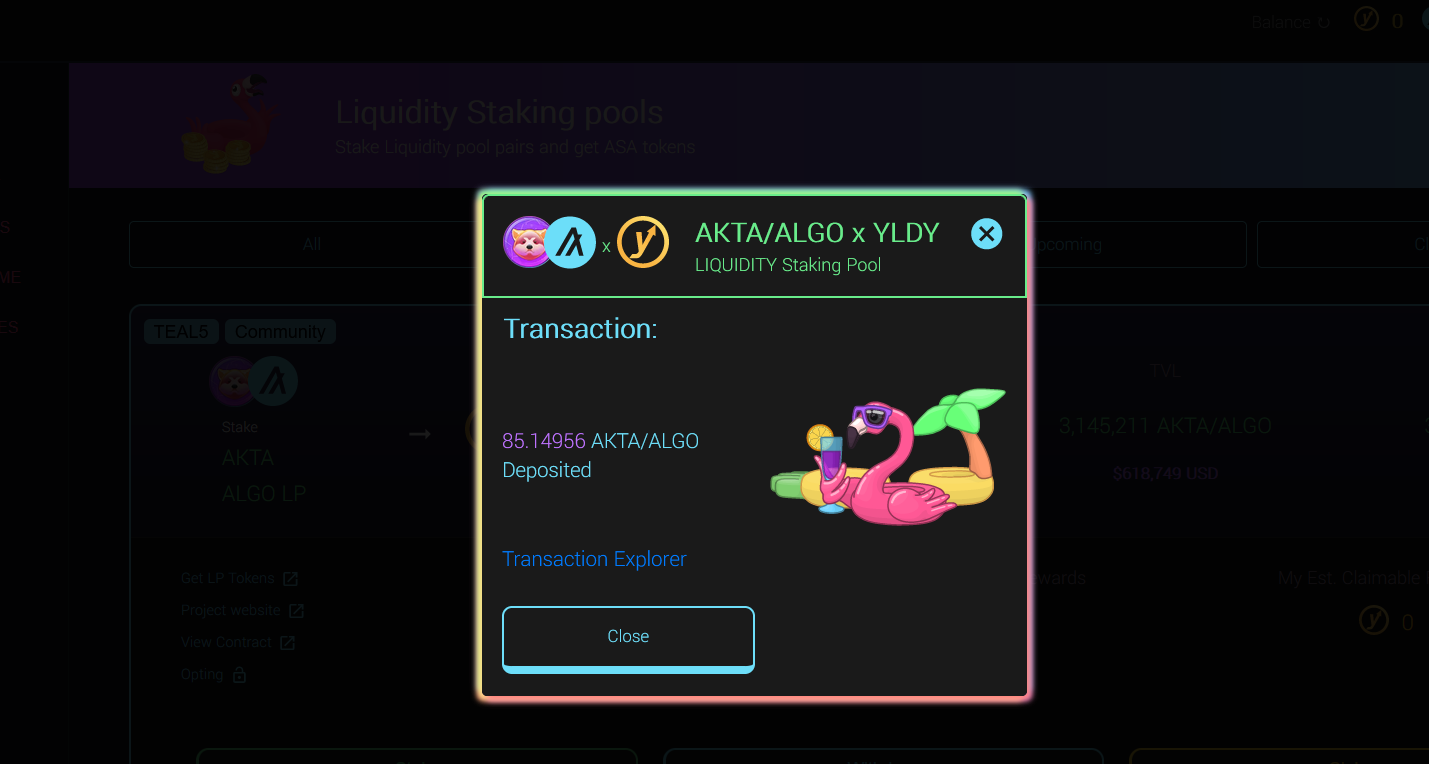

- Go to Yieldly and stake your LP tokens

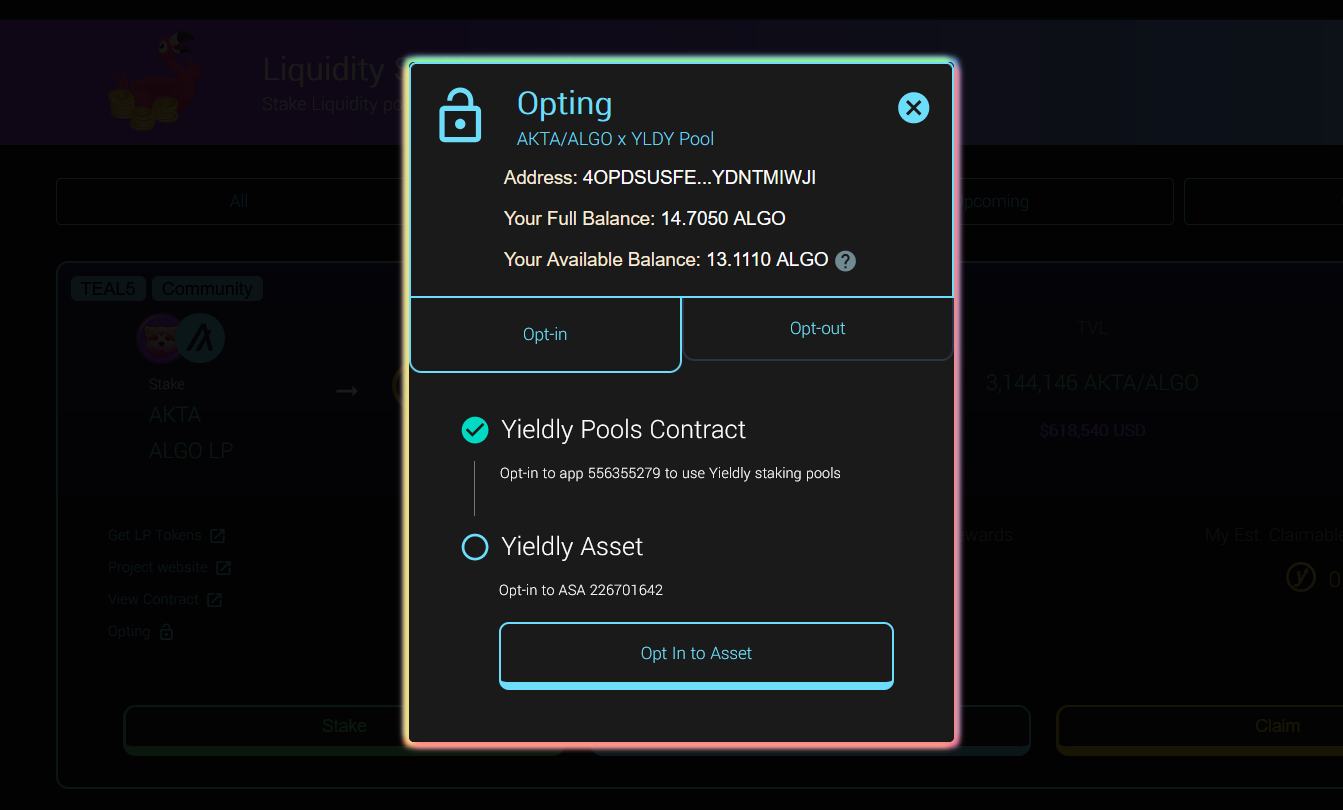

- In order to provide liquidity you will need to confirm 2 “Opt-in” transactions and supply tokens

- Congratulations, you’re a liquidity provider on Algorand!

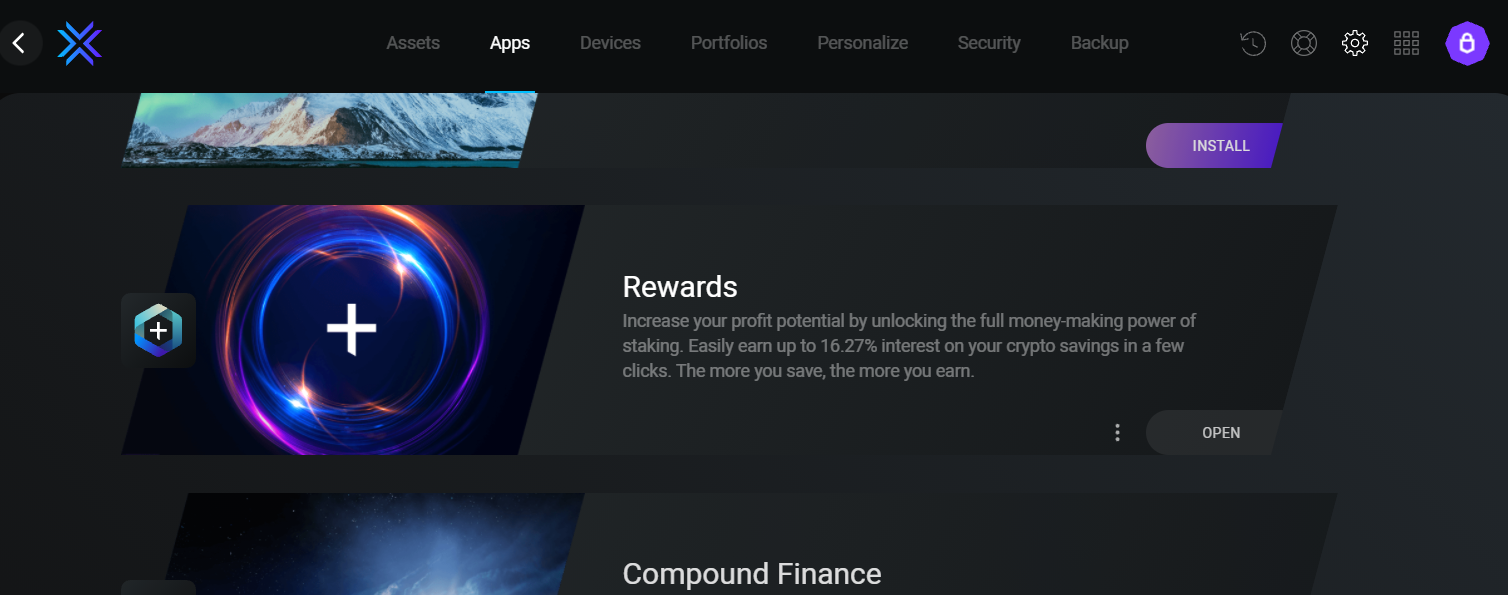

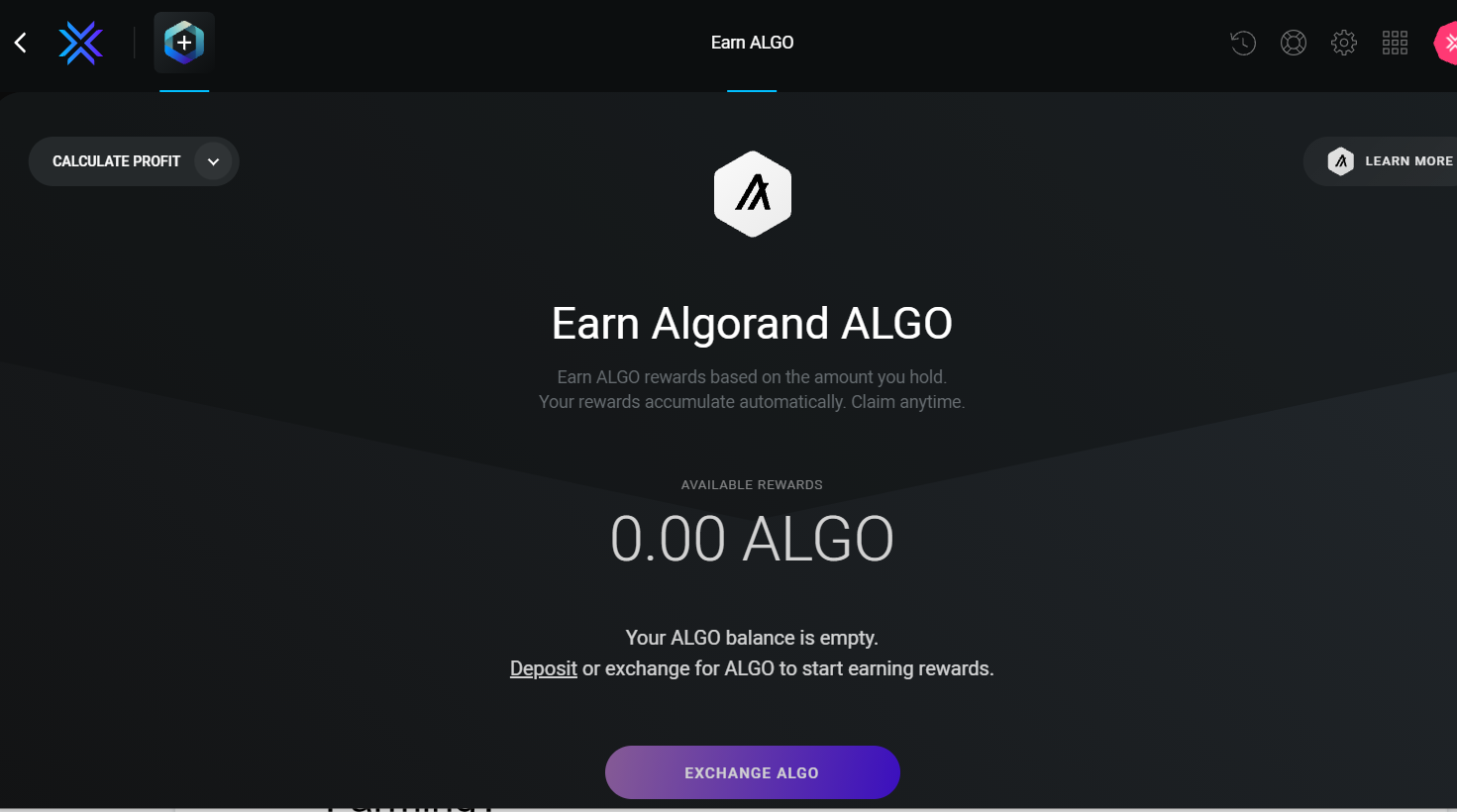

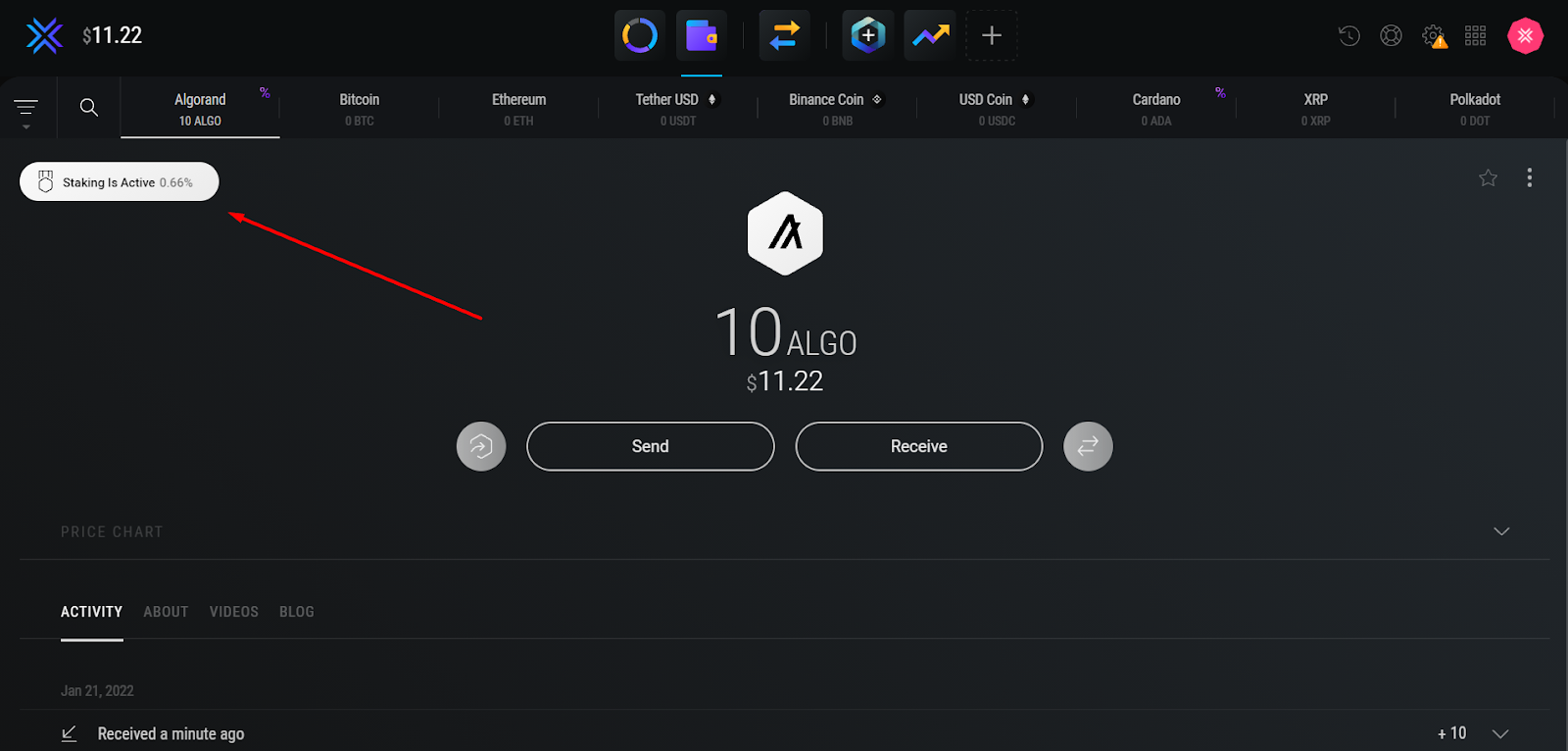

Staking on Exodus

You can stake on Algorand using the Exodus application.

- Firstly, you will need to install the “Rewards’ app

- Then, go to “Assets” and choose Algorand.

- Send some ALGO to your wallet to start earning

- Now, coins you hold are staked and generating profit

Should I use Algorand for Staking and Yield Farming?

There’s no denying that Algorand is in the early stages of growth for staking and yield farming. However, it’s ambition to become “the blockchain for FutureFi” means it could be one of those early opportunities that yield farmers love to find.

That’s because Algorand is taking a unique approach to staking, which helps it to stand out against other PoS systems. Also, it has a credible team with a clear long-term vision. Finally, the Algorand Foundation is in the process of incentivizing DeFi on Algorand, which is likely to increase the opportunities in future.

For all these reasons, yield farming and staking on Algorand are worth investigating. However, as always, this is not investment advice and you should always do your own research first.

Here you can check yield farming opportunities on other chains: https://de.fi/explore

Check our guides:

Tezos Ultimate Yield Farming Guide [Infographics]

Solana Network Ultimate Yield Farming Guide [Infographics]

Fantom Network Ultimate Yield Farming Guide [Infographics]

Huobi ECO Chain Ultimate Guide for Yield Farming

Polygon Network Ultimate Guide for Yield Farming

Binance Chain Ultimate Guide for Yield Farming

EOS Ultimate Yield Farming Guide

Arbitrum Ultimate Guide [Infographics]

The Ultimate Yield Farming Guide For Terra Blockchain (Luna) [Infographics]

The Ultimate Guide to Avalanche Network

Ultimate Guide to Yield Farming on Harmony (with infographics)

Ultimate Guide to Tron Network [Infographics]

The Ultimate Yield Farming Guide For Moonriver Network

The Ultimate Yield Farming Guide For Celo

The Ultimate Yield Farming Guide For KuCoin Community Chain

The Ultimate Yield Farming Guide For NEAR Protocol

And join us on twitter and telegram!

Good luck in farming!